Opening (IRA): SPX May 16th 5000/5030/5785/5815 Iron Condor... for a 10.45 credit.

Comments: High IVR. After having taken small profit on the setup I put on before "Liberation Day," back in with a more symmetric setup in a higher IV environment.

Metrics:

Buying Power Effect: 19.55

Max Profit: 10.45

ROC at Max: 53.45%

50% Max: 5.23

ROC at 50% Max: 26.73%

Will generally look to take profit at 50% max, roll in untested side on side test, manage at 21 DTE.

SPX (S&P 500 Index)

Combined US Indexes - Lower High Lower Low checked; What next...As previously expected, a lower low has been achieved.

What was not expected was the speed, magnitude and extent of the fallout.

Next up, since it is about 3.5 Standard Deviations out, we can start looking for a consolidation, although there might be slightly more downside and we need a higher low in the expected range within box. Having said that, it is possible to see it overextend downwards briefly.

There is a long term support, Fibonacci downside target zone just below.

So expecting a short term bounce between Monday to Wednesday at the earliest, and following that a consolidation area formation.

Geopolitics, Rates, and Risk: Why 1987 Is Back on the RadarThe current mix of geopolitical tensions, policy uncertainty, and fragile market sentiment brings to mind the setup ahead of October '87.

Without stabilizing signal, especially from the U.S. administration this weekend, the risk of a sharp correction is not negligible.

SPY: Breaking Levels; TASPY broke down the Weekly demand line and now looking to break the Monthly demand.

Looking to possibly test the bottome weekly trendline.

Possibly a 530 price target and if weakness continues, possibly below more to 520 then 510.46 to fully retest that bottom trendline.

The market has bene crazy, people calling bottom, wanting to catch the reversal. I mean, I would want to catch this “V” up too, but have to see if it keeps trending down to the bottom trendline.

LMK what you think and if you have any TA, tag me!

*Not FA

Post-Liberation Day Sell-Off – Crash or Correction?Liberation Day has turned into a dramatic "blow the markets back out" day for the SPY , with a significant daily drop of nearly 6%, slicing decisively below the critical 200-day moving average at $574.46. Historically, breaking below the 200-day MA is a strong bearish signal, indicating potential further downside momentum.

The previously identified key bearish pivot, the "Best Price Short" at $565.16, served as a crucial resistance level from which sellers aggressively stepped in, intensifying today's sell-off. Given the current bearish sentiment, the next immediate downside targets without a significant bounce (dead-cat bounce) include:

Half 1 Short (Momentum target): $505.28 (already tested)

High Vol Momentum Target 1a: $497.66

Half 2 Short (secondary bearish momentum): $486.41

Extended Momentum Target (HH Vol Momo Target 2a): $475.16

For traders who missed the initial move, look to re-enter shorts if there's a modest retracement toward the previously broken "Weeks High Short" at $520.16, maintaining tight risk control with stops ideally set just above the "Best Price Short" ($565.16).

Critical levels summary:

Ideal Short Re-entry Zone: $520.16

Profit Targets: $497.66, $486.41, and ultimate $475.16

Stop Loss Area: Slightly above $565.16

Major Broken Support (Resistance now): 200-day MA at $574.46

Today's significant volume spike further reinforces bearish conviction. RSI is deeply oversold at 23.24, suggesting caution for potential short-term bounce, but any bounce is likely to be short-lived unless there's a substantial political or economic pivot soon.

These levels are algorithmically defined, designed to remove emotions from trading. Trade responsibly, adhere to your strategy, and protect your capital.

Breaking: SPX6900 ($SPX) Surged 23% Today Amidst Market TurmoilThe price of SPX6900 ( SP:SPX ) Surged 23% today amidst market volatility. Albeit it wasn't only the crypto industry undergoing correction, the stock market has had its own fair share of the dip with about $1.5 trillion wiped out from US stock market at open today.

As of the time of writing, SP:SPX is up 16.36%, there is still room for price surge as hinted by the RSI at 53. A breakout above the 1-month pivot could cement the path for a move to the $1 pivot.

Similarly, a break below the 50% Fibonacci level could negate the aforementioned bullish thesis leading to a consolidation move to the 1-month low region.

SPX6900 Price Live Data

The live SPX6900 price today is $0.537989 USD with a 24-hour trading volume of $58,478,403 USD. SPX6900 is up 18.38% in the last 24 hours. The current CoinMarketCap ranking is #100, with a live market cap of $500,863,790 USD. It has a circulating supply of 930,993,090 SPX coins and a max. supply of 1,000,000,000 SPX coins.

S&P 500 to tank to 5,100 pointsPEPPERSTONE:US500

The S&P 500 broke below critical support after Trump announce massive tariffs on everyone, worst than expected. Volume is increasing to the downside, and it looks like the next wave down has already started.

Wave C is supposed to be equal or larger than wave A, and reach the next critical support, which will lead us to 5,100 points in the next couple of weeks.

I heard that net tariffs on China are 54%, does than means that iPhones are going to rise in price 54%?

Maybe it will be reconsidered later, and the market will bounce in the future, but not likely in the short term.

Good luck to you

SPX short term VP analysisI have done a short term volume profile analysis with support and resistance levels. Market is at long term trendline as well. I Expect a small bounce and some grinding for a week or so fighting the long term trendline.

Personally I think it will crash through the trendline after a week of grinding, but will watch closely and make short term trades

SP500- Don't be fooled by yesterday's pumpThe markets reacted strongly to Jerome Powell's latest commentary, sparking a notable rally. However, traders should be cautious before assuming this marks the beginning of a new uptrend. While there has been a slight shift in market structure, the broader trend remains intact. Overlooking the strength of the next resistance level could prove to be a costly mistake.

The Big Picture: S&P 500 Daily Chart Analysis

Examining the TRADENATION:US500 posted daily chart, the key question is: has the trend truly reversed? While a green-bodied candle signals some bullish momentum, SP500 remains below critical resistance levels. Notably, it closed beneath what I call the "Do or Die" zone—an area that aligns with prior lows and, more importantly, the daily 200 SMA. This suggests that what we’re seeing could be a lower high forming within the broader downtrend.

Hourly Outlook:

On the hourly chart, we see a strong reversal from 5500, but the move appears corrective rather than impulsive. It seems to be forming an ABC-style correction, with the market currently in wave C. Calculating the potential top of wave C, we find it aligns perfectly with a key resistance level and the 200-day SMA.

Conclusion:

While we may see some upside heading into the end of the week, I believe this rally will be short-lived. Once SP retests the broken support—now acting as resistance—I expect the downward trend to resume, with my target remaining at 5200 (as previously discussed).

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Using Fibonacci/Measured Moves To Understand Price TargetThis video is really an answer to a question from a subscriber.

Can the SPY/QQQ move downward to touch COVID levels (pre-COVID High or COVID Low).

The answer is YES, it could move down far enough to touch the pre-COVID highs or COVID lows, but that would represent a very big BREAKDOWN of Fibonacci/ElliotWave price structure.

In other words, a breakdown of that magnitude would mean the markets have moved into a decidedly BEARISH trend and have broken the opportunity to potentially move substantially higher in 2025-2026 and beyond (at least for a while).

Price structure if very important to understand.

Measured moves happen all the time. They are part of Fibonacci Price Theory, Elliot Wave, and many of my proprietary price patterns.

Think of Measured Moves like waves on a beach. There are bigger waves, middle waves, smaller waves, and minute waves. They are all waves. But their size, magnitude, strength vary.

That is kind of what we are trying to measure using Fibonacci and Measured Move structures.

Watch this video. Tell me if you can see how these Measured Moves work and how to apply Fibonacci structure to them.

This is really the BASICS of price structure.

Get Some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

S&P500 down -4.84%, worst day since 2020 COVID crash! GAME OVER?The S&P500 (SPX) had yesterday its worst 1D closing (-4.84%) in exactly 5 years since the COVID flash crash started on March 11 2020 (-4.89%). Not even during the 2022 Inflation Crisis did the index post such strong losses in a day.

Obviously amidst the market panic, the question inside everyone's minds is this: 'Are we in a Bear Market?'. The only way to view this is by looking at SPX's historic price action and on this analysis we are doing so by examining the price action on he 1W time-frame since the 2008 Housing Crisis.

As you can see, starting from the Inflation Crisis bottom in March 2009, we've had 4 major market corrections (excluding the March 2020 COVID flash crash which was a Black Swan event). All of them made contact with the 1W MA200 (orange trend-line) and immediately rebounded to start a new Bull Cycle. Those Bull Cycles typically lasted for around 3 years and peaked at (or a little after) the red vertical lines, which is the distance measured from the October 15 2007 High to the May 07 2011 High, the first two Cycle Highs of the dataset that we use as the basis to time the Cycles on this model.

The Sine Waves (dotted) are used to illustrate the Cycle Tops (not bottoms), so are the Time Cycles (dashed). This helps at giving a sense of the whole Cycle trend and more importantly when the time to sell may be coming ahead of a potential Cycle Top.

This model shows that the earliest that the current Cycle should peak is the week of August 11 2025. If it comes a little later (as with the cases of October 01 2018 and June 01 2015), then it could be within November - December 2025.

The shortest correction to the 1W MA200 has been in 2011, which only lasted 22 weeks (154 days). The longest is the whole 2008 Housing Crisis (73 weeks, 511 days). All other three 1W MA200 corrections have lasted for less than a year.

On another note, the 1W RSI just hit the 34.50 level. Since the 2009 bottom, the market has only hit that level 5 times. All produces immediate sharp rebounds. The December 17 2018, March 16 2020 and August 15 2011 RSI tests have been bottoms while May 09 2022 and August 24 2015 bottomed later but still produced sharp bear market rallies before the eventual bottom.

Uncertainty is obviously high but these are the facts and the hard technical data. Game over for stocks or this is a wonderful long-term buy opportunity? The conclusions are yours.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Are Time and Reason in Harmony in SPX?Are Time and Reason in Harmony in SPX?

S&P 1D Technical and Fundamental Analysis;

This structure, which looks like an ordinary decline on the SPX daily chart ... in fact, we can say that it carries the pieces of a big scenario that develops synchronously both technically and fundamentally.

Let me explain now;

5 December 2024 was not just a breaking point. Because Trump's statements after taking the presidency for the second time, especially the message that ‘customs walls may rise’ had become clear.

In the same week, the uptrend in SPX quickly weakened and declined as the FED gave the message ‘Interest rate cut is not imminent’.

From here, Bullish Sharq started the formation of harmonic formation.

Now comes the week of 1 May.

- FED's interest rate decision,

- Trump's budget plan,

- And one of the critical macro thresholds where company balance sheets are announced.

While everything is going well so far, if we take into account that the chart will also touch a strong trend line, it may mean ‘either a bounce or a collapse from here’.

Because the price in the market does not just move, it looks for reasons .

I would also like to ask you here;

What will greet the market when this date comes?

Harsh interest rate rhetoric?

Trump's aggressive economic agenda?

Or a recovery supported by positive balance sheets?

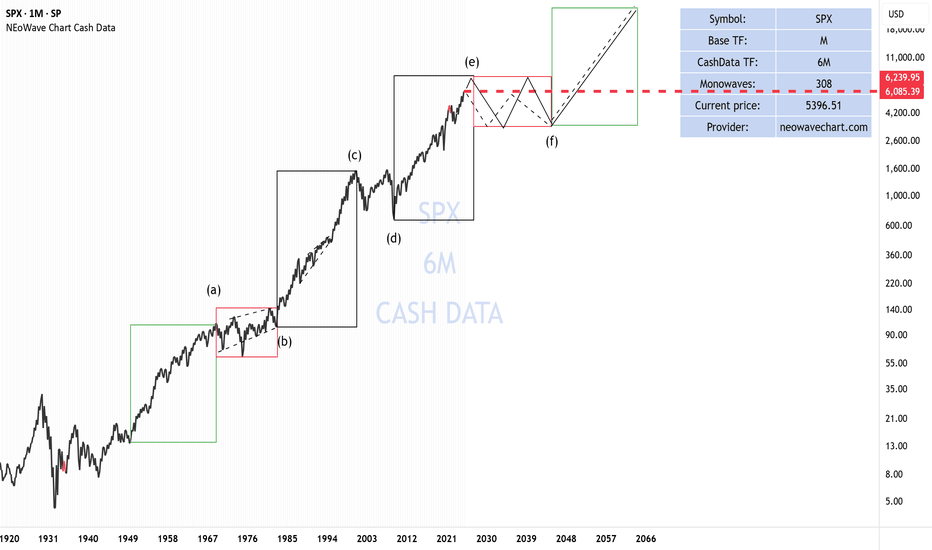

S&P 500 resistance levels#SPX

Upon observing the 6-month cash data of the S&P index, it becomes clear that this index has reached significant resistance levels. However, it is still too early to proclaim the beginning of a major correction in this index. That said, it can be anticipated that a potential price correction might extend to the range of 4800 to 4500.

When comparing the wave count of this index with the Warren Buffett Indicator, both reveal a common message: the S&P is currently situated in sensitive zones.

There are two critical price ranges for this index that could lead to significant price reversals: the first range is between 6085 and 6240, and the second range is between 7900 and 8000.

Head & Shoulder Breakdown: Will S&P 500 Drop Another 10%?● The S&P 500 has experienced significant volatility recently, mainly due to President Donald Trump's announcement of new tariffs.

● On April 3, 2025, the index saw a nearly 5% drop, its worst single-day loss in five years.

● The recent price action suggests that the index has broken below the neckline of the Head and Shoulder pattern, indicating a potential continuation of the downward trend.

◉ Key support levels to watch

● 1st Support - 5,200 - 5,250

● 2nd Support - 4,950 - 5,000

Combined US Indexes - Lower High checked; Lower Low next...As expected from previous analysis, there is a lower high likely as the TD Sell Setup is Perfected. This just missed the target but has the TD Bear Trend intact

Following, a Bearish Engulfing pattern plus a Gap Down occurred yesterday.

Breaking back into Extension Zone box... and likely to protrude out the other side.

MACD is turning down in the bearish zone too.

So, looking for a lower low now...

Nightly $SPY / $SPX Scenarios for April 4, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇸📊 March Employment Report Release: The Bureau of Labor Statistics will release the March employment report, with forecasts predicting an addition of 140,000 nonfarm payrolls and an unemployment rate holding steady at 4.1%. This data will provide insights into the labor market's health and potential implications for Federal Reserve policy.

🇺🇸💬 Federal Reserve Chairman Powell's Address: Federal Reserve Chairman Jerome Powell is scheduled to speak at 11:25 AM ET. Investors will be closely monitoring his remarks for any indications regarding future monetary policy, especially in light of recent market volatility.

🇺🇸📈 Market Reaction to 'Liberation Day' Tariffs: Following President Donald Trump's announcement of new tariffs, dubbed "Liberation Day" tariffs, the markets experienced significant declines. The S&P 500 dropped 4.8%, and the Nasdaq Composite fell 6%, marking the worst trading day since 2020. Investors are bracing for continued volatility as the market digests the potential economic impacts of these tariffs.

📊 Key Data Releases 📊

📅 Friday, April 4:

👷♂️ Nonfarm Payrolls (8:30 AM ET):

Forecast: +140,000

Previous: +151,000

Indicates the number of jobs added or lost in the economy, excluding the farming sector.

📈 Unemployment Rate (8:30 AM ET):

Forecast: 4.1%

Previous: 4.1%

Represents the percentage of the total workforce that is unemployed and actively seeking employment.

💵 Average Hourly Earnings (8:30 AM ET):

Forecast: +0.3%

Previous: +0.3%

Measures the month-over-month change in wages, providing insight into consumer income trends.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

S&P 500 Down 3% – Divergence AppearsThe S&P 500 (SPX) continues to show a strong bearish bias and is approaching the 5,300-point level in the short term. Selling pressure remains steady as post-“Liberation Day” uncertainty persists, with markets concerned that the recently announced tariffs could significantly impact the U.S. economic outlook. As a result, this could severely limit the performance of equity indices like the S&P 500.

Bearish Channel

Since February 20, the SPX index has maintained consistent downward momentum, establishing a new bearish channel in the short term. The index has now broken below the key 5,400-point support level. However, the speed of the recent declines may have created an imbalance in market forces, which could pave the way for a bullish correction in upcoming sessions.

Divergence in Indicators

MACD: Both the MACD line and the signal line have shown higher lows in recent trading sessions, which contrasts with the lower lows in the SPX price, indicating a bullish divergence.

RSI: The RSI is showing a similar pattern, with the line forming higher lows while price continues to make lower lows. Additionally, the RSI is now approaching the 30 level, which is typically considered the oversold zone.

These divergence and oversold signals suggest that bearish momentum has accelerated sharply, potentially signaling short-term exhaustion. As the balance between buyers and sellers begins to stabilize, this may be an early indication that upward corrections could occur in the next few sessions.

Key Levels:

5,780 points – Distant resistance: This level aligns with the 200-period moving average. A return to this zone could mark the start of a new bullish phase, posing a threat to the current bearish channel.

5,530 points – Near resistance: This area corresponds to neutral levels seen in recent weeks. It may become a target zone for potential corrective upward moves.

5,388 points – Key support zone: This level matches the lowest prices since September 2024 and is where the price is currently consolidating. If the index breaks decisively below this level, it could lead to a more extended bearish channel in the short term.

By Julian Pineda, CFA – Market Analyst

Trump Goes 'Cynosure' of All Eyes as He Walked Into '1930' RoomThe Striking Parallels Between Trump's 2025 Tariffs and the Smoot-Hawley Tariff Act of 1930

The recent trade policies under President Trump's second administration bear remarkable similarities to the controversial Smoot-Hawley Tariff Act of 1930, both in approach and potential consequences. These parallels offer important historical lessons about protectionist trade policies.

Protectionist Foundations and Scope

Both trade initiatives share fundamentally protectionist motivations aimed at shielding American industries from foreign competition. The Smoot-Hawley Act increased import duties by approximately 20% with the initial goal of protecting struggling U.S. farmers from European agricultural imports. Similarly, Trump's 2025 trade agenda explicitly aims at "backing the United States away from integration with the global economy and steering the country toward becoming more self-contained".

What began as targeted protections in both eras quickly expanded in scope. While Smoot-Hawley initially focused on agricultural protections, industry lobbyists soon demanded similar protections for their sectors. Trump's tariffs have followed a comparable pattern, beginning with specific sectors but rapidly expanding to affect a broad range of imports, with projected tariffs exceeding $1.4 trillion by April 2025—nearly four times the $380 billion imposed during his first administration.

Specific Tariff Examples

The parallel implementation approaches are notable:

Trump imposed a 25% global tariff on steel and aluminum products effective March 12, 2025

Trump raised tariffs on all Chinese imports to 20% on March 4, 2025

Trump imposed 25% tariffs on most Canadian and Mexican goods

Smoot-Hawley increased overall import duties by approximately 20%

Smoot-Hawley raised the average import tax on foreign goods to about 40% (following the Fordney-McCumber Act of 1922)

Global Retaliation and Economic Consequences

Perhaps the most striking similarity is the international backlash. The Smoot-Hawley tariffs triggered retaliatory measures from over 25 countries, dramatically reducing global trade and worsening the Great Depression. Trump's 2025 tariffs have already prompted counter-tariffs from major trading partners:

China responded with 15% tariffs on U.S. coal and liquefied natural gas, and 10% on oil and agricultural machines

Canada implemented 25% tariffs on approximately CA$30 billion of U.S. goods

The European Union announced tariffs on €4.5 billion of U.S. consumer goods and €18 billion of U.S. steel and agricultural products

Expert Opposition

Both policies faced significant opposition from economic experts. More than 1,000 economists urged President Hoover to veto the Smoot-Hawley Act.

Trump's 2025 tariffs? Reaction is coming yet...

Potential Economic Impact

The historical record suggests caution. The Smoot-Hawley Act is "now widely blamed for worsening the severity of the Great Depression in the U.S. and around the world". Trump's "more audacious intervention" similarly carries "potentially seismic consequences for jobs, prices, diplomatic relations and the global trading system".

These striking parallels between trade policies nearly a century apart demonstrate that economic nationalism and retaliatory trade cycles remain persistent challenges in international commerce, with historical lessons that remain relevant today.

Stock market Impact

Just watch the graph..

--

Best wishes,

Your Beloved @PandorraResearch Team 😎

April 3rd Daily Trade Recap EOD accountability report: +$161.25

Sleep: 6 hour, Overall health: not good at all.

**Daily Trade Recap based on VX Algo System **

9:42 AM Market Structure flipped bullish on VX Algo X3!

10:30 AM Market Structure flipped bearish on VX Algo X3!

11:11 AM VXAlgo ES 10M Buy signal (double signal)

12:04 pm Market Structure flipped bullish on VX Algo X3!

1:31pm Market Structure flipped bearish on VX Algo X3!

1:40 PMVXAlgo NQ 10M Buy Signal double signal

Another wild day, market went extremely bearish and has been rejecting the 5 min resistance and playing out as expected.

Welcome to the real world Uncle Sam!The market can withstand a lot of pressure.

It can handle:

the dawn of "fake news" and outright "lying"

the pollution and "enshitification" of social media

imperialist ideas of a Gaza takeover

partnering with a Russian totalitarian state

overhyping of AI and Nvidia's overpricing

populist politics

unworldly valuations of tech stocks

What it cannot handle is:

Upsetting the world order

Undermining of NATO, Europe, and allies

Starting trade wars with your best friends

Establishing tariffs which will harm the US economy

I love the US stock market, and US animal spirits, it's the best in the world.

But when risk rises, then secure investments like bonds/treasuries become the smart money move. Stocks become "risk off"

Risk is rising, tariffs will pressure inflation, inflation kills economies and markets.

The European defense industry will benefit, the US consumer will pay higher prices.

Higher risk, could mean a lack of confidence, and confidence powers the stock market.

Batton Down the Hatches.

Trading Note: I sold all my US holdings on Tuesday, at the break of the double top neckline (see chart).

My target price is the 2021 high, before the one-year bear market. Its a big drop, I give it a 60-70% chance.

RSI & ROC Negative Medium-term divergences

Of course this could all change if Trump backtracks on trade wars, tariffs and imperialist rhetoric.

But until then, enjoy the ride.

S&P500 6th time in 14 years that this buy signal flashes.S&P500 is sinking under its MA50 (1w) and is headed straight to the next support level, the MA100 (1w).

Last time it touched this level was in October 30th 2023 and that's alone a great buy signal.

It's the RSI (1w) you should be paying attention to as it is approaching the 33.00 level, which since August 2011 it has given 5 buy signals that all touched the MA100 (1w).

Obviously in 2022 we had a bear market, March 2020 was the COVID Black Swan and December 2018 the peak of the U.S.-China trade wars.

Trading Plan:

1. Buy on the MA100 (1w).

Targets:

1. 6500.

Tips:

1. This is a long term trade and it is all about your approach to risk. If you can handle unexpected dips below the MA100 (1w), then you will be greatly rewarded by the end of 2025.

Please like, follow and comment!!