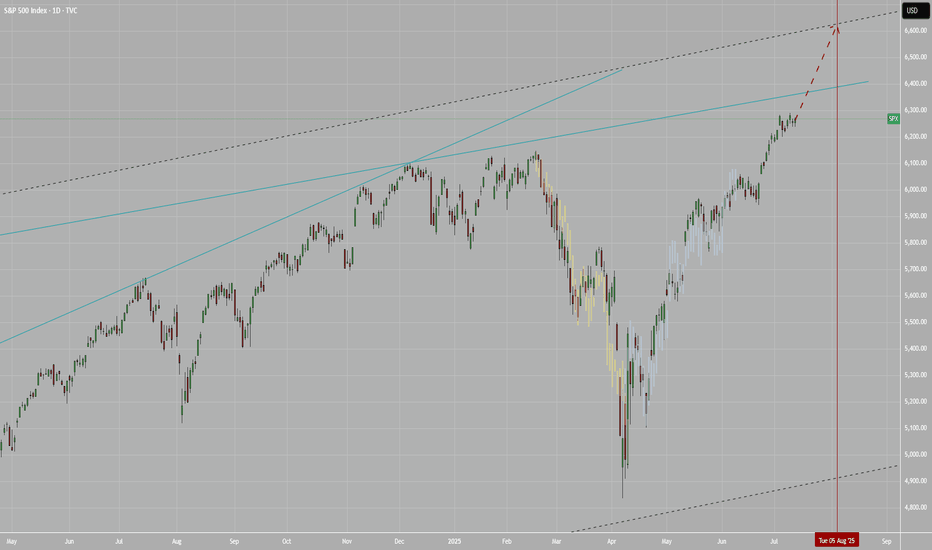

US500 Bearish Idea: Waiting for Structure Break ConfirmationWatching the SPX US500 right now 📈 — it’s rallied hard with strong momentum and is pushing into a key resistance level ⚠️. Since price is overextended, I’m expecting a pullback towards equilibrium on the current move 🔄. My bias is bearish from this level 🔻, with entry dependent on a break in structure on the 30-min timeframe ⏳.

All is explained in the video 🎥 (not financial advice).

S&P 500 (SPX500)

S&P500 at pivot zone Stocks are climbing higher, with S&P 500 futures up on hopes for interest rate cuts and solid company earnings. The outlook is positive, especially in the finance world—bankers, hedge funds, and asset managers are expected to get higher bonuses this year, reflecting stronger market conditions.

On the global front, the US is looking to tighten control over chip exports to China by adding better tracking in semiconductors. At the same time, Taiwan’s TSMC reported a possible leak of trade secrets, which led to arrests.

Trade talks are also heating up. Japan and Switzerland are sending officials to the US to push for lower tariffs, while India’s government is heading to Moscow just after criticism from the US over its Russian oil purchases.

Conclusion for S&P 500:

The rally has strong backing from earnings and rate-cut hopes, but investors should be alert. Rotation into small-cap stocks could continue, while tech and chip sectors may face headwinds from new trade and security pressures.

Key Support and Resistance Levels

Resistance Level 1: 6380

Resistance Level 2: 6400

Resistance Level 3: 6436

Support Level 1: 6295

Support Level 2: 6256

Support Level 3: 6214

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

S&P500’s Bullish Island Turns Risky: Elliott Wave Says “Top”The S&P500 Index( SP:SPX ) started to rise and even created a new All-Time High(ATH=$6,428) with the help of the Bullish Long Island Pattern , as I published in my previous idea on May 14, 2025 .

The S&P500 Index is currently moving near the Potential Reversal Zone(PRZ) , upper line of the ascending channel , the Important Resistance line , and the Yearly Resistance(1) .

In terms of Elliott Wave theory , the S&P500 Index appears to be completing microwave 5 of microwave 5 of the main wave 5 .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks .

I expect the S&P500 Index to correct at least -4% and fall to the lower line of the ascending channel .

First Target: $6,233

Second Target: $6,033

Note: Stop Loss(SL) $6,513

Do you think S&P500 Index can create a new ATH above $6,500 !?

Please respect each other's ideas and express them politely if you agree or disagree.

S&P 500 Index Analyze (SPX500USD), Daily time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

The Platinum BulletOver the years, I have posted a lot of educational content here on TradingView. Everything from Elliot waves to Wyckoff, psychology to Gann.

I have been lucky as a trader, 25 years doing this you pick up a thing or two. But above everything else, what you realise is that trading is a mindset game and not a technical one.

Many new traders try their luck. They are either experts in another field or simply successful in something else, or they come to the trading arena seeking wealth.

Both tend to get humbled quickly.

It is common for many new traders to put so much emphasis on the strategy, they overlook the psychology. You see, a strategy might work for someone, but you can't get it to work for you. This could simply be the time on the charts you lack, the timeframe or the instrument you are trading. The account balance or the fact you are not used to seeing 3-4 losses in a row.

When it comes to trading, less really is more!

Here's a simple one for you.

Take the mechanical range post I posted.

Now look at this;

On the larger timeframes we can see clearly the ranges and the supply/demand.

Then dropping down to the daily.

This is where, the technical aspect becomes less important and the psychology behind the move shows it's hand.

I have added volume and the AD line just to show how obvious this can be.

What do you see? Well as the price goes up, the volume goes down, we know we took liquidity to the upside.

So, if nothing else you would anticipate a pullback phase.

Then you get the clarity. Price drops and then pushes back, yet fails to make a new high. Almost like the volume told you it was about to happen.

Where did it pull back to?

Adding a simple volume profile too, from the swing high to the swing low. You can see the majority of the sell off (PoC) happened at a specific price point. Price pulled back to exactly that region before dropping.

The drop caused a local change in character and immediately took out the swing low - the last swing low of the leg up. (the real change in the trend).

There is obviously more to cover than this, but that is for another post.

Once you learn the way markets capitalise on the fear, the greed, the herd mindset, sentiment of the retail crowd. You can use the sentiment analysis in your favour.

You don't need 6 screens, fancy indicators, there is no silver bullet or 100% win rate strategies. And no a bot won't make you a Billionaire overnight.

If it was that easy, we would have no doctors, lawyers or firefighters; they would all be professional Bot traders.

Simplify your approach, put emphasis on the proper mindset, psychology and risk management and you will do alright!

Stay safe in the markets!

Some other recent posts;

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principal trader has over 25 years' experience in stocks, ETF's, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

Okay, Let's Take a Live Look Into the Market 📺⚡ Okay, Let's Take a Live Look Into the Market 💹🔥

Important levels across S&P 500, Bitcoin, and XRP are all flashing 🔴 right now. Here's what I'm seeing in real-time:

📈 S&P 500 Futures – 6,351 Is Everything

The 6,351 level marks the midpoint of the rising channel.

On Friday, I flagged 6,430 as critical resistance — price rejected perfectly.

Now we’re attempting a rebound, but we’re stuck at mid-channel.

⚠️ A confirmed breakout above 6,351 could reignite upside momentum.

👉 Yes, this is a 1-minute chart, but precision matters when watching key structural levels — especially in legacy indices.

💥 BTC – 115,700: The Grandmaster Level

Zoom out and see the massive yellow horizontal on the chart: 115,700.

It’s not just any number — this is the ultimate resistance-turned-support battleground.

We’re currently under it, which keeps pressure to the downside.

A reclaim flips the structure bullish and opens room for trend continuation.

📌 Until we’re above it, this remains the dominant resistance across the entire crypto macro framework.

🧩 XRP – Still Facing Rejection

On the 2H/3H chart, XRP continues to flirt with resistance but fails to confirm strength.

This aligns with both the S&P 500 stalling at 6,351 and Bitcoin being capped at 115.7K.

📉 When multiple assets respect key levels in sync, it signals market-wide hesitation.

🔄 Cross-Market Confluence

It’s fascinating to watch:

A TradFi index (S&P)

A macro crypto asset (BTC)

A mid-tier alt (XRP)

...all pivoting around hyper-precise structural resistance at the same time.

✅ These aren’t coincidences. They’re systemic correlations.

🔮 What’s Next?

If S&P 500 breaks above 6,351, it could act as a risk-on signal.

That momentum could help BTC flip 115,700 — a massive deal.

And if that happens, XRP could finally follow with a stronger move.

Until then? We respect resistance and wait for confirmation. 📊🔍

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

Rob the Rally SPX500: Enter Before Resistance Catches You🦹♂️💎 “SPX500 Vault Breach – Layered Robbery in Progress!” 💼📈

(Thief Trader's Multi-Limit Entry Bullish Blueprint – No Mercy, Just Money)

📍Asset: SPX500 / US500

🎯Plan: Bullish Heist

🧠Style: Layered Limit Orders | Thief Strategy Entry | Zero Mercy Execution

📈Target: 6600.00

🛑Stop Loss: 6200.00

💣Entry: Any level — thieves adapt, not wait!

🌍 Welcome to the Global Robbery Room, Traders!

It’s your boy Thief Trader, back in the vault with another plan to crack the SPX500 like a safe on Wall Street. This one’s for the bold bulls who like to rob with precision, not permission. 🎯💰

💼 The Setup – High Stakes, High Floors

SPX500 is lining up for a classic breakout breach. This isn’t just technical — it’s tactical warfare. Market noise? Ignore it. We operate on strategy and steel nerves. 🧠🔫

🔥 Entry Protocol – Layer Up or Miss Out

🧱 Multiple limit orders across price zones — like planting C4 charges on every door.

🎯 Enter wherever price dips — don’t wait for permission from retail traders.

🎯 No fixed entry — this is Thief Layering: get in where you fit in.

🚪 Escape Plan – Stop Loss Strategy

📍 SL: 6200.00

Why? That’s where the guards start showing up. If price drops below, we vanish.

💡 Be flexible — smart robbers don’t get caught, they regroup.

💎 Target Loot – The Golden Zone

📍 Primary TP: 6600.00

Once we breach the 6500+ resistance, it's a moonwalk. Lock gains or trail with confidence.

📢 Warning for Scalpers & Swing Thieves Alike:

Only play Long-side. Don’t try to rob both ends — that’s suicide.

Big wallet? Scale heavy. Small bag? Layer light but tight.

Always use trailing stops — never trust the market with your escape bag. 🎒💸

📊 Thief Intel – Why We’re Bullish

✅ Index rotation favors large-cap strength

✅ Macro sentiment + institutional bias points UP

✅ No bearish COT signals in sight

✅ Fed tone & economic backdrop: neutral to supportive

This isn’t hopium. It’s strategy.

🚨 NEWS FLASH – Stay Stealthy!

Do NOT enter during economic bombs 💣 (NFP, CPI, Fed minutes, etc.)

Market noise kills precision. We only move in silence and with SLs trailing tight.

💬 Smash that BOOST 💖 if you’re riding with the Thief Army.

Share this plan, spread the word, and let’s rob the markets the smart way.

📢 Tag your crew, stack your layers, and let’s hit 6600 like pros.

📌Disclaimer: Not financial advice — this is a market operation plan for educational use. Trade at your own risk. Smart thieves plan exits before entries. 💼📉📈

🦹♂️ Thief Trader out.

💸 Rob smart. Rob clean. Rob global.

SPX500 Dips Ahead of NFP as Tariff Risks RiseSPX: S&P 500 Dips to Close July — Still Positive for the Month Amid Tariff Tensions & Fed Uncertainty

The S&P 500 retreated in the final session of July, weighed down by renewed tariff concerns and lingering uncertainty around the Fed’s next move. Despite the late pullback, the index remains positive for the month overall.

Looking ahead, non-farm payrolls (NFP) and U.S. jobs data are expected to have a strong impact on market direction. In addition, August 1st marks a key date for potential tariff developments, which could trigger further volatility.

Technical Outlook – SPX500

The index has dropped approximately 2.5% since yesterday and maintains a bearish bias as long as it trades below 6283. If the price continues to slide, the next downside target is 6246, with further support at 6223.

However, if the price manages to close above 6289 on the 1H timeframe, it could trigger a bullish recovery toward 6320 and 6341.

Pivot Line: 6283

Support Levels: 6246 • 6223

Resistance Levels: 6320 • 6341

$XLV vs $SPY at multi year low. Is more downside expected? In this space we talk a lot about the market outperformance and how this has resulted in indexes at ATH. The SP:SPX and NASDAQ:NDX and their corresponding ETFs: NASDAQ:QQQ and AMEX:SPY have also made ATHs. But if peel under the surface we can observe that very few sectors have consistently outperformed the S&P 500. The Technology sector represented by AMEX:XLK has consistently outperformed the $SPY. The $XLK/ AMEX:SPY is in a upward channel depicted by the purple line. The SPDR select sector Technology sector has consistently increased its weightage on AMEX:SPY and the ratio $XLK/ AMEX:SPY is currently at 0.41 which is an ATH.

But the same cannot be told about the SPDR Healthcare Sector. The ratio between $XLV/ AMEX:SPY is making multi year low. With the ratio currently at 0.21 it is approaching its multi-year lows of 0.1975. The ratio was so low last in Sept 2000. Hence the question comes what should we expect the AMEX:XLV which is making new lows against the AMEX:SPY ? Will we visit the lows of 0.1975? If it happens then can we expect a upward momentum from his double bottom situation?

In my estimate in this bull market and Tech sector outperforming the AMEX:XLV will make new lows vs AMEX:SPY and the ratio will revisit the 2000 lows. But if on the macro front we have weak jobs numbers and recession risk rising then the AMEX:XLV can in fact draw inflows and outperform the index. Hence my estimate $XLV/ AMEX:SPY will sweep the multi-year low and then bounce back into 2026.

Verdict: Still more downside possible in $XLK/$SPY. Go long AMEX:XLV when the ratio is @ 0.1975 and into 2026.

This V-Pattern on SPX500 Is Stupid CleanHey, it’s Skeptic.

In this video, I’m breaking down a clean V-pattern setup on SPX500 — right in line with what I taught in yesterday’s educational post.

We’re starting from the Daily time frame and walking through the logic behind my long trigger, why the previous fakeout was actually useful, and how to set your stop-loss depending on your trading style (H4 vs 15min).

This isn’t just chart talk — it’s about reading the story behind the candles.

If it helped you see things clearer, give it a boost and drop your thoughts below.

Let’s keep learning — one trap at a time.

Until next time, peace out.

📌 Disclaimer: This video is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk.

S&P 500: Bearish For The Short Term! Sell It!Welcome back to the Weekly Forex Forecast for the week of July 28 - Aug 1st.

In this video, we will analyze the following FX market for the week of Aug 4-8th:

S&P 500 (ES1!)

The S&P 500 rose Friday to fresh highs, following a busy week of tariff updates and earnings. The S&P ended the week with its fifth straight record close, its longest such streak in over a year.

No reason to consider selling. Wait for pullbacks to FVGs for high probability buys.

FOMC and NFP loom. Be careful to avoid new entries during news times.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

ES | SP500 - Weekly Recap & Gameplan - 03/08/25📈 Market Context:

Traders are currently anticipating a possible 0.25% rate cut during the upcoming September FOMC meeting, which continues to support the broader bullish framework.

Although the market pulled back after the Non-Farm Employment Change data came in below expectations, overall optimism remains.

Sentiment has now cooled off from last week's greed and shifted to a more neutral stance. Historically, August tends to bring some chop and pullbacks, but the structural bias still leans bullish.

🧾 Weekly Recap:

• ES kicked off the week with strong upward momentum, climbing steadily into Thursday.

• Along the way, price swept a key 4H swing high, breaking into new highs before initiating a retracement.

• This price action hinted at a short-term distribution and possible liquidity grab ahead of a correction.

📌 Technical Outlook & Game Plan:

→ I'm anticipating a move into the Monthly Fair Value Gap — a high-probability liquidity zone on my radar.

→ That area could act as a springboard for bullish continuation or at least provide a strong reaction.

→ Until that happens, I remain short-biased targeting the 6226$ zone, which I've marked as a major level.

🎯 Setup Trigger:

Once price taps 6226$, I'll monitor for:

• Clear break of structure on the 4H and 1H timeframes

• Formation of new demand zones indicating potential reversal

→ On confirmation from the lower timeframes, I’ll shift my focus toward long setups, potentially targeting new highs.

📋 Trade Management:

• Stoploss: Below the demand zone formed on 1H–4H

• Target: I’ll trail my stop to lock in profits as price moves higher

• Note: Although I’ll be watching for ATH retests, I plan to manage risk actively and book profits along the way

💬 Like, follow, and comment if this breakdown supports your trading! I’ll be sharing more detailed setups and educational posts — stay connected!

S&P500 corrective pullback key support at 6200Key Support and Resistance Levels

Resistance Level 1: 6316

Resistance Level 2: 6374

Resistance Level 3: 6430

Support Level 1: 6200

Support Level 2: 6112

Support Level 3: 6073

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

S&P 500 Daily Chart Analysis For Week of August 1, 2025Technical Analysis and Outlook:

During the trading activity of the previous week, the S&P 500 Index displayed a predominantly bearish movement after completing our Outer Index Rally target of 6420, as highlighted in the prior week’s Daily Chart Analysis, with the primary objective now being to plug our Mean Support at 6200.

It is essential to recognize that the current price movement may trigger a significant further pullback to the Mean Support level of 6090. Following this downturn, it is expected that the index will resume its upward momentum, aiming for a retest of the Outer Index Rally peak at 6420.

Simple Psychology Tips Using Volume for Better TradingMany newer traders assume that when someone says "psychology" in trading, they are referring to mindset.

It is also widely believed that trading is about the BEST entries.

Now, think of it this way. It is not about winning trades, it is actually about managing losses well to allow you to take the winners over and over again. You might think that a 3 to 1 risk-to-reward strategy is boring, you might have gone all in on your favourite crypto project. But what makes the difference between gambling and trading is actually very, very simple. So simple, in fact, many overlook it or simply ignore it.

Most seek a silver bullet - high win rates and perfectly timed entries, then they overleverage and move stops on the one "good trade" they are seeking to make.

Whilst doing this, they tend to overload the 6 monitors they have purchased to trade with a thousand indicators, which they don't really need.

The candlesticks tell a story, volume supports that story. When you learn any technique from Elliott Waves to Wyckoff, they all have a dependence on volume - even if the correlation is not apparent.

Look at this first image.

Price had moved down since the vertical line, the AD line also moved down - sell-off, in full swing. But then volume starts to shift before the AD line starts to increase.

Now, look at what happens next...

As we move forward and the new vertical line shows where volume spiked, the AD line starts to decrease as the price continues to rise.

This is enough of a story to start your analysis.

We then get a move with a lower high formed.

As this plays out, the sell-side volume rises, creating momentum for the short position.

Look a little closer and you will see, that the volume on the move up just before the drop was also decreasing. Making a divergence to price.

You might feel that the market is against you, or that the big players are single-handedly seeking your stops. But the truth is, the psychology in moves such as this one shown is where most retail traders either have greed that markets will only go up for ever or the fear that they are missing out on a market that only goes up forever.

It is that herd mentality that generates the liquidity for the professionals.

Losing 1% on a trade, is part of the process, risking 80%> on a single move will make you paper rich for about 10 minutes before the real losses set in.

This is where the psychology and the basic techniques such as risk management and understanding what candlesticks and volume bars are telling you, will make a world of difference to your results.

A/D line and volume are free on @TradingView and to be fair you don't need to overcomplicate it more than that!

Stay safe, have a great weekend all!!!

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principal trader has over 25 years' experience in stocks, ETF's, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

Correction Ahead? SP500 Prints Reversal Signal at Key Resistance📘 This market moves like a textbook chart

SP500 is acting like a perfect case study from a trading manual. Back in early April, the index dipped just below 5,000, right into a confluence support zone ( I had spoken about this at the time ) – formed by the long-term ascending trendline and the 2022 all-time high. Just like other U.S. indices, the market reversed aggressively from that area.

🚀 A 30% rally in 4 months

From that low, SP500 rallied around 30% in just four months. An incredible move that brought the index straight to the upper boundary of the yearly rising channel.

🕯️ Bearish signal at the top

And just like in NAS100’s case , the index printed a strong Bearish Engulfing candle exactly at that resistance level. This kind of signal, after such a rise, shouldn’t be ignored.

📉 A correction is not only probable – it’s needed

A pullback from here is not just likely, but in my opinion, healthy and necessary . Short-term speculators could look for a move toward the 6,150 zone, which would already offer decent room for profit.

🔍 What if it goes deeper?

I wouldn’t be surprised to see a correction down to 5,750–5,800. That’s about a 10% decline, which wouldn't even classify as a bear market, just a normal reset after a euphoric rally.

🧠 Perspective matters

In a market that gained 30% in four months, a 10% correction is not a crash — it’s discipline being restored.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

SP500 → Countertrend correction before growthFX:SPX500 is correcting against an upward trend. In the second half of the week, the market received fairly positive fundamentals during the reporting period.

S&P 500 futures found support after strong reports from Meta and Microsoft, which exceeded earnings expectations and forecasts thanks to AI. The rise in futures supported demand for the “Magnificent Seven” despite Powell's hawkish comments. The focus is on Apple and Amazon reports in the evening, which could strengthen the tech rally. On Friday, we are seeing a countertrend correction in which the market is testing the 6288 zone of interest.

Support levels: 6288.4, 6262.6

Resistance levels: 6342, 6371

Most likely, the market will form a false breakout of support during the correction. If the bulls keep the index above the key level, we can expect continued growth in the short and medium term.

Best regards, R. Linda!

S&P 500 (ES1): Post FOMC, Buyers Pushing Back To The Highs!In this video, we will analyze the following FX market for July 31 - Aug 1st.

S&P 500 (ES1!)

In the Weekly Forecast for the S&P 500, we highlighted:

- price is bullish, and expected to go higher. It did move to ATH before pulling back.

- the sell side liquidity under the ascending lows would draw price.... which it did.

- the Area of Fair Value below the lows, with the Demand Zone as the potential level where a

a high probability long could setup.... which was spot on!

Did you benefit from the forecast? Let me hear from you if you did, in the comment section.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

S&P Correction Window is official - VOLATILITY AHEADIt's that time of year where the pre-summer push wraps and the summer lull and potential

pause gets underway.

July 31 finished on a bit of a sour note with over 67% of stocks declining today and US indexes finishing RED despite the big gaps and bullish pops on MSFT and META post earnings.f

SPX Key Levels

-watch the 21 day moving average

-watch the 50 day moving average

-more dynamic support in the 100/144/200 moving average cluster

I'll be taking bites at the 5/10/15% correction levels with options and looking for this dip

to be bought by retail and institutions.

Will August 1 US Tariff Deadline matter? After Japan and Eurozone came in and said a deal is being done, I was thinking this would be a dud. BUT, Dr. Copper says "maybe" on the global

tariff deadline with the largest single day move in history (bearish). Being the perfect time of year for a correction (the other being Feb-Apr), and the technicals looking so clean for an

orderly pullback, VIX may float higher and make things more interesting in the next 30-60 days.

Strategies matter, I'll be trading risk defined, but there are great opportunities ahead. A pullback is sure better than literally watching all-time highs every single day.

Thanks for watching!!!

S&P500 uptrend pause supported at 6355The S&P 500 slipped -0.12% after initially rising +0.3%, as Fed Chair Powell’s cautious “wait-and-see” stance on rate cuts dampened sentiment. The metals and mining sector dragged the index lower, falling nearly -4% after the U.S. announced surprise copper tariff details—excluding refined metal until 2027—leading to a sharp -20% drop in COMEX copper futures.

However, market sentiment rebounded overnight, driven by strong tech earnings. Meta surged +11.5% post-market on upbeat Q3 guidance and rising AI-driven ad revenues, while Microsoft rose over +8% thanks to better-than-expected Azure cloud growth and a $30 billion AI infrastructure investment.

Conclusion:

Despite short-term pressure from the Fed’s tone and commodity weakness, strong AI-driven earnings from major tech firms are likely to support a positive bias for the S&P 500 in the near term, especially in the tech-heavy growth segments. Broader gains may depend on upcoming inflation data and Fed clarity.

Key Support and Resistance Levels

Resistance Level 1: 6470

Resistance Level 2: 6500

Resistance Level 3: 6545

Support Level 1: 6355

Support Level 2: 6315

Support Level 3: 6282

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.