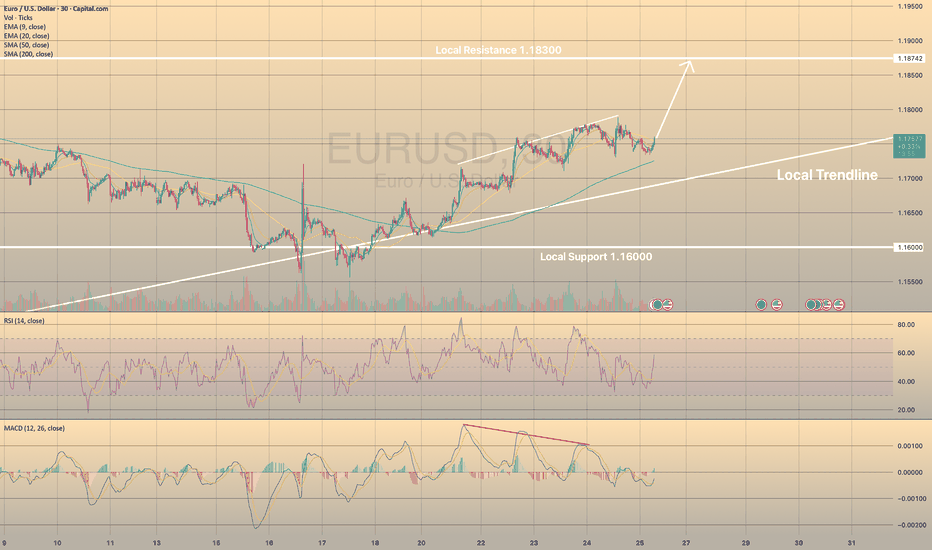

EURUSD HOLDS BULLISH MOMENTUMEURUSD HOLDS BULLISH MOMENTUM📈

24 July I wrote about bearish divergence in EURUSD. Now we see that this resulted into decline towards sma200 on 30-m chart. Currently the price is rebounding from this moving average.

What is the sma200?

The sma200 is a technical indicator that calculates the average closing price of a forex pair or crypto over the past 200 trading periods. It’s used to identify long-term trends, smooth out short-term price fluctuations, and determine potential support or resistance levels.

There is high possibility that the price will continue its way towards local resistance of 1.18300.

Sma200

RACE (Ferrari) – Quality has its PriceMIL:RACE has a technically interesting setup that also fits well with the weekly setup that I presented a few weeks ago.

The current consolidation has once again reached the lower zone and should find support from here one more time. Recently, a significant bounce was achieved from here several times. In addition, Ferrari is moving at the daily SMA 200 line and has bounced upwards from this (as well as from the horizontal support). In the 4h chart we see a nice RSI divergence as well as a breakout from a falling wedge. Both bullish signals.

Fundamentally, Ferrari is not cheap, but quality has its price. The backlog extends years into the future, the pre-order lists are full to bursting, the line-up presented is technically flawless and in demand and the cash flow is immense. In addition, the company is still family-owned (which secures the share price) and the current F1 season with Hamilton and Leclerc as the team should also be interesting.

We are initially targeting the area around EUR 438 and then the previous ATH at EUR 457. This results in an ROI of 10%. Should the daily closing price fall below EUR 400, the trade would be disqualified and closed.

Target zones

438 EUR

457 EUR

Support Zones

400 EUR

Ferrari - Don't Miss Out on 50% ROI!Very strong setup here. Ferrari respects the SMA200 for years and did touch the SMA200 and bounce from it. It also respected the current trendline and the SMA200 and trendline bounce did happen at the 23rd Fib retrace level. Very bullish setup.

--

🐂 Trade Idea: Long - RACE

🔥 Account Risk: 20.00%

📈 Recommended Product: Stock

🔍 Entry: +/- 426,00

🐿 DCA: No

😫 Stop-Loss: 390,00

🎯 Take-Profit #1: 600.00 (50%)

🎯 Trail Rest: Yes

🚨🚨🚨 Important: Don’t forget to always wait for strong confirmation once possible entry zone is reached. Trade ideas don’t work all the time no matter how good they look. Do not get a victim of FOMO, there is always another trade idea waiting. 🚨🚨🚨

If you like what you see don’t forget to leave a comment 💬 or smash that like ❤️ button!

—

Ferrari is a super strong brand. Backlog is huge and current waiting time is measured in years not months. Luxury stocks were punished during the last months because of fear of growth and a weak consumer but Ferrari is somewhat else. Misconceptions regarding shipments and China are putting pressure on Ferrari's shares since the third-quarter announcement. Nevertheless, the shipments' decline is a result of an ERP transition, and the reduction in China is intentional.

Don't forget, people who buy Ferraris do not care about inflation or the economic situation of a country. Also, you can't lease a Ferrari, you can only buy it. This gives the manufacturer a strong cashflow. In addition, Ferrari's unique market position, strong brand, and prudent management justify its high valuation and promise market-beating returns.

—

Disclaimer & Disclosures pursuant to §34b WpHG

The trades shown here related to stocks, cryptos, commodities, ETFs and funds are always subject to risks. All texts as well as the notes and information do not constitute investment advice or recommendations. They have been taken from publicly available sources to the best of our knowledge and belief. All information provided (all thoughts, forecasts, comments, hints, advice, stop loss, take profit, etc.) are for educational and private entertainment purposes only.

Nevertheless, no liability can be assumed for the correctness in each individual case. Should visitors to this site adopt the content provided as their own or follow any advice given, they act on their own responsibility.

TCS: SMA 200 for long positionHello traders,

The stock we are going to watch is $NSE:TCS. This stock is related to IT sector. This stock is mostly moving in an upward direction. Currently, it is taking some additional support of SMA200 in 4h time frame. This stock can shoot upwards at anytime.

If you're a option trader, consider buying the premium which is having the liquidity. Consider exiting near 4100 to protect your profits.

Thanks & regards,

Alpha Trading Station

FTSE 100 Big triangle from 2023 breakout and retestOn the Daily chart for FTSE 100, we can observe a massive triangle that was forming in 2023. It started in Februaty and produced a breakout in December. For the past few days the price has been correctign and now it's retesting the resistance of the triangle, now acting as a support.

This support is aligning with the 0.382 Fib and the 200 SMA

The development on it is very important. If the price provides a reversing indication in the following hours, this can be a nice entry for a trade that can target the previous swing high at around 7750 - 7770 and bossibly higher

ETH Reach important resistanceHello friends.

after 1 week Rally , Etherum Reach its important resistance level , Near 1700.

i see a reaction to Trendline , pink line i drawn on the chart.

also MA200 is here too...

so i think ETH will fall to at least 1450 , where there are 1450 support level

and 50% fibonacci retracement level.

if the situation is permanent , Price will bounce from this level approch 1700 again.

hope have good investments and trades.

dont forget to have a Stoploss and control your risks.

GOOD LUCK.

Market Update 9/15/2022Tomorrow I will put all of these into one idea and only update that, so you all will see everything in one spot. Sorry for making it difficult (People on tradingview).

Watch the video. The key parts are important and should not be ignored. This is not a video about appl, but the whole market and BTC.

Adobe near SMA200 on weekly chart.This is the weekly chart of Adobe, we can see that price is very close to SMA200. I would like to see it testing this support level, but i would also want a divergence at RVI and RSI. For now, none of the oscillators have a divergence at lows, but all 4 have a divergence at highs.

SPY play with 90% PoP!Hello, guys hope all is well. Today we will be looking at $SPY and how I will play the market this week.

Based on the expected move for this week of $6.79 we are possibly looking at a range between $410.01 - $423.59. On Monday I opened the Put side ($400 / $398 and collected $9 per contact) of my Iron Condor and leg into my Call side roughly Thursday afternoon or right before close.

Last week we saw a slight dip in the markets from Monday's open of $424.43 to Friday's close of $414.92. This 2.24% drop has made the $VIX pop to the $20 levels from the mid to high teens. With this pop, we will be able to take advantage in one of two ways.

1) We can keep our stricks the same as we did last week because we still believe that there is a lot of supply at this price and we want to collect more premium.

2)We will be able to get lower on the put side/higher on the call side while still collecting the same amount of premium as we did last week.

I will be going with the second option because although there may be supply at these levels I still want to sell the .10 - .05 deltas with a $2 widespread.

I'll be looking to collect between $8-$10 per contract on the put side give me roughly a 4% gain while also looking for the same percent gain on the Call side later on in the week. Since no additional collateral is needed to add the Call side, we are looking at a minimal gain of 8% if we stay in our expected range.

important areaIf the formation breaks down the support trend line and goes under the sma200 it will become very bearish

LONG Breakout ADOBE After Q1 after consolidationWhen discarding covid19 effect, only once since September 2012 has SMA200 been above SMA50.

Right now there is a balancing act going on.

Yet over this week the price has broken out from the previous 3 tops and had strong support in 420-430 after Q1 postings.

Since then there has been a strong RSI14 development and is showing a strong yet not "overbought" tendency.

I have entered long in 515.23 today, as the spike in price over the last 3 days will ensure that SMA50 will stay above SMA200.

Bitcoin sensitive conditions ! Hey guys , According to my previous analysis, bitcoin is currently involved in the price of 0.786 fibo , With the current world conditions , Bitcoin doesn't seem to work logically !!!

I hope this price closes above SMA200 during the weekly time frame .

Otherwise the lower prices I have specified will be available !

---- Login with science . Good Luck ----

APT Long on SMA200 bouncePros:

* FI and MACD going up when prices is dropping

* Doji reversal that gapped up

* RSI at 31

Cons:

Taking a little bit more risk by buying above doji high instead of waiting for confirmation.

Overall Trade Grade: 83% (10/12)

Uptrend: 1/2

MACD: 2/2

Force Index: 2/2

RSI: 2/2

Reversal candle: 1/2

Entry timing: 2/2