RUN breaks resistance at 22.60, finds new supportRUN broke resistance today, having a high of 23.66, then dropping to find new support at 22.76 Earnings are coming up, and estimates have analysts bullish on the stock according to finance.yahoo.com

It has support, potentially better-then-expected earnings ahead, and did well today in a bad market. It is competing well with $TSLA in the solar and battery department, and was on a breakout today. Maybe a rally tomorrow? 5DMA looks good and the ichimoku cloud is still in the green at close. Looks promising to me.

Solar

RUN finds support at 21.45 todayRUN came out hot at open, surging 4% an hour after the open, then pulling back to 21.60. Earnings coming on Feb 27, price looking to stay up before then. Needs to break 52w high at $22.40 tomorrow, should stay up to earnings. As a company, earnings look promising, and company is beating TSLA in battery and solar tech. Seems promising. Would be getting in at the end of the day, entry price $21.85, target price $24, stop loss $22.30. New support line today at $21.45.

Aurora Clean Tech RisingAurora Solar Technologies a low float big potential company. Fully diluted share count of just over $96 mil along with Sales presence in Asia, 50% gross Margin, and a current addressable market of $435 mil + in the growing clean energy sector.

They provide a suite of In- line Solar cell visualization and diagnostic equipment to aid in the manufacturing of solar Cells, Allowing companies to cut cost due to Labor and poor cell quality. They have been obtaining repeat orders / larger orders of this suite of Equipment as well as just received a order from the world's largest Solar Cell Manufacture which speaks volumes to where this company is heading.

Currently in a bullish up trend trading just above its .115 support and with both dema 11/22 cross and moving higher along with A/D above its ema I see lots of short term influence to keep this stock rising. Financials at End of Feb and news of any more new volume orders should break through .15 and reaching .19 in Feb. I currently hold a mid term goal of .26 but with growing orders new improvements to the system along with order from World Largest manufacture and the Savings to the Manufactures they provide I see Aurora heading towards $1 going into 2021

CNRG is the best-performing clean power ETF over its lifetimeI'm highly interested in energy right now, but in the long term I'm just really worried about the oil and gas industry. Thanks to Swanson's Law, the price of solar panels continues to fall. Battery technology is also rapidly getting better, and we seem to be witnessing the mainstreaming of electric cars. According to FactSet, the "Independent Power and Renewable Electricity Producers" segment grew its earnings by an astounding 138% last year, making it the fastest-growing segment of the market. That's why I decided it's time to get in. In planning my entry, I compared nine clean energy ETFs to see which one offers the best performance over time.

The second-best performer was QCLN, a passively managed FirstTrust Green Energy ETF. The reason this fund has done so well is its high exposure to Tesla, which comprises 10% of its holdings. That worries me, because Tesla's current valuation is extremely high at a forward P/E of over 70, and QCLN's forward P/E is accordingly also pretty high at over 24. It also has a pretty bad price-to-cash-flow ratio of about 13, which makes me worry about the financial health of the companies in the fund.

So I was glad to find an even better performing ETF that's at a more attractive valuation: CNRG. CNRG, an SPDR "enhanced strategy" fund, is only about a year and a quarter old, so there isn't a ton of history to go on. During that time, however, it has handily beaten QCLN. Also, the fund's valuation is better by pretty much every metric, with a P/E closer to 19 and a price-to-cash-flow of about 10. That's still high, but it's more defensible than the QCLN numbers. Both funds pay about 1.2% in dividends. CNRG's largest holding is micro-cap fuel cell maker FCEL, which has rallied since a huge earnings beat last quarter. Exposure to FCEL could make this fund a lot more volatile than QCLN.

Here's CNRG compared to QCLN:

And here's CNRG vs. the S&P 500:

JKS - time to take some profits?Since recommendation in November NYSE:JKS is +40%, and is now appraoching major resistance region. Therefore, it is wise to take some profits, with idea to reload after some period of consolidation.

Overall, chart is very constructive and healthy pullback with potential inverted H&S should build strength for much higher levels in the years to come.

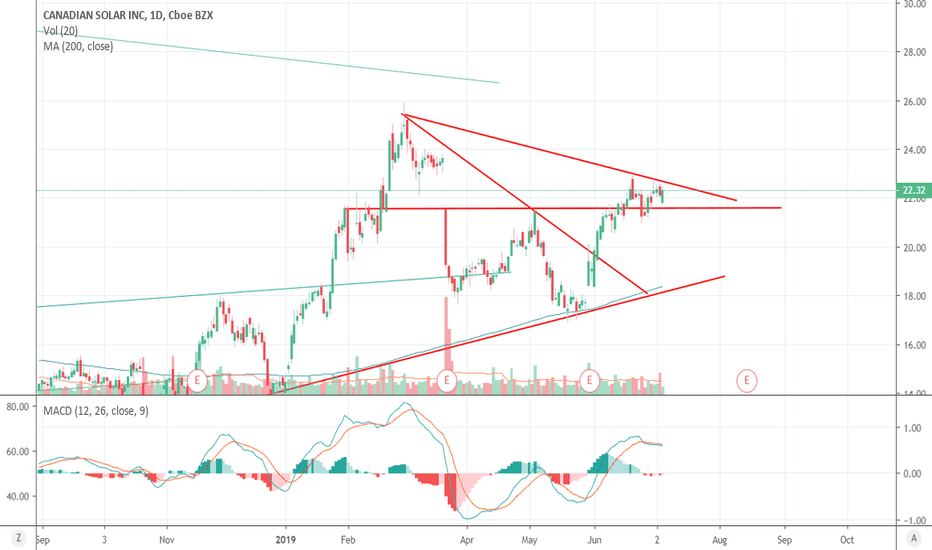

$CSIQ: Good fundamentals and daily trend signal...$CSIQ has a strong chart here, and good valuation in a very interesting growth industry. The daily chart has a signal here indicating a steep rally is starting, this might end up evolving into a larger timeframe trend, as the quarterly flashes a breakout over time.

I'm looking forward to holding if that is the case, after this daily signal reaches the target.

Cheers,

Ivan Labrie.

50% Confidence of $12 Break 2025, 75% Confidence of $10 BreakI have 14 shares of Vivint solar. This was a holding I initiated to do something with the remainder $100 in my trading account this past week, and to invest into solar/energy.

Looks like the company has suffered from shorting defamation in the past: www.thestreet.com

SimplyWallSt states that "Revenue is forecast to grow 13.6% per year." The returns this year have surpassed the US Electrical market and the US Market overall. In the last 5 years this company has had 20.5% Historical annual earnings growth, so I feel confident in the 13% forecast of revenue which will support the growth of this stock by 2025.

I'm confident it will break $10 by 2025.

Enphase to Find Resistance at $36 in Early 2025Although Enphase is an excellent inverter company for solar panels, and has treated its investors to a 420% year to date increase in value, I am feeling that CNN Business's analysis is too optimistic:

"The 10 analysts offering 12-month price forecasts for Enphase Energy Inc have a median target of 30.00, with a high estimate of 40.00 and a low estimate of 26.00. The median estimate represents a +21.85% increase from the last price of 24.62."

Solar panel companies have a tremendous amount of competition and also failure rate when we look at them historically. Due to the consistent innovation and subsequent outdating of previous technology, it is possible that a company like Enphase could be completely off the trading market within a decade. Yes, it could even happen in the next 12 months. I would not invest into this company if I wanted to sell within 6-12 months.

Do I think this stock is going to go under in the next 12 months? No, but I also don't think that it could hit a median of $30 within the next year.

Let the technology, market, and consumers play it out for the next 5 years and we will see this stock increase from $24.62 to over $35.

I have 70% confidence in this analysis. I am holding Enphase and PLUG to diversify into the energy sector.

JKS - bright future for solar ahead?With ongoing worldwide trends towards clean energy, there is good potential for solar sector to shine in the years ahead.

After rather significant selloff recently some ideas are trying to put a bottom finally, and NYSE:JKS is one of them.

Good earnings released today and breakout through neckline of inverse H&S provide initial signs of reversal.

I entered position on breakout today, and plan to hold as one of core holdings for next year, with some short-term trading in and out.

Long SPWRYou don't have to be a tree hugger to get this... And, why we need "Earth Day" when every day is Earth Day is beyond my ken. OK, enough about me.

This pattern (and global warming - dang! Sorry.) suggests it might be time to buy SPWR.

If you are in California, affected by the fires in any way, my heart goes out to you.

$SUNW Breaks Out To The Upside On Strong VolumeWe believe the worst is over for $SUNW after yesterday's impressive price action. There's a lot of room to the upside that the stock needs to make up from looking at fibonacci. We believe prices will keep climbing.

About $SUNW

Sunworks, Inc., through its subsidiaries, provides photovoltaic based power systems for the agricultural, commercial, industrial, public works, and residential markets in California, Massachusetts, Nevada, Oregon, New Jersey, and Washington. The company also designs, finances, integrates, installs, and manages systems ranging in size from 2 kilowatt for residential loads to multi megawatt systems for larger projects. In addition, it offers a range of installation services, including design, system engineering, procurement, permitting, construction, grid connection, warranty, system monitoring, and maintenance services to its solar energy customers. The company was formerly known as Solar3D, Inc. and changed its name to Sunworks, Inc. in March 2016. Sunworks, Inc. was founded in 2002 and is headquartered in Roseville, California.

As always, trade with caution and use protective stops.

Good luck to all!

VSLR Long IdeaHere is an idea for a quick trade. I have a one hour BUY signal on VSLR. Notice the last time we got the 1 hr BUY it went up for a few days and was a nice return. Be Nimble.

Trump the Great! (Or Not)Trump has been in Office for 921 days. He campaigned on bringing back old industries like steel and of course 'clean' coal. He lived up to his promises of lifting and removing thousands of environmental regulations and laws. So what are the results?

....................1/20/09 - 1/20/17..............1/20/09 - 7/30/11..............1/20/17 - 7/30/119 ..........

ETF .............. OB %chg after 8 Years..............OB Days in Office 921..............TR Days in Office 921

SLX .............. 55.58%............................144.79%............................-7.35%

KOL .............. 1.18%..............................281.81%...........................-2.80%

XLE .............. 69.18%..............................73.26%..........................-15.62%

TAN .............. -74.91%..............................-7.66%...........................63.31%

SPY .............. 181.42%...............................9.84%...........................32.63%

QQQ .............. 340.81%............................106.47%...........................57.23%

XHB .............. 218.83%.............................54.52%............................22.74%

Lessons to be taken. 1. Regulations can help keep smaller players out of your industry, thus reducing competition - Hence 'drill baby drill' not always a good thing.

2. No one believes or want our 'clean' coal. 3. The masses are smarter than the select elite few who deny climate change and are investing in solar.

SUNRUN INC - NASDAQ: $RUN Ready To Run Again?After going topside nearly two weeks ago on solid volume, shares of SUNRUN INC - NASDAQ:RUN find themselves consolidating the recent thrust on lower volume and in a fine manner as we can observe from the Daily chart above.

In addition, the stock presently finds itself perched above all of its important moving averages 20/50/200 DMA's and in fine technical shape.

Furthermore, when we extend out to both the Weekly and Monthly time-frames, we can also see that RUN displays excellent technical characteristics. Thus, we have a stock that remains in favorable shape across multiple time-frames, which is certainly a healthy picture from a technical viewpoint.

Moving forward, both investors/traders may want to continue to monitor the action closely for if and when RUN should be capable of taking-out the $19.30 level, such development would likely trigger its next meaningful run/advance into all-time highs and Blue Sky's.

Kill the CancerExxon conned and scammed the public of early action on climate change, a genius business move, but a sold soul. waiting until september to short the company to $1 unless they announce a total 180 to entirely renewable tech which would be a lol. Invest and bet on the future you envision or believe to see. Fk exxon.