SOLANA at key support zone - Is $160 within reach?BINANCE:SOLUSDT has reached a major support level, an area where buyers have previously shown strong interest. This zone has acted as a key zone, increasing the likelihood of a bounce if buyers step in.

A bullish confirmation, such as a strong rejection pattern, bullish engulfing candles, or long lower wicks, would strengthen the case for a move higher. If buyers take control, the price could rally toward the $160 target. However, a decisive breakdown below this support would invalidate the bullish scenario and could lead to further downside.

This isn’t financial advice, just my take on how I approach support and resistance zones. Best to wait for clear confirmation, like a strong rejection or a volume spike, before making a move.

Every trader has a unique perspective. Let’s discuss this setup within the TradingView community!

Solusdt

SOL/USD Technical Analysis (March 31, 2025)🔹 Potential Scenarios:

✅ Bullish Path (Green): If the price holds above the Golden Pocket (119.89 - 121.15) and breaks 147.38, it may continue rising toward 165-176 and possibly 201-210.

❌ Bearish Path (Red): A drop below 112.40 could push the price toward 109-119, and further breakdown may lead to 78-86 or even 51-57 in extreme cases.

🔄 Neutral/Alternative Path (Yellow): If support holds but no strong breakout occurs, the price may consolidate and later move in either direction.

💡 Key Levels to Watch:

Resistance: 147.38, 165-176, 201-210, 272+

Support: 119-121 (Golden Pocket), 112.40, 78-86, 51-57

📌 Keep an eye on price reactions at these levels to confirm the next move.

SOL | Accumulation Zones | BEST BUY ZONESSolana has topped out after its new ATH in January, and it has clearly marked the beginning of the bearish cycle since then.

The bearish-M pattern in quite significant in the weekly timeframe. ( More info on that pattern here, on the ETH chart ):

From a technical indicator perspective, we see a clear "sell" sign - a strong signal from a trend-based indicator:

Which every way we are heading down (stair step or pin drop), there are a few noteworthy zones to watch:

_______________________

BINANCE:SOLUSDT

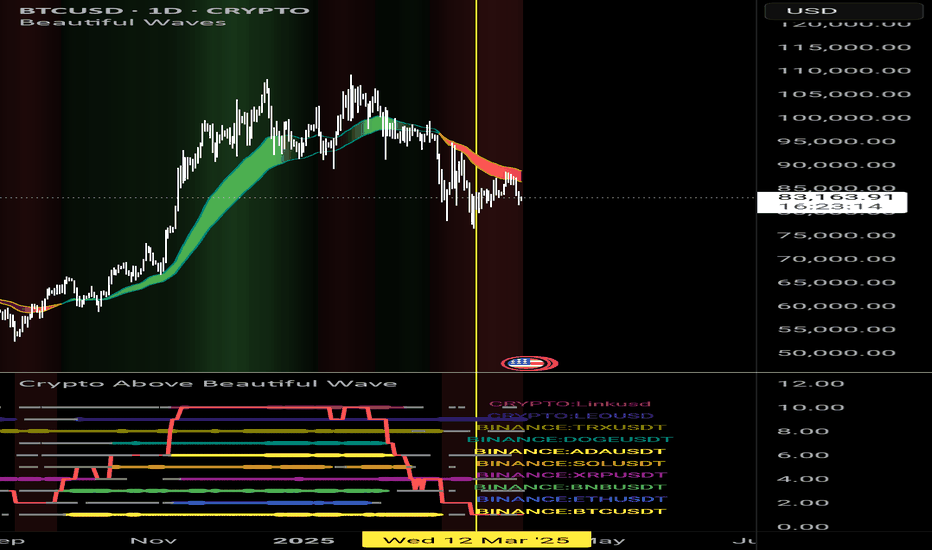

Good r:r on alts.I have made market watch baded on indicator on main screen. It aggregate view on main alts. Fat dot is bullish. Thin coloured dot is signaling possible entry. Gray dot is bearish. No dot is just downtrend. Solid line is showing how market is performing. Now its valie is 1. In the recent past it was good place to enter long trades. Marked with yellow lines. Be aware. If this is entry into bear market there will be dead cat bouces so manage your risk.

SOL/USDT – Key Support Test: Will It Hold or Break?#SOL/USDT #Analysis

Description

---------------------------------------------------------------

Solana (SOL) has been in a strong uptrend since late 2023, but recent price action suggests a key test of support around the $115–$135 zone. This level was previously a major resistance and is now being retested as support.

Moving Averages: The price has dipped below the shorter EMAs but is still above the long-term moving average.

Bearish Momentum: The recent sharp drop suggests selling pressure, but the support zone could lead to a reversal.

Two Scenarios:

🔼 Bullish: If the support holds, SOL could bounce back towards $180+ and continue its uptrend.

🔽 Bearish: If support breaks, a deeper correction to $43–$60 is possible.

📊 Trading Strategy

Long Entry: If a strong bounce occurs from the $115–$135 zone, targeting $180+.

Short Entry: A confirmed breakdown below $115 could trigger a move toward $60 or lower.

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Feel free to share your thoughts and insights. Don't forget to like and follow us for more trading ideas and discussions.

Best Regards,

VectorAlgo

The Global BTC Shake out is coming before 1 million BTC in 2037I believe it worth stating that we might be in a moment where bitcoin is gonna shake everyone out and make everyone sell or at least all those who think 1 million BTC is coming soon. The great Bitcoin reset cycle will occur eventually before true mass adoption... we could very well retest $15,000 as bottom sometime next year.. if true BUY and hodl and invest consistantly for a whole decade and reap the reward of a 1 million bitcoin probably in 2037-38 and Bitcoin by then will be nearly on par with golds market cap by then or below it. And youll become among the weathiest of the wealth.

SOLUSD Solana Bullish Change: LongAs I published yesterday the bearish trade setup,shortly before reaching the profit target,I have closed it manually and updated below the trade idea in the comment section,to inform you. Because of bullishness of tech,and weaker USDolalr, now crypto,specially Bitcoin, Solana and Eth following Tech: Bullish.

Important:

177.93 (red line9 IS MAJOR RESISTANCE: AND PROTECTED TWICE BY THE EBARS;WHO CONTROL THAT REGION:

Once broken Solana can climb higher to 228-244. If not, we will face sudden fast drop down, and possible midterm bearish sideways:

aS IT WILL BE THE THIRD ATTEMPT OF sOLANA TO BREAK THIS MAJOR RESISTANCE; IF NOT SUCCESSFULLY; WE CAN ESTIMATE BEARISH SIDEWAYS8sALAMI DOWNRUN).

Also it will be possible,that in April 2025 because of Trumps tariffs, the market participants

will liquidate their positions immediately,capital outflow.

Currently as Godl and silver also bearish,check my other ideas, the bullish trendchange is cinfirming.

Neverthe less I mad 4 different setups and profit targets,to help ya making better decisions.

Additionally expect the unexpeted:If the market conditions change before your profittarget reached,take that profit and prepare for the other direction.

Volatility and many unexpected events awaiting us.

I,for my part,ignore news, even what Trump says,and just focus to the chart, because it tells exactly when then market starts to change its direction.So I recommand ignoring the hype and news, but being focused on what the market and price does:The market is always right!

Have a nice day.

Valuation iMe Messenger: Reach 5-20% of Telegram's $30B ?Valuation Potential of iMe Messenger: Why It Has the Prospect to Reach 5-20% of Telegram's $30 Billion Valuation?

Authors: SanTi Li, Naxida, Feng Yu, Li Feiyu

Abstract:

In the Web3 era, the functionality of messaging applications is no longer limited to information transmission. Many failures of Web3 social applications (SocialFi) stem from a lack of sustained user engagement and long-term foundation, or their core functionality merely copying existing platforms (such as borrowing from Twitter). Additionally, the integration of tokens into these platforms often lacks depth and practical utility. Social applications, once adopted by users, establish strong defensive moats, and further integrating Web3 elements such as multi-domain payments, multi-chain interaction, financial services, and decentralized applications can significantly enhance their intrinsic value.

iMe Messenger (LIME), as an extension of Telegram's ecosystem, enhances and optimizes its functionality while maintaining a unique market position. This has attracted growing attention from users, investors, and institutional clients.

By analyzing market trends, user demands, and the synergies between Telegram, its public blockchain TON, and iMe Messenger, this paper explores why iMe Messenger has the potential to reach 5-20% of Telegram's valuation and how it fits within the triad of TON, Telegram, and iMe to mutually enhance value.

1. Market Positioning and User Value of iMe Messenger

1.1 Compatibility with Telegram: Lowering User Migration and Learning Costs

iMe Messenger ( GATEIO:LIMEUSDT LIME) is not only a standalone social application but also a Pro-version developed on top of Telegram, allowing seamless synchronization of chat history, contacts, and channels. This drastically reduces migration costs, enabling iMe to inherit Telegram's ecosystem rather than building an entirely new application from scratch.

Essentially, every Telegram user can also be an iMe user, and all iMe users are inherently Telegram users.

1.2 Enhanced Features for Greater User Engagement and Experience

Building upon Telegram's core, iMe offers additional features such as:

●Integrated Wallets: Supporting multi-chain payments and fund transfers among Telegram friends, including BSC, Solana BINANCE:SOLUSDT , ETH, and TON.

●Translation & Content Organization: Enabling translation for personal and group chats without requiring Telegram's Star VIP subscription.

●Payment and Exchange Integration: Supports Binance Pay and Uniswap's DEX functionalities.

●Improved Group Features: Introduces Crypto Box, similar to WeChat's red packet and gifting features.

●AI Assistant & Antivirus Protection: Enhances user experience with AI-driven features.

●Latest AI Integrations: Users can directly utilize AI models like Gemini and GPT for multi-format content creation and image generation.

●Enhanced Privacy: Strengthened encryption and privacy protection.

●Customizable UI: More personalized interface options than Telegram, appealing to specific user demographics.

These enhancements make iMe a superior choice for certain use cases compared to Telegram's native experience.

Feature Telegram iMe Messenger

Core Messaging ✅ ✅ + Premium Antivirus

Cross-Platform Sync ✅ ✅

AI Translation & Speech-to-Text ✅ (VIP only) ✅ (Free via Lime token)

Multi-Chain Transfers ❌ ✅ (Supports Sol, BSC,

ETH, etc.)

AI BOT Integration ✅ ✅ (Advanced AI models)

Functional Optimization ❌ ✅ (More user-friendly UI)

Payment System ❌ ✅ (Binance Pay, CryptoBox)

Staking Services ❌ (Requires third-party access) ✅ (Directly accessible

in Wallet module)

Telegram API Requirement ✅ (Native API) ❌ (Requires external

API access)

Independent App Download ✅ (App Store) ✅ (App Store)

2. Valuation Comparison: iMe vs. Telegram

2.1 Telegram's Valuation Logic

Telegram is currently valued at approximately $30 billion, primarily due to:

1.A massive user base of 900 million to 1 billion with rapid growth.

2.A deep ecosystem including groups, channels, Bot economy, ad revenue, and potential Web3 applications.

3.TON blockchain integration, enhancing payment and application functionalities.

4.An expected IPO and its role in the broader blockchain and AI landscape.

Telegram's valuation is based on user scale × monetization potential × technology moat × IPO expectations, with some influence from its blockchain interactions with TON.

2.2 iMe's Growth Potential

Currently, iMe's Fully Diluted Valuation (FDV) is around $20 million, with 18 million users. While this is significantly lower than Telegram's 900+ million users, its interoperability with Telegram provides substantial user growth potential.

Considering Web3 applications with over 10 million real registered users are rare, iMe's niche appeal could further bolster its valuation. With a 600% growth over 3.5 years, iMe has promising expansion potential.

Factors contributing to iMe’s ability to achieve 5-20% of Telegram’s valuation:

1.User Growth: If iMe captures 5-10% of Telegram's user base (45M-90M users), its market valuation would rise accordingly.

2.Monetization Potential: Ad revenue, VIP subscriptions, Binance Pay integration, and staking services expand its financial ecosystem.

3.Token Utility & Burning Mechanism: Increased usage of Lime token for payments and transactions enhances its long-term value.

4.Multi-Chain Support: Since Telegram prioritizes TON, other blockchain tokens need a third-party solution—iMe fills this gap.

5.TON Ecosystem Integration: iMe strengthens its value by serving as a gateway for blockchain applications within Telegram’s ecosystem.

2.3 Other Reasons for the Valuation Growth Potential of iMe Messenger

There are many projects in the market with overestimated and inflated values, but it is indeed difficult to find undervalued Web3 projects. The core reasons for this mostly relate to the operational strategies of project teams over a period of time, project management styles, and the experiences and habits of personnel. There are even intricate connections with partner institutions, investors, and other stakeholders.

Apart from the valuation growth potential points compared in sections 2.1 and 2.2, the hidden value and potential of the iMe project are also related to the following factors:

1.iMe’s operational model primarily exists within its internal ecosystem and lacks sufficient collaboration with media, rating agencies, and third-party content platforms. This has resulted in valuable updates and the five advantages we mentioned earlier being largely unknown to many investors and enthusiasts.

2.Limited collaboration with KOLs (Key Opinion Leaders) in value-driven or hype-driven streams. In fact, this project was discovered as early as the end of 2021, but we waited to see if others would also identify its value and write about it. However, we found that very few people had actually created content on it. Later, after communicating with the project team, we discovered that they indeed lacked deep collaboration with content institutions and KOLs. Unlike 2018, when PR agencies were of relatively high quality—such as Block72 and Winkrypto, which had at least dozens of team members providing comprehensive support—by 2025, many so-called PR agencies consisted of just one or two individuals. This has significantly increased the difficulty for project teams in making the right choices and the probability of encountering pitfalls. This situation is as challenging as distinguishing between Dogecoin in 2020 and the tens of thousands of meme tokens emerging daily today.

3.Since 2024, Lime has only gradually been listed on new exchanges. Previously, it was primarily listed on Gate, which is known for its extensive range of trading pairs but lacks significant independent AMA (Ask Me Anything) sessions or media promotion through research reports. From 2023 onwards, many major exchanges adopted a strategy of listing only entirely new projects. This strategy undoubtedly impacted a group of high-quality projects that were listed around 2021 and had successfully endured the bear market. With the recent wave of meme token promotion and the market adjustments of 2024-2025, exchange operators and traders have begun to recognize the underlying issues in purely new projects and meme-based projects.

4.The team has a strong technical mindset, focusing on R&D while lacking market operation experience. This issue is not unique to iMe’s team. Even a project as robust as Algorand, which had an MIT-backed “king bomb” team, later faced operational chaos due to blind hiring of Web2 product managers who lacked experience and made misguided decisions.

5.Insufficient utilization of traffic and promotional platforms. During due diligence, we found that the iMe team produces high-quality animations and content. However, these materials are often only published within their own community and Twitter. Many high-quality users are not necessarily effective disseminators—just as in real life, many exceptionally talented individuals are not good at expressing themselves or spreading information. Therefore, leveraging high-quality third-party platforms and engaging in interactive campaigns (such as writing contests) is also key to furthering brand building.

In summary, the fundamental prerequisite for a project to have sufficient growth potential is that its core technology is strong and its sector and market trends are favorable. However, a lack of brand promotion and groundwork is one of the primary reasons why high-quality content goes undiscovered. This issue can be mitigated with the support of large institutions, major exchanges, or influential figures. This is also one of the main reasons why undervalued projects have room for valuation growth.

3. The Impact of the BINANCE:TONUSDT TON Ecosystem on IME’s Valuation

3.1 Growth Potential of the TON Ecosystem

TONUSDT

TON, as the decentralized blockchain platform officially supported by Telegram, encompasses multiple application scenarios, including DeFi and GameFi. Telegram is actively promoting the TON ecosystem.

1.TON’s growth potential: TON currently has a market valuation exceeding $10 billion, and with its integration into the Telegram ecosystem, its value could potentially double in the future.

2.Potential of TON payments: IME has a built-in TON wallet, gradually making it one of the most important payment and transaction gateways within the TON ecosystem. This undeniably enhances IME’s long-term product value. Although the Lime token has not yet been launched on the TON chain, this development is likely imminent.

3.Binding effect between TON and Telegram: TON is poised to become the Web3 core of Telegram’s economic system. As a Telegram-compatible all-in-one development application, IME is naturally positioned to benefit from this ecosystem’s growth.

3.2 Direct Impact of TON on IME’s Valuation

The expansion of the TON ecosystem means that IME is no longer just a messaging app—it is becoming a Web3 gateway. If TON’s overall valuation grows to $20 billion or beyond, then iMe, as an important Web3 entry point, will also see an increase in its valuation. TON’s decentralized payment services and smart contract capabilities, combined with iMe’s built-in multi-chain wallet, provide strong support for Telegram-based iMe users. This transforms iMe from a mere communication tool into a cross-chain financial and social platform.

(This also applies to native iMe users—i.e., institutional users who directly use the iMe software without relying on the Telegram client—bringing new users to Telegram’s ecosystem and creating potential TON adopters.)

Risks and Challenges

Of course, the development of iMe Messenger is not without risks. As a platform based on decentralization and blockchain technology, it faces multiple challenges similar to those of Telegram, including technical security, user privacy protection, and regulatory policies. There is also the systemic risk of Telegram suddenly ceasing API development (although such a move would be self-sabotaging for Telegram itself). Additionally, the Web3 market is highly competitive, with new products continuously emerging, exerting competitive pressure on iMe. How to ensure user privacy and security while continuously optimizing product features and enhancing user experience will be key to iMe Messenger’s future development.

4. Comprehensive Summary: Factors Affecting iMe’s Valuation

Based on the above analysis, iMe’s development trajectory and speed suggest that it has the potential to reach 5-10% of Telegram’s user base. The expansion and growth of iMe also contribute to the overall expansion and development of Telegram. At the same time, by leveraging the mutual benefits of the Telegram and TON ecosystems, iMe can create additional value. This enables iMe to benefit from Telegram’s strong user retention moat while positioning itself as a potential Web3 or secondary version of Telegram.

From the perspectives of user base, business model, TON enablement, integrated wallet, and Lime token functionalities, IME has the potential to achieve a valuation of 5%-20% of Telegram’s estimated value, equating to a valuation of over $1.5 billion. As the Telegram ecosystem matures and the TON network further develops, iMe’s market value may continue to grow, with potential for further valuation increases.

Overall, iMe

LIMEUSDT

Lime is not merely a secondary development software utilizing Telegram’s API. Instead, it is a Web3 social communication and payment tool with significantly stronger utility. Its valuation model is closer to a combination of Wallet + Telegram + TON + AI, making it more akin to a Web3 version of WeChat. It holds the potential to become a fully realized Web3 social application. Hopefully, it will ultimately succeed alongside Telegram.

Next, we will explore the long-term value of several public blockchain networks. May the force be with you~

Friendly Reminder: This article is created for research and educational purposes only and does not constitute investment advice. The Web3 space is simultaneously full of opportunities and risks. We encourage readers to conduct their own research (DYOR) on every project or topic.

sol buy midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

ETHUSD ETHEREUM Long following TechNasdaq turns, crypto follows.

Eth,Solana and bitcoin ,also XRP temporarily changing their directions to follow tech hype, and Trump´s tariffs-announcments.

There is no rational reason in behind of it: As traders we never care,what people say or do! We only follow the price,changes,and our trading rules.Only! What others say in the news or Social media, doesnt care us as traders,because we have understood that only the market is right.If the market says,go long,we follow.If market says,Sell! Then we go short.

Also dealing with quick profit taking is essential. We see that our profit target showing us attractive and lucrative profit numbers, and we get emotional: But the market says:Take that little profit and Get out here! Or Come with me in my direction,otherwise I will take away your profits!

As traders we have no emotional, and zero tolerance for emotional issues,regarding trading!

Therefor we are flexible. We have only one goal: Making Money!

As much and as many as we can! sIMPLE1

4 approches,with short term,midterm,profit taking targets.

Also keep it mind that the green zones are no stop loss zones,but they represent areas where we can cover more longs.

The key is whether it can be supported and rise near 137.28

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

The April TradingView competition is sponsored by PEPPERSTONE.

Accordingly, we will look at the coins (tokens) and items that can be traded in the competition.

Let's talk about the SOLUSD chart.

--------------------------------------

(ETHUSD 1D chart)

The circled sections on the chart are important support and resistance sections.

Since the M-Signal indicators on the 1D, 1W, and 1M charts are passing through the 137.28-180.38 range, it is important to see whether it can receive support and rise this time.

If it fails to rise, it is likely to fall to the Fibonacci ratio range of 2 (80.31) ~ 1.902 (88.47).

-

We need to see if the OBV can rise above the Fibonacci ratio of 1.27 (141.08) as it rises above the middle line.

Since the OBV indicator itself has fallen below the 0 point, there is a high possibility that the selling pressure will increase.

Therefore, we need to check the support and resistance points when the OBV rises above the 0 point.

If it shows support near 180.38, I think it is highly likely that it will turn into an upward trend and rise.

-

Therefore, when the competition starts, check if it is located in the 137.28-180.38 range, and if not, it is expected that a sell (SHORT) position will be advantageous.

Even if the price is maintained above 137.28,

- There is a possibility that it will be difficult to maintain a buy (LONG) position due to the fact that the OBV is located below the 0 point,

- The M-Signal indicator on the 1W, 1M charts is in a reverse arrangement, etc.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote it to update the previous chart while touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------

SOL buy/long setup (4H)In the hourly timeframes, bullish signals are visible on the Solana chart.

The trigger line has been broken. Bullish (ICH) is present on the chart. Higher lows (L) are forming.

We are looking for buy/long positions in the demand zone.

A 4-hour candle close below the invalidation level will invalidate this analysis

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

Solana (SOL) 22.03.2025In the near term, Solana (SOL) is showing a desire to return to its price channel, but further asset allocation is likely to be delayed until the summer of 2025. Despite the possible optimistic outlook for growth, it is worth preparing for corrective moves in September. SOL is among the three assets where market makers are already active, which may indicate artificial liquidity maintenance or position accumulation.

Significant growth is likely to be expected in Ethereum (ETH), while recent momentum is more likely to manifest itself in Bitcoin (BTC) and Solana (SOL). The long-awaited altcoin season may start soon, which requires investors to be more selective. It is recommended to reallocate capital from fundamental assets to high-risk instruments with growth potential, keeping a balance between risk and return.

Special attention should be paid to the Solana ecosystem, where promising projects such as PRCL are already present, which emphasizes the technological and investment attractiveness of blockchain.

Alex Kostenich,

Horban Brothers.

SUI/USDTHello friends

You can see that after the price fell in the specified support area, the price was supported by buyers and caused the resistance to break, and now, when the price returns to the specified ranges, you can buy in steps and move with it to the specified targets, of course, with capital and risk management...

*Trade safely with us*

XRP/USDT:BUY LIMITHello friends

You can see that after the price fell in the specified support area, buyers came in and supported the price and created higher ceilings and floors.

Now we can buy at the specified levels with capital and risk management and move with it to the specified targets.

*Trade safely with us*

SOL/USDT: UPDATE SIGNALHello friends

You can see that after the price fell in the specified support area, buyers came in and supported the price and made a higher ceiling.

Now we can buy at the specified levels with capital and risk management and move with it to the specified targets.

*Trade safely with us*