SOLANA UPDATEHello friends🙌

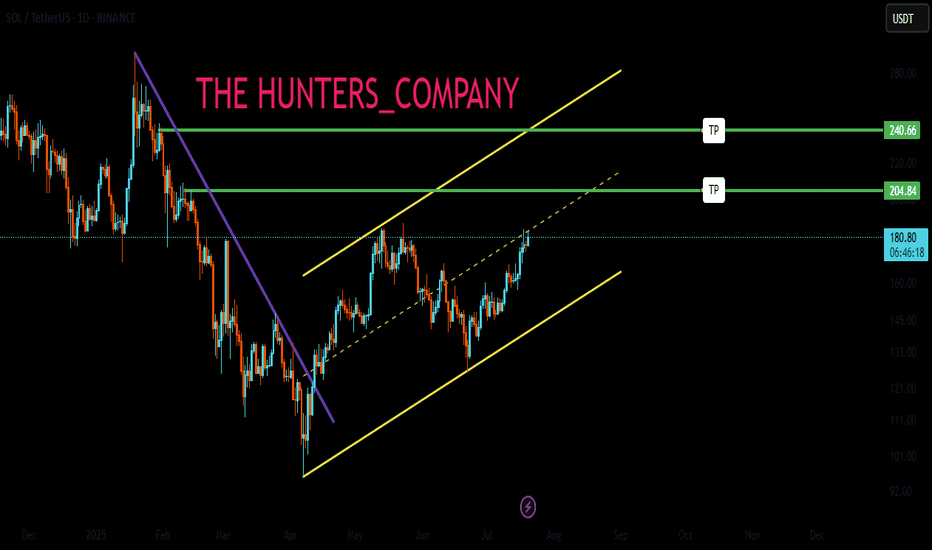

📉Given the decline we had, you can see that buyers came in and supported the price and were able to change the trend and create an ascending channel.

📈Now, considering that the price is hitting higher ceilings and floors, we can expect an ascending wave until the ceiling of the channel.

Don't forget risk and capital management.⚠

🔥Follow us for more signals🔥

*Trade safely with us*

Solusdtidea

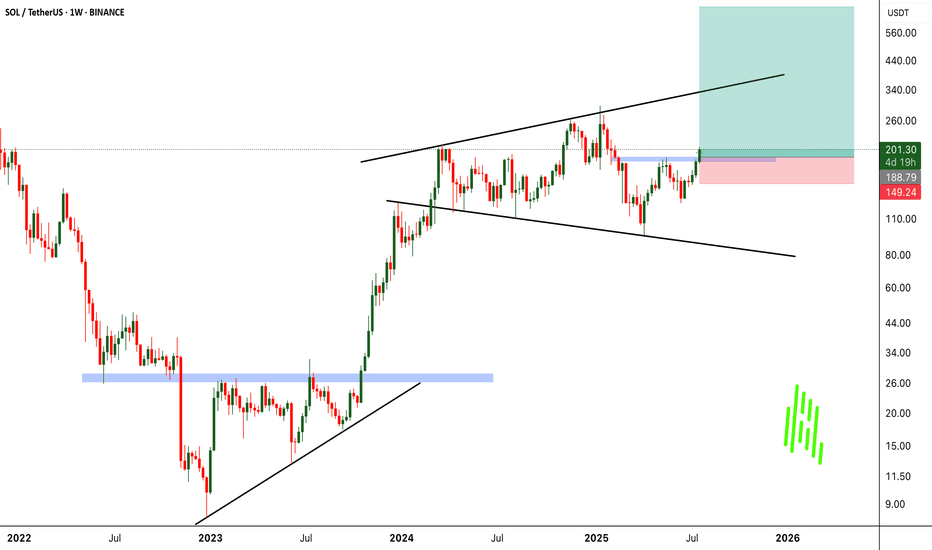

SOLUSDT on Fire! Bullish Wedge Fuels INSANE Upside Potential!BINANCE:SOLUSDT has been exhibiting strong bullish momentum, currently trading within a broadening wedge pattern. This technical structure often signals increased volatility and the potential for decisive moves in either direction. In the present scenario, the breakout above the psychological $200 resistance level suggests that bulls are firmly in control, fueling hopes of further upside.

The continuation of momentum hints at the market preparing for another leg up. The immediate price target lies at $300, where traders may expect some profit-taking and resistance. However, should momentum sustain and buying pressure persist, BINANCE:SOLUSDT has the potential to surge toward the $700 region, aligning with the pattern’s projected price expansion.

As always, managing risk is key. Use a well-placed stop loss below the support level to protect your capital. Breakouts can be explosive, but discipline and proper risk management make all the difference.

BINANCE:SOLUSDT Currently trading at $201

Buy level : Above $200

Stop loss : Below $150

Target 1: $250

Target 2: $300

Target 3: $500

Target 4: $700

Max leverage 2x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

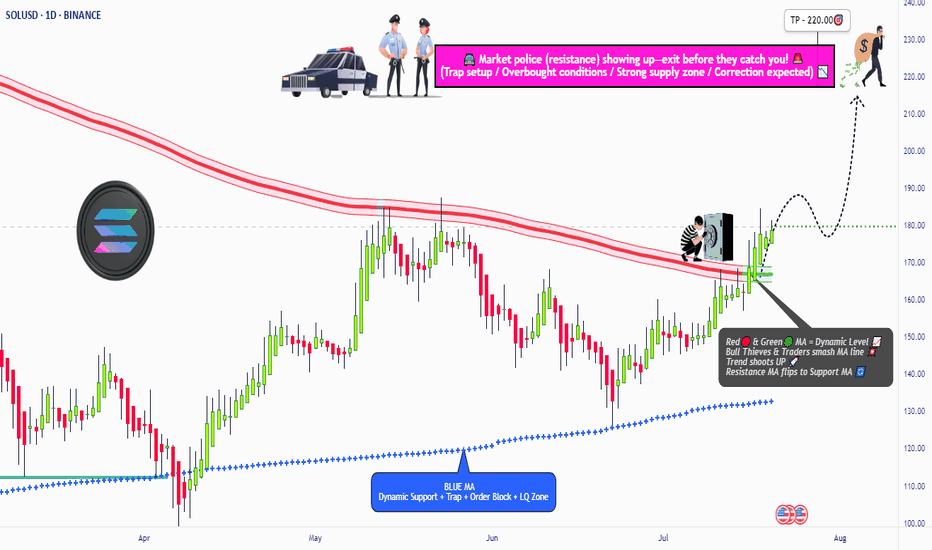

"SOL/USD BULLISH HEIST! Steal Profits Like a Pro"🏆 "SOLANA HEIST ALERT! 🚨 Bullish Loot Ahead – Thief Trading Style (SOL/USD)" 🏆

💸 Steal Profits Like a Pro – Day/Swing Trade Plan 💸

🌟 Greetings, Market Pirates & Profit Raiders! 🌟

Hola! Bonjour! Hallo! Marhaba! 🤑 Dear Thieves & Trend Snipers, the SOL/USD vault is WIDE OPEN! Time to execute the heist with precision.

🔥 THIEF TRADING MASTER PLAN 🔥

🎯 Mission: LONG SOLANA (Escape Near Blue ATR Line)

⚠️ Danger Zone: Overbought | Consolidation | Bear Trap Ahead

🏆 Rule: "Take Profit & Treat Yourself – You’ve Earned It!" 💪💰

📈 ENTRY STRATEGY (The Heist Begins!)

"SWIPE THE BULLISH LOOT!" – Enter at any price, but smart thieves use:

Buy Limit Orders (15-30min timeframe)

Swing Low/High Pullbacks for optimal entry

DCA/Layering Strategy (Multiple limit orders for max loot)

🛑 STOP-LOSS (Escape Plan)

📍 Thief SL: Below nearest low (Daily MA @ $160.00)

⚠️ Adjust SL based on: Risk tolerance, lot size, & DCA layers.

Pro Tip: Tighten SL if market flips bearish!

🎯 TARGETS (Profit Escape Routes)

🎯 Main Take-Profit: $220.00 (or exit earlier if momentum fades)

🧲 Scalpers: Only LONG! Use trailing SL to lock gains.

💰 Big Bank Thieves: Go all-in. Smaller Raiders: Join swing traders.

📰 WHY SOLANA? (Fundamental Boosters)

Bullish Momentum (Tech + Sentiment Driving Price)

Macro Trends, On-Chain Signals 👉 Check Liinkss 🔗

Intermarket Analysis: Crypto & equities syncing for gains!

⚠️ TRADING ALERTS (News & Risk Control)

🚨 News = VOLATILITY! Avoid new trades during major releases.

🔒 Protect Running Trades: Use trailing stops to secure profits.

💥 SUPPORT THE HEIST! (Boost & Win Together) 💥

🔥 Hit the "LIKE" & "BOOST" button to strengthen our Thief Trading Squad!

🚀 More Heist Plans Coming Soon – Stay Tuned! 🤑🎉

📌 Reminder: This is NOT financial advice – DYOR & manage risk!

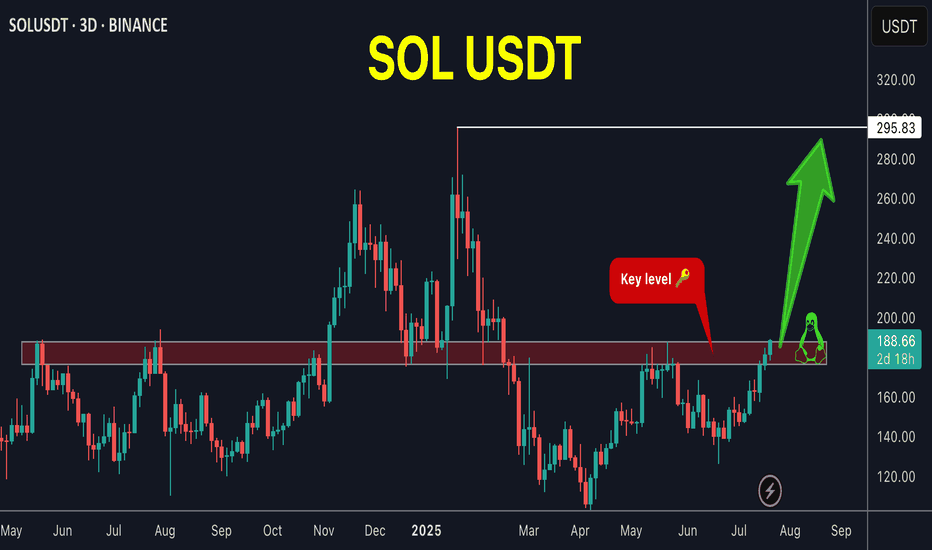

Is SOLANA SOL Ready for a Breakout? Bounce from Falling Channel?

🔍 Chart Pattern and Price Structure Analysis

This chart illustrates a well-formed descending channel (parallel falling channel) that has been developing since mid-January 2025. Currently, the price is approaching the upper boundary of this channel — a key decision area.

🟡 Technical Pattern

Descending Channel: This pattern is characterized by a series of lower highs and lower lows, representing a medium-term bearish trend.

The price is now testing the upper resistance of this channel, a crucial point that could either trigger a breakout or result in another rejection.

📈 Bullish Scenario

If the price successfully breaks out above the upper trendline (around $152–$154), several resistance targets come into play:

1. $164.5 — A minor horizontal resistance and key psychological level.

2. $182.2 — A strong historical resistance zone.

3. $210–$217.8 — A previous consolidation/resistance zone.

4. $237.7, then $261–$280 — Key bullish targets if momentum sustains.

5. Ultimate target near $295.1–$295.7 if broader market sentiment remains strong.

📌 Bullish Confirmation:

Valid daily candle breakout above the channel.

Strong breakout volume.

Successful retest of the breakout area as new support.

📉 Bearish Scenario

If the price fails to break above the channel and gets rejected, we may see a continuation of the downtrend with potential moves to these support levels:

1. $140–$138 — Current minor support zone.

2. $128 — Recent consolidation support.

3. $115.5 — Major support from April.

4. $95.2 — The lowest support zone on the chart.

📌 Bearish Confirmation:

Strong rejection candle (e.g., bearish engulfing) from upper channel.

Weak breakout attempt with declining volume.

Break below the lower channel support or creation of a new lower low.

📊 Conclusion

The current setup is a classic descending channel, indicating a strong mid-term bearish structure.

Price is now at a make-or-break zone — a breakout could signal a trend reversal, while a rejection could extend the current downtrend.

Traders should wait for a confirmed breakout or clear rejection before entering a position.

#SOLUSDT #Solana #CryptoAnalysis #TechnicalAnalysis #DescendingChannel #BreakoutAlert #CryptoTrading #BullishScenario #BearishScenario #Altcoins #CryptoTA

Double Top Alert: SOLUSDT Setup Screams ReversalYello Paradisers, will you act like a pro and prepare for the next clean short opportunity on #SOLUSDT, or will you fall for the same breakout trap again just before the market punishes greed?

💎#SOLUSDT is displaying a textbook double top formation just under a well-respected resistance zone. This kind of structure is no joke—it’s a consistent precursor to sharp downside when liquidity gets taken from retail longs who are too eager to buy high. The market rarely gives second chances. What you’re looking at now is one of them.

💎Price has printed a double top around the $185 to $188 region. That zone has repeatedly acted as a ceiling, and buyers have failed to maintain any strength above it. The lack of follow-through is a major sign of exhaustion, especially after the second tap failed to even test the previous high with conviction.

💎Instead of breaking out, SOLUSDT has rolled over and is now struggling under the $176.23 minor resistance. That weakness is already being confirmed on lower timeframes. As long as this area holds as resistance, there is no justification for any probable aggressive long setups. This is a market preparing to punish overleveraged traders.

💎There’s a clear invalidation for this setup, and it’s extremely important to stick to it. Any 4H candle closing above $190.18 would break this structure and force us to step back and reassess the setup. Until that happens, the current bearish thesis remains firmly in play.

💎The nearest support sits at $168.86 which has highest probability that price may visit there. This level may act as a brief pause, but if the selling intensifies, it will likely break. A confirmed move below that level opens the door toward the true target of this breakdown, which is the $153.95 major support zone. That’s where we’ll be watching for a real reaction.

💎The current structure is heavily skewed toward the downside. Bears are clearly in control below $176.23, and the market has shown no signs of reclaiming key levels that would shift that control back to the bulls. Any bounce should be treated as corrective unless proven otherwise by a structural shift.

Strive for consistency, not quick profits, Paradisers. Treat the market as a businessman, not as a gambler. If you master that mindset, you’ll already be far ahead of the crowd.

MyCryptoParadise

iFeel the success🌴

SOL/USD "Solana vs U.S Dollar" Crypto Heist Plan (Day/Swing)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the SOL/USD "Solana vs U.S Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Yellow MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (156.00) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the nearest/swing low level Using the 4H timeframe (130.00) Day / Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 175.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸SOL/USD "Solana vs U.S Dollar" Crypto Market Heist Plan (Swing/Day) is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰🗞️🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

SOLUSDT Reversal Brewing — Watch This Level or Get Wrecked!Yello Paradisers — Are you paying attention to #SOLUSDT? Because what’s forming right now isn’t just noise — it’s a high-probability reversal setup that could trap the late bulls or become the kind of move that sets the tone for the next few weeks. Either way, the next play is going to separate professionals from gamblers. Let’s talk.

💎#SOLUSDT has been printing textbook bearish price action for weeks — lower lows and lower highs on the major time frame. But something critical has just changed. A break in market structure has occurred, and we’ve now got a higher high. That’s your first probable signal that the tide may be turning. Now comes the most important test — can we form the higher low to confirm this shift?

💎What makes this setup even more interesting is that we’re not just seeing a random bounce. SOL is in the middle of potentially probable completing two major bullish reversal patterns — an inverse head and shoulders and a Quasimodo. The left shoulder and neckline are already locked in. The right shoulder? Still cooking. But here’s the thing — the previous resistance, which aligns perfectly with where the right shoulder could form, is lining up as a textbook retest zone. That means we could get the higher low right there, completing both patterns at once.

💎Right now, price is struggling against multi-timeframe resistance, and that’s exactly what we want. It increases the probability of a short-term pullback to the key zone — around 110.9 to 115 — before the real breakout happens. If that level holds, and we print a confirmed higher low, this whole setup becomes explosive.

💎First area of resistance sits at 153, but that’s just the appetizer. The main zone we’re looking at is 173 to 181. That’s the bigger move that this structure is potentially building toward. But let’s be clear — if SOLUSDT closes a candle below 110.9, the entire setup gets invalidated. That level is your line in the sand.

This is the kind of setup we live for — clean structure, clear invalidation, and serious upside potential. But don’t rush it. The market will reward the ones who wait, not those who chase. Let others panic. Let others fomo. You focus on execution.

Trade smart, Paradisers — and always remember, only a few will catch the real move. Be one of them.

MyCryptoParadise

iFeel the success🌴

#SOL/USDT#SOL

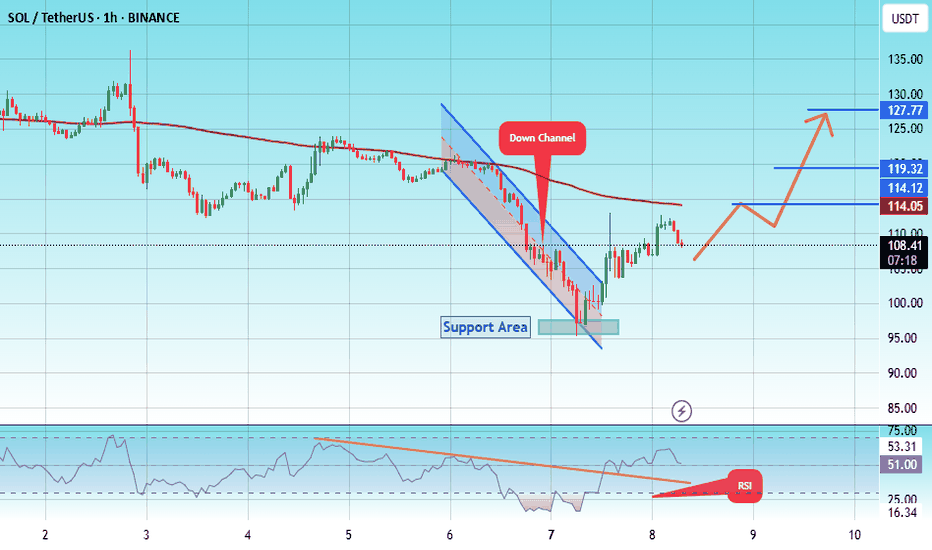

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 134

Entry price 137

First target 140

Second target 144

Third target 149

SOLUSDT SOLUSDT Analysis 📊

🔹 Support Levels: 118, 112, and 107 USD

🔹 Resistance Levels: 130 and 150 USD

✅ The price has reacted positively after testing the 118-112 USD support zone, showing a short-term bullish move with increasing volume.

📉 If the price fails to break 130 USD, a pullback to 118 USD is possible.

📈 A breakout above 130 USD could pave the way for a move toward 150 USD.

🔍 Conclusion: The bullish trend remains unconfirmed until 130 USD is broken.

#SOLUSDT: Price to turn extreme bullish! Get ReadyHey there everyone! 👋

I’ve got some updates on the BINANCE:SOLUSDT price. It’s been testing a crucial level, and it’s showing some really strong bullish signs and patterns. But here’s the thing, we’re starting to think there might be a possible reversal coming up in the next few days. If we’re right, the price could hit all three targets we’ve been tracking.

Remember, though, that this is just our analysis, and it’s always a good idea to use accurate risk management when you’re trading.

Thanks for your support! 😊

If you want to help us out, here are a few things you can do:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

SOLUSDT heading towards resistance 180SOLUSDT has bounce from monthly support MS1. A weekly support marked as WS1 on the chart is also sitting just above it. Therefore, this zone 95-110 was a confluece of these support levels and a bounce was justified. Now the price is heading towards weekly resistance which is sitting around 165-180 zone. However, it is facing daily resistance DR1 and currently pushing there. With a bit of struggle, it shall pierce through this DR1 resisatnce to head towards weekly resistance. And exactly above that weekly resistance, monthly resistance MR1 is also sitting with zone 180-200. Therefore, this is a confluence of the resistances and will cause the upward movement of the price to stall there and cause some push back. Lets see how it reacts there but if in long some profit taking on that resistance confluence zone is definitely a rational behavior.

SOL/USD "Solana vs U.S Dollar" Crypto Heist Plan (Swing / Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the SOL/USD "Solana vs U.S Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Blue ATR Line. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (120.00) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 168.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : Only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸SOL/USD "Solana vs U.S Dollar" Crypto Market Heist Plan (Day / Swing Trade) is currently experiencing a bullishness,., driven by several key factors.☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

#SOL/USDT#SOL

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 95.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 108.50

First target: 114.06

Second target: 119

Third target: 127

SOLUSD Daily Trend Analysis - BullishSOLUSD – Bullish Momentum Alert

Date: April 11, 2025

The Momentum indicator has confirmed a bullish signal for SOLUSD on April 11, 2025.

Entry Price: Opening price on April 12, 2025 — $120.96

Stop Loss: $94.93

Bullish Targets:

Target 1: $139.02

Target 2: $171.00

Target 3: $212.20 (Only if price breaks and closes above $171)

⚠️ Disclaimer: This is my personal market analysis and not financial advice. I may not be correct every time.

All traders are strongly advised to conduct their own technical analysis for entries, stop-loss, and exit strategies. Trading involves substantial risk — trade wisely.

Solana Weekly Outlook – Eyes on the Trendline!CRYPTOCAP:SOL is showing impressive strength by bouncing right off its long-term rising trendline, which has acted as a reliable support zone since 2021. History is repeating — each touch has led to a solid upside move, and this time might not be different.

Key Points:

Price is holding the macro uptrend like a champ.

Stochastic RSI is reversing from the oversold region — a classic early reversal signal.

The major resistance zone (near ATH) is the next big test.

Clean structure, strong base — bulls might just be warming up.

If price manages to reclaim the resistance zone above, we could see an explosive move toward new highs. But if it breaks below the trendline, caution is key.

SOL/USD "Solana vs US Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the SOL/USD "Solana vs US Dollar" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / swing low level Using the 4H timeframe (150.00) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 90.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

SOL/USD "Solana vs US Dollar" Crypto market is currently experiencing a Bearish Trend,., driven by several key factors. 📰🗞️Read Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future Prediction:

📌Keep in mind that these Fundamental factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩