Solar

VSLR long ideaAfter breaking above the trend line and a retest VSLR had a nice move higher. It now pulled back again and is starting another move higher. Looks good

SOLARCOIN Daily SLR/USD Range Bound, No Catalyst Yet for UpsideDAILY Chart - SLR/USD out of wedge, on daily, needs to hold the $0.0415$ which is acting a support right now (blue line) It will make its decision

Long Vivint Solar (VSLR)- Bullish on NYSE:VSLR

- Stock broke above a short-term symmetrical triangle pattern.

- Prices are supported by a rising trend line

- MACD broke above the signal line while MFI is turning up (>50)

- On a weekly chart, the stock is trading within an ascending triangle pattern.

SPWR Solar RallySPWR is off to a strong start in 2019, up 25% already. We just received the buy signal from the Megalodon!

The Megalodon indicator uses an artificial intelligence, combined with data from over 500 buy setups, and over 2000 indicators to produce extremely accurate buy signals on any and all asset classes!

SEDG - Solaredge Technologies12/26 MACD cross-over with CCI entry crossing 0 on weekly candlestick chart.

Solaredge Technologies is down from peak of $68 and showing entry point at $38.03 on chart.

Market Cap value $1.65B

Enterprise value $8.4B

Total debt -0-

Free cash flow $150M

Sales growth rate: 22%

Expected value: $3.3-3.5B

About: SEDG

Israeli Solar company SolarEdge Technologies, Inc. offers an inverter solution for a solar photovoltaic (PV) system. The Company's products include SolarEdge Power Optimizer, SolarEdge Inverter, StorEdge Solutions and SolarEdge Monitoring Software. Its product roadmap consists of categories, including power optimizers, inverters, monitoring services, energy storage and smart energy management. The Company's power optimizers provide module-level maximum power point (MPP) tracking and real-time adjustments of current and voltage to the optimal working point of each individual PV module. The Company's solution consists of a direct current (DC) power optimizer, an inverter and a cloud-based monitoring platform that operates as a single integrated system.

Recently partnered with Google using Google assistant for EV charging and 6x faster charging. World's first EV Solar Inverter.

Request needed for a 10-year back-up battery for 10-hr. house charge and ability to rapid charge EV, we're almost there.

Mencari Support dan Resistance Dari Solar DegreeSolar degree adalah kedudukan matahari yang berubah setiap tahun. Sebenarnya kedudukan bumi yang berubah, namun dalam sistem Geocentric jika observer atau pemerhati dari bumi kelihatan seakan-akan matahari yang bergerak. Antara 4 sudut penting dalam setahun adalah apabila matahari dalam kedudukan

0°- Spring Equinox

90° - Summer Solstice

180° - Fall Equinox

270° - Winter Solstice

Ok, kita akan cuba mark untuk mencari support dan resistance untuk salah satu instrument saham US Steel. Pada chart harian (Daily Chart) boleh ditandakan tarikh untuk 4 sudut penting matahari atau solar degree. Kemudian, ukur jarak 90° dan didapati antara Summer dan Fall selama lebih kurang 95 hari. Jadi, support dan resistance akan kelihatan pada setiap 95 ticks pergerakan US Steel. Senang bukan?

Possible FSLR Short Term UptrendNASDAQ:FSLR has tanked lately do to China cutting incentives for solar energy in the rest of 2018. The market has reacted to the news and now the stock is very oversold. My outlook is for the stock to climb back up because of the strong volume shown in the last trading day.

Share your opinion, comments and questions. Good Luck!

I will keep updating this post.

FSLR: Aggressive long...long term implicationsI like $FSLR here, I've been buying gradually for the last few days, but looking to also take a shorter term position here. It might be a good spot to buy long term OTM calls, but you can also go long with a tight stop if today we see a new daily high. If you are not positioned and looking for exposure to solar, then a 1-10% long term position built gradually during a few days up to a month would be ideal for you. Long term, the chart implies we could go to $400 without much problems.

A reminder of why solar is so bullish here: www.greentechmedia.com

Best of luck,

Ivan Labrie.

SEDG - buy the dipSEDG (Solaredge) was sold off rapidly in the past 3 days, which was unsurprising, given the massive run-up after earnings. It is now near a support level: approximately the price it was hovering around pre-earnings, presenting a good opportunity to go long.

This play is risky. The stock is still a "falling knife".

Short term target: $54 - $58 monthly calls

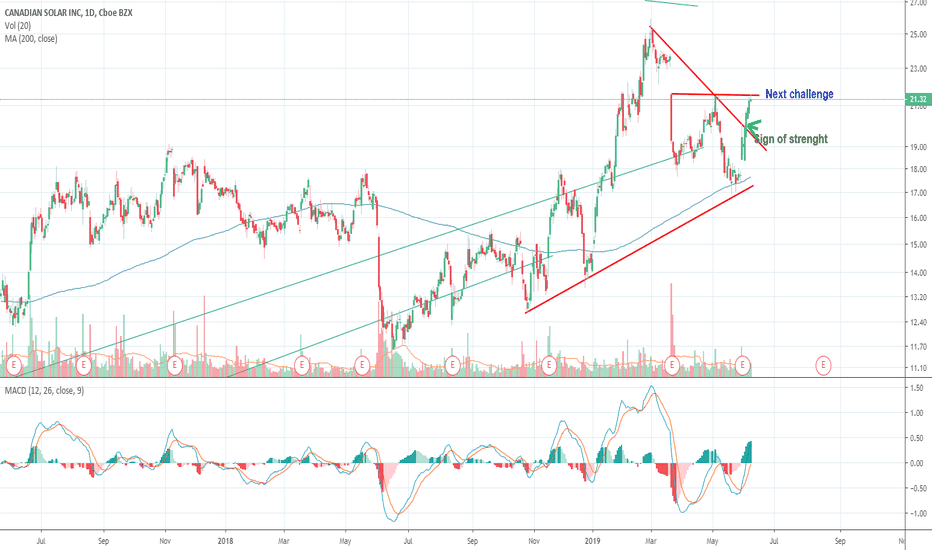

TRADE IDEA OF THE WEEK IN CSIQWe like how the Solar Sector is trading separate compared to the rest of the market right now so we entered this trade today. We are hoping for this to be a longer term swing trade for us but it depends on the price action. The momentum looks nice to the upside and I decided to post the weekly chart on this to show the strength in this current move.

Good luck to all!

FLSR approaching a critical pointDear reader,

Do not trust me. I am a beginner in terms of performance and veteran in terms of experience. The market does not care about the latter remember that always.

This is my analysis for FSLR a stock I have traded successfully and unsuccessfully in the past.

Where are we standing?

Longer timeframe:

- Inside a wide multi-week box starting early December 2017 consolidating the 50 point run from the lows.

- Current price action is at approaching resistance.

Shorter timeframe:

- Stock acting strong after a 1-week small consolidation in early March.

Even longer timeframe (monthly):

- We sit in front of volume pocket from the calamitous 2011 fall. 112 should be the longer timeframe target for a future move.

Where are we heading:

Scenario 1:

- Rejection of multi-year resistance and we go back to trade inside the box or consolidate around the current level. (red line / weekly timeframe)

Scenario 2:

- Continuation previous to consolidation at the 75-76 level. 2018 highs. (orange horizontal line / daily timeframe))

Scenario 3:

- This is where things get interesting and for this, you need the monthly chart as the next point of resistance will be 112.12 YES, 37 points above of the current price action. (purple line / monthly timeframe)

I admit Scenario 3 is short-term is a bit wishful thinking yet worth keeping in mind as possible.

How to trade it:

- If you have traded this from within the box adjust your stops accordingly closer to the top of the box.

- In the longer timeframe leaps could be potentially interesting with the bigger goal in mind.

Thanks for reading. Views are my own.

FSLR approaching a critical pointDear reader,

Do not trust me. I am a beginner in terms of performance and veteran in terms of experience. The market does not care about the latter remember that always.

This is my analysis for FSLR a stock I have traded successfully and unsuccessfully in the past.

Where are we standing?

Longer timeframe:

- Inside a wide multi-week box starting early December 2017 consolidating the 50 point run from the lows.

- Current price action is at approaching resistance.

Shorter timeframe:

- Stock acting strong after a 1-week small consolidation in early March.

Even longer timeframe (monthly):

- We sit in front of volume pocket from the calamitous 2011 fall. 112 should be the longer timeframe target for a future move.

Where are we heading:

Scenario 1:

- Rejection of multi-year resistance and we go back to trade inside the box or consolidate around the current level. (red line / weekly timeframe)

Scenario 2:

- Continuation previous to consolidation at the 75-76 level. 2018 highs. (orange horizontal line / daily timeframe))

Scenario 3:

- This is where things get interesting and for this, you need the monthly chart as the next point of resistance will be 112.12 YES, 37 points above of the current price action. (purple line / monthly timeframe)

I admit Scenario 3 is short-term is a bit wishful thinking yet worth keeping in mind as possible.

How to trade it:

- If you have traded this from within the box adjust your stops accordingly closer to the top of the box.

- In the longer timeframe leaps could be potentially interesting with the bigger goal in mind.

Thanks for reading. Views are my own.

SHORT ON FIRST SOLAR!Short going once, going twice and let's sell...

Here we have it, as you can see my previous call on this didn't go in my favour at all in fact it went to the upside taking out current highs. This time it's sell time. I believe that we may be in for a real treat and prices may decline at 72.00 or go to the upside and reverse near the 76.00 Region taking out lows of 65.00/50.00

Let's Wait And See!

TP: 65.00/50.00