MT Buy Opportunity LoadingCommodities have remained very cheap against the recent rise in Major World Indexes.

This includes iron ore.

And this cheapness can create opportunities in the iron and steel industry.

The price can get even cheaper.

The analysis does not contain a very high quality risk / reward ratio, but I think it is possible to make very profitable trades based on this idea in lower time frames.

Parameters

Risk/Reward Ratio : 1 / 1.68

Stop-Loss : 13.632

Goal : 20.43

Steel

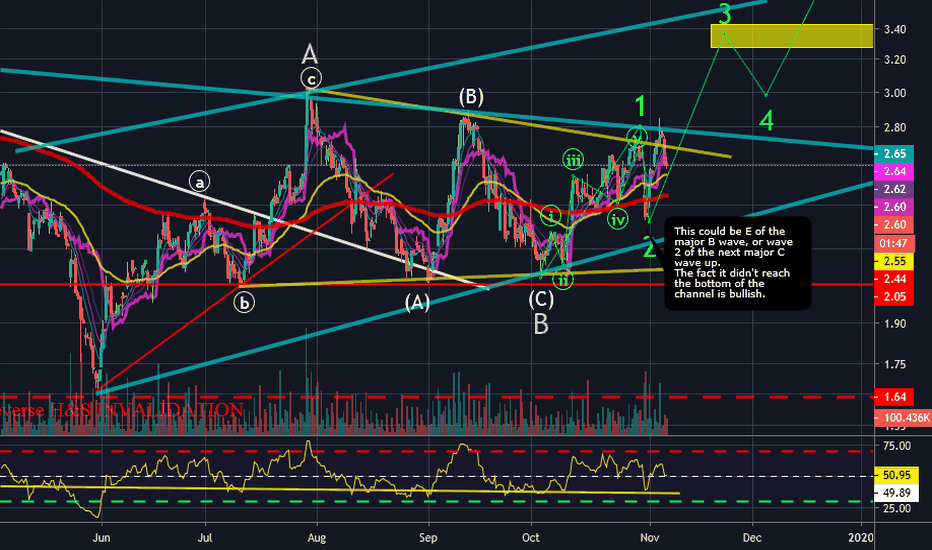

Correction Maybe FinishedWe were waiting for an abcde sideways move inside the larger B wave.

It looks like either the e wave ended short, or we could have just had an abc inside the B wave, which would mean this could be the next impulsive move up.

We could go long and set our stop loss to $2.30. If price can hold above 2.33, technically this is looking bullish now.

Business Cycle update - Not bottom yet Business cycle still points to more downside for steel prices and treasury yields

CLF JOINS S&P SMALLCAP 600 - SHORT SQUEEZE! As we've been posting, Cliffs is a turn-a-round play with a new organic HBI plant coming online within the 1st qtr of 2020.

After the market closed, news hit that the company will be added to the S&P SmallCap 600.

S&P would not list CLF before looking at the company and its financials. CLF is a solid play.

We figure fair market value is between $13 and $15 per share at current earnings, market cap, etc...

With over 100 million shares short, this could be the biggest short squeeze in a long time!

ADDING ANOTHER 2,000,000 SHARES IN THE MORNING BEFORE THE STOCK SPIKES

DISCLAIMER

This website and our posts are for general information only. No information, forward looking statements, or estimations presented herein represent any final determination on investment performance. While the information presented in this website and our posts has been researched and is thought to be reasonable and accurate, any investment is speculative in nature. StockKid, and/or our agents cannot and do not guarantee any rate of return or investment timeline based on the information presented herein.

By reading and reviewing the information contained in this website and our posts, the user acknowledges and agrees that StockKid, and/or our agents do not assume and hereby disclaim any liability to any party for any loss or damage caused by the use of the information contained herein, or errors or omissions in the information contained in this website or our posts, to make any investment decision, whether such errors or omissions result from negligence, accident or any other cause.

Investors are required to conduct their own investigations, analysis, due diligence, draw their own conclusions, and make their own decisions. Any areas concerning taxes or specific legal or technical questions should be referred to lawyers, accountants, consultants, brokers, or other professionals licensed, qualified or authorized to render such advice.

In no event shall StockKid, and/or our agents be liable to any party for any direct, indirect, special, incidental, or consequential damages of any kind whatsoever arising out of the use of this website, our posts or any information contained herein. StockKid, and/or our agents specifically disclaim any guarantees, including, but not limited to, stated or implied potential profits, rates of return, or investment timelines discussed or referred to herein.

US STEEL coiling up$x $aks US steel looks good-Potential for lower prices before it breaks above this descending pattern. I was bearish on X above 46. I didn't think it would come this far down but some special could be in the works.. It could go RIPPING higher but I would not blink if it dropped to 5 or 6 per share again. Bear chart from 2018:

CRAMER IS A FRAUD! SHORT SELLERS ARE PAYING HIM OFF! *** BUY ***ON JANUARY 11, 2019...CRAMER SAID THE FOLLOWING ABOUT CLEVELAND-CLIFFS...

Jim Cramer Gives His Opinion On Cleveland-Cliffs, SINA, Take-Two And More

Craig Jones , Benzinga Staff Writer

January 11, 2019 8:23am

On CNBC's "Mad Money Lightning Round", Jim Cramer said Cleveland-Cliffs Inc

CLF 4.52% is the best company in the show...

NOTHING HAS CHANGED SINCE CRAMER TOLD PEOPLE "CLIFFS IS THE BEST COMPANY IN THE SHOW...ACCEPT..CLIFFS PAID OFF SHORT TERM DEBT AND ISSUED AN OVER $100 MILLION SHARE BUYBACK ALONG WITH RECORD EARNINGS.

INSIDERS HAVE ALSO BEEN BUYING UP THE STOCK

FOLKS, READ CLIFFS LAST EARNINGS CALL / TRANSCRIPT..

CLIFFS RECENTLY PAID OFF SHORT TERM DEBT, THE COMPANY HAS NO DEBT COMING DUE FOR A GOOD 5 YEARS

SINCE JANUARY 11, CLEVELAND-CLIFFS HAS BEATEN EARNINGS EVERY QTR WITH NOTHING BUT POSITIVE CONFERENCE CALLS

THERE IS A HUGE SHORT POSITION IN CLIFFS AND IF THE STOCK SPIKES UP, THE SHORTS WILL LOSE HUNDREDS OF MILLIONS OF DOLLARS.

ON OCTOBER 19, 2018, Cleveland Cliffs CEO Lourenco Goncalves berated analysts and short sellers on his company's conference call.

TODAY, IRON ORE WAS UP OVER $3.50 TO $96.01...THERE IS NO SLOW DOWN OR SURPLUS FOR IRON ORE AND IT CONTINUES TO MAKE RECORD HIGHS

CLIFFS HAS ITS PRODUCT TIED INTO LONG TERM CONTRACTS AT VERY HIGH PRICES

WHEN CLIFFS WAS TRADING AROUND $78 YEARS AGO...IRON ORE WAS NO WHERE NEAR WHAT IT'S TRADING AT TODAY! CLIFFS IS MAKING MONEY HAND OVER FIST AT THESE RECORD HIGH PRICES

THE CEO SAID THERE IS NO SURPLUS AND HE SEES THE ROBUST DEMAND FOR HIS PELLETS CONTINUING INTO THE FUTURE WITH NO SLOW DOWN

SO...THE CEO HAS BEEN VERY OUT SPOKEN AGAINST THE DIRTY WALL STREET BROKERS AND SHORT SELLERS...AS USUAL, IT'S OK FOR DIRTY BROKERS, ANALYST AND SHORT SELLERS TO TALK NEGATIVE ABOUT A COMPANY BUT GOD FORBID THE CEO TALKS NEGATIVE ABOUT THEM. SAME OLD DIRTY GAME, ANOTHER CORRUPT WALL STREET DAY.

CRAMER IS A CROOK...HE PUMPS STOCKS TO BENEFIT HIMSELF AND HIS WALL STREET CRONIES.

ON 08/16/2019...JIM CRAMER WAS ALMOST CRYING AND SAID..."VIACOM CLASS A & B ARE BOTH TRADING LOWER AND IT IS DRIVING HIM CRAZY. HIS CHARITABLE TRUST OWNS VIACOM CLASS A."

WELL CRAMER...HOW DOES IT FEEL TO GET SLAMMED!

VIACOM DAILY CHART LOOKS LIKE THE COMPANY IS GOING BANKRUPT AND IT CONTINUES TO SINK!

YOU KNOW WHAT THEY SAY ABOUT PAYBACK RIGHT CRAMER?

CRAMER'S FRAUDULENT REMARKS ON CLEVELAND-CLIFFS TODAY WILL BRING HIM BAD CARMA INTO THE FUTURE AS YOU CAN ALREADY SEE, VIACOM IS GOING BANKRUPT!

DISCLAIMER

This website and our posts are for general information only. No information, forward looking statements, or estimations presented herein represent any final determination on investment performance. While the information presented in this website and our posts has been researched and is thought to be reasonable and accurate, any investment is speculative in nature. StockKid, and/or our agents cannot and do not guarantee any rate of return or investment timeline based on the information presented herein.

By reading and reviewing the information contained in this website and our posts, the user acknowledges and agrees that StockKid, and/or our agents do not assume and hereby disclaim any liability to any party for any loss or damage caused by the use of the information contained herein, or errors or omissions in the information contained in this website or our posts, to make any investment decision, whether such errors or omissions result from negligence, accident or any other cause.

Investors are required to conduct their own investigations, analysis, due diligence, draw their own conclusions, and make their own decisions. Any areas concerning taxes or specific legal or technical questions should be referred to lawyers, accountants, consultants, brokers, or other professionals licensed, qualified or authorized to render such advice.

In no event shall StockKid, and/or our agents be liable to any party for any direct, indirect, special, incidental, or consequential damages of any kind whatsoever arising out of the use of this website, our posts or any information contained herein. StockKid, and/or our agents specifically disclaim any guarantees, including, but not limited to, stated or implied potential profits, rates of return, or investment timelines discussed or referred to herein.

Trump the Great! (Or Not)Trump has been in Office for 921 days. He campaigned on bringing back old industries like steel and of course 'clean' coal. He lived up to his promises of lifting and removing thousands of environmental regulations and laws. So what are the results?

....................1/20/09 - 1/20/17..............1/20/09 - 7/30/11..............1/20/17 - 7/30/119 ..........

ETF .............. OB %chg after 8 Years..............OB Days in Office 921..............TR Days in Office 921

SLX .............. 55.58%............................144.79%............................-7.35%

KOL .............. 1.18%..............................281.81%...........................-2.80%

XLE .............. 69.18%..............................73.26%..........................-15.62%

TAN .............. -74.91%..............................-7.66%...........................63.31%

SPY .............. 181.42%...............................9.84%...........................32.63%

QQQ .............. 340.81%............................106.47%...........................57.23%

XHB .............. 218.83%.............................54.52%............................22.74%

Lessons to be taken. 1. Regulations can help keep smaller players out of your industry, thus reducing competition - Hence 'drill baby drill' not always a good thing.

2. No one believes or want our 'clean' coal. 3. The masses are smarter than the select elite few who deny climate change and are investing in solar.

AKS support and resistance, can it break through?looking where AKS might head next, may need to cool down a bit before pushing higher, but good earnings and momentum are on its side. needs to hurdle current levels and create a base here for me to want to go long, If you missed the run, wait for some consolidation at support and go long with a tight stop. GL

Turkish steel manufacturer will 4x your investment in 4 yearsDepressed Turkish Lira and the local economic indicators have been weighing in to the valuation of this fundamentally solid company. I recommend buying and holding this stock at this level in (USD terms) and holding it for at least 4 years. It will pay off if you have the tolerance to be patient.

Steel Stocks Ready to RumbleCup and Handle Patterns on all the major players and the ETF. Bullish pattern

TX LongTX, Ternium S.A. Steel company. I believe a short term bounce is imminent given the strong balance sheet and income statement. On top this company pays good dividend, which would make it highly lucrative for longterm and income oriented investors. However, TX is not as liquid relative to other big mining companies, thus sharp price movements occur frequently. I feel selling is over done even though stock is still in the down trend channel. With upcoming qe and fiscas stimulus in China, demand for steel may pick up in near future. Furthermore, there is a widening divergence between steel and iron ore prices. I believe this divergence has to close in time, as iron ore is the primary component of steel.I believe there will be a strong support with +-5% but has a good upside.

Business Cycle update - Still more downside for Steel and RatesBusiness cycle still points to more downside in steel prices and treasury rates. Recent declines are too fast and such fast declines are usually followed by some bounce/consolidation before more downside.

(2X-3X) $NCS Already showing signs for reversal? This could setup to be a big 2x or 3x move coming. $NCS is a metal building company and owns lots of components and products used by other companies. They had a big merger and are re-branding to Cornerstone. This will be huge for the company, and with steel prices looking to rebound a reversal is setting up nicely. Also, weekly bullish divergence is occurring (see previous chart).

Don't get in a Pickle!

$NCS Potential Head and Shoulders Bottoming Play? 2x Possible Your main pickle here fellow traders. I believe a clear trade setup is here. Merger with Ply Gem might let this one take off. Green lines are/were uptrend channels, red for downtrend. Brighter colors for more recent/relevant ideas. Setup as follows:

Entry below ~$7.00

Exit between ~$15.00-$16.00 - possible taking profits at other levels on the way up (i.e. $10, $12, $14, etc.).

Stop loss ~$6.00

Happy trading, don't get in a pickle!

The Shill Pickle

5 MILLION SHARES, BUYOUT / GOING PRIVATE. VALUE PLAY, STRONG BUYWe have been in and out of Cliffs for a while.

Recently, the stock again popped up on our scanner.

Cliffs is the oldest iron ore company founded in 1847

We did hear a rumor of a possible buyout / merger and even the potential for the company to go Private. If either of these rumors pan out, we think the stock is worth at minimum, $20 all day long!

Currently the stock is trading at an extreme discount to the industry. In fact, J.P. Morgan just raised the price target to $17.00 due to the high demand for Cliffs Iron Ore.

The stock should be trading around $15.00 right now and upwards of $18 to $20 after the next earnings report.

At current levels, Cliffs is a GIFT!

We are currently only holding CLIFFS and 4 other positions. Everything else we've posted and sold has produced us great returns.

Our track record within TradingView speaks loud and clear!

Position: 5 Million Shares

Average Cost: $9.75

LONG

EVR Pushing the ATH.EVRAZ is pushing its ATH- which was last years YR3. As can be expected there are some signs of profit taking at this level but shares are being bought up immediately and if this continues EVR will break its ATH into clear skies. 603 is the YR1 pivot. Looking at last year there was a major pullback each time EVR reached a yearly pivot so waiting for a weekly close above, or buying the pullback is the move.

Volume profile shows a double distribution with the POC at 376, however value is consistently building higher into a positive skew to support the bullish thesis, with the POC for the broadening formation at 535.

Fundamentals are excellent, as is the dividend. Stockopedia 99/99.

Business cycle points to weakness in EM equitiesSlowing business cycle also points to further weakness in EM equities until end of 2019 or steel prices turn higher.

SPX may be more resilient but upside should be limited.

IF EM equities will be under pressure, it is likely that DXY will be strong in the coming months.

SHORT EEM bounces. Be cautious on SPX