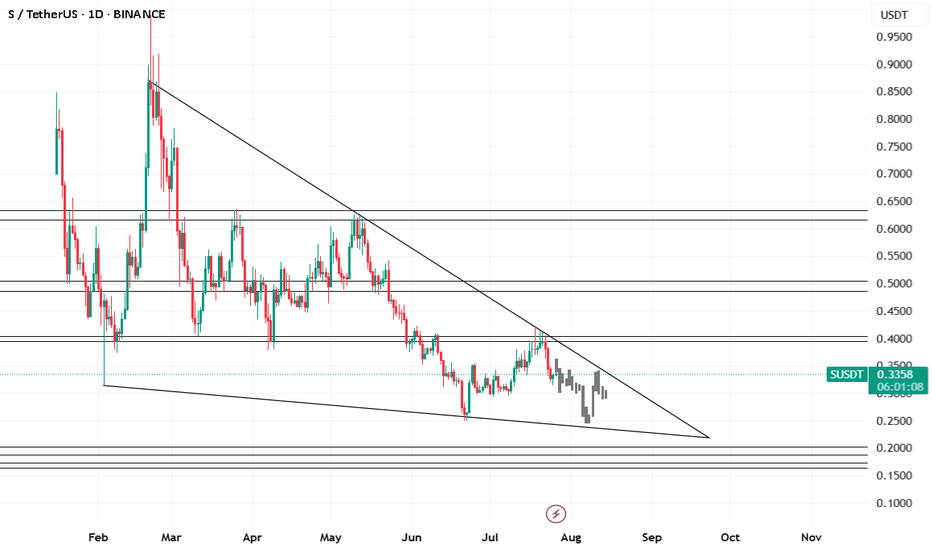

S - SONIC 1DSonic lacks the buying volume to break through its resistances.

The project, after a name change, has become Matic 2.

I expect that we'll soon reach support levels of 30 cents and 25 cents after the pullback is complete. If these supports are broken, the next support levels will be 20 cents and 17 cents.

If the 40 to 43 cent resistance breaks with high volume, there's a possibility of growth to 50 cents. If 50 cents is broken, growth to 63 cents becomes possible.

Sonicrsystem

SONIC | (Previously Fantom) | HUGE BULLISH PatternFTM has now officially been replaced on most exchange and is now trading as Sonic.

At first we saw an initial drop, typical "sell the news" actions, but now there is a bullish pattern forming in the 4h timeframe.

SONIC is bullish because:

✅ Upwards trendline trading

✅ Higher Lows

✅ Bullish chart pattern: W-Bottom

_______________

BYBIT:SONICUSDT

SUSDT - This opportunity might not come around again.!All tokens built on the Ethereum network pumped yesterday as ETH moved up by just 4%, and SONIC (S) stood out as the top performer among them, surging by around 22%.

Currently, the coin has formed a symmetrical triangle pattern, which has been broken to the upside with a massive green candle. It's now retesting the 0.382 Fibonacci level — a key zone to watch for continuation.

This is a massive investment opportunity to buy the token at around $0.55 only.

The long-term targets for S in 2026 are insane — the most conservative target for now is $1.20.

Best regards Cecilion🎯

FTM Delisting | OFICIALLY Becoming SONIC (S)Although a name change for FTM was announced in Aug 2024 already, many exchanges still list FTM, and this will soon change.

It is expected the Fantom will officially be delisted and become SONIC within the next two months.

In August 2024, Sonic Labs announced that they would be replacing Fantom with a new token called Sonic (S). Sonic Labs have confirmed that all existing FTM holders would be able to convert to S at a fixed rate of 1 FTM : 1 S. However, many exchanges will only transfer now, as they will finally be delisting FTM for good and converting all FTM S. This will be done at a conversion rate of 1:1.

_________________________

Make sure you don't miss the latest ETH update, since BTC is likely heading towards a new ATH and ETH stands much more to gain.

_________________

CRYPTO:SONIUSD

POLONIEX:FTMUSDT

S 01/29/2025@Sonic has been abandoned by the market, market maker and team in terms of pricing and therefore has acted completely bearish, even in the positive parts of the market and the positive signals issued by the indicators, #Sonic still failed to grow and falls with the slightest event.

According to the Sonic team's opinion and conclusion to support the price, this trend will change soon and I think we will see the price increase according to the green line.

#S #FTM #FANTOM

Weekly Momentum On Major Pairs (Week 13/2024)

First Thing First: This analysis is for “general overview only” as it is solely based on price action. That’s why it is called momentum analysis in the first place. Support/Resistant, Volume Macro view nor any other factors are not used during write up. Refer to the individual pair analysis for a more comprehensive write up.

XXX/USD: Neutral

Gold & Silver: Very Bullish

XXX/JPY: Neutral

Stock Indexes: Neutral

BitCoin/ETH: Very Bullish

Week 13 (31/03/2024)

Weekly Momentum On Major Pairs (Week 12/2024)First Thing First: This analysis is for “general overview only” as it is solely based on price action. That’s why it is called momentum analysis in the first place. Support/Resistant, Volume Macro view nor any other factors are not used during write up. Refer to the individual pair analysis for a more comprehensive write up.

XXX/USD: Very Bearish

Gold & Silver: Mixed

XXX/JPY: Very Bullish

Stock Indexes: Very Bullish

BitCoin/ETH: Very Bearish

Week 12 (24/03/2024)

Weekly Momentum On Major Pairs (Week 11/2024)First Thing First: This analysis is for “general overview only” as it is solely based on price action. That’s why it is called momentum analysis in the first place. Support/Resistant, Volume Macro view nor any other factors are not used during write up. Refer to the individual pair analysis for a more comprehensive write up.

XXX/USD: Slightly Bearish

Gold & Silver: Mixed/Bullish

XXX/JPY: Neutrel

Stock Indexes: Bearish

BitCoin/ETH: Bearish

Week 11 (17/03/2024)

Weekly Momentum On Major Pairs (Week 4/2024)

First Thing First: This analysis is for “general overview only” as it is solely based on price action. That’s why it is called momentum analysis in the first place. Support/Resistant, Volume Macro view nor any other factors are not used during write up. Refer to the individual pair analysis for a more comprehensive write up.

XXX/USD: Mixed

Gold & Silver: Mixed

XXX/JPY: Slightly Bearish

Stock Indexes: Mixed

BitCoin/ETH: Mixed

Week 4 (27/1/2024)

Weekly Momentum On Major Pairs (Week 3/2024)

First Thing First: This analysis is for “general overview only” as it is solely based on price action. That’s why it is called momentum analysis in the first place. Support/Resistant, Volume Macro view nor any other factors are not used during write up. Refer to the individual pair analysis for a more comprehensive write up.

XXX/USD: Slightly Bullish

Gold & Silver: Slightly Bearish

XXX/JPY: Mixed

Stock Indexes: Bullish

BitCoin/ETH: Mixed

Week 3 (13/1/2024)

Weekly Momentum On Major Pairs (Week 2/2024)First Thing First: This analysis is for “general overview only” as it is solely based on price action. That’s why it is called momentum analysis in the first place. Support/Resistant, Volume Macro view nor any other factors are not used during write up. Refer to the individual pair analysis for a more comprehensive write up.

XXX/USD: Slightly Bearish

Gold & Silver: Slightly Bearish

XXX/JPY: Bullish

Stock Indexes: Neutral

BitCoin/ETH: Mixed

Week 2 (6/1/2024)

Weekly Momentum On Major Pairs (Week 52/2023)First Thing First: This analysis is for “general overview only” as it is solely based on price action. That’s why it is called momentum analysis in the first place. Support/Resistant, Volume Macro view nor any other factors are not used during write up. Refer to the individual pair analysis for a more comprehensive write up.

XXX/USD: Slightly Bullish

Gold & Silver: Mixed/ Neutral

XXX/JPY: Bearish

Stock Indexes: Bullish/ Slightly Bullish

BitCoin/ETH: Neutral

Week 52 (30/12/2023)

Weekly Momentum On Major Pairs (Week 52/2023)First Thing First: This analysis is for “general overview only” as it is solely based on price action. That’s why it is called momentum analysis in the first place. Support/Resistant, Volume Macro view nor any other factors are not used during write up. Refer to the individual pair analysis for a more comprehensive write up.

XXX/USD: Slightly Bullish/Neutral

Gold & Silver: Bullish

XXX/JPY: Slightly Bullish

Stock Indexes: Mixed

BitCoin/ETH : Bullish

WK 52 (23 Dec 2023)

Weekly Momentum On Major Pairs (Week 51/2023)First Thing First: This analysis is for “general overview only” as it is solely based on price action. That’s why it is called momentum analysis in the first place. Support/Resistant, Volume Macro view nor any other factors are not used during write up. Refer to the individual pair analysis for a more comprehensive write up.

XXX/USD: Bullish

Gold & Silver: Slightly Bullish

XXX/JPY: Slightly Bearish

Stock Indexes: Bullish

BitCoin/ETH : Slightly Bearish

WK 51 (17 Dec 2023)

Weekly Momentum On Major Pairs (Week 48/2023)

First Thing First: This analysis is for “general overview only” as it is solely based on price action. That’s why it is called momentum analysis in the first place. Support/Resistant, Volume Macro view nor any other factors are not used during write up. Refer to the individual pair analysis for a more comprehensive write up.

XXX/USD: Bullish

Gold & Silver: Very Bullish

XXX/JPY: Very Bullish

Stock Indexes: Slightly Bullish

BitCoin/ETH : Bullish

WK 48 (26 Nov 2023)

Weekly Momentum On Major Pairs (Week 47/2023)

First Thing First: This analysis is for “general overview only” as it is solely based on price action. That’s why it is called momentum analysis in the first place. Support/Resistant, Volume Macro view nor any other factors are not used during write up. Refer to the individual pair analysis for a more comprehensive write up.

XXX/USD: Very Bullish

Gold & Silver: Very Bullish

XXX/JPY: Very Bullish

Stock Indexes: Very Bullish

BitCoin/ETH : Neutral/Slightly Bearish

WK 46 (11 Nov 2023)

Weekly Momentum On Major Pairs (Week 46/2023)First Thing First: This analysis is for “general overview only” as it is solely based on price action. That’s why it is called momentum analysis in the first place. Support/Resistant, Volume Macro view nor any other factors are not used during write up. Refer to the individual pair analysis for a more comprehensive write up.

XXX/USD: Slightly Bearish

Gold & Silver: Very Bearish

XXX/JPY: Mixed

Stock Indexes: Mixed

BitCoin/ETH : Very Bullish

WK 46 (11 Nov 2023)

Weekly Momentum On Major Pairs (Week 45/2023)First Thing First: This analysis is for “general overview only” as it is solely based on price action. That’s why it is called momentum analysis in the first place. Support/Resistant, Volume Macro view nor any other factors are not used during write up. Refer to the individual pair analysis for a more comprehensive write up.

XXX/USD: Very Bullish

Gold & Silver: Mixed

XXX/JPY: Very Bullish

Stock Indexes: Bullish

BitCoin/ETH : Bullish

WK 44 (28 Oct 2023)

Weekly Momentum On Major Pairs (Week 44/2023)

First Thing First: This analysis is for “general overview only” as it is solely based on price action. That’s why it is called momentum analysis in the first place. Support/Resistant, Volume Macro view nor any other factors are not used during write up. Refer to the individual pair analysis for a more comprehensive write up.

XXX/USD: Slightly Bearish

Gold & Silver: Mixed (Gold is Up/Silver is not)

XXX/JPY: Mixed

Stock Indexes: Bearish

BitCoin: Very Bullish

WK 44 (28 Oct 2023)

Weekly Momentum On Major Pairs (Week 43/2023)

First Thing First: This analysis is for “general overview only” as it is solely based on price action. That’s why it is called momentum analysis in the first place. Support/Resistant, Volume Macro view nor any other factors are not used during write up. Refer to the individual pair analysis for a more comprehensive write up.

XXX/USD: Neutral

Gold & Silver: Very Bullish

XXX/JPY: Slightly Bullish

Stock Indexes: Very Bearish

BitCoin: Very Bullish

WK 43 (21 Oct 2023)

Weekly Momentum On Major Pairs (Week 42/2023)First Thing First: This analysis is for “general overview only” as it is solely based on price action. That’s why it is called momentum analysis in the first place. Support/Resistant, Volume Macro view nor any other factors are not used during write up. Refer to the individual pair analysis for a more comprehensive write up.

XXX/USD: Very Bearish

Gold & Silver: Very Bullish

XXX/JPY: Very Bearish

Stock Indexes: Slightly Bullish

BitCoin: Bearish

WK 42 (14 Oct 2023)