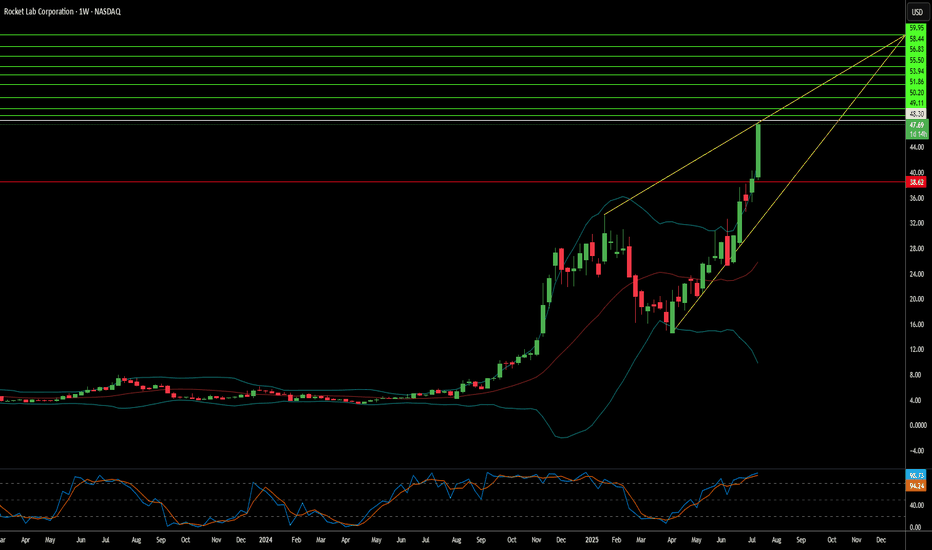

Rocket Lab to new all time highs as more things go to spaceRocket Lab build rockets. CEO has an extremely bright aura. Hard to find a better story-driven pure space play with SpaceX being private. I like Rocket Lab and invested because as more and more things fly and go to space, it has the wind at its back.

Space

Is Rocket Lab the Future of Space Commerce?Rocket Lab (RKLB) is rapidly ascending as a pivotal force in the burgeoning commercial space industry. The company's vertically integrated model, spanning launch services, spacecraft manufacturing, and component production, distinguishes it as a comprehensive solutions provider. With key operations and launch sites in both the U.S. and New Zealand, Rocket Lab leverages a strategic geographic presence, particularly its strong U.S. footprint. This dual-nation capability is crucial for securing sensitive U.S. government and national security contracts, aligning perfectly with the U.S. imperative for resilient, domestic space supply chains in an era of heightened geopolitical competition. This positions Rocket Lab as a trusted partner for Western allies, mitigating supply chain risks for critical missions and bolstering its competitive edge.

The company's growth is inextricably linked to significant global shifts. The space economy is projected to surge from $630 billion in 2023 to $1.8 trillion by 2035, driven by decreasing launch costs and increasing demand for satellite data. Space is now a critical domain for national security, compelling governments to rely on commercial entities for responsive and reliable access to orbit. Rocket Lab's Electron rocket, with over 40 launches and a 91% success rate, is ideally suited for the burgeoning small satellite market, vital for Earth observation and global communications. Its ongoing development of Neutron, a reusable medium-lift rocket, promises to further reduce costs and increase launch cadence, targeting the expansive market for mega-constellations and human spaceflight.

Rocket Lab's strategic acquisitions, such as SolAero and Sinclair Interplanetary, enhance its in-house manufacturing capabilities, allowing greater control over the entire space value chain. This vertical integration not only streamlines operations and reduces lead times but also establishes a significant barrier to entry for competitors. While facing stiff competition from industry giants like SpaceX and emerging players, Rocket Lab's diversified approach into higher-margin space systems and its proven reliability position it strongly. Its strategic partnerships further validate its technological prowess and operational excellence, ensuring a robust position in an increasingly competitive landscape. As the company explores new frontiers like on-orbit servicing and in-space manufacturing, Rocket Lab continues to demonstrate the strategic foresight necessary to thrive in the dynamic new space race.

GE Aerospace: How to go to the moon!GE's stock is soaring due to strong earnings and optimistic future guidance from its aerospace division.

1. Blowout Earnings: GE Aerospace reported earnings per share of $1.75, far exceeding analysts' expectations of $1.10.

2. Surging Orders: The company saw a 46% increase in orders last quarter, signaling strong demand for its products.

3. Revenue Growth: GE generated $10.8 billion in revenue, beating forecasts of $10 billion.

4. Wall Street Optimism: Analysts are raising price targets, with some predicting the stock could climb even higher.

5. Industry Momentum: The aerospace sector is experiencing a boom, with GE positioned as a key player.

I'm betting we are close to a pullback and then catapult to New ATH!

To the Moon: Space Isn't Just for Billionaires. It's for You TooTo your parents, getting involved in space meant joining NASA, becoming an astronaut, or — more realistically — building a scale model of the Saturn V and telling them you wanted to be "just like Neil Armstrong."

Today? You don’t need a PhD, perfect vision, or the ability to survive on dehydrated ice cream. The economics of orbit is accessible from your screen through the shares of publicly listed companies.

While billionaires are busy trying to out-flex each other in orbit, there’s a rapidly growing group of public companies that you can use as a launchpad to space exposure.

Let's explore (pun intended) how space is no longer science fiction only — it's an economic sector you can trade.

🚀 SpaceX: The Giant with a Gravitational Field

First, let’s get this out of the way: SpaceX is still private. Elon Musk’s rocket-powered unicorn dominates the headlines — and deservedly so. The company is launching Starlink satellites by the hundreds, winning NASA contracts, and discussing building cities on Mars where we can move and grow space potatoes.

But unless you have deep VC connections or you run a private equity fund, you can’t buy SpaceX stock yet. (Cue the tiny violin.) According to private-market estimates, SpaceX boasts a valuation of $350 billion, making it the world’s most expensive private company.

What you can do is invest in companies that supply, compete with, or benefit from the SpaceX era. Here are a few ideas.

🛸 Rocket Lab NASDAQ:RKLB : The Mini-SpaceX

If SpaceX is the Goliath of orbital launches, Rocket Lab is the David — except instead of a slingshot, it's using the Electron rocket and prepping the bigger Neutron.

Rocket Lab specializes in small satellite launches — think communications, Earth observation, climate monitoring. The company is cheaper, faster, and more frequent than the heavy-lifters like Falcon 9 by SpaceX. If you’re bullish on the boom in low-Earth orbit activity, Rocket Lab could be the small-cap rocket you can strap your portfolio to.

Bonus points — it’s not just a launch company. Rocket Lab, valued at around $10 billion, is expanding into satellite manufacturing, in-orbit services, and deep space missions.

👽 Intuitive Machines NASDAQ:LUNR : Houston, We Have a Moonshot

With a ticker symbol NASDAQ:LUNR — obviously leaning into the Moon theme — Intuitive is all about lunar landers and space infrastructure. The company is part of NASA’s Commercial Lunar Payload Services (CLPS) program, helping deliver payloads (science experiments, rovers, tech gizmos) to the Moon.

In the absence of crypto moons, these guys are aiming for the real thing.

But be warned: Intuitive is a true moonshot investment. As recently as March, the company's moon lander, Athena, couldn't pull off a stellar touchdown and its shares nosedived roughly 60%. Year to date, the stock is down 55%.

The startup is pioneering in a market that doesn’t quite exist yet at scale. Revenues are coming in phases, tied to contracts, with success as lumpy as a Moon crater. In a nutshell? It's a high-risk, high-reward kind of ride.

Still — if you're looking for an early, pure-play exposure to the Moon economy, Intuitive Machines, valued at just $1.5 billion, is basically as close as you can get.

🌟 Northrop Grumman NYSE:NOC : The Silent Space Titan

While Rocket Lab and Intuitive Machines get the Reddit buzz, Northrop Grumman keeps a low profile, winning contracts and building stuff that actually gets yeeted into space.

The company is deeply involved in NASA’s Artemis program, manufacturing boosters for the Space Launch System (SLS) — the rocket that’s supposed to return humans to the Moon. It also makes satellite systems, missile defense tech, and stealthy aerospace goodies for the US government.

Northrop isn’t going to quadruple overnight on a meme rally — it’s worth just under $70 billion. But it provides serious, steady exposure to the high-stakes space game — with dividends. It’s the choice for traders who like their moonshots with a side of mature risk management.

✨ Lockheed Martin NYSE:LMT : Space Cowboys in Business Suits

Lockheed Martin isn’t just the F-35 fighter jet company. It also builds the Orion spacecraft — NASA’s chosen ride for deep space missions, including Mars (if Elon doesn’t get there first).

Lockheed’s space division covers everything from weather satellites to missile warning systems. The company, worth around $111 billion, has been in the space race before Jeff Bezos came up with Blue Origin and way before Musk founded SpaceX.

Think of Lockheed like the expert-level astronaut: calm, collected, and still racking up mission hours while everyone else is learning which button not to press.

💫 Boeing NYSE:BA : Sometimes Up, Sometimes… Not So Much

Boeing’s Starliner capsule is supposed to ferry astronauts to the International Space Station. Supposed to. It’s been delayed more times than your average budget airline flight.

The astronauts that were stuck in space for nine months? Riding a Starliner that failed during docking (the mission was supposed to be a ten-day roundtrip). So Musk’s SpaceX had to intervene and bring those two space explorers back to earth in March.

Still, despite technical hiccups and PR headaches, Boeing remains heavily involved in the space economy. It builds rockets, satellites, and space station modules. Even when it trips, it trips forward — thanks to government contracts and industrial clout.

If you can stomach some turbulence, Boeing, worth $134 billion, offers another angle on the space trade.

🌙 RTX NYSE:RTX : Watching the Skies

You may not think "space" when you hear RTX (formerly Raytheon), but you should. The company builds sensors, satellites, and missile tracking systems — vital components of the US space and defense apparatus.

Space isn’t just about launching astronauts and rovers; it's about surveillance, communications, and security. RTX, valued at a whopping $168 billion, plays behind the scenes, helping make space a battlefield for signals, not soldiers.

Steady, profitable, and sneakily important, RTX is the stealth bomber of space stocks.

🪐 Other Orbit-Worthy Notables

Outside of the headliners, there’s a growing constellation of companies playing critical roles in space commerce:

Redwire NYSE:RDW : In-space manufacturing and tech solutions.

Blacksky Technology NYSE:BKSY : Real-time satellite imagery and analytics.

Virgin Galactic NYSE:SPCE : Richard Branson’s waning dream of space tourism, working to make suborbital flights a regular experience (careful, though, the stock is down 99.9% from peak).

☄️ Your Portfolio Doesn't Have to Stay on Earth

Space is no longer just a billionaire’s playground or a sci-fi dream. It's an investable theme — one that covers exploration, infrastructure, defense, data, and connectivity.

Sure, the sector is volatile. There will be delays, explosions (hopefully unmanned), stock swings, and moments where it all seems like an expensive science experiment. But there’s also real innovation, massive contracts, and a trillion-dollar economy forming right above our heads.

The thing is, while the biggest names in tech make the headlines and get daily coverage , you won’t see those space companies featured on the front page of big financial journals or covered in the weekly take of your financial podcast.

Traders who are serious about catching the big moves before they blast off should keep one tool close: the earnings calendar . These companies’ quarterly reports highlight progress, revenue, profit or loss figures, and present forward-looking guidance to act as a compass to traders and investors.

The economics of space isn’t just exciting because it’s shiny and futuristic — it’s exciting because the groundwork is being laid quietly, deal by deal, launch by launch. And the traders who are paying attention before the crowd shows up? They’re the ones best positioned for lift-off.

Your turn : Are you already investing in the space economy? Did we miss any names in there? Tell us — what’s your favorite way to reach for the stars? ✨🚀🌔

Breaking: Intuitive Machines ($LUNR) Up 2% In Mondays Premarket The shares of Intuitive Machines, Inc. (NASDAQ: NASDAQ:LUNR ) are up 2.35% in Monday's premarket session. A company that designs, manufactures, and operates space products and services in the United States.

Its space systems and space infrastructure enable scientific and human exploration and utilization of lunar resources to support sustainable human presence on the moon. The company offers lunar access services, such µNova, lunar surface rover services, fixed lunar surface services, lunar orbit delivery services, rideshare delivery services to lunar orbit, as well as content sales and marketing sponsorships.

Technical Outlook

As of the time of writing, shares of Intuitive Machines, Inc. (NASDAQ: NASDAQ:LUNR ) are up 3% in premarket session. Trading in tandem with the 1-month low pivot albeit close to the support point, NASDAQ:LUNR is gaining momentum with a break above the 38.2% Fibonacci retracement point set to be the catalyst to spark a bullish renaissance for NASDAQ:LUNR shares.

Though the Relative Strength Index (RSI) is oversold at 30, NASDAQ:LUNR is looking poised to break the psychological 38.2% Fib level. Intuitive Machines, Inc. earnings is coming up Tuesday, May 13, 2025, before market open.

Analyst Forecast

According to 6 analysts, the average rating for LUNR stock is "Strong Buy." The 12-month stock price forecast is $15.5, which is an increase of 118.62% from the latest price.

Can Satellites Redefine Military Power?The strategic chessboard of military technology is undergoing a profound transformation, where Lockheed Martin plays a pivotal role with its advancements in satellite communication systems. The company has recently marked a significant milestone with the successful Early Design Review (EDR) of the MUOS Service Life Extension program, aimed at enhancing secure military communications. This leap forward is not just about maintaining current capabilities but about reimagining how military power can be projected and managed through space.

Lockheed Martin's collaboration with SEAKR Engineering introduces a groundbreaking feature: a reprogrammable payload processor for satellites, which could revolutionize operational flexibility in space. This technology allows for in-orbit adjustments, ensuring satellites can evolve with changing mission requirements without the need for costly replacements. This innovation challenges us to consider the future of warfare, where adaptability and real-time changes could dictate the outcome of conflicts, far beyond the traditional battlefield.

The implications of such technological advancements extend beyond military strategy; they invite a broader conversation about the role of private-sector innovation in national defense. With commercial giants like Starlink reshaping satellite communication, the military must now decide whether to continue investing in proprietary technologies or integrate commercial solutions. This dilemma poses a fascinating question: In an era where technology evolves at breakneck speed, how will traditional military assets adapt to maintain relevance and superiority?

Eternal PainWill Virgin Galactic ever provide share holders with anything but pain?

The board is no help as they continue to issue more shares. However; there is a potential bright future.

Currently the equity value of the company is lower than the liquidation value of the firm. The enormous cash burn is slowing as most of the capex necessary for flights is ready to go. Given their booking backlog, once they start a solid rhythm a lot of cash is going to be generated.

Look at their most recent investor presentation. With conservative estimates when (if) regular flights begin one spaceport will generate $500m per annum in EBIT [ ] With profits and any sort of multiple on earnings the future could be galactic.

My hopium induced reason for owning this since $5.90 is one day in the next 3-5 years this could be a legitimate 100+ bagger. Space is the ultimate growth arena and with SpaceX focused on mars and industrial matters, Blue Origin no where to be found, the moat is large and the industry is wide open.

Could BA be a wrinkle in the market?BA seems to be facing challenges. However, advancements in technology, along with opportunities in space and defense spending, present a gap that could benefit the company. While I don't have a specific time horizon, I see an opportunity to profit by going against the grain. It's a difficult path, but the potential is there.

MNTS short cover rally preparing to resumesell cycle appears to have been completed. short vol ratio data suggesting we will resume higher soon.

expecting recovery of 2.10 level by q1 2025, at which point the first portion of profits will be secured.. the rest would be held speculatively to 5$-10$ ranges.

lots of bullish macro-economic narrative developments as well to fuel the rally higher.

LUNR IM-2 Launch upcoming in January 2025The privately held Intuitive Machines, LLC, became a public company after merging with a special-purpose acquisition company, Inflection Point Acquisition Corp., in February 2023. The company is listed on the Nasdaq, incorporated in Delaware. On February 22, 2024, the Odysseus IM-1 spacecraft landed on the Moon. It was the first privately built craft to land on the Moon, and the first American spacecraft to do so since 1972. The Odysseus lander fell on its side when landing, but its instruments remained partially functional (albeit with a reduced downlink capacity), so the mission was judged successful. ( WIKIPEDIA )

This company is picking up momentum and creating higher support while enjoying increased volume for the past three months. It looks like this stock seems to climb during the period when they have a space mission or achieve a new contract. Recently they achieved a Contract worth 4.8 Billion Dollars USD with NASA which is a serious contract and not something to be taken lightly. This contract opens up additional revenue opportunities with other companies. Intuitive Machines is increasing REVENUE YOY at a compounding rate, and has seasoned experienced executives in almost every position of leadership. The company is very motivated and explanatory with their products, and you can access user manuals on their technology. It looks like a very legit company that plans on being around for the next space age and further. They have technology in space communications that could possibly be adapted for satellites that transmit signals to earth as various companies are switching to satellites for cellular tech. Inutitive machines market cap is roughly 915.29 Million USD. Their contract is worth 4.8 billion dollars.

www.reuters.com

Following the launch of IM-1, Intuitive Machines' stock surged 35% in one trading day, rising 75% total by Friday, February 16.

Intuitive Machines’ stock sank 32% after the Odysseus moon lander fell on its side on 23 February 2024.

This stock is a great buy for stability while also offering potential for break outs to scalp shares and sell to play short term trends, while going up in the long term. The stock offers consistent news and they are very motivated to become a Space power house for the USA.

BlackSky | BKSY | Long at $1.09BlackSky Technology NYSE:BKSY is a small company focused on satellite imagery tech. It's another name from the SPAC-boom era that suffered a massive price drop - reaching a high of $17.41 in 2021 and a low of $0.86 in 2024. However, based on my selected simple moving averages (SMAs), there may be a price "influx" soon as it merges with its primary SMA (white line) and consolidates further or rises. Fundamentally, the company needs more time to prove itself as a growth/earnings generator, but in the near"er"-term, there may be some price movement in its future. It's currently in a personal buy zone at $1.09.

Target #1 = $1.50

Target #2 = $1.75

Target #3 = $2.00

RKLB: Critical point on Timeline Going to avoid getting into the fundamentals of this company, as I've covered them before (have been increasingly better with the contracts they've won).

As we can see from this range price formed over the past 2 years, RKLB's 3-month downtrend could end through a reversal with great upside. It happened entering the final 70 days of last consolidation period, and I'm awaiting more confirmation for it to happen again in this period.

Keep in mind that price:

- Tapped the bottom of this demand zone (has never closed below)

- Broke below descending wedge (can reclaim before Friday)

- Is being hurt by S&P PA (last pump coincided with rising S&P)

I would be weary of longing any stocks at this point, but will be closely observing how RKLB closes Friday to inform the next steps.

TESLA 130 AFTER EARNINGS !! High Valuation: Tesla’s market capitalization has skyrocketed in recent years, leading some to argue that its current valuation is not justified by its earnings or sales figures. If these critics are correct, Tesla’s stock could be overpriced, and a market correction could be on the horizon.

2. Competition: The EV market is becoming increasingly crowded. Traditional automakers like General Motors and Ford are ramping up their EV production, and newcomers like Rivian are making waves as well. Increased competition could erode Tesla’s market share.

3. Regulatory Risks: Tesla operates in a highly regulated industry. Changes in policies related to EVs, self-driving technologies, or environmental standards could have a significant impact on Tesla’s operations.

4. Production and Delivery Challenges: Tesla has faced criticism for production delays and quality control issues in the past. If these problems persist, they could harm Tesla’s reputation and bottom line.

LUNR a space exploation penny stock with momentum LONGLUNR got an injection of trader and investor interest this week on the news that their lunar

lander ( robotic unmanned) is launch ready. While it is a publically owned company, 50% is

insiders, 40% retail investors and 10% institutions. In is in the shadow of NASA in Houston from

whom it has drawn employees. Of particular importance last spring when there was a news

catalyst , price went to the moon into the 45 level. This time around is early in the cycle.

In February from liftoff to descent and landing took two weeks. Volumes topped out at 7M

shares per day. Current volume is about 760K. Price was flat in the Friday after-hours trading

on expected diminished trading. I expect LUNR to be actively traded until the news starts

getting old. After that, the 50% insiders some of what are just rank and file employees

but some of which are executive types with larger share quantities may find away to augment

the news cycle. My stop loss is 5 at the Friday afternoon low pivot. My target is near to the

head and shoulders of the February high pivot. I especially note a 425% earnings beat ( they

only burned 20% of the cash burning projection set by the analysts. Earnings is soon to arrive.

This could turn out to be a Tim Sykes' "supernova" with news digestion associated momentum

synergized with another earnings beat ( the earnings is probably all grants from NASA and the

Pentagon). I assert this could turn out to a a great trade.