VIX Hits 27-Year Extreme. Is the Market About to CRASH or SOAR?The Volatility Index (VIX displayed by the blue trend-line) has entered a level that has visited only another 5 times in the last 27 years (since August 1998)! That is what we've called the 'VIX Max Panic Resistance Zone'. As the name suggests that indicates ultimate panic for the stock markets, which was fueled by massive sell-offs, leading to extreme volatility and uncertainty.

So the obvious question arises: 'Is this Good or Bad for the market??'

The answer is pretty clear if you look at the chart objectively and with a clear perspective. In 4 out of those 5 times, the S&P500 (SPX) bottomed exactly on the month of the VIX Max Panic signal. It was only during the 2008 U.S. Housing Crisis that VIX hit the Max Panic Zone in October 2008 but bottomed 5 months late in March 2009.

As a result, this is historically a very strong opportunity for a multi-year buy position. If anything, today's VIX situation looks more similar to September 2011 or even the bottom of the previous U.S. - China Trade war in March 2020.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

SPX (S&P 500 Index)

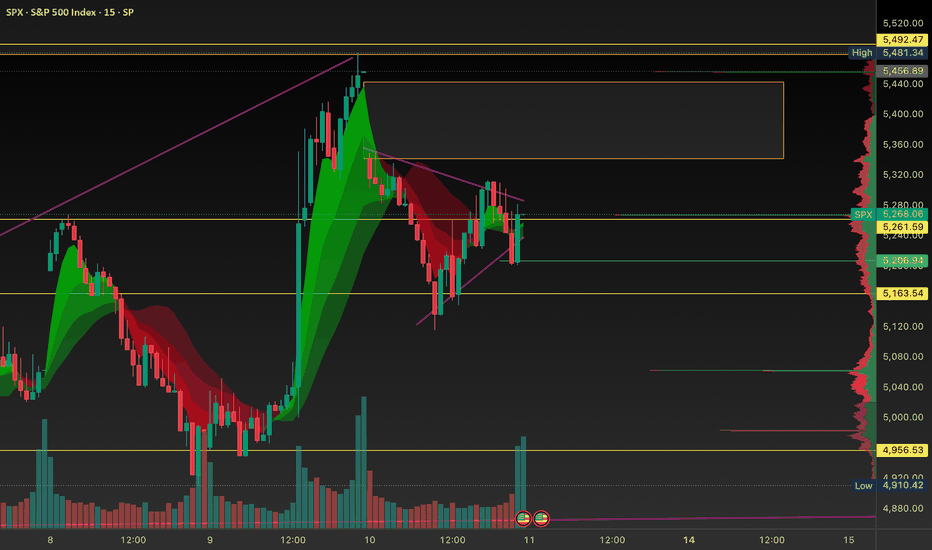

Just Let Me Cash Out Before the Weekend | SPX Analysis 11 April Let’s be honest…

This week has been ridiculous.

The market pumped harder than a spin class on espresso because of a rumour.

Then dumped.

Then teased a breakout.

Then decided against it mid-sentence.

It’s been a full-blown rollercoaster of overreactions, headline bait, and “wait, what did Trump say now?” moments.

But amidst the noise, the plan is still holding up.

5400?

Still resistance.

Still our pivot level.

Still doing its job.

---

👁️ Trader’s Eye View – Charting the Nonsense

Let’s recap what I’m seeing:

📉 Earlier this week, the 5400 bull trigger got pierced by an emotional market surge.

But there was no confirmation, no sustained breakout – and we’ve reversed since then.

Now?

We’re seeing the start of a rising channel – but every turn seems to align with a tweet, a walk-back, or a reaction to misread data.

It’s like price is drawing patterns using the tip of a headline.

That’s not conviction.

That’s chaos dressed as structure.

🧭 What I’m Doing Now

📌 Still bearish below 5400

📌 Watching for a move to 5000 or the rising channel low

📌 Will use Tag ‘n Turn, Pulse Bars, and GEX flips for entries

The ideal scenario?

Let my bear swing cash out before the close, pour something brown into a glass, and avoid blood pressure spikes over the weekend.

That’s the play.

---

🎯 Expert Insight – When the Chart's Not Lying, But the Headlines Are

Mistake:

Assuming a spike equals a breakout. Trading on headline strength instead of chart strength.

Fix:

Let the level prove itself.

5400 is my line in the sand – not because I said so, but because price keeps reacting to it.

That’s structure. That’s what we trade.

---

Fun Fact

In 2020, the average headline-related spike in SPX lasted under 37 minutes before mean-reverting.

This week?

We saw multiple trillion-dollar reactions last less than half an hour.

It’s not a breakout if it’s a sugar rush.

"When the VIX is low, look out below!""When the VIX is low, look out below!"

+

FEDs motto "Higher for longer"

=

Fed rate hikes to go: 2-3 left

it is pivot time, change of market dynamic from "bad news is good news" to "bad news is bad news".

state of economy is not good and it will start sinking in to investors and public

SPX: Roller Coaster Fest. Looking for a possible short?Not FA*

A lot of set ups looking like flags. Missed the move up but caught puts today for good profit. Or decent profit. I have yet to conquer on how NOT to sell too early? Anyone have any tips?

Set up I’m seeing right now (SPY/SPX): Looks to be flagging.

Green Ray for a short entry

Overall sentiment still feels very bearish. Trump seemed to postpone the tariffs to prevent this market from tanking into near *recession* touches but some say it was a manipulative swing?

So thinking we sell off Friday - as China tariff deal still yet to solidify. A lot of uncertainty overall.

Also on the 1M, the set up looks like a bear flag.

Let me know what you guys think and any insight is welcome! Still new to TA and really wanting to get better at understanding charts/levels. Goal is to be consistent in trading and profitable, very profitable.

GLHF

BTC SPX Ratio At Its LimitsAs BTC has matured, it has revealed its limits relative to SPX. Any time the price rises above 15, a correction follows.

While it has not yet cracked I find myself violating my own rules again and compelled to share this chart with you BEFORE the crack.

Markets are volatile and I am simply trying to keep people from getting hurt. Do not make the mistake of thinking BTC is a safe asset.

Bulls best to take profits.

Click boost, follow, subscribe, and let me help you navigate these crazy markets.

SPX repeating 2022 patternI had said in a earlier post( see link to Related publication) that Vix is indicating we will be in 2022 style market and so far indeed it is, except for the breakdown from the wedge last week.

Expect the price to fluctuate within the wedge to consolidate before a breakout

The comparison shows close similarity of the wedge and path (except last week)

S&P500 Vast Support from previous High. New 2 year Bull started.The S&P500 / US500 has reached a bottom and is rebounding.

The rebound is taking place just over the 1week MA200 but also the key pivot line that was previously a Cycle High and now turned Support.

We have seen this another 2 times in the last 10 years and both time caused a massive rally.

This puts an end to the tariff war correction and based on the chart starts a new 2 year Bull Cycle.

Minimum rise before was +58%. Target 7600.

Follow us, like the idea and leave a comment below!!

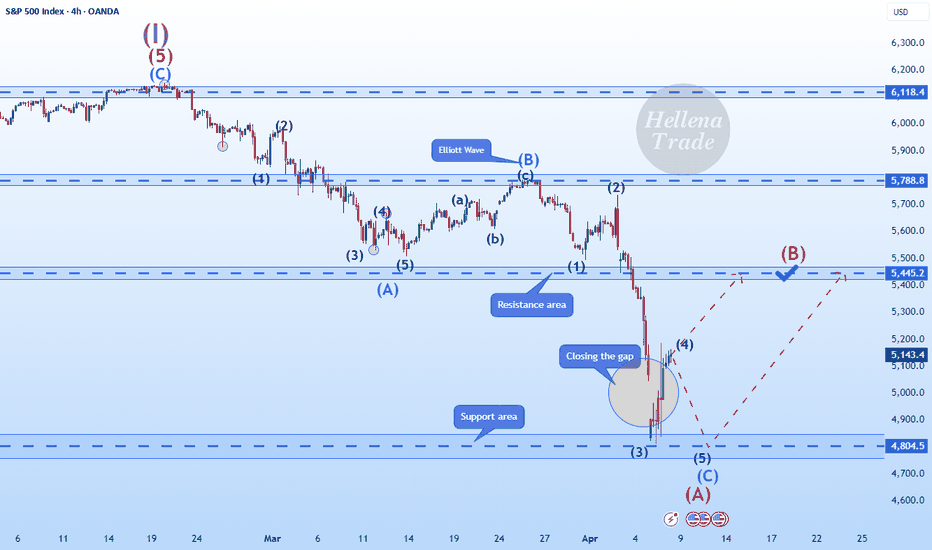

Correction has begun in SPXWe can almost say that 4800 has been touched and given that the downward movement was very fast, this wave is most likely the A-wave of a triangle and the upward waves that are forming after the 90-day suspension of the stalls are considered as a corrective wave.

Previous SPX Analysis

Trump Pump Just Broke the Charts12% Up in a Day. Now What?

What a difference a headline makes.

Monday:

Markets dump. Panic. Retail sells the low.

We hit our bearish targets like clockwork.

Wednesday:

Markets explode like they found a cheat code.

SPX rallies 9.5% in a day.

Nasdaq? A completely unhinged 12% up.

All because… tariffs might be paused again.

You can’t make this stuff up.

But you can trade it.

When Euphoria and Edge Collide

The Trump Pump Parade

After last week’s fake-news-induced dump, we now have headline euphoria.

No earnings beat. No rate cut. No macro shift.

Just one rumour:

“Trump might pause tariffs.”

Cue the biggest one-day rally since 1933.

Nasdaq: +12%

SPX: +9.5%

SPX now kissing the 5400 bull trigger level

Financial media?

Throwing a rave.

Retail?

FOMOing back into the top.

It’s madness.

But it’s not structure.

The System Trader’s Reality

Meanwhile, in the AntiVestor camp…

The bear swing is still on but under review.

Why? Because we trade levels, not vibes.

And 5400 has always been our pivot.

We’re now sitting right on it, with overnight futures starting to drift lower – like the market just realised it left the oven on.

The decision zone is here.

Hold 5400?

It’s time to shift gears.

Bull thesis activates. Tag ‘n Turn setups. Bull Pulse Bars. GEX Bulls Eye trades.

Lose 5400?

We go right back to feeding the bears.

It’s not emotional. It’s mechanical.

This is what system trading looks like.

---

Expert Insights: The Market Owes You Nothing

Mistake:

Getting emotional after missing a rally or overstaying a short.

Fix:

Use a system with defined levels.

5400 was always the line.

You don’t need to guess the pivot. You just need to trade it when it confirms.

This rally may be overblown.

But until the market proves otherwise, you don’t fight the tape – you ride it with structure.

---

Fun Fact

The last time the Nasdaq moved more than 10% in a day?

March 13th, 2020 – the height of COVID panic buying.

That rally was followed by… a further drop.

Then a V-bottom.

Then a massive bull market.

So… is this the start of something new?

Or just another overcaffeinated bounce?

History says: Don’t decide early. Let price confirm.

Trump's Second Term Brings Sharpest Market Decline Since 2001It's gone nearly three months or so... (Duh..? WTF.. less than 3 months, really? 🙀) since Donald Trump entered The White House (again).

Those times everyone was on a rush, chatting endless "Blah-Blah-Blah", "I-crypto-czar", "crypto-capital-of-the-world", "we-robot", "mambo-jumbo", "super-duper", AI, VR and so on super hyped bullsh#t.

What's happened next? We all know.. mostly all US stocks and crypto markets turned to 'a Bearish Mode', or to at least to 'a Correction' (that is still actual at this time).

Here's a short educational breakdown for Nasdaq Composite index NASDAQ:IXIC what we think about all of that, at our beloved 💖 @PandorraResearch Team.

Trump's Second Term Brings Sharpest Market Decline Since 2001: Analyzing the recent 15% Stock Market Plunge

President Donald Trump's second term has coincided with a dramatic stock market downturn, with the S&P 500 losing approximately 15% of its value since his January 2025 inauguration. This represents the worst start to a presidential term since George W. Bush in 2001 during the dot-com crash. The decline has erased more than $3 trillion in market value, driven primarily by concerns over trade policies, particularly the implementation of new tariffs.

Market analysts point to growing fears of potential stagflation—a toxic combination of slow economic growth and high inflation—as investor confidence continues to deteriorate despite pre-election expectations of business-friendly policies.

Unprecedented Market Decline Under the New Administration

Historical Context of Presidential Market Performance

The current market downturn stands out in stark relief when compared to previous presidential transitions. The S&P 500 has fallen nearly 10% in the first 10 weeks since Trump's inauguration on January 20, 2025, marking the worst start under a new president since George W. Bush in 2001. This decline is significantly worse than the start of the prior five administrations, with Bush's roughly 18% drop during the dot-com crash being the only steeper decline in recent presidential history. Looking further back, only Richard Nixon experienced a comparable early-term market decline with a 7.2% drop, highlighting the severity of the current situation.

When examining presidential market performance metrics, Trump's second term has already distinguished itself negatively. During the first 50 days, the S&P 500 declined by 6.4%, positioning it among the poorest market starts since 1950. By contrast, the best 50-day starts were achieved by John F. Kennedy (up 9.4%), Barack Obama (up 5.7%), and Bill Clinton (up 4.2%), demonstrating how unusual the current market trajectory is in historical context.

Magnitude of the Current Decline

The scale of market value destruction has been substantial. More than $3 trillion has been erased from the S&P 500's value over approximately 52 trading sessions since Trump's inauguration. By early April 2025, the decline had accelerated to approximately 15% from Inauguration Day, pushing the market dangerously close to bear territory. Market analysts note that if the S&P 500 reaches a 20% decline from its recent peak, it would mark the earliest instance of a bear market during a new administration based on S&P 500 history since 1957.

The tech-heavy Nasdaq Composite has suffered even more severely, with declines exceeding 11% by mid-March. This demonstrates the particular vulnerability of growth stocks that had previously led market gains, now facing the most significant corrections.

Key Factors Driving the Market Downturn

Trade Policy Uncertainty and Tariff Concerns

Trade policy, particularly the implementation and threat of tariffs, has emerged as the primary catalyst for market turmoil. The unpredictable nature of these policies has created significant uncertainty for businesses, investors, and consumers alike. Trump's "on-again, off-again approach to tariffs" has effectively extinguished the optimism that initially buoyed markets following his election victory in November 2024.

The market decline accelerated dramatically after what was termed the "Liberation Day" event, during which Trump announced plans for unprecedented tariff escalation. Two-thirds of the S&P 500's 15% decline occurred after this announcement, prompting Ed Yardeni of Yardeni Research to observe that "Liberation Day has been succeeded by Annihilation Days in the stock market".

Fear of Stagflation and Economic Instability

Many economists have warned that the new tariffs could reaccelerate inflation at a time when economic growth may be slowing, creating conditions for stagflation. This combination is particularly concerning for investors, as it creates a challenging environment for corporate profitability and economic prosperity. The risk that tariffs could trigger this economic condition has effectively neutralized investor optimism regarding other aspects of Trump's agenda, including potential regulatory reforms and tax reductions.

Shift in Market Sentiment

The market has undergone a fundamental transformation in sentiment from the period immediately following Trump's election victory to the current environment. Initially, investors had bid stocks up to record highs, anticipating benefits from tax cuts, deregulation, and business-friendly policies. However, this optimism has been replaced by growing concern about economic direction.

As one market strategist noted, "We have witnessed a significant shift in sentiment. A lot of strategies that previously worked are now failing". The S&P 500 has relinquished all gains made since Trump's November 2024 election victory, representing a striking reversal in market confidence.

Potential Long-Term Implications

Historical Patterns and Future Outlook

Historical analysis suggests that poor market starts during presidential transitions often foreshadow continued challenges. According to SunDial Capital Research strategist Jason Goepfert, rough starts represent a "bad omen" for stocks based on past performance patterns. His analysis indicates that markets typically show a median return of -1.9% six months after such a start, and after a year, they generally remain flat. Among similar historical instances, only four out of ten cases resulted in more gains than losses over the following year.

Administration's Response to Market Decline

Unlike during his first term, when Trump regularly referenced strong stock market performance as evidence of his administration's success, his second-term approach appears markedly different. Some market analysts have noted that "The Trump administration appears to be more accepting of the market's decline, potentially even welcoming a recession to achieve their broader objectives". This shift in attitude has further unsettled investors who previously expected the administration to prioritize market stability.

Technical challenge

The tech-heavy Nasdaq Composite index has recently soared 12% for its best day since January 2001.

But did you know what happened next in 2001? The major upside trend as well as 5-years SMA were shortly broken and market printed extra 40 percent Bearish decline.

Similar with what's happening in 2025..!? Exactly!

Conclusion

Trump's second presidential term has coincided with one of the worst stock market starts in modern American history, comparable only to George W. Bush's entry during the dot-com crash of 2001.

The approximately 15% market decline since inauguration represents a loss of trillions in market value and a complete reversal of the optimism that followed his election. Trade policy uncertainty, particularly regarding tariffs, has emerged as the primary driver of market instability, creating fears of potential stagflation and undermining business confidence.

As historical patterns suggest that poor starts often lead to continued underperformance, investors remain concerned about the market's trajectory through the remainder of 2025 and beyond.

--

Best 'a bad omen' wishes,

Your Beloved @PandorraResearch Team 😎

07/04/25 Weekly Outlook Last weeks high: $88,502.90

Last weeks low: $77,786.89

Midpoint: $83,144.89

Never a dull moment in this game, last week we saw a relatively flat move from Bitcoin as traditional markets continued their heavy sell-offs thanks to the tariff trade war. The high of the week coming from the run up to Trumps tariff announcement, that then retraced as the speech went on and as the week closed a heavy capitulation move down.

As the week begins BTC's price hit as low as $74,500 barely frontrunning the HTF goal of $73,500 to close the inefficiency wick from the US election 6 months ago. For me this is where I start to pay attention to where buyers may be stepping into the market at this HTF support area. Obviously the worry is still in Tradfi, just how low will the SPX, DJI etc go? That's hard to tell but there is certainly a huge amount of fear in the market and fear brings opportunity.

The NY open should be an interesting one and should set the tone for the week, A reclaim of the weekly low sets up yet another SFP long opportunity to then go and test the midpoint, acceptance under the weekly low may provide one last push to close tout the move to $73,000.

The Federal Reserve is having am emergency closed board meeting today too, if an emergency cut to interest rates comes of this to boost growth then BTC will definitely see the benefits of this.

Good luck for the week ahead!

Hellena | SPX500 (4H): LONG to resistance area of 5445.2.Explaining what is happening in terms of wave theory is quite difficult, but always possible. Of course, geopolitics has been affecting the price a lot lately, but even in this chaos there are regularities.

Let's take a look at the wave markup. I believe that there is a big correction going on at the moment. Most likely it is not finished yet and has just started to form wave “B”, which means that wave “C” is coming, but I still want to see an upward movement to the resistance area at 5445.2. The price has been in a downtrend for too long and I think a correction is very likely. Well, let's see.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Nightly $SPY / $SPX Scenarios for April 10, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇸📈 U.S. Tariff Pause and Increased Tariffs on China: President Donald Trump announced a 90-day pause on tariffs for most trading partners but increased tariffs on Chinese imports to 125%. This move led to a surge in global stock markets, with the S&P 500 rising by 9.5% and the Dow Jones by 7.9%.

🇨🇳📈 China's Retaliatory Tariffs: In response, China imposed additional tariffs of 84% on U.S. goods, escalating trade tensions and impacting global markets.

📊 Key Data Releases 📊

📅 Thursday, April 10:

📈 Consumer Price Index (CPI) (8:30 AM ET):

Forecast: 0.1%

Previous: 0.2%

Measures the average change over time in the prices paid by consumers for goods and services, indicating inflation trends.

📉 Initial Jobless Claims (8:30 AM ET):

Forecast: 219,000

Previous: 225,000

Reports the number of individuals filing for unemployment benefits for the first time, reflecting labor market conditions.

🗣️ Fed Governor Michelle Bowman Testifies to Senate (10:00 AM ET):

Provides insights into the Federal Reserve's perspective on economic conditions and monetary policy.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

S&P 500 - Analysis and Rebound levels! 4/7/2025S&P 500 just pulled off a slick rebound at 4835.04 - Let's hope it's legit. A close above the 50-week SMA keeps momentum alive. If not, eyes on the next landing zones at 4754.17 and 4699.43. No panic! Don’t let the noise rattle your game plan! 😎

#SP500 AMEX:SPY SP:SPX

S&P - What will happen next for the S&P?The S&P 500 has been dropping quickly after Trump's tariff policies were announced. It fell from 5750 to 4900, and is now at 5053, all in just a few days. This is a sharp decline, and sellers are clearly in control right now.

However, after such a big drop, it's common to see a short-term bounce before the market continues to fall. There is strong resistance between 5400 and 5500, which lines up with the golden pocket (a key level in technical analysis). This could make it harder for the S&P to rise past these levels.

Looking further down, there is another strong support area between 4500 and 4600. This level also matches the golden pocket on the daily chart, making it an important point for potential support. If the market keeps falling, we could see this area tested before any significant recovery.

Right now, it seems likely that the market will keep going lower. My main expectation is that we’ll get a small rally first, which could trick some traders into thinking the market is recovering, before continuing down. However, with all the uncertainty around the news and policies right now, it's also possible the market could keep dropping sharply without much of a rally.

Keep a close eye on the markets and stick to good risk management practices. If you don’t, it could really hurt your portfolio. Stay alert and adjust your strategy as things change.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

The Stock Market (SPX) Will Also RecoverGreat news my dear friends, reader and followers, truly great news.

The S&P 500 Index (SPX) is now reversing after challenging a strong support level. This level is the 0.618 Fib. retracement for the bullish wave that started after the October 2023 market low. A strong bounce is visible as soon as this level was hit.

The correction is a classic ABC and the C wave is very steep. When a move is really strong, great force, it can't last that long. So the drop happened all at once, fast, and this means a fast end as well as a strong reversal, but the reversal will not be the same.

We are more likely than not to experience a long drawn out recovery, higher highs and higher lows long-term. Higher prices next.

This is the main support level, 0.618 around 4885. If this level breaks, the next strong support sits at 4540. We are going up.

It is not only Bitcoin and the Altcoins, the stock market will also grow.

The correction is over.

Total drop amounts to a little more than 21%.

This is huge and more than enough.

The bears are satisfied. The bears are done. A bearish wave is followed by a bullish wave.

Short bearish action, long bullish action.

Thank you for reading.

Namaste.

HOW IS CRYPTO SHAPING UP?Trump and tariffs have a firm grip on the economic world as of late, so where does that leave the crypto market?

TOTAL has a clear structure since the beginning of the bull market in 2023, in the last 3 days TOTAL has wicked into the bullish trendline support but sits within a bearish trend channel. This level also coincides with the bullish orderblock that started the leg up post US election so a very strong level of support here.

Do I think this is the end and the bottom is in? The chart would make a very good case for it however I believe that the Geo-politics outweigh Technical Analysis currently, at least in the short term. Everyone is watching for the latest news release/Trump announcement and all the time that is going on the market is very reactionary with less passive orders and more reactionary news based market orders. That taken into account in the short term this is a game of musical chairs with massive volatility swings and liquidations left right and center, a traders dream.

I'm very interested in how the FED will react to this, once we start getting emergency or early interest rate cuts that for me is when BTC will take the next step up and will flip to an investor/buy and hold environment, whether that's from here, lower or higher I'm not sure but but BTC needs a risk-on environment to thrive and Trump is doing his best to force J Powells hand.

S&P500: Trump's 90-day tariff pause just saved the day??S&P500 is having so far a +9.50% rise from today's low as even though Trump announced a 125% raise to China tariffs, he lowered and paused tariffs for 90 days to all countries that contacted the U.S. for negotiation. The 1D technical outlook is about to get neutral (RSI = 42.537, MACD = -181.510, ADX = 39.036) as the rebound is taking place at the HL bottom of the Bullish Megaphone, while the 1W MA200 stayed intact.

A similar Megaphone was last seen during the previous 2018 Trade War and was completed with the COVID crash that started an abnormal rally to new ATH to correct the equally abnormal crash. Needless to say, it was based on quick rate cuts but the situation isn't all that different today. Trump's stance towards negotiating, coupled with highly anticipated rate cuts, can deliver an equally abnormal rally now.

The previous HH of the Bullish Megaphone hit the 2.0 Fibonacci extension. This time if the rally extends to the end of the year, targeting the 1.5 - 1.618 Fibonacci Zone would be considered fair (TP = 6,900).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Retests, Rallies, and Bear Swings LoadingYou know what’s better than nailing a trade?

Not having to flip, flop, hedge, unhedge, reverse, scalp, and do the full Hokey Cokey just to survive.

Today was one of those days – the kind where the plan just works.

Futures? Wild.

Down 143, up 188, then back to flat - all before most traders finished their first sip of coffee.

But while price whipsaws, I’m not chasing shadows.

I’ve got my line out.

My bear swing is on.

And I’m just waiting for the exit alert to ding.

---

Let’s break down what happened:

Yesterday’s tariff chaos acted like a Mr. Miyagi market prank.

“Tariff on.”

“Wait, just kidding.”

“Tariff off.”

The move up?

Landed exactly at Monday's news spike and the days 5250 gamma flip level – which we had marked and mapped.

Perfect resistance.

Retest. Rejection.

Bear pulse bars triggered.

And now the swing is on.

Trade location: Dialled in.

Directional bias: still bearish under 5400.

Execution: GEX levels + pulse bar structure.

Retests, Not Reversals

Tuesdays action also gave us something sneaky:

An intraday retest of the recent lows.

Now, if you’ve been around since the 2020 V-turn era, you’ve seen this before.

Panic sell.

Sharp bounce.

Retest the low to check for real conviction.

Then make the real move.

This retest could be the prelude to a bull thesis - but not yet.

Structure comes first. Bias second.

Until we break clean above 5400, I stay bear-biased.

---

Expert Insights: Don’t Trade Like You’re in a Dance-Off

The Mistake:

Overtrading volatility. Flipping bias every 15 minutes. Trading like it’s a talent show.

The Fix:

Pick your structure. Define your invalidation.

Enter once, scale in if needed, and let it play out.

No need to “turn around and shake it all about.”

Leave the Hokey Cokey for weddings.

---

Fun Fact

During the 2015–2020 bull run, the average false breakout-to-retest cycle happened within 3 sessions after a panic reversal.

Translation?

Markets often retest panic lows before deciding the next big move.

This isn’t new. It’s just noisy. And totally tradable.

...Another fun fact

Did you know?

The 104% tariff imposed by the U.S. on Chinese imports is among the highest in modern history, reminiscent of protectionist measures not seen since the early 20th century.

Nightly $SPY / $SPX Scenarios for April 9, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇸📈 Implementation of New U.S. Tariffs: As of April 9, the U.S. has imposed a 104% tariff on Chinese goods, escalating trade tensions and raising concerns about a potential global economic slowdown.

🛢️📉 Oil Prices Decline Sharply: In response to escalating trade tensions, oil prices have fallen nearly 4%, reaching their lowest levels since early 2021. Brent crude dropped to $60.69 per barrel, while West Texas Intermediate (WTI) declined to $57.22.

📊 Key Data Releases 📊

📅 Wednesday, April 9:

📦 Wholesale Inventories (10:00 AM ET):

Forecast: 0.3%

Previous: 0.8%

Indicates the change in the total value of goods held in inventory by wholesalers, reflecting supply chain dynamics.

🗣️ Richmond Fed President Tom Barkin Speaks (11:00 AM ET):

Remarks may shed light on economic conditions and policy perspectives.

📝 FOMC Meeting Minutes Release (2:00 PM ET):

Provides detailed insights into the Federal Reserve's monetary policy deliberations from the March meeting.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis