GOLD Support Ahead! Buy!

Hello,Traders!

GOLD keeps falling just

As I predicted but the price

Will soon hit a horizontal support

Around 3235$ from where we

Will be expecting a local

Bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Smartmoney

EUR_AUD LOCAL SHORT|

✅EUR_AUD is going up now

But a strong resistance level is ahead at 1.8018

Thus I am expecting a pullback

And a move down towards the target of 1.7900

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Waiting for the Liquidity Flush – Will We Get That Drop or a StoCurrently holding a short position and have been waiting for a decent liquidity flush towards my TP zone for almost a day now. The thing that bothers me is how slow the price action is—it's grinding lower, but at the same time, building up a new liquidity shelf just above my entry.

This makes me concerned that we might see a quick liquidity sweep to the upside (taking out stops, possibly including mine) before any real move down happens. The area around my TP is loaded with liquidity, but the market seems hesitant to make that push.

What’s your opinion—are we likely to get that clean drop soon, or should we brace for a fake-out and stop hunt first?

BTCUSD: Bearish Continuation & Short Signal

BTCUSD

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell BTCUSD

Entry - 10686

Stop - 10837

Take - 10422

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EURUSD: Short Trading Opportunity

EURUSD

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short EURUSD

Entry Point - 1.1717

Stop Loss - 1.1764

Take Profit - 1.1614

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

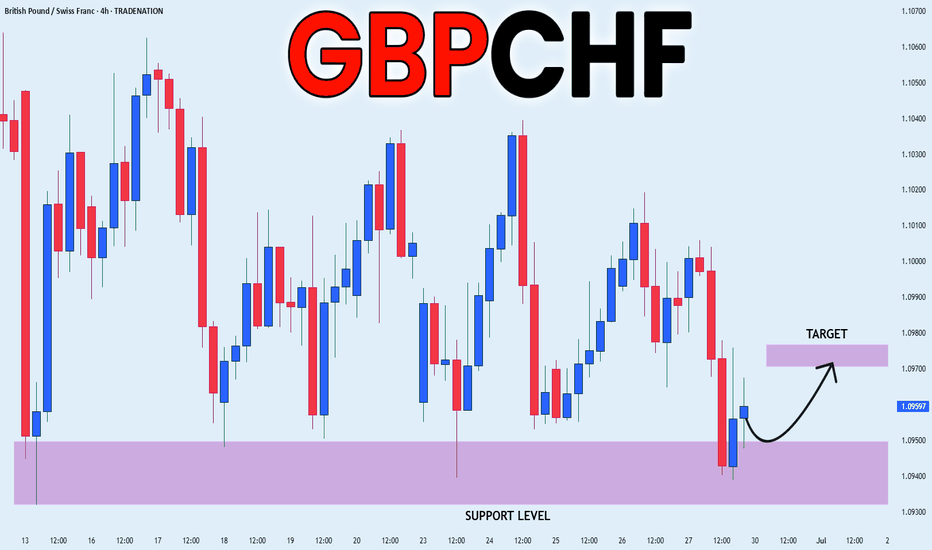

GBPCHF: Will Start Growing! Here is Why

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the GBPCHF pair price action which suggests a high likelihood of a coming move up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NATGAS: Forecast & Trading Plan

The analysis of the NATGAS chart clearly shows us that the pair is finally about to tank due to the rising pressure from the sellers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NZD-JPY Potential Short! Sell!

Hello,Traders!

NZD-JPY is slowly approaching

A horizontal resistance level

Around 87.994 so despite

The strong uptrend

We will be expecting a

Local bearish pullback on Monday

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DXY Swing Short! Sell!

Hello,Traders!

DXY keeps falling down

And the index broke the

Key wide horizontal level

Around 97.800 which is now

A resistance and the breakout

Is confirmed so we are very

Bearish biased and we will

Be expecting a bearish

Continuation on Monday

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP_CHF RISKY LONG|

✅GBP_CHF fell down sharply

But a strong support level was hit at 1.0932

Thus as a rebound is already happening

A move up towards the target of 1.0970 shall follow

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD_JPY SHORT FROM RESISTANCE|

✅NZD_JPY is set to retest a

Strong resistance level above at 88.000

After trading in a local uptrend for some time

Which makes a bearish pullback a likely scenario

With the target being a local support below at 87.341

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CHF-JPY Local Long! Buy!

Hello,Traders!

CHF-JPY is trading in a strong

Uptrend and the pair made a

Bullish breakout from the bullish

Triangle pattern and is now seems

To be consolidating above the

Support cluster around 180.740

So we are bullish biased and

We will be expecting a further

Bullish move up on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD_NZD LOCAL LONG|

✅AUD_NZD is trading along the rising support line

And as the pair is going up now

After the retest of the line

I am expecting the price to keep growing

To retest the supply levels above at 1.0789

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD-CHF Will Fall! Sell!

Hello,Traders!

USD-CHF keeps falling down

And the pair broke the key

Horizontal level of 0.8090

Decisively so we are bearish

Biased and we will be expecting

A further move down next week

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DXY STRONG DOWNTREND CONTINUES|SHORT|

✅DXY is going down currently

In a strong downtrend and the index

Broke the key structure level of 98.000

Which is now a resistance,

And after the pullback

And retest, I think the price

Will go further down next week

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-NZD Bullish Bias! Buy!

Hello,Traders!

EUR-NZD is trading in a

Strong uptrend and the pair

Is printing higher highs and

Higher lows while breaking

Important key levels such

As 1.9270 which is now

A support and the pair

Is consolidating above the

New support so we are

Bullish biased and we will

Be expecting a further move

Further up on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USOIL: Long Trading Opportunity

USOIL

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy USOIL

Entry - 65.03

Stop - 62.60

Take - 69.73

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPAUD: Short Trade Explained

GBPAUD

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell GBPAUD

Entry Level - 2.1010

Sl - 2.1065

Tp - 2.0874

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

SPY: Bearish Continuation is Expected! Here is Why:

Looking at the chart of SPY right now we are seeing some interesting price action on the lower timeframes. Thus a local move down seems to be quite likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

SILVER: Bulls Will Push

The price of SILVER will most likely increase soon enough, due to the demand beginning to exceed supply which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBP-CHF Rebound Ahead! Buy!

Hello,Traders!

GBP-CHF is hovering above

The wide horizontal demand

Level around 1.0926 from

Where we are already

Seeing a bullish rebound

So a further local bullish

Move up is to be expected

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD 4H: not all that glitters is bullish...The 4H chart shows a clean descending triangle breakdown. Price failed to reclaim the trendline and was rejected under both MA50 and MA200. The bounce into 3325–3340 was absorbed — classic liquidity sweep and fade. Volume confirms bearish control.

Technically, the breakdown below 3320 opens the way toward $3293 (1.0 Fibo), $3250 (1.272 extension), and final target at $3195 (1.618), where buyers might step in. RSI supports the continuation without signs of reversal. Structure broke — and the market is telling us where it's heading.

Tactical plan:

— Entry at market or on a retest of $3325–3335

— Targets: $3293 → $3250 → $3195

— Stop: above $3340 (above MA50 and broken trendline)

When gold looks shiny, smart traders look deeper. This breakout isn’t golden — it’s a trap for late bulls.

Soybeans Crashing Into Demand — Reversal Coming or Trap?1. COT REPORT — Updated June 17, 2025

📌 Non-Commercials (Speculators)

Long: +5,661 → 195,984

Short: -9,226 → 110,761

✅ Net Long Increase: A clear bullish shift in speculative positioning (+14,887 net contracts). This is an early indication of a sentiment reversal.

📌 Commercials (Hedgers / Producers)

Long: +6,023

Short: -5,806

➡️ The decrease in net shorts suggests improving confidence among institutional players.

📌 Total Open Interest: 846,169 (down by 12,776)

❗ This slight drop may be linked to position rotation or partial profit-taking.

2. NET POSITIONS CHART INSIGHT

Commercial traders remain structurally net short, but their exposure has been gradually declining since March.

Non-commercial traders have increased their net long positions since April, aligned with the price's technical recovery.

The current price is trading near the historical mean, indicating neutral conditions with potential room for further upside.

🕰️ 3. SEASONALITY OUTLOOK

The June–July period has historically been bearish:

June Average Performance:

Last 5 years: -39.61

Last 2 years: -38.71

July Average Performance:

Last 20 years: -44.82

Last 2 years: -34.73

📉 August and September typically continue this seasonal downtrend.

🟨 Caution is advised on initiating long positions during this phase.

📊 4. TECHNICAL OUTLOOK —

Current Structure:

Rising channel has broken to the downside with a strong bearish impulse candle.

RSI is neutral but previously showed bearish divergence.

Key Support Zones:

1035–1025: Intermediate support area already tested.

1012–994: Golden Pocket aligned with a demand block — likely target zone with high potential for reaction.

Possible Scenarios:

🔴 Bearish Continuation: A retracement followed by a move down into the 994–1000 range, where a tactical long setup may emerge.

🔵 Bull Trap and Reversal: A rapid recovery above 1050, potentially triggering a continuation to 1080 (range top).

5. EXECUTION SUMMARY

Primary Bias: Bearish in the short term

🎯 Target Zone: 994–1000

🛑 Invalidation Level: Weekly close above 1055

Tactical Long Setup: Monitor price action at 994–1000 for bullish reaction.

Macro context and speculative positioning suggest a structural bottom may develop in Q3 2025, but current conditions are not yet favorable for a full swing position.

CADCHF at the Cliff's Edge – Is a Breakdown Imminent? 🧭 Technical Context

Price is currently sitting at the key support area of 0.5890–0.5900, tested multiple times since April.

This week’s candlestick shows a clear close below the intermediate micro-structure (two consecutive closes under recent lows), confirming bearish pressure.

The weekly RSI remains in a neutral-to-low zone, trending downwards with no active bullish divergence.

📉 Technical Conclusion: Active bearish bias. Watch out for potential false breaks below 0.5890 as liquidity traps.

📊 COT Report – as of June 17, 2025

🇨🇦 CAD

Non-Commercials: added +8.5k long contracts, aggressively cut −18.3k shorts

→ Excessive optimism, potential exhaustion on the buy-side

Commercials: added +31k shorts

→ Typical hedge behavior – signaling protection from CAD devaluation

🇨🇭CHF

Net positions in gradual decline with no sharp moves → CHF remains in consolidation, with a defensive tone

Open Interest dropped by −19.5k → Institutional money exiting positions

→ Interpretation: Market likely preparing for a directional breakout, CHF could act as a safe haven

📉 COT Conclusion: CAD appears overbought, CHF still gathering strength. Bearish bias on CADCHF remains intact.

📅 Seasonality – June Pattern

CHF tends to strengthen in June:

+0.0095 (10Y average), +0.0068 (5Y average)

CAD shows structural weakness in June:

−0.0027 (10Y), −0.0076 (5Y)

📉 Seasonality Conclusion: June favors CAD weakness and CHF strength → Bearish confirmation for CADCHF

🧠 Retail Sentiment

92% of retail traders are long CADCHF, only 8% are short

→ Extreme imbalance = classic contrarian signal

📉 Sentiment Conclusion: Confirms potential for continued downside on CADCHF

✅ Trade Plan Summary

📌 Base scenario:

Short CADCHF if we get a daily/weekly close below 0.5890

🎯 Target 1: 0.5820

🎯 Target 2: 0.5770

🚫 Invalidation: daily close above 0.5960 (invalidates current setup)

📌 Alternative scenario:

Short from 0.5960–0.6000 if we get a bearish rejection pattern → ideal for better R/R