S&P 500 (SPX500)

Intraday Buy Opportunity: US500Intraday Idea - We look to Buy TRADENATION:US500 at 5735

Technical View

Trades at the highest level in 12 days

The rally has posted a correction count on the intraday chart

An overnight negative theme in Equities has led to a lower open this morning

Bespoke support is located at 5735

Previous resistance, now becomes support at 5725

Stop: 5695

Target: 5867

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Hellena | SPX500 (4H): LONG to resistance area of 5830.Colleagues, the previous forecast is not canceled, but I decided to update it a bit in the form of a new forecast. I have set the target a little closer, so that I don't have to wait too long.

I believe that the price will continue its upward movement and will reach the area of 5830. It is quite possible that the price will correct to the area of 5597, completing the wave “2” of small order.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

$SP500 $SPX Is the bull run over?#SP500 SP:SPX S&P500

Is this just a bull-run retracement or the beginning of a bigger crash?

Is the bull run over?

Every major crash started with an “innocent” 10–15% pullback. 🧐

It’s difficult to draw any conclusions right now, but once the current bounce is over, the next retracement will give us more clues. ⏳👀

Are you bullish or bearish? 🐂 🐻

SPX 5800 Strong resistance200 days HILO EMA central line has always given a strong support resistance in the past and I would expect that to be so this time as well. Since the market structure broke when prices crossed the lower outer ema band, even if the price goes above the middle line I would not consider it to be bullish.Only when the prices hit the upper or lower band a new trend can be confirmed.

For now I am just going to be short term trader and a cautious long term investor accumulator

of fundamentally good stocks. Not Tesla :)

Notice how the inner lines align with the the other lines before the breakdown! A kind of step formation, indicating the period selection of 200 ema is sound

$DXY 10% Declines along with $SPX declines from 1987-1995In case you are wondering if the drop in the $USDOL TVC:DXY US Dollar of 10% from a high is a sign of something major going on in the stock market, it reminded me of research I did right when I got out of college in 1987.

Here's a quick overview of that pattern of TVC:DXY declines of 10% against the backdrop of SP:SPX or S&P500 Index declines at that time. The 1987 stock market crash is on the far left of this graph and gets the chart started for you to review.

The 10% drops from highs in the TVC:DXY index are labeled with yellow arrows and there were 9 of them across this time series from 1987-1995.

We can imagine how a Non-US investor would handle both a drop in the TVC:DXY and a drop in the SP:SPX , but a drop of both the TVC:DXY and SP:SPX of 10% together would mean a loss of 20% for the non-US investor. That is a painful loss and perhaps more than investors wanted to risk.

Historically, it was a good time to look for a stock market bottom AFTER a drop in the TVC:DXY index and the green boxes at the top show the risk of a deeper decline in the SP:SPX was minimal after this scenario.

So the end result of this analysis is that the Dollar can be viewed as a contrarian indicator after a meaningful decline, as in 10% in this time frame. Look for other signs of a market bottom, especially using my TVC:VIX signals (5 point spike indicator and VIX75% retracement) to help define a bottom. The VIX75 signal triggered on Monday, March 24th, indicating that the panic from the selloff had moderated to a point enough to signal that the panic was over.

Do some more research for yourself and see if the TVC:DXY drop was an "asset allocation" shift as US investors bailed out of US stocks to invest in non-US stocks or was it another wave of non-US investors dumping US stocks to cut risk.

Either way, know what you are investing in and question everything. These days, it is more important to be educated and use TradingView to chart and research the past will help you be a more educated investor.

Cheers,

Tim

SPY/QQQ Plan Your Trade For 3-25-25 : Top PatternToday's Top Pattern suggests the SPY/QQQ will find resistance slightly above yesterday's closing price level and attempt to roll over into a bearish price trend.

Watch today's video to see which levels I believe will be the top for the SPY & QQQ.

I do expect metals to rally over the next 3+ weeks and I'm watching for this morning's bounce to carry onward and upward.

Bitcoin should be rolling downward off that FWB:88K top level I predicted months ago.

We are moving into a topping phase - so get ready for the markets to attempt to ROLL DOWNWARD over the next 5+ trading days into a deeper low price level.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

S&P 500: The Correction Is Not Over Yet – Targets Around 5000At the moment, the S&P 500 is holding relatively stable, but I believe the current decline is just part of a larger correction following decades of growth.

Right now, the index is retracing to the 50% pullback area (marked on the chart), which aligns with a typical retest before a potential continuation of the downward move. In this zone, a manipulation is likely, after which the decline may resume.

An additional confirmation of this scenario is the unfilled gap below, which remains uncovered. Historically, the market tends to close such gaps. Moreover, there are untested price levels lower on the chart, suggesting a high probability of further downside movement, with targets around 5000 points.

I will keep monitoring the situation and update my outlook as new data emerges.

Price climbing with Volume warningsPrice climbed after the bullish headsup we had on Friday

Strong bullish signs:

Strong close with little selling at the top

Closing above LT MA's and daily previous high

Bearish: Volume is not picking up - hint that this is an up reaction but the trend is still down, be careful with longs at this point

Dow Jones on the weekly chartAs you can see, due to recent economic news and Trump's economic approaches, we have unfortunately witnessed a decline in major indices, including the Dow Jones. We are currently at the last available support level, which is the bottom of the Dow Jones long-term channel, and we need to see how it reacts to this level in tomorrow's news and the CPI release.

Breaking: SPX6900 ($SPX) Surged 21% Today The price of SPX6900 ( SP:SPX ) surged Nearly 25% today amidst breakout of a falling wedge.

Created on the Ethereum blockchain, SPX6900 is an advanced blockchain cryptography token coin capable of limitless possibilities and scientific utilization. With a growing momentum and hardworking community the coin seems to be a contender in the incoming bullrun speculated by traders.

As of the time of writing, SP:SPX is up 16.35% trading in tandem with the 1-month high axis. a break above that point could signal a trend continuation to the $0.70 - $0.80 pivot.

Similarly, should SP:SPX cool-off, immediate consolidation point resides in the 38.2% Fibonacci retracement point.

SPX6900 Price Live Data

The live SPX6900 price today is $0.616856 USD with a 24-hour trading volume of $45,031,583 USD. SPX6900 is up 21.61% in the last 24 hours, with a live market cap of $574,288,459 USD. It has a circulating supply of 930,993,090 SPX coins and a max. supply of 1,000,000,000 SPX coins.

S&P500 INTRADAY oversold bounce back capped at 5777S&P500 INTRADAY oversold bounce back capped at 5777

Key Support and Resistance Levels

Resistance Level 1: 5777

Resistance Level 2: 5844

Resistance Level 3: 5872-5920

Support Level 1: 5604

Support Level 2: 5539

Support Level 3: 5500

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

SPY/QQQ Plan Your Trade for 3-24-25 : Bozu Trending PatternToday's Bozu Trending pattern suggests a very aggressive price move is likely. I believe this move will be to the upside after my weekend research suggested we are moving into a "blow-off" topping pattern that will act as a Bull Trap.

Overall, I belive the SPY/QQQ have about 2-3 days up upward price trending early this week, then the markets will suddenly roll into a topping pattern and start to aggressively move downward.

The next base/bottom of the continued downward price trend sets up in early/mid April. The March 21-24 base/bottom is likely the minor base/bottom we have seen over the past 3-5+ days.

I believe the breakdown in the SPY/QQQ late this week and into next week will result in a new lower low - causing the Consolidation phase of this downturn to extend down to the 520-525 level on the SPY.

Bitcoin is very close to my $88,000 upper target level (only about $250 off that level). Get ready, BTCUSD should make an aggressive move downward after stalling near the FWB:88K level peak.

Gold and Silver are moving into a trending mode. I believe both Gold and Silver will rally this week and into the next few weeks as we expand into the Expansion phase.

Buckle up. If my research is correct, we are going to see a BIG ROLLOVER this week.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

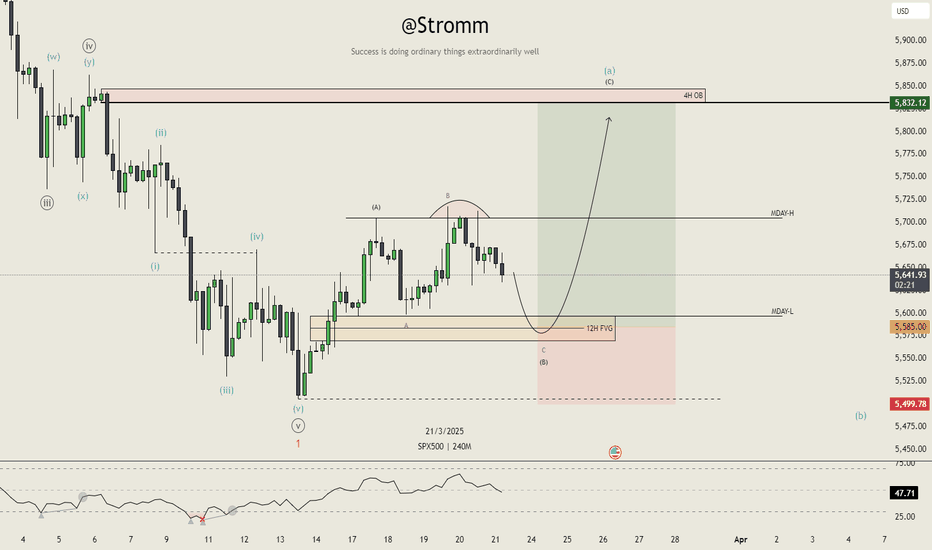

S&P 500 Setting Up for a Breakout – But Not Before One More TrapAs I’ve said before, the FOREXCOM:SPX500 is a key reference for my crypto trading . That’s why I sat down and took a closer look at the chart – and I’m now ready to place a limit order , based on what I’m seeing.

I believe we’re still in a correction phase , and it’s far from over . However, I think it’s realistic that we’ll see a move toward $5,832 next week . Before that happens, I expect either today’s Monday Low or next week’s Previous Weekly Low to get swept, ideally triggering a dip into the 12-hour Fair Value Gap just below.

That’s where I see my entry zone forming. It’s also the exact area where Wave B overshoots the starting point of Wave ABC, making it a clean Flat correction pattern, with Wave C completing to the downside before we get a solid move upward.

I’m setting my stop-loss below the $5,500 low. If this setup plays out, I expect the S&P to push toward $5,832 , and after that, I’m anticipating a larger correction that could take the index back down to $5,500 or even $5,450 over the coming weeks.

Timing remains unclear for that move after, but the structure is here , and I’m looking forward to seeing how it plays out.

Looking for a minimum of ES 5850In the days to come our initial pattern off the recent has the high probability to get into the 5850 area.

Here I will be looking for a pullback.

If this pullback can be viewed as corrective in it's structure then I expect the subdivisions and pathway on my ES4Hr chart should follow suit. However, if the pullback turns out to be impulsive, I will be looking for follow through for either Minor B having completed early, or the alternate wave (iv). If that sort of price action were to materialize, it's Friday's low of 5651.25 that must support any drop if we're to continue to subdivide higher and have this minor B take more time.

S&P nearing the 38% retracement and flag top! Intraday Update: The S&P futures are up today following possible tariff news being factored in from some weekend headlines about "targeted reciprocal tariffs" for April 2nd, which is allowing for the S&P to near the 38% retracement which would be the top of the beer flag pattern and setup.

S&P 500 Analysis: Markets Start the Week on a Positive NoteS&P 500 Analysis: Markets Start the Week on a Positive Note

A week ago, while analysing the S&P 500 index chart (US SPX 500 mini on FXOpen), we noted that the market had officially entered a correction phase, as the price had declined more than 10% from its February 19 peak. This drop was driven by mounting uncertainty over the potential economic damage caused by the Trump administration’s tariff policies in international trade.

However, this morning, markets are showing signs of optimism following reassuring statements from officials over the weekend.

According to Reuters:

→ Trump announced plans to hold talks with Chinese President Xi Jinping, while the U.S. Trade Representative is set to meet his Chinese counterpart this week.

→ The European Union has taken a conciliatory stance, delaying its initial countermeasures against the U.S. until mid-April.

As a result, sentiment appears to have shifted towards optimism, with the S&P 500 index (US SPX 500 mini on FXOpen) trading approximately 4% above this month’s low.

Technical Analysis of the S&P 500 Index (US SPX 500 mini on FXOpen)

As noted on 17 March:

→ The price is forming an ascending channel (marked in blue).

→ The fact that the price has reached the lower boundary of the channel suggests that bearish momentum may be fading.

Currently, we are witnessing an attempt at a bullish reversal from the channel’s lower boundary.

From a bearish perspective, resistance may emerge around the 5750 level, where the price has previously reacted (as indicated by the arrows).

From a bullish perspective:

→ Bears have lost control of the 5600 level.

→ A bullish gap at the start of the week indicates a significant shift in market sentiment. If positive news continues to emerge throughout the week, the S&P 500 index (US SPX 500 mini on FXOpen) could attempt a rise towards the median of the identified channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

S&P500 Next Key Levels I will be waiting to see if we get some short term buying before continuing down to $5,200 levels.

Waiting for price to reach the $5,800 area and anticipating a strong rejection to continue the bearish trend.

After confirmation of the rejection, I will be looking for simple lower lows, lower highs before entering a sell, preferably around the $5,600 mark.

What are your thoughts on the AMEX:SPY and the THINKMARKETS:USDINDEX in general?

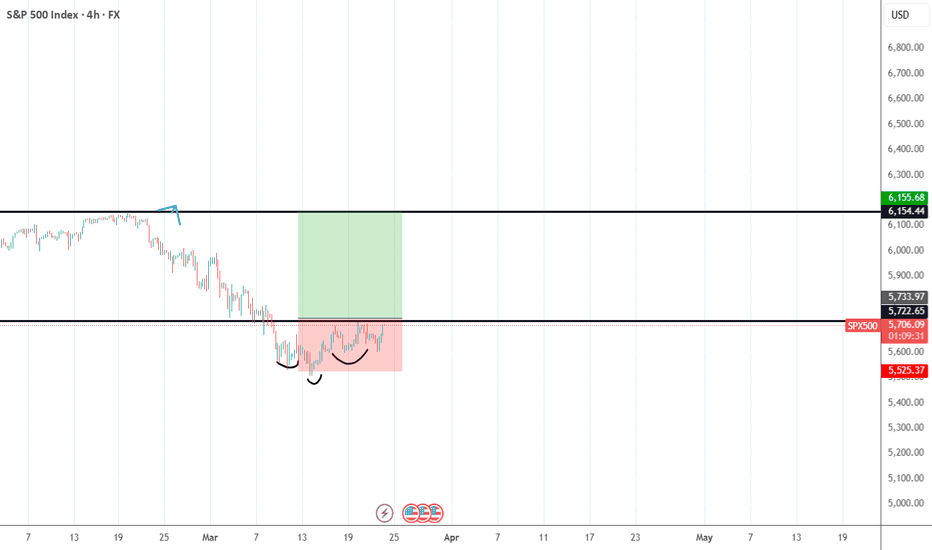

BUY SPX500SPX500 Trade Idea: Bullish Continuation Setup

Market Overview

The SPX500 has shown strong bullish momentum, and a continuation of this trend is likely if price holds above the 5,772-support area. A confirmed breakout from this level could provide an ideal buying opportunity.

Trade Setup

Entry: Buy at 5,733 (waiting for confirmation at key support)

Stop Loss (SL): 5,525 (below strong support zone)

Take Profit (TP): 6,154 (next key resistance level)

Analysis & Rationale

✅ Bullish Trend Continuation – Price action suggests strong momentum, favoring further upside.

✅ Key Support at 5,772 – A breakout above this level will confirm bullish strength.

✅ Favorable Risk-to-Reward Ratio – Well-defined SL and TP provide a balanced strategy.

Trading Plan & Execution

Wait for confirmation at 5,772 before entering.

If price holds, execute a buy order at 5,733.

Set SL at 5,525 to limit downside risk.

Take profit at 6,154, adjusting the stop-loss accordingly if price gains momentum.

This trade setup follows the bullish market structure, providing an opportunity to capitalize on SPX500’s continued upside potential. However, monitor economic data and global market sentiment for any shifts in trend.

📌 Risk Disclaimer: Always implement proper risk management and adjust your strategy as market conditions evolve.

Trading Is Not Gambling: Become A Better Trader Part III'm so thankful the admins at Tradingview selected my first Trading Is Not Gambling video for their Editor's Pick section. What an honor.

I put together this video to try to teach all the new followers how to use analysis to try to plan trade actions and to attempt to minimize risks.

Within this video, I try to teach you to explore the best opportunities based on strong research/analysis skills and to learn to wait for the best opportunities for profits.

Trading is very similar to hunting or trying to hit a baseball... you have to WAIT for the best opportunity, then make a decision on how to execute for the best results.

Trust me, if trading was easy, everyone would be making millions and no one would be trying to find the best trade solutions.

In my opinion, the best solution is to learn the skills to try to develop the best consistent outcomes. And that is what I'm trying to teach you in this video.

I look forward to your comments and suggestions.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver