Seasonal Cattle Spread Worked Out Great +$4000 PotentialBoy I must admit, I sure do miss dealing with these spread markets. Far less time effort and less stressful then intraday trading outrights, that is for sure.

Shout out to @NorthStarDayTrading for the awesome Auto Support Resistance Indicator. I love it!

Spreadtrading

Selling 5 Delta Spreads!Hello guys, hope all is well. Today I got into a SPY $411 / $408 spread expiring 06/04 /21. This put credit spread has a 5 delta which gives it a 95% chance of it being OTM by expiration rendering it worthless. I was able t to get $9 of credit for each spread which would give me a 3.09% ROI for the week.

Hope you have a great day

We'll Meat Again, Don't Know Where...This one can be a volatile spread, and that goes both ways.

The idea is to buy Live Cattle and sell Lean Hogs for a trade that runs May though to August. The reason for this trade is seasonal. That is, there is a pattern that tends to repeat itself each year.

Heading into mid-year, Cattle slaughter tends to be high while Hogs are at the opposite end. But that pattern reverses itself when we are past mid-year and looking towards the end of the year. That creates the spread movement.

In the last 25yrs, buying April Cattle and selling Dec Hogs, has lost money only 3 times. 22 out of 25 is not bad. Optimized data of course, but there is a pattern there! The average profit in that time has been over $3500 for one spread. You can also do this spread in nearby contracts, eg Dec Cattle.

It’s a volatile one though. Drawdowns can be, what’s the word…interesting. It makes this trade more about getting entries correct. An early to mid-June pull back has happened in more years than not. Waiting for that can give a better entry time.

Caveat: it ain’t that simple. Spread trading takes knowledge, support, patience and trade management, but the gems are there when we look in the right place.

One last thought: you cannot use 'beef stew' as a password. It's just not stroganoff.

- Please follow and like for more trade ideas and learny stuff! -

This Corn Spread Can PopThis is a good spread to trade. If you’ve not traded Corn before, just read on, because this style of spread trading is interesting. It has both technical and fundamental aspects and is built on a history of good stats.

Corn has an annual crop cycle. It’s planted in April/May, subject to weather issues in the following months, then harvested for first delivery on the Dec futures contracts. The Dec contract is based on what they call the ‘new crop’.

But before then, there are other contracts still banging about.

Corn futures have March, May, July, Sep and Dec maturities. So any active contracts before Dec are based on the ‘old crop’, the stuff that was harvested last year.

So early to mid-year, we have a situation where some of the futures contracts are based on known supply and others (Dec and beyond) are based on the stuff that is still green. That young and growing crop is subject to uncertainty of weather and other growing conditions.

Spreads are great tools in which to trade shifting certainty. And with something like an annual cycle of growth and harvest, you build a database and look for what they call seasonal patterns.

The Trade:

Selling the Sep and buying Dec for a hold of several months, in the past has proven to be a very reliable trade.

In fact, optimized for timing, an entry during May and an exit early August has been profitable 95% of the time in the last 20 years.

For 2020, I like this spread now given the market is in backwardation. That means the near (short) month is trading above the back (long) month. Corn has had a great run up over the past few months and pull back might see that backwardation reverse to contango and move with the seasonal trend.

Stats:

19yrs out on 20yrs profitable. That’s selling the spread in May and buying back in August. Optimized timing of course, but still the numbers are good.

In the last 10yrs, profit has averaged about 10 cents, or $500 per spread. Drawdowns have been three figures also, aside from 2011-2013 when things went a bit crazy.

Trading;

This one has an exchange listed spread so entry, exit and GTC stops are easy.

For something like this, I would tend to start with a 3*ATR for a stop and see where it goes. Entries by way of selling into rallies.

Check your broker offers SPAN margining. If not, get a new broker.

Alternatives:

The same spread can be achieved by selling July instead of Sep. Some years that is a better option, some not. More often than not, it would carry more volatility (up and down).

Crude Oil Spreads: A Quick Intro.Spreads are complex instruments. This is just an introduction and some ideas to get our brains ticking over. I had started writing a guide to understanding these three types of spreads, but it just got a little long. It might be easier to do it this way:

What do you see above?

Here are some observations to get started:

1

All spreads topped out well before June Crude Oil topped out. From about 17th Feb, those spreads stopped gaining. Could spreads be a way to take a contrary position as a trend exhausts itself, and have a little room for error? It certainly is here (although not always the case).

2

Look at the ATR for each. Spreads show lower volatility.

3

Correlations (the CC shows the spread correlation to the underlying June contract). Correlations seem strong during a trend then do their own thing at other times. Change creates opportunity. Constant correlations are not as fun.

4

Basic spreads: bull and bears – are directional. That is, they move closely with the underlying. More complex spreads, like the fly and condor seem to be suited to shifting sentiment along the forward curve.

5

Flies and condors are very similar. The condor tends to have a little more volatility than the fly. In this case, it’s not much.

-

It can be a complex subject, worthy of something closer to a book, than a comment here, but it’s a start.

Just a warning – going down the spread trading path might change everything.

-

A couple of futures markets where flies and condors are often traded: Crude, Natural Gas, Grains, Eurodollars (and most other STIRs). Options - that's a totally different chat....

Cattle and Corn: An Obscure Spread With Interesting NumbersAn interesting spread here. I’ve traded this one on and off over the years. It’s a long-term hold and some years this spread just has a nice smooth trend.

Think of this spread as a cost of carry, in a way. Or perhaps: wholesale versus retail is a better way to look at it.

Feeder Cattle (young moo cows) + Corn (food) + time equals Live Cattle (grown up ones).

It’s like that math parents do when say “do you realize how much it costs to have a teenager and send him/her to college?”

In futures we can trade that, for cattle and corn at least. We can see where base cost of production is over or undervalued and with a bit of patience, these kinds of trend trades reveal themselves.

This one has a great seasonal pattern. That is, it tends to repeat itself each year. Not every year, but most years. Research says selling Feeders and Corn and buying live Cattle can be quite profitable. On average, an entry late April and exit late Sep has been profitable every year since 2005.

From 2006 onwards: 100% strike rate, average profit $3374 for one spread.

Formula:

(+2*400*Live Cattle) – (1*50* Corn) – (1*500 * Feeders)

Essentially it says one contracts of feeders (50000lbs) plus one of corn (5000 bushels) makes about two live cattle (80000lbs).

Some also trade a 1 Corn: 2 Feeders and 4 Live Cattle. Its’ essentially halving the corn requirement from above.

Remember, there are no rules in spread trading. Our job is to find the correlations and trade them.

Risk:

Hmmm, there are two ways to look at that. The stats say the worst drawdown in the last 15yrs in $5400 and that is about double of most other years in that time. So it’s not a small risk trade.

The other way is to eyeball a chart. That recent move from +2000 to 0 did not take long at all. Unless get a well-timed entry, then stops will have to be wide - a few thousand at least (about 3.3 times ATR). It’s one where you would start with a wide stop and bring it in should you see some equity.

Entries and exit need finesse since it’s not an exchange traded spread. Experienced spreaders only, with knowledge of seasonality. In you are new to these kinds of spreads, mark it down as market knowledge and come back for a look later on.

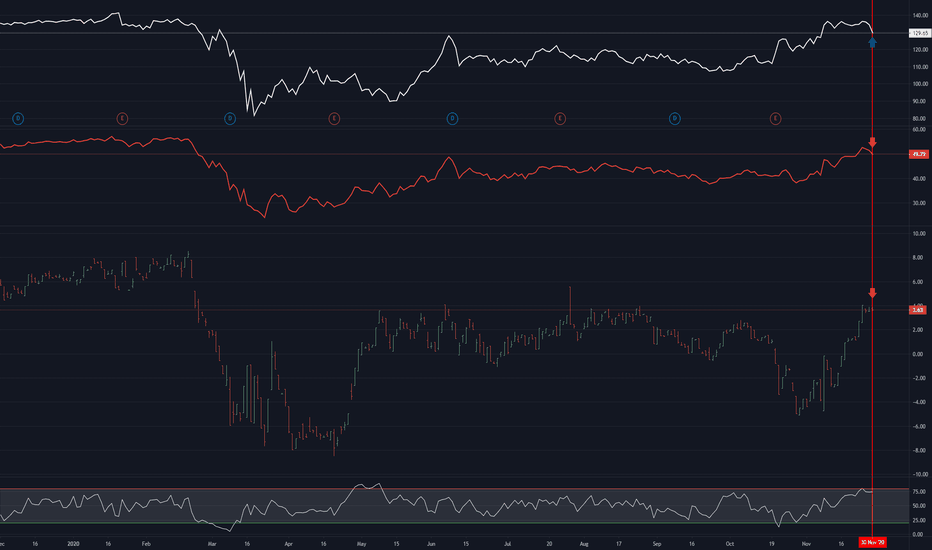

Pay attention to the Bitcoin Futures premium! What is this?

This chart is offering a look at the behavior of the Bitcoin Futures premium and how it tends to behave. The chart in the top position is a symbol I use to track the premium of the front month futures contract over the Perpetual futures (as a proxy for spot). In this case, the front month contract are the June futures, so the symbol is: FTX:BTC0625-FTX:BTCPERP ...

I'm using the FTX futures, but you can substitute your exchange of choice - just make sure you're comparing two series from the same exchange. The important thing to understand is that the symbol is calculating the difference between the two prices.

Why should I care?

For the uninitiated, futures contracts exist as a tool to hedge risk in any given market. Therefore, by paying attention to futures spreads, you can get a more incisive feel for how the market is acting. You can learn if people are willing to pay more (or less) for a product at a future date, and by how much; the utility of this information comes more into focus by comparing it to previous cycles.

During the previous two cycles, the spreads were much tighter. In the March cycle, the spread was testing a maximum of +5% over spot buy for most of it's life was averaging closer to 2-3%. In December it was even smaller, living mostly around +1%. As you can see, the current cycle has oscillated between +5% and +10%, as evidenced by the regression channel. For an even more in-depth comparison, the spread during the 2017 bull market peaked out at about +10% as well, so we're in a similar environment now. What I'm finding interesting today is that the spread is threatening to close the session outside of the channel and even went negative over night!

That's nice, but what can I do about it?

Trade it! I've had a fair amount of success trading the spread outright over the past year by going buying one contract and selling the other in accordance with the price action. This can be a bit ungainly though because the spreads tend to move fast and you have to leg out of the trades because the order execution on most of the platforms isn't up to par. There are pro's and con's to consider... trading the spread is a great way to put on high probability trades with minimal margin risk, but expect to experience frustrating amounts of slippage.

The other thing you can do is use it as a directional indicator. The chart at the bottom shows how the futures premium leads price spot price time and again. I haven't found a way to reliably forecast the magnitude of what the corresponding move in spot will be, but the spread tends to oscillate around the price. When it gets too high, the spread contracts. Selling in the futures then leads to selling in spot, and vice-versa. Just be advised that we're in an extremely extended market environment. Spreads can and will go negative, so needless to say, there's a lot more risk to the downside.

Low Risk Weekly SPY Credit Spread I'm looking to enter $357 SPY spreads and holding till DOE on the 22nd. I'm aiming to collect 5-6 credits per-contract with a goal to grow capital invested by a minimum of 5% for the week.

-With the SPY trading at roughly $375, we would need a -4.8% move to the downside for the week for the price to come down into the range of our strick.

-Price is trading above the 50 and 200 day SMA

-$357 is below the 50 day SMA.

-Strike is in the zone on .382 fib retracement zone for 52 weeks high and low.

-In the zone of support on 4h chart.

-91%-93% of OTM if held to DOE.

Let me know what you think. Have a nice day.

Pair Trading - Mean Reversion on BTCUSDTPERP/ETHUSDTPERPPrice might be crossing under the fast MA (yellow) and revert towards the slow MA (purple), the mean. For this trade, you can do a 1.3-to-1 reward to risk setup - 3% target profit, 2.2% stop loss.

Pair Trading (from Wiki): A pairs trade or pair trading is a market neutral trading strategy enabling traders to profit from virtually any market conditions: uptrend, downtrend, or sideways movement. This strategy is categorized as a statistical arbitrage and convergence trading strategy.

Pair Trading - Mean Reversion on BCHUSDTPERP/LTCUSDTPERPPrice might be crossing over the fast MA (yellow) and revert towards the slow MA (purple), the mean. For this trade, you can do a 1.5-to-1 reward to risk setup - 9% target profit, 6% stop loss.

Pair Trading (from Wiki): A pairs trade or pair trading is a market neutral trading strategy enabling traders to profit from virtually any market conditions: uptrend, downtrend, or sideways movement. This strategy is categorized as a statistical arbitrage and convergence trading strategy.

my hedged trade on FacebookHi everyone,

This is another trade taken today: Long Facebook vs Short JC DECAUX.

Facebook has lost about 20% from its august top.

Fundamentals are still strong (ROE, revenues, margin, cash flow), the management is strong as well.

I choose to hedge it with JC DECAUX, traditional advertising industry, with weakening fundamentals (debt and cash flow are bad), Moody's outlook is negative, and the management is not that good (actually they are the heirs of the founder, compare with Facebook that is run by its founder...).

This is implemented with barrier options maturing in 90 days.

Comments are welcome!

10/19 TSLA Bullish Ascending TriangleHere are my thoughts on TSLA for the week of 10/19.

Red Horizontal Lines are points of resistance.

First the top of the triangle must be broken with a closing candle. (that is the easy part)

the hard part will be to break the first two resistance levels.

If we get a candle closing above each line then we can shoot higher.

If we open green I might look into a 450/460 spread

As always I look forward to your criticism for or against this play.

2 Pair tradesHi everyone,

I just wanted to share 2 trades I took today.

First one is Long Alibaba versus Short Carrefour.

Retail industry trade, e-retail vs traditional. Fundamentals speak by themselves (Revenue growth, ROE, etc all in favor of BABA).

This a 90 day trade (using barrier options). Going to the winter, it is a replay of the covid trade.

The second one is Long Teleperformance Short Publicis.

Advertising industry. Companies are expected to continue to slash their traditional advertising budgets due to the covid crisis and they continue to move to online advertising (bad for Publicis).

In the meantime, Teleperformance has moved to full Work From Home and fundamentals and management is excellent.

It is a 90 day trade as well, so we'll see how it goes...

Thanks for your comments!

10 million Intermarket Spreads index ETF commodities etc / Hello

New strategy spread.

I made my initial deposit to 10 M.

I was losing big money on 1 M and i thought on a scale i was trading i should add up some money on the deposit.

For 10 M i trade 5000 SP and 500 DOW. For 1 M capital it should be 500 and 50 respectively and so on. It is safer.

SP vs DOW. I put orders every 10 points in sp and evry 100 points in dow. lets see..

Update ONLY - Intermarket Spreads index ETF commodities etc /

I Believe the sp vs DOW spread is the most profitbale for me at the moment. I will stick with it.

10 million Intermarket Spreads index ETF commodities etc /

Thank you.

Opening balance 25 june 2020 13 736 029 $

Closing balance 10 july 2020 13 790 860$

increase of +/- 54.000 $

I traded the EURHKD vs CHFHKD + AUDUSD vs NZDUSD .

It has been less volatile than indices IMHO. I will trade bigger size and i stress less.

THank you !

MAX Drawdown -10% adjusted today.

Mar/2020 11.82%

Feb/2020 31.94%

Jan/2020 4.51%

Dec/2019 1.23%

Nov/2019 5.46%

The way i get my numbers of unit is DOW / SP500 = 28622/3265 = 8.77 but i am biased SP. In fact i should be 9 SP and 1 DOW.

BE patient is IMPORTANT. This result took me a few days.

Please remember. I always spread..... Except when i am not 8-) My point is , in the SPY vs DIA for example i spread all the time and i add until it is profitable. I add once or twice per day, no more.

I trade mostly

SPY vs DIA vs QQQ

WHEAT vs CORN

others when opportunities arise.

That s it. The simpler the better.

Have a good week.

Patience is the key IMHO.

All in light size.

I will trade more spread in ETF PAIRS.

Employing an ETF pairs strategy may be useful when there is a disconnect between assets that are usually highly correlated.

Sector, country, and index ETFs also provide opportunities for the pairs trader, usually involving going long on a strong ETF and short on a weaker one.

It’s important to exit the trades when the assets realign or the trends of strong and weak assets reverse. It would also be wise to set a loss limit on each trade, and realize that markets are dynamic; relationships that existed yesterday may not necessarily exist tomorrow.

MRCI encourages all traders to employ appropriate money-management techniques at all times. www.mrci.com

This is a site above i use for season trading.

Patience is the key. It is important to trade well, not just trade !

Bear in mind i can not trade futures on this platform as i use the minimum service. I recommend the book from MRCI.

.LOG

RECAP - 15:13 15-Nov-19

I spread-trade mostly.

The guy who spreads and makes a little every day is the one who walks away with

the big money.

–A veteran trader, quoted in Futures

Trade to Trade Well- Not Make Money.

www.nasdaq.com

Spread positions tend to be less risky than outright long (buy) or short (sell) positions.

But not all the time. Always remember, it is not 100% full proof.

Mostly WHEAT versus CORN.

But others as well.

This is a demo.

Please read below for understanding.

Money managment is important as well as patience etc...

I follow more or less the spread strategy with the seasonability strategy -

Keith Schap – The Complete Guide to Spread Trading

The guy who spreads and makes a little every day is the one who walks away with

the big money.

–A veteran trader, quoted in Futures

and

Toepke, Jerry. "Moore Research Center, Inc."

Why Seasonals Work. McGraw-Hill, 14 May 2009. Web. 05 May 2016.

Every time i enter a trade in WHEAT i enter a trade in CORN with the same amount of units.

Trade accordingly your account size.

The trades can last hours, days or weeks.

Patience and discipline and money management. I will not lose more than 65% of the equity.

I can trade every hour or other.

Intercommodity Spread

The Intercommodity Spread is a spread between two different commodities, but

in the same delivery month. Often this spread will set-up according to seasonality

or occasionally a harvest supply/demand picture.

The Corn-Wheat Spread

The Intercommodity Spread is our focus for today! Specifically, we will analyze

the merits of the Corn-Wheat Spread going into the 1st and 2nd quarter of 2011.

This is a trade that I have monitored since the 80’s. I believe that it was first

notable in the mid 60’s. The beauty of taking a classic trade and reviewing the trends

and history of the trade saves time in research and previous observations may even save

money on potential variances to watch for.

In this particular spread, we note that July may be a strong month for corn as the weather

conditions, plantings acreage, export numbers may still be unknown. The crop is still vulnerable

until toward harvest which is in the fall.

On the other hand, the harvest for the soft red winter wheat may be in July, allowing

the market to regard the saturation of a harvested crop.

One may look at the months; March, July and September contracts for this particular

spread trade and select another, but this is the anatomy of the spread, not to be confused with a trade

recommendation.

As a matter of fact, this spread may be reversed at another time of

the year.

June may be a time frame to review the Wheat-Corn Spread. These grains are

both feed product and may also be affected by livestock production trends, global

supply-demand figures, weather conditions and basis for the farmer.

The wheat is

typically a heavier protein cereal, while corn does not vary to the extreme. In modern

times patents on the seeds of varied grains has become big business. The USDA regulates

the delivery, grades and contract size regular for delivery. The seeds and

fertilizers must also endure disease and pests. There are Government Subsidy programs

as well in some cases to control the crops being planted. In recent times, Africa has

been know to lease land for crops to fulfill some of their required grain inventories

in countries such as China.

Technically, it is good to pull up a spread chart to monitor the merit of the potential

move. One may select their Indicators to best confirm an entry.

There is no audio in my videos.

This is a demo ac. I have a real ac with oanda.

.LOG

Trading Commodity Seasonal Patterns

There is no such thing as a sure thing, but ignoring this chronological behaviour

of seasonality and the tools readily available to help predict these patterns is

a mistake for futures traders.

A knowledgeable broker who is MRCI equipped and spread savvy is a keen idea if you want

to get into trading seasonal commodities.

The more tools you utilize within using the approach of seasonality trading can help

you in whatever commodity or commodities you wish to trade.

Trading Commodity Seasonal Patterns

Every calendar year there are different seasons. It is how we plan our lives.

Weather is the first to come to mind, but there are holidays, sports, shopping and

many more that help break up the monotony of our day to day patterns.

The commodities market is no different. Just as you use a calendar to plan and

differentiate Thanksgiving from Opening Day in baseball, you can use the same

calendar to blueprint possibly when wheat futures will be high and copper prices low.

Traders can use these seasonal patterns to their advantage because it allows a certain

degree of predictability of future price movements, rather than being bombarded by an

endless stream of often contradictory market noise. Now of course there are other

factors too numerous to list that can affect the futures markets, but certain conditions

and events reoccur at annual intervals and help traders anticipate where the market is

headed.

Seasonality Of Futures

Although not 100% accurate-as any weatherman will tell you-weather is, in fact,

the chief contributor to seasonal futures trading. The annual cycle from warm to cold

weather and then back again affects all the agricultural commodity markets as their

supply and demand coincides with the planting and harvesting seasons. However, the

annual weather pattern can stretch its power to all the commodities. For example,

demand for heating oil typically rises as cold weather approaches but subsides as

inventory is filled and decreases even more as the summer months get closer.

The calendar not only gives us climate related seasons, but also the annual

passing of important dates that then creates 'seasons' of its own. The due date for

filing U.S. income taxes is every April 15th. Monetary liquidity may decline as taxes

are paid, but rise as the Federal Reserve recirculates funds.

These annual cycles in supply and demand give rise to the seasonal price phenomena or

what we would simply call seasonality. This annual pattern of changing conditions may

cause a more or less well-defined annual pattern of price responses. Seasonality, then,

may be defined as a market's natural rhythm-an established tendency for prices to move

in the same direction around similar time most years.

In a market strongly influenced by annual cycles, seasonal price movement tendencies

may become more than just an effect of seasonal cause. It can become so ingrained as to

become nearly a fundamental condition in its own right - almost as if the market had a

memory of its own. Why? Once consumers, producers, traders, and the like fall into a

particular pattern, they tend to rely on it-almost to the point of becoming dependent on

it. This dependency can be tricky as such trading patterns do not repeat without fail.

The seasonal methodology, as does any other, has its own inherent limitations. For instance

, some summers are hotter and dryer than others thus leading to less of a supply than

what was predicted for the fall. Even trends of exceptional seasonal consistency are

best traded with common sense and caution. A basic familiarity with current seasonality

fundamentals and a simple technical indicator will help enhance selectivity and timing

of entries and exits.

Seasonal Futures Spread Trading

The Moore Research Center (MRCI) is one of the leaders in assessing these seasons and has

evaluated up to 55 years of history against the market behaviour of current contracts.

This research has been used, and still is, by major exchanges like the CME, CBOT and

others including hedge funds and traders. They are members and regulated by the Commodity

Futures Trading Commission (CFTC) as a Commodity Trading Advisor (CTA). MRCI presents a

list of fifteen seasonal futures spread trading ideas each month, covering all commodity

sectors: grains, energies, currencies, livestock, etc. Every spread they present has

shown at least an 80 percent historic reliability over 15 years (when available) and

Moore Research provides detailed statistical data for every year the individual spread

has been tracked. Their spread trading cycles last anywhere from a week or so up to

around 3 months. Most of them average about 4-6 weeks. Each spread has a pre-determined

entry and exit date along with a pre-calculated point at which the spread would be exited

if it became a loser. Every spread is updated each day on their web site from the day it

goes on to the day it comes off and their results are recorded. MRCI uses the daily

settlement prices of the market as the values to label their entry and exit prices.

There is no such thing as a sure thing, but ignoring this chronological behaviour of

seasonality and the tools readily available to help predict these patterns is a mistake

for futures traders. A knowledgeable broker who is MRCI equipped and spread savvy is a

keen idea if you want to get into trading seasonal commodities. The more tools you utilize

within using the approach of seasonality trading can help you in whatever commodity or

commodities you wish to trade.

Toepke, Jerry. "Moore Research Center, Inc." Why Seasonals Work. McGraw-Hill, 14 May 2009. Web. 05 May 2016.

Disclaimers:

* Past results are not necessarily indicative of future results. The risk of loss in futures trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

** SEASONAL TENDENCIES ARE A COMPOSITE OF SOME OF THE MORE CONSISTENT COMMODITY FUTURES SEASONALS THAT HAVE OCCURRED OVER THE PAST 15 YEARS. THERE ARE USUALLY UNDERLYING FUNDAMENTAL CIRCUMSTANCES THAT OCCUR ANNUALLY THAT TEND TO CAUSE THE FUTURES MARKETS TO REACT IN A SIMILAR DIRECTIONAL MANNER DURING A CERTAIN CALENDAR PERIOD OF THE YEAR. EVEN IF A SEASONAL TENDENCY OCCURS IN THE FUTURE, IT MAY NOT RESULT IN A PROFITABLE TRANSACTION AS FEES, AND THE TIMING OF THE ENTRY AND LIQUIDATION MAY IMPACT ON THE RESULTS. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT HAS IN THE PAST OR WILL IN THE FUTURE ACHIEVE PROFITS UTILIZING THESE STRATEGIES. NO REPRESENTATION IS BEING MADE THAT PRICE PATTERNS WILL RECUR IN THE FUTURE.

The inverse correlation GOLD vs OIL 08:10 05-Sep-19

Gold can be used for speculation but is preferred as a safe haven. Crude,

on the other hand, can be used as a store of value but is preferred as a

speculative play.

This combination makes these two assets work great together as mutual hedges.

Gold helps offset the risk of higher uncertainty, while oil can take advantage of

market moves.

Broadly speaking, you could say that gold and petroleum are inversely correlated.

There are a couple of major caveats to add to that notion. The first is that more

nuance allows for more sophisticated trading. The second is that there is more to

oil prices than just the market.

born2invest.com

Understanding Intermarket Spreads: Platinum and Gold

www.cmegroup.com

Basics of Futures Spread Trading

March 5, 2011 by Craig Turner

www.danielstrading.com

.LOG

Forex basket Trade the NEWS :

For most new traders, the biggest challenge is getting a profitable strategy that works

for the long term. Usually, trend-following systems are favored because they tend to have

a very good risk-to-reward ratio. Trading the currency market is essentially a numbers

game, basically traders look for strategies or systems that have a positive overall

yield. The profit factor of any strategy is also very essential, because a profitable

strategy should make more money or pips, than it loses. After some extensive research,

I have discovered one of such systems. This strategy is built on one of the oldest

trading adages around; “cut your losses early and let your profits run”

and “the trend is your friend”.

Basket trading involves opening a series of correlated or uncorrelated trades, and after

an adequate amount of time, closing the trades when the overall sum of the trades

is positive i.e. when the net value of all open trades is positive or close to our

targeted profit-value.

It is not 100% guarantee.

The Trading setup

The truth behind the Forex market is that currencies trend. This means that currencies

have a tendency to keep gaining or diminishing over a long period of time. There are a lot

of concepts about trading cycles and swings, but in reality if we were to zoom out of

our charts we would notice a very obvious and unmistakable trend direction. Basket trading

involves gauging the potential strength or weakness of a pair, and placing several trades

that align with that analysis.

Key Reports/Factors that Move FX Markets

Any world events /news

Financial crises and elections create financial uncertainty and, in turn, impact value

of a country’s currency

Central Bank monetary policy announcements Will affect size/growth rate of a

nation’s money supply and, in turn, interest rates; can include key interest rate

changes, buying/selling government bonds, reserve requirements changes

FOMC (Federal Open Markets Committee)

Meets 8 times a year to set U.S. monetary policy and key interest rate changes;

impacts value of U.S. dollar, world’s reserve currency

U.S. Dollar Index

Measures the value of U.S. dollar relative to a basket of currencies for the

U.S.’s most significant trading partners.

ZSN21-ZSK21The second good looking bear spread in soybeans complex. If you consider to trade both, i would either recomend to allocate your position between both 2 or just trade 1 on them. They tend to behave similliar, so it is not wise to trade correlated assets and manage them as 2 standalone trades.

This soybeans oil spread is much less risky. Historical lowest prices were arround -0,2 which is about 150$ from current prices. That could be manage as position trade and do not put SL in to the market. But i strongly recommend everytone use SL. RRR is again over 2,2:1, which give us more chances to stay profitable even if my probability is below 50%. Since you follow all my trades, the probability is between 60-70%, but stay focused and trade on your own risk.

This trade seems good even for people with smaller account.

In the graph you can see marked SL below the recent low. It is a logical place where to put SL, if you do so.

Good luck to everyone

ZSH2021-ZSF2021There is a good opportunity in Soybeans complex. However this bear spread is a bit more aggresive as the price could go as low as -50. Therefore this is not suitable for position trade, but to put SL to the market to minimalize your loss in case of another fall. But there is a good potential with reduced risk. 4:1

The probability of the succes is on our side, if nothing really suprising happen in USA/China trade war. Because China is the biggest buyer of US soybeans to feed their pigs mostly.

Soybeans is as almost commodities the market with strong contango. In other words the further contracts should be more pricey, because there are costs for storage, insurance, risk etc. Negative prices cannot last long in the mid/long term as describe above. The spread just need time before supply and demand find their equal value for both sides.