TRADERSAI - A.I. Powered Model Trades for Today, THU 08/08Bear Trap, Bull Trap, or Consolidation?

The aftermath of the recent market sell off could be interpreted - as of now - as a potential bear trap (if you are bullish), a potential bull trap (if you are bearish), or a consolidation of the downside move.

Our models have not formed any near term directional bias, yet, and are in an indeterminate state, waiting for further analyses of today's and tomorrow's daily closes.

In the mean time, read below for our models' trading plans for the day.

tradersai.com

#ES #ESMINI #SP500 #SPX #SPY #Fed #China #Yuan #Yields #Rates #Earnings

Sp1

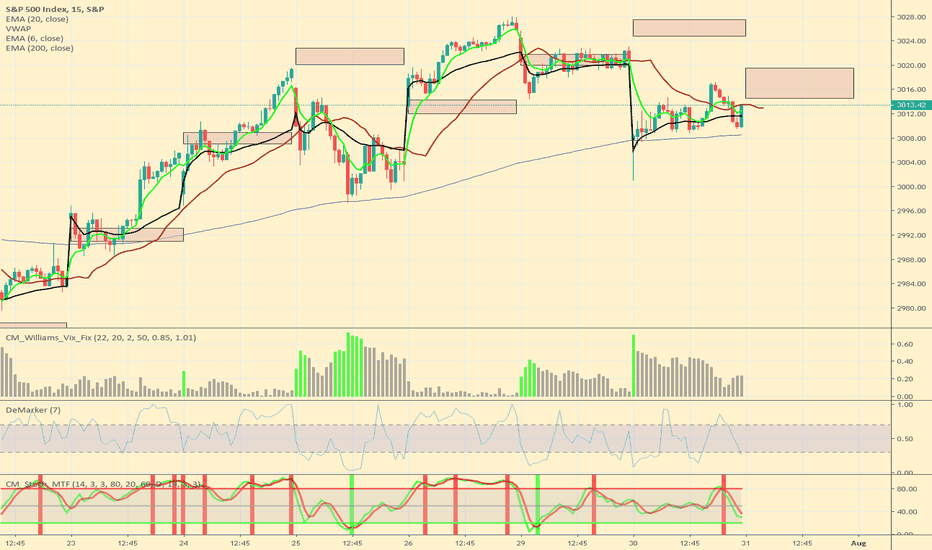

Bulls and Bears zone for 08-08-2019After a very volatile session yesterday, market has been trading sideways during overnight session.

One would expect at least a test of the .50 or .618 Fibonacci level during overnight session.

Perhaps, we could see a test of overnight High before any direction is set.

Levels to watch 2895---2897

TRADERSAI - A.I. Powered Model Trades for WED 08/07 - OUTCOMESResults of our models' trading plans, published in the morning, are now available. Anyone can verify/cross-check the triggering of these trades from any source that provides charts.

THE GIST:

Medium-Frequency Models: Lead to +54.36 index points in gains on six longs and four shorts.

Aggressive, Intraday Models: Lead to +57.56 index points in gains on twelve longs and eleven shorts.

Both of our models lead to excessively high number of trades today, indicating a prevalence of uncertainty in the direction of the market and a lack of dominance on the part of either the bulls or the bears.

THE DETAILS:

For the trade-by-trade details with time stamps, please check out the article below:

tradersai.com

#ES #SPX #SP500 #SPY #IndexTrading #Results #Outcomes #TradingPlans #Education #China #Tariffs #Tradewar #Yields #Yuan

TRADERSAI - A.I. Powered Model Trades for Today, WED 08/07Plan your Trades Ahead - and Stick to the Plan - in this Yo-Yo of a Market!

Those who tended to believe that Monday's big drop was done with Tuesday's comeback might be finding themselves caught off guard with the overnight futures falling again. The opening drop may or may not last, but it is more than likely that the volatility is here to stay for some more time.

Whether you are a novice in the markets or a professional trader, you need to plan your trades ahead (to suit your specific risk tolerance and capital levels) and then stick to that plan in the thick of markets' volatile moves in either direction. That's the best way to avoid getting whipsawed.

Read below for our models' trading plans for the day.

tradersai.com

NOTES - HOW TO INTERPRET/USE THESE TRADING PLANS:

(i) The trading levels identified are derived from our A.I. Powered Quant Models. Depending on the market conditions, these may or may not correspond to any specific indicator(s).

(ii) The results of these indicated trades would vary widely depending on the timeframe you use (1 minute, or 5 minute, or 15 minute or 60 minute etc), the quality of your broker's execution, any slippages, your trading commissions and many other factors.

(iii) These are NOT trading recommendations for any individual(s) and may or may not be suitable to your own financial objectives and risk tolerance - USE these ONLY as educational tools to inform and educate your own trading decisions, at your own risk.

#ES #ESMINI #SP500 #SPX #SPY #Fed #China #Yuan #Yields #Rates #Earnings

TRADERSAI - A.I. Powered Model Trades for TUE 08/06Results of our models' trading plans, published in the morning, are now available. Anyone can verify/cross-check the triggering of these trades from any source that provides charts.

On the heels of the extreme volatility yesterday, our models' published trading plans proved to be consistent in their ability to adapt to market conditions and generate market beating returns in today's sharp recovery as well. If you executed the trading plans to realize positive returns today as well, congratulations on your disciplined execution! If you could not, then use it as a learning experience and identify where you deviated from the plans and try to fine tune them next time (consider paper trading until you can consistently execute the plans).

THE GIST:

Medium-Frequency Models: Lead to +2.20 index points in gains on four longs.

Aggressive, Intraday Models: Lead to +13.70 index points in gains on six longs and one short.

THE DETAILS:

For the trade-by-trade details with time stamps, please check out the article below:

tradersai.com

IMPORTANT NOTES (NOT your typical fine print, but IMPORTANT and MEANT to DRAW YOUR ATTENTION TO):

(i) The index by itself is NOT tradable. The model plans here based on the S&P index level can be used to trade any instrument that tracks the index – the futures on the index (ES, ES-mini), the options on the futures (ES options), the SPX options, the ETF SPY are just a few examples of the instruments one can adapt these plans to.

(ii) The trades indicated are not reflective of or indicative of any specific outcomes for any specific individual – your exact results would vary widely, depending on the time frame you use – tick chart, 1-min chart, 5-min chart, 15-min chart etc, as well as the quality of the execution of your broker, the stop levels you use based on your risk tolerance and your trading style.

(iii) These plans and results are hypothetical and NOT an investment advice to buy or sell any specific securities but are intended to aid – as informational, educational, and research tools – in arriving at your own investment/trading decisions. Please read the full disclosures at the bottom of the article on our website for additional notes and disclaimers.

#ES #SPX #SP500 #SPY #IndexTrading #Results #Outcomes #TradingPlans #Education #China #Tariffs #Tradewar #Yields #Yuan

TRADERSAI - A.I. Powered Model Trades for Today, TUE 08/06Dead Cat Bounce or Short Term Bottom?

There are a lot of theories one can find - and read into the charts - to argue for either case, and a lot of TV talking heads pounding the tables for or against each theory.

At TradersAI.com, we do not pretend to know the answer to that question - nor do we care to engage in an attempt to find an answer. What we strive to, however, do is to look for actionable, executable trading opportunities to squeeze out some positive returns - one index point at a time. Sometimes we succeed and sometimes we fail, and we keep trying to learn and refine our models. Read below for our models' trading plans for the day.

tradersai.com

#ES #ESMINI #SP500 #SPX #SPY #Fed #China #Yuan #Yields #Rates #Earnings

TRADERSAI - A.I. Powered Model Trades for MON 08/05 - OUTCOMESResults of our models' trading plans, published in the morning, are now available. Anyone can verify/cross-check the triggering of these trades from any source that provides charts.

On this extremely volatile day, our models' published trading plans proved to be consistent in their ability to adapt to market conditions and generate market beating returns. Some of you who followed our morning trading plans have reached out with gratefulness for the handsome profits they made on this brutal day on the market. Thank you for sharing your success and Congratulations on showing the discipline to follow and execute the plan in the midst of such a volatility!

THE GIST:

Medium-Frequency Models: No trades were triggered today.

Aggressive, Intraday Models: Lead to +34.90 index points in gains on two shorts.

THE DETAILS:

For the trade-by-trade details with time stamps, please check out the article below:

tradersai.com

#ES #SPX #SP500 #SPY #IndexTrading #Results #Outcomes #TradingPlans #Education #China #Tariffs #Tradewar #Yields #Yuan

S&P’s BEARish ResistanceBack in September ‘18, a proper correction took place after a second attempt against this BEARish Resistance. Today, nearly a year later, we are approaching the same level of resistance; what do you think is going to happen?

With it’s current range, between the BEARish Resistance and the Red Support Line, a prominent “Megaphone” pattern has formed; usually signifying: “Attention: GET OUT WHILE YOU STILL CAN!”

That said, I believe the market is due for a major correction towards the Red Support Line.

Trade well my friends.

TRADERSAI - A.I. Powered Model Trades for Today, MON 08/05Trade War Chaos...Explained by Laws of Physics!

Those who thought we could just bull doze our way through global trade wars without even a scratch, need to look no further than Physics 101 to appreciate the fact that there will be repercussions to our own economy from a trade war with a major trade "partner". It may or may not prove to be long lasting or really damaging - only time can tell.

For now, markets are acting as if investors are just waking up to the possibility of any damage at all - at least it appears so in the overnight futures markets. It may or may not set the tone for the week - our models indicate waiting for the daily close today to make a near term directional call.

Retail traders need to be doubly careful to not get sucked into whipsaw moves in either direction as the spikes could be pronounced with no major directional move at the end. Read below for our models' trading plans for the day.

tradersai.com

#ES #ESMINI #SP500 #SPX #SPY #Fed #Powell #NFP #Jobs #Payrolls #Rates #Earnings

NOTES - HOW TO INTERPRET/USE THESE TRADING PLANS:

(i) The trading levels identified are derived from our A.I. Powered Quant Models. Depending on the market conditions, these may or may not correspond to any specific indicator(s).

(ii) The results of these indicated trades would vary widely depending on the timeframe you use (1 minute, or 5 minute, or 15 minute or 60 minute etc), the quality of your broker's execution, any slippages, your trading commissions and many other factors.

(iii) These are NOT trading recommendations for any individual(s) and may or may not be suitable to your own financial objectives and risk tolerance - USE these ONLY as educational tools to inform and educate your own trading decisions, at your own risk.

Bulls and Bears for 08-05-2019Market has been selling off during overnight session. Since the sell off has been so aggressive last few trading sessions, I would expect Fibonacci 1.272 and/or 1.618 levels of Fridays RTH to be good resistance levels.

This selling seems like end of December of 2018.

Levels to watch 2894---2896

Reports to watch:

US:PMI Services Index

9:45 AM ET

US:ISM Non-Mfg Index

10:00 AM ET

TRADERSAI - A.I. Powered Model Trades for FRI 08/02 - OUTCOMESResults of our models' trading plans, published in the morning on Friday, are now available. Anyone can verify/cross-check the triggering of these trades from any source that provides charts.

THE GIST:

Medium-Frequency Models: Lead to +1.60 index points in gains on two longs.

Aggressive, Intraday Models: Lead to +30.49 index points in gains on two longs and one short.

THE DETAILS:

For the trade-by-trade details with time stamps, please check out the article below:

tradersai.com

IMPORTANT NOTES (NOT your typical fine print, but IMPORTANT and MEANT to DRAW YOUR ATTENTION TO):

(i) The index by itself is NOT tradable. The model plans here based on the S&P index level can be used to trade any instrument that tracks the index – the futures on the index (ES, ES-mini), the options on the futures (ES options), the SPX options, the ETF SPY are just a few examples of the instruments one can adapt these plans to.

(ii) The trades indicated are not reflective of or indicative of any specific outcomes for any specific individual – your exact results would vary widely, depending on the time frame you use – tick chart, 1-min chart, 5-min chart, 15-min chart etc, as well as the quality of the execution of your broker, the stop levels you use based on your risk tolerance and your trading style.

(iii) These plans and results are hypothetical and NOT an investment advice to buy or sell any specific securities but are intended to aid – as informational, educational, and research tools – in arriving at your own investment/trading decisions. Please read the full disclosures at the bottom of the article on our website for additional notes and disclaimers.

#ES #SPX #SP500 #SPY #IndexTrading #Results #Outcomes #TradingPlans #Education #TradingEducation #Forecast #Outlook

TRADERSAI - A.I. Powered Model Trades for Today, FRI 08/02Strong Jobs Numbers or Trade War Tariffs?

In a normal world, the strong jobs numbers would actually make any rate cut expectations ludicrous; but, as we all know, there is nothing normal about our world as far as "political leadership" is concerned. Hence, there can be another factor - aka "the (self inflicted) Trade War Tariffs" - that can drive the interest rate (cut) expectations.

Which expectation/concern dominates the other, is going to determine the market direction for some time - until there is a clear directional breakout in one direction. Notwithstanding the current downturn, the bull is not dead yet even though the bear is growling just around the corner.

Read below for our models' trading plans for today. Good luck with your trading!

tradersai.com

NOTES on HOW TO INTERPRET/USE THESE TRADING PLANS:

(i) The trading levels identified are derived from our A.I. Powered Quant Models. Depending on the market conditions, these may or may not correspond to any specific indicator(s).

(ii) The results of these indicated trades would vary widely depending on the timeframe you use (1 minute, or 5 minute, or 15 minute or 60 minute etc), the quality of your broker's execution, any slippages, your trading commissions and many other factors.

(iii) These are NOT trading recommendations for any individual(s) and may or may not be suitable to your own financial objectives and risk tolerance - USE these ONLY as educational tools to inform and educate your own trading decisions, at your own risk.

#ES #ESMINI #SP500 #SPX #SPY #Fed #Powell #NFP #Jobs #Payrolls #Rates #Earnings

Bulls and Bears zone for 08-02-2019Overnight session market has been sideways except this morning when bulls started to push higher.

It might be a good idea to keep an eye on 50% range area from yesterday's RTH session.

Level to watch 2944---2946

Reports to be aware of are as follows:

US:Consumer Sentiment

10:00 AM ET

US:Factory Orders

10:00 AM ET

TRADERSAI - A.I. Powered Model Trades for THU 08/01 - OUTCOMESResults of our models' trading plans, published in the morning, are now available. Anyone can verify/cross-check the triggering of these trades from any source that provides charts.

THE GIST:

Medium-Frequency Models: Lead to +38.36 index points in gains on one long and one short.

Aggressive, Intraday Models: Lead to +37.19 index points in gains on one long and one short.

A NOTE ON NON-CORRELATED RETURNS, and SUBJECTIVE v/s OBJECTIVE TRADING:

With this, both our medium frequency models and aggressive intraday models started the new trading month with a gain of 30+ index points while the index itself lost 26.82 index points, trading that very index. This continues the trend of the last 12 months by our models of yielding returns that are non-correlated to the index while trading the very index itself.

Today's volatile headlines surrounding additional tariffs on China caused a U-turn in the market action while it was on a positive roll and near session highs, and the efficacy of using emotionless, quantitative, pre-defined trading plans was demonstrated clearly by both our models and their positive returns generated with just two trades each, encapsulating the two distinct directional biases that demarcated the session.

We attribute this kind of swift adjustment in trading biases to the quantitative nature of our strategies and strongly believe that subjective, emotional human judgment would have impaired a trader's ability to adapt - in a timely manner - to such volatile turns in the market sentiment mid-way through the session.

THE DETAILS:

For the trade-by-trade details with time stamps, please check out the article below:

tradersai.com

#ES #SPX #SP500 #SPY #IndexTrading #Results #Outcomes #TradingPlans #Education #TradingEducation #Forecast #Outlook #NonCorrelatedReturns

Is this the beginning of CRASH everyone has been anticipatingEven though last couple of sessions market has sold off aggressively, this is just a pull back.

I believe S&P will bounce soon and make new ATH.

There is strong support at .382 and .50 Fibonacci levels.

My pattern suggests that we should find out next week if market will resume its original up trend or continue to sell off.

Bulls and Bears zone for 08-01-2019Overnight session market has rallied but barely got above 50% range of yesterday's RTH range. We could expect a rally and perhaps a sell off.

Level to watch: 2985----2987

Few reports to keep an eye on:

US:PMI Manufacturing Index

9:45 AM ET

US:ISM Mfg Index

10:00 AM ET

US:Construction Spending

10:00 AM ET

Bulls and Bears zone for 07-31-2019It seems like it is going to be a range bound day today until Fed announcement.

Level to watch 3014---3016

Few reports that could impact the market:

US:Chicago PMI

9:45 AM ET

US:State Street Investor Confidence Index

10:00 AM ET

US:EIA Petroleum Status Report

10:30 AM ET

US:FOMC Meeting Announcement

2:00 PM ET

US:Fed Chair Press Conference

2:30 PM ET

Bulls and Bears zone for 07-30-2019All night so far market has been selling off. I would expect Bulls to defend 3000 level and try to reverse for the day session in anticipation of FOMC meeting tomorrow.

Level to watch 3006 --- 3004

Couple of reports that could impact the market:

US:Consumer Confidence

10:00 AM ET

US:Pending Home Sales Index

10:00 AM ET

TRADERSAI - A.I. Powered Model Trades for FRI 07/26 - OUTCOMESResults of our models' trading plans, published in the morning, are now available. Anyone can verify/cross-check the triggering of these trades from any source that provides charts.

THE GIST:

Medium-Frequency Models: No trades were planned for the day.

Aggressive, Intraday Models: Lead to +12.60 index points in gains on one long.

THE DETAILS:

For the trade-by-trade details with time stamps, please check out the article on our website (not allowed to post links here).

IMPORTANT NOTES (NOT your typical fine print, but IMPORTANT and MEANT to DRAW YOUR ATTENTION TO):

(i) The index by itself is NOT tradable. The model plans here based on the S&P index level can be used to trade any instrument that tracks the index – the futures on the index (ES, ES-mini), the options on the futures (ES options), the SPX options, the ETF SPY are just a few examples of the instruments one can adapt these plans to.

(ii) The trades indicated are not reflective of or indicative of any specific outcomes for any specific individual – your exact results would vary widely, depending on the time frame you use – tick chart, 1-min chart, 5-min chart, 15-min chart etc, as well as the quality of the execution of your broker, the stop levels you use based on your risk tolerance and your trading style.

(iii) These plans and results are hypothetical and NOT an investment advice to buy or sell any specific securities but are intended to aid – as informational, educational, and research tools – in arriving at your own investment/trading decisions. Please read the full disclosures at the bottom of the article on our website for additional notes and disclaimers.