Using Put Options to Protect Your Stock PortfolioCME: Options on E-Mini S&P 500 Futures ( CME_MINI:ES1! )

Last week’s bloodshed of global financial market made history. Nearly all major asset classes fell into a market turmoil driven by tariffs and retaliations.

Let’s focus on the US stock market:

• Dow Jones Industrial Average dropped 7.76% in the week of March 31st to April 4th, making it the 4th worst weekly performance on record

• S&P 500 slipped 8.77%, the 4th worst week in history

• Nasdaq Composite fell 9.18%, the 2nd worst week

• Russell gave up 9.34%, the 3rd worst week

All four stock index futures were in negative territory year-to-date. On Sunday evening, E-Mini S&P 500 opened 178 points lower to 4,932, losing 17.1% YTD.

All parties ultimately come to an end. After two years of double-digit gains, the unstoppable US stock market finally cracked. As more tariffs and retaliations are expected to escalate, I am afraid that we are only seeing the beginning, rather than the end.

For stock investors, this is a good reminder of market risk, something we always talk about but seldomly pay attention to. The “return of investment” should be focusing on the repayment of your money, a safety issue. Only after that should we talk about the gain from the investment. It is a necessity to protect your portfolio to achieve long-term growth.

Trading with Options on E-Mini S&P 500 Futures

For investors with a diversified portfolio, Put Options on the E-Mini S&P 500 futures are effective and cost-efficient tools. Investors who long the stocks will lose money, should stock prices fall. Put options would gain in value, providing a hedge to the portfolio.

The following illustration shows a hypothetical example, given:

• An investor has a $250,000 portfolio holding a diversified pool of U.S. stocks

• CME E-Mini S&P 500 futures ( NYSE:ES ) have a contract size of $50 times the index value

• The June contract (ESM5) was quoting at 4,935 Sunday evening Friday, making the notional value of 1 contract $246,750, approximately equal to our portfolio value

• Assuming the portfolio moves closely in line with the S&P 500

• The investor wants to limit the loss of his portfolio to 12%. If the S&P 500 index is currently around 4950, a put option with a strike price of 4350 would roughly correspond to a 12% decline

Hedging trade illustration:

• The investor buys 1 put option on the June futures with the strike price of 4,600

• CME quote on that Put option is 223. As the contract is $50 times the index, the premium upfront for one put option contract is $11,150 (223*$50), ignoring any commissions

• The put premium is calculated as 4.46% of the $250K portfolio

If S&P drops to 4,200 (-15.15%) by the end of April:

• Without the put, the portfolio lost $37,879, assuming the same loss with the S&P

• The 4600-strike put is now 400 points in-the-money

• The investor sells the put and receives $20,000 (= 400 x 50)

• The loss of portfolio will be 37879+11150-20000 = $29,029

• With an E-mini S&P put protection to mitigate loss from the stock portfolio, the investor lost 11.6% (= 29029 / 250000), which is 3.5% lower than the S&P loss and with the preset loss limit

If S&P drops to 4,000 (-19.2%) by the end of May:

• Without the put, the portfolio lost $47,980, assuming the same loss with the S&P

• The 4850-strike put is now 600 points in-the-money

• The investor sells the put and receives $30,000 (= 600 x 50)

• The loss of portfolio will be 47980+11150-30000 = $29,130

• With an E-mini S&P put protection to mitigate loss from the stock portfolio, the investor lost 11.6% (= 29,130 / 250000)

As we can see here, when the S&P falls sharply, the investor will be able to cap his loss to 11.6%. In a “protective put” strategy, we would consider the option premium an insurance contract for owning stocks. If the index rises, the portfolio return would be lowered a little because of the premium upfront, that is, the cost of insurance. However, the protection is a lifesaver if the index falls.

Before jumping into action, the investor needs to run a correlation analysis using the daily value of the portfolio against the S&P 500 closing prices. Here is how:

• Some trading software has correlation feature built in already

• If not, pull 1-year daily portfolio balance and 1-year S&P closing prices, export them to Excel. Run correlation test with these two data series using Excel data analysis tool.

• Alternatively, we could drop the data into ChatGPT and ask AI to do the work for us.

If the correlation is greater than 50%, it means that S&P 500 is a good fit to hedge the portfolio. If it is not, we could try the correlation analysis using the other stock index closing prices, such as the Dow, the Nasdaq 100 and the Russell 2000. Then replace E-Mini S&P 500 futures with the stock index futures contract best fit the portfolio.

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

S&P 500 (SPX500)

$SPX $NAS100 FILL THE GAP = "LEARNED BEHAVIOR" IN PLAY🏒🏒🏒🏒🏒FILL THE GAP! FILL THE GAP! FILL THE GAP!

Hopefully, institutions want to reach 7,000 from here, as the majority of them wrote in public New Year resolutions.

A great example of learned behavior.

Let’s watch.

FILL THE GAP! FILL THE GAP! FILL THE GAP!🏒🏒🏒🏒🏒

SPX500 & Nasdaq: Confluence! Confluence! Confluence!With consumer confidence off at circuit breaking levels, the market, technically, has reached extreme levels of support. Let's look at it:

Technicals:

(1) Horizontal Levels of support

(2) 50%/61.8% fib confluence

(3) exDiv1

(4) extreme indicators

(5) Chikou span testing cloud support

(6) 28% drop is SPX

All of these levels are lining up around the same location. And just like in real estate "Location! Location! Location!" is the adage; in markets, "Confluence! Confluence! Confluence!" is the adage!

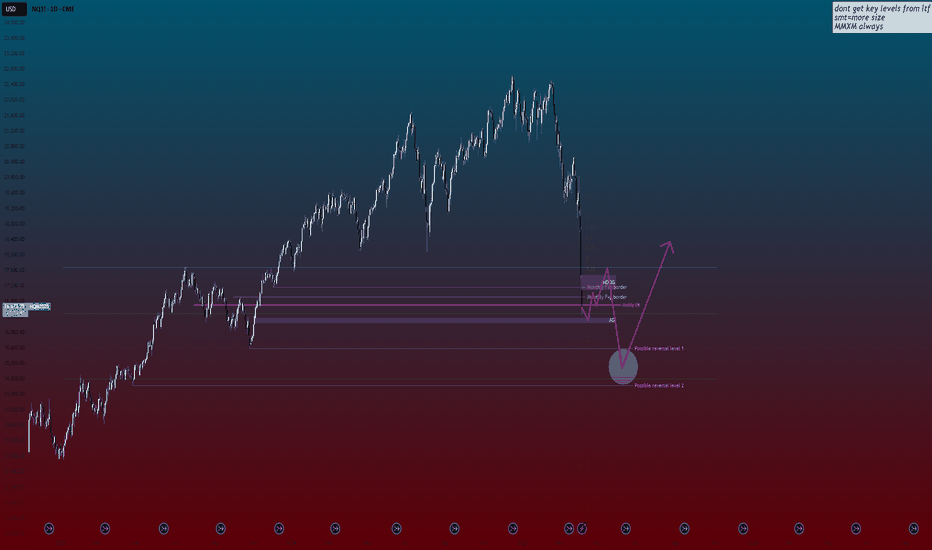

When will NASDAQ stop melting? You can't say I didn't warn you!I hate to say I told you but I warned about this crash at my analysis back at September 2024 for NQ1! (you can see it at related ideas below), anticipating market moves based on structure well before the narrative around election and tariffs even began circulating.

We often see markets engineer these kinds of dramatic dives below obvious lows. This projection towards the 4.0-5.0 zone looks characteristic of such a liquidity hunt, designed to clear out sell-side stops and shake out traders before a potential major move higher – a dynamic not unlike what we anticipated previously.

While the projected sharp drop on NQ1! below key levels like the Monthly Order Block near 3.0 and the AG (actual gap) level near 3.5 might look aggressively bearish, I'm viewing this as a potential setup for a significant buy opportunity.

My attention is focused on that "Possible reversal level 1" between 4.0 and 5.0. If price stabilizes and shows rejection signs within this zone, it could signal the start of a powerful rally, potentially targeting levels back up towards the 1.75 area or even revisiting prior highs.

Remember, these market structure plays can take time to fully develop, just as previous setups did. We could see NQ consolidate or even briefly dip lower within that 4.0-5.0 zone before the anticipated upward reversal truly gains traction.

Thanks for reading, boost and follow to stay liquid and not become liquidity.

Wish you safe and informed trading decisions.

___________

CME_MINI:NQ1! TVC:VIX

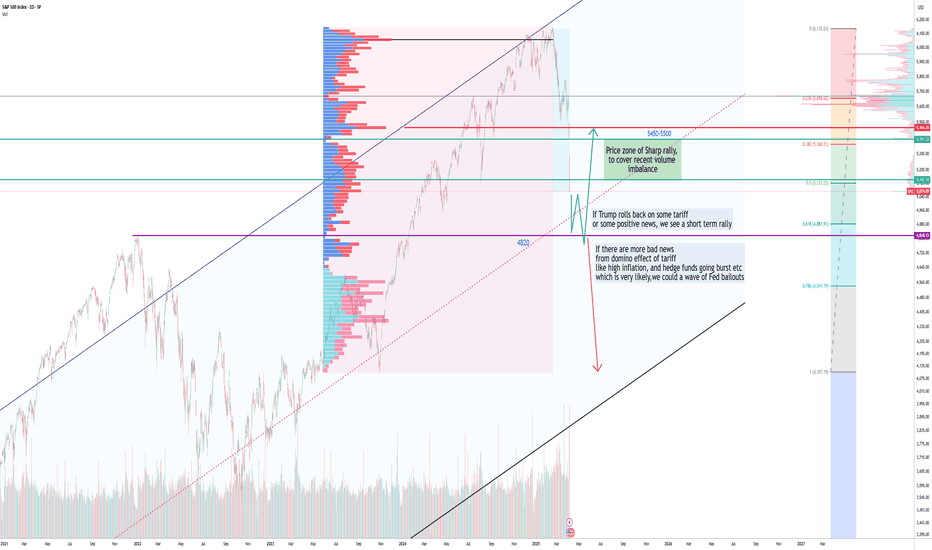

SPX updateSP500 E-min futures opened 200 pnts lower as I predicted. I have to make frequent updates because of the fast changing environment. This is just reading the market and you all can do it with practice.

Volatility on futures options has crossed 100! My God! I have never seen such readings. With SPX being at key level at 2022 peak and also at HVN, some positive news from Trump adviser that 50 countries want to negotiate with Trump, I see the market rally to 5000 very likely Monday open or close.

But I still believe 4150 as final resting place. I dont see any crashes below 4800 except 150 points near the target, as far as I can read.

But outside the readings, I do suspect a banking crisis like 2008 is looming. That would change everything because Trump is against bailouts. We will see when that happens

SPX Important update: Crash of 200pnts on MondayThree days back I had warned of a crash which did materialise beyond my expectation.

Today again based on the same VP analysis and additionally major trendline break principal I am predicting a 200pnts crash on Monday as we have enter a major low volume region. I hope I am wrong for the sake of all those who are still invested

The market achieved the first target of green trendline break and is now touching the red trendline. Since the price is close to the LVN's another crash is extremely high probability. Had it been near a HVN, I would expect a bounce. The next target coincides with the 2023 Oct bottom. But 4800 (peak of 2022) could offer some support and then 4120

Major trendline break principle is: when a major trendline is broken the price will mirror the rise and fall an equal distance from the breakpoint as from the high to the breakpoint. Check my related post where I show many such cases

Weekly Market Forecast: Short Term Buys, Then Sells! In this video, we will analyze the S&P 500, NASDAQ, AND DOW JONES Futures for the week of April 7 - 11th.

The Stock Market Indices may find support at current levels for a Bear Market Rally. Wait for the market structure shift to the upside before taking any buys. Let the market confirm it's intended direction first, then look for valid buy setups for a short term countertrend play.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

S&P 500 Records Largest Weekly Decline Since 2020The S&P 500 Index has suffered its steepest two-day drop since the pandemic crash in March 2020. On April 4th, 2025, the benchmark index closed at 5,074.08, down 322.44 points (5.97%). This marks a loss of $5.4 trillion in market value across just two sessions.

The sell-off followed comments from Federal Reserve Chair Jerome Powell. He warned that President Donald Trump’s new tariffs could lead to persistently higher inflation. All 11 sectors in the S&P 500 closed in the red. Only 14 stocks remained positive as Nvidia and Apple fell more than 7%, while Tesla dropped 10%.

The Nasdaq 100 Index plunged 6.1%, confirming a bear market after losing over 20% from its February peak. The rapid decline mirrors the speed seen during the 2020 COVID crash and the 2000 dot-com bust.

President Trump announced sweeping tariffs on U.S. imports on Wednesday. These include a 10% general tariff and higher rates on dozens of countries. China responded by imposing a 34% levy on American goods. The tit-for-tat measures triggered fears of a full-scale global trade war.

Global markets reacted sharply. Investors pulled out of stocks and moved into safer assets like government bonds. The two-day loss of $5 trillion on the S&P 500 set a new record, surpassing the $3.3 trillion loss during March 2020.

Rick Meckler, of Cherry Lane Investments, said the escalation is now deeper than many investors expected. The initial belief that tariffs were a negotiation tactic has now given way to serious market concerns.

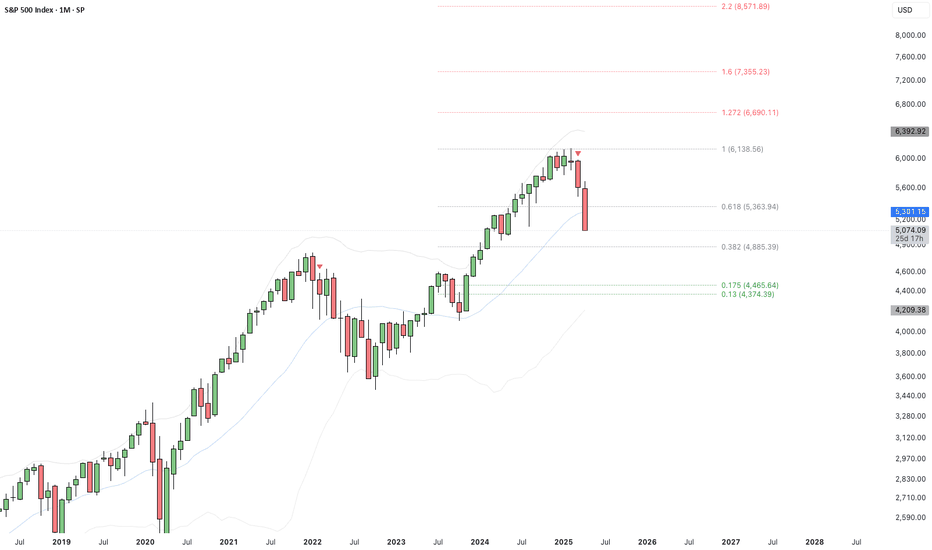

Technical Analysis: Price Approaching Key Support Zones. Will They Hold?

The S&P 500 has shown a bearish trend since early 2025. Several weekly candles have closed bearish, confirming a strong downtrend. Currently, the index is trading lower toward a key ascending trendline near $4,930.

The $4,930 support level may offer short-term support. A bounce from here could see a brief recovery. However, the sentiment remains bearish without strong economic data or policy changes.

Further Downside Risk If Support Fails

Another horizontal support sits at $4,780. If both support levels fail, the index may fall toward the $4,500 psychological zone. This level is crucial as it marks a long-term support and potential reversal point.

At present, bearish momentum dominates, with much strength coming from trade war fears. Unless data shifts investor sentiment, the downtrend may persist.

SPX500: The trendline show a bottom in Sept 2025 at 4700 We're being magnetically pulled toward the trendline bottom around 4700.

Based on the current MACD and RSI signals, the bearish scenario could continue until September–October 2025. This correction is very similar to the one from 2022.

There will be some dead cats bounces, but do not be fooled, the MACD is reseting hard.

Stay sharp. Be ready.

DYOR.

S&P 500 at Decision Zone: Relief Rally or Continuation Lower?📄 The hourly chart is currently at a critical inflection point after a steep drop from recent highs. We’re seeing signs of a potential corrective rally forming, but the battle between bulls and bears is far from over.

🧭 Key Zones to Watch:

Fib Resistance (0.55–0.62): 5,400–5,536

Bullish Breakout Target: 5,707

Bearish Breakdown Target: 4,925

Neutral Pivot: 5,061 (current consolidation zone)

📊 If price reclaims and holds above 5,536, a continuation toward 5,707 becomes likely.

🚨 However, a rejection in the Fib zone followed by a drop below 5,061 may confirm renewed bearish momentum targeting the 4,925 region.

This setup provides clear structure for both bulls and bears. Keep an eye on volume, price action confirmation, and respect risk management.

💡 Comment your thoughts below! Are you leaning bullish or bearish here?

Are We Witnessing a Black Swan Event?I’ve spent most of the day digging through charts and studying past crashes — because what we’re living through right now might be a once-in-a-decade opportunity.

This current market crash feels eerily close to a black swan event.

No one really expected Trump to push tariffs this far, and the consequences are already rippling through global markets. If this escalates into true economic isolation, the effects could be both tremendous and long-lasting.

That said, there’s another possibility:

This might just be a blip in history — a bold negotiating tactic that works out, shocks the system temporarily, and fades away.

There’s even speculation this could mirror the 1989 crash, with some analysts warning of a potential 20% drop by Monday.

If that happens, I’d rather not be frozen by fear. I want to act with intention. I want my plan in place and my orders ready.

Before I share stock ideas I believe can outperform in the long run…

Let’s first walk through what I believe might be playing out — at least for now. (Keep in mind, these theses can change fast.)

Before the crash, it looked like a replay of 2022:

Markets were clearly overvalued and due for a correction — back then, it was driven by regional bank failures, and the Fed quickly stepped in to stabilize things.

But now, selling pressure is accelerating.

This looks less like 2022 and more like 2020 — where markets broke down in response to a larger, fast-moving, global crisis.

Even though we’re seeing similarities, things can shift very quickly.

We still haven’t seen key reversal signs — like a Doji candle — and more importantly, there’s been no intervention yet from the government or global forces.

Until that happens, panic may continue to snowball.

And as we know from history, panic doesn’t operate on logic.

Source:

📚 2020 Stock Market Crash en.wikipedia.org

Is This a Bear Market or a Golden Opportunity?The indices have plummeted sharply, and whether you believe this is due to Trump’s tariffs or would have happened anyway, regardless of the trigger, the reality remains the same.

Both the S&P 500 and Nasdaq 100 are officially in bear market territory— defined by a decline of more than 20% from their peaks . Meanwhile, the Dow Jones Industrial Average is down approximately 15%.

Given these facts, the big question is: Are we in a bear market, or is this a fantastic buying opportunity? 📉📈

Now, let's break down the key levels, potential scenarios, and how to approach the current market environment. 🚀

Dow Jones 30 (DJI): Navigating Key Support and Resistance Levels

On the weekly chart, DJI has been in an uptrend since the pandemic lows of 2020. The double top formation from 45k measured target has already been exceeded, and the index is now approaching a critical confluence support zone between 37k and 37,700.

📌 My Outlook:

• I believe this support will hold in the near future, presenting a buying opportunity.

• Resistances: 40k and 41,600 are important technical levels and potential targets for bulls.

💡 Alternative Scenario:

• If DJI starts rising without testing the long-term confluence support, I will focus on selling opportunities, particularly around the 41,500 zone, as we have 2 unfilled gaps from last week.

________________________________________

S&P 500 (SPX): Bear Market Territory, But Still Holding Uptrend (posted main chart)

According to classical theory, SPX is now officially in bear market territory. However, we are still above the ascending trend line established from the 2020 pandemic low, and approaching a confluence support zone around 4,820 - 4,900.

📌 My Outlook:

• I will be looking for buying opportunities if the index continues its decline towards the 4,820 - 4,900 zone next week.

• Target: Filling the first gap at 5,400.

💡 Alternative Scenario:

• If the week begins positively, and SPX doesn’t reach the 4,900 support zone, I will focus on shorting opportunities on gap filling, aiming for a return to 5,000.

________________________________________

Nasdaq 100 (Nas100): Hovering Above Key Support

Unlike DJI and SPX, Nas100 is still well above the ascending trend line from the 2020 pandemic low. However, it is nearing an important horizontal support defined by the 2021 ATH and the 2024 lows.

📌 My Outlook:

• Drops towards 17k or slightly lower could present good buying opportunities, anticipating a potential rise to fill the gaps.

💡 Alternative Scenario:

• If the price rises above 18.500k zone without dipping under 17k I will look for selling opportunities.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Institutional Demand: SP500 longsHey,

Trump’s April 2025 tariffs triggered a global market crash, with the Dow plunging and the Nasdaq entering a bear market. China retaliated, raising recession fears. News warns of rising unemployment, inflation, and a major economic slowdown.

So what does this mean for us as traders and investors?

Volatility equals opportunity.

The S&P 500 is approaching a strong demand zone and trendline. I’m not a fan of trying to catch the exact bottom — just have a consistent plan to scale in, buy once at the zone or do it in chunks. But with prices this low, it’s a great time to consider adding more. Data shows, every major crash has rebounded sooner than expected for the past 100 years.

Great opportunities where fear makes people miss it.

Kind regards,

Max

"SPX500/US500" Index CFD Market Heist Plan (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "SPX500 / US500" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

Stop Loss 🛑: (5730) Thief SL placed at the nearest / swing high level Using the 8H timeframe swing / day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 5300 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"SPX500 / US500" Index CFD Market Heist Plan (Swing/Day) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Corrective waves and trade war at the same time.Even before the trade wars started, I think the uptrend was over.

* The purpose of my graphic drawings is purely educational.

* What i write here is not an investment advice. Please do your own research before investing in any asset.

* Never take my personal opinions as investment advice, you may lose your money.

Geopolitics, Rates, and Risk: Why 1987 Is Back on the RadarThe current mix of geopolitical tensions, policy uncertainty, and fragile market sentiment brings to mind the setup ahead of October '87.

Without stabilizing signal, especially from the U.S. administration this weekend, the risk of a sharp correction is not negligible.

S&P 500 Daily Chart Analysis For Week of April 4, 2025Technical Analysis and Outlook:

During this week's trading session, the Index experienced lower openings, completing the Outer Index Dip at 5403, as highlighted in the previous week's Daily Chart analysis. This development lays a foundation for a potential decline targeting the Outer Index Dip at 5026, with the possibility of further extension to the subsequent target of the next Outer Index Dip, 4893. An upward momentum may materialize at either completed target level, with the primary objective being the Mean Resistance level of 5185.

SPX 1D 200 EMA Retest? As the 9&21W EMAs cross and a new local low printing after a SFP top, could the S&P500 be getting its first major correction since Jan 2022?

From a TA standpoint this kind of setup looks to be high probability with good R:R for the bears. Targeting the 1W 200 EMA is the most logical area as it remains major support and whenever tested holds strong.

From a bulls standpoint this is worrying but could be rectified with a reclaim of the 9&21 EMAs preventing a "death cross" from there acceptance above the high would be the next step to maintain the rally.

Fundamentals play a major role and the geopolitical world shows no signs of slowing down, perhaps the tariffs angle is introducing uncertainty in American companies? Or the index is just exhausted from 2.5 years of climbing? Either way the chart is an interesting one to monitor for now.

SPX, What is next? Trump knows best!Just putting my personal view based on market information and minimum speculation.

I hope my warning of a crash in my last post was useful

I rely heavily on volume profile and market geometry and of course my indicator( check it out: HiLo Ema squeeze bands)

I expect the market to fall to 4820 (about 61.8% fib level) to fill some volume gap, also 2022 peak, do a small a-b-c bottom and then rally back up to say 5450 ish, if some good news is heard. This would be just a bear rally

But I believe, Trump has opened a pandora's box and the market is still not aware of the full impact of it, or maybe it did realise and hence the crash

16% of USA budget is used for interest payment. If inflation rises and China and Japan keep selling treasuries, the bonds will go down. Not to speak of some major hedge funds like Citadel and banks holding trillions in treasury bond would increase their unrealised losses on bonds. But the stock market fall will force them to liquidate the bonds realise the loss, unless Fed buys the bonds back, which they will as always. That would be QE and the next bull run will begin. The banks have been holding the bonds since covid. Remember Silico Valley bank going burst! That was a sample.

Fed has managed to clicked the can down the road long, but Trumps policies will send the can in Fed's face

A financial liquidity baby seeded by Fed and Biden Adm during covid is about to take birth soon as financial crisis

I am bearish till Fed announces QE

Post-Liberation Day Sell-Off – Crash or Correction?Liberation Day has turned into a dramatic "blow the markets back out" day for the SPY , with a significant daily drop of nearly 6%, slicing decisively below the critical 200-day moving average at $574.46. Historically, breaking below the 200-day MA is a strong bearish signal, indicating potential further downside momentum.

The previously identified key bearish pivot, the "Best Price Short" at $565.16, served as a crucial resistance level from which sellers aggressively stepped in, intensifying today's sell-off. Given the current bearish sentiment, the next immediate downside targets without a significant bounce (dead-cat bounce) include:

Half 1 Short (Momentum target): $505.28 (already tested)

High Vol Momentum Target 1a: $497.66

Half 2 Short (secondary bearish momentum): $486.41

Extended Momentum Target (HH Vol Momo Target 2a): $475.16

For traders who missed the initial move, look to re-enter shorts if there's a modest retracement toward the previously broken "Weeks High Short" at $520.16, maintaining tight risk control with stops ideally set just above the "Best Price Short" ($565.16).

Critical levels summary:

Ideal Short Re-entry Zone: $520.16

Profit Targets: $497.66, $486.41, and ultimate $475.16

Stop Loss Area: Slightly above $565.16

Major Broken Support (Resistance now): 200-day MA at $574.46

Today's significant volume spike further reinforces bearish conviction. RSI is deeply oversold at 23.24, suggesting caution for potential short-term bounce, but any bounce is likely to be short-lived unless there's a substantial political or economic pivot soon.

These levels are algorithmically defined, designed to remove emotions from trading. Trade responsibly, adhere to your strategy, and protect your capital.