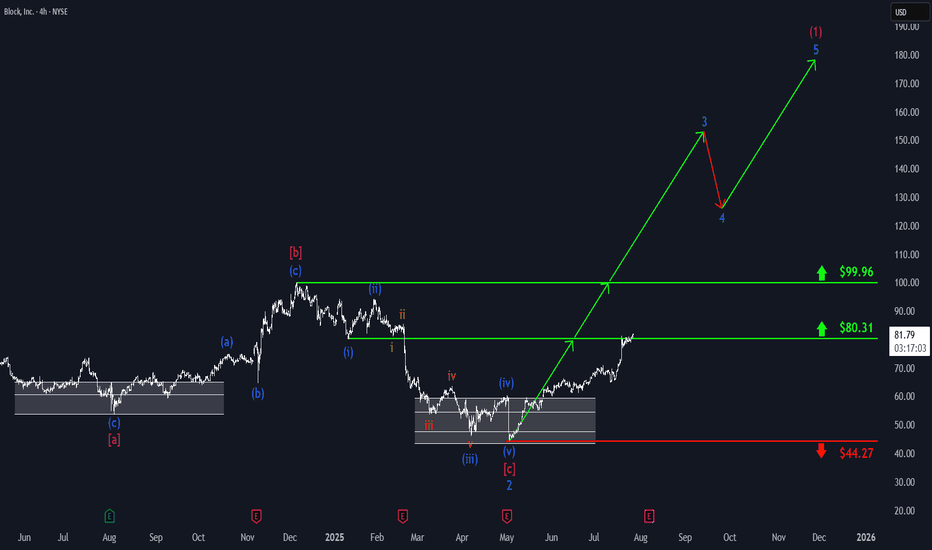

Block: Key Resistance HitBlock has made a strong upward move, reaching resistance at $80.31. Thanks to this positive momentum in our primary scenario, we fully focus on further gains as part of turquoise wave 3, which is expected to push the price decisively above the next resistance at $99.96. The subsequent pullback in wave 4 should also occur above this level, before wave 5 ultimately completes magenta wave (1) – marking the first major leg up in the ongoing bullish impulse.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do (for more: look to the right).

SQ

Block | XYZ | Long at $64.84Block's NYSE:XYZ revenue is anticipated to grow from $24 billion in FY2024 to $32 billion in FY2027. With a current price-to-earnings ratio of 13.8x, debt-to-equity ratio of 0.36x, and rising cash flow in the billions, it's a decent value stock at its current price. Understandably, there is some hesitation among investors due to competitive fintech market and economic headwinds. But, like PayPal NASDAQ:PYPL , growth is building.

From a technical analysis perspective, the price dropped to within my historical simple moving average bands. Often, but not always, this signals a momentum change and the historical simple moving average lines indicate an upward change may be ahead. While the open price gaps on the daily chart in the $40s and GETTEX:50S may be closed before a true move up occurs, NYSE:XYZ is in a personal buy zone at $64.84.

Targets:

$80.00

$90.00

$100.00

[*) $134.00 (very long-term)

SQ - Building "Block"Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 After being stuck in an accumulation phase for almost two years, SQ has finally broken above its range.

The shift in momentum is now confirmed in favor of the bulls, with the price trading within the rising channel marked in blue.

🏹 As SQ retests the lower blue trendline, I will be looking for trend-following long positions, targeting the $200 round number.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Block (SQ): Preparing for a Breakout Year in 2025NYSE:SQ is shaping up to either become one of the top picks for 2025 or face a potentially challenging year ahead.

From the monthly chart, NYSE:SQ has mostly traded between $100–$35 since its IPO in 2015. While the $35 level seems unlikely to be revisited anytime soon, the current focus is on reclaiming the Value Area High (VAH) at $100. Success here could trigger strong percentage gains over the next few months.

We’re adopting a cautious approach, closely monitoring the chart. On the lower time frame, NYSE:SQ is sitting in a key support/resistance zone (highlighted as a yellow box). Ideally, we want to see a break above the Value Area Low (VAL) and the completion of a smaller 5-wave cycle, marking the end of wave (i). A bearish divergence on the RSI at this stage would add confluence. Following this, a pullback could provide the perfect entry point for a long position.

At this time, we haven’t placed a limit order. A break below $55 would be a critical red flag, suggesting potential bearish developments, though this scenario seems unlikely without unexpected negative news.

FULL Trading Portfolio Update! How I'm positioningFULL Trading Portfolio Update! How I'm positioning for what comes next in the markets.

In this video, we will discuss:

-How I'm positioning my trading portfolio right now

-All my current H5 trades

-All trades I CUT loose

-What comes next!

Check it out now for all the updates and some great trade ideas

Not financial advice.

Block $SQ Weekly Chart Break Out🚀 **Block ( NYSE:SQ ) Weekly Chart Breakout!** 🚀

Block's weekly chart signals a bullish breakout, hinting at potential upside momentum. Watch for confirmation as key resistance turns to support. Eyes on the next price targets! 📈

#SPX500 AMEX:SPY NASDAQ:QQQ #BITCOIN #CRYPTO

Block text book inverse head and shouldersThe weekly chart of Block, Inc. (SQ) displays a textbook inverse head and shoulders pattern, a classic bullish reversal setup. After consolidating within a range for an extended period, the price appears to have broken above the neckline, signaling potential upward momentum. The target range, indicated by the blue zone, aligns with historical resistance levels.

Key observations:

• Neckline breakout confirms the pattern.

• Support levels to watch: $86.83 and $88.16.

• Potential 🎯 Target: $198.06, aligning with previous highs.

• Indicators such as RSI and Ichimoku Cloud complement the bullish outlook.

This setup suggests a favorable risk-to-reward ratio, but patience is key.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Trading involves significant risk, and you should consult with a qualified financial advisor before making any investment decisions. Always perform your own research and analysis. Past performance does not guarantee future results.

Square ($SQ) Set to LAUNCH! 84% Upside!🔥 Square ( NYSE:SQ ) Ready to Skyrocket! 84% Upside! 🚀

📢 High Five Setup Alert on Block ( NYSE:SQ )!

My H5 Indicator is flashing green, signaling a prime opportunity to take a position in $SQ!

Key Highlights:

Bullish Breakout: We’ve broken out of the Bullish Falling Wedge pattern and successfully retested.

Volume Ignition: Launching off the volume shelf with a volume gap to fill, setting up for a powerful move.

📈 Price Targets:

Primary Target: $149

Main Move Target: $162

This setup is primed for action! Will you be adding NYSE:SQ to your watchlist? Stay tuned for more insights!

👍 Like | Follow | Share 👍

Stay updated with weekly trade ideas using my HIGH-FIVE SETUP trading strategy. Don’t miss out on the next big move!

SQUARE is retesting the Inverse H&S before heading 80% higher! NYSE:SQ SQUARE (BLOCK) is retesting the Inverse H&S before heading 80% higher!

The trading gods have blessed us with a pullback to around $90ish, as requested. This is the retest of the Inverse H&S pattern.

-H5_L indicator is GREEN

-Already broken out of falling wedge.

-Launched off Volume Shelf and filling the GAP.

-Fintech is starting to run

-Stage 2 is just starting!

Buying more here!

🎯$110

🎯$149

🎯$162

NFA

SQ - wait for discountSQ - pulling back into buy zone. Wait for around 50ish.

Earnings in couple of weeks, I bet this will reach the buy zone before that. If earnings beat with strong forecast, can push this higher.

Stop Loss - 40

Long entry - 50-54

Target # 1 - 100

Target # 2 - 130

Target # 3 - 150

High Five Setup Alert on Block $SQ !! 84% Upside!🔥 Square ( NYSE:SQ ) Ready to Skyrocket! 84% Upside! 🚀

I posted this earlier, but a couple of people requested a video analysis on Square (BLOCK), so here it is; enjoy!

📢 High Five Setup Alert on Block ( NYSE:SQ )!

My H5 Indicator is flashing green, signaling a prime opportunity to take a position in SQ!

Key Highlights:

Bullish Breakout: We’ve broken out of the Bullish Falling Wedge pattern and successfully retested.

Volume Ignition: Launching off the volume shelf with a volume gap to fill, setting up for a powerful move.

📈 Price Targets:

Primary Target: $149

Main Move Target: $162

This setup is primed for action! Will you be adding

SQ

to your watchlist? Stay tuned for more insights!

👍 Like | Follow | Share 👍

Stay updated with weekly trade ideas using my HIGH-FIVE SETUP trading strategy. Don’t miss out on the next big move!

BLOCK INC $SQ #SQ Inverse head and shoulders could see $200In the fast-paced trading scene, the inverse head-and-shoulders pattern is a key sign for spotting bullish reversals. This pattern features three distinct dips: a lower "head" nestled between two higher "shoulders." When the price breaks above the "neckline," it hints at a possible change from a downtrend to an uptrend.

Traders usually jump in at this breakout point, placing stop-loss orders just below the right shoulder. They also rely on technical indicators like moving averages, the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD) for extra confirmation, creating a well-rounded strategy to seize these trading chances.

Key Takeaways

The inverse head and shoulders pattern is just the upside-down version of the regular head and shoulders.

It can help forecast reversals during downtrends.

Once this pattern is complete, it indicates a bull market ahead.

Investors often take a long position when the price surpasses the neckline resistance.

SQ - Square LongSQ is showing accumulation within this broadening structure.

We're looking for a higher low to change this bearish trend on the smaller timeframe and then can set up with a stop loss below the support.

The current low here could become a partial rise which would give this structure a 70% chance of breaking to the upside as per Bulkowski.

We await the higher low and monitor closely.

$SQ Breakout Possible SQ looks to be about to start a new leg up if it can breakout of its wedge. Sq had a clean close above resistance with increased volume on 10/10/24. It experienced an inside day on 10/11/24 with still elevated relative volume from the prior days break out. Sq rejected at the top of the wedge but did not really show any slowdown of buying just an absorption of some selling as the prior days lows were not breached. The inside day on the11th appears to be a rest day looking for continuation and a breakout out the wedge targeting 72 and 74 dollars. The next area where the stock can potentially meet supply if it does continue on its newly started uptrend would be 79.82 (rounded to 80) then 87.52, the current yearly highs, and the 89.97 which is the prior years highs.

Trade Safe Every1!

@T.w.i.n.e.y

SQ Block Options Ahead of EarningsIf you haven`t sold SQ before the previous earnings:

Now analyzing the options chain and the chart patterns of SQ Block prior to the earnings report this week,

I would consider purchasing the 60usd strike price Puts with

an expiration date of 2024-8-16,

for a premium of approximately $3.72.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SQ, preppin for MULTI-WEEKLY Price Growth! SQ recorded significant net buying / accumulation at the current range. Volume has surged 21% over its average numbers conveying buyers positioning in anticipation of technical and fundamental growth.

SQ has dramatically overextended its multi year correction from a peak at 283 back in August 2001, a pandemic era. Recent price movement is hinting of a trend reversal. The stock is sitting at a 1.0 FIB level, this is beyond bargain / discount already.

It is currently consolidating at a 4-year longstanding major support. This support range of 60-70 has been tested many times in the past and has proven its strength over and over. It is now currently bouncing off this range with precision.

Weekly descending trendline has been broken conveying an impending trend turnaround. Histogram has registered new higher lows -- buyers are persistent on taking the price higher from the present price base.

Fundamentally speaking, SQ last quarter earnings looks rosier than ever with EPS beating by 17.41% and a weighty $4.99B revenue, a 26% increase.

Spotted at 67.0

TAYOR

Safeguard capital always.

---------------------------------

FINANCIAL DATA REFERENCE:

Financials

Quarterly financials

MAR 2023

(USD) Mar 2023 Y/Y

Revenue 4.99B 25.99%

Net income -16.84M 91.75%

Diluted EPS -0.03 92.11%

Net profit margin -0.34% 93.41%

Operating income -6.17M 96.15%

Net change in cash 910.28M 133.09%

Cash on hand - -

Cost of revenue 3.26B 22.9%

Mar 2023EPS beat by 17.41%

EPS (USD)

Expected

0.34

Reported

0.40

Surprise

17.41%