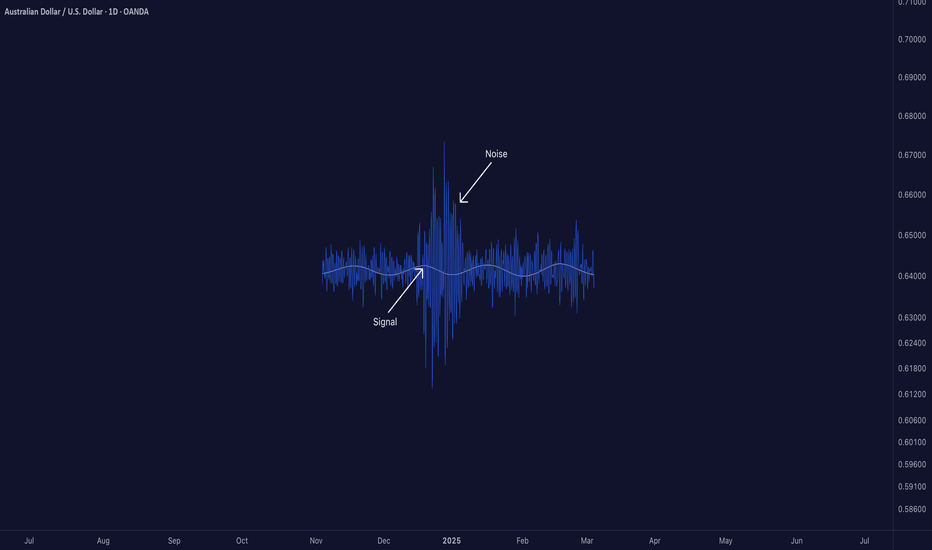

Signal-to-Noise Ratio: The Most Misunderstood Truth in Trading█ Signal-to-Noise Ratio: The Most Misunderstood Truth in Quant Trading

Most traders obsess over indicators, signals, models, and strategies.

But few ask the one question that defines whether any of it actually works:

❝ How strong is the signal — compared to the noise? ❞

Welcome to the concept of Signal-to-Noise Ratio (SNR) — the invisible force behind why some strategies succeed and most fail.

█ What Is Signal-to-Noise Ratio (SNR)?

⚪ In simple terms:

Signal = the real, meaningful, repeatable part of a price move

Noise = random fluctuations, market chaos, irrelevant variation

SNR = Signal Strength / Noise Level

If your signal is weak and noise is high, your edge gets buried.

If your signal is strong and noise is low, you can extract alpha with confidence.

In trading, SNR is like trying to hear a whisper in a hurricane. The whisper is your alpha. The hurricane is the market.

█ Why SNR Matters (More Than Sharpe, More Than Accuracy)

Most strategies die not because they’re logically flawed — but because they’re trying to extract signal in a low SNR environment.

Financial markets are dominated by noise.

The real edge (if it exists) is usually tiny and fleeting.

Even strong-looking backtests can be false positives created by fitting noise.

Every quant failure story you’ve ever heard — overfitting, false discoveries, bad AI models — starts with misunderstanding the signal-to-noise ratio.

█ SNR in the Age of AI

Machine learning struggles in markets because:

Most market data has very low SNR

The signal changes over time (nonstationarity)

AI is powerful enough to learn anything — including pure noise

This means unless you’re careful, your AI will confidently “discover” patterns that have no predictive value whatsoever.

Smart quants don’t just train models. They fight for SNR — every input, feature, and label is scrutinized through this lens.

█ How to Measure It (Sharpe, t-stat, IC)

You can estimate a strategy’s SNR with:

Sharpe Ratio: Signal = mean return, Noise = volatility

t-Statistic: Measures how confident you are that signal ≠ 0

Information Coefficient (IC): Correlation between forecast and realized return

👉 A high Sharpe or t-stat suggests strong signal vs noise

👉 A low value means your “edge” might just be noise in disguise

█ Real-World SNR: Why It's So Low in Markets

The average daily return of SPX is ~0.03%

The daily standard deviation is ~1%

That's signal-to-noise of 1:30 — and that's for the entire market, not a niche alpha.

Now imagine what it looks like for your scalping strategy, your RSI tweak, or your AI momentum model.

This is why most trading signals don’t survive live markets — the noise is just too loud.

█ How to Build Strategies With Higher SNR

To survive as a trader, you must engineer around low SNR. Here's how:

1. Combine signals

One weak signal = low SNR

100 uncorrelated weak signals = high aggregate SNR

2. Filter noise before acting

Use volatility filters, regime detection, thresholds

Trade only when signal strength exceeds noise level

3. Test over longer horizons

Short-term = more noise

Long-term = signal has more time to emerge

4. Avoid excessive optimization

Every parameter you tweak risks modeling noise

Simpler systems = less overfit = better SNR integrity

5. Validate rigorously

Walk-forward, OOS testing, bootstrapping — treat your model like it’s guilty until proven innocent

█ Low SNR = High Uncertainty

In low-SNR environments:

Alpha takes years to confirm (t-stat grows slowly)

Backtests are unreliable (lucky noise often looks like skill)

Drawdowns happen randomly (even good strategies get wrecked short-term)

This is why experience, skepticism, and humility matter more than flashy charts.

If your signal isn’t strong enough to consistently rise above noise, it doesn’t matter how elegant it looks.

█ Overfitting Is What Happens When You Fit the Noise

If you’ve read Why Your Backtest Lies , you already know the dangers of overfitting — when a strategy is tuned too perfectly to historical data and fails the moment it meets reality.

⚪ Here’s the deeper truth:

Overfitting is the natural consequence of working in a low signal-to-noise environment.

When markets are 95% noise and you optimize until everything looks perfect?

You're not discovering a signal. You're just fitting past randomness — noise that will never repeat the same way again.

❝ The more you optimize in a low-SNR environment, the more confident you become in something that isn’t real. ❞

This is why so many “flawless” backtests collapse in live trading. Because they never captured signal — they captured noise.

█ Final Word

Quant trading isn’t about who can code the most indicators or build the deepest neural nets.

It’s about who truly understands this:

❝ In a world full of noise, only the most disciplined signal survives. ❞

Before you build your next model, launch your next strategy, or chase your next setup…

Ask this:

❝ Am I trading signal — or am I trading noise? ❞

If you don’t know the answer, you're probably doing the latter.

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

SNR

NZDUSD Bearish moveShort-setup: breakdown of support

Trigger: Price has decisively broken below S1 (0.59337) and the 200-hour MA (red) on the 1h chart.

Confirmation: RFI just dipped below its ascending trendline and failed to reclaim it—momentum is bearish.

Entry: Short at market 0.5930–0.5925 (just below S1).

Initial Stop: Above R2 at 0.5944 (≈15-18 pips stop).

Targets:

T1: S2 at 0.5886 (~45 pips → RRR ≈ 1:3)

T2: R3 (long-term) at 0.5853 if momentum stays strong (~75 pips → RRR ≈ 1:5)

⚡ Highlight: This is a bank-order-flow style fade—selling the break of the minor support after a test of the 200-hour MA confluence.

XAUUSD Revision 25 December 2024Hello Nation!

It’s Christmas. Happy holidays to all who are celebrating it. Let’s do a bit of homework. The market tend to slow down towards the end of the year. I am just doing this update for my own reference. For me personally, i did not take any entry or trades today, maybe for the next few days.

I might just wait for 2025. I have made preparations and plans for 2025 and i hope you do too. Planing and preparation are very important. The new year is definitely a good time to reset, restart and refresh your journey.

As for today, nothing much that i can say. Gold is still sideways on the Higher Time Frames. We open up bullish up to mid London session. I see like a Double top pattern at the H1 zone. With the M15 box. I would say that’s a setup or a hint for to entry sell. Price moved down, a good reaction but it did not even touch 100 Pips.

We are still ranging within 2620 - 2610. I would prefer to take a break. Let the new year come.

Enjoy your Holidays!

BTCUSD Revision 22 December 2024Hello Nation!

Let’s see what BTC did. We open today at 96537 area. It did made a huge gap breaking a Resistance level. The same Level became a Support. As multiple rejections can be seen. To me that a good hint for a buy entry. I marked out my m15 Box and that will be my point of interest for a buy entry.

With 30 Pips SL risk and 100 Pips TP. It will be a nice winner. I did took this entry but i secured at 94 Pips. My risk was smaller than 30pips as i make them precise on m1 or m5.

Price went up straight to a Daily SBR area. Once i spotted Price was breaking a support on the H1, this information is key to me. I marked the Support that broke and that same area is now Resistance. A point of interest which i will monitor.

Again, I drew out my m15 box after the identifying Support and Resistance in that area. Upon seeing multiple bearish reactions. I was confident price will be making a move down. I took a sell entry.

This time i targeted the H1 low which give me a bit more than 100 pips. I secured this entry at 138 Pips. Knowing that there was gap during market open. I could have attempted to target much lower. But i am happy with what i got. It was a very good day for me.

BTC is just bouncing off its supply and demand. As you know, I don’t make predictions on my post. I will only try to share what story that i see after the candles happen.

Thank you for Reading. Good Bye!

XAUUSD Revision Saturday 21 December 2024Hello Nation!

Let’s look how Gold did today. We started at around the 2594 area. It was looking like it may move down further till right before London Open,Buyers came in and took control. We did not even touch the low of yesterday.

By London Session, We had a H1 Resistance Break. Price consolidated for a while. Bouncing on the previous Resistance which becomes a support. The multiple rejections of the candles is a hint for me to be ready for a buy setup.

With a 30 pips Risk and a target of 100 pips. It went straight to break another H1 Resistance Level. Similarly, that Resistance level becomes a Support Level. M15 box clearly support this idea. But it was too close to a red folder news (PCE Price index).

But risk takers would have survive the news if they attempted with the usual 30pips Risk Setup. Price didn’t even break the m15 box. It went straight breaking another H1 Resistance.

Another RBS Moment on the H1. A very clean body break on the m15 gives us a loud possibility that price was continuing upwards. With another M15 box. I might consider this as a low risk entry as Price was with good momentum and a very clear show of direction.

We can spot 3 beautiful entries with the focus on H1 and M15 SNR. As i am writing this, I am still in a buy position which i entered earlier.

As i had explained, I am just sharing what i see. I believe in trading there are no 100% winning Strategy. Even myself, do suffer from losses and missed opportunities. I simply just want to pen it down so that i can read these notes and improve myself. Trading is an endless studying journey and the best teacher is our mistakes.

I also do hope this will benefit the person who red it with hope they can learn from my mistakes and experience. I am not a market mover or a forex educator. Just someone who buy and sell candles like you.

Conclusion for Gold today. It Reversed from Bearish to Bullish.

Thank you for Reading! And Good bye!

XAUUSD Revision Thursday 19 December 2024Hello Nation!

I had to wait for FOMC to conclude before doing this update. Let’s start with Gold opening at 2646 area. Price went straight bullish to the highest SBR level which was created by yesterday’s candles.

From there we can follow that price have a bearish reaction which ended up moving Sideways bouncing to top and bottom of the m15 for many hours.

While price doing so, i can also see my favourite setup developing which i marked with the m15 box. With price showing rejection from that box. That is a hint for me that sell entry was possible.

I mark the sell position with a risk of 30 Pips SL and TP of 100 Pips. Usually i will go down to lower timeframe like the m5 or m1 to precise my entry. But for these daily updates, i will stick with m15.

I have another SBR Zone at 2637 / 2638 area. But, as my m15 SBR was clear for entry. Time was too close to FOMC. Congratulations to those who manage to catch that sell entry. I chose to sit tight and just watch how Gold reacts to the news .

Conclusion for today, It was another sellers day. Hours of consolidation during London Session and we are ending the day with an estimate of 200 pips drop due to FOMC.

I am just sharing what i see. I am just taking notes for my own setups and maybe i can improve to be a better trader.

Thank you for reading and Goodbye!

XAUUSD Revision Wednesday, 18 December 2024Hello Nation!

This is my first post. My intention here is just spend some time to look back at what Gold did today. I will try very best to do this repeated daily.

Firstly, i am scalper. I trade using SNR and breakouts method. I would also plan my trades from higher timeframes. But this ‘Revision’ I will just focus on H1 and M15. I am just be sharing my views on what had happened and how i could have navigated the markets with my entries.

Let’s start from the market open at 2651. Price went bullish touching the H1 SBR area. It respected that area and pushes down towards the H1 Support.

A Strong Bullish reaction from the H1 support, Price return to M15 Box area which i had marked.

For me, A rejection from the m15 box is a hint for sell. Usually M1, will be my entry Timeframe. But as i had mentioned, i will only focus on H1 and M15 here.

I had marked my 1st sell Position. Risk 30 Pips, TP 100 Pips.

Moving down further, the previous H1 support was broken and it became a possible Resistance.

Again, I marked the m15 SBR with a box. Wait for price to return into the box area.

Similarly like the Previous Sell entry, several rejections can be spotted which can be a strong hint for a sell entry.

I had mark the 2nd Sell Position for you to see clearly. Risk 30 PiPs and TP 100 Pips.

To conclude, Gold was a beautiful Sell today. I hope you did well for yourself today. Maybe in writing these notes, i get to revise and also improve myself as a trader.

Thank you for reading! And Goodbye.

XAUUSD Forecast for Monday, June 24th 2024This publication offers insightful forex analysis leveraging the smart money concept, focusing on understanding market movements driven by institutional traders and major players. Through meticulous support and resistance analysis, it provides a comprehensive view of key price levels and potential market turning points. By combining these strategies, the analysis aims to uncover strategic entry and exit points, empowering traders with valuable insights into market dynamics and optimal trading decisions.

KOG - Identify your zones!Identifying the correct zones and regions for your trading:

Many of our followers will know that not only do we have Excalibur targets, we give the exact levels and price points that we want the price to achieve. What we also do, is show you the boxes (zones) on the chart for the wider community, to help steer you in the right direction. Price action plays a huge part in this and it’s something all traders should learn, however, zones are effective, not only in trading the right way, but knowing when you’re in the wrong way!

Price is a series of test on levels. It creates trends or ranges but will always do the same thing. Once we understand this, we know it's not the market that is the problem, it’s us, the trader. If we learn it's behaviour all we then need to do is make sure our money and risk management is up to scratch. It's never 100%, but if we test a level, it breaks, structure suggests it's going against us, don't hold on to hope, or add more in the direction you intended. Cut the damn thing like it's a poison to your account.

You need to treat this as a business, no matter what your account size. Every day there are large institutions who want to take your money away from you, you’re in this market to take from them and give them as little as possible. You should have a risk model in place, am I going to risk a certain percentage of my account? Am I going to stick to a stop loss of a certain number of pips? Am I going to have a risk reward that makes sense? Your stop loss and risk management plan are your best friend in this market, it allows you to limit the losses and live to trade another day.

The market will give you clues as to what it’s going to do, breaks, tests, and retests. We can plan the move before it happens this way, we know if it breaks a level, that level turns into support or resistance then it’s going to go and test the next level.

Remember:

The market will always give you a chance to get out of a trade if it’s going against you, as traders our ego's take over and we hold on to hope. If you're in a whipsaw and choppy market and in the wrong direction, your safest option, even if it ends up going your way in the end is to get out of it and limit your losses. You can always find another entry point for a better risk reward.

Ego is one of the biggest killers of accounts and works both ways. Hold on to a failing plan it will humble you. Show the market you’re too confident, it will humble you! Know when to trade, know when not to trade, know when you’re in the wrong way and accept defeat!

The example on the chart is showing you a simple 4H timeframe, with the zones in place. We know price will play zones and levels, it has to test these almost to see if it likes that price point or not. It will either break or reject the level.

If it breaks, you will usually see a forceful break, then the retest of the level which turns previous support/resistance into new support/resistance, or it will reject, in which case you will usually find the reversal. When trading with a bias or a target in mind, the market will use these zones (levels) to work within and as traders, we should know that if a level is hit, that’s our target reached, or, if it’s broken, that’s sign that we should either start thinking about managing the trade or getting out of it. In order to plot the levels, you will need to zoom out of the chart. Similar to the ‘Simple trading strategy’ we have shared in the past, you will use the peaks and troughs dragged across to present day, to identify your zones. Why? You may ask! Because the market is historical, the levels are the levels, and “levels don’t lie”.

Concern:

What many traders do, and it’s not their fault, it’s just a lack of education and trading experience, is hold on to trades with huge drawdown. They will place a trade in one direction, price goes against them, instead of implementing a stop loss, they will convince themselves the market will come back to this price, so instead “I’ll turn that into a swing trade”. This is the wrong way to think about the market, especially if you’re an intra-day trader, which most of us are. Shown on the chart, you can see, the level breaks, the level is retested, the retest in confirmed and the price moves away from the level. Once, the retest if confirmed, that’s the market telling you the trader, listen, you’re potentially in the wrong way, and we’re going to test another level higher/lower, so prepare yourself.

This is a really simple way, together with a risk model in place, to limit losses and maintain a healthy account.

Please try it and let us know!

As always, trade safe.

KOG

RUNE USDT: SOLD ALL OF MY RUNE... I sold my first 50% on my previous chart that I failed to gauge the right top.

Now, here I am again thinking that this will be the top. Relatively it is. More on sentiment reasons. I will not explain further, since the explanation are very much the same with the previous chart I did. Here it will be just a bit more detailed and applied with sentiment.

SOLD 6.9 I just find it funny, and related to the fibs. Tried to drag it further while still respecting the levels. Thank you. PS: I added Trend line. I will short accordingly.

EURGBPRegarding our observations, currently there are Absoloutly more buyers in the market.

Two buy setups!

After breaking 0.8560

The other is any reaction to the trendline!

the second one is much mor riskier.

Two shorting opportunities are the one after breaking 0.8490 down and the other is after reaching 0.8600

short it : NZDUSD Hello, traders. The support and resistance level of 0.620 may soon be reached by the New Zealand dollar, which is currently going through a correction phase. The trend is downward at the moment. Throughout this trading week and the one after it, we'll keep an eye on NZDUSD in case a selling opportunity appears at the 0.620 zone. We've launched a short position to meet with money and risk management standards, and we'll add more in the zone.

Daily chart

Weekly Chart