SPY/QQQ Plan Your Trade For 4-15 : Base Rally PatternToday's pattern suggests the SPY/QQQ have been busy forming a BASE and may transition into a moderate rally mode.

I believe this move will prompt the SPY to move above the $550 level, potentially targeting $555-565 over the next 48 hours.

This upward move could be related to news or Q1:2025 earnings.

I don't believe the markets really want to move downward at this time, although I do believe the markets will move into a topping pattern by the end of this week.

Gold and Silver are moving into BLANK pattern day, today. Given the fact that we are between rally patterns and the metals charts show a very clear FLAGGING formation (watch my video), I believe we are moving into a FLAG APEX that will prompt a move above $3300 (for Gold) and $33 (for Silver). It's just a matter of time.

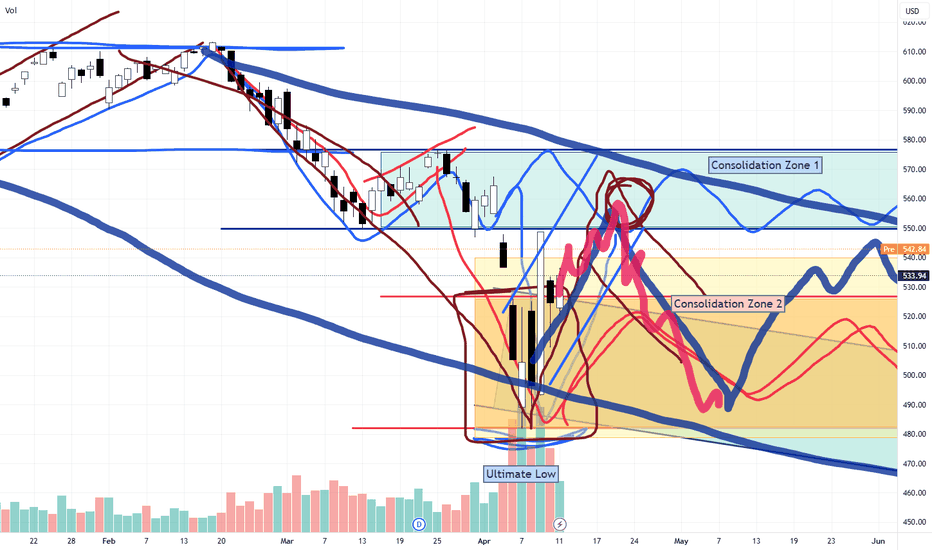

BTCUSD is still struggling in the Consolidation phase. As I keep suggesting, I believe the next move for Bitcoin is to the downside. But, until we break this consolidation phase, price will continue to roll around within the consolidation range.

Remember, we are going to be moving back to more normal volatility. So you need to understand these huge daily ranges are going to vanish over the next 3-5+ days.

Volatility will likely move back to the 1% to 2.5% range very quickly.

Get some..

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPDR S&P 500 ETF (SPY)

SPY Approaching Major Resistance Zone SPY has rallied sharply from its recent low, but it's now pressing into a critical resistance zone. Price is currently sitting just below a major unfilled gap between $539.54 and $548.94. Until this gap is filled and the market closes decisively above it, the broader downtrend remains intact and risk of a reversal is elevated.

Current Price Action:

SPY has reclaimed $535.29, a short-term support that must hold if bulls are to maintain momentum.

Price is hesitating under the gap, a common reaction area where sellers often defend.

Moving averages are turning upward, indicating short-term strength, but we’re still below key longer-term resistance zones and the 200 EMA (not shown).

Downside Risk Levels If Rejected:

$489.73 – minor horizontal support

$481.80 – a prior low and key reference point for buyers

$474.14 – structural support area from prior consolidation

Extended targets: $454.29 and $426.80 if broader weakness resumes

Analysis : This area between $539–$549 is the battleground. If SPY can fill the gap and close above $549 with follow-through, that would be the first meaningful technical confirmation of a potential trend reversal.

However, failure to clear this level could open the door for a larger pullback. Watch price action and volume closely — a rejection here would indicate that sellers are still in control, at least in the medium term.

As always, be patient and let the chart confirm the direction. For now, SPY is at a decision point — one that will likely dictate the next leg in this market.

Nightly $SPY / $SPX Scenarios for April 15, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🏦 Major Bank Earnings: Bank of America (BAC) and Citigroup (C) are set to report Q1 earnings before the market opens. BAC is expected to post an EPS of $0.81, while Citigroup anticipates $1.84. Investors will closely watch these reports for insights into the financial sector's health amid ongoing market volatility.

💊 Healthcare and Consumer Goods Reports: Johnson & Johnson (JNJ) is also scheduled to release its earnings, with forecasts indicating an EPS of $2.57. These results will provide a glimpse into the performance of the healthcare and consumer goods sectors.

📊 Key Data Releases 📊

📅 Tuesday, April 15:

📈 Import Price Index (8:30 AM ET):

Forecast: +0.1%

Previous: +0.4%

Measures the change in the price of imported goods, indicating inflationary pressures.

🏭 Empire State Manufacturing Survey (8:30 AM ET):

Forecast: -10.0

Previous: -20.0

Assesses manufacturing activity in New York State, providing early insights into industrial performance.

🗣️ Fed Governor Lisa Cook Speaks (7:10 PM ET):

Remarks may offer perspectives on economic developments and policy considerations.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

April 14th Trade Journal & Market AnalysisApril 14th Trade Journal & Market Analysis

EOD accountability report: +565

Sleep: 6 hour, Overall health: recovering, cant seem to get over 6 hour sleep.

**Daily Trade Recap based on VX Algo System **

9:30 AM VXAlgo ES X1 Sell Signal (triple sell signal)

9:41 AM Market Structure flipped bearish on VX Algo X3

11:02 AM Market Structure flipped bullish on VX Algo X3!

12:20 PM VXAlgo ES X1 Buy signal (Triple buy signal)

2:11 PM Market Structure flipped bullish on VX Algo X3!

3:20 PM VXAlgo ES X1 Sell Signal (triple sell again)

Today traded inside the zone, tested the 10min MA from the other day, held very well and bounced strong.

Bot alerts were on fire today.

Tuesday plan: Look for a backtest to support again on 48 min and push up to the MOB.

SPY Short From Resistance! Sell!

Hello,Traders!

SPY went up again

To retest a wide horizontal

Resistance level of 551.00$

And as the political situation

Remains unstable we are

Bearish biased and we will

Be expecting a local move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

S&P 500 Technical Analysis: Z-Score HMA Indicator OutlookOutside of the obvious news on Tarriffs, let's just focus on technicals for a moment:

In case you’re in a hurry:

My HMA Z-Score Probability Indicator is currently signaling overbought conditions.

The Z-Score has moved into the upper green zone, a level where reversals have historically occurred.

Hull Moving Average (HMA) remains upward for now, but is approaching a potential flattening point.

Price continues to respect a descending trendline, indicating resistance remains intact.

Unless the trendline is broken with conviction, the probability favors a bearish reversion in SPY.

HMA Z-Score Indicator Forecast: SPY Nearing Reversion Risk

This week, my HMA Z-Score Probability Indicator is signaling a statistically significant overbought condition in SPY. In case you are unfamiliar, this tool blends the statistical power of the Z-Score with the responsiveness of the Hull Moving Average to give us high-probability momentum and mean reversion setups.

Let’s break down what it’s showing right now and why a pullback may be imminent.

Z-Score in the Green: What That Means

The Z-Score component of my indicator is now in the upper green zone, which I’ve defined as statistically overbought territory. This isn’t arbitrary, it's based on historical distribution thresholds that flag when price has moved too far, too fast from its average.

In past instances when the Z-Score has reached these levels, the market has often reverted back toward the mean. It's not guaranteed, of course but the odds shift. This is one of the key features of my indicator: identifying these moments where the risk/reward tilts away from chasing price and toward anticipating a reversion.

HMA as a Momentum Filter

The Hull Moving Average (HMA) provides the trend context in this setup. Right now, the HMA is still pointing upward, but it’s starting to show early signs of rounding off. If it begins to flatten or turn downward while the Z-Score remains elevated, that would act as a confirmation of a momentum shift and strengthen the case for a pullback.

The HMA has consistently helped filter out false Z-Score signals when the trend is strong. But when both tools start aligning, that's when I pay closer attention.

Descending Trendline Holding as Resistance

On the chart, I’ve drawn a descending trendline connecting recent swing highs. So far, price has failed to break through this line, continuing a pattern of lower highs.

As long as price respects that line, it suggests sellers are still in control of the short-term structure. If SPY gets rejected again here, particularly while the Z-Score is elevated, the probability of a downside move increases significantly.

Bearish Bias: What the Data Suggests

The core logic behind this setup is based on reversion to the mean. When price extends beyond typical volatility bands (as measured by the Z-Score) and momentum stalls (as reflected by the HMA), it often precedes a return to more normalized levels.

Right now, we have:

A Z-Score reading in overbought territory,

A potentially topping HMA,

Resistance still holding at the descending trendline.

That’s a confluence of signals that, in my indicator's design, suggests a bearish reversion is more likely than a continuation.

What I’m Watching This Week

To confirm the setup, I’ll be watching for:

HMA flattening or beginning to roll over,

Break of recent short-term support to trigger downside momentum.

If these conditions start stacking up, the short bias becomes actionable. If instead we see a breakout above the trendline with conviction and volume, I’ll re-evaluate because no indicator is bigger than price.

The HMA Z-Score Probability Indicator is designed to anticipate high-probability turning points, and right now, it's signaling elevated risk for a short-term reversal in SPY.

As always, these are probabilities, not certainties.

SPY Resistance coming upVolume and trend analysis showing key levels to watch. But in this market single chart analysis is not enough. I look at Dollar Index, Gold, 10Y Treasury Bonds. All indicate low confidence in USA economy. Unless these improve I will remain bearish even if SPX,SPY breaks to the upside.

But most likely the markets will reverse at max resistance, as the hedge funds who are under liquidity pressure will start selling again

SPY Massive Long! BUY!

My dear subscribers,

SPY looks like it will make a good move, and here are the details:

The market is trading on 534.03 pivot level.

Bias - Bullish

My Stop Loss - 519.46

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 560.94

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

SPY/QQQ Plan Your Trade For 4-14 : Up-Down-Up PatternToday's pattern suggests the markets will move in a moderate upward price trend.

Although I don't expect anything huge today, I do believe the EPP structures/layers support this upward price move and that we'll see the SPY attempt to move back towards/above 550 over time.

The QQQ will likely follow the SPY higher over the next 5+ days.

Don't get too excited about this upward price move because it is structurally moving to setup a PEAK that will transition into a downtrend near April 22-25. This peak will create a downward price flag (a new inverted EPP) structure that will assist in developing a new sideways price structure carrying into June/July.

In other words, it looks like we are trapped between 480-585 on the SPY, and we will likely stay within that wide consolidation range for another 2-3 months.

Gold should attempt to rally this week, trying to break above $3300. I believe this is a critical level for Gold and also presents a breakaway level for Silver near $33.00

Bitcoin has moved into APEX VOLATILITY and will continue to trap BUYERS into believing BTCUSD is breaking away from the consolidation range. This is a BULL TRAP.

I believe BTCUSD will ROLL OVER within about 4-5 days - setting up a big breakdown move as the SPY/QQQ also roll downward in about 5+ days.

We still continue to see volatility and sideways price action. Still lots of opportunities for skilled traders.

Get Some..

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Tariff Exemptions Stir the Bounce | SPX Analysis 14 April 2025It’s Monday… and the markets are once again dancing like a puppet on a tweet-fuelled string.

One minute, tariff fears.

The next, selective exemptions for “favourites.”

Now the weekend’s over and futures are bouncing higher like none of it happened.

SPX looks set to test – or break – the 5400 bull trigger, and if you’ve been following the last few newsletters, you’ll know that’s a big one.

We’ve mapped it.

We’ve rejected it.

Now we’re staring it down… again.

---

The 5400 Line Returns

Let’s back up.

5400 has been my bull/bear trigger for weeks.

When we’re below it, I’m hunting bear swings.

Above? I start reassessing bullish setups, GEX bulls-eye trades, and pullback long entries.

This week, the GEX flip is also sitting around 5400.

That’s no coincidence.

It’s now more than just a price level –

It’s the emotional fault line between headline-driven panic and headline-driven hope.

So… do we flip bullish?

Not so fast.

Strategy: Structure First, Narrative Second

Just because futures are up doesn’t mean momentum is back.

We’ve seen far too many fakeouts, tweet-spikes, and algorithm blinks to trust the first move on a Monday.

That’s why my plan is simple this week:

✔️ 5400 is still the decision line

✔️ No aggressive trades until price confirms

✔️ Will adapt only if structure shifts – not just sentiment

This week isn’t about swinging for the fences.

It’s about precision. Patience. And setup clarity.

Behind the Charts: Tinkering, Rebuilding, Refining

While the markets work out their next identity crisis, I’m taking the time to:

Optimise my new charting layout

Tweak + update my indicator codebases

Re-align my tools for speed and efficiency

Because if the market wants to act like a circus,

I’ll tighten the tent and sharpen the knives.

---

Expert Insight – Don’t Rush the Flip

Common mistake:

Flipping long just because futures are green.

Fix:

Use anchored levels like 5400 as your decision points – and only flip bias when structure confirms.

GEX flips, pulse bars, and price action matter.

Tweets do not.

---

Fun Fact

Did you know?

In 2023–2024, over 60% of intraday SPX rallies over 1.5% failed to hold past 2 days when triggered by political headlines.

Translation?

Headline rallies are easy to sell into – unless they’re confirmed by price.

SPX sharp moves begin arround monthly option expiryWatch out for the this weeks options expiry on Thursday (Friday being holiday)

During volatile time option expiry does produce sharp moves. They are not that significant during normal markets. Also key levels approaching. Monday after Easter, I am expecting the new move to happen. Breakdown or breakout.

I am sure the big boys are aware from the social media that everyone is expecting a reversal and they will set up a trap. They will make us thing we are wrong create a FOMO to the upside and then sell

A volume drop could indicate a big move

Weekly $SPY / $SPX Scenarios for April 14–17, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🏦 Major Financial Earnings Reports: This week, investors will focus on earnings from prominent financial institutions, including Goldman Sachs, Bank of America, and Citigroup. These reports will provide insights into the financial sector's health amid recent market volatility.

📺 Tech and Healthcare Earnings: Key tech and healthcare companies such as Netflix, TSMC, and UnitedHealth Group are also scheduled to release earnings. Analysts will scrutinize these reports for indications of sector performance and future outlooks.

🏠 Housing Market Indicators: The release of housing starts data and a homebuilder confidence survey will shed light on the housing sector's response to recent economic conditions and tariff implementations.

🇪🇺 European Central Bank Meeting (April 17): The ECB is expected to address recent tariff developments and may announce interest rate decisions in response to economic pressures.

📊 Key Data Releases 📊

📅 Monday, April 14:

🗣️ Philadelphia Fed President Patrick Harker Speaks (6:00 PM ET): Insights into regional economic conditions and monetary policy perspectives may be provided.

🗣️ Atlanta Fed President Raphael Bostic Speaks (7:40 PM ET): Remarks may offer perspectives on economic developments and policy considerations.

📅 Tuesday, April 15:

📈 Import Price Index (8:30 AM ET):

Forecast: +0.1%

Previous: +0.4%

Measures the change in the price of imported goods, indicating inflationary pressures.

🏭 Empire State Manufacturing Survey (8:30 AM ET):

Forecast: -10.0

Previous: -20.0

Assesses manufacturing activity in New York State, providing early insights into industrial performance.

📅 Wednesday, April 16:

🛍️ Retail Sales (8:30 AM ET):

Forecast: +1.2%

Previous: +0.2%

Indicates consumer spending trends, a primary driver of economic growth.

🏭 Industrial Production (9:15 AM ET):

Forecast: -0.2%

Previous: +0.7%

Measures the output of factories, mines, and utilities, reflecting industrial sector health.

🏠 Homebuilder Confidence Index (10:00 AM ET):

Forecast: 38

Previous: 39

Gauges builder sentiment in the housing market, indicating construction activity trends.

📅 Thursday, April 17:

📈 Initial Jobless Claims (8:30 AM ET):

Forecast: 223,000

Previous: --

Reports the number of individuals filing for unemployment benefits for the first time, reflecting labor market conditions.

🏠 Housing Starts (8:30 AM ET):

Forecast: 1.41 million

Previous: 1.5 million

Tracks the number of new residential construction projects begun, indicating housing market strength.

🏭 Philadelphia Fed Manufacturing Survey (8:30 AM ET):

Forecast: 3.7

Previous: 12.5

Measures manufacturing activity in the Philadelphia region, providing insights into sector health.

🏦 European Central Bank Interest Rate Decision: The ECB will announce its interest rate decision, with markets anticipating a potential cut in response to tariff impacts.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysi

SPY, More pain to come? SPY / 1D

Hello Traders, welcome back to another market breakdown.

SPY is showing strong bearish momentum, breaking below resistance. However, the price is in the oversold zone for now. Hence, instead of jumping in at current levels, I recommend waiting for a pullback into the middle of the range zone for a more strategic entry.

If the pullback holds and sell mode confirms, the third leg lower could target new lows.

Stay disciplined, wait for the market to come to you, and trade with confidence!

Trade safely,

Trader Leo.

SPY/QQQ Plan Your Trade Overview For 4-12 : Thank youThis video is mostly a big thank you for all the great comments and questions over the past few weeks.

I've been posting these videos on TradingView for almost a year and the types of viewers/followers I've been gaining is incredible.

You guys & gals have really impressed me with your questions and engagement. Many of you follow me for months without ever commenting or asking any questions.

I received a call from a client/follower in Alberta last night and he reported last week's gains at over 300% by following my videos.

I received a message from another TV follower saying he's been following my videos for many months and, after a bad loss a few years back, he has decided to give trading another go.

I've stated it before and I'll keep saying it.. I'm not trying to scam you out of anything. I'm trying to show you the RIGHT SKILLS and TECHNIQUES for you to learn to become a better, more skilled trader.

The way I look at it is like this...

If I can teach you half of what I know and see on the charts, then you guys will be able to achieve so much greater success and have gained/retained the knowledge to do it on your own.

You watch me do it over and over on these charts. Guess what - you are LEARNING at the same time.

Now, after a couple of years of doing this and following my videos, you've GAINED an education on how to trade more efficiently, manage risk more efficiently, and achieve your trading goals (I hope).

Right now, I'm getting messages/comments from people saying they are making 200%, 300%, 500%, or more every week or two from my videos.

That is absolutely incredible. I just want to urge you to remember I'm not 100% perfect in predicting the markets. No one EVER really is 100% perfect at it.

In the long run, as long as you don't get super greedy, you'll survive any minor losses and live to trade another day.

That is probably the most important thing I can teach you - trade within a proper scale to your RISK LEVEL. Never BET THE FARM on your trades. Always have a 50% to 70% cash reserve.

Anyway. Thank you. I really appreciate all of you.

Hope you enjoy this video.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPX/GOLD ratio near to key supportcrossing below moving average of 200 months could trigger a secular movement in favour of gold.

Potential global debt colapse and lack of confidence in USD + high valuation, mag-7 concentration and high growths expectations on AI are macro/fundamental facts that supports this idea.

Barrick Gold (strong buy) I want you guys take a look at some things real quick

Current Environment Macro Landscape:

Defensive + Hard Assets -

Gold, Miners, Energy, Real Estate (inflation hedges)

AI & Mega Cap Tech -

MSFT, NVDA, AMZN — inflows

China / Trade War Plays -

FCX, CAT, Global Industrials

Reflation / Commodity Rotation-

Oil, Copper, Uranium, Ag plays

gold:

safe haven play amid geopolitical risk and tariffs

Strong correlation with real interest rates + USD — lower rates + weaker dollar = bullish

Tariffs = inflationary = bullish for gold

Strong gold reserve base + relatively low AISC

copper:

1. China Tariffs = Industrial Policy Countermoves

If the U.S. imposes more tariffs on China, China could respond with stimulus or infrastructure spending — which increases demand for copper.

China is the world’s largest consumer of copper, and its response to tariffs often includes pro-growth policies.

2. Copper is Critical for EVs, Grids, and Renewables

Global push toward electrification, clean energy, EVs, etc., requires a massive amount of copper.

Demand is secular, not cyclical — even if tariffs temporarily suppress growth, the long-term demand curve is strong.

3. Tight Supply Outlook

Copper supply is constrained globally. Many copper mines are aging, with long lead times for new projects.

Barrick is developing world-class copper assets (e.g., Reko Diq in Pakistan — one of the largest undeveloped copper-gold deposits in the world).

lets not forget the most revenue being generated from operations comes from their Nevada mines.. US PRODUCTION

gold barrick isnt the only mining company money is moving to, take some thought into moving money to commodities

April 11th Trade Journal & Market AnalysisApril 11th Trade Journal & Market Analysis

EOD accountability report: +1566.50

Sleep: 6 hour, Overall health: going thru Flu symptoms

**Daily Trade Recap based on VX Algo System **

12:08 PM Market Structure flipped bullish on VX Algo X3!

1:00 PM VXAlgo ES X1 Sell Signal (2x Signal)

Today was a very choppy for the early part of the day, tested pre market lows and almost broke it because of consumer sentiment.

We eventually bounce and started moving upward toward the 5 min and 10 min resistance , and eventually broke out with the market structure flipping bullish at 12:08, we went back for a 1 min MOB backtest and pushed up further.

Monday plan; look for back to support as noted on the video

Trump Tariffs - Trade War - High Volatility - Key LevelsEasy trading for 2025, right? Haha

We are seeing some of the wildest swings ever in the markets

Extreme intraday swings and volatility is getting everybody's attention

This video discusses all key levels and current seasonality

Hoping for the best and preparing for the worst