StakeStone, Falling Wedge & Easy 205% Profits PotentialIs it too early? It is never too early to be early. StakeStone started trading in early May, less than two months ago. The chart is young but the pattern is old; a perfect falling wedge.

There is a low 22-June and many pairs ended their correction on this exact day. StakeStoke broke out of the falling wedge pattern, based on an internal trendline, so there is already some signals favoring an up-move next.

Predicting the next move is not hard, up. What is harder is the timing, how long will it take for STOUSDT to start an upsurge? It is very close. It is so close now that I can say within days, or, I can also say that it is already growing because a low happened on the 22nd, but to say this we need confirmation.

The confirmation comes when prices move above 0.0750 and beyond.

This is a good chart. Very low risk with a high potential for reward. It is a good chart but remember that there is always risk involved. Market conditions can change, prices move down rather than up. If this happens, just wait patiently because a reversal is very close. This is only a warning, we are 100% bullish.

Thanks a lot for your support.

Namaste.

STO

POLYMESH $POLYX As you know I've been interested in fractals for a long time and recently I've been interested in fractals projects after the initial listing, I saw this project which at first glance seemed new to me, but it's not, it's Polymath which rebranded and decided to develop in the same direction of securitization of the market, but more ambitiously launched its blockchain and got a Swiss license.

Post about RWA

Frankly speaking, I have been following the direction of securitization since 2017 and always saw prospects in it (securitization tokens, exchanges for securitization tokens, STO) but there were a lot of problems, because before only credited investors could trade on special platforms, etc. By 2024 the market gave a little progress now everyone is talking about the RWA (real world asset) acceleration. Post about RWA

In which I also see the future.

this is the coinmarketcap for such assets - just look at it.

stomarket.com

Back to the POLYMESH project, they say they will be trading tokenized assets (RWAs) on their blockchain and there is a lot of promise here if they do indeed tokenize assets

They are in the process of transitioning from POLY to POLYX.

Speaking of fractals, I've shown above the chart the POLYGON fractal when it all started. What you see the big green candles up is buying at 177M capitalization.

This is a high risk investment, do your research, post your opinion in the comments.

Best Regards EXCAVO

I see nothing good here... There is literally nothing good seeing #Euro and #USD reaching parity.

Clearly, and despite the roughly same volume at each top, the 6-year-double top is no joke. Especially considering the fact that its fueling the violation of a major round-numbered multi-year support right at this moment.

Most probably if not sure, Due to the fact that it takes longer to build than to tear down, #EURUSD will trade between 0.80-0.90 before Dec22 pushing the market into a (deeper) recession and inflation will hit harder this time.

XTZ on the next Bitcoin $250k Peak with three possible pricesXtz on three possible price points going into the next Bitcoin Bull Run 2023. Keep in mind Tezos is a baby platform but with a massive war chest of over $600 million from their ICO. They are a likely candidate like Cardano to displace Ethereum as the number two in crypto rankings. Tezos has brilliant coders/programmers and tackling the STO market which will be a massive shift from conventional Wall Street markets. This is a gem waiting to explode. The three price targets I have her are between $250.00 up to $2,500.00. Please keep in mind that this is only my opinion and I am basing this on the current trendline trajectory that is apparent on this three-year chart.

EUR/CHF🇪🇺 🇨🇭 to RISE and test the 1.07344 level.EUR/CHF🇪🇺 🇨🇭 is rising in the Upward and we see that the price is coming back to the channel. According tot he bullish cross of 25&50 ma , ROC 6 swing an crossover of the Stochastic the price is going to test the 1.07344 level.

If you like the idea PLEASE don't forget to hit the LIKE 👍👍👍button

Also share your thoughts and charts here in the comment ⌨️ section.

ICON is primed to make HUGE gains - over 2500% GAINSIcon is one of the gem many has yet to realise. This is the Korean ETHEREUM. Icon is the only one that is worth mentioning in KOREAN market as of now. LITERALLY can own 50% of Korean market when this matures as Icon is already working with huge enterprises and Korean governments now.

One reason i say this is because it is building an STO platform. this platform enables publicly listed or even SME companies (ANYONE) to join Icon network to launch tokenisation services.

And STO reminds us of ICO. what ICO helped ETHEREUM make 10000% gains.

So in long term outlook, icon can do this gains, and a wider and more regulated light.

Right now, Icon development for STO token standard is completed.

We are only waiting on STO smart contract(stabilization stage) and official STO platform in ICONest 2.0 (in development).

31st May 2020 is their next update on development. Of course STO is the only thing im mentioning here, Icon has also recently partnered LCX, which is an STO platform regulated and partnered with World Economic Forum! This is a hint for you guys.

What the chart means?

This means, every $1000 invested into ICX can potentially make you $25000. or 25X your Bitcoin holdings.

MACD in Long term is looking BULLISH! and you know when weekly shows bullish, icon can jump up to the sky. If you are not a trader and long term holder, this is def a good one to get on IMO. 100 million Market Cap for ICON is just a dream. this can go up beyond 10Billion in a bull run

This is just being conservative when it reaches near ATH of last bull run, and we know once bull run started, prices goes crazy up. and another 100x from here is not unachievable. which means every $1000 into ICX can make you $100000.

This is also under a hedge fund manager Buy Up to list of $5 currently and in a bull run its going up and beyond. Current price is only a small 0.30 cents. an easy 10X SHORT term. The chart drawn can happen sooner if development and partners start using ICON Platform. a true gem to watch for.

This is just my opinion. DYOR

OWN lauching STO's in April May and June,, Retraced to 0.618 fib,.. Make or brake situation at this point. RSI looking good with no bearish signs.

Stochastic momentum should shift north,,

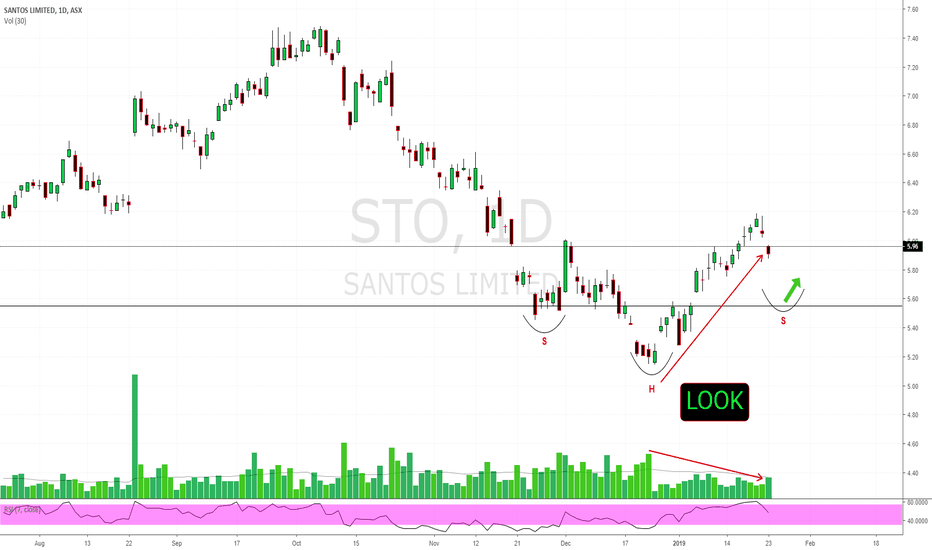

Long Statoil oversold / +200smawww.tradingview.com

Stock is oversold and ready to reverse. Statoil got good volume and market cap. Target is floating stop/loss = 0.5

Ride this baby to the moon, or jump off if it's out off fuel and reaches the stop-loss.

US OIl WTI CLK7May Oil contract rolls Apr 20. Expect a gap!

Open Interest is currently 2.22m (Mar 28 CFTC Reports)

Time Line: Mar 28, Mar 21, Mar 14, Mar 7, Feb 28

K (000's)

Producer Longs: 410, 416, 402, 342, 323

Prdcr Shorts: 663, 678, 674, 663, 661

Prdcr Net: 253, 262, 272, 321, 338

Money Manager Longs: 345, 361, 384, 418, 429, 449

MM Shorts: 135, 128, 129, 61, 61, 44

MM Net: 210, 233, 255, 357, 368, 405

The tables suggest both producers and MM's have reduced their May positions around March 7+

They have rolled forward - longer months have risen and increased :=+40 pts

The OI is total all months out to 2021. Current month (May) is 586k

My chart says this contract is still long.

My Weekly chart says old Support now Resistance was circa $53 and my rising channel base is circa $51.

The ellipse at $52 is possible as there is minimal resistance in front of us to $53.30

In any event this contract only has about 12 Trading Days tops before I move to Jul (N) which is circa 80 pts+ on May.

So $2.00 (4%) in <12 days

CLK17 WTI Weekly FuturesFeb 13 19:30 AEDT

CL WTI May Weekly Update

Consolidation and Seller Absorption Bars!.

Buy Area -sub $54.20 down to $54.00

(I don't think it will make $53.50)

Good Support at $53.10/20 (buy a few wells at that price)

Struggling with the T-Line at the moment,

but the 55 SMA is sweeping up nicely for added future support.

Text book Dow with a break out; higher highs / higher lows

and it appears to be now re-testing the breakout.

Looking at the big picture this really look like a bull trap flag, but the arithmetic doesn't work,

so I am bullish until it breaks below $53 then it could free fall back to $46 coz there is nothing

to stop it, then break below and back to double bottom at $37.

But right now I am with the CoT and Long with a tgt expectation of those upper body gaps.

Remember you are Adults and this is only my opinion, not a guarantee

... and just my 2c worth