Softs

COOTTON📊 COTTON

⏱ TIME: 1W

📝It is reaching very important areas for spot purchases, and you can make purchases in a gradual and managed manner. It has also been checked for fundamental analysis and is a sustainable and strong project for the future.

⭕️risk: LOW

📍buy market:89 $

📌TP1: 104 $

📌TP2: 116 $

📌TP3: 124 $

📌TP4: 150 $

⛔️SL: 74.5$

Sugar and FCOJ Take the Bullish BatonThe soft commodities sector of the commodity market can be highly volatile. Historically, sugar, coffee, cotton, cocoa, and frozen concentrated orange juice futures that trade on the Intercontinental Exchange have doubled, tripled, and halved in value over short periods. While clothing and other consumer goods depend on the cotton market, the other sector members are foods.

The soft commodity sector rose in 2021, and Q1 2022

Coffee and cotton rose to multi-year highs in 2022

FCOJ takes off on the upside in April and makes a new multi-year high

Sugar could be next for three reasons

Trading softs from the long side- Buy those dips

Brazil is the world’s leading producer and exporter of three of the soft commodities; sugar, coffee, and oranges. Sugar comes from two sources, sugar beets and sugarcane. Brazil’s tropical climate makes it the leading sugarcane producer. Arabica coffee beans are popular in the US and other areas, while Robusta beans produce espresso coffees. Brazil leads the world in Arabica production. While many people associate orange production with Florida and California, Brazil is the world’s top orange producer. Cocoa, the primary ingredient in chocolate confectionery products, comes mainly from West Africa, as the Ivory Coast and Ghana produce over 60% of the world’s annual supplies.

Soft commodities are agricultural products, so the weather in growing areas typically determines the prices each year. Since the 2020 pandemic, the price action has been anything but ordinary.

The two latest soft commodities to lead the sector on the upside have been sugar and FCOJ futures.

The soft commodity sector rose in 2021, and Q1 2022

In 2021, the composite of the five soft commodities that trade in the futures markets on the Intercontinental Exchange rose 31.57%. In Q1 2022, the softs added to gains, rising 6.58%, with all five members posting gains.

Cotton futures led the softs higher with a 20.51% gain. Cocoa futures moved 5.16% to the upside, with FCOJ posting a 3.86% gain. Sugar rallied 3.23%, and Arabica coffee futures eked out a 0.13% gain.

Meanwhile, coffee and cotton rose to new multi-year highs during the first three months of 2022.

Coffee and cotton rose to multi-year highs in 2022

In June 2020, coffee futures made a higher low under the $1 per pound level before taking off on the upside.

The weekly chart shows the bullish trend of higher lows and higher highs that took coffee futures to $2.6045 per pound in early February 2022. Coffee futures rose to the highest price since 2011.

Cotton futures also rose to the highest level since 2011, peaking at the $1.4614 per pound level in April 2022.

Coffee futures were over the $2.20 level, with cotton above $1.40 on April 14.

FCOJ takes off on the upside in April and makes a new multi-year high

Frozen concentrated orange juice futures are the least liquid of the five soft commodities, based on daily volume and open interest metrics. While the FCOJ futures arena rose to a new multi-year high in Q1 2022, the bullish price action continued in April with higher highs.

The chart shows that nearby FCOJ futures rose to $1.8660 per pound last week, the highest level since March 2017. The all-time high in the orange juice market came in 2016 at $2.35 per pound.

Brazil is the leading producer and exporter of oranges and Arabica coffee beans. The South American country also is the leader in free-market sugarcane production and exports.

Sugar could be next for three reasons

Sugar futures rose to 20.69 cents per pound in November 2021, the highest price since February 2017.

The weekly chart shows that sugar futures were above the 20 cents per pound level last week. Sugar is approaching the first technical resistance level at the November 2021 20.69 cents high. Above there, the next target is at the October 2016 23.90 high, which is a technical gateway to the 2011 36.08 cents per pound peak.

Three factors support sugar prices in April 2022:

Rising inflation is lifting all commodity prices, and the trend is always your best friend in markets across all asset classes.

Rising crude oil and natural gas prices support sugar. Crude oil is over the $100 per barrel level, and natural gas stopped just short of $7 per MMBtu last week. Multi-year highs in the energy market support sugar as it is the primary input in Brazilian ethanol production. As more sugarcane goes into ethanol production, less is available for exports.

Sugarcane production costs are increasing as they are labor-intensive. The rising Brazilian real makes sugar more expensive to produce.

The chart illustrates the technical breakout to the upside in the Brazilian currency against the US dollar. A higher real increases the cost of production, putting upside pressure on sugar’s price.

Trading softs from the long side- Buy those dips

Stocks and bonds have been shaky in 2022, and cryptocurrencies have not yet of the slump that took prices lower since the November 2021 highs. Commodities have been the place to be for investors and traders over the first four months of 2022. The latest inflation report will likely keep the bullish party in raw material markets going.

I remain bullish on soft commodities as they are highly volatile and can offer explosive returns. Sugar is my top choice as of April 15, as the sweet commodity loosed poised to eclipse the 2021 high on its way to higher ground. Meanwhile, I favor all soft commodities in the current environment. The optimal approach to the sector has been buying on price weakness, and I expect that to continue. Bull markets rarely move in straight lines, and corrections can be the best route to optimizing returns over the coming weeks and months.

--

Trading advice given in this communication, if any, is based on information taken from trades and statistical services and other sources that we believe are reliable. The author does not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects the author’s good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice the author provides will result in profitable trades. There is risk of loss in all futures and options trading. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This article does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.

Long ZSK2023 x Short ZCK2023Corn seems expensive compared to Soybean for 1 year ahead delivery. Maybe the too tight corn SxD due to Ukr war and post USDA Planting Intentions pressuring the spot prices is pricing too much for 2023 crop. While soybean seems behind the curve on a comparative basis.

RSI for the ratio spread at 30s

The decline is not done yet. ExplainedCoffee reached our target at 120. However, there is still no signal the decline is done and we want to follow the trend. The support is broken and it makes me believe there is a big chance we can see a retest of important support/resistance near 104. So, if you still hold your shorts, consider adding trailing stops and let the good time roll.

Trend change is coming. Potential entries and targetsThe COT report is bearish, the seasonal tendency is to the downside. We have a divergence in the 4h chart. So, where do we sell? I think breaking below Thursday's low or formation of lower high would be good entries. 120 has been an important level for Coffee. It has to be tested again and it is our swing target.

US Coffee futures ( KC1!) - stay short for C wave US Coffee futures ( KC1!) has completed ABC zigzag up side where C wave was extended impulse.

It dropped in wave A in 15 min time frame, so get in to sell trade in B wave near 124.25, with stops above invalidation level above 127.50 for target of C wave down up to 116.50, which is the 4th wave zone of internal wave of C previous wave of Up cycle.

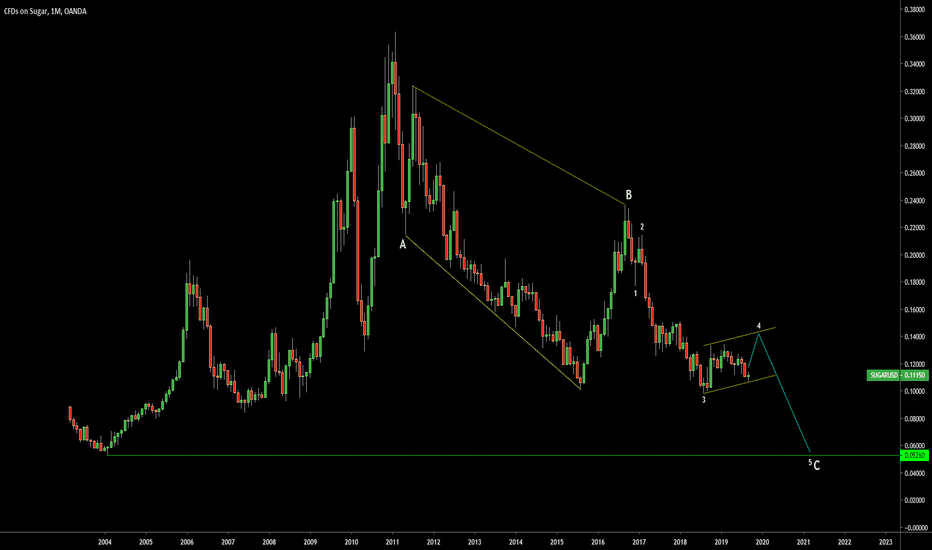

US Sugar futures ( SB1!) - stay short for bearish outlookUS Sugar futures ( SB1!) has completed ABC zigzag as the part of Y wave, as mentioned in previous updates. The total sequence is WXY as double zigzag, which is well known in Elliott wave theory and mostly seen in commodities and currencies.

In last updates, we already posted the bull set up for buy a C wave, Now its over.

stay short in B wave up at around 12.73-81 with stops above 12.97 for target range of 12.25 as support zone or lower too.

make sure that B wave is not too sharp before entering the trade set up.

EW Analysis: COCOA May Remain SidewaysCOCOA is sideways for the last 10 years and seems like it will stay like that.

Hello traders!

Today we will talk about Cocoa and its price action from Elliott Wave perspective.

Well, looking at the longer-term weekly chart, we can see Cocoa moving sideways for the last 10 years in the 3700 – 1700 range, ideally within a bigger bearish triangle pattern in wave »B« before we may see even more weakness into a wave C towards 1000 level. But, it is not ready yet, because sub-wave (E) is still missing, so we will probably see a recovery at the end of the year or in 2021 before a bigger sell-off.

As you can see, in the shorter-term daily chart, we are currently tracking a three-wave A-B-C decline within wave (D) that can send the price down to the lower triangle line and 2000 – 1800 area. The only question is, either is sub-wave B already finished or will we see a retest of 2500 – 2700 resistance area before a decline into wave C to complete a higher degree wave (D).

All being said, be aware of more weakness for Cocoa this year, but downside can be limited, so at the end of 2020 or at the beginning of 2021 we may see another, bigger recovery for the final wave (E).

Trade well!

Coffee perfectly placed for rebuying Taking support at daily kijunsen which coincide with 50% retracement of current rally, you would never like to miss a buy. In a bull run RSI at 50 needs to give support and it almost kissed that level. Re buying here can provide quick profits towards 100 and recent high. Fundamentally, Brazilian Real rallied big after we spotted bottom against USD at 4.10 . Coffee supplies still abundant.

Coffee reaches accumulation levelsCoffee is trading near multi year horizontal support of 95 cents. While excessive supply and falling Brazilian real crushed the prices, there is ray of hope ahead. With price almost reaching 95 level which seems safe accumulation level, there can be gains in coming months. Farmers in Brazil are reducing coffee cultivation area will lead reduction in inventories in coming months. Price hovering near critical long term support risk to reward is very low for investing in coffee for some months.

Please feel free to leave comments and get in touch with us on:

Twitter: bit.ly/2o9ItrA

Youtube: bit.ly/2Nh8sbE

Tradingview: bit.ly/2PCbed1

Happy Trading!

Team Bitbloxx

#OJ_F $OJ_F #OrangeJuice – BULL SPREADA bull spread OJK19-OJN19 is quite low and it offers interesting RRR. COT analysis confirms an oversold state of a market.

Entry -1,5

SL -2,0 ($75/contract)

PT 0,0 ($225/contract)

LONG #OJ_F $OJ_F #OrangeJuice - LONGOrange Juice price is a bit oversold and a bullish correction could come very soon.

#OJ_F $OJ_F #OrangeJuice - Bull spreadOrange Juice price is a bit oversold and a bullish correction could come very soon. I built a bull spread OJF19-OJH19 and I wait for an entry about -1,50 with SL -2,50 ($150/contract) and PT 2,00 ($525/contract).

Research: Short/Sell Sugar (PENDING)Lester Davids, our Trading Desk analyst, is bullish on sugar over the medium term, but in the short term there may have a potential short/sell.

Interesting that all the softs (except wheat) have all moved together. Possibly look to accumulate a basket of softs on a bit of a pull back.

Long July18 Cotton25 Apr 2018 Cotton #2 Ice

July18 CTN2018

Price fall of Apr24 points to immediate support at 81.10 then 80.70

This latter support is significant and failure here (Daily close below) will open next support at 79.70 (double bottom retest) and 77.70

If the double bottom retest gives way then price will probably move down to 74.40 (minimum) or more likely 73.90 support.

But that is only a maybe and is much further away from the current position.

Current area support 81.10 is reasonably substantial. So rejection longs could be entered in the rectangle with stops in the 80.30-80.20 area (rising dotted line). Upside is assumed to be slow and staircased with an ultimate short term move back to 85.00 area. This would then start projecting an ascending triangle with medium term (Dec18/Mar19) potential of 92+

Stops should rise in parallel with the upward sloping trend line. Any close below breech would signal exit all longs - not establish shorts, but a "hurry up and wait!" position, while new price pattern unfolds.