S&P 500 is gearing up for a drop to $348.11 or even $218.26.SP:SPX AMEX:SPY are gearing up for a potential crash. Markets and indices seem aligned for a downturn.

What will trigger it?

Hard to say, but watching the stock and crypto markets, it certainly looks that way.

My expectations for SPX / SPY:

➖ Fibonacci 161.80% targets have been reached.

➖ Key downside levels: $348.11 and $218.26.

TVC:DXY

The dollar index is leaning towards growth for now. I think it might follow this scenario. Let’s keep an eye on how things develop.

SPX (S&P 500 Index)

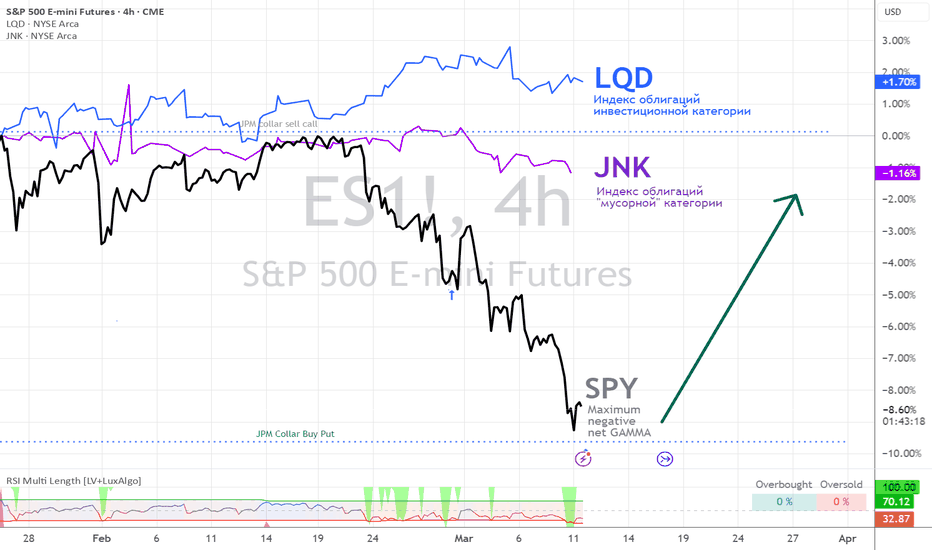

Glory to the Bear! - And My Plan is in MotionGlory to the Bear! - And My Plan is in Motion | SPX Market Analysis 11 Mar 2025

It’s time to salute the bear—SPX is nearly 10% down, officially flirting with correction territory. The NASDAQ has already crossed the line, and blue-chip stocks are falling fast, shedding high single and low double digits in a matter of days.

But here’s the difference—there’s no panic. This isn’t a blind sell-off; it’s structured, calculated, and methodical. The market isn’t falling apart in chaos—it’s crumbling with precision. That tells me one thing: this move has legs.

I’m already locked and loaded on the bearish side, with 5255 as my next major target. Until we see a meaningful reclaim of 5800, I won’t even consider flipping bullish. For now, it’s all about collecting profits—or watching for hedge triggers.

---

Deeper Dive Analysis:

The SPX correction is nearly here, and unlike past sell-offs, this one feels controlled, structured, and lacking in panic. That’s what makes it even more powerful.

The Market Breakdown – How We Got Here

The SPX is down 9.49%, inching closer to official correction levels. While the speed of the decline has been slow, the trend is now unmistakable—we are firmly in a bearish structure.

Monday’s move steepened the downtrend, confirming the break below the sideways channel.

The NASDAQ has already crossed correction territory, leading the decline.

Blue-chip stocks are getting slaughtered, dropping in high single and low double digits.

Technical Levels – Why This Bear Move Is Clear

One of my favourite things in technical analysis is when everything interlocks perfectly—and that’s exactly what’s happening.

The first bearish target on the daily charts has been reached, causing a minor bounce—likely profit-taking.

The larger expanding triangle breakout target is 5255, which just happens to be 200% of the previous target.

The next bullish play isn’t even on my radar until SPX reclaims 5800.

Trading Execution – No Need to Rush

With my bearish positions locked in, there’s no reason to chase or force trades. The plan is simple:

Let the market do its thing.

Wait for profits to roll in—or hedge triggers to fire.

No new bullish trades until SPX climbs back above 5800.

Right now, the market is rewarding patience. This is what structured trading looks like—sticking to the plan and executing with confidence.

---

Did you know? In 1929, stock tickers ran hours behind during the market crash, leaving traders guessing how much they had lost until the end of the day.

The Lesson? Market chaos rewards those who plan ahead. Unlike traders in 1929, you don’t have to wait for a newspaper headline to know what’s happening—but if you’re not following a strategy, you’re still guessing.

End of hibernation for the bears?AMEX:SPY is at a pivotal point and could potentially be at the top of the bullish cycle that began in October 2022. If this prediction proves accurate, I think we could see a maximum low of $510 for this year. There are a couple of caveats, including one that will be a clear indicator of whether or not this wave count is accurate, which I will explain later.

On the 1000R chart ($10), this uptrend was confirmed by Supertrend and volume activity. Volume drastically increased at the start of Wave (3) in March 2023 and did not taper off until the start of Wave (4) in July 2024. This was the strongest impulse in the trend, which is common for Wave 3. You can also see the ADX line of the DMI indicator (white line) was at its highest level during that period.

Assuming Wave (5) is already complete, we can observe that the volume in Wave (3) was considerably less than Wave (5).

Other observations supporting this wave count:

- Wave (4) retracing into the territory of Wave 4 of (3)

- Alternation in corrective patterns between Wave (2) and Wave (4); flat in (2) and straight down in (4)

- Wave (5) extending to nearly 1.618 of (1)

While the points I’ve made so far suggest that the market may be on the verge of a crash, the image gets more complicated when you take a closer look on the 250R chart ($2.50). I’ll start with what I’m counting as Wave 4 of (5). The price ended at ATH in Wave 3 and then corrected in an unmistakable five wave descending wedge pattern. This can only be a fourth wave of a larger impulse, so we can conclude with a fair amount of confidence that the wave that follows will be the last.

Here is where things get interesting. The price moved from $575 on January 13th to a slightly higher ATH of $609.24 on January 24th before being rejected again. This uptrend unfolded in a typical bullish pattern and left a notable gap at $584, which is the only gap still left unfilled. The trend change is confirmed on the moving averages. Notice the serious drop in volume that followed as well.

Despite the shift in volume, there are two issues I have with this wave count that are preventing me from calling this a confirmed correction:

1. Wave 5 of (5) was awfully short and only extended roughly $2 above the end of Wave 3 of (5). This does not break any rules, but it is unusual.

2. What I have labelled as Wave B of Wave (1) or (A) of the correction made a new ATH on Friday February 14th, which should invalidate this wave count since the end of Wave 5 of (5) should be the peak.

The second point is why some may think that we are about to resume the larger bull trend, however there is a possibility that they are mistaken based off the PA on the actual index SP:SPX and futures CME_MINI:ES1! . On the SP:SPX chart, we can see that the index did not break the ATH at $6128.18 set on January 25th, and instead rejected at $6,127.24.

CME_MINI:ES1! also failed to notch a new ATH on Friday and I have observed the price action create a nearly perfect bearish butterfly pattern. Also notice how the volume is significantly lower than in the uptrend that began on January 31st.

So the question remains: are we at a tipping point or will the bulls regain control? Right now it’s unclear, but I will keep my bearish sentiment until SP:SPX makes a new ATH, which will invalidate this theory. Since only the ETF that tracks it only made a slightly higher high on low volume, I’m skeptical of the PA on AMEX:SPY at the moment. This is why I entered puts on Friday.

If the trade plays out, I expect the price to quickly move to fill the gap at $584, which is still conveniently located at what I cam considering the 1.236 extension of Wave A, which is a common target extension in flat corrections. I will keep my puts open until this idea is invalidated, as the Wave C drop will likely be caused by a news event that could come at any time. Let me know if you guys are seeing the same thing or something different. Good luck to all!

$SPY Short Term Bullish atm.. idea for BullsWell... seeing is we hit my target, I thought I might bless the Bulls with a little bit of Eye Candy.... This is what you want...

The Fib breakdown of the Golden Pocket above at the 1.61... we hit the retracement... and now back to the .78

We hold here and it can get bullish quick.

Bearish Path in Next post... otherwise we make a lower high and fall to $525 and fast.

Nightly $SPY / $SPX Scenarios for March 11, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🇯🇵🤝 Japan-U.S. Trade Discussions 🤝: Japanese Trade Minister Yoji Muto is visiting Washington from March 9–11 to engage in discussions with U.S. officials. The talks aim to strengthen economic ties and address trade concerns, including potential exemptions for Japanese exports from proposed U.S. tariffs. These negotiations could influence sectors such as automotive and steel, impacting market dynamics.

🇨🇳📊 China's National People's Congress (NPC) Developments 📊: The 2025 National People's Congress is underway in Beijing from March 5–11. Key economic targets and policy directions set during the NPC may affect global markets, including the U.S., especially in areas related to trade, technology, and foreign investment.

📊 Key Data Releases 📊:

📅 Tuesday, March 11:

📄 JOLTS Job Openings (10:00 AM ET) 📄:This report provides data on job openings, hires, and separations, offering a comprehensive view of the labor market's dynamics.

Forecast: 7.71 million

Previous: 7.6 million

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult with a professional financial advisor before making investment decisions.⚠️

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

AMAZON at important support. Positive days coming?AMZN looking at good support. We can see positive days if it works.

Many cryptocurrency dominance charts, as well as Nasdaq and other stock charts too, showing the same pattern. Is the reversal starting? Check my other analysis too.

We’ll see.

This is not investment advice. Please do your own research.

Wishing you best.

-YusufDeli

Bearish Outlook for VX1!Bearish Post Description for TradingView

Title: Bearish Outlook on VIX Futures - Time to Brace for a Pullback!

Hey traders, take a look at this VIX Futures chart (CBOE Volatility Index - VX1 Futures) published by FairValueBuffet on TradingView (Mar 10, 2025, 20:58 UTC). The technicals are screaming caution, and here’s why:

- Supply/Demand Zone Breakdown: We’ve hit a critical supply zone (highlighted in yellow) with a sharp spike, suggesting heavy selling pressure. The price action is showing rejection at this level, hinting at a potential reversal.

- Moving Averages: The 18-week and 52-week SMAs are converging, with the price breaking below the shorter-term SMA, reinforcing bearish momentum.

- Bearish Divergence: The RSI and Williams %R at the bottom show clear bearish divergence. Despite a price spike, the momentum indicators are declining, indicating weakening bullish strength.

- Seasonality Indicator: The bottom-right seasonality chart (COT data for VX Futures) shows a historical tendency for volatility spikes around this time, often followed by a correction.

With the VIX jumping to 24.700 and a volume of 137.66K, coupled with the bearish technical setup, I’m anticipating a pullback in the near term. Keep an eye on the 20.000 support level—failure to hold could see us testing lower grounds. Let’s stay cautious and consider short opportunities or hedging strategies!

---

CBOE:VX1! CME_MINI:ES1! AMEX:SPY

Bullish Case for S&P 500 - Fundamental Perspective

While the VIX chart suggests short-term volatility, the broader S&P 500 presents a compelling bullish case based on fundamentals as of March 10, 2025. Here’s why we might see upside potential:

- Economic Resilience: Recent data points to robust corporate earnings growth, with many S&P 500 companies exceeding Q4 2024 expectations. This earnings strength supports a sustained rally.

- Interest Rate Outlook: The Federal Reserve has signaled a dovish stance, with potential rate cuts on the horizon. Lower interest rates typically boost equity valuations, especially for growth stocks in the S&P 500.

- Gold and Bonds Correlation: The chart shows a dip in gold prices and bond yields stabilizing, which historically correlates with risk-on sentiment. This could drive capital back into equities, favoring the S&P 500.

- Market Sentiment: Despite short-term volatility (as seen in the VIX), investor confidence remains high, supported by strong consumer spending and improving global trade conditions.

Given these fundamentals, the S&P 500 could be poised for a bullish run, especially if volatility subsides and the 18-week SMA on the VIX chart starts to flatten. Consider long positions or adding exposure if the market holds key support levels. Stay tuned for confirmation!

---

Note: This analysis is based on the provided chart and my knowledge up to March 10, 2025. For the latest updates or to validate these trends, I can perform a web search or analyze additional X posts if requested!

Not Financial Advice

Start of bearish cycle for equities $SPXSP:SPX confirming trend reversal on high time frame as it attempts to breach the 50 weekly MA for the first time since the start of the 2022 bear market. Macroeconomic environment is full of uncertainty and recession signals, with POTUS Trump openly confirming that some short term pain in assets is needed for the US economy to reset and go on a better path forward.

S&P500: Broke its 1W MA50 after 17 months. Recovery or collapse?The S&P500 turned oversold on its 1D technical outlook (RSI = 29.430, MACD = -85.410, ADX = 51.223) as it breached today its 1W MA50 for the first time since the week of October 30th 2023, i.e. almost 1.5 year. That was a week of a very aggressive recovery after a Channel Up correction, with the bullish sequence reaching 9 straight green weeks. With the 1D RSI ovesold and the 1W RSI almost on the 39.15 Support, which was the low of the October 23rd 2023 1W candle, the index couldn't have been technically on a better long term buy spot.

Needless to say, the market can't rise if the fundamentals are against it and right now the geopolitical tensions and more importantly the trade war isn't helping. If the index does find a positive catalyst to take advantage of, then the bullish technicals of the Channel Up bottom will prevail, and this week's candle may resemble the Max Pain 1W candle under the 1W MA50 of October 23rd 2023. Even if it doesn't rise as high as the 2.382 Fibonacci extension of that rally, we would expect in that instance a 2.0 Fib extension rally like the post August 2024 bullish wave (TP = 6,700). Failure to find support this week though, will most likely result in further collapse (even more aggressively so) to the 1W MA100.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

S&P 500 Breakdown at Key Support LevelThe S&P 500 is showing clear signs of technical weakness as it breaks below a key support level around 5,675, coinciding with the 200-day EMA. This breakdown follows a rejection at 6,130, a recent high that established a resistance zone.

With the index now trading below the 50-day EMA, downside risks are increasing. If the 5,668 level fails to hold, further declines toward the next major support zone could materialize. Traders will be watching for a potential retest of broken support as resistance before determining the next move.

Key Levels to Watch:

📉 Support: 5,668

📈 Resistance: 6,130

-MW

Still Bearish, Still Grinding – Patience Remains the KeyStill Bearish, Still Grinding – Patience Remains the Key | SPX Market Analysis 10 Mar 2025

Another week, another grinding bearish move—but are we truly breaking down, or is this just another market head-fake?

Friday gave us a tease of a breakdown, only to bounce right back into the range by the close. The overnight futures are dipping slightly, but we’re not yet below last week’s lows, meaning the bears haven’t fully taken control—yet.

The scenarios remain unchanged, the bias is still bearish, and patience remains the best strategy. We’re watching for confirmation—because in this kind of slow-motion market, forcing a trade only leads to frustration.

---

Deeper Dive Analysis:

The market is playing the ultimate waiting game, and traders are getting impatient. It’s been grinding lower, teasing a real breakdown, only to snap back into the range by the week’s end. It’s like watching a boxer throw a knockout punch—only for the opponent to wobble, but never hit the canvas.

The bearish move is still intact, but it’s moving in slow motion. It’s not a dramatic crash, but a controlled decline, inching lower each day.

📌 Friday’s Tease – The Breakdown That Wasn’t

The market attempted a decisive break lower but failed to hold.

By the close, price had bounced back into the range, leaving traders confused.

This type of fake breakdown is what traps emotional traders, forcing them to chase moves that never materialize.

📌 Overnight Futures – More of the Same?

Futures dipped slightly, but last week’s lows remain unbroken.

A real downside continuation requires price to actually commit below key levels.

For now, it’s just more of the same slow-motion grind.

📌 The Bearish Bias is Still in Play – But It Needs Confirmation

The larger descending channel is still guiding price lower.

The bias remains bearish, but conviction is lacking.

If the market doesn’t break soon, we could see another bounce-back-to-nowhere scenario.

📌 The Plan – Stay Hedged, Stay Patient

No need to force a position—the market hasn’t fully committed.

Let the range confirm a direction before taking on new risk.

Stay ready—because once the move happens, it could be fast.

Right now, the market is whispering, not shouting. The traders who listen to what price is actually doing, rather than what they want it to do, will be the ones who capitalize when the next real move arrives. 🚀📉

---

Fun Fact

📢 Did you know? In 1986, a trader at the Chicago Mercantile Exchange accidentally placed a $7 billion order instead of $7 million, causing a massive market spike before it was caught and reversed.

💡 The Lesson? Even the smallest trading mistake can have enormous consequences—which is why having a structured system like the SPX Income System can help avoid costly errors and keep your trades under control.

SPX Will Grow! Long!

Here is our detailed technical review for SPX.

Time Frame: 45m

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 5,770.40.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 5,863.87 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

SPX: the “kangaroo” marketSince the establishment of financial markets there has been a market separation on bullish and bearish markets. Traders just invented the third option called the kangaroo market, in an attempt to describe recent developments of price movements. It refers to rare development of the price movements when the price of an asset goes strongly in one direction and then returns back to a starting position, all within one single trading day. It also reflects the level of uncertainty that is currently evident. The S&P 500 continues to be in a correction mood. The index was struggling to sustain the 6K level, however, the price moves from the previous week are showing that the market is slowly losing nerves. The worst week since September is behind, as analysts noted. On Monday, the index tried for one more time to reach the 6K resistance, and then finally reverted to the downside. The lowest weekly level was at 5.670, which was the last time traded in July 2024, while a total weekly loss accounts for 3,1%.

Jobs report posted on Friday, brought figures which were lower from market expectation, with a 151K in NFPs. The unemployment rate was also higher by 1pp, ending the month at 4,1%. This is not a good sign for the economy, adding to its high uncertainty over US Administration trade tariffs. Currently, trade tariffs are playing a crucial role when it comes to market sentiment. In this sense, the negative sentiment might continue, but unfortunately, also the kangaroo moves. The market is trying to find new grounds, which might take some time.

Bearish Outlook for US500: Watching 5,200 SupportAfter testing support at the end of February, the US500 fell below this key level at the start of March, signaling the potential for a deeper correction.

In my view, this scenario is likely, and any rebound this week could present a good selling opportunity for speculators.

My target for this correction is the 5,200 support zone. A stabilization above 6,000 would invalidate this outlook.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Weekly $SPY / $SPX Scenarios for March 10–14, 2025 🔮🔮

🌍 Market-Moving News 🌍:

🇨🇳📉 China's Retaliatory Tariffs 📉: In response to U.S. tariffs, China has imposed up to 15% tariffs on U.S. products, including cotton, chicken, corn, and soybeans. This escalation raises concerns about a potential global trade war, which could negatively impact U.S. exporters and broader market sentiment.

🇪🇺💶 European Fiscal Expansion 💶: Germany has announced significant increases in defense and infrastructure spending, marking a shift in fiscal policy. This move may stimulate European economic growth, potentially affecting U.S. markets through interconnected global trade and investment channels.

📊 Key Data Releases 📊:

📅 Wednesday, March 12:

📈 Consumer Price Index (CPI) (8:30 AM ET) 📈:The CPI measures the average change over time in prices paid by urban consumers for a basket of goods and services, serving as a key indicator of inflation.

Forecast: +0.2% month-over-month

Previous: +0.3% month-over-month

📅 Thursday, March 13:

🏭 Producer Price Index (PPI) (8:30 AM ET) 🏭:The PPI reflects the average change over time in selling prices received by domestic producers, offering insights into wholesale inflation trends.

Forecast: +0.1% month-over-month

Previous: +0.2% month-over-month

📅 Friday, March 14:

🛒 University of Michigan Consumer Sentiment Index (10:00 AM ET) 🛒:This index measures consumer confidence regarding personal finances, business conditions, and purchasing power, providing insights into consumer sentiment.

Forecast: 95.0

Previous: 96.4

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult with a professional financial advisor before making investment decisions.⚠️

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

Validation of a long term top in the SPX continues to playballLast week I posted an update on my SPX cash index analysis...found below.

At the end of last week, we see where the price action has been filling in nicely as of Friday. Some key take-a-ways. First, is the price action has breached the area that I am counting as the wave 4 of one lesser degree. This would be an initial clue that the bull market pattern that started back in August of last year is cracking. This would be the area that I am counting as the intermediate wave (4). I am forecasting this recent price action down is the Minor A wave of the beginning of a stair stepped decline that has a high probability of coming back into that area of the August 2024 lows after we retrace higher in a minor B wave, labeled in Red.

What's important about price coming back into this area of approximately 5121-4950 is this the area that price could hold and manage a higher high, essentially meaning that my count is off by one degree...and what I am counting as a wave (III) super-cycle top will get pushed out to end of 2025-2026. However, to breach this area even incrementally, would provide much the same clues we're getting now, about price breaching the minor wave 4 of one lesser degree.

Below this must hold area, is where my forecast of a super-cycle wave (III) gets confirmation...until then we look for clues of validation...but confirmation does not come until price cane breach this area. To breach this area would reflect in price action that resembles the below.

SPX Is About to Explode – Here’s What I’m WatchingSPX is at a critical level, and whichever way it breaks, the move could be huge. Here’s my take:

If we drop below 5663, I see a move down to 5534 – 5445. If that zone fails, we could head toward 5332, and if selling pressure keeps up, 5234 might be next.

But if we break above 5800, the bulls could take over, pushing to 5972, and maybe even 6149.

It’s all about reaction levels now. I’m watching these zones closely—what’s your take? Are we heading up or breaking down?

Kris/ Mindbloome Exchange

Trader Smarter Live Better

BRIEFING Week #10 : Dollar reversed, WTI may be nextHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

S&P500 1week MA50 test is the last before the Cycle tops.S&P500 / US500 tested this week its 1week MA50 successfully as the price almost touched it and rebounded.

We have seen this kind of behavior in the last 9-12 months before a Bull Cycle tops.

In fact with the 1week RSI trending downwards on a bearish divergence, today's price action looks more similar to the October 13 2014 1week MA50 fakeout, which was breached marginally but rebounded immediately.

Based on that, a 6500 Cycle Top target by October 2025 is very much realistic.

Follow us, like the idea and leave a comment below!!