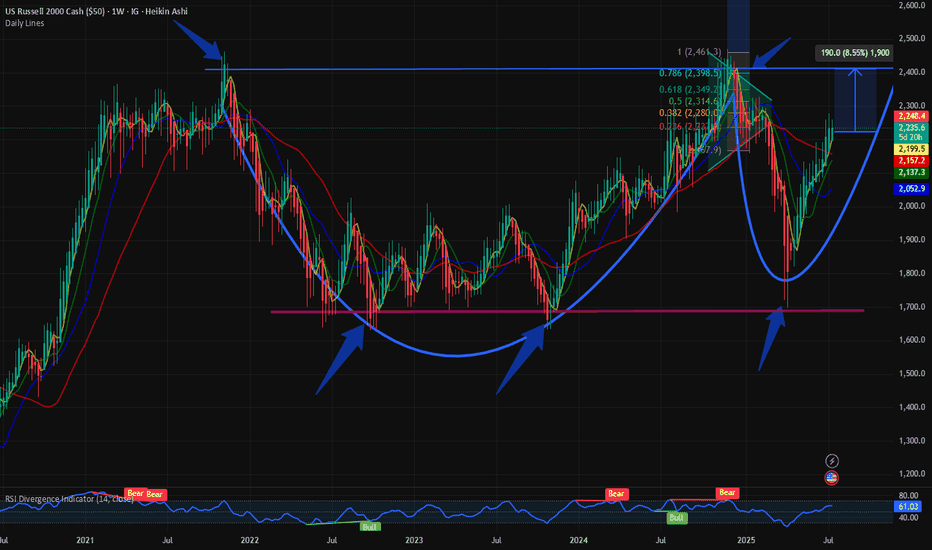

$RUSSEL: Completion of Cup and Handle formation or higher?The small cap index $RUSSEL has had a good past couple of months and has bounced back from its lows. We visited the small cap index on May 1st when we identified the trend reversal. The $RUSSEL was in the recovery mode after the Liberation Day capitulation.

IG:RUSSELL in a bounce back mode. But upside is capped @ 2400 for IG:RUSSELL by RabishankarBiswal — TradingView

This cup and handle pattern is still on hold, and I also predicted that the upside is capped @ 2400. Currently the $RUSSEL is @ 2222.

So how much upside can we expect from here with TVC:DXY making new lows? My assumption is that $RUSSEL will fail to break above 2400, and the handle part will not break out of the reverse neckline. So, the upside in the small caps is capped @ 2400 which seems to be a major resistance indicating a 9% upside from here.

Verdict : $RUSSEL Cup and handle pattern nearing completion. 2400 is the upper resistance. Still some more room to run.

Smallcapstocks

ASAHI INDIA GLASS- Bullish Flag & Pole Breakout (Daily T/F)Trade Setup

📌 Stock: ASAHI INDIA GLASS ( NSE:ASAHIINDIA )

📌 Trend: Strong Bullish Momentum

📌 Risk-Reward Ratio: 1:3 (Favorable)

🎯 Entry Zone: ₹851.00 (Breakout Confirmation)

🛑 Stop Loss: ₹809.00 (Daily Closing Basis) (-5 % Risk)

🎯 Target Levels:

₹875.10

₹897.85

₹920.90

₹945.65

₹969.00.00 (Final Target)

Technical Rationale

✅ Bullish Flag & Pole Breakout - Classic bullish pattern confirming uptrend continuation

✅ Strong Momentum - Daily RSI > 60, Weekly RSI >60 Monthly rsi >60

✅ Volume Confirmation - Breakout volume 121.30K vs previous day's 1.63M

✅ Multi-Timeframe Alignment - Daily and weekly charts showing strength

Key Observations

• The breakout comes with significantly higher volume, validating strength

• Well-defined pattern with clear price & volume breakout

• Conservative stop loss at recent swing low

Trade Management Strategy

• Consider partial profit booking at each target level

• Move stop loss to breakeven after Target 1 is achieved

• Trail stop loss to protect profits as price progresses

Disclaimer ⚠️

This analysis is strictly for educational purposes and should not be construed as financial advice. Trading in equities involves substantial risk of capital loss. Past performance is not indicative of future results. Always conduct your own research, consider your risk appetite, and consult a financial advisor before making any investment decisions. The author assumes no responsibility for any trading outcomes based on this information.

What do you think? Are you watching NSE:ASAHIINDIA for this breakout opportunity? Share your views in the comments!

SUN PHARMA | Inverted Head & Shoulders BreakoutSun Pharma has completed an Inverted Head and Shoulders pattern on the daily chart, signaling a potential bullish reversal.

📈 Entry: Buy above ₹1800 (breakout confirmation)

📉 Stop Loss: ₹1722 (below right shoulder support)

🎯 Targets (based on Fibonacci extensions & previous resistance zones):

• ₹1837.30

• ₹1875.35

• ₹1914.20

• ₹1953.90

• ₹1994.35

• ₹2034.55

The neckline breakout has occurred with decent volume, reinforcing the validity of the setup. As always, risk management is key — trailing stop loss recommended as price moves in favor.

💡 Disclaimer: This is for educational purposes only. Do your own research before making any trading decisions.

RUSSELL 2000 at 200 day SMA#TGIF. A simple chart to end the week. The US Small Cap index Russel 2000 its just hovering above its 200 Day SMA on the daily chart. Every time this happened in the last 1 year it was a bullish indicator in a medium term. The 50- and 100-Day SMA are below the 20 Day SMA which is a short term bearish indicator.

Psychedelic Stocks About to Trip! 100%+ UpsidesPsychedelic Stocks About to Trip! 🍄

RFK Jr. has been named the top health official in Trump's administration, and he's known for his stance against big pharma and preference for natural products like psychedelics. This could be a game-changer for psychedelic stocks!

In this video analysis, I dive deep into the potential impact RFK Jr. could have on key psychedelic stocks: AMEX:CYBN , NASDAQ:CMPS , NASDAQ:ATAI , and $MNMD.

These stocks are poised for significant movement, and you won't want to miss out on the insights and strategies I share. Not financial advice. 👇

Bearish Flag Breakdown in Nifty 50 – A Shorting Opportunity Bearish Flag Breakdown in Nifty 50 – A Shorting Opportunity

🚨 Entry: Sell at 23,645

🚨 Stop Loss: 24,050

🚨 Target: 22,580

🚨 Risk-to-Reward Ratio: 1:3

🔍 Analysis:

The Nifty 50 has formed a classic bearish flag pattern, signaling potential downside momentum. A breakdown below 23,645 provides an ideal entry point for short-sellers, with a tight stop-loss to limit risk.

With a strong confluence of technical indicators pointing toward further downside, the target of 22,580 aligns with the measured move of the flagpole, offering an attractive risk-to-reward ratio of 1:3.

💡 Tip: Always adhere to your trading plan and risk management strategy. Never risk more than you can afford to lose.

---

⚠️ Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. I am not SEBI-registered. Please consult with your financial advisor before making any trading decisions. Trade responsibly!

---

What’s your view on this setup? Let me know in the comments below!

Symbotic Hypergrowth? $850 Price TargetOverview

Symbotic Inc. is an A.I. and robotics automation company based in Wilmington, Massachusetts that is looking to increase the ability for companies to keep up with growing demand. To do this, they utilize artificial intelligence software to maintain records and warehouse organization with the assistance of SKU numbers. Autonomous robots then account for, store, and retrieve items in a fraction of the time that it would take a human being. Symbotic's mission is to increase supply capabilities through the symbiotic relationship of artificial intelligence and robots. Its origins trace back to 2007, before it was known as Symbotic, and the company went public in 2022 ( NASDAQ:SYM ).

Call it FOMO, but I think Symbotic Inc. has the potential of becoming a hypergrowth stock. I built my own fundamentals tracker to get a pulse on the tech company's vitals and, while it still is not a profitable company, it looks like it's in the early stages of becoming so. The fundamentals for Symbotic provide me the confidence to invest despite the presence of red flags which led me to performing a deep dive. My price target for Symbotic Inc. is $850 with a projected timeline before 2030.

What I Don't Like

SYM has lost nearly 60% in value since July 2023 from a high of $64.15 to its current share price of $26.87. If you look up Symbotic Inc. on a search engine then you will also see that there are numerous law firms attempting to build class action lawsuits. The headlines can't help but to sow distrust by utilizing strong statements such as "misleading investors" and "inflated revenue" within their subjects. Within the last few weeks Symbotic had to file a delayed annual report due to self-identified accounting errors within their balance sheets. Also, if you dig through their filings, you will find that Symbotic Inc. was born from a deal with SVF Investment Corp which, according to the filings, was headquartered in the Cayman Islands.

I can only assume that the business dealings with SVF Investment Corp were to facilitate equity financing and an expedited public launch for SYM. From my findings, SoftBank Group Corp ( TSE:9984 ) is an investment conglomerate and the parent company to multiple subsidiaries. You guessed it, it is affiliated with SVF Investment Corp which functions as a "blank check company" for SoftBank. In my limited knowledge, this translates as a way for SoftBank to inject a substantial investment into the company that is now known as Symbotic Inc. No matter how savvy they may have been to launch Symbotic Inc., business deals that originate in the Cayman Islands typically raise one's eyebrows.

What I Do Like

Symbotic Inc. seems to have a pretty solid vision for global expansion and has attracted some significant institutional investors such as SoftBank, Vanguard, BlackRock, and Morgan Stanley to name a few. In fact, according to the NASDAQ site, 282 institutional investors hold 82% of Symbotic Inc.'s Class A Common Stock. Symbotic Inc. was founded by Richard "Rick" Cohen who currently serves as the CEO and is a legacy to the Cohen family who founded C&S Wholesale Grocers. Symbotic's technology is used by C&S Wholesale Grocers which is one of the largest privately held companies in the United States.

Symbotic and SoftBank have partnered on a separate venture known as GreenBox which is meant to deliver automated warehouses made possible by Symbotic's hardware and software. According to the company's site, GreenBox is supplying warehouses as a service to consumers. With an increase in online shopping, I believe that Symbotic is both seeing and filling a need in an industry that its founder is very familiar with. I can also envision Symbotic spreading its reach internationally which helps fuel my massive price target. Megacap stocks need to have a global influence and extend across industries, which Symbotic appears to be preparing for.

Fundamentals

Right now, Symbotic Inc. is in its early stages and is bringing in a negative income which makes it a risky investment. However, the company's total revenue has increased by 200% from 2022-Q4 to 2024-Q4; the gross profit has also increased by 147% in the same timeframe. Symbotic's net income has revealed consistent losses since 2022, but the 2024 annual report had the smallest loss on record at a negative $84.7M which is a 39% improvement from 2022 and a 59% improvement from 2023. No matter which way you cut it, the company is still absorbing annual losses so it will be important to keep an eye on improvements and deficiencies to identify any consistent trends.

NASDAQ:SYM has 585,963,959 total outstanding shares according to the 2024 Annual Report published at the beginning of December. This is a far cry from the 106M outstanding shares reported on some financial websites and even here on TradingView. From my findings, around 100M of Symbotic's shares are Class A Common Stocks and the remaining 485M are Class V Common Stocks. My focus is on the market capitalization which is a tool that I like to use when establishing long-term price targets. For Symbotic, which has the potential for global reach and use across multiple industries, I think it's reasonable to achieve a market capitalization of $500B.

Price Target

With the current number of outstanding shares at a market cap of $500B, this would place Symbotic's share price at $853. This type of growth would turn a $1,000 investment today into $31,710 at the projected target price; a whopping 3,000% return. HOWEVER, a lot has to happen to make this come to fruition. One thing I would like to see, in addition to profitability, is for Symbotic to begin buying back its own stock.

It's become my investing philosophy that companies who believe they are undervalued will buyback their shares while companies that believe they are overvalued will issue new shares. Symbotic's total outstanding shares have increased by 5.8% since its annual report at the end of 2022. I think that my philosophy is best tailored to established companies so it is possible that Symbotic could be an exception. Because the company is so new, it may need to issue more shares to generate enough capital to stay afloat while its roots set.

NVTS - The next Explosive Small Cap?! 300% UpsideCharturday #2: NASDAQ:NVTS 💾

A top 5 trade for me right now!

Weekly Analysis:

-H5 Indicator is GREEN

-Broke out of downtrend & falling wedge in which we hit our first profit target and now retesting the breakout. I bought more shares/ options this past week.

-Sitting on a volume shelf with a lot of room to run!

-Williams CB still forming, if we continue our bounce into this week we will have a form Williams CB

🔜🎯$4.65🎯$6🎯$7.62🎯$11.17🎯$12.29

⏲️Before May2026

Not financial advice.

$NVTS - Presenting a buying opp. before it's massive 300% move! NASDAQ:NVTS

As I said from the beginning, this name is going to be a bumpy ride, but I believe it's presenting another buying opportunity as we pull back to level 2 support at $2.90ish, which is also where the 9ema and falling wedge retest area are. I'm not concerned because we haven't started moving big on the IWM yet, and until then, most small caps won't move unless they have a catalyst.

-H5 Indicator is GREEN

-Searching for out support to create our Williams Consolidation Box officially

-Two separate volume shelfs below.

Everything is still intact; you just have to be patient.

NFA

$FUBO UPDATE! We may be primed for a BIG BOUNCE! NYSE:FUBO

-Staying patient and believe we may now be going for a triple bottom before we have our large move to the upside as you see on the daily chart below.

-Weekly H5 indicator is still GREEN

-We are also on the floor and green bounce area on the williams r%! Which to this point you've see what happens when we get there

-I'm not concerned because we haven't started moving big on the IWM yet and until then most small caps won't move unless they have a catalyst.

Ramco Cements: Bullish Flag BreakoutNSE:RAMCOCEM Ramco Cements has recently given a bullish flag breakout at ₹1040, indicating a strong upward momentum in the stock. A bullish flag pattern is a continuation pattern that signifies the resumption of an uptrend after a brief consolidation phase. The breakout from this pattern suggests a renewed buying interest, backed by robust volumes.

Trading Setup:

Entry Price: ₹1040

Stop Loss: ₹987 (below the consolidation zone)

Targets:

First Target: ₹1072.10

Second Target: ₹1104.10

Third Target: ₹1136.10

Fourth Target: ₹1168.05

Final Target: ₹1200.05

Risk-Reward Ratio:

This trade setup offers a favorable risk-to-reward ratio of 1:3, making it an attractive opportunity for swing traders.

Key Observations:

The stock has been in an uptrend, supported by strong institutional buying.

The breakout is accompanied by above-average volumes, adding conviction to the move.

Key resistance levels are expected at the target prices, while the stop loss is strategically

placed below the recent consolidation range to minimize risk.

Recommendation:

Traders can consider buying Ramco Cements at ₹1040 for the above-mentioned targets. Ensure strict adherence to the stop loss of ₹987 to manage risk effectively.

Disclaimer: This analysis is for educational purposes only. Please conduct your own research or consult with a financial advisor before taking any trading or investment decisions.

$NVTS - The Next High Five Trade! 300% UPSIDE!!!🚀 The Next H5 Trade 🚀

Navitas Semiconductor - NASDAQ:NVTS 💾

-Falling Wedge Currently Breaking Out!

-H5 Indicator is Green and Giving a BUY Signal

-Williams R% needs to create support and it's Williams Consolidation Box. I'm thinking we get a big push up to $3.50 - $4 before pulling back to retest the falling wedge breakout and continue higher.

-Launching off of a massive Volume Shelf with a large GAP to $4.65

-500M Mkt Cap Name (High Risk / High Reward)

-Any partnerships or big news out of this name with Semi's spinning back up the Gain Train then this name won't be hard to EXPLODE higher with it being a small cap.

🎯$4.65

🎯 $8.47

📏 $11.17

⏳ Before APR 2026

Thank you for all the love 50 was tough for a Monday morning, I really appreciate all of you!

Not Financial Advice

IS ELF BEAUTY FINALLY BOTTOMING OUT?! LET'S SEE!NYSE:ELF is at a key S/R zone and has shown buyers will step in well before this thing try's to dip under $100! That's great news as that gives us a great risk/reward ratio area!

MACD, RSI, and the Stochastic are all starting to curl upward off the bottom, indicating the start of a bottoming reversal. My trade setup and execution details are below. Not Financial Advice.

Entry: $118 Break

PT1: $152

PT2: $175

Final PT: $220

S/L: Break below $100 at $97.72.

$SOUN :Is Sound Hound AI the next small cap to SURGE?! 98% move!NASDAQ:SOUN

Is Sound Hound AI the next small cap to SURGE?!

I believe this stock is gearing up for a 98% move higher! So, let's dive into my video below, which talks about the NASDAQ:SOUN stock charting setup for a SURGE to the upside and how it meets my 5/5 trading setup! (My personal trading strategy)

Not financial advice.

Like ❤️ Follow🤳 Share 🔂

Comment what stock you want to see charting analysis on below.

$IWM $RTY : Small Caps Ready to Explode! 💥 Small Caps Ready to Explode! 💥

We will be at ATH's this week: AMEX:IWM AMEX:TNA CAPITALCOM:RTY

While everyone is buzzing about NASDAQ:TSLA CRYPTOCAP:BTC and how they will continue to skyrocket if election results stick and continue to favor Trump, no one’s talking about SMALL CAPS! Remember, during his last term, small caps had an impressive run. Let’s dive into the technicals in my latest video.

In this video, we cover:

1️⃣ Technical Analysis: We’ll analyze charts and multiple indicators, all pointing to AMEX:IWM heading HIGHER. 📈

2️⃣ Patterns: A massive multi-year cup and handle pattern with an ascending triangle breakout is in play.

Drop a comment below if you learned something new or want to explore any topics further.

Stay tuned for more insights and show some love!

LIKE | FOLLOW | SHARE

CAPITALCOM:RTY AMEX:IWM AMEX:TNA

NFA

US2000 / Small Cap / Russell Bullish Robbery Plan To Steal MoneyHola! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist US2000 / Small Cap / Russell Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss 🛑 : Recent Swing Low using 1h timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

Mid/Smallcap || Recovery As Expected, What now? The Midcap and Small Cap Index have shown signs of recovery as anticipated in my previous analysis. The index is now trading above the 20 EMA Band in the 2-hour timeframe (TF). However, several key conditions must still be met before we can confirm a sustained bull run:

1. 2-hour RSI should cross above 75 to signal strong upward momentum.

2. Daily timeframe (DTF) RSI needs to exit the Bear Zone.

3. NIFTY50 is still awaiting confirmation to move out of the Bear Zone, which would provide broader market support.

$QS : A QUANITIFIED SWING SETUP! 80%+ MOVE LOOMING! NYSE:QS A QUANITIFIED SWING SETUP! 👊

NASDAQ:TSLA DEAL INBOUND?!

3 Reasons Why in this Video: 📹

1⃣ My "High Five Trade Setup" strategy

2⃣ Catalyst: #QuantumScape started shipping Battery cells to carmakers and had price target increased to $7

3⃣ Symmetrical Triangle Breakout (MM: 80%+)

Company Overview:

QuantumScape Corp, a company focused on developing next-generation battery technology for electric vehicles (EVs) and other applications.

Video analysis 3/5 dropping today. Stay tuned!🔔

Like ♥️ Follow 🤳 Share 🔂

Are they gonna be a batter cell goliath in this space?! Comment below if you are a believe in NYSE:QS

Not financial advice.

AMEX:IWM NASDAQ:QQQ AMEX:SPY NASDAQ:TSLA NASDAQ:IBRX NASDAQ:UPXI NASDAQ:WULF #ElectricVehicles #TradingSignals #TradingTips #options #optiontrading #StockMarket #stocks