Narrative Noise vs. System ClarityApparently, the market was “uncertain” today.

Somewhere between Trump retracting his Powell shade, the Fed playing PR dodgeball, and tariffs being simultaneously on and off the table… headlines were doing what they do best: explaining yesterday with confidence.

But the chart?

The chart spoke first.

We came into the session ready for bullish confirmation.

Instead, we got a clean rejection of 5400, with early signs of downside pressure before lunch.

This is why we follow price, not PR.

Today’s action didn’t invalidate the bull bias completely, but it sure made the case that bears aren’t done just yet.

Let’s unpack what we saw and where we’re headed next.

---

Additional images mentioned can be seen on my main blog

---

SPX Market Outlook - Structure Rejected, Futures Rolling

While the headlines continue to spin post-news confusion, the price action remains our guide.

Yesterday, we came into the session prepared for a bullish continuation, but 5400 acted as a firm barrier once again.

The daily chart showed a clear rejection, and despite the bullish lean in the morning, the structure leaned bearish by session’s end.

Now, as I write this before the cash open, overnight futures are pushing lower, indicating potential follow-through.

That doesn’t confirm anything just yet - but it does tilt the bias.

Here’s what I’m watching:

5400 = still key resistance

5300 = GEX flip level - will reassess bearish view if we break and hold below it

5000 remains the target for the Wolfe pattern continuation

Upper Bollinger tag is in - another technical sign of short-term exhaustion

No bear pulse bar yet, but a clean V-shaped reversal is visible on the chart

ADD remains near bull extreme - offering more bear potential than bull in the short term

Bias remains bearish below 5300, and I’ll reassess to add in below that level.

---

GEX Analysis Update

5500 - 5400 - 5350 all look interesitng levels

5300 is the current flip point

---

Expert Insights: React to Price, Not PR

❌ Mistaking news for a setup

Narratives are seductive. They come with headlines, urgency, and lots of confident pundits.

✅ Stick to the chart

Price told us today’s story long before CNBC tried to.

5400 rejection. No pulse bar. Bullish exhaustion on ADD.

That's not confusion. That's confirmation — if you're paying attention.

---

Rumour Has It…

Trump was overheard saying, “Maybe Powell’s alright. Maybe.” Dow gained 0.3% and then shrugged.

5400 is reportedly suing for emotional damages after being rejected for the third time this month.

A Wolfe Wave ghost briefly appeared on the chart, waved, and vanished near 5300.

(This section is entirely made-up satire. Probably.)

---

Fun Fact - News Always Arrives After Price

Markets don’t wait for clarity.

They move first, then the headlines scramble to explain why.

The pattern is timeless:

Price shifts.

Smart traders react.

Media catches up.

Retail says, “Oh, THAT’S why.”

Yesterday was no exception.

So if the news says “flat and uncertain,” but the chart shows a failed breakout, don’t wait for a CNBC blessing to press the button.

The system already said what it needed to say.

Spy!

US500 Day Trade Setup: Liquidity Pools, Gaps & What’s Next?The US500 (S&P 500) 4-hour chart recently showed a gap up, followed by a strong move into the previous range highs. This price action likely triggered buy stops and tapped into buy-side liquidity above the prior swing highs. After this liquidity sweep, the market has pulled back and is now consolidating just above a visible gap, which sits slightly below the current price level.

From a Wyckoff perspective, this resembles an upthrust after distribution, where price runs stops above resistance before reversing. The current pullback suggests a potential test of the gap area, which often acts as a magnet for price, especially if there’s unmitigated liquidity left behind.

Using ICT (Inner Circle Trader) concepts, the recent move above the range high can be seen as a raid on buy-side liquidity, followed by a retracement. The gap below current price represents an imbalance, and ICT traders often look for price to revisit such inefficiencies before resuming the trend.

🌐 Fundamental & Sentiment Backdrop

Recent data shows the S&P 500 has experienced a sharp correction in April, with a monthly drop of about 5.75% from the previous month, but it remains up 6.8% year-over-year (YCharts). The market has been volatile, with sentiment shifting due to macroeconomic concerns, including renewed trade tensions (notably new tariffs), a mixed earnings season, and questions about the Federal Reserve’s next moves (IG).

Wall Street analysts have recently revised their year-end targets lower, citing increased risks from tariffs and slowing earnings growth (Yahoo Finance). The VIX is elevated (28.45), and the put/call ratio is above 1, indicating heightened hedging and caution among market participants (YCharts).

🏦 Wyckoff & ICT Concepts in Play

🏗️ Wyckoff: The recent rally into the highs and subsequent pullback fits the upthrust after distribution narrative. If the market fails to reclaim the highs, a move back into the gap (potentially as a sign of weakness) is likely.

💧 ICT: The gap below current price is a clear area of interest. If price trades down to fill this gap, watch for a reaction—either a bounce (if demand steps in) or a continuation lower if the gap fails to hold.

💡 Day Trade Idea (Not Intra-day)

Scenario: If price trades down to fill the gap just below the current level (around 5,300–5,320), monitor for a bullish reaction (such as a strong daily close, a bullish order block, or a clear rejection wick).

Trade Plan:

🕵️♂️ Wait for price to fill the gap and show a bullish daily signal.

🎯 Enter a day trade long at the next day’s open if confirmation is present (e.g., a bullish daily candle close or a break above the previous day’s high).

🛑 Place a stop loss just below the gap or the most recent swing low.

📈 Target the previous high near 5,400 for a day trade, or consider scaling out if momentum continues.

Alternative: If price fails to hold the gap and closes below it on the daily chart, consider a day trade short the following day, targeting the next liquidity pool below (e.g., 5,200).

⚠️ Disclaimer

This analysis is for educational purposes only and does not constitute financial advice. Trading involves risk, and you should do your own research or consult with a professional before making any trading decisions. Past performance is not indicative of future results.

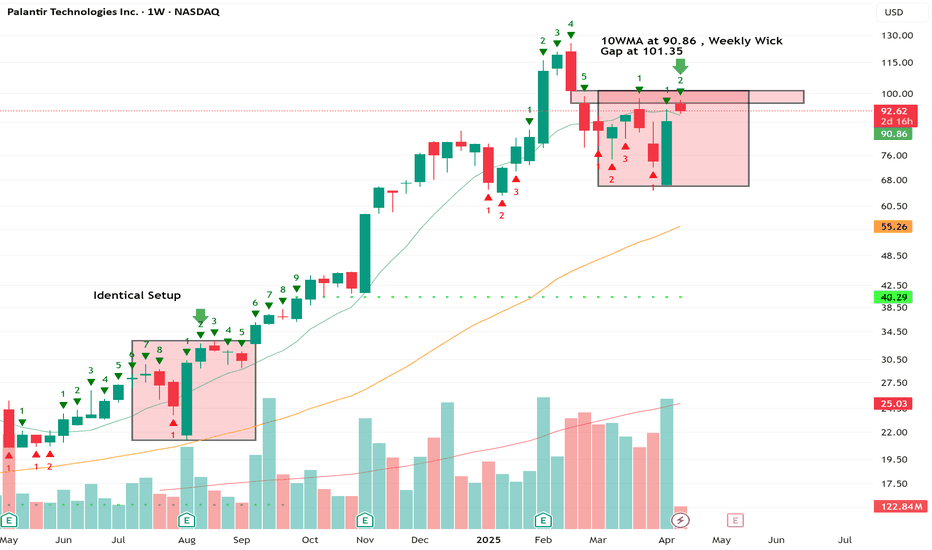

$PLTR Trade: Buy $90.86 , Target $101.35Beep Beep. Hope everyone is taking care of their trading accounts during this volatile phase in the markets. I noticed an identical setup on the weekly from back in August 24' and I'm looking to take advantage. We have a trend reversal on the Tom Demark sequential that helps identify trend exhaustion through a 9 Count. Currently on a 2 Count, we're testing the gap while simultaneously testing the 10WMA at 90.86.There is also a weekly gap at 101.35 ... Entry would be the 10WMA. Target the weekly Gap. Trade is as follows:

Trade Idea - Swing NASDAQ:PLTR $95 Calls 4/25

Entry - 10 WMA @ $90.86

Target - Gap on Weekly at $101.35

SPY/QQQ Plan Your Trade Update For 4-23 : Rally-111 PatternToday's pattern really showed up pre-market.

Where was the rally today? It happened before the US markets opened for business.

The SPY/QQQ had already moved up into my upper resistance area on strong buying overnight.

I knew I had to run my father around most of the day, so I booked my profits this morning and tried to catch one little SPY rally (that didn't work out).

So, I started taking some positions for next week's potential downtrend, and I thought, "How much risk am I taking on these trades if the markets continue to move upward?"

I realized I would be taking about $1000 to $1400 in total risk, but my expiration date is near May 16. So my target for any profit really needs to be before May 10th or so.

If the markets do what I expect, I'll be sitting back, watching my profits grow as the markets trend downward into my May 2 Major Bottom (I hope).

I created this video to highlight the now partially confirmed inverted EPP pattern that setup the Ultimate High in early trading today.

Now that we've completed the inverted EPP pattern, we should be looking for the ES/SPY/QQQ to move downward, shift into a sideways/upward price flag. Then, break down into the new Consolidation phase.

Essentially, if my EPP patterns play out well, I timed my move away from longs/calls and into shorts/puts almost perfectly. Now, I just need to sit back and wait for the markets to make a move.

This is what trading is all about. You can't kick the markets to do what you want them to do. You have to learn to take what the markets give you and fall in line with market trends.

When you do that well, profits start to fall into your lap (if you are patient).

Follow along as I break down these market trends and learn how to develop your own skills.

GET SOME.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

April 21st Trade Journal & Stock Market Analysis**April 21st Trade Journal & Stock Market Analysis**

EOD accountability report: +9335.75

Sleep: 8 hour, Overall health: tired

**Daily Trade Signals based on VX Algo System**

9:37 AM Market Structure flipped bearish on VX Algo X3

12:01 PM VXAlgo ES X1 Buy signal,

2:16 PM VXAlgo ES X1 Buy signal (double signal)

3:05 PM VXAlgo NQ X3 Buy Signal

3:31 PM Market Structure flipped bullish on VX Algo X3!

April 23 Trade Journal & Stock Market Analysis April 23 Trade Journal & Stock Market Analysis

EOD accountability report: +2325 on Eval, didn't trade funded

Sleep: 10 hour, Overall health: :check:

— 9:00 AM Market Structure flipped bullish on VX Algo X3!

— 11:30 AM Market Structure flipped bearish on VX Algo X3!

— 12:30 PM VXAlgo ES X1 Buy signal (triple buy signal) B+ set up

— 1:33 PM VXAlgo YM X1 Sell Signal (triple sell signal) B+ set up

— 1:55 PM Market Structure flipped bullish on VX Algo X3!

— 2:30 PM Market Structure flipped bearish on VX Algo X3!

— 3:31 PM VXAlgo ES X1 Buy signal (double signal)

Next day plan--> Short 48m MOB

Video Recap -->

Nightly $SPY / $SPX Scenarios for April 24, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for April 24, 2025 🔮

🌍 Market-Moving News 🌍

🇪🇺 European Banks Brace for Tariff Impact: European banks are facing a challenging outlook as U.S. tariff hikes raise recession fears. Analysts anticipate slower revenue growth and increased loan loss provisions, with institutions like BNP Paribas expected to report earnings reflecting these pressures.

✈️ Airline Industry Faces Booking Declines: European airlines report a 3% drop in planned summer trips, with leisure travel down 8% compared to 2024. Economic concerns and rising travel costs, particularly among Gen Z travelers, are contributing factors. Airlines like Ryanair and Air France-KLM are considering fare adjustments to maintain demand.

👗 Kering's Revenue Drops Amid Gucci Struggles: Luxury group Kering reported a 14% decline in Q1 revenue, with flagship brand Gucci experiencing a 25% drop. The company attributes the downturn to ongoing brand challenges and macroeconomic factors affecting consumer spending in key markets.

📊 Key Data Releases 📊

📅 Thursday, April 24:

📦 Durable Goods Orders (8:30 AM ET):

Forecast: +2.1%

Previous: +0.9%

Measures new orders for manufactured durable goods, indicating manufacturing sector health.

📈 Initial Jobless Claims (8:30 AM ET):

Forecast: 222,000

Previous: 215,000

Reflects the number of individuals filing for unemployment benefits for the first time, signaling labor market trends.

🏠 Existing Home Sales (10:00 AM ET):

Forecast: 4.14 million

Previous: 4.26 million

Indicates the annualized number of existing residential buildings sold, providing insight into housing market conditions.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

CHIP SECTOR TO CRASH SMH The chart posted is the SMH we are now in the final 5th wave and it is a classic 5th wave Diagonal in the 5th wave wave to form a double top into fib cycle peak .From here we should see a major break down in All chip stocks into Oct 2025 but we should see the first leg down low march 10/20th 2025 this should be a Very Bearish action world wide see spy and qqq as well . This is the warning to All traders EXIT INTO RALLIES THE BEST OF TRADES WAVETIMER

PIVOTAL DAY AHEAD FOR $SPX: Will We Reclaim the Highs or Begin tTechnical Breakdown: We’re at a critical junction for the S&P 500. After completing a 5-wave structure, SP:SPX is teetering near a decision point. Two potential paths are now unfolding:

Bullish Scenario (🟢):

A daily close above 5386 would invalidate the current bear thesis.

This opens the door to a push toward the 90–100% Fib retracement zone (5685–5750).

Short-term traders may look to ride the momentum if 5485 is broken cleanly.

Bearish Scenario (🔴):

A rejection at current levels, coupled with a close below 5386 and a gap-fill back down, confirms the bearish triangle setup.

If this plays out, we’re targeting a drop to the 4600–4400 range based on the 1.618 and 2.618 Fibonacci extensions and broken trendline dynamics.

This aligns with the Elliott Wave breakdown (W5 peak, now in corrective ABC structure).

🧩 Macro Context:

High inflows to safe havens like gold suggest rising fear.

Volatility is elevated, and liquidity is thinning post-earnings season.

💥 Conclusion: Tomorrow’s close is not just another candle – it’s a potential macro trigger. Either we confirm a final leg higher in this cycle, or the bearish wave unfolds in full.

⏳ Watch 5386 closely.

SPY - support & resistant areas for today April 23 2025These are Support and Resistance lines for today, April 23, 2025, and will not be valid for the next day. Mark these in your chart by clicking grab this below.

Yellow Lines: Heavily S/R areas, price action will start when closing in on these.

White Lines: Are SL, TP or Mid Level Support and Resistance Areas, these are traded if consolidation take place on them.

SPY/QQQ Plan Your Trade For 4-23 : Rally-111 PatternToday's RALLY pattern suggests the SPY/QQQ will continue to push higher, possibly breaking upper resistance near $550/493.

As I suggested in this video, I believe the upward price trend bias will continue into Friday (4-25) and suddenly shift into a BEARISH price trend/bias early next week.

The May 2-5 Major Bottom cycle low, my research predicts, will happen and should prompt a fairly strong downward price trend as we near the end of April and head into early May.

Gold and Silver will likely consolidate a bit over the next 24-48 hours. So, this is a great time to pick lower entry price levels for LONGS/CALLS.

Ultimately, I'm still expecting Gold to rally above $3750 before the end of May and attempt to target $4500++ before the end of June.

BTCUSD is moving into a potential "INVALIDATION" phase. Although I'm currently estimating the probability of that invalidation at about 20-30%, it is still a valid price trend.

I believe BTCUSD will shift into a downward price trend as the markets continue to unwind excesses through the May, July, and October lows, according to my cycles.

The big opportunity for traders over the next 48 hours is playing the upward trend bias in the SPY/QQQ - then moving into a mode of preparation for next week's breakdown/downward price trend in the SPY/QQQ.

So, play it smart. Follow the chart and don't try to be a superhero.

Play what is in front of you and prepare for the bigger price swings headed into next week and beyond.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Tariff Talks Flip the Tape - 5400 Under FireWolfe Gasping, Bulls Grinning

Well, this is exactly what every bear didn’t want to wake up to…

Overnight, markets surged higher after Trump hinted at easing tariffs and gave Powell a thumbs-up. It’s like watching your opponent trip mid-game, then suddenly recover, score a hat trick, and throw you a smug grin.

That line in the sand we’ve been talking about?

5400.

It’s been the invalidation level for weeks – and now it’s being bulldozed like it never mattered.

This isn’t about guessing the news.

It’s about having a clear point where your bias says, “Okay, I’m out.”

The Wolfe was working… until it wasn’t.

And that’s okay.

Because while the bear swing has been fantastic, we’re now seeing what might be the higher low reversal we flagged a few weeks ago - just without the drop to 5000 first.

Frustrating? A little.

Unexpected? Not really.

Tradable? Absolutely.

Let’s look at how this flips our setup for today.

---

SPX Market View - Bull Bias Activated (Finally)

Well, that escalated quickly.

With the overnight futures surge and 5400 now breached, the Wolfe Wave is officially off the board. Our long-standing bear bias has been invalidated — and we flip bullish for the first time in weeks.

This is the power of having a system.

You don’t need to guess. You just need a line in the sand. Ours was 5400. Price crossed it. The bias flips.

Here’s what I’m watching now:

5400 is now the breakout zone – if it holds at the cash open, bulls have full control

Higher low structure playing out across the daily chart

GEX positioning will be key — I’ll be watching for hedging demand shifts to confirm upside stability

This doesn’t mean we go all-in bull mode with blind optimism.

It means we assess new setups in line with the price action, and if they confirm – we act.

Bull’s got the ball (for now).

Let’s see if he fumbles or scores.

GEX Analysis Update

5300 acting as the updated flip point overnight

SPX prices potentially gaping 100+ points assuming the futures hold their gains.

---

Expert Insights: Know Your Invalidation

❌ Clinging to a bias too long

It’s tempting to hold on to the story. “Wolfe’s still in play,” you tell yourself… even after price says otherwise.

✅ Know your invalidation level

5400 was the line. It’s been clear for weeks. Once price punched through it — the plan said, “That’s it. Game over for the bear.”

No ego. No hoping. No rewriting the script mid-trade.

Your system needs boundaries.

Otherwise, it’s not a system — it’s a story.

---

Rumour Has It…

Trump’s tweet this morning: “Tariffs are dumb. Powell’s alright. Markets UP!” Dow gained 200 in 10 seconds.

CNBC now referring to 5400 as “The Enlightenment Zone.”

The Wolfe Wave was last seen howling into the wind and fading into the distance.

(This section is entirely made-up satire. Probably.)

---

Fun Fact - The 5400 Flip

Here’s a kicker for you…

5400 has flipped bias more times than any other round number level in the SPX this year.

It's the psychological equivalent of a market mood swing.

And every time price hits it, traders start reaching for different narratives:

“It’s resistance.”

“Now it’s support.”

“No wait, it’s just a number.”

“Actually, it’s Fibonacci-magnet-retrograde!”

Sometimes it’s just this:

5400 = The Line Where We Flip.

Meme of the Day - “Wolfe’s Out. Bull’s In.”

IMAGES ON MAIN BLOG

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

April 22st Trade Journal & Stock Market Analysis** April 22st Trade Journal & Stock Market Analysis**

EOD accountability report: +325

Sleep: 3 hour, Overall health: tired

**Daily Trade Signals based on VX Algo System**

— 9:00 AM Market Structure flipped bullish on VX Algo X3!

10:20 AM VXAlgo NQ X1 Sell Signal

10:30 AM VXAlgo ES X1 Sell Signal

10:51 AM VXAlgo ES X1 Sell Signal

11:20 AMVXAlgo ES X1 Sell Signal (Triple signal) C+ set up

1:12 PM VXAlgo NQ X3 Sell Signal (Double X3 signal)

1:30 PM Market Structure flipped bearish on VX Algo X3!

3:00 PM Market Structure flipped bullish on VX Algo X3!

3:10 PM VXAlgo ES X1 Sell Signal (Triple signal) C+ set up

SPY/QQQ Plan Your Trade Update For 4-22 : EPP StructuresThis video highlights why the Excess Phase Peak pattern is so important for traders to understand and follow.

Imagine being able to see into the future and to be able to plan/project price action in a way that is like putting together building blocks (or Leggos).

That is what the Excess Phase Peak pattern represents for all traders.

Once you understand it and learn to use it, you'll see how it presents very clear opportunities for you to plan and execute fantastic trades in any market.

Fibonacci Price Theory, Energy Cycles, & The Excess Phase Peak patterns are really the core structures of price.

Elliot Wave is fantastic for "after the fact" type of analysis. IMO, you don't really know how the EW count is truly structured until after the current major wave structure is complete (meaning you are 2-3 waves into the new (counter-trend) structure.

Watch this video and try to think about how I'm taking the EPP patterns to learn to plan out opportunities for price based on STRUCTURE - not indicators or averages.

This is how the markets work.

Pay attention and GET SOME.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Approaching the 200-Week SMA – AgainHistory doesn’t repeat… but it sure does rhyme.

If all you did was buy the S&P 500 every time it touched the 200-week moving average, you would’ve: ✔️ Bought 2011, 2016, 2018, 2020, 2022… 💰 Absolutely cleaned house.

Now in 2025, we’re approaching the same level again. That SMA has acted like a trampoline for the last 15 years — will it bounce once more?

🧠 Food for thought as fear builds and the market cools.

Let’s see if the buyers step in where they always have. 👀

SPY - support & resistant areas for today April 22 2025These are Support and Resistance lines for today, April 22, 2025, and will not be valid for the next day. Mark these in your chart by clicking grab this below.

Yellow Lines: Heavily S/R areas, price action will start when closing in on these.

White Lines: Are SL, TP or Mid Level Support and Resistance Areas, these are traded if consolidation take place on them.

SPY Plan Your Trade For 4-22 : Breakaway In Counter TrendToday's pattern suggests the markets are moving in a counter-trend mode and that we may see a Breakaway type of price bar.

The current trend is Bearish. Thus, I believe the current Counter-Trend is Bullish.

As many of you already know. I picked up some Calls off the lows yesterday after noticing a complete EPP pattern (Ultimate Low) setup about 75 minutes before the end of the regular trading day on 4-21.

My opinion, overall, is that we are still stuck within a consolidation phase. But that doesn't mean we can't see the SPY/QQQ move higher (toward the upper consolidation high) or roll back downward (toward the lower consolidation low).

I do believe we are moving into a moderate upward price trend over the next 3-4+ days where price will attempt to retest the 525-535+ level on the SPY, then ROLL into a top and start a sharp downtrend.

This volatility presents an incredible opportunity for traders. Staying ahead of these trends is key to improved success.

The SPY Cycle Patterns are fairly clear. We've moved into consolidation, and the price is very volatile. The Counter Trend pattern today may setup a 3-4+ day minor rally in the SPY/QQQ.

But, ultimately, I believe the SPY/QQQ will roll downward into the May Cycle lows - just as I have been predicting for the past 45+ days.

Don't get greedy. Play the immediate trend and learn to identify the EPP patterns on 5-minute charts.

Today should be a very good day for traders.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Plan Your Trade Update For 4-21 : Waiting For The EPP SetupThis video is, hopefully, going to help many of you learn to use the Excess Phase Peak (EPP) pattern more efficiently.

For months, I've been trying to teach all of you to use this pattern to efficiently identify and trade some of the biggest price moves.

Remember, price only does TWO THINGS - TREND or FLAG.

These components are essential to the EPP pattern setup.

First, price must TREND into a peak or trough.

Second, price must pullback from the peak or trough.

Third, price must move into a SIDEWAYS/FLAGGING formation.

Forth, price must break away from the sideways/flagging formation and attempt to TREND into the new consolidation phase.

Fifth, once the new consolidation phase starts, price will trend and flag within the consolidation range for a period of time - before...

Sixth, price will attempt to break up or down to the Ultimate High/Low.

This chart of the ES/SPY will show you how I used my analysis to "front-load" my positions before the Easter holiday weekend.

I've been telling all of you the markets would likely attempt to move a little bit higher, trying to target 525-535 (if we are lucky). Then, price would roll into a topping formation and move downward towards my May 3-6th low (estimate).

Last Thursday, I decided to throw on two positions to protect against any big news that may cause the markets to collapse over the holiday weekend.

I picked up :

4 SDS CALL options @ $23 expiring on May 16

3 XLF PUT options @ $47 expiring on May 16

Both of those trades worked out perfectly this morning. I booked 2 of the XLF and 2 of the SDS for profits near 1030 AM PT. Lovely.

Next, in between phone calls and loading up my car for a short trip, I noticed a beautiful EPP pattern setting up in the ES, and that EPP pattern has already reached what I believe to be the Ultimate Low.

I tried to get into 2 SPY Call options @ $512 and held my breath to see if I timed the entry well.

NOT.

I took a $280+ loss on those two Calls.

I waited a bit longer to see what price did, and after the price setup a base below $510 on the SPY, I loaded up on two more SPY Calls @ $510 and two SSO calls @ $67 about 70-80 minutes before the end of trading.

The way I looked at it, I already had my downside trades placed from last Thursday, and I just added some upside exposure while my downside trades were profitable.

I didn't know if the SPY would rally or not, but the EPP Ultimate Low setup suggested NOW is the time to buy.

So, I kept both downside and upside trades active to protect my account overnight.

The SPY rallied into the close, and I ended up making some nice profits off that EPP Ultimate Low.

Now, I'm going to wait to see what happens tomorrow morning and try to BOOK my upside trades in profits while letting my longer-term downside trades play out into early/mid May.

This is trading. The entire purpose of trading, like I trade, is to position for the best opportunities and try to catch the GIFTS the market throws at you as often as possible.

Nothing is guaranteed, but price ultimately shows us everything we need to know.

Watch this video to see if you understand the EPP Ultimate Low that prompted me to buy my CALLS today.

If so, then you are starting to GET IT, and that is a very big step towards improving your trading skills.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Nightly $SPY / $SPX Scenarios for April 22, 2025 🔮

🌍 Market-Moving News 🌍:

🚗 Tesla's Q1 Earnings on Watch: Tesla is set to report Q1 earnings after market close. Analysts expect EPS of $0.58 on $23.4B revenue. Investors are focused on delivery guidance, cost-cutting measures, and updates on the robotaxi program and Optimus robot. CEO Elon Musk faces pressure to refocus on Tesla amid concerns over his political engagements.

📉 Market Volatility Amid Tariff Concerns: U.S. markets remain volatile due to ongoing trade tensions. The S&P 500 has declined 14% from its February high, with investors closely monitoring corporate earnings for insights into the economic impact of recent tariffs.

📊 Key Data Releases 📊

📅 Tuesday, April 22:

🏠 Existing Home Sales (10:00 AM ET):

Forecast: 4.20 million

Previous: 4.38 million

Provides insight into the housing market's health and consumer demand.

📘 IMF Global Financial Stability Report (10:15 AM ET):

The IMF will release its latest assessment of global financial markets, focusing on systemic risks and financial stability.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

SPY repeat of ladle patternJust presenting what I see. Prices likely to be pulled back up to the LVN looking at good buy volume at close. However the days volume wasn't great because of the Europe holiday

Holidays ar common for whipsaw prices. With european markets open today, I wont be surprised if the market head back up for a day or two watch out for the resistance line

Safe trading

Noise, S&P Scenario, Gold BubbleThank you to the tradingview community for engaging and supporting my content.

After another rough start to the week, we have a bit of a crossroads ahead for the S&P

1) We revisit the April 7 lows and poke lower with bear trap opportunities

2) We hold Monday April 21 lows and grind back up to gap fill and revisit 5400-5500 resistance

3) We go nowhere with a lot of intraday volatility and noise (between the April 7 low and the April 9 high)

The markets are on high alert

DXY

Gold

Bitcoin

US Bonds vs Treasuries (yields rising)

Trump is more vocal about threatening the FED or firing Powell and the concern is truly unprecedented

Trade War pause is still ongoing, China is being vocal as well to make sure countries don't simply line up to support the US. For all of this to calm down, US and China have to play nice. China is likely able to hold the line longer than the US in the near-term

Thanks for watching!!!

Tears of Liberty. Lets Make America Sell Again.Over the past decade, the U.S. stock market has significantly outperformed global stock markets excluding the United States. This divergence in returns has been one of the defining features of global investing since 2015, with U.S. equities—especially large-cap technology stocks—driving much of the outperformance.

Annualized Returns (2015–2025)

AMEX:SPY , S&P 500 Index(U.S.):

The S&P 500 delivered an average annualized return of 13.8% over the past ten years.

NASDAQ:ACWX , MSCI All World ex U.S. (Rest of World):

Global stocks outside the U.S. returned an average of 4.9% annually over the same period

Year-by-Year Breakdown

Year | SPX | World ex U.S. | U.S. Surplus

2024 23.9% 4.7% +19.2%

2023 23.8% 17.9% +5.8%

2022 -19.6% -14.3% -5.4% (!)

2021 26.6% 12.6% +14.0%

2020 15.8% 7.6% +8.2%

2019 30.4% 22.5% +7.9%

2018 -6.6% -14.1% +7.5%

2017 18.7% 24.2% -5.5% (!)

2016 9.8% 2.7% +7.1%

2015 -0.7% -3.0% +2.3%

Key Drivers of Performance

U.S. Outperformance

The U.S. market’s dominance was driven largely by the rapid growth of technology giants (such as Apple, Microsoft, Amazon, and Alphabet), which benefited from strong earnings growth, global market reach, and significant investor inflows.

International Underperformance

Non-U.S. markets faced headwinds such as multiply choking sanctions and tariffs, slower economic growth, political uncertainty (notably in Europe), a stronger U.S. dollar, and less exposure to high-growth technology sectors.

Valuation Gap

By 2025, U.S. stocks are considered relatively expensive compared to their international counterparts, which may offer more attractive valuations going forward.

Recent Shifts (2025 Trend):

As of early 2025, international stocks have started to outperform the S&P 500, with European and Asian equities seeing renewed investor interest. Factors include optimism over economic recovery in China and strong performance in European defense and technology sectors.

Long-Term Perspective

Historical Context

While the past decade favored U.S. equities, this has not always been the case. For example, during the 2000s, international stocks outperformed the U.S. following the dot-com bust.

Market Weight

The U.S. accounts for roughly 60% of global stock market capitalization and about 25% of global GDP, so its performance has a substantial impact on global indices.

Conclusion

From 2015 to 2025, the U.S. stock market delivered nearly triple the annualized returns of global markets excluding the U.S., primarily due to the outperformance of large-cap technology stocks.

While this trend has persisted for most of the decade, early 2025 shows signs of a potential shift, with international equities beginning to close the performance gap. Investors should remain aware of valuation differences and the cyclical nature of global market leadership.

The main technical chart for U.S./ ex U.S. ratio indicates the epic reversal is in progress.