SCRTUSDT UPDATE

SCRT Technical Setup

Pattern: Falling Wedge Breakout

Current Price: $0.2453

Target Price: $0.59

Target % Gain: 160.55%

Technical Analysis: SCRT has broken out of a falling wedge on the 1D chart, indicating a bullish reversal. The breakout is confirmed with strong green candles and volume build-up.

Time Frame: 1D

Risk Management Tip: Always use proper risk management.

Solusdt

KAVAUSDT UPDATEPattern: Falling Wedge Breakout

Current Price: $0.4567

Target Price: $0.74

Target % Gain: 60.53%

Technical Analysis: KAVA has broken out of a long-term falling wedge on the 1D chart, with strong bullish momentum and price closing above the trendline resistance. This breakout signals potential continuation toward the projected target.

Time Frame: 1D

LISTAUSDT UPDATELISTAUSDT Technical Setup

Pattern: Falling Wedge Breakout

Current Price: $0.1893

Target Price: $0.30

Target % Gain: 60.04%

Technical Analysis: LISTA has broken out of a falling wedge pattern on the 12H chart with increasing momentum. Price is holding above the breakout trendline, suggesting bullish continuation. A confirmed breakout with volume could push price to the projected target.

Time Frame: 12H

Risk Management Tip: Always use proper risk management.

MEGA MEGA MEGAPHONE - Insane Upside for Solana SOLUSD SOLUSDTMassive Megaphone setup identified.

Testing double resistance zone...if pass:

Target $420-800, in fast and short lived spike.

Target $1300-1500, in slow and steady...

Looks like either $2T Injection or/and Rate Cuts priced in and about to be announced.

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations

sol buy midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

MAGICUSDT UPDATE

MAGIC Technical Setup

Pattern: Symmetrical Triangle Breakout

Current Price: $0.2253

Target Price: $0.290,

Target % Gain: 30.06%

Technical Analysis: MAGIC has broken out of a symmetrical triangle on the 4H chart with a strong green candle and volume spike, signaling bullish momentum and a potential 30% upside move.

Time Frame: 4H

Risk Management Tip: Always use proper risk management.

SOLUSDT SHORT IDEAUnder current market conditions, the area near 148.3 has been identified as a critical resistance zone, where the AI model detects a high-probability trade setup.

From a technical perspective, a clear directional bias based on recent price action patterns. Suppose the market demonstrates increased volume and price stability above key moving averages in the 148.3 area. In that case, traders are advised to monitor for trend-continuation entry opportunities in alignment with the prevailing momentum.

Profit targets are defined at 145.0 and 140.2, corresponding to logical technical support zones. These levels are designed for staged profit-taking across different trade management styles. Stop-loss should be strictly enforced at the designated level; once breached, the strategy is considered invalidated in order to limit potential downside.

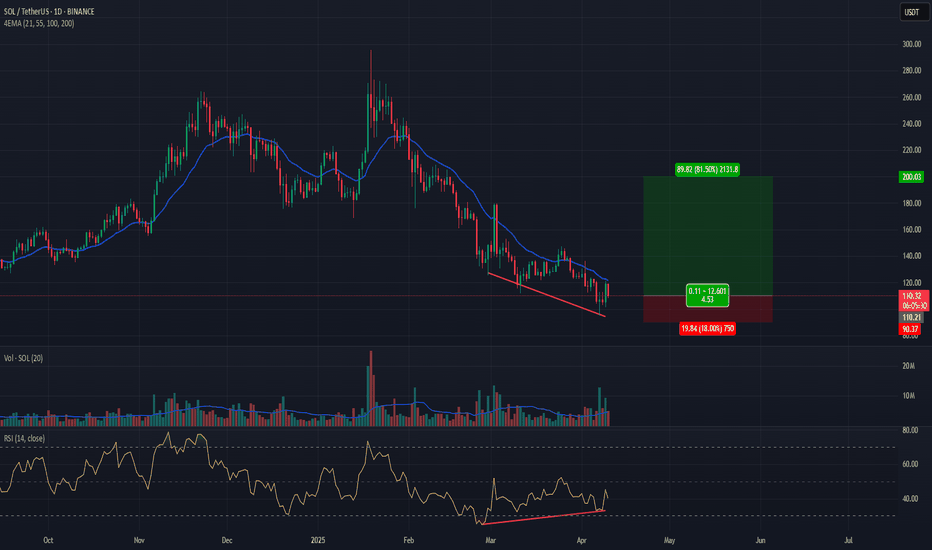

SOL Trade Setup – Structure Shift & Higher Low FormationSolana (SOL) has shown significant strength after deviating below range lows and tagging $95, quickly recovering and reclaiming key support, indicating a bullish structural shift. We’re now watching for a retrace into the $120 zone, which could confirm a higher low and set up a strong medium-term long entry.

🔹 Entry Zone:

Around $120

🎯 Take Profit Targets:

🥇 $162

🥈 $187

🥉 $213

🛑 Stop Loss:

Daily close below $110

Solana Classic Signals (5 Total) & Bullish ConfirmationIt is the first time that Solana moves back above EMA55 after producing a major low since late 2024. Naturally, when this event happened back in late 2024 what followed was a bullish impulse. This is always the case as this is a confirmed classic bullish signal.

Solana is trading daily above EMA55 and this confirms mid-term growth potential.

The low happened 7-April and produced the highest buy volume in more than a year, since March 2024.

The difference is that March 2024 was a peak while April 2025 was a bottom. The volume signal is another classic.

The RSI is really strong with a reading reaching ~60.

The MACD is on the bullish zone now, it has been trading in this zone since 19-April.

There is a broken downtrend line (black) and this is another classic.

We have a total of five classic signals and we used these one hundred trillion times in the past few years to predict how the market would behave next. The list goes as follows:

» Moving averages

» Volume indicator

» Oscillators (MACD & RSI)

» Chart patterns

» Trendlines

Another one that we use very often is candlestick reading. Even if it is not mentioned in the analysis, it is always there. The bottom is confirmed with a reversal candlestick pattern.

» These are some of the classic signals, all bullish. Bullish means up. Solana is going up.

Thank you for reading.

Namaste.

SOL/USDT 1H: Distribution Phase – Short Setup Below $150SOL/USDT 1H: Distribution Phase – Short Setup Below $150

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Conditions (Confidence Level: 8/10):

Price at $148.45, showing neutral-bearish structure after rejection at previous candle high (PCH).

Hidden bearish divergence visible on RSI, signaling potential downside continuation.

Market Makers actively distributing within premium zone ($152 – $154).

Trade Setup (Short Bias):

Entry: $148.40 – $148.60 range.

Targets:

T1: $146.20

T2: $144.80

Stop Loss: $150.20 (above PCH and resistance zone).

Risk Score:

7/10 – Strong rejection at $150.00 – $150.50 resistance supports setup, but minor bounce risk due to oversold RSI.

Key Observations:

Resistance cluster confirmed at $150.00 – $150.50.

Volume profile supports bearish continuation, with recent breakdowns in market structure.

Smart Money likely positioned short after multiple liquidity sweeps at highs.

Distribution signals align with hidden bearish divergence on RSI.

Recommendation:

Short positions favored within entry zone with stop above $150.20.

Consider scaling profits at $146.20 and $144.80 to maximize reward.

Monitor price action around $146.20 for potential absorption or stronger breakdown.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Solana | BULLISH ON SOL | SOL Dominates Blockchain RevenueEven with a dip in activity particularly around memecoins, Solana has managed to hold its ground impressively when it comes to generating revenue.

While you might think fewer transactions would automatically mean less money coming in, Solana's performance shows otherwise. This ability points to the solid value being created by the different applications and uses on the network right now.

A big reason for this financial resilience is the continued strength of dApps on Solana. These apps have been really effective at bringing in fees and adding value to the network. It seems that while the hype around certain speculative tokens has died down significantly, the core utility and economic activity within Solana's dApps are still going strong. This shift towards more fundamental uses for generating revenue is a really positive sign for how the network can keep growing in the long run.

Looking ahead the future for SOL is bright imo as more projects are linking Artificial Intelligence with Solana, taking advantage of its speed and low costs to build new things. Plus, the introduction of Solana ETFs in Canada is a big step.

Other Solana-based alts including Official Trump (TRUMP), Jupiter (JUP), Raydium (RAY), and Bonk (BONK), have followed SOL with good price increases.

It seems like the focus is shifting towards building more lasting and useful applications. With ongoing support for developers and increasing interest from the traditional financial world, Solana seems well-positioned to handle market ups and downs and keep finding new ways to create value in the future. I'll definitely be watching to accumulate for the long-term.

______________________________

BINANCE:SOLUSDT

Why Solana (SOL) might correct to the $75–$85 range?Let’s break down why Solana (SOL) might correct to the $75–$85 range, considering fundamental factors, news, events, technical analysis, Coinbase orders, and on-chain activity.

Fundamental Factors

Solana is a high-performance blockchain known for its speed and low fees. However, in 2024–2025, it faces several challenges that could impact its price. One of these challenges is the phenomenon of meme tokens, often referred to as the " Meme Casino ," which has become a significant part of Solana’s ecosystem.

1. Decline in DeFi, NFT, and Meme Token Activity

Solana has been widely used for DeFi and NFT projects and has established itself as the leading blockchain for meme tokens. However, in 2024–2025, these sectors are experiencing a downturn. For instance, NFT trading volume and DeFi activity on Solana have significantly dropped compared to their peak levels in 2021–2022. Interest in meme tokens like BONK, which temporarily boosted demand for SOL, may also fade due to the volatility of this market. This reduces the demand for SOL tokens for transactions within the ecosystem, putting downward pressure on the price and diminishing the token’s fundamental value.

2. Competition from Other Blockchains

Solana competes with networks like Ethereum (following the Ethereum 2.0 upgrade and the introduction of sharding), Arbitrum, Optimism, and newer players such as Sui and Aptos. These blockchains also offer high performance and low fees, potentially drawing developers and users away from Solana and reducing interest in SOL.

3. Regulatory Risks

In 2024–2025, regulators worldwide, particularly in the U.S., are tightening control over cryptocurrencies. Meme tokens, which drive a significant portion of Solana’s activity, are often associated with scams. I believe that 99.999% of meme tokens are scam coins, and this could lead to regulatory actions that harm the meme sector on Solana. Since Solana heavily relies on this sector, the price of SOL could plummet to levels like $2–$11.

4. Declining Interest in Meme Tokens on Solana

In 2023–2024, meme tokens like BONK temporarily increased Solana’s popularity and demand for SOL. However, in 2025, this hype may fade, as the meme token market is prone to sharp rises and falls. This could reduce network activity and, consequently, the price of SOL. In other words, "the music is slowly fading."

Technical Analysis

On the provided SOL/USDC chart (5-day timeframe), several key points support the idea of a correction to the $75–$85 range:

➖ Volume Profile

On the right side of the chart, the volume profile shows a significant trading volume (a thick zone) in the $75–$85 range. This indicates strong support, making it a likely area for the price to return to due to high liquidity.

➖ Trend Structure

The chart shows signs of a slowing uptrend: shorter upward impulses and increasing volatility (short candles with long wicks). This could signal a reversal or the start of a correction.

➖ Correction Target: $75–$85 Zone ("Coinbase Orders")

The $75–$85 range, marked as "Coinbase orders," is a support zone with limit buy orders. For example, on Coinbase alone, there are orders for 44,419 SOL worth $3,553,520. Similar orders may exist on other exchanges like Binance, Kraken, OKX, and others, creating a strong demand zone.

➖ Hyperliquid Liquidation Map

According to the Hyperliquid Liquidation Map, the $75–$85 range contains liquidation levels for long traders. A drop to this level could trigger a cascade of liquidations, intensifying the downward move but also attracting buyers looking for an entry point.

What Event Could Trigger a Correction?

An expected correction in Bitcoin to the $70,000–$76,000 range could act as a trigger for Solana and other cryptocurrencies to fall, as the altcoin market often follows BTC.

===

I believe this will be the last corrective bounce for cryptocurrencies, synchronized with a bounce in the S&P 500. After that, I expect all markets to enter a deep decline.

🤔🤔🤔

Support around 148.18 is important

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(SOLUSDT 1D chart)

The OBV Line indicator on the 1M chart is formed at the 148.18 point.

Therefore, the key is whether it can be supported around 148.18 and rise above the M-Signal indicator on the 1W chart.

If not, and it falls, you should check whether it is supported near the M-Signal indicator on the 1M chart.

-

Since the M-Signal indicators of the 1D, 1W, and 1M charts are converging, I think the current location is an important support and resistance zone.

-

If it continues to rise, there is a possibility that it will touch the HA-High indicator point of the 1D chart, which is around 225.0.

However, since the HA-High indicator of the 1M chart is formed at the 179.74 point, we need to see if it can break through this area upward.

-

Since the StochRSI indicator is in the overbought zone, even if it rises further, it will eventually show a downward trend.

We need to create a response strategy by keeping this in mind.

In other words, we need to check whether the price is maintained above the M-Signal indicator of the 1D chart or above the M-Signal indicator of the 1W chart and create a response strategy.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- Explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote it to update the previous chart by touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an upward trend following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year upward trend and faces a 1-year downward trend.

Accordingly, the upward trend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

Based on the BTCUSDT chart, I think it is around 42283.58.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely that they will act as volume profile ranges.

Therefore, in order to break through these ranges upward, I think the point to watch is whether they can receive support and rise near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising range in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) range.

In order to do that, we need to see if it is supported and rises near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but based on the previous decline, we expect it to fall by about -60% to -70%.

Therefore, if it starts to fall near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the bear market starts.

------------------------------------------------------

SOL Targets $175 With 20% Surge From Key SupportHello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for Solana 🔍📈.

Solana is currently trading within a strong descending channel. I anticipate a potential 20% price increase in the coming days, targeting the $175 level and a possible breakout to the upside. A key daily support zone has also been highlighted on the chart to provide additional context.📚🙌

🧨 Our team's main opinion is: 🧨

Solana’s stuck in a strong downtrend, but I’m eyeing a 20% bounce to $175 and a breakout soon—plus there’s a key support zone marked on the chart to watch.📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

Breaking: $PENGU Spike 33% Today Gearing For Another Leg UpThe price of Pudgy Penguins ( CSECY:PENGU ) a solana based NFT platform similar to Magic Eden saw notable uptick of 33% today, reclaiming $600 million market amidst breaking out of prolong oversold levels.

About

PENGU is the official coin of Pudgy Penguins.

Pudgy Penguins has become the face of crypto with one of the most influential communities in the industry. From large companies wearing the Penguin, to being featured in ETF commercials, to garnering millions of followers and over 50 billion views, the Pengu has become a cultural icon.

Technical Outlook

Since listing, CSECY:PENGU has seen a notable uptick of +2,000% before sharply consolidating losing about 94% of market value. Present market metrics hints at a possible move to the $0.0266 resistant point and a break above the ceiling of that pivot would spark a move to the ATH recorded.

With the RSI at 73, CSECY:PENGU is looking to capitalize on the dip and make a comeback, with all present metrics hinting at a bullish reversal to the ATH territory.

Pudgy Penguins Price Data

The Pudgy Penguins price today is $0.008763 USD with a 24-hour trading volume of $379,038,248 USD. Pudgy Penguins is up 31.78% in the last 24 hours. The current CoinMarketCap ranking is #107, with a market cap of $550,838,659 USD. It has a circulating supply of 62,860,396,090 PENGU coins.

SOL ANALYSIS🔮 #SOL Analysis 🚀🚀 Update

💲💲 As we said #SOL performed the same. #SOL is trading in a Ascending Broadening Wedge Pattern and there was a breakdown of the pattern. Now we can expect a breakout of the resistance and a bullish move

💸Current Price -- $151

⁉️ What to do?

- We have marked crucial levels in the chart . We can trade according to the chart and make some profits. 🚀💸

#SOL #Cryptocurrency #DYOR

SOL / USDT Update - Breakout in Play! Check out the 1H chart for SOLUSDT. Solana is showing strength in a rising channel, with a recent breakout from a symmetrical triangle to support at $150.

If we break to $165, we could see a strong move higher. But if rejected, watch for a pullback to $150 or lower.

What’s your take?

Is a great time for holding Solana?!Hello guys!

What I see:

Ascending Channel: Price has been moving inside a clearly defined upward-sloping channel since the start of 2023, showing a strong long-term uptrend.

33% Correction: Recently, SOL experienced a 33% correction from its local high, testing the previous breakout zone (highlighted in light blue). This area has now acted as a strong support.

Bullish Signal: Price is attempting to reclaim and close above a key horizontal resistance level (~$132), noted by the text: “If the price closes above this level, then buy it.” A close above this level would confirm a bullish reversal and suggest strength returning to the trend.

RSI Outlook: The RSI indicator at the bottom shows a potential reversal from the lower range, indicating possible bullish momentum building.

Projection: If the price successfully closes above the mentioned resistance zone, the structure supports a potential move toward a new high, as marked by the arrow pointing toward the upper channel boundary (above $250 and potentially up to $300+).