Smartmoneyconcepts

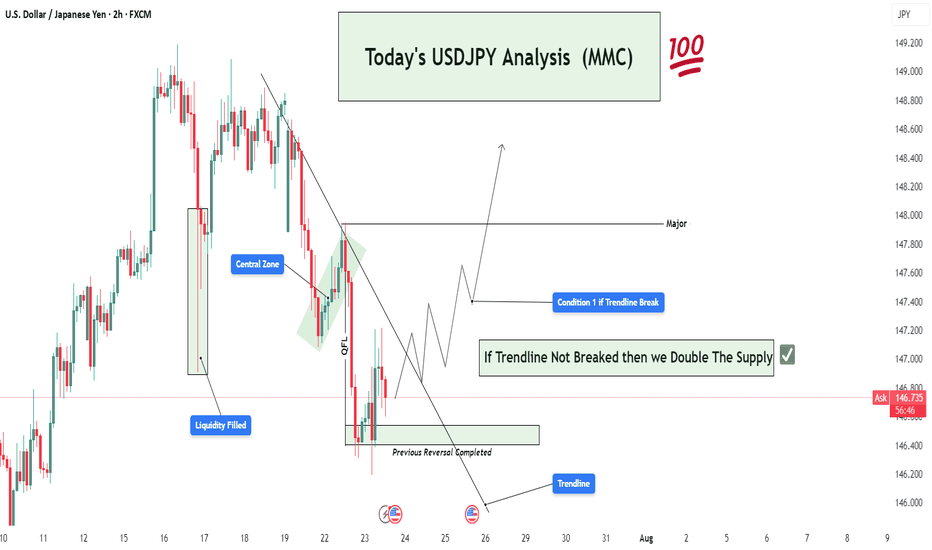

USDJPY 2H Analysis : Trendline Break or Double the Supply?🧠 Market Context:

The market has recently undergone a liquidity grab followed by a temporary bullish reaction, indicating that large players (institutions or market makers) are manipulating price around sensitive zones before committing to a direction.

🧱 Key Technical Zones & Observations:

🟩 1. Liquidity Filled Zone (Smart Money Move)

Location: Around July 17.

Explanation: Price dropped impulsively into a pre-marked liquidity pocket. This filled buy-side liquidity resting below previous lows.

Implication: Smart money has now captured trapped breakout sellers. Expectation of reversal or bullish mitigation.

🟧 2. Central Zone (Supply/Distribution Area)

This zone was tested multiple times, signaling it as a supply-rich region.

Acted as a base for previous strong bearish move.

If the trendline is broken, price may retest this Central Zone, potentially acting as resistance again.

🟩 3. QFL Formation (Quantity Following Line)

Nature: Base breakout with a fast snap-back indicates institutional demand.

The structure signals a failed breakdown or liquidation trap.

Actionable Insight: Strong bounce potential here, ideal for sniper long entries if market structure shifts bullish.

🟦 4. Trendline (Critical Validation Tool)

The descending trendline from July 18 has acted as dynamic resistance.

Multiple rejections validate its significance.

Main Conditional Setup hinges on this trendline:

Break = Bullish structure shift

No break = Trend continuation (retest of demand or breakdown)

🔁 5. Previous Reversal Completed

Price action has printed a reversal model (possibly Wyckoff-style accumulation or spring).

Completion of the pattern aligns with upcoming directional decision.

✅ Conditional Trade Scenarios:

🔺 Condition 1: Bullish Breakout Above Trendline

Setup: Price breaks and closes above the trendline with volume and momentum.

Action: Buy on retest of broken trendline or confirmation candle.

Targets:

Short-term: 147.50

Major: 148.00 – strong resistance/supply zone

Validation: Structure shift + momentum + rejection of prior supply.

🔻 Condition 2: Rejection from Trendline (Trendline Holds)

Setup: Price respects the trendline and fails to break.

Action: Short on bearish engulfing/rejection.

Plan: "Double the supply zone" as per your label.

Targets: 146.20 → 146.00 zone

This respects the previous price memory and liquidity void.

🧠 Deeper MMC Insight:

The market is in indecision phase, balancing between continuation and reversal.

Institutional footprints (QFL + liquidity fills + trendline rejections) suggest preparation for a trap-spring-accumulate or distribution-breakdown move.

Watch for fakeouts around the trendline – MMC logic says market makers often induce both directions before committing.

🧭 Trade Management Tips:

If long: Protect below the QFL base.

If short: Watch for manipulation around the Central Zone.

Wait for confirmation: Don’t pre-enter before structure validates direction.

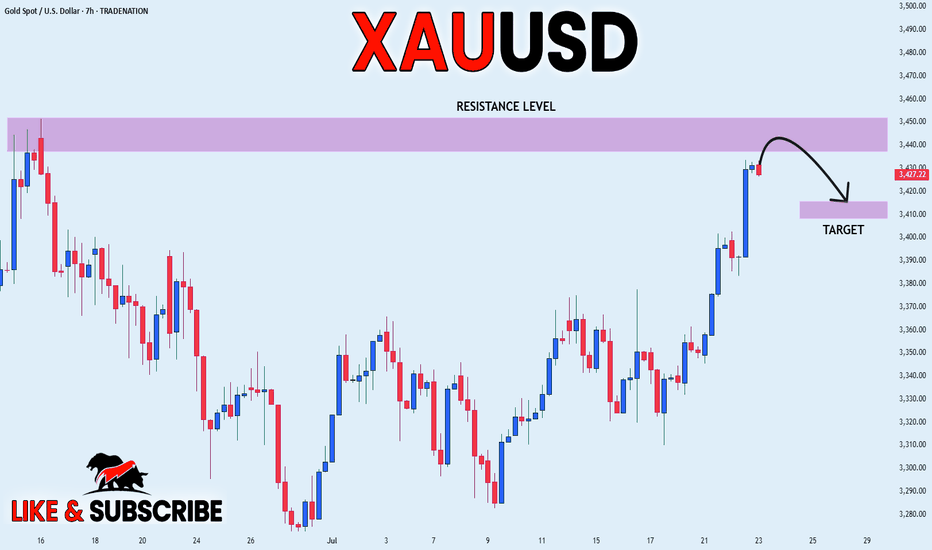

GOLD SHORT FROM RESISTANCE|

✅GOLD is set to retest a

Strong resistance level above at 3450$

After trading in an uptrend for some time

Which makes a bearish pullback a likely scenario

With the target being a local support below at 3414$

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

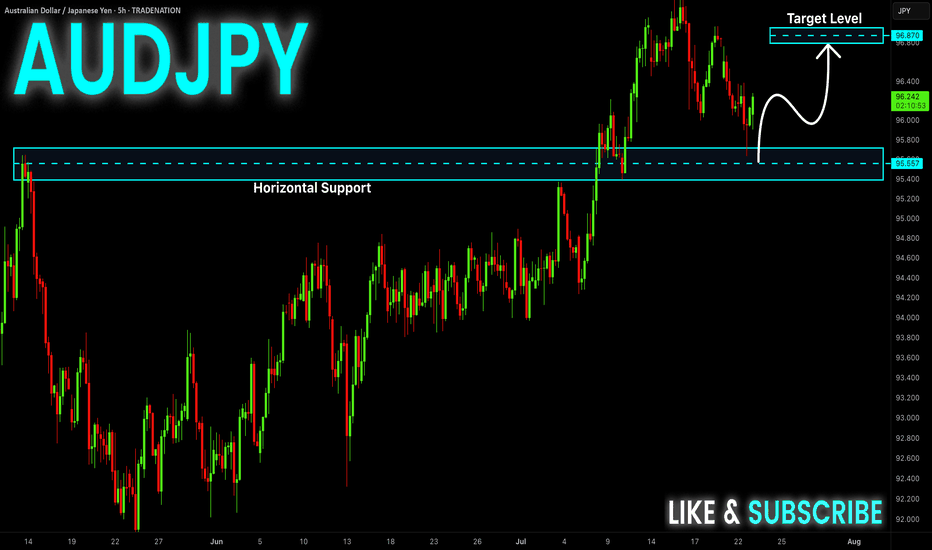

AUD-JPY Will Grow! Buy!

Hello,Traders!

AUD-JPY already made a

Bullish rebound from the

Strong horizontal support

Of 95.610 and as we are

Bullish biased we will be

Expecting a further bullish

Move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

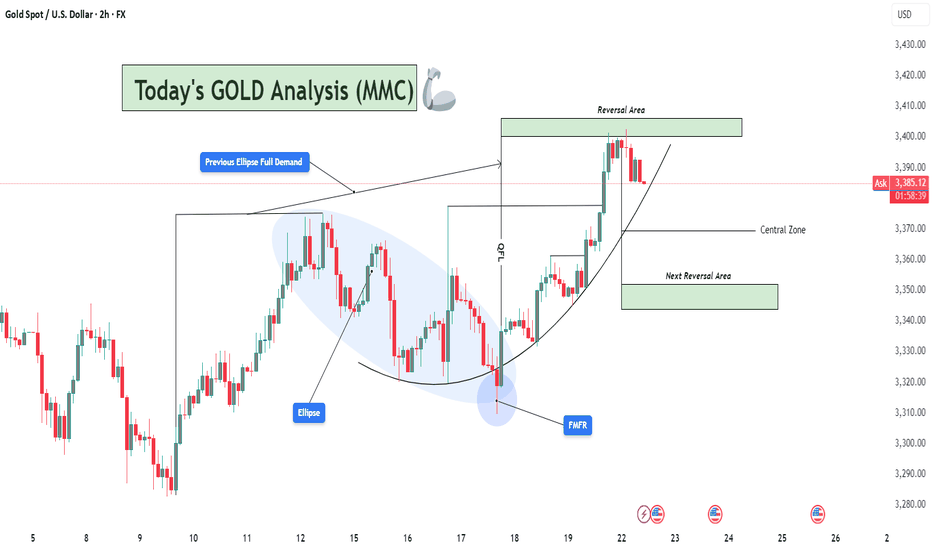

XAUUSD Analysis : From Ellipse Demand to Reversal Zone – Target Hello traders!

Let’s decode today’s GOLD setup using the MMC (Mirror Market Concepts) strategy. This is a clean and textbook example of how institutional price delivery works – from demand creation to reversal zones. Let’s go step by step👇

🔵 Previous Ellipse Full Demand – The Accumulation Phase:

The market initially formed an Ellipse structure, which you’ve rightly marked as the Previous Full Demand Zone. This is where smart money started to accumulate long positions after pushing the market into a discounted area.

Price remained inside this ellipse zone for a while, showing slow and controlled price action with multiple rejections from the bottom. This type of price behavior is usually a trap zone, where retail traders are shaken out, and institutions silently build their positions.

💥 FMFR Zone – Where Momentum Begins:

On July 18, a clear FMFR (Fresh Money Flow Reversal) took place. This is the moment where price broke out of the ellipse demand zone with strength.

This FMFR marks the transition from accumulation to markup phase. It signals that the market makers have done their job in collecting liquidity and are now ready to drive price upward.

From this FMFR, the market respected a curved path — a classic MMC parabolic build-up, showing buyer dominance throughout.

📈 One-Time Delivery (OTD) – Clean Impulse:

Following the FMFR, price followed a One-Time Delivery (OTD) move. You’ve marked this beautifully with the vertical box showing the aggressive bullish impulse.

The candles are strong, consecutive, and with minimal pullbacks — a sign that the market is being delivered efficiently by the institutions toward their target.

🟩 Reversal Area – Target Reached:

Price has now entered the Reversal Area (Supply Zone), which was expected based on previous structure and imbalance. The market is reacting to this area already — giving signs of exhaustion.

From an MMC perspective, this is a potential “sell to buy” or “buy to sell” trap zone, where the market could either reverse completely or engineer liquidity before moving again.

⚖️ Central Zone – Balance Area:

Below the current price lies the Central Zone, which is a neutral area where the market may consolidate if it fails to hold higher or reject immediately. This area usually acts as a pause or buffer zone, often seen before the market decides the next leg (up or down).

🔄 Next Reversal Area – Demand Reload Zone:

If price drops, the Next Reversal Area marked below (around the 3,345–3,355 range) will be crucial. This is the zone where you should watch for:

Bullish rejections

FMFR signals

Trap candles (like liquidity wicks)

Expect this area to act as the next “Buy Program”, where institutions might step back in to reload longs.

🧠 Conclusion & Trader Mindset:

✅ Market respected MMC phases: Accumulation ➝ FMFR ➝ Delivery ➝ Reversal

🛑 Currently in a high-probability reaction zone – wait for confirmation before trading.

👁️ Watch how price behaves in the Reversal Area — rejection or continuation?

🔁 If market retraces, Next Reversal Area is your prime hunting zone for long setups.

🔔 Stay Patient – React, Don’t Predict.

Let the market reveal its next move. Whether it’s a pullback to reload longs or a deeper retracement, MMC logic will guide you to stay on the right side.

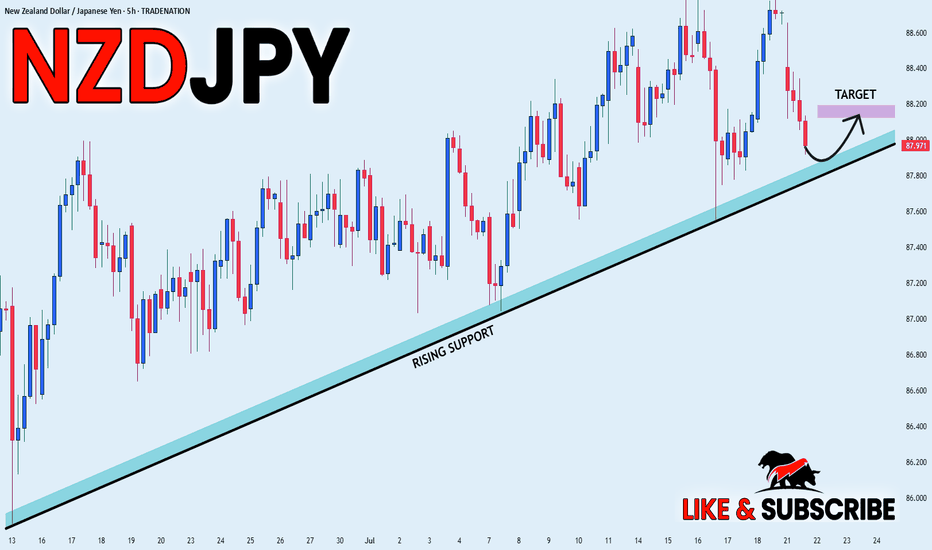

NZD_JPY RISING SUPPORT AHEAD|LONG|

✅NZD_JPY went down from

The resistance just as I predicted

In my previous analysis but now

The pair is approaching a rising

Support line from where we will

Be expecting a local bullish rebound

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

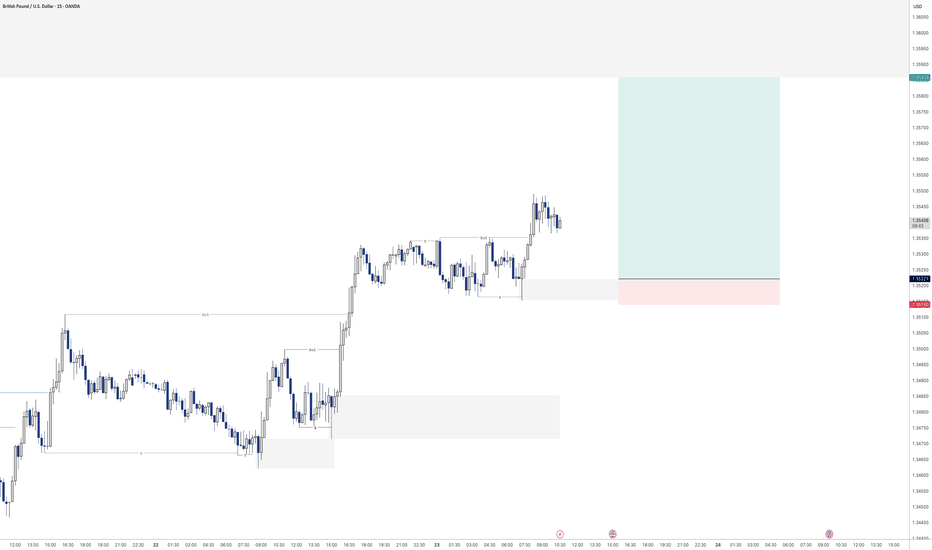

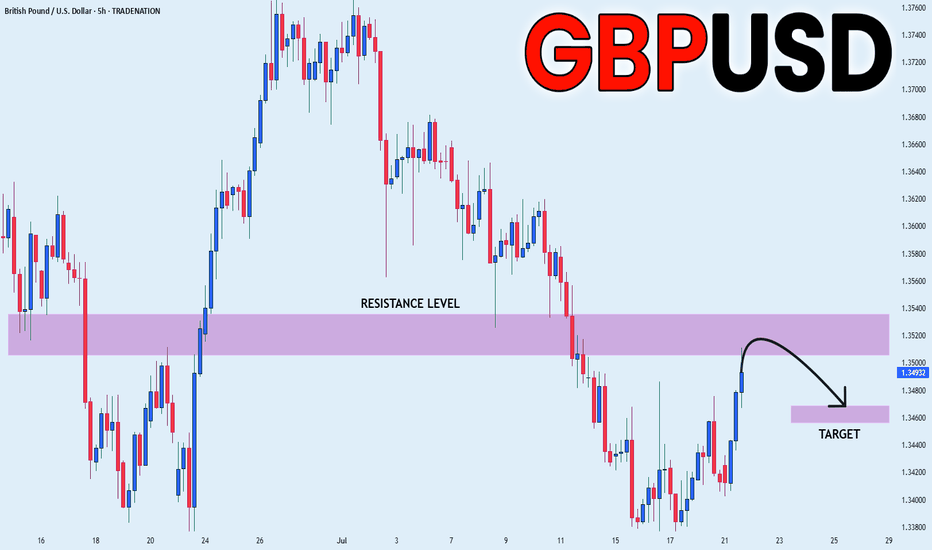

GBP_USD RESISTANCE AHEAD|SHORT|

✅GBP_USD has been growing recently

And the pair seems locally overbought

So as the pair is approaching

A horizontal resistance of 1.3520

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

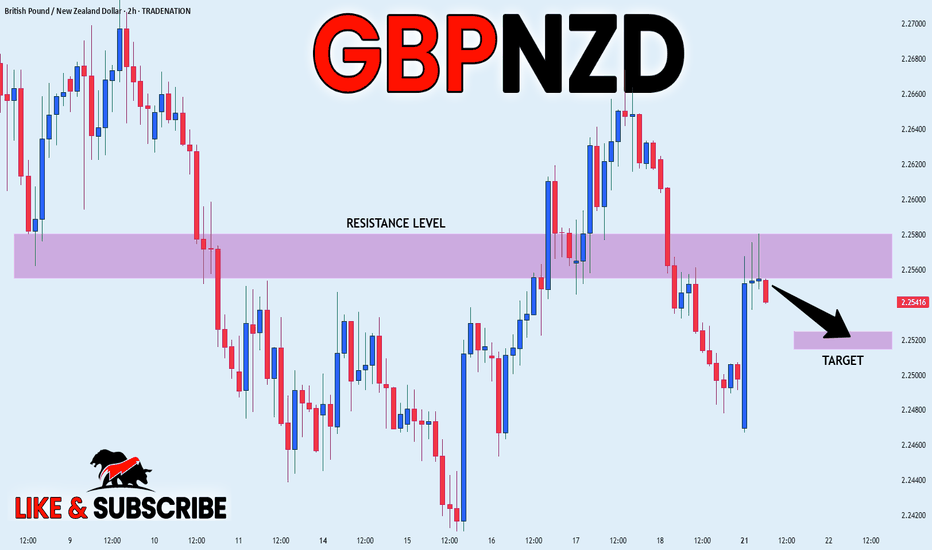

GBP_NZD LOCAL SHORT|

✅GBP_NZD made a retest of the

Local horizontal resistance level of 2.2580

And as you can see the pair is already

Making a local pullback from

The level which sends a clear

Bearish signal to us therefore

We will be expecting a

Further bearish correction

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

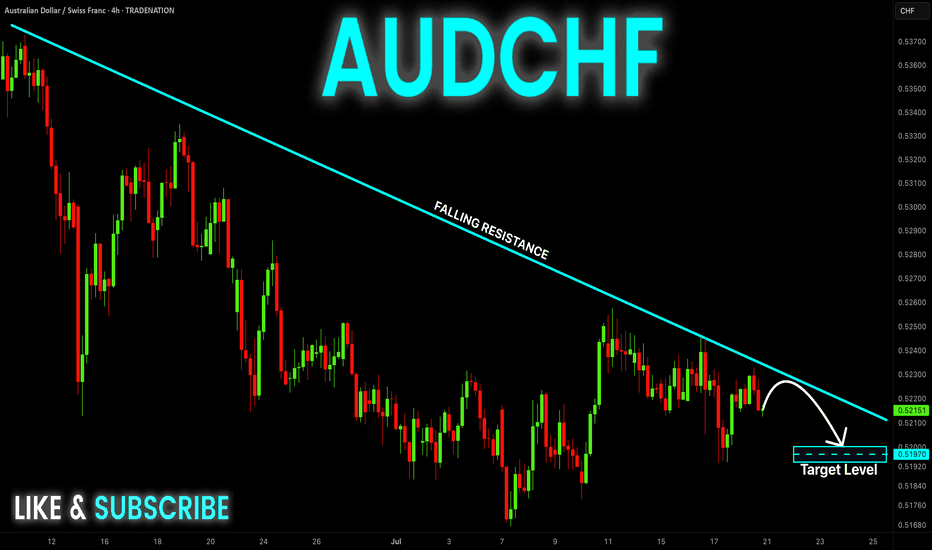

AUD-CHF Risky Short From Falling Resistance! Sell!

Hello,Traders!

AUD-CHF is trading in a

Downtrend along the falling

Resistance line so we are

Bearish biased and after

The potential retest of the

Falling resistance we will

Be expecting a further

Bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

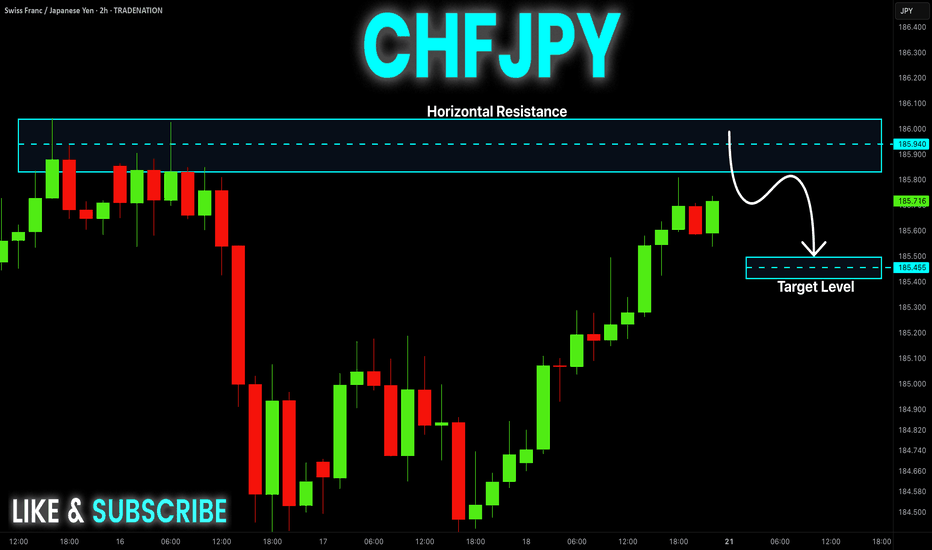

CHF-JPY Resistance Ahead! Sell!

Hello,Traders!

CHF-JPY keeps growing in

An uptrend and the pair is

Locally oversold so after the

Retest of the horizontal

Resistance of 186.000

From where we will be

Expecting a local bearish

Pullback on Monday

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

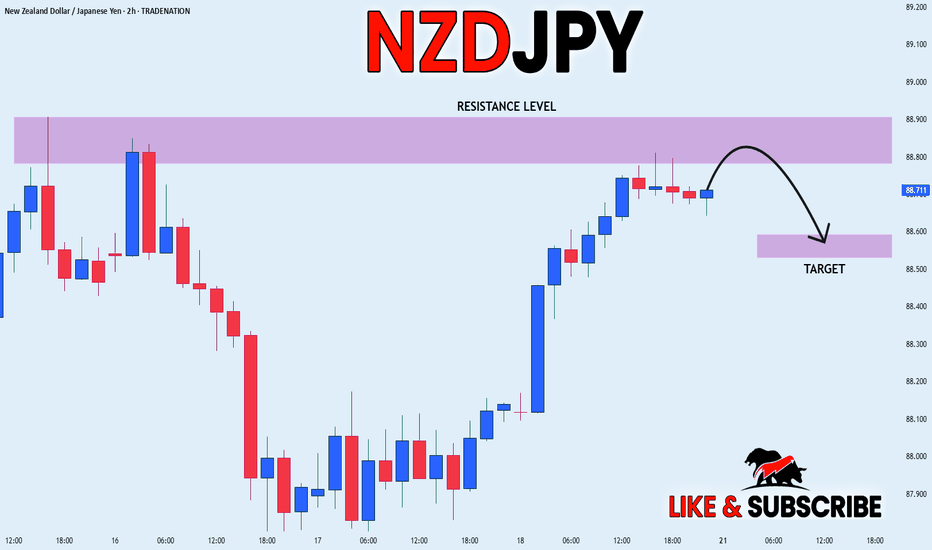

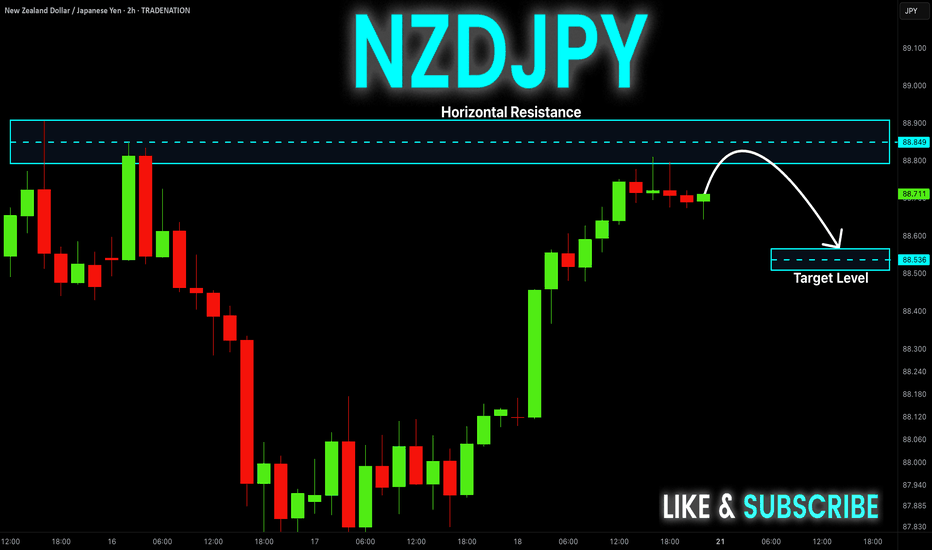

NZD_JPY PULLBACK EXPECTED|SHORT|

✅NZD_JPY has been growing recently

And the pair seems locally overbought

So as the pair has approached

A horizontal resistance of 88.900

Price fall is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

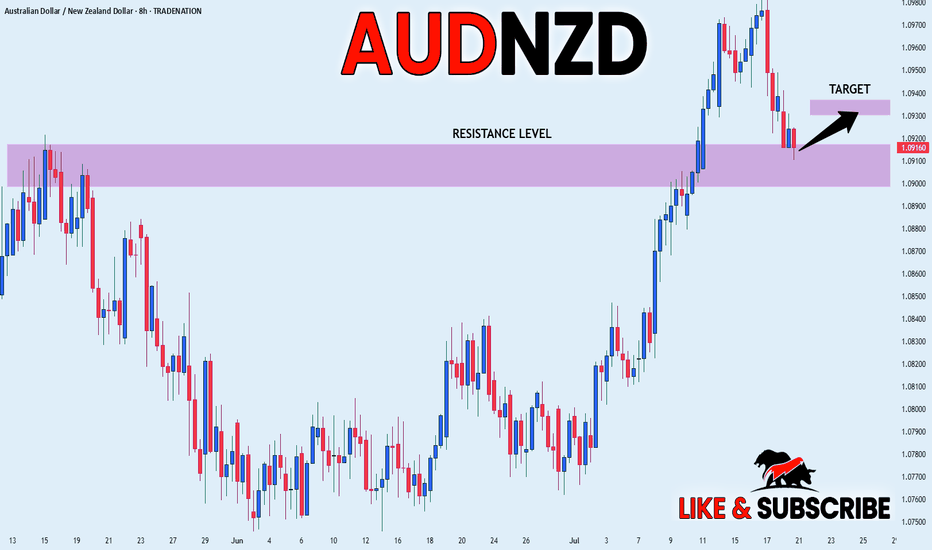

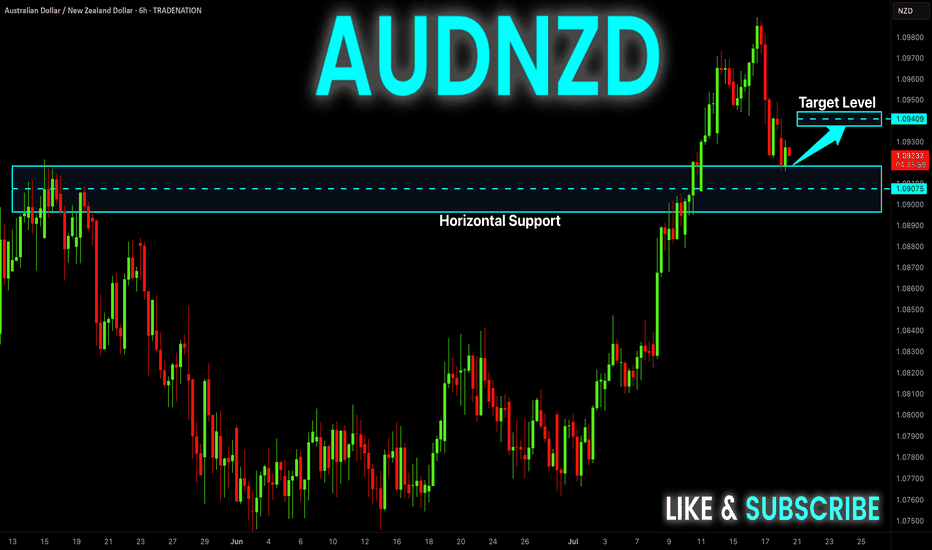

AUD_NZD GROWTH AHEAD|LONG|

✅AUD_NZD fell down sharply

But a strong support level was hit at 1.0910

Thus I am expecting a rebound

And a move up towards the target of 1.0930

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

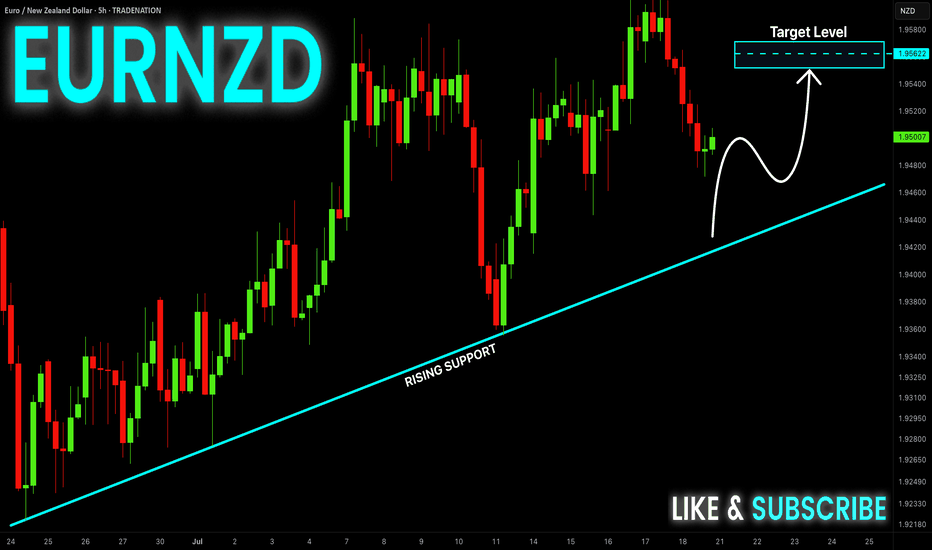

EUR-NZD Will Grow! Buy!

Hello,Traders!

EUR-NZD is making a local

Bearish correction while trading

In an uptrend along he rising

Support so after the pair hits

The support line a local bullish

Rebound is to be expected

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD-JPY Local Short! Sell!

Hello,Traders!

NZD-JPY has hit a horizontal

Resistance level of 88.851

And we are already seeing

A bearish reaction so we will

Be expecting a local

Bearish move down

On Monday!

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

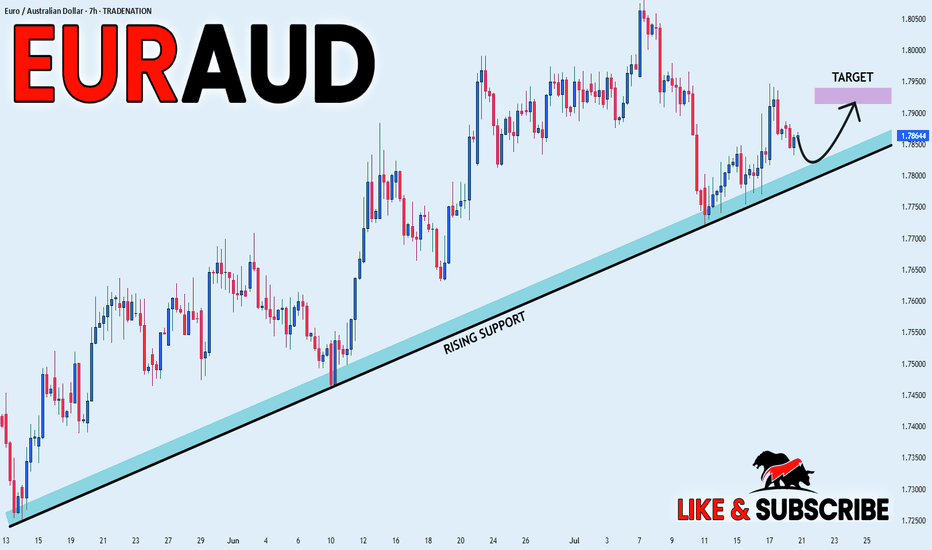

EUR_AUD WILL GROW|LONG|

✅EUR_AUD is trading in an uptrend

With the pair set to retest

The rising support line

From where I think the growth will continue

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

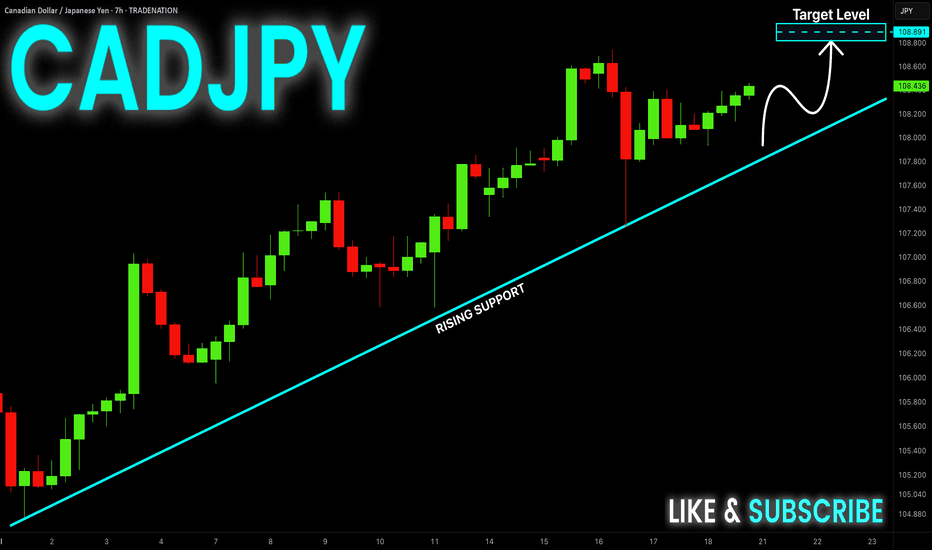

CAD-JPY Will Keep Growing! Buy!

Hello,Traders!

CAD-JPY keeps trading in

An uptrend and there is a

Rising support below so

We are bullish biased

And we will be expecting

A further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CAD_JPY BULLISH BIAS|LONG|

✅CAD_JPY is trading along

The rising support

And as the pair will soon retest it

I am expecting the price to go up

To retest the supply levels

Above at 108.708

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-AUD Strong Uptrend! Buy!

Hello, Traders!

EUR-AUD is trading along

The rising support line in a

Strong uptrend so we we are

Bullish biased and as the pair

Is going down to retest the

Support we will be expecting

A rebound and a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD-JPY Will Keep Growing! Buy!

Hello,Traders!

USD-JPY is trading in an

Uptrend along the rising

Support line and the pair

Already made a bullish

Rebound and is consolidating

In a local range so as we

Are bullish biased we will

Be expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

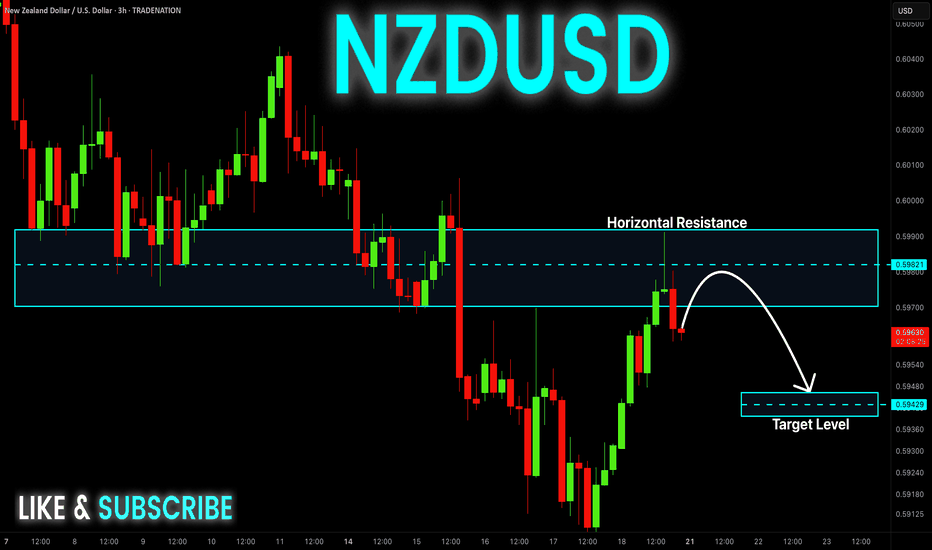

NZD-USD Will Go Down! Sell!

Hello,Traders!

NZD-USD already made a retest

Of the horizontal resistance

Of 0.5992 from where we

Are seeing a bearish reaction

And we will be expecting a

Further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD-NZD Rebound Expected! Buy!

Hello,Traders!

AUD-NZD is making a retest

Of the horizontal support

Level of 1.0909 and as the

Pair is trading in an uptrend

We will be expecting a

Local bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD_USD POTENTIAL SHORT|

✅NZD_USD is going up to retest

A horizontal resistance of 0.5990

Which makes me locally bearish biased

And I think that we will see a pullback

And a move down from the level

Towards the target below at 0.5947

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.