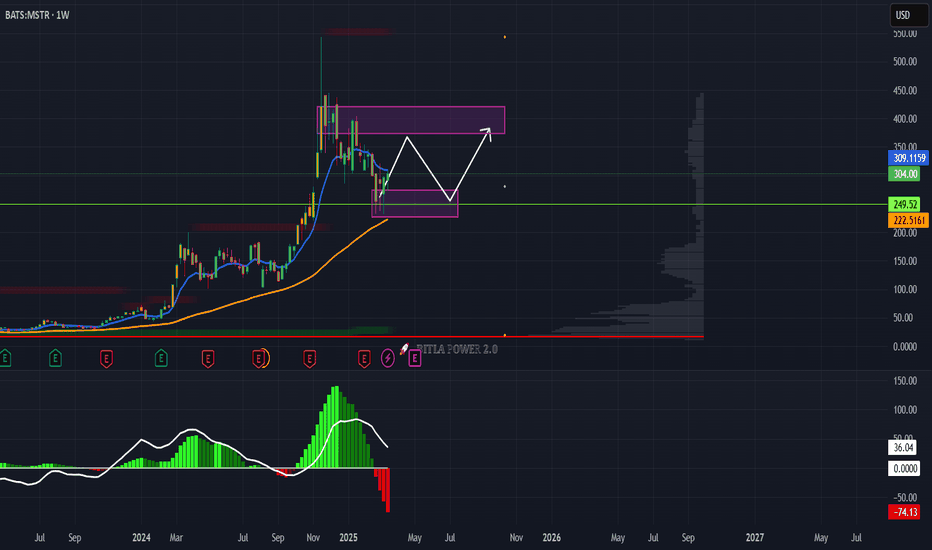

MicroStrategy To $370?Hello friends! I'm back with an analysis of MSTR. As we can see, the price had a significant drop of 57% from November 2024 to March 2025. The price is highly correlated with Bitcoin, and said cryptocurrency is in a wave 4 within an Elliott wave pattern. Therefore, Bitcoin will be returning to test $110,000. Therefore, MSTR, holding 499,096 bitcoins, will see a very significant rise in its price. In the short term, MSTR will be going to test its luck at $370 per share. However, it is highly likely that it could return to $410 per share. MSTR has many technical and fundamental indicators in its favor to be a highly profitable value asset. The best buying zones are below $300 per share.

Disclaimer: This is only an opinion; it should not be used as investment advice or recommendation.

Stocks

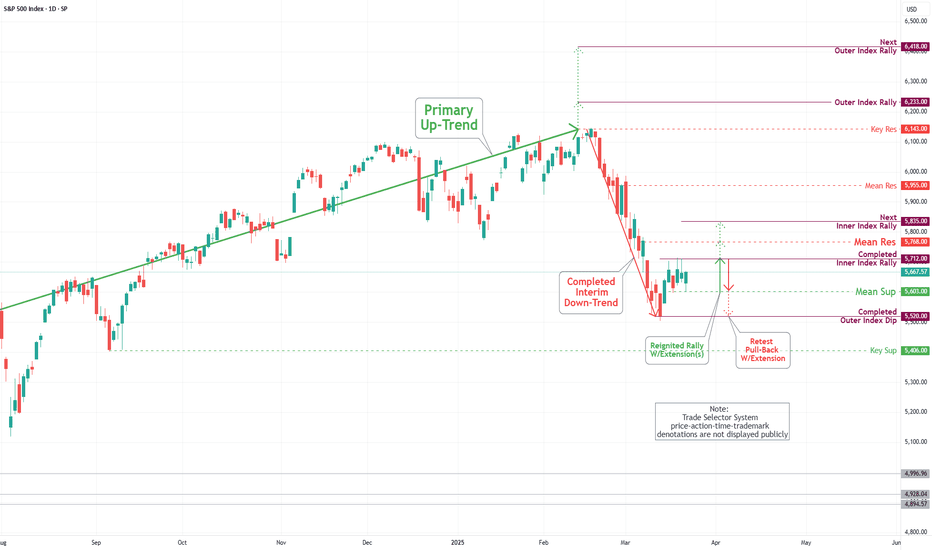

S&P 500 Daily Chart Analysis For Week of March 21, 2025Technical Analysis and Outlook:

During the course of this week's trading session, the S&P 500 achieved the designated target for the Inner Index Rally at 5576, which occurred midweek. This target was accompanied by considerable volatility, ultimately hindering upward movement. On the week's final trading day, the index experienced a notable decline, resulting in a significant drop that reached our critical target, Mean Support, at 5603.

Consequently, the index is now poised to target a retest of the Inner Index Rally level 5712, with a subsequent potential target identified at the Mean Resistance level 5840. It is essential to consider that upon reaching the Inner Index Rally target of 5712, a decrease in the current price level is anticipated, which may lead to a retest of the Mean Support at 5601. Furthermore, an extended decline is possible to revisit the completed Outer Index Dip at 5520 before the resumption of an upward rally.

It will be a bumpy ride downhillTesla's fanboys would not like it.

The company is facing turbulent times ahead and is still failing to provide what was promised years ago.

1. The legislators won't approve SDC also known as autonomous cars in the near future, because a human supervision is required. So the robotaxi is just a fiction.

2. Robots development is way behind the competitors. We all see the Boston Dynamics' Atlas, Mercedes-Benz project and some other projects. Comparing the Optimus project with the best out there is non-sense, because it fails on all fronts. Considering NVidia now open-sourced their project and collaboration with Google and Disney, IMO Tesla is out of the robo market now.

3. We see clear signs of a distribution phase at the top, fuelled by a lot of insider sells.

*Support levels are shown on the chart as green boxes. .

It is NOT a TRADING ADVISE .

There is a HIGH RISK of losing money when trading.

TSLA stock might be considered UNSAFE right NOW.

AMD 1st breakout made. Now waiting for the 1day MA50.AMD is trading inside a Channel Down since November 1st 2024 and under a second layer of lower highs since December 4th 2024.

Along with the 1day RSI that just crossed above its own Resistance level, the price crossed above that second layer of lower highs.

This is the first sign of an upcoming bullish breakout but the last Resistance to confirm that is the 1day MA50.

If that breaks, go long and target 144.00.

Follow us, like the idea and leave a comment below!!

SMCI: Channel Up bottomed on the 1D MA50. Long term Target: $148Super Micro Computer Inc is neutral on its 1D technical outlook (RSI = 52.184, MACD = 0.800, ADX = 28.146), the ideal condition to go on a long term buy as the price has been holding the 1D MA50 for 2 straight weeks. The goal now is to cross again above the 1D MA200 but that was already done on February 18th and the pattern that has been established is a Channel Up. The market however may be aiming at much higher as the November 14th 2024 bottom was priced on the Head of an Inverted Head and Shoulders pattern, a technical bullish reversal formation that targets its 2.0 Fibonacci extension once completed. The trade is long, TP = 148.00.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Apple - Will Apple visit the $200 zone again?Apple has officially started its daily downtrend. The $200 support zone is a level that has been respected often in the past, with a high confluence of the Golden Pocket. It is highly possible that Apple could revisit this level and make a strong bounce. Until then, there is a high probability that this level could be revisited until the downtrend is broken.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

Lets chat in the comment section. See you there :)

World Index Shows 5Th Wave Is Still MissingWorld Index ETF with ticker TSX:XWD has extended its rally for 261,8% Fibonacci retracement, which is ideal zone for wave 3, so current slow down can be just a higher degree ABC correction in wave 4. It’s now testing interesting and important textbook support at the former wave 4 swing low and 38,2% Fibonacci support area, from where we may see a bullish resumption for wave 5 this year. Invalidation level is at 90.

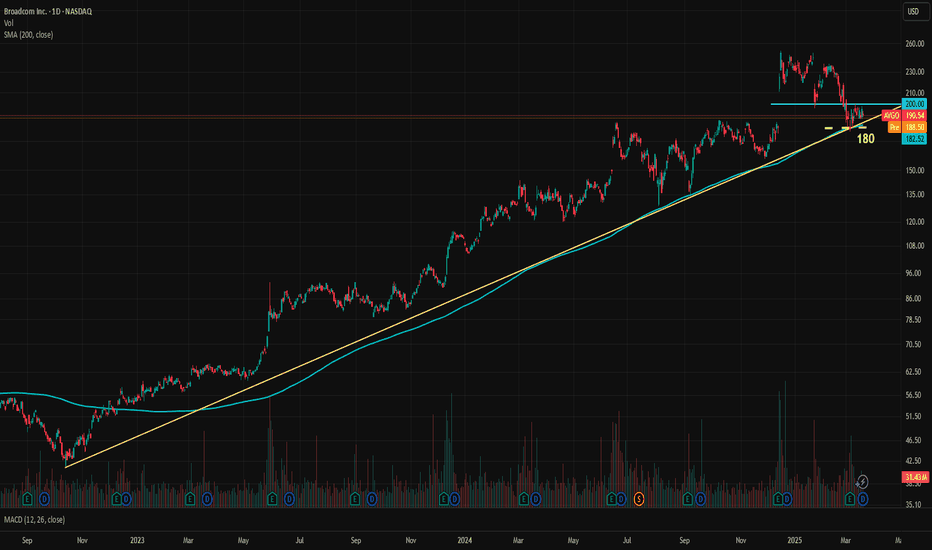

AVGO Stuck Between Key Levels, A Calm Before the Storm?Broadcom, one of the key favorites in the AI rally, is at a crossroads. AVGO has been in a steady logarithmic uptrend since October 2022, carrying the stock price from 41.51 to 251.88, marking an impressive 506% gain in about two and a half years. The company's EPS has been consistently increasing over the years and is expected to accelerate further this year. Although valuations are high, if Broadcom's performance in 2025 meets or exceeds expectations, the bullish case remains strong. The forward P/E for 2025 end is 28.7x.

Currently, the price is stuck between the trendline and the 200 resistance level. The uptrend is supported by the 200-day moving average. The trendline sits around 184, while the SMA is at 182.50. For a more cautious approach, 180 can be considered the key medium-term support level. If 180 holds and AVGO manages to break above the 200 resistance, there is significant upside potential for the bulls.

The current analyst consensus for the 12-month price target is 251, which also coincides with the stock's all-time high (ATH).

TESLA pricing its long-term bottom. $450 rebound highly likely.Nine months ago (June 26 2024, see chart below), we signaled the start of an enormous rally on Tesla (TSLA), which eventually hit our minimum Target ($400), based on a fractal from 2014 - 2016:

Since the upper 1.382 Fib Target wasn't achieved, the model is readjusted and this count makes better sense. Based on the 1W RSI we are on a bottom similar to October 30 2017 around the 4.0 Time Fib extension. That past sequence initiated a rebound towards the market Resistance before the next decline headed to the 5.0 Fib extension.

As a result, we believe Tesla will find a bottom here and target $450 just below the Resistance level.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Adobe (ADBE) Shares Plunge, Holding Near 22-Month LowsAdobe (ADBE) Shares Plunge, Holding Near 22-Month Lows

Last week, Adobe Inc. (ADBE) reported its quarterly financial results:

→ Earnings per share: Actual = $5.08, Expected = $4.97

→ Gross revenue: Actual = $5.71 billion, Expected = $5.66 billion

Additionally, according to CNBC, the design software giant announced plans to double its AI revenue by the end of the financial year. However, despite these positive figures, Adobe Inc. (ADBE) shares plummeted by approximately 13%, returning to price levels last seen in May 2023.

This decline may reflect investor concerns over Adobe’s AI monetisation strategy and the potential loss of its competitive edge in generative AI.

Technical Analysis of Adobe Inc. (ADBE) Shares

Price movements have established key points (marked with circles) forming a downward channel, which has remained relevant for over a year:

→ The price has fallen to the lower boundary, which previously acted as support in June 2024.

→ It remains below the psychological level of $400 but has not dropped significantly further.

→ The price has not fallen below the 13 January low, recorded after the earnings report.

These factors suggest that demand is preventing further declines in ADBE shares. If positive catalysts emerge, buyers may attempt to push the price back above the $400 level, potentially opening the path towards the channel’s median.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Gold Short to $2675Looks overpriced. CMC Gap at $2675, there is high chance to go to $2000 if filling the gap won't be enough to bounce back.

I expect to close my Short between $2675 and $2300. Of course anything might change.

In my opinion we can get a Black Swan event this or next week. Most of the stocks, indices, crypto looks very dumpy short term.

Nightly $SPY / $SPX Scenarios for March 21, 2025 🔮 🔮

🌍 Market-Moving News 🌍:

🇯🇵📉 Japan's Inflation Data Release 📉: Japan will release its inflation figures for February on March 21. Analysts expect a slight decrease in the Consumer Price Index (CPI) from January's 4.0% to approximately 3.5%. This data could influence global markets, including the U.S., as it may impact the Bank of Japan's monetary policy decisions.

📊 Key Data Releases 📊:

📅 Friday, March 21:

🛢️ Baker Hughes Rig Count (1:00 PM ET) 🛢️:

Previous: 592 rigs

This weekly report provides the number of active drilling rigs in the U.S., offering insights into the health of the oil and gas industry.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult with a professional financial advisor before making investment decisions.⚠️

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

US100 BEARISH FLAG|SHORT|

✅US100 is trading in a

Strong downtrend and

The price has formed a

Bearish flag pattern so

And on top of that the

Horizontal resistance

Of 20,000 is ahead so

We are super bearish

Biased and IF we see a

Bearish breakout we

Will be expecting

A further move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ELI LILLY: The time to buy and target 1,300 is now.Eli Lilly is neutral on its 1D technical outlook (RSI = 48.409, MACD = -5.160, ADX = 28.927) and this is technically the most efficient level to buy for the long term towards the end of the year, as the price is sitting around its 1W MA50. The macro pattern is a Channel Up starting back in March 2019 and every time this broke under the 1W MA50 (but remained supported above the 1W MA100) and consolidated, it was the most efficient long term buy signal. In 6 years this has only happened 4 times and all those times the 1W RSI hit the 38.750 S1 level. The immediate target of all bullish waves that started after such bottoms, has been the 2.0 Fibonacci extension. Go long, TP = 1,300.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Meta bottom in?Meta has moved back above the key $600 level after holding the 200-day average test. Today the stock has broken its short-term bearish trend line, too. A close above the trend line should be a positive technical development for the stock, making it one to watch in the days ahead.

By Fawad Razaqzada, market analyst with FOREX.com

Quick Technical Take on Agape ATP Corporation (ATPC)Let’s break down the 1-hour chart for Agape ATP Corporation (ATPC) as of March 20, 2025. The stock’s sitting at $1.02, down about 1%, and it’s been a wild ride lately.

The price spiked to $3.00 in late January before crashing hard. Since then, it’s been hanging around the $1.00 mark, which has been a solid support; buyers keep stepping in here, like clockwork, especially in early March.

The Bollinger Bands show the price dipping below the lower band in mid-February, hinting at an oversold bounce, and now it’s consolidating near that $1.00 level. We’ve got a recent "Sell" signal at $1.06, so there’s some short-term bearish pressure.

The SmartMCDX indicator below the chart is flashing mixed signals: green for bullish, red for bearish. Lately, it’s leaning red, suggesting the bears might have the upper hand for now. Volume’s pretty quiet, which means no big players are jumping in yet, so we might just keep drifting near $1.00.

What to Watch : If the price holds above $1.00, we could see a push toward $1.06 or even $1.20. But if it breaks below $1.00, things could get ugly, maybe dropping to $0.90. For now, I’d sit tight and see which way the wind blows; $1.00 is the key.

COINBASE This is the time to buy and target $400Coinbase Global (COIN) has been trading within a Channel Up pattern since the March 25 2024 High, so effectively a whole year. In the past 10 days it has been consolidating on top of the 1W MA100 (red trend-line), which is the natural long-term Support of the market.

During the same time it entered the Mayer Multiple Bands (MMB) Buy Zone, consisting of the 3 SD (green trend-line) and 2 SD (blue trend-line) below levels, which has given the ultimate buy signals since the January 2023 market bottom. Practically, the stock is consolidating within the 2 SD below and 1W MA100, a tight buy range.

Given the symmetry of the Channel Down Bearish Legs (both -48.39%), we expect a similar symmetry on its Bullish Legs too. Since the previous one reached the 1.236 Fibonacci extension, we are confidently targeting $400 before this Cycle tops. That would also make a perfect entry within the MMB Sell Zone that consists of the Mean MM (black trend-line) and 1 SD above (grey trend-line).

Notice also how the 1W RSI touched the Support of the September 06 2024 Low.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Apple (AAPL): -50%. According to the planElliott Wave Analysis of Apple stock

.

● NASDAQ:AAPL |🔎TF: 1W

Fig. 1

The long-term wave markup has not been adjusted for the past three years. Except that the orthodox tops and bottoms and targets for third waves are slightly refined.

.

● NASDAQ:AAPL |🔎TF: 1W

Fig. 2

Earlier, at the end of 2023 , we have already suggested wave ((iv)) in 3 in the form of a running flat. As we can see, the attempt was unsuccessful, the formation of a sideways correction continues to this day. It can be a running flat or an expanded flat, the latter of which assumes a break of the 124.17 low.

Important breakdown in the Gold & Silver ratio !!!This is a heads up that concerns the PM sector as well as all other assets.

An important breakdown just happened in the Gold & Silver ratio. This means precious metals bull resumes and SILVER will now overperform gold !! We are now in back test mode !

For the other asset classses this is good news also, because this breakdown in the ratio signifies the return of (asset) inflation. So this is good for stocks and crypto also.

It remains to be seen whether PM's will outperform stocks. My guess is YES.

Alibaba (BABA) Share Price Declines from 40-Month HighAlibaba (BABA) Share Price Declines from 40-Month High

As shown in the Alibaba (BABA) share chart, the price reached a 40-month high this week, surpassing $145 per share.

Bullish sentiment is being fuelled by news related to AI prospects in China. According to media reports:

→ China’s AI spending is increasing through investments from state-owned enterprises, private companies, and local authorities, aiming to keep pace with the US $500 billion Star Gate project.

→ Alibaba plans to invest $52 billion over three years in artificial intelligence and cloud computing.

Technical Analysis of Alibaba (BABA) Shares

Despite a positive fundamental backdrop, the chart signals potential concerns:

→ The price is near the upper boundary of the ascending channel, which could act as resistance.

→ Bulls attempted to break the $145 level (which has acted as resistance since late February) on 17 March but failed, as the price could not hold above this mark.

→ Using your preferred oscillator, you are likely to observe a bearish divergence between peaks A and B.

This suggests that bullish momentum may be weakening, and investors could consider taking profits after Alibaba’s exceptionally strong price rally—up approximately 70% since early 2025. If so, a break below the orange trendline could lead to a correction towards the median of the blue channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Nightly $SPY / $SPX Scenarios for March 20, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🇨🇳🏦 People's Bank of China (PBOC) Interest Rate Decision 🏦: On March 20, the PBOC will announce its latest interest rate decision. While specific expectations are not detailed, any adjustments could influence global markets, particularly in the Asia-Pacific region.

🇬🇧🏦 Bank of England Interest Rate Decision 🏦: The Bank of England is scheduled to announce its interest rate decision on March 20. Analysts anticipate that the central bank will maintain the current rate at 4.5%, following a recent reduction. This decision will be closely watched for its implications on the UK economy and global financial markets.

📊 Key Data Releases 📊:

📅 Thursday, March 20:

📉 Initial Jobless Claims (8:30 AM ET) 📉:This weekly report indicates the number of individuals filing for unemployment benefits for the first time, providing insight into the labor market's health.

Forecast: 225,000

Previous: 220,000

🏭 Philadelphia Fed Manufacturing Index (8:30 AM ET) 🏭:This index measures manufacturing activity in the Philadelphia Federal Reserve district, with positive numbers indicating expansion.

Forecast: 10.0

Previous: 18.1

🏠 Existing Home Sales (10:00 AM ET) 🏠:This data reflects the annualized number of previously constructed homes sold during the prior month, offering insights into the housing market's strength.

Forecast: 3.95 million annualized units

Previous: 4.08 million annualized units

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult with a professional financial advisor before making investment decisions.⚠️

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

Microsoft (MSFT): The "Can’t Go Wrong" Stock... Until It DoesAh, Microsoft—the tech titan that could probably survive a meteor impact. 🌍☄️ With a market cap so large it could buy entire countries and still have spare change for a few yachts, MSFT is the stock that everyone loves... even when it’s overvalued. But hey, let’s take a look at the "genius" behind the current price action. 🔍💰

📊 The Almighty Stock Performance (Because Fundamentals Don’t Matter Anymore?)

📉 Price: $385.76 (up a whole 0.00584%! Call the champagne guy! 🍾)

📊 Intraday High: $387.88

📉 Intraday Low: $383.27 (because even Microsoft has bad days, right? 😅)

🔮 200-day moving average: $423.98 (oh look, it's trading below that... bearish much? 🐻)

So, let me get this straight. MSFT is 7.80% down year-to-date, but analysts are still screaming “BUY! 🚀.” Sure, because blindly trusting price targets has always worked out well for retail investors. 🤑

💰 Valuation: Overpriced? Who Cares, It’s Microsoft!

📢 Intrinsic Value Estimate: $316.34

😬 Current Price: $385.76

💰 Overvaluation? About 18%

But let’s be honest—does valuation even matter anymore? If people are throwing money at meme coins, why not pay a premium for MSFT? 🤷♂️ It’s basically a subscription service at this point—you pay every month, and the stock just keeps draining your wallet. 💸

🤖 AI Goldmine or Just Another Buzzword?

Microsoft has been riding the AI hype train harder than a teenager with ChatGPT. 🚂💨 Their enterprise AI growth is over 100%, and they’re pulling in a $13 billion annual run rate from AI services. But sure, let’s pretend that no one remembers the last time “the next big thing” crashed and burned. (cough dot-com bubble cough). 💀💾

Evercore analysts claim MSFT will dominate AI for enterprises. Well, duh. If you’re an enterprise and don’t buy Microsoft AI services, Satya Nadella himself might show up at your office and force you to install Windows 11. 🏢💻

📉 Risk Factors? No Way! MSFT is Invincible... Right?

🦅 Hawkish Fed = Potential Market Sell-Off (But don’t worry, just HODL, right? 🤡)

🚀 Tech Bubble Concerns (Microsoft will totally be the exception… like every overhyped stock before it. 😬)

🧐 Overvaluation? Pfft, who cares? (People said the same about Tesla at $400. Look how that turned out. 🪦)

📢 Analyst Hot Takes (Because They’re Always Right 😂)

📊 D.A. Davidson: Upgraded to Buy with a price target of $450. (Ah yes, let’s just throw numbers out there. Why not $500? $600? 🚀)

🔮 UBS: Predicts $3,200 for gold, but Microsoft will somehow go even higher. (Probably. Because… reasons. 🤷♂️)

🎭 Final Thoughts: Buy? Sell? Just Panic?

Microsoft is basically the “safe” tech stock everyone clings to while pretending that the market isn’t built on dreams and overleveraged hedge funds. 🏦💰 If you believe in the power of monopolies, overpriced AI services, and analysts pulling price targets out of thin air, then MSFT is your golden ticket. 🎟️💎

Otherwise, maybe—just maybe—waiting for a dip below fair value isn’t the worst idea in the world. But what do I know? I’m just some guy on the internet. 🤷♂️

🚀💸 Good luck, traders. You’ll need it. 😈📉

💬 What do you think? Drop your thoughts below! 👇🔥