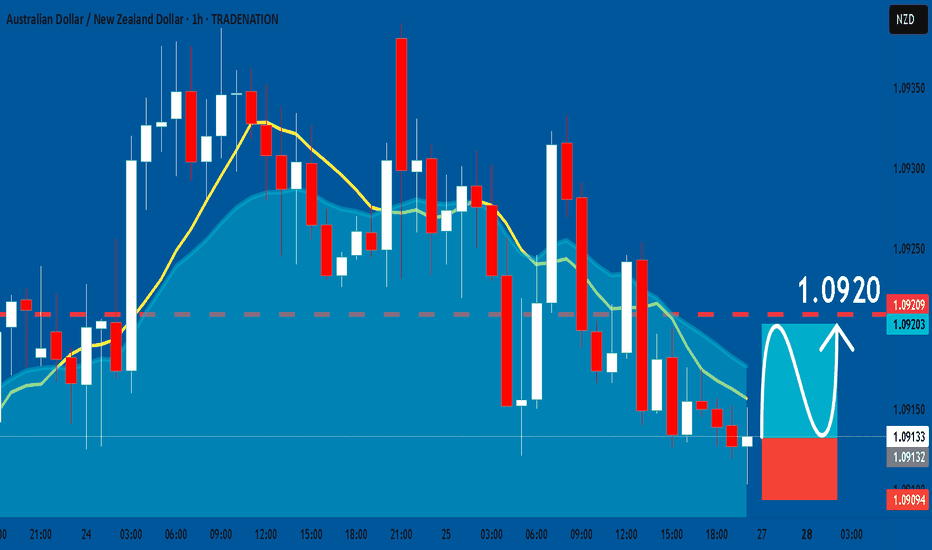

AUDNZD: Bullish Continuation & Long Trade

AUDNZD

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy AUDNZD

Entry Level - 1.0913

Sl - 1.0909

Tp - 1.0920

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Smartmoney

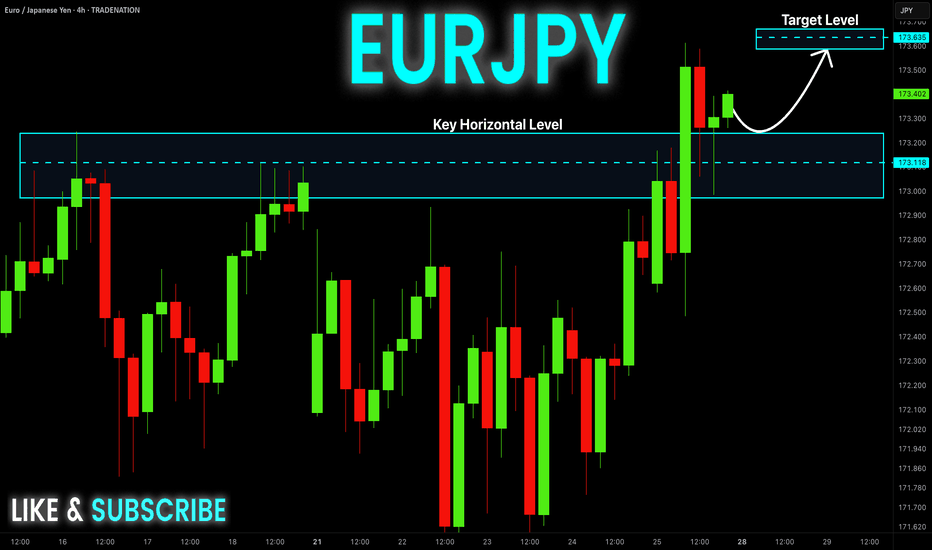

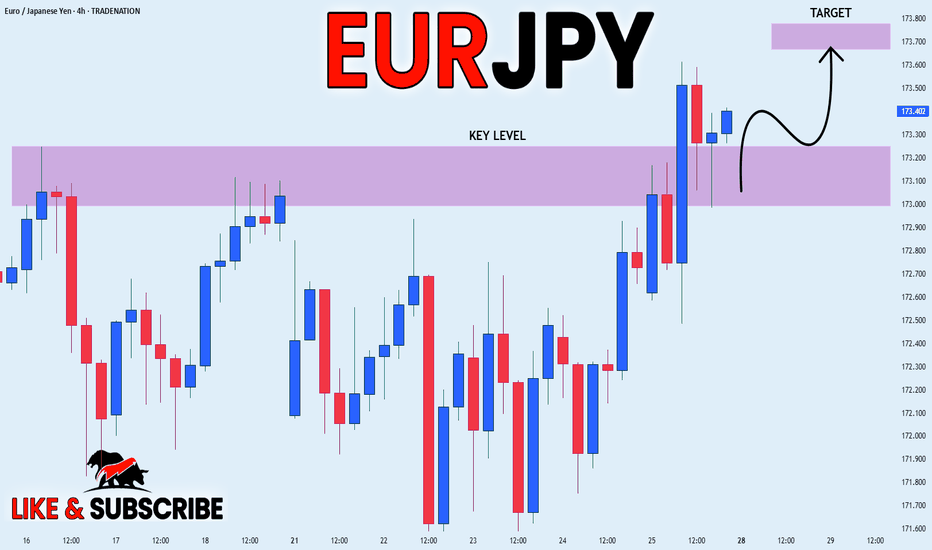

EUR-JPY Local Long! Buy!

Hello,Traders!

EUR-JPY is trading in an

Uptrend and the pair made

A breakout, a retest and

A bullish rebound from the

Horizontal support of 173.200

So we are bullish biased and

We will be expecting a

Further bullish move up

On Monday!

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

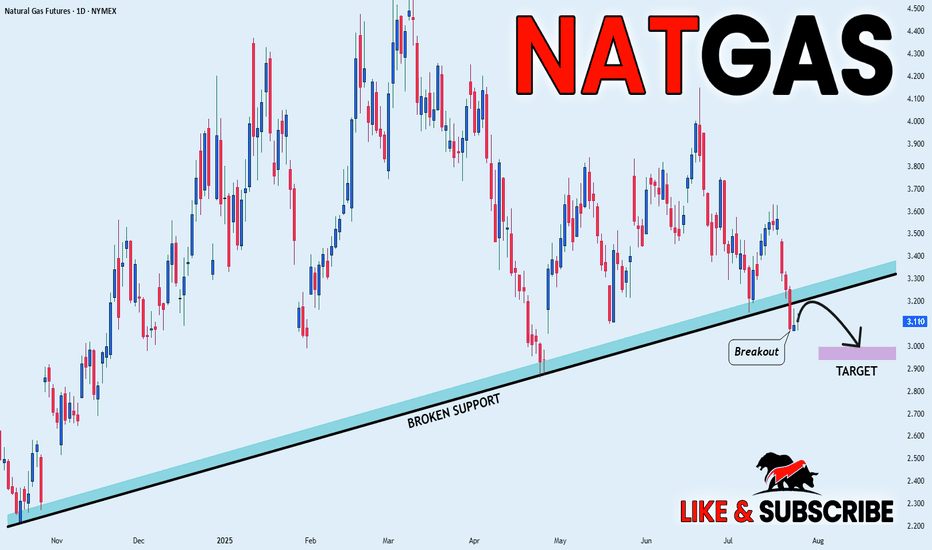

NATGAS BEARISH BREAKOUT|SHORT|

✅NATGAS broke the rising support

While trading in an local downtrend

Which makes me bearish

And I think that after the retest of the broken line is complete

A rebound and bearish continuation will follow

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

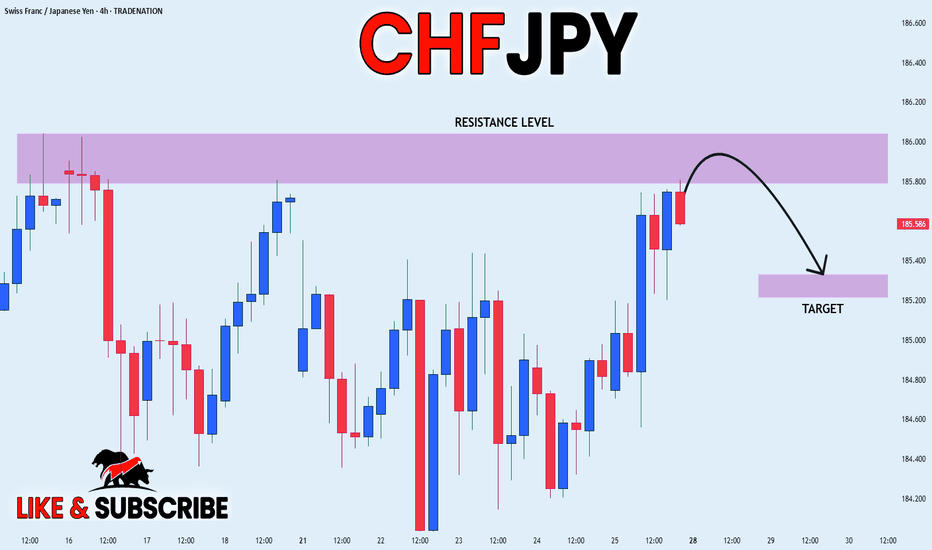

CHF_JPY RISKY SHORT|

✅CHF_JPY is going up now

But a strong resistance level is ahead at 186.036

Thus I am expecting a pullback

And a move down towards the target of 185.329

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

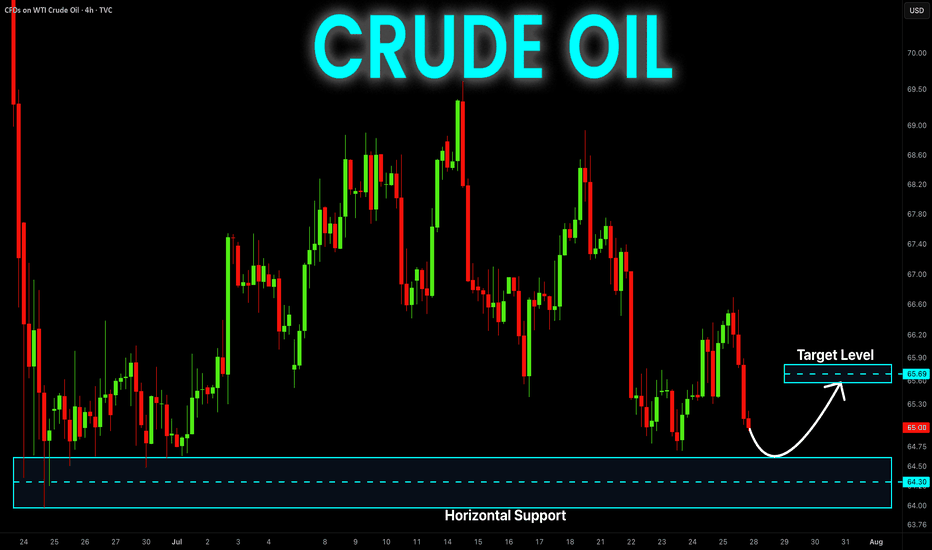

CRUDE OIL Risky Long! Buy!

Hello,Traders!

CRUDE OIL will soon hit

A horizontal support

Of 64.50$ and as it is

A strong level we will be

Expecting a local bullish

Rebound on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

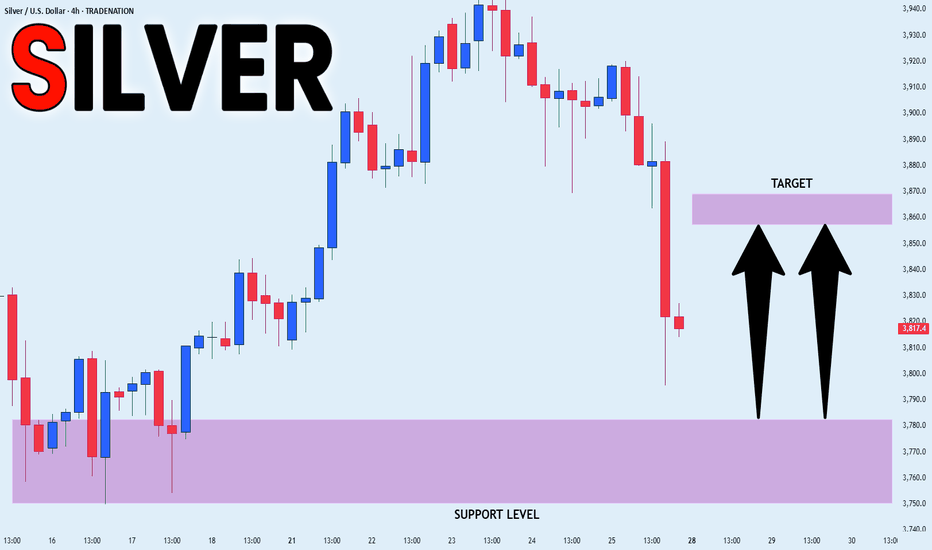

SILVER SUPPORT AHEAD|LONG|

✅SILVER has been falling recently

And Silver seems locally oversold

So as the pair is approaching

A horizontal support of 37.80$

Price growth is to be expected

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

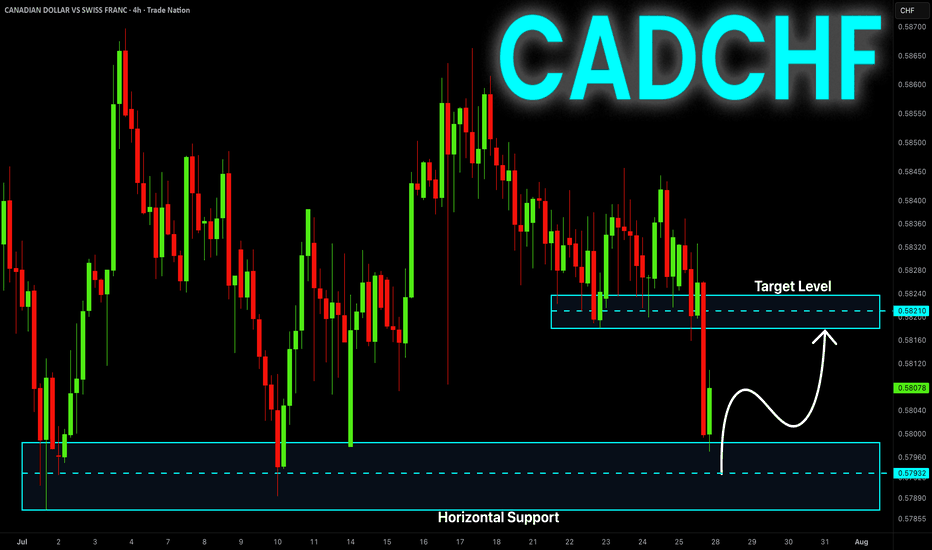

CAD-CHF Local Rebound Ahead! Buy!

Hello,Traders!

CAD-CHF made a retest

Of the horizontal support

At 0.5797 from where we

Are already seeing a bullish

Reaction so we will be

Expecting a further local

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

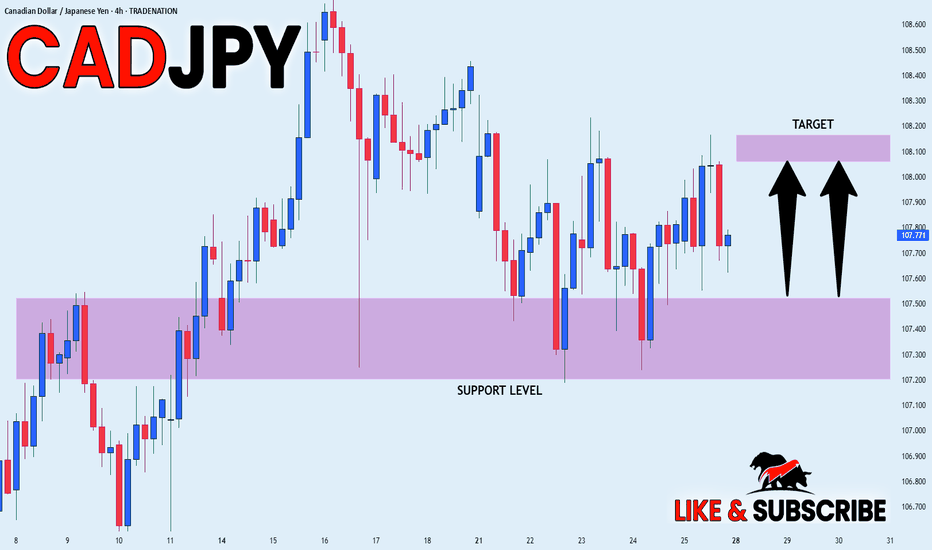

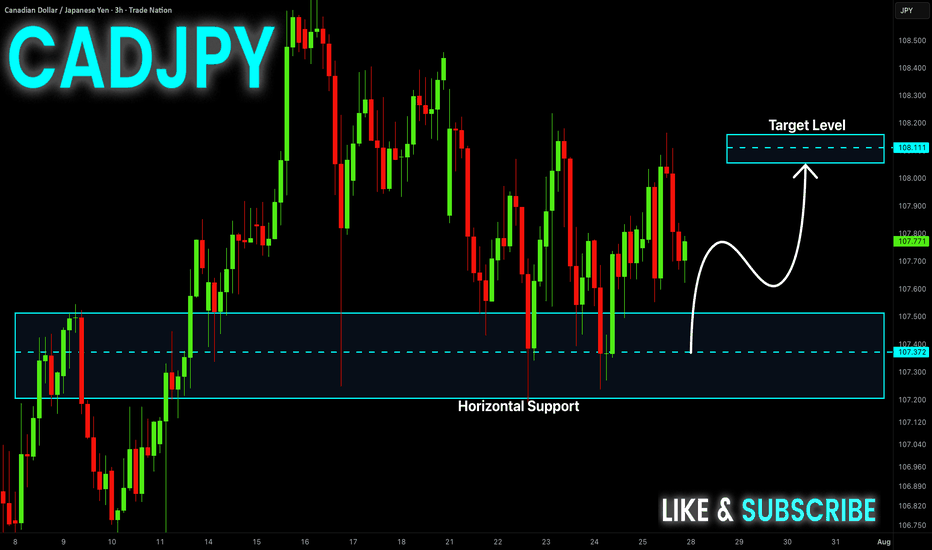

CAD_JPY WILL GO UP|LONG|

✅CAD_JPY will soon retest a key support level of 107.500

So I think that the pair will make a rebound

And go up to retest the supply level above at 108.100

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

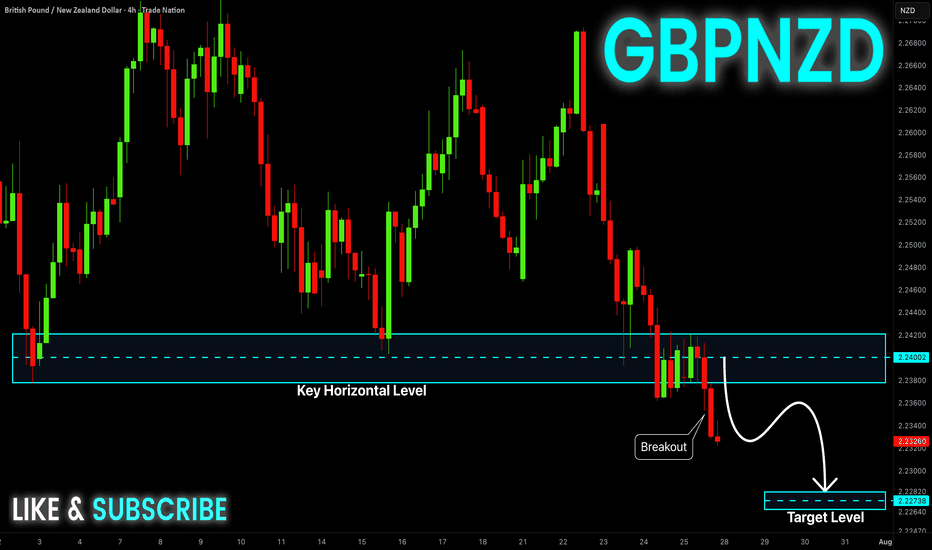

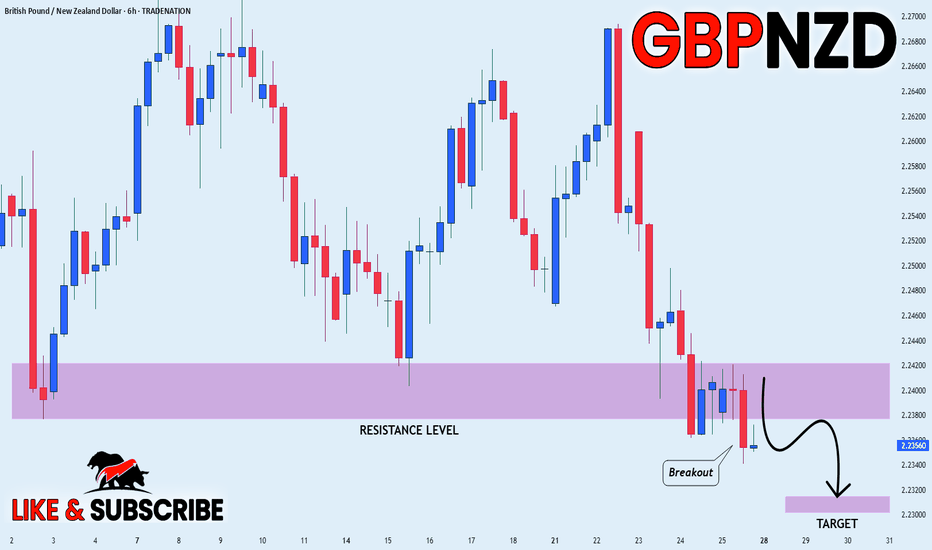

GBP-NZD Will Keep Falling! Sell!

Hello,Traders!

GBP-NZD keeps falling down

And the pair made a strong

Bearish breakout of the key

Horizontal key level of 2.2400

And the breakout is confirmed

So we are bearish biased and

We will be expecting a further

Bearish move down on Monday

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_JPY WILL GROW|LONG|

✅EUR_JPY will keep growing

Because the pair is in the uptrend

And recently broke the key level of 173.200

So we will be expecting

Bullish continuation

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

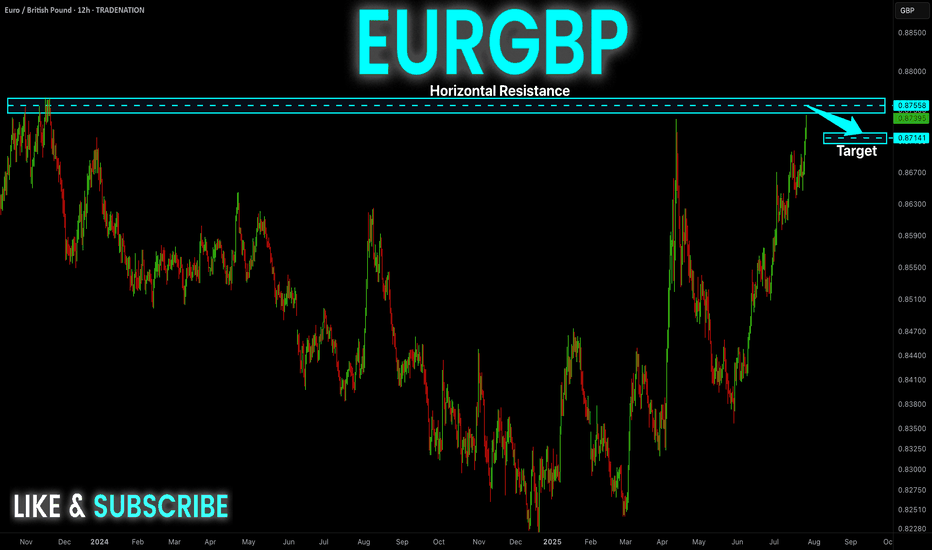

EUR-GBP Swing Short! Sell!

Hello,Traders!

EUR-GBP keeps growing in

A strong uptrend but the pair

Is locally overbought so after

The price hits a horizontal

Resistance level of 0.8764

We will be expecting a

Local bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

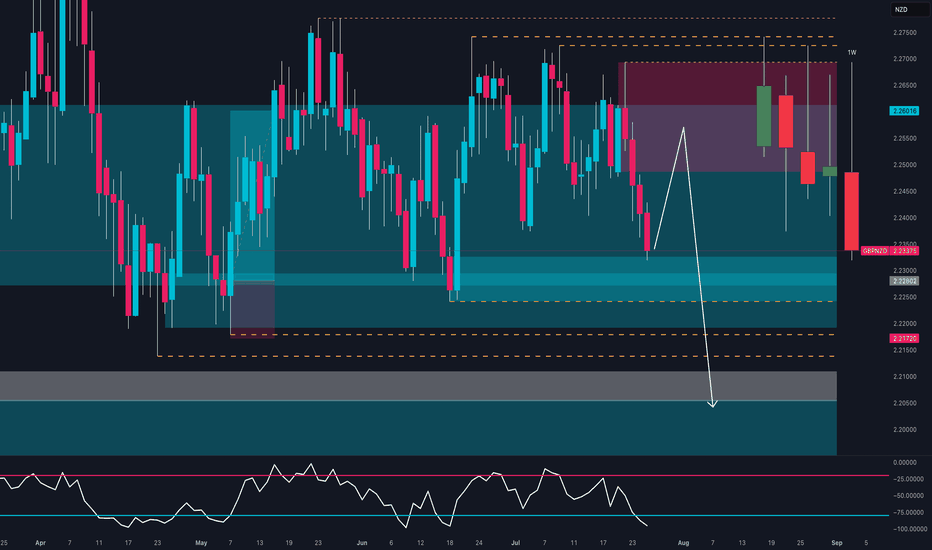

GBPNZD Breakdown – Smart Money Turns Fully Bearish🧠 Macro + COT + Sentiment Context

Commitment of Traders (COT) – Asset Managers

Institutional asset managers are significantly net short on GBPNZD, with positioning at its lowest level of the year and declining sharply since May. This reflects a clear bearish stance from smart money and reinforces the current downward pressure.

Sentiment & Momentum Indicators

DPO: -54.9 → Indicates a moderately bearish momentum phase.

Wyckoff: -20.3 → Price is in a distribution phase, suggesting weakness.

Speed: 3.2 → Low acceleration, but directional bias remains bearish.

Market Mood: Neutral, but leaning into oversold territory.

Seasonality (July 1st – Sept 30th)

Historically, GBPNZD performs positively in this period:

3Y: +1.7%, 5Y: +1.6%, 10Y: +2.3%, 15Y: +2.8%

However, in 2025, price is diverging sharply from seasonal norms. The pair is trading against historical patterns, suggesting a seasonal anomaly where institutional flow is dominating historical behavior.

🧱 Technical Outlook (Daily Chart)

GBPNZD had been consolidating in a clear range between 2.2170 support and 2.2750 resistance since May. The pair has now broken down with a strong, full-bodied weekly candle, closing below the 2.2320 demand zone.

Key Technical Zones:

Supply zone (2.2494–2.2659) → A clear rejection zone that initiated the current selloff.

Demand zone (2.2170–2.2300) → Has been tested twice already, increasing the probability of a clean breakdown.

RSI (Daily) → Currently neutral, with a sequence of lower highs and no bullish divergence in sight — indicating weak momentum.

✅ Conclusion & Trade Plan

Directional Bias: Bearish (Short)

Although seasonality typically supports bullish price action for GBPNZD in Q3, the current context is decisively bearish. Institutional positioning, price structure, and sentiment all confirm a potential shift in direction, reinforced by a confirmed weekly breakdown.

Bearish Targets:

📍 First: 2.2170 (recent support test)

📍 Second: 2.2000–2.1900 (April swing low)

📍 Extension: 2.1750 (base of previous accumulation zone)

Invalidation Criteria:

A weekly close above 2.2490 (supply zone breached)

Bullish RSI divergence + weekly recovery candle

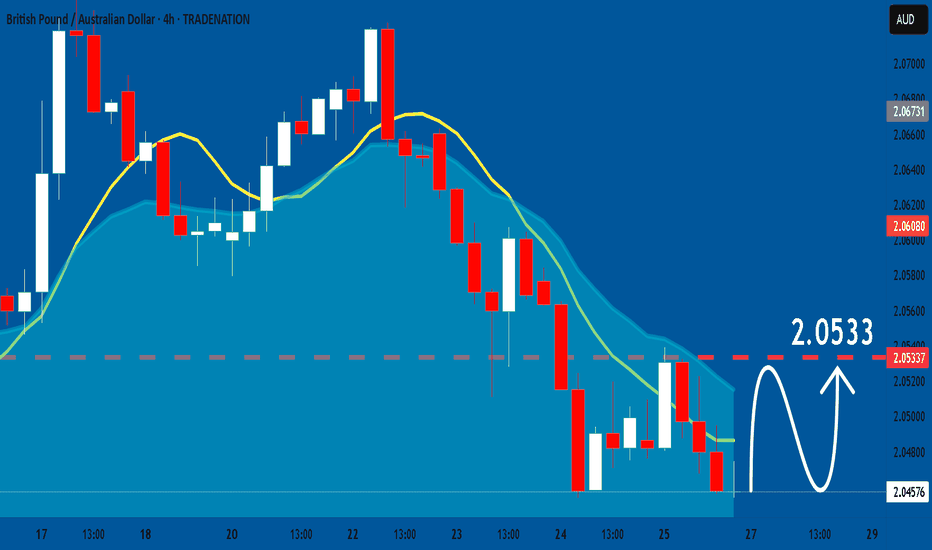

GBPAUD: Bullish Forecast & Outlook

Balance of buyers and sellers on the GBPAUD pair, that is best felt when all the timeframes are analyzed properly is shifting in favor of the buyers, therefore is it only natural that we go long on the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

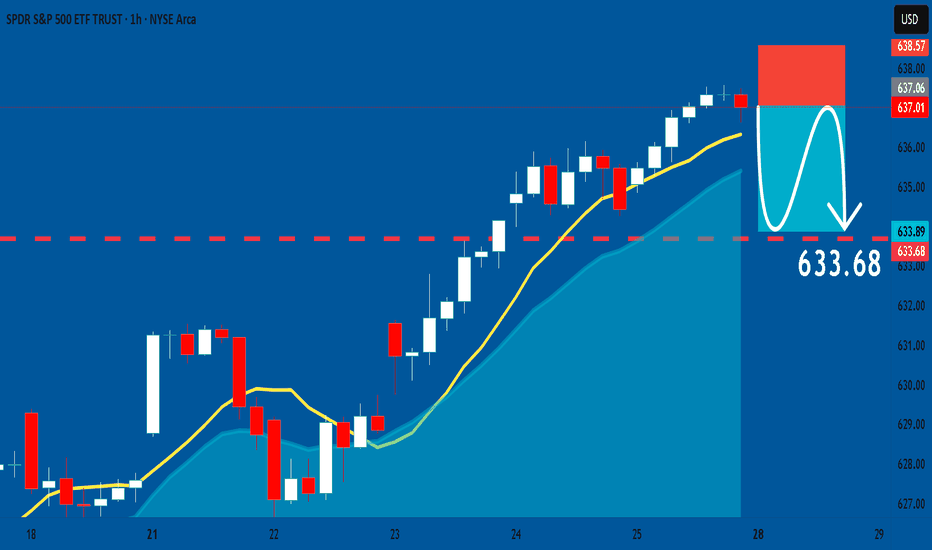

SPY: Bearish Continuation & Short Signal

SPY

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short SPY

Entry Point - 637.01

Stop Loss - 638.57

Take Profit - 633.58

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

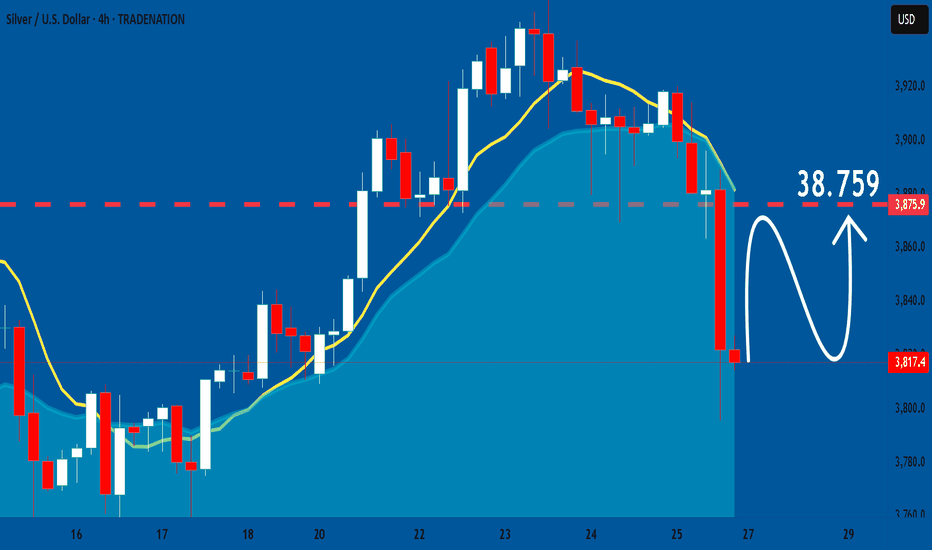

SILVER: Expecting Bullish Continuation! Here is Why:

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the SILVER pair price action which suggests a high likelihood of a coming move up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

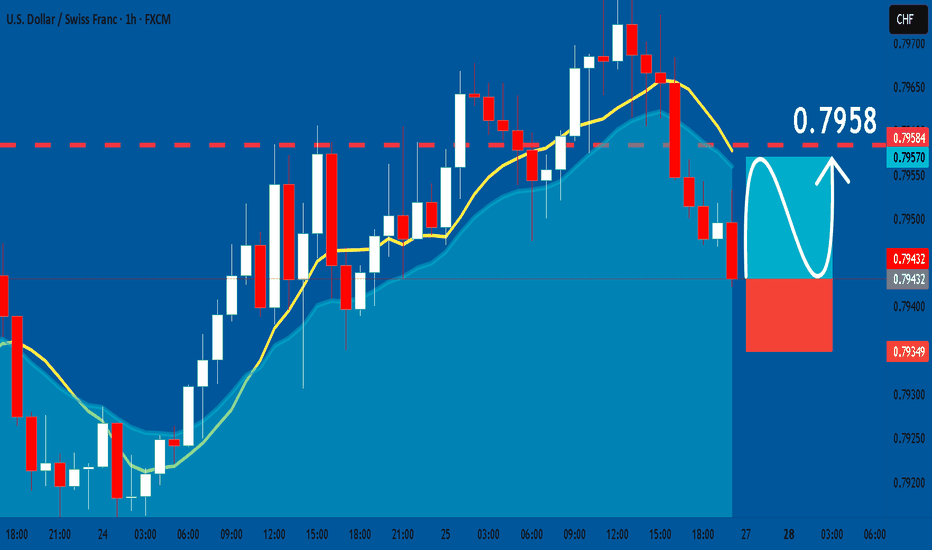

USDCHF: Long Signal Explained

USDCHF

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long USDCHF

Entry - 0.7943

Sl - 0.7934

Tp - 0.7958

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

CAD-JPY Rebound Ahead! Buy!

Hello,Traders!

CAD-JPY made a retest

Of the horizontal support

Of 107.400 from where we

Are already seeing a bullish

Rebound and we will be

Expecting a further bullish

Move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

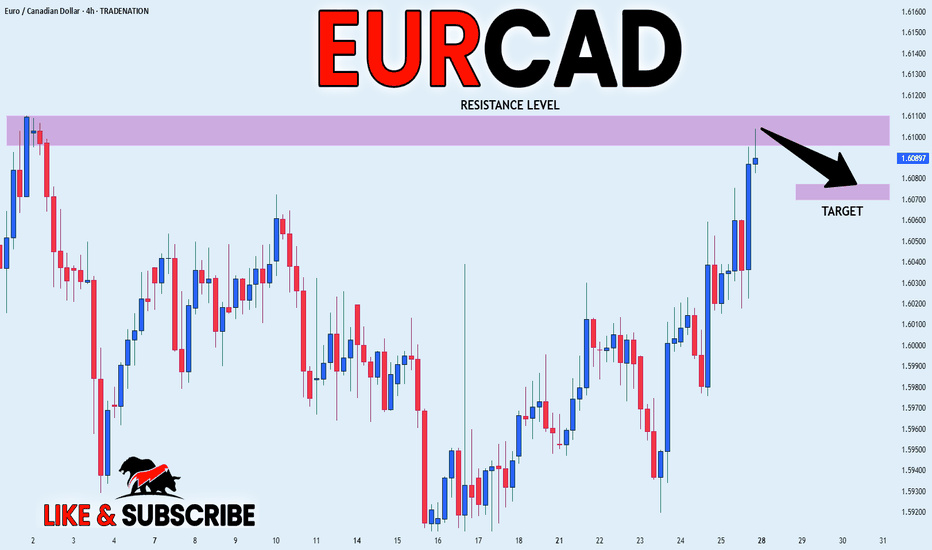

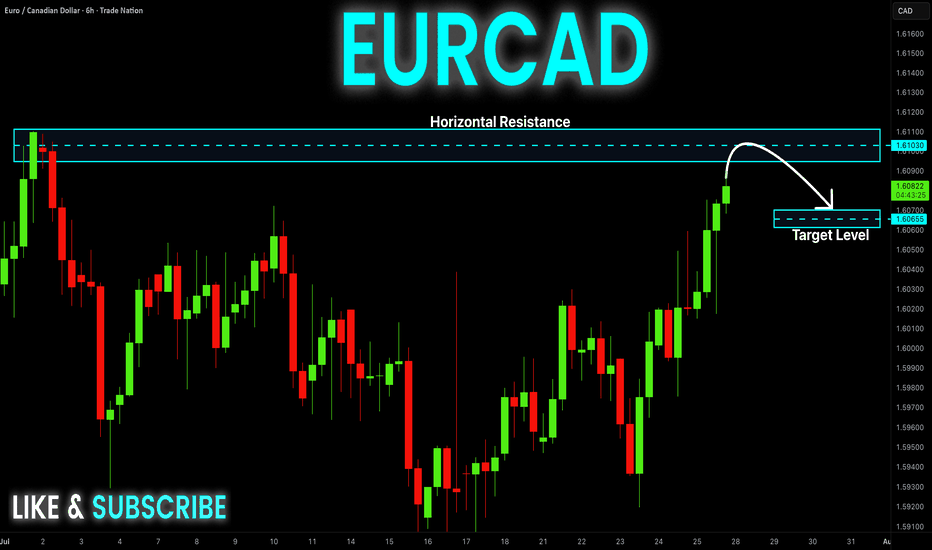

EUR_CAD LOCAL SHORT|

✅EUR_CAD is going up to retest

A horizontal resistance of 1.6110

Which makes me locally bearish biased

And I think that we will see a pullback

And a move down from the level

Towards the target below at 1.6077

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

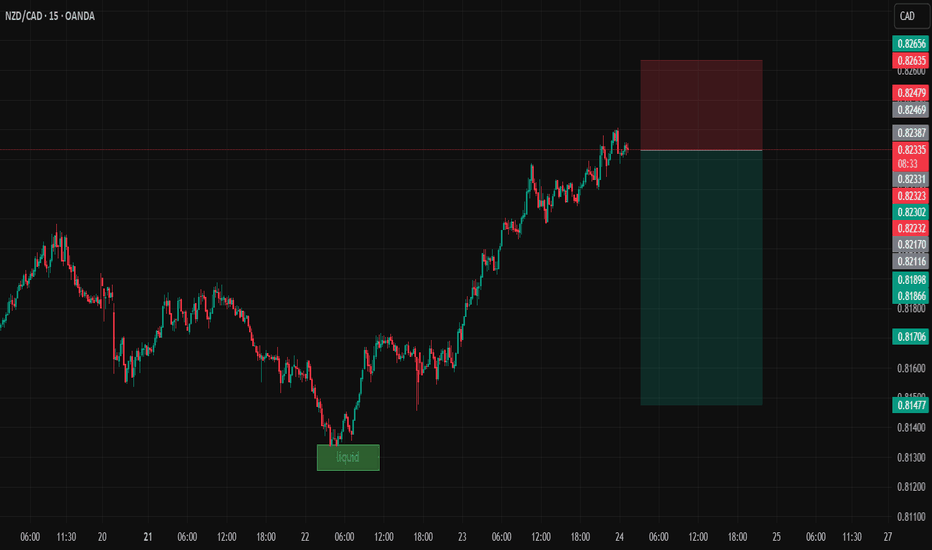

NZDCADDate:

July 24,2025

Session:

Tokyo and London session

Pair:

NZDCAD

Bias:

Short

liquidity pool that is waiting to be swept this week. Looks like price is gonna be magnetized towards that pool level during London and Tokyo. The trade may even stretch into NYC.

Entry: 0.82331

Stop Loss: 0.82635

Target: 0.81475

RR: 2.81

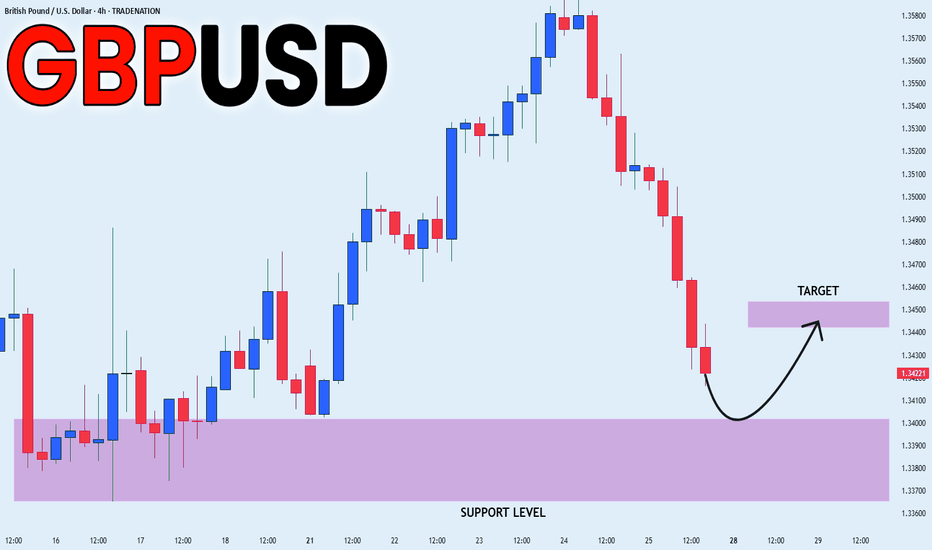

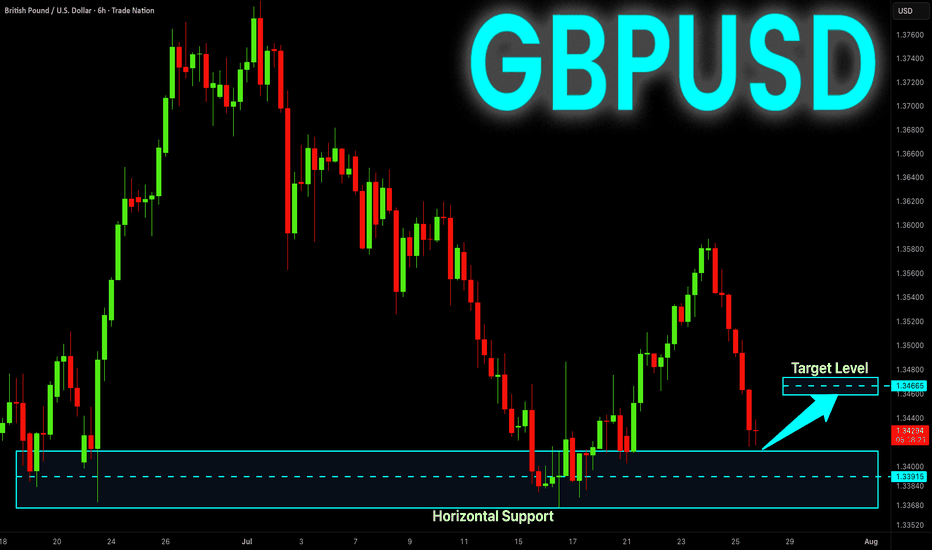

GBP_USD LONG FROM SUPPORT|

✅GBP_USD has been falling recently

And the pair seems locally oversold

So as the pair is approaching

A horizontal support of 1.3399

Price growth is to be expected

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-CAD Risky Short! Sell!

Hello,Traders!

EUR-CAD is trading in a

Strong uptrend so we are

Bullish biased long-term

However a strong horizontal

Resistance is ahead at 1.6110

And the pair is overbought

So after the retest of the

Resistance we will be

Expecting a bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP_NZD BEARISH BREAKOUT|SHORT|

✅GBP_NZD is going down currently

As the pair broke the key structure level of 2.2400

Which is now a resistance, and after the pullback

And retest, I think the price will go further down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP-USD Support Ahead! Buy!

Hello,Traders!

GBP-USD went down but

The pair will soon hit a

Horizontal support level

Of 1.3400 from where we

Will be expecting a local

Rebound and a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.