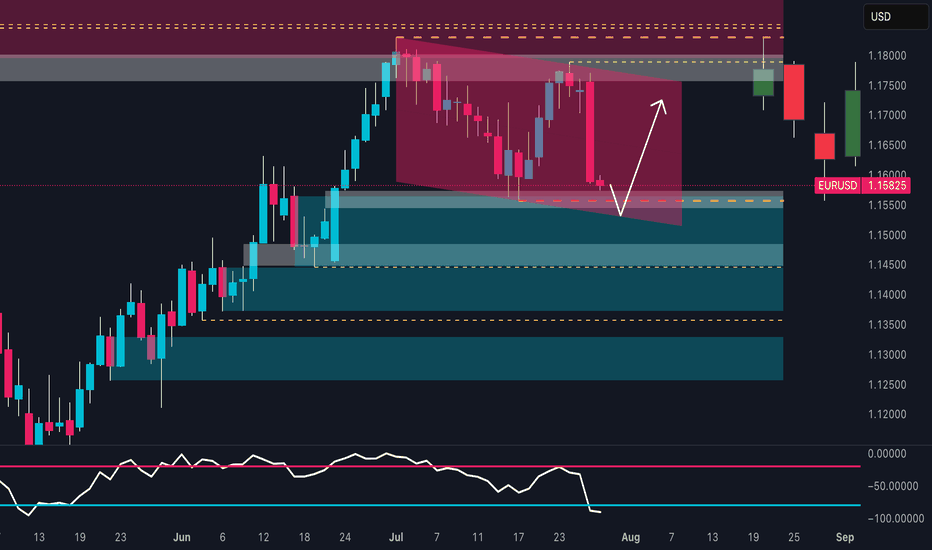

EUR/USD at a Turning Point:Rally or Trap for the Bulls?📉 Technical Analysis

Price has decisively broken out of the descending channel highlighted in recent weeks. The weekly support zone between 1.1540 – 1.1580 is holding, triggering a significant technical reaction. The weekly RSI has entered oversold territory, suggesting a potential short-term reversal.

Key Support: 1.1530–1.1580 (currently reacting)

Key Resistance: 1.1720–1.1780 (inefficiency & supply zone)

Base Case: Potential rebound toward 1.1720–1.1750 before next structural decision

🧠 Sentiment Analysis

82% of retail traders are long, with an average entry at 1.1635

Only 18% are short, a clear minority

This extreme imbalance suggests downside pressure may persist to flush out weak long hands before a genuine reversal takes place.

📊 COT (Commitment of Traders)

USD Index:

Non-Commercials increased both long (+663) and short (+449) positions → uncertain stance but slight USD strengthening

EUR Futures:

Non-Commercials increased long (+6,284) and short (+8,990) positions, but net increase favors the bears

This shift signals a bearish turn in sentiment among large speculators, indicating short-term downward pressure.

📈 Seasonality

In July, EUR/USD historically tends to rise, but:

This year’s price action is underperforming the seasonal pattern, showing relative weakness

August is historically flat to slightly bearish

Seasonality does not currently support a strong bullish continuation

✅ Strategic Conclusion

Current Bias: Bearish-neutral (with short-term bullish bounce expected)

A technical rebound toward 1.1720–1.1750 is likely (liquidity void + RSI bounce + retail imbalance)

However, 1.1720–1.1750 is a key supply zone to monitor for fresh shorts, in line with:

Dollar-supportive COT data

Overcrowded long retail positioning

Weak seasonal context

🧭 Operational Plan:

Avoid holding longs above 1.1750 without macro confirmation

Monitor price action between 1.1720–1.1750 for potential short re-entry

Clean breakout above 1.1780 → shift bias to neutral/bullish

Smartmoney

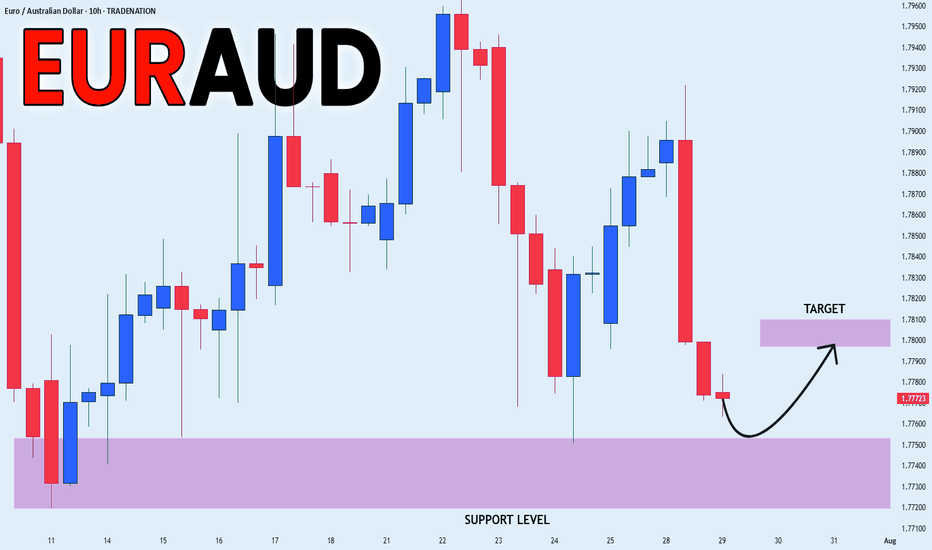

EUR_AUD LOCAL GROWTH AHEAD|LONG|

✅EUR_AUD will soon retest a key support level of 1.7750

So I think that the pair will make a rebound

And go up to retest the supply level above at 1.7800

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-NZD Will Grow! Buy!

Hello,Traders!

EUR-NZD keeps falling

Down and we are bearish

Biased mid-term but there is

A horizontal support level

Below at 1.9370 so after

The retest we might expect

A local bullish correction

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP_CAD RISKY SETUP|LONG|

✅GBP_CAD is going down to retest

A horizontal support of 1.8320

Which makes me locally bullish biased

And I think that we will see a rebound

And a move up from the level

Towards the target above at 1.8380

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD-NZD Rebound Ahead! Buy!

Hello,Traders!

AUD-NZD made a retest

Of the wide horizontal support

Level again at 1.0909 and we

Are already seeing a bullish

Reaction so a local bullish

Rebound can be expected

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

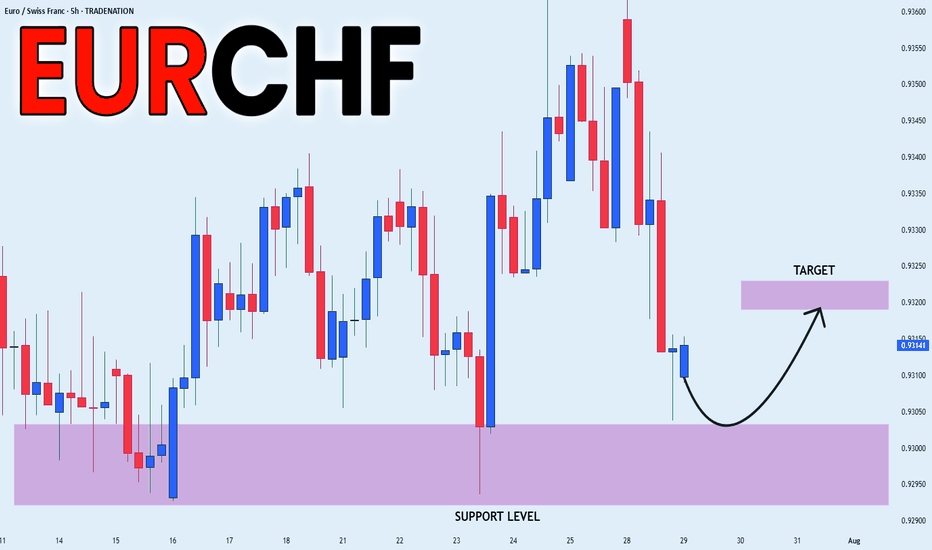

EUR_CHF RISKY LONG|

✅EUR_CHF is set to retest a

Strong support level below at 0.9300

After trading in a local downtrend for some time

Which makes a bullish rebound a likely scenario

With the target being a local resistance above at 0.9320

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

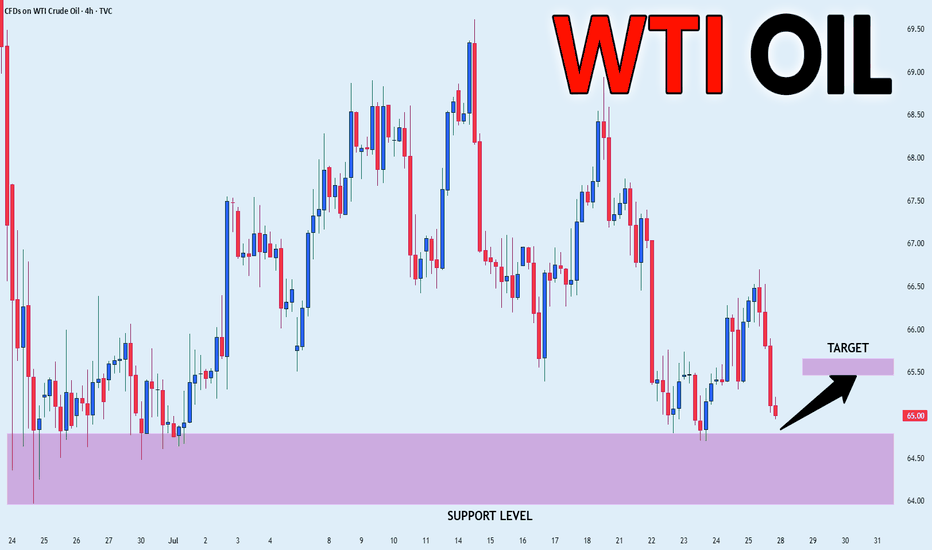

CRUDE OIL Bullish Continuation! Buy!

Hello,Traders!

CRUDE OIL made a rebound

From the support just as

I predicted and the price

Went further still and broke

The key horizontal level

Of 66.50$ and the breakout

Is confirmed so we are

Bullish biased and we will be

Expecting a further bullish

Move up!

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DXY LOCAL SHORT|

✅DXY is going up now

But a strong resistance level is ahead at 98.948

Thus I am expecting a pullback

And a move down towards the target of 98.451

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD Epic Trendline Breakout! Sell!

Hello,Traders!

GOLD was trading along

A long-term trend-line but

It is broken now and the

Breakout is confirmed so

We are bearish biased now

And we will be expecting a

Further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD_CHF SHORT FROM RESISTANCE|

✅USD_CHF has been growing recently

And the pair seems locally overbought

So as the pair is approaching

A horizontal resistance of 0.8064

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

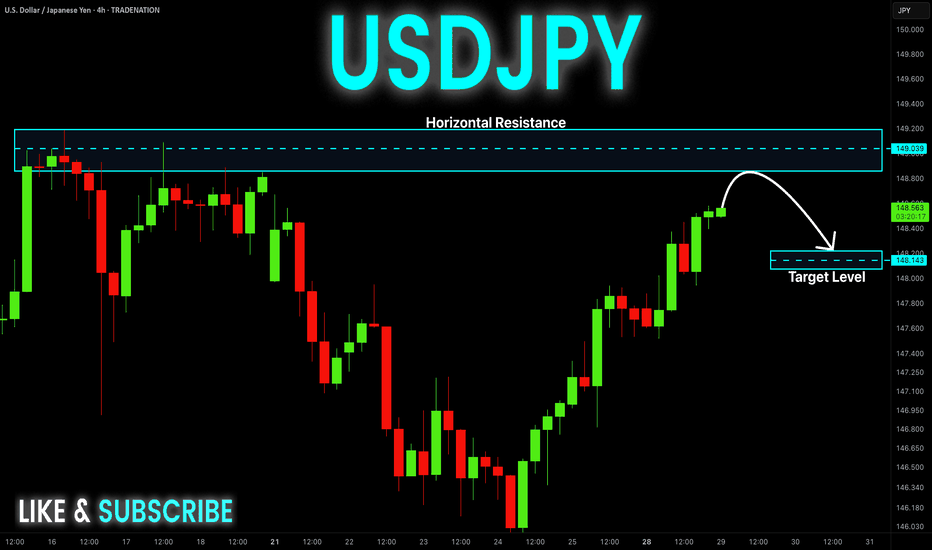

USD-JPY Is Overbought! Sell!

Hello,Traders!

USD-JPY is trading in a

Strong uptrend and the pair

Will soon hit a horizontal

Resistance of 149.200

So after the retest a

Local bearish pullback

Is to be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

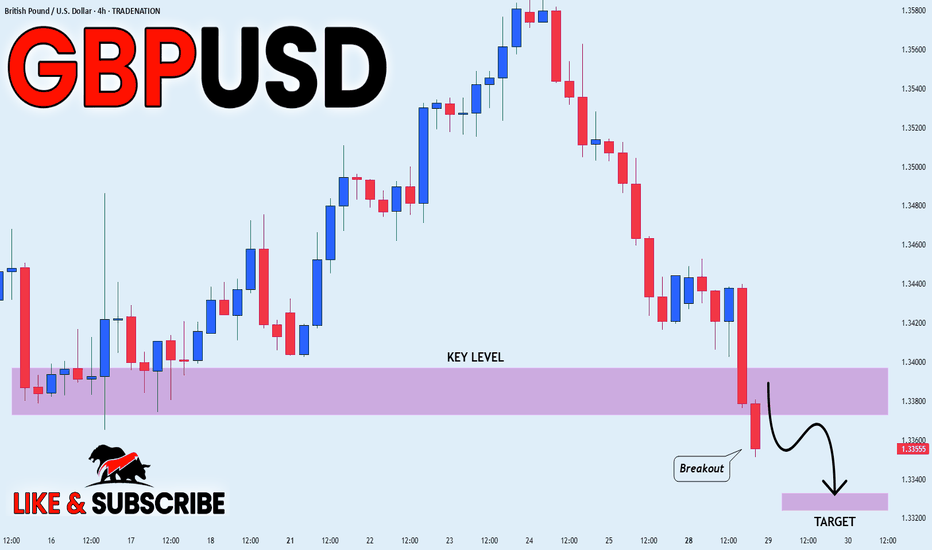

GBP_USD BEARISH BREAKOUT|SHORT|

✅GBP_USD is going down currently

As the pair broke the key structure level of 1.3380

Which is now a resistance, and after the pullback

And retest, I think the price will go further down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-USD Support Ahead! Buy!

Hello,Traders!

EUR-USD is making a massive

Bearish correction and the pair

Is already locally oversold

So after it hits a horizontal

Support level below at 1.1568

We will be expecting a local

Bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

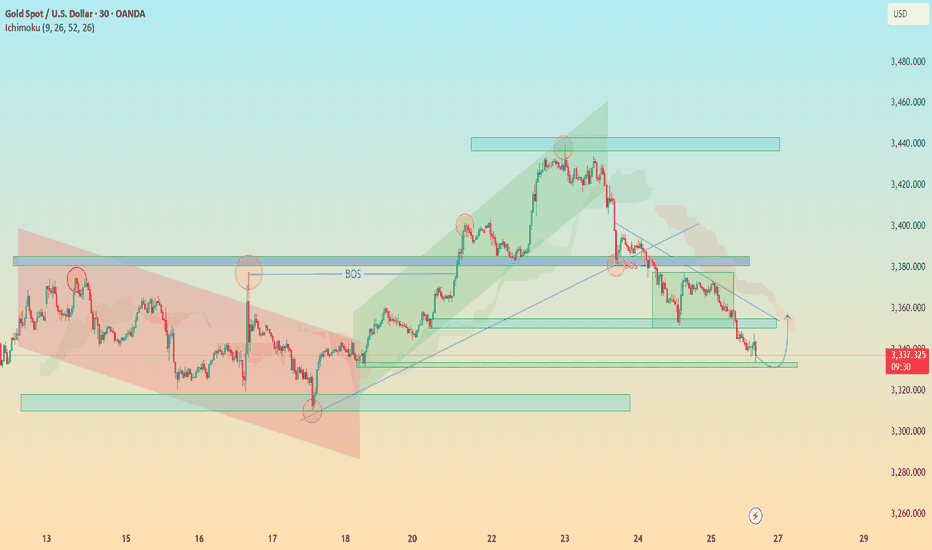

"XAU/USD Hits Major Demand – Is a Relief Rally Brewing?"🟡 XAU/USD (Gold) – Demand Zone Rejection in Play | Bullish Correction Ahead?

Timeframe: 30-Minute | Date: July 25, 2025

Created by: AllyPipsExpert

Indicators: Ichimoku Cloud, BOS (Break of Structure), Dynamic S/R, Trendlines

---

🔍 Technical Analysis & Key Insights:

🔸 1. Market Recap – Distribution & Downtrend Confirmation:

After the Break of Structure (BOS) near 3385, gold confirmed a bearish reversal following the distribution phase at the top resistance zone around 3445–3460.

Bearish momentum was sustained by a descending trendline, paired with a bearish Kumo (Ichimoku cloud) crossover.

🔸 2. Major Zone Tagged – Key Demand Area Tested:

Price has now reached the critical demand block at 3320–3340, a zone that previously initiated bullish impulse on July 18–19.

The current bullish projection (in blue) reflects potential short-term recovery or correction phase, following oversold conditions and historical support strength.

🔸 3. Bullish Reversal Potential – Short-Term Retracement?

The blue arrow reflects a likely bullish retracement toward 3360–3380, aligning with trendline retest and potential Kumo rejection.

Expect sellers to re-enter if price retests former BOS/imbalance zone, creating scalp or swing sell setups on confirmation.

---

🔧 Confluences & Technical Highlights:

Confluence Point Description

Demand Zone Strong previous accumulation at 3320–3340

BOS Retest Area Key liquidity level now acting as resistance

Ichimoku Cloud Price below cloud = bearish bias maintained

Descending Trendline Reinforces bearish structure unless broken

Price Action Rejection wick at demand + potential short squeeze

---

🎯 Trade Outlook:

🧭 Bias: Short-Term Bullish Rebound → Long-Term Bearish Continuation

🟩 Support: 3320 – 3340

🟥 Resistance: 3360 – 3385 (BOS & Trendline zone)

🔁 Scenario: Bounce → Retest → Continuation lower (unless breakout confirmed)

---

📘 Why This Chart Could Be Featured:

✅ Multi-layered Analysis: BOS, zones, cloud, price action, and psychological zones used together.

✅ Forward-Looking: Projects the next logical market reaction instead of just explaining the past.

✅ Clean, Structured, Educational: Layout and visuals guide the viewer through logical trade steps.

✅ Value-Packed: Provides actionable levels and flexible scenarios — helpful to traders of all levels.

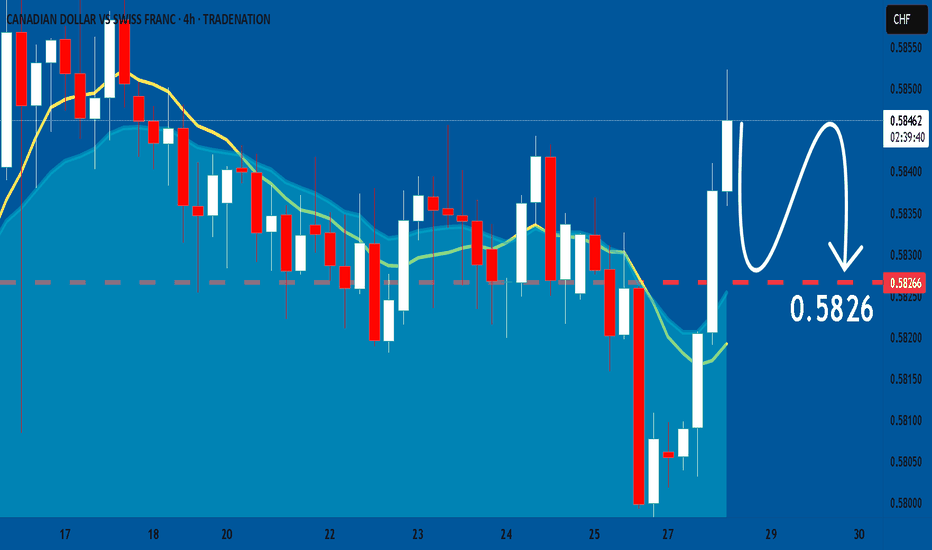

CADCHF: Market of Sellers

The recent price action on the CADCHF pair was keeping me on the fence, however, my bias is slowly but surely changing into the bearish one and I think we will see the price go down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NZDJPY: Free Trading Signal

NZDJPY

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy NZDJPY

Entry - 88.612

Stop - 88.524

Take - 88.757

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

USDJPY: Market of Sellers

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current USDJPY chart which, if analyzed properly, clearly points in the downward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

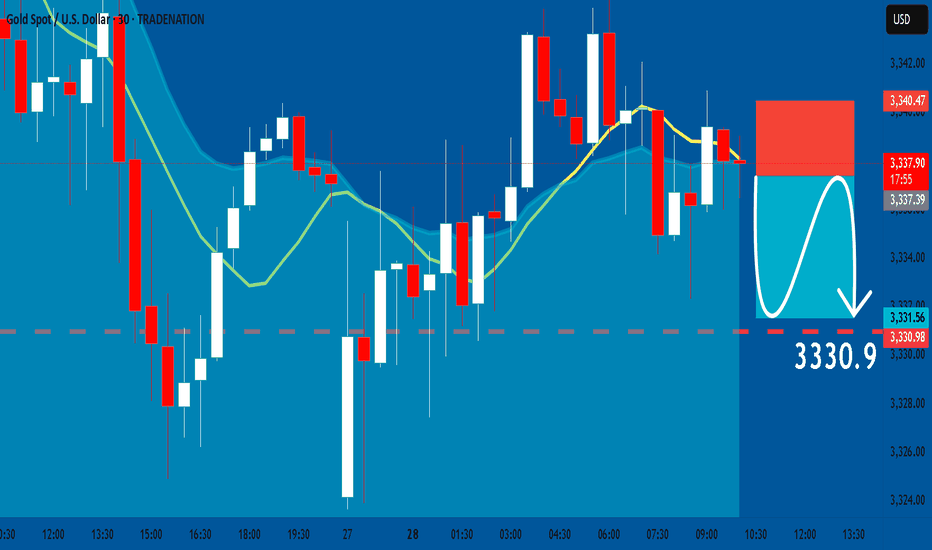

GOLD: Short Trade with Entry/SL/TP

GOLD

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short GOLD

Entry Point - 3337.3

Stop Loss - 3340.4

Take Profit - 3330.9

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

CRUDE OIL REBOUND AHEAD|LONG|

✅CRUDE OIL is going down now

But a strong support level is ahead at 64.69$

Thus I am expecting a rebound

And a move up towards the target of 65.50$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

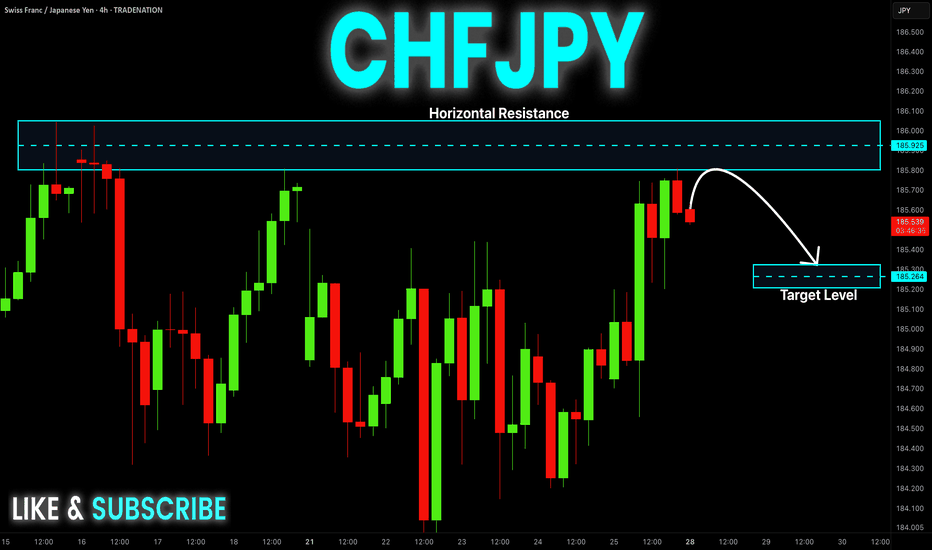

CHF-JPY Short From Resistance! Sell!

Hello,Traders!

CHF-JPY keeps trading in

An uptrend and the pair

Is locally overbought so after

The pair hits the horizontal

Resistance level of 186.000

We will be expecting a local

Bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

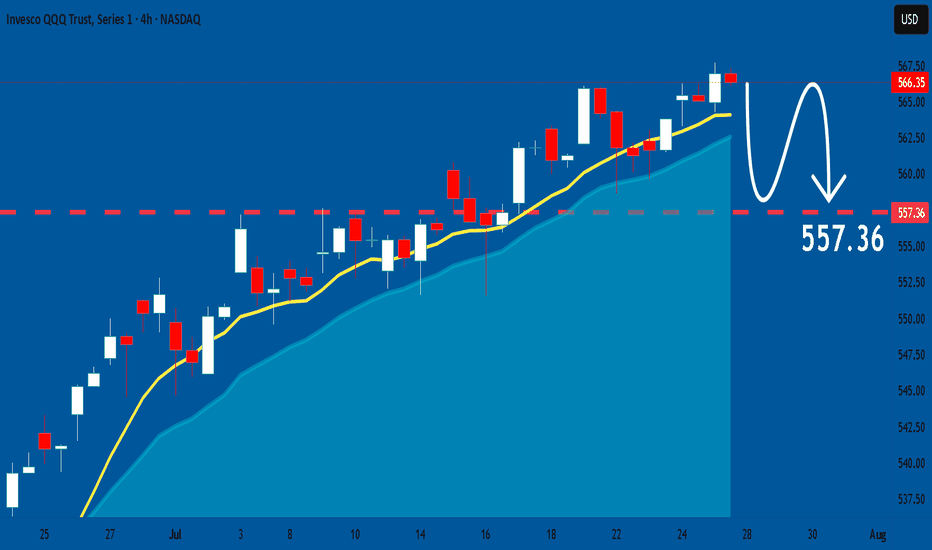

QQQ: Price Action & Swing Analysis

The analysis of the QQQ chart clearly shows us that the pair is finally about to tank due to the rising pressure from the sellers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

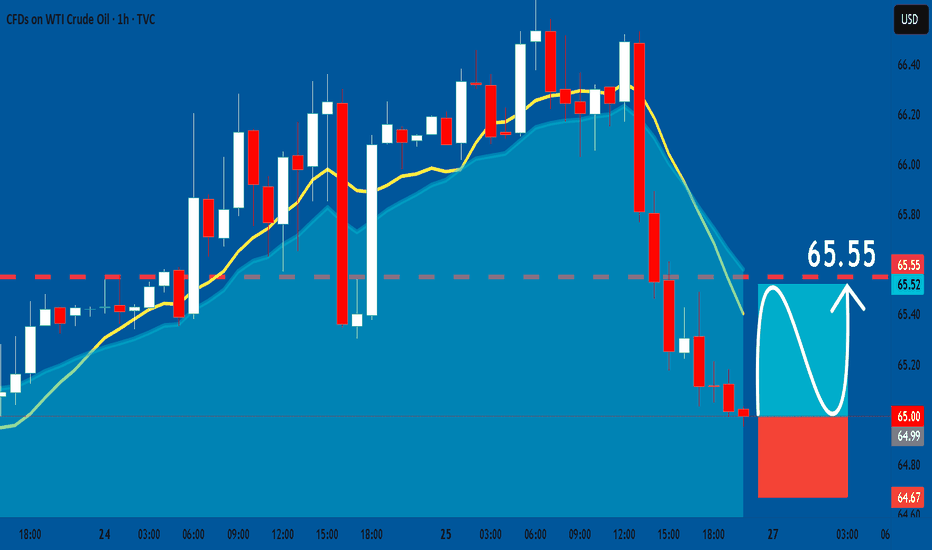

USOIL: Long Trade with Entry/SL/TP

USOIL

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long USOIL

Entry Point - 65.00

Stop Loss - 64.67

Take Profit - 65.55

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️