Microsoft’s Big Moves This Quarter | From Activision to AI AgentMicrosoft’s Revenue Surge: The Power of AI, Gaming, and Strategic Investments

Microsoft has released its Q1 FY25 earnings for the quarter ending in September

The stock saw a 6% drop, indicating the results fell short of investors' high hopes. Trading at over 30 times projected earnings for next year, expectations for Microsoft were significant.

CEO Satya Nadella stated

“Our AI business is set to exceed an annual revenue run rate of $10 billion next quarter, making it the fastest business in our history to reach this milestone.”

This means that AI will soon account for about 4% of Microsoft's total revenue in under three years a remarkable feat for a global giant.

If you need a quick summary, here are three main points:

1. ☁️ Azure’s growth is slowing. As Microsoft’s key player in the AI competition, Azure grew 34%, down slightly from 35% in the prior quarter (after adjustments). This comes as Google Cloud raised the bar, with its growth accelerating from 29% to 35% during the same period.

2. 🤖 AI growth is limited by hardware supply, as capacity struggles to meet demand. Data center expansion is a long-term process, and Microsoft is investing heavily in infrastructure, aiming for a growth boost by 2025.

3. 👨👩👧👦 Consumer-focused products like Gaming and Devices are underperforming. Although not essential to Microsoft's core business, their poor performance has impacted overall results.

Here’s a breakdown of the insights from the quarter.

Overview of today’s insights:

- New segmentation.

- Microsoft’s Q1 FY25 overview.

- Key earnings call highlights.

- Future areas to monitor.

1. New Segmentation

Revised Business Segments

In August, Microsoft announced a reorganization of its business segments, effective this quarter. The purpose? To better align financial reporting with the current business structure and strategic management.

Summary of the main changes

- Microsoft 365 Commercial revenue consolidation: All M365 commercial revenue, including mobility and security services, now falls under the Productivity and Business Processes segment.

-Copilot Pro revenue shift: Revenue from the Copilot Pro tool was moved from Productivity and Business Processes to the More Personal Computing segment under Search and news advertising.

-Nuance Enterprise reallocation: Revenue from Nuance, previously part of Intelligent Cloud, is now included in Productivity and Business Processes.

-Windows and Devices reporting combination: Microsoft now reports Windows and Devices revenue together.

Impact of These Changes:

Core Segments Overview:

In summary:

- The Productivity and Business Processes segment has grown significantly.

- The Intelligent Cloud segment has decreased due to the reallocation of Nuance and other revenue.

Products and Services Overview:

- M365 Commercial now includes Nuance, shifted from the Server products category, along with integrated mobility and security services.

- Windows & Devices have been merged into a single, slower-growth category.

Additional Insights:

- Azure, Microsoft's cloud platform, is reported within 'Server products and cloud services.' Although its growth rate is shared by management, exact revenue figures remain undisclosed.

Azure’s past growth figures have been adjusted for consistency, with the last quarter’s constant currency growth recast from 30% to 35%, setting a higher benchmark. Tracking these metrics is challenging due to limited revenue disclosure, but this recast indicates Azure's raised growth expectations.

2. Microsoft’s Q1 FY25 Performance

Financial Summary:

-Revenue: Up 16% year-over-year, reaching $65.6 billion (exceeding estimates by $1 billion). Post-Activision Blizzard acquisition in October 2023, the growth was 13% excluding the merger.

New Product and Services Segmentation Results

- Server products & cloud services: $22.2 billion (+23% Y/Y).

- M365 Commercial: $20.4 billion (+13% Y/Y).

- Gaming: $5.6 billion (+43% Y/Y), influenced by Activision.

- Windows & Devices: $4.3 billion (flat Y/Y).

- LinkedIn: $4.3 billion (+10% Y/Y).

- Search & news advertising: $3.2 billion (+7% Y/Y).

- Enterprise & partner services: $1.9 billion (flat Y/Y).

- Dynamics: $1.8 billion (+14% Y/Y).

- M365 Consumer products: $1.7 billion (+5% Y/Y).

Core Business Segments Breakdown:

- Productivity and Business Processes: Increased 12% Y/Y to $28.3 billion, supported by M365 Commercial, especially Copilot adoption.

- Intelligent Cloud: Grew 20% Y/Y to $24.1 billion, with Azure AI driving growth.

- More Personal Computing: Grew 17% Y/Y to $13.2 billion, including a 15-point boost from Activision. Devices fell, but search and ad performance improved under new segmentation.

Key Observations:

- Microsoft Cloud revenue climbed 22% Y/Y to $39 billion, making up 59% of total revenue (+3 percentage points Y/Y).

- Azure continues to drive cloud services and server products' growth.

- Xbox growth has surged due to the Activision acquisition since Q2 FY24, expected to stabilize by Q2 FY25.

- Windows OEM and devices combined, showing a 2% decline in Q1 FY25.

- Office rebranded to Microsoft 365; updated naming will be used starting next quarter.

- Margins: Gross margin at 69% (down 2pp Y/Y, 1pp Q/Q); operating margin at 47% (down 1pp Y/Y, up 4pp Q/Q).

- EPS: Increased 10% to $3.30, beating by $0.19.

Cash Flow and Balance Sheet:

- Operating cash flow: $34 billion (52% margin, down 2pp Y/Y).

- Cash**: $78 billion; Long-term debt**: $43 billion.

Q2 FY25 Outlook:

- Productivity and Business Processes: Anticipated 10%-11% Y/Y growth, steady due to M365, Copilot inclusion, and expected LinkedIn growth of ~10%. Dynamics set to grow mid-to-high teens.

- Intelligent Cloud: Projected 18%-20% Y/Y growth, slightly slowing, with Azure growth expected between 28%-29%.

- More Personal Computing: Forecasted ~$14 billion revenue, declines in Windows, Devices, and Gaming anticipated, with some offset from Copilot Pro.

Main Takeaways:

- Azure's growth slowed to 34% Y/Y in constant currency, with AI services contributing 12pp, up from 11pp last quarter. This marks a dip from the recast 35% prior and included an accounting boost.

- Capacity limitations in AI persist; more infrastructure investments are planned, with reacceleration expected in H2 FY25.

- Commercial performance obligations grew 21% to $259 billion, up from 20% in Q4.

- Margins were pressured by AI infrastructure investments; Activision reduced the operating margin by 2 points.

- Capital expenditures increased by 50% to $15 billion, half dedicated to infrastructure, with further Capex growth expected.

- Shareholder returns included $9.0 billion through buybacks and dividends, matching Q4 repurchases.

Earnings Call Highlights:

Azure AI saw a doubling of usage over six months, positioning it as a foundation for services like Cosmos DB and SQL DB. Microsoft Fabric adoption grew 14% sequentially, signaling rapid uptake.

AI Expansion: GitHub Copilot enterprise use surged 55% Q/Q, with AI-powered capabilities used by nearly 600,000 organizations, a 4x increase Y/Y.

M365 Copilot has achieved a 70% adoption rate among Fortune 500 companies and continues to grow rapidly.

LinkedIn saw accelerated growth in markets like India and Brazil and a 6x quarterly increase in video views, aligning with broader social media trends.

Search and Gaming: Bing’s revenue growth surpassed the market, while Game Pass hit a new revenue record, propelled by Black Ops 6

Capital Expenditures: CFO Amy Hood highlighted that half of cloud and AI investments are for long-term infrastructure, positioning the company for sustained growth.

4. Future Outlook

Energy Needs: Microsoft, facing higher power demands, plans to revive a reactor at Three Mile Island with Constellation Energy by 2028 to power its AI data centers sustainably.

Autonomous AI Agents: Coming in November, these agents will perform tasks with minimal human input, enhancing efficiency. Copilot Studio will allow businesses to customize these agents, with 10 pre-built options to start.

Industry Impact: Salesforce has launched Agentforce, signaling increased competition. CEO Mark Benioff recently compared Microsoft’s Copilot to the nostalgic Clippy, stoking rivalry.

For further analysis stay tuned

Stockpicks

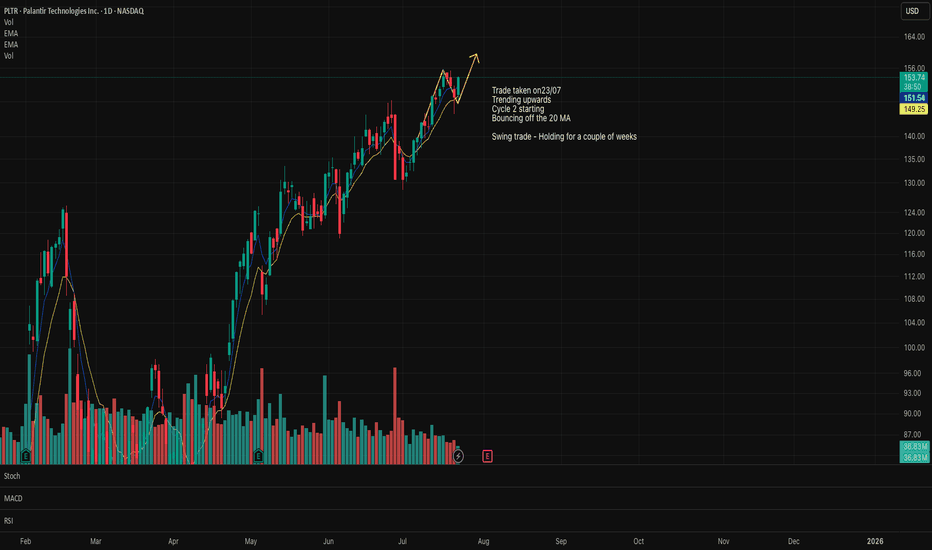

PLTR moving higherPLTR expected to move higher.

The price is bouncing off the 20MA and respecting it.

Making new higher/highs and higher lows.

Earnings is due shortly, which could have a negative impact to the price.

However, the long term outlook for the company is still strong.

Anyone else have thoughts on this stock?

ADM 1D: 10-Month Channel Says Goodbye?Since July 18, 2024, ADM had been locked in a clean downward channel — well-behaved, well-respected. But in May 2025, the structure finally cracked: price broke out, crossed above the 50-day MA, and pulled back for a textbook retest right on the channel’s upper edge. So far, the breakout is holding. The next targets sit at 50.6 (0.618), 53.5 (0.5), and 56.5 (0.382). As long as price stays outside the channel, the bullish structure remains intact.

Connor’s RSI down below is quietly doing its job — already bounced from deep oversold, now curling up with momentum. It’s not flashy, but in this context it signals early strength before the crowd notices.

Fundamentally, ADM is still cleaning up after the early-2024 accounting scandal that nuked investor trust. But management moved fast: reinstated buybacks, tightened guidance, and Q1 2025 came in strong — $22.6B revenue, $0.88 EPS, both beating expectations. ADM remains a pillar of the U.S. ag sector, and in an era of global food anxiety, that means structural demand isn’t going anywhere.

Вот адаптированный перевод финального блока под **английский пост**, в том же живом и профессиональном стиле:

Enjoyed the idea? Like, share, and drop your thoughts in the comments.

It helps keep the content visible, free, and accessible to everyone.

Got your own charts or takes? Let’s discuss them below.

Berkshire Hathaway | No More Apple Pie & Bank Bread!No More Apple Pie and Bank Bread | Buffett’s Recipe for Market Caution

Berkshire Hathaway has recently disclosed its earnings amid fluctuating around a $1 trillion valuation. A notable update is its continued reduction of stakes in overvalued assets, including a 20% decrease in holdings of Apple and Bank of America, boosting its cash reserves to $325 billion

Although Warren Buffett himself isn't favoring share buybacks at present, Berkshire Hathaway stands as a compelling investment option

Why Berkshire Hathaway's $325 Billion Cash Pile Signals Market Caution

The company's net earnings remain subject to significant fluctuations due to rules requiring valuation changes of investment holdings. However, there was a slight decline in operating earnings, mainly driven by lower insurance underwriting income. Despite this, that segment is historically volatile, and year over year aka YoY, the company has maintained strong performance.

Yea2date aka YTD, operating earnings have risen over 10%, totaling just under $33 billion compared to just below $29 billion last year. This points to an annualized earnings estimate of approximately $44 billion, implying a price2earnings aka P/E ratio of about 22, without factoring in over $320 billion in cash and significant investment holdings.

Excluding cash and investments, the adjusted P/E ratio is closer to single digits. Share buybacks have paused, reflected in a ~1% decrease in the outstanding shares YoY, signaling Berkshire's assessment of current market valuations.

Segment Highlights

The various business units within Berkshire Hathaway showcase its robust asset base and earning capacity. Insurance underwriting income saw a sharp YoY drop, but other business areas performed strongly. Income from insurance investments remained solid, and BNSF, its railroad subsidiary, also showed strong results despite a double digit YoY decline.

Berkshire Hathaway Energy continues its growth, cementing its position in the utility sector with significant renewable energy ventures. For context, NextEra Energy (NEE), with a market capitalization of $160 billion, posted quarterly earnings around 10% higher.

Berkshire's other controlled and non-controlled businesses contribute over $13 billion annually, underpinning its diversification and consistent earnings performance. This strength across segments underscores its formidable financial health.

Market Context

Currently, market valuations are elevated by historical standards.

Excluding periods of earnings dips, market enthusiasm is exceptionally high, with the S&P 500 P/E ratio nearing 30x, approaching levels last seen in 1999. Buffett and Berkshire appear to view a 3% yield from such a P/E as unattractive, especially when bonds offer higher returns.

The 2008 Playbook

Berkshire's track record of effectively utilizing its cash reserves is notable. Excluding its insurance float, the company still holds $150 billion in cash.

During the 2008 financial crisis, Berkshire leveraged its liquidity for strategic investments in companies like General Electric, Swiss Re, Dow Chemical, and Bank of America, as well as finalizing the full acquisition of BNSF in 2010. This proactive use of capital proved advantageous.

The current strategic sale of assets suggests Berkshire is preparing for potential market downturns. Given high S&P 500 valuations, reallocating part of an S&P 500 position into Berkshire Hathaway could be wise, ensuring exposure to a cash-rich portfolio capable of seizing future opportunities. Meanwhile, Berkshire’s earnings are valued lower than the broader market, potentially minimizing major downturn risks.

Investment Risks

A key risk is that timing the market is inherently challenging, with the adage "time in the market beats timing the market" serving as a caution. If Berkshire's market outlook is incorrect, its $300+ billion in cash could underperform while broader markets remain strong, which would diminish its appeal as an investment.

Final Thoughts

Berkshire Hathaway has taken the bold step of liquidating some of its most significant and priciest holdings, opting to incur capital gains taxes to increase liquidity. This move has bolstered its cash position to $325 billion, $150 billion above its float level. Meanwhile, its strong operational businesses continue generating healthy cash flow.

Drawing on its successful strategies during the 2008 crisis, Berkshire appears to be positioning itself for another downturn amid current high market valuations. We advise investors to consider shifting part of their S&P 500 exposure into Berkshire Hathaway for enhanced diversification and potential benefits in a market correction, long story short Berkshire Hathaway remains a robust investment opportunity but wont make millionaire!

What do you think moonypto fam?

IAG Stock Took some heat! Is there anything to take here?🟢SeekingPips🟢 has this on the radar.

⭐️ Have your levels ready and wait for your A+⭐️ Setup.

ℹ️ Our levels are here marked out.

I have ZERO interest in taking a position here however a deeper sell-off and I will start paying attention.❗️

⚠️ ALERTS set and LEVELS marked.

🟢Now go away and ENJOY your WEEKEND and lets HURRY UP AND WAIT and lets see what NEXT WEEK has for us👍

$DG: Dollar General – Discount Dynamo or Bargain Bust?(1/9)

Good afternoon, folks! ☀️ NYSE:DG : Dollar General – Discount Dynamo or Bargain Bust?

NYSE:DG ’s at $82, riding a rocky retail road! Is this budget king stacking cash or just scraping by? Let’s rummage through the bins! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 82

• Recent Moves: Down 0.78% from Mar 7 close, per web data 📏

• Sector Vibe: Retail shaky, but discounts hold appeal 🌟

It’s a bumpy ride with a bargain twist! 🚛

(3/9) – MARKET POSITION 📈

• Market Cap: ~$18B (219.93M shares) 🏆

• Operations: 20,000+ stores, rural retail champ ⏰

• Trend: X posts hint at turnaround hopes 🎯

Tough, but planted firm in small towns! 🏡

(4/9) – KEY DEVELOPMENTS 🔑

• Analyst Takes: Bernstein’s $90 PT, per X 🔄

• Store Push: 575 new stores planned for 2025 🌍

• Market Mood: Mixed—soft sales vs. value focus 📋

Chugging along, eyes on the prize! 💪

(5/9) – RISKS IN FOCUS ⚠️

• Consumer Woes: Low-income pressure, per X 🔍

• Competition: Walmart, Dollar Tree crowding in 📉

• Margins: Profit dips spook, per web data ❄️

Risks stalk like aisle lurkers! 🕵️

(6/9) – SWOT: STRENGTHS 💪

• Scale: 20,000+ stores, rural reach 🥇

• Value Play: Budget shoppers’ haven 📊

• Growth: New store spree in 2025 🔧

A lean, mean discount machine! 🛒

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Margin squeeze, soft sales 📉

• Opportunities: Reinvestment, consumer shift 📈

Can it turn pennies into profit? 🤔

(8/9) – 📢DG at $82, retail’s rough—your guess? 🗳️

• Bullish: $95+ soon, value shines 🐂

• Neutral: Flatline, risks weigh ⚖️

• Bearish: $70 crash, margins fade 🐻

Cast your lot below! 👇

(9/9) – FINAL TAKEAWAY 🎯

DG’s $82 stance shows grit 📈, but retail’s a grindstone 🌾. Volatility’s our sidekick—dips are DCA gems 💰. Snap ‘em up, rise steady! Paydirt or pyrite?

$AVGO: Broadcom – AI Chip Powerhouse or Tariff Tightrope?(1/9)

Good morning, crew! ☀️ NASDAQ:AVGO : Broadcom – AI Chip Powerhouse or Tariff Tightrope?

With NASDAQ:AVGO at $194.94 after a Q1 earnings slam dunk, is this semiconductor star riding the AI wave to glory or teetering on trade war woes? Let’s unpack the circuits! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 194.94 as of Mar 10, 2025 💰

• Q1 2025: Revenue $14.92B (up 23% YoY), EPS $1.60 📏

• Movement: Up 10% post-earnings Mar 6, +8.6% Mar 7 🌟

It’s buzzing like a chip factory on overdrive! ⚡

(3/9) – MARKET POSITION 📈

• Market Cap: ~$93.5B (151.62M shares) 🏆

• Operations: AI chips, software solutions ⏰

• Trend: 42% of 2024 revenue from software, per web data 🎯

A heavyweight in the AI silicon ring! 🌐

(4/9) – KEY DEVELOPMENTS 🔑

• Earnings: Q1 beat with $14.92B, Q2 forecast tops estimates 🔄

• AI Boom: Custom chips fuel hyperscaler demand 🌍

• Sentiment: Shares rallied, per Mar 6-7 posts 📋

Thriving, wired for the future! 💡

(5/9) – RISKS IN FOCUS ⚠️

• Tariffs: Trade uncertainties loom, per web reports 🔍

• Competition: Nvidia, Marvell in the race 📉

• Valuation: Premium pricing raises eyebrows ❄️

High stakes, but risks are on the radar! 🕵️

(6/9) – SWOT: STRENGTHS 💪

• Q1 Win: $14.92B revenue, EPS $1.60 beat 🥇

• AI Edge: 77% AI revenue growth in Q1 📊

• Forecast: Q2 sales outlook shines 🔧

Powered up for the AI era! 🔋

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Tariff risks, high valuation 📉

• Opportunities: 18% earnings growth projected 📈

Can it outrun trade clouds and soar? 🤔

(8/9) – 📢Broadcom at $194.94, AI chips sizzling—your vibe? 🗳️

• Bullish: $220+ by June, AI rules 🐂

• Neutral: Stable, tariffs balance ⚖️

• Bearish: $170 slide, risks bite 🐻

Drop your pick below! 👇

(9/9) – FINAL TAKEAWAY 🎯

Broadcom’s $14.92B Q1 haul screams AI strength 📈, but tariff shadows hover 🌫️. Volatility’s our sidekick—dips are DCA dynamite 💰. Snap ‘em up, ride the surge! Goldmine or gamble?

$NIFTY: Nifty 50 – India’s Market Meltdown or Hidden Gem?(1/9)

Good Morning, folks! ☀️ NSE:NIFTY : Nifty 50 – India’s Market Meltdown or Hidden Gem?

Gift Nifty’s at 22,555, down 65 points, and the index is off 13% since October 2024! Is this a crash landing or a golden ticket in disguise? Let’s unpack the chaos! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Gift Nifty: 22,555, down 65 points (Mar 6, 2025) 💰

• Recent Trend: 13% drop from Oct 2024 highs 📏

• Sector Mood: Autos, real estate dragging, per web reports 🌩️

It’s a bumpy ride, but bargains might be brewing! 🔧

(3/9) – MARKET POSITION 📈

• Index Weight: 50 top Indian firms, 65% of NSE market cap 🏅

• Scope: Spans 13 sectors, from banks to tech ⏳

• Trend: Bearish streak persists, down 13% since Oct 🎯

Still a heavyweight, but feeling the squeeze! 🌐

(4/9) – KEY DEVELOPMENTS 🔑

• Earnings Slowdown: Growth at 5%, down from 20%+ 🔄

• Macro Woes: U.S. tariffs, trade tensions spook investors 🌍

• Market Vibe: Gift Nifty signals a sour start 📋

Tough times, but sectors might shine through! 💡

(5/9) – RISKS IN FOCUS ⚡

• Geopolitics: U.S. tariff threats hit exports 🔍

• Sector Slump: Autos, real estate under pressure 📉

• Volatility: Bearish trend grips tight 🌪️

Rough waters ahead, but storms pass! 🛡️

(6/9) – SWOT: STRENGTHS 💪

• Diversity: 13 sectors, broad economic play 🏆

• Scale: Tracks India’s biggest players 📈

• Value: Potentially undervalued, per web buzz 🔩

A battered champ with fight left! 💼

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: 5% earnings growth, macro drag 📉

• Opportunities: Sector plays in banks, tech shine 📈

Can it dodge the punches and rally? 🤔

(8/9) – 📢Nifty at 22,555 (Gift), down 13%—your call? 🗳️

• Bullish: $24K soon, undervalued steal 🦬

• Neutral: Flatline, risks offset ⚖️

• Bearish: $20K next, bears rule 🐻

Vote below! 👇

(9/9) – FINAL TAKEAWAY 🎯

Nifty’s 13% slide and $116 Gift price signal trouble 📉, but undervalued sectors tease upside 🌱. Volatility’s our mate—dips are DCA fuel 🔥. Buy low, aim high! Hit or miss?

$MRNA: Moderna – mRNA Magic or Biotech Bubble?(1/9)

Good afternoon, folks! ☀️ NASDAQ:MRNA : Moderna – mRNA Magic or Biotech Bubble?

CEO drops $5M on shares, sparking a 9% surge—is this a biotech rocket or a hot air balloon ready to pop? Let’s crack the code! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Trend: Up 9% after CEO’s $5M buy on Mar 5, 2025 💰

• Context: Biotech’s a rollercoaster—posts on X show optimism 📈

• Sector Vibe: Volatile, but insider faith lifts spirits 🌈

It’s a wild climb—buckle up! ⚡

(3/9) – MARKET POSITION 📈

• Market Cap: Around $12B (based on 384M shares, est.) 🏅

• Operations: mRNA pioneer, vaccines to cancer therapies ⏳

• Trend: CEO’s move signals undervaluation hope 🎯

Solid player in the biotech jungle! 🌋

(4/9) – KEY DEVELOPMENTS 🔑

• Insider Buying: CEO’s $5M grab on Mar 5, 2025 🔄

• Buzz: Posts on X tie surge to leadership confidence 🌐

• Reaction: Market cheers, up 9% in a blink 📣

Risin’ like dough in a warm oven! 🔥

(5/9) – RISKS IN FOCUS ⚠️

• Volatility: Biotech swings wild amid macro uncertainty 🔎

• Policy: Healthcare shifts could sting 📉

• Pipeline: New products unproven, per X chatter 🌬️

High stakes, high drama! 🎭

(6/9) – SWOT: STRENGTHS 💪

• Innovation: mRNA tech reshapes medicine 🏆

• Confidence: CEO’s $5M bet screams belief 📊

• Legacy: COVID vaccine king, still swinging ⚒️

A biotech beast with bite! 🐺

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Volatility, macro jitters hit hard 📉

• Opportunities: New mRNA goodies, partnerships loom 📈

Can it brew more magic or fizzle out? 🧪

(8/9) – 📢 Stock up 9% after CEO’s $5M buy—your call? 🗳️

#

• Bullish: $50+ soon, biotech boom 🚀

• Neutral: Holding steady, risks weigh ⚖️

• Bearish: $25 looms, bubble bursts 🐻#

Drop your vote below! 👇

(9/9) – FINAL TAKEAWAY 🎯

Moderna’s 9% pop on insider buying hints at hidden gems 📈, but biotech’s a stormy sea 🌊. Dips are our playground—DCA heaven 💸. Snag ‘em cheap, ride the wave! Winner or wild card?

$TGT: Target Corporation – Retail Titan or Fading Star?(1/9)

Good evening, shoppers! 🌙 NYSE:TGT : Target Corporation – Retail Titan or Fading Star?

Target’s at $116 on March 4, 2025—is this a golden ticket or a clearance rack trap? Let’s unpack the cart and find out! 🔧

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 116 as of Mar 4, 2025 🤑

• Past Peek: Down 20% from $145.65 earlier this month 📉

• Sector Vibe: Retail’s feeling the squeeze, folks 🎮

It’s a bumpy ride, but deals might be hiding! 🛠️

(3/9) – MARKET POSITION 📈

• Market Cap: Roughly $53.15B (458.21M shares) 🏬

• Footprint: Around 1,950 stores, online sales popping 📡

• Trend: Brand loyalty high, but rivals are circling 🛡️

Still a heavyweight in the retail ring! 🏋️♀️

(4/9) – KEY DEVELOPMENTS 🔑

• Retail Scene: Spending’s tight, consumers picky 📅

• Digital Gains: E-commerce up, per past trends 🖥️

• Market Buzz: $116 hints at cautious buyers 🎤

Pivoting fast, but aisles are jammed! 🧭

(5/9) – RISKS IN FOCUS ⚠️

• Rivals: Walmart, Amazon playing hardball 🚨

• Economy: Inflation biting, tariffs looming 💸

• Swings: Retail stocks dance to a wild beat 🎶

Rough waters, but storms pass! 🌪️

(6/9) – SWOT: STRENGTHS 💥

• Name Value: Trendy goods, solid rep 💎

• Reach: 1,950+ stores, wide net 🗺️

• Online Edge: Digital sales climbing 📱

Loaded with ammo for the retail fight! 🔥

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES 🧐

• Weaknesses: $116 shows hesitation, margins tight 📋

• Opportunities: Push Target Circle, grow e-sales 🚀

Can it snag the prize or just scrape by? 🤷♂️

(8/9) – 📢Target’s $116, retail’s shaky—your call? 🗳️

• Bullish: $130+ soon, undervalued 🚀

• Neutral: Holding steady 🚬

• Bearish: $100 coming, trouble ahead 🕳️

Drop your vote below! 👇

(9/9) – FINAL TAKEAWAY 🎯

Target’s $116 price paints a shaky picture 📈, but its brand’s a rock 🌎. Swings are our playground—dips turn into DCA wins 💰. Buy low, aim high! Hit or miss?

COINBASE ($COIN) Q4—CRYPTO CASH PILES UPCOINBASE ( NASDAQ:COIN ) Q4—CRYPTO CASH PILES UP

(1/9)

Good evening, TradingView! Coinbase ( NASDAQ:COIN ) just dropped a Q4 banger 💰 $ 2.27B revenue, up 138% YoY 🌍 Full ‘24 hits $ 6.29B—let’s unpack this crypto hauler!

(2/9) – REVENUE SURGE

• Q4 Take: $ 2.27B 🌟 138% leap from ‘23

• Full ‘24: $ 6.29B 💼 115% climb

• Subs: $ 2.3B 📈 64% jump

NASDAQ:COIN ’s raking it in—trades and fees soar!

(3/9) – EARNINGS POP

• Q4 EPS: $ 4.68 🏆 beats $ 2.11 guess

• Net: $ 1.3B 🌞 300% YoY surge

• EBITDA: $ 3.3B 💪 two years of green

NASDAQ:COIN ’s cash flow hums—profit’s real!

(4/9) – BIG MOVES

• Global Cut: 19% Q4 from overseas 🌐

• Next Up: Derivatives, USDC push 📊

• Stock Dip: Flat post-earn 🤔 profit grabs?

NASDAQ:COIN ’s stretching wide—crypto’s workhorse!

(5/9) – RISKS ON DECK

• Crypto Swings: Price drops sting 🕸️

• SEC Suit: Regs loom ⛔ costs nip

• Rivals: Binance lurks ⚡ tight race

Hot streak—can it sidestep the traps?

(6/9) – SWOT: STRENGTHS

• Haul: $ 2.27B Q4 🚛 volume beast

• Subs: $ 2.3B 💡 steady stream

• Profit: $ 3.3B EBITDA 🏋️ cash stack

NASDAQ:COIN ’s hauling freight—built tough!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Trade lean 🌫️ thin ice

• Opportunities: Global reach 🌏 reg wins

Can NASDAQ:COIN outpace the bumps?

(8/9) – NASDAQ:COIN ’s $ 2.27B Q4—what’s your take?

1️⃣ Bullish—$ 350+ in sight 😎

2️⃣ Neutral—Good haul, risks linger 🤷

3️⃣ Bearish—Crypto dips drag it down 😕

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

NASDAQ:COIN ’s $ 2.27B Q4 and $ 6.29B ‘24 pile up big—crypto hauler 🪙 High P/E, but cash flows—gem or jinx?

HOME DEPOT ($HD) Q4—HOME FIXES SPARK A SURGEHOME DEPOT ( NYSE:HD ) Q4—HOME FIXES SPARK A SURGE

(1/9)

Good afternoon, TradingView! Home Depot ( NYSE:HD ) is buzzing—$ 39.7B Q4 sales, up 14.1% 📈🔥. Extra week and SRS deal fuel zing—let’s unpack this retail giant! 🚀

(2/9) – REVENUE RUSH

• Q4 Sales: $ 39.7B—14.1% up from $ 34.8B 💥

• Full ‘24: $ 159.5B—4.5% rise from $ 152.7B 📊

• Boost: $ 4.9B from 14th week

NYSE:HD ’s humming—fixer-uppers unite!

(3/9) – EARNINGS GLOW

• Q4 EPS: $ 3.13—beats $ 3.03 est. 🌍

• Net: $ 3.0B—up from $ 2.8B 🚗

• Dividend: $ 2.30—up 2.2%, juicy 🌟

NYSE:HD ’s profit shines—steady cash!

(4/9) – BIG PLAYS

• SRS Buy: Pro segment zaps growth 📈

• Comp Sales: +0.8%—first up in 2 yrs 🌍

• Stores: 12 newbies—expansion zip 🚗

NYSE:HD ’s flexing—home king reigns!

(5/9) – RISKS IN VIEW

• Housing: Rates, $ 396.9K homes—yikes ⚠️

• Inflation: Wallets tighten—sting 🏛️

• Comp: Lowe’s nips—tight race 📉

Hot run—can it dodge the bumps?

(6/9) – SWOT: STRENGTHS

• Lead: $ 159.5B—top dog 🌟

• Comp: +0.8%, 7.6% trans. jump 🔍

• SRS: Pro cash flows—steady juice 🚦

NYSE:HD ’s a retail beast—rock solid!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Housing drag—boo 💸

• Opportunities: Rate cuts, SRS lift—zing 🌍

Can NYSE:HD zap past the risks?

(8/9) – NYSE:HD ’s Q4 surge—what’s your vibe?

1️⃣ Bullish—Growth shines bright.

2️⃣ Neutral—Solid, risks hover.

3️⃣ Bearish—Housing stalls it out.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

NYSE:HD ’s $ 39.7B Q4 and SRS spark zing—$ 159.5B year hums 🌍🪙. Premium P/E, but grit rules—gem or pause?

CICC ($601995.SS) Q4—CHINA’S IB STAR KEEPS SHININGCICC ($601995.SS) Q4—CHINA’S IB STAR KEEPS SHINING

(1/9)

Good morning, Tradingview! CICC ($601995.SS) is humming—$ 33.108B ‘23 revenue, steady into ‘24 📈🔥. Q4 hints at grit—let’s unpack this finance champ! 🚀

(2/9) – REVENUE HUM

• ‘23 Total: $ 33.108B—up 0.5% YoY 💥

• ‘24 Wealth: $ 6.657B—subset shines 📊

• Trend: X says stable—no big dips

CICC’s ticking—China’s steady glow!

(3/9) – EARNINGS SNAP

• ‘23 Profit: $ 6.107B—down 11.5% 🌍

• Q4 ‘24: X buzzes mixed—details soon 🚗

• Lead: Tops IB, wealth—no sweat 🌟

CICC’s grit holds—market maestro!

(4/9) – BIG MOVES

• Forum: China-Japan ‘24—global zip 📈

• Lead: Equity financing king—steady run 🌍

• No Merge: Solo path shines on 🚗

CICC’s flexing—China’s finance ace!

(5/9) – RISKS IN SIGHT

• China Slow: Demand wobbles—yikes ⚠️

• Regs: Rules tighten—costs nip 🏛️

• Comp: Fintech bites—heat’s on 📉

Solid run—can it dodge the storm?

(6/9) – SWOT: STRENGTHS

• IB Lead: Equity king—top dog 🌟

• Wealth: $ 6.657B—steady juice 🔍

• Global: HK, NY, London—big reach 🚦

CICC’s a steady beast—rock solid!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: 11.5% dip—slow zing 💸

• Opportunities: Policy lift, global buzz 🌍

Can CICC zap past the bumps?

(8/9) – CICC’s Q4 grit—what’s your vibe?

1️⃣ Bullish—Value shines bright.

2️⃣ Neutral—Solid, risks hover.

3️⃣ Bearish—China stalls it out.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

CICC’s $ 33.108B ‘23 and Q4 buzz spark zing—$ 6.657B wealth hums 🌍🪙. China’s ace, but risks lurk—gem or pause?

CITIC SECURITIES CHINA’S FINANCE CHAMP STAYS STEADYCITIC SECURITIES—CHINA’S FINANCE CHAMP STAYS STEADY

(1/9)

Good morning, Tradingview! CITIC Securities is humming—$ 37.7B ‘23 revenue, holding firm in ‘24 📈🔥. Q4 whispers hint resilience—let’s unpack this China giant! 🚀

(2/9) – REVENUE HUM

• ‘23 Segment: $ 37.7B—up 0.5% YoY 💥

• ‘24 Trend: Steady, no big drops—X buzz 📊

• Driver: Banking, investments chug on

CITIC’s ticking—China’s steady hand!

(3/9) – EARNINGS GLOW

• ‘23 Profit: $ 7.1B—up 5.1% YoY 🌍

• Q4 ‘24: X says solid—details soon 🚗

• Lead: Tops China’s IB—no sweat 🌟

CITIC’s grit shines—market maestro!

(4/9) – BIG PLAYS

• Asset Shift: Mgmt. to new arm—efficiency zip 📈

• Market Share: 24.5% A-share lead 🌍

• Global Push: Overseas ops perk up 🚗

CITIC’s flexing—China’s finance king!

(5/9) – RISKS IN VIEW

• China Slow: Demand wobbles—yikes ⚠️

• Regs: Rules tighten—costs nip 🏛️

• Tensions: U.S.-China friction bites 📉

Hot run—can it dodge the heat?

(6/9) – SWOT: STRENGTHS

• IB Lead: 24.5% China share—top dog 🌟

• Profit: $ 7.1B—5.1% growth 🔍

• Focus: New energy bets—future zip 🚦

CITIC’s a steady beast—rock solid!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Profit dip, China lean 💸

• Opportunities: Global cash, stimulus lift 🌍

Can CITIC zap past the bumps?

(8/9) – CITIC’s Q4 grit—what’s your vibe?

1️⃣ Bullish—Value shines bright.

2️⃣ Neutral—Solid, risks hover.

3️⃣ Bearish—China stalls it out.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

CITIC’s $ 37.7B ‘23 and Q4 buzz spark zing—$ 7.1B profit hums 🌍. China’s champ, but risks lurk—gem or pause?

Finolex Cables: Unveiling the Bullish Momentum Beyond Resistancewww.tradingview.com

Current Market Overview

Finolex Cables Ltd. has exhibited significant price movements recently, indicating potential future trends. The stock is currently priced at 914.95, with notable highs and lows. Analyzing key technical indicators and historical data, we can formulate a well-rounded prediction.

Technical Indicators

Price Levels:

--------------

-> Support Levels: 800, 700

-> Resistance Levels: 1,090, 1,345.75, 1,577

Volume Profile:

------------------

Strong volume around 11,757,413 suggests significant interest and potential support at this level.

Break of Structure (BOS):

-----------------------------

Multiple BOS annotations indicate significant trend changes, highlighting key reversal points.

Order Blocks and D-Key Levels:

-------------------------------------

Order blocks (OB) and D-Key levels mark areas of high trading activity and potential reversal zones.

Historical Performance

The chart showcases several Break of Structure (BOS) points, signaling critical trend reversals. The recent price action around the 800 support level suggests a potential rebound, while resistance levels at 1,090, 1,345.75, and 1,577 indicate possible challenges ahead.

Future Projections

Based on the current analysis, we can outline three potential scenarios:

Bullish Scenario:

-------------------

-> Minimum Projection: 1,090 (+17.38%)

-> Average Projection: 1,345.75 (+47.08%)

-> Maximum Projection: 1,577 (+72.36%)

If the stock breaks above the 1,090 resistance level and sustains this momentum, it may target higher levels. This would require strong buying pressure and favorable market conditions.

Bearish Scenario:

---------------------

If the stock fails to break above 1,090 and instead breaks below the 800 support level, it could decline further towards 700. This would indicate continued bearish pressure and lack of buying interest.

Conclusion

-------------

The technical analysis suggests a potential bullish trend for Finolex Cables Ltd. The support levels around 800 and 700 provide a strong foundation, while the resistance levels at 1,090, 1,345.75, and 1,577 offer potential targets. Traders should monitor these levels closely and consider the projections when making trading decisions.

The Convoluted Wellness Movement Say what you will about RFK Jr, but his ideas, if implemented even in some small ways, would have a drastic impact on the psychopharmaceutical industry. I'm a therapist myself, and I can't tell you how many teenagers are placed on SSRIs and ADHD medication without careful consideration for long term effects. Not that these medications are poisonous - they can be very helpful for many. I do think they are overprescribed, however, and can lead to lifelong dependency if not used carefully or with intent. While I don't think psychedelics would be great for teenagers and their developing brains (says the guy who took mushrooms for the first time at 17), I do think they are a powerful alternative, and do not require as much consistent dosing. The pharmaceutical industry will try to push microdosing, so as to make greater profits.

Do I think psychedelics will be implemented as mental health treatment successfully on the first go-around? Not necessarily. Do I think that certain people with a family history of psychosis and mood disorders should avoid psychedelics? Probably.

The companies at the forefront of this research could be in a decent position to spike in value. They may be eventually bought out by other entities, of course, or simply lose their speculative value. Maybe this is already happening. I'm wondering if CYBIN in particular, is forming a bottom here. It does look trapped in an endless wedge, with every pump getting aggressively sold. However, volume is steadily increasing week by week, which could indicate some hidden accumulation.

MindMedicine may be positioned a little better, from a technical perspective. I've bought back into both MindMedicine and Cybin equally over the last day or two. Not a big position, but perhaps worth the gamble. Each could easily decline by 50% or more from here. MNDMD at least seems to have a healthier chart.

The bigger concern is whether these companies' finances can withstand more time before regulatory clarity, as well as governmental stability as a whole. Things are looking very strange in the U.S. Either way, there is a movement (public or not) towards homeopathic medicine.

I guess we'll see. This investment is entirely speculative, and seems just as likely to trend towards zero as it is to explode 10x in value.

This is my personal opinion, and is meant for personal use only - not as financial advice. These stocks have relatively low volume and are prone to wild price swings.