SYNA Platform Position Trading SetupSYNA formed a strong bottom based on hidden Dark Pool Quiet Accumulation that continues intermittently as the stock moves up over several months. There is High Frequency Trader trigger momentum periodically, which triggers Smaller Funds Volume Weighted Average Price orders. The control of price continues to remain in the giant Buy Side Institutions Dark Pool buying activity.

Smallerfunds

ADP Platform Sideways PatternADP has shifted to a Platform sideways candlestick pattern, and is experiencing some Dark Pool Quiet Rotation™. However, there is underlying buying activity of Smaller Funds, Professional Traders, and Investors. The candlestick pattern is compressing on the upside of the Trading Range at this time.

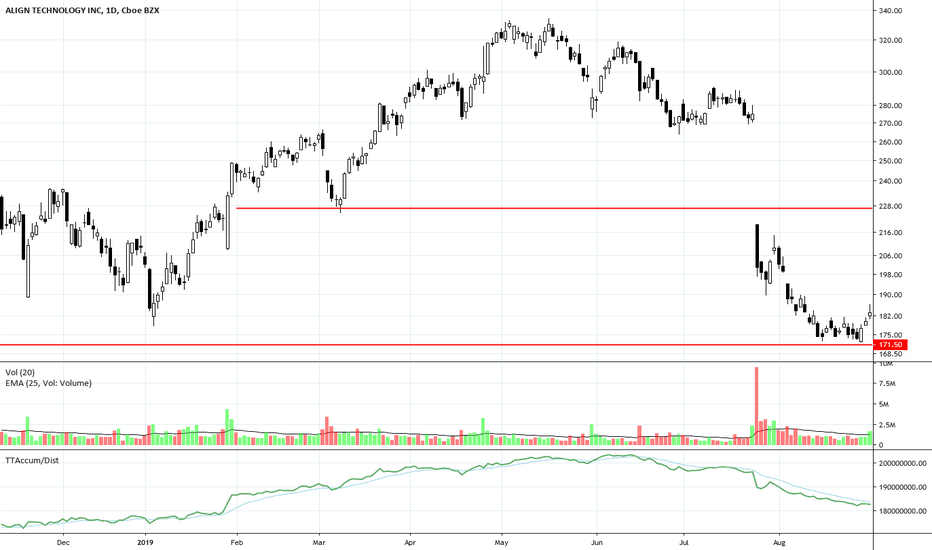

ALGN at Long-Term Support LevelALGN gapped down at the end of July on weak earnings news. It has now collapsed to a strong long-term support level. The final capitulation by Smaller Funds managers has ended. The consistency of the candlestick pattern with closely aligned lows and an early Shift of Sentiment™ pattern on the Balance of Power Indicator reveals some Dark Pool Quiet Rotation™ at this level.

MMM Starts BottomMMM had a massive High Frequency Trader gap down in April, but has now found support at a previous low from 2016 that is a fundamental support level. Massive Smaller Funds Volume Weighted Average Price selling occurred after the gap down. The bottom has shifted the trend to the upside.

UTX Heavy VWAP ActionUTX recently had a High Frequency Trader early morning huge black candlestick, which triggered Smaller Funds’ Volume Weighted Average Price orders. The Buybacks have struggled to maintain price at the support level, which is around $121.

CERN Testing Previous HighCERN gapped in April to quickly complete the short-term bottom formation. It ran up on pro traders and smaller funds buying in the past few days. It is now nearing the previous high’s resistance of last August. This may create a retracement due to profit-taking by the professional traders.