Bad End of the Day for SPY?After a strong rally to the upside it's hard to see price moving downward, afterall we've bean hearing a lot of possitive news througout the media. But as a trader aren't we supposed to be contrarians? Well after looking at how today ended It could be hypothesised that the stong move to the upside has calmed down since bulls failed to break through recisstance and were pushed to lower levels. I interpet this as a bearish signal which can be traded in 3 ways, 2 being the ones drawn out in the chart. The other a more long term and risky trade with stops at 300 looking for a long term reversal back into the december lows. Although nothing is ciertan as of yet this market should be watched closely since it could have severe implications on the future of the world economy.

Standardandpoor500

S&P 500 LONGS&P 500 is showing a signal that is very similar to my other idea published about the US30.

It has broken through a descending resistance line and is looking good for a long position.

SP500 Short Opportunity by ThinkingAntsOkThe Main reasons to think that a bearish movement is about to star are the next ones:

A) Same situation than the bearish movement in October 2018

observe how the price made exactly the same formation that is doing now, we can use it as a guide to develop our setup on this current scenario.

B)The current Technical situation on the 4hs Chart:

-The price is facing a Resistance Zone

-Volume decreasing ( Weakness of the bullish movement)

-On the resistance zone, we can see a Pin bar on that area (reversal pattern)

-On the 15minutes chart, we can see divergence on the last movement that is making.

Based on this, we expect a bearish movement to start at any moment, if that happens we will be looking for short opportunities on the first Corrective structure out from the ascending trendline.

We will cancel this idea if the price keeps rising above the current Resistance zone.

Updates coming soon!

S&P 500 - Next Steps for 2019+Over the last 7 years, S&P 500 has respected EMA 200 + long term diagonal support; with very similar touch-points.

There is currently a challenging double top in the 295 area which might push the price down to consolidate between 257-295. The current channel is between 273-295 which if you want to profit, you would want to zoom-in a trade set-up with a lower time-frame.

If consolidation remains, this could be in danger zone as it approaches a very strong support with EMA 200 + long-term trend line which was just tested in December 2018.

Stochastic indicator also tell us good information about the trend confirmation of the movements:

-It remains over the 'Stoch' limits when the rally has been continuous

- Spikes down the limit with aggressive bound representing big support rejection

- Inside limit area: consolidation

A good approach with the stochastic , EMA and trend line would be the following:

- 295 break up + continuous 'stoch' above limit will definitely confirm another rally with 295 as resistance in case a fake break happens

- A break below 273 with 'stoch' inside limit areas might indicate a possible test of the biggest support: around 258 levels touching EMA 200 + trend line .

- Stochastic below the limit on this scenario could mean an aggressive sell-off and will have to see if it bounces on 258 + EMA 200 + trend line which could be a good buy opportunity with low stop loss.

This long-term strategy is currently in a neutral position, we would need to wait for channel confirmation. If you want to trade, you would need to go into a lower time frame.

Semana importante!Puede que el crash ya haya empezado! / Maybe the crash has already started!

Los últimos serán los primeros... / The last will be the first ...

Si corrige puede que lleguemos al nivel de los 2570 puntos. / If there is a correction, we may reach the 2570 points level.

Debería ser así por la clara divergencia entre el precio y el indicador RSI. / It should be that way because of the clear divergence between the price and the RSI indicator.

----------------------------------

Good luck!

"Top and Bottom Analysis" ES-MINI SP500 by ThinkingAntsOk4H CHART EXPLANATION:

Main Items we Observe on the Chart:

-Price broke out the bearish channel, starting a bullish movement.

-Currently, the price is inside a corrective structure and is trying to break out with low volume.

-The las support of the price is the middle trendline of the weekly ascending channel.

Based on this if the price breaks out below 2834.0 with close candlesticks we expect a continuation of the bearish movement towards 2730.00 paying attention to the middle support zone at 2793.00

MULTI TIMEFRAME VISION:

-Weekly :

-Daily:

SP500 "16 days of bearish movement" by ThinkingAntsOkOn today’s post, we are going to have a look over the last 16 days when the SP500 started a bearish movement. going from 2961,5 to 2799.0 (-5,44%)

- We can see that the bearish channel that works as the main trend was broken yesterday starting a corrective structure that now is facing a major resistance zone

- That zone is composed by the previous ascending trendline that was broken, we can expect a pullback to that area. And also in the zone, we have a resistance level.

- We expect the price to stay between the resistance level and the ascending trendline that was broken, we can see that volume is decreasing and recently a 4H pin bar was completed over this area.

- If the price consolidates there and we find reversal signals then we will be looking for Short setups on the breakout of the current corrective structure trendline.

- If price re-enters the ascending trendline and closes above that area, we will cancel our short vision over SP500.

This vision is just an Idilic concept on how e-mini sp500 can evolve, we will give an update on the situation when price and volume give us more information on how to proceed

WEEKLY VISION:

*Please note that the above perspective is our view on the market, We do not give signals and take no responsibility for your trades.

S&P500 - SHORT, SHORT, SHORTAMEX:SPY is a very strong short. I consider this a perfect setup with very little risk in terms of loss and probability.

Buy/Sell Signal:

SPY is the ETF of the S&P500, that's why I will look at SPY in my analysis. The S&P had a major run-up since the crisis in 2008. In recent months, it is struggling with among the 300 level. Since the beginning of 2018, the S&P broke multiple support levels and confirmed the lower green SupertrenD support channel. This channel was established in 2015 and predicted the low of December 2018. The recent run-up faces now the red SupertrenD resistance channel which established in the top of 2015. The fact that the current triple top of the S&P never reached the earlier established resistance channel is a strong indicator that the trend is going to be over soon. Another bearish signal is the zero slope of the MultiRSI which indicated a bearish cross in the near term future and the declining volume in the recent run. The trader can enter a short position right now. The Stop-Loss should be the 300 level and should be considered if the S&P established 300 as support or breaks through 300 with massive volume.

Targets:

The first target is the green support channel which will move up over time. The longer it takes to break down, the higher or target will be. Profits can be taken in between 255$ and 240$. If this is the start of a recession, then the next target will be lower. I will give further information for these targets once the short is playing out.

I hope this was helpful!

Best,

Felix Kewa

"Top and Bottom Analysis" S&P 500 (SPX) by ThinkingAnts4H CHART EXPLANATION

As we explained on the Daily/Weekly Analysis, price is on a Strong Bearish Zone, a confluence of:

-Daily Resistance zone (Possible Triple top).

-Wedge Pattern showing weakness of the Ascending movement.

-Pullback to the broken Daily Ascending Trendline .

-Bearish Divergence MACD .

We expect a Break out of the Ascending Wedge Pattern Below 2855.8 towards 2727.2.

If price makes this confirmation we will be looking for sell setups over the mentioned area, paying atention to the Middle support level betwen those points.

Updates comming soon!

MULTI TIMEFRAME VISION:

- Weekly

-Daily

S&P500: Buy opportunity on the 1D Higher Low.The index is trading within a 1D Channel Up that is currently on its Higher Low zone (RSI = 53.748, MACD = 22.840, Highs/Lows = 0.0000). The fundamental environment may be largely negative buy purely from a technical standpoint, the 2,780 - 2,790 is an optimal long opportunity. TP = 2,849.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

S&P 500 short to 2734 points SPX price forecast fall

S&P 500 index pretty much peaked on 2734 previous value.

Now, made new high in a form 2856 peak which is nothing but new high which will hardly be surpassed now.

Stoch RSI confirms bearish momentum and projected bearish crossover.

I personaly don't see these price ranges sustainable in this form on this price range and i would suggest selling a position on SPX.

After short to 2734, probably lower high will follow, but right after further drop is expected since this high price index has not a single mathematical justification for " existance" .

Yet, it present, true, but only temporarily so buyers/shareholders will feel safe after previous price crash occurred on November 15.th onwards.

Index value can be used in order to manipulate with it on lower levels, therefore, i m expecting new low after this short and lower high.

Gradual drop forms should occur as decribed on an idea on SPX posted :

Regardless price index is being pushed or holders might think they've missed a chance, my personaly advice is to sell position rather to hold and drop with your assets.

Mathematical price range of drop which will be achieved will be sub 1867 points on SPX which represents significant loss and massive pullback built in phazes :

*2400 points revisit (buyer will tell " it's a higher low, we should accept it" )

*2200 points (expecting massive volume, fire sell and spiking on precious metals) since " players" want to reinvest in something stable.

*1867 points (as third retrace stage) making full retrace on SPX index which should play out in October 2015th and January/February 2016 and instead droping from initial index value (1867) points, index has been pushed by 50% (up to 2723).

Good luck

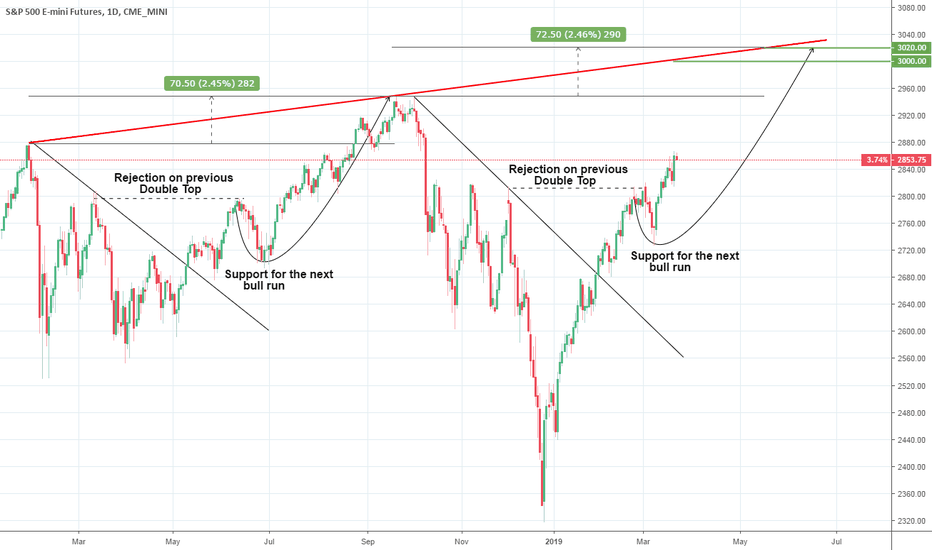

Is 3,000 realistic for S&P by mid 2019?Fundamentally the Fed made clear this week that it is as their outlook doesn't include any hikes for 2019.

From a technical perspective we also believe there is a strong possibility to see 3,000 by this summer. We see a similar pattern behavior to those of June/ July 2018, when the index was rejected on the previous Double Top but found the necessary Support to fuel the next bullish leg.

Similarly we had a Double Top rejection at the start of March but the price found again support and is already much higher than the rejection level. This has all the characteristics of the 2018 pattern and if the High to High rate continues (+2.45%), we can estimate the next (all time) High to be around 3,000.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

S&P500: Caution. First bearish signal detected.S&P500 has been on a very strong bullish trend since the bottom made in December. On 1D it entered a Channel Up (RSI = 65.879, MACD = 44.180, Highs/Lows = 4.6120) that recently approached overbought stochastic levels. The first bearish signal was the break of the Rising Wedge's supporting trend line that holds since the December bottom. If the 0.5000 Fibonacci retracement level breaks, it will be the first time on the 1D Channel Up pattern this will happen, as all the previous tests provided the necessary support for a new Higher High. If 2,765 breaks then we will most likely see a pull back on the 1W scale, testing the 0.382 retracement level at 2,624.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

S&P 500 - US Economy CrashingJust look at that chart. The S&P 500 peaking around 3000. The pair is heading for this region again with a number of strong weeks behind it, climbing it's

way to the 3000 area once again. Price stalled at 2940 region, just shy of 3000 and is charging back towards it now to retest. I am anticipating the price to hit 3000 or very close, and around this level the US economy will more than likely crash. The US Debt is at an all time high, trade deals etc and unemployment are not looking so bright either without going into detail.

I am anticipating that there will be a 40-60% drop in price in the S&P 500. 40% will take the price to around 1800, 50% down to 1500 and 60% down to 1200. If you take the time to look at the past market structure of the S&P 500, all of these are key levels from in the past, making them all perfectly attainable levels for the price to fall to in a bear market.

With Brexit and the US Economy looking bleak, I believe both economies will be heading south. This being said, gold will more than likely rise, as it usually always does when the economy is weak, golds strength grows and grows. As for crypto, all I will say is watch...

S&P Cyclical Sell signalThis is a cross factor comparison between the S&P500 and the Civilian Unemplyment Rate. The latter can be used as a benchmark to anticipate the long term cyclical behavior of SPX within its market cycles.

The conclusion is quite obvious. when the unemployment rate is low, a sell signal arises on SP500. When then unemployment rate is high, the index waves a buy flag. We are currently on a low unemployment/ sell signal cyclical phase.

S&P: Filling the Gap to 2800.The index is extending the very bullish medium term trade on the 1D Channel Up (RSI = 66.757, MACD = 33.440, Highs/Lows = 39.4506) having completely reversed the bearish bias of the recent correction since the December bottom. The next obvious target is the December 03 Gap fill (2,814). The sequence that is expected to be followed is of a similar fashion as that of mid January's. We continue to be long on S&P, this time with TP = 2,800.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.