Stocksignals

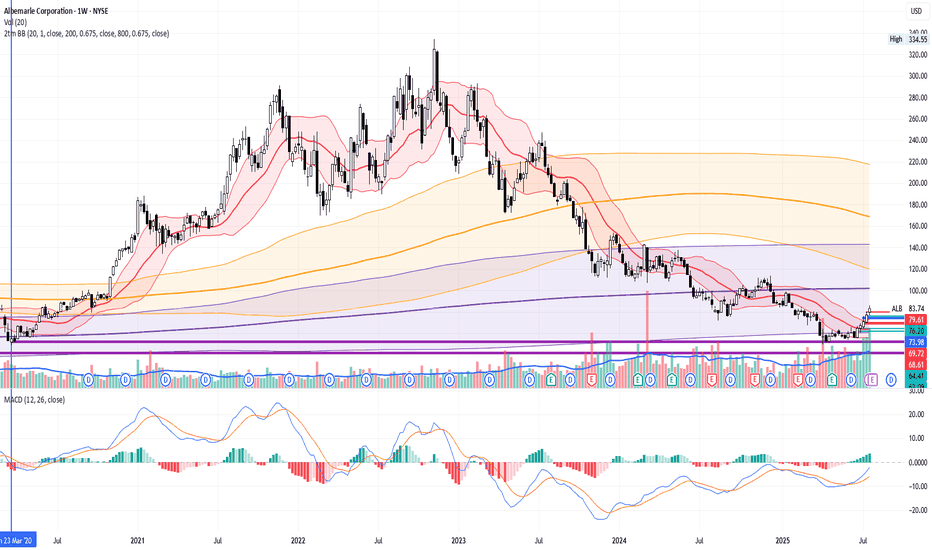

ALB Long, Resurrection of lithium trendALB have started to rise in recent weeks. It's price stays near 5-year lows.

Long-term Price Levels already have worked to bounce the stock by around 50%+.

Most likely funds have started to trade it in Mean Reversion strategies. So, the movement back to 200MA and 800MA on Weekly time-frame is quite possible.

As fast as banks would start to rise stock's rating - it will go sky high.

Recently UBS already cut it's rating to "Sell". Yet, trend already is mighty enough and just kept going higher.

Full margin on every black 1D candle!

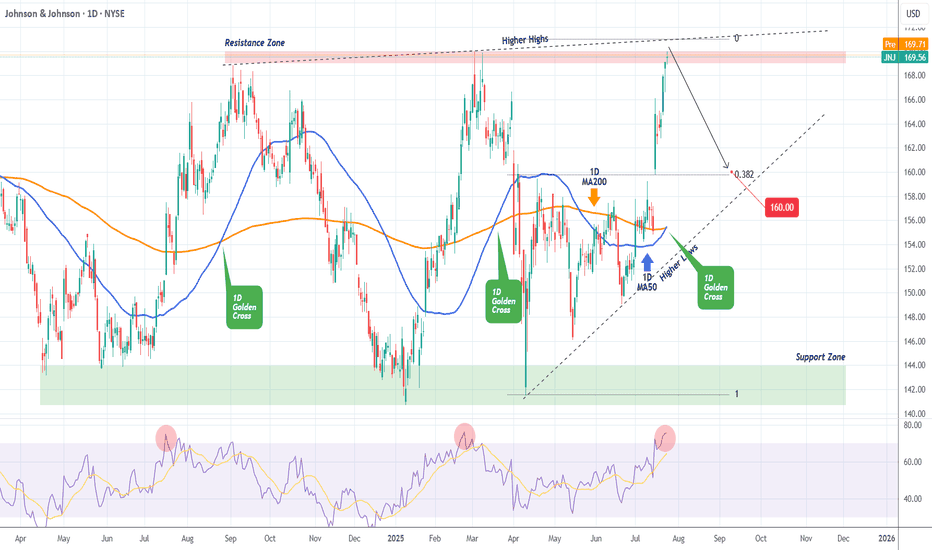

JOHNSON & JOHNSON Sell opportunity on a Double Resistance.It's been 9 months (October 11 2024, see chart below) since our last Johnson & Johnson (JNJ) analysis, where we gave a very timely sell signal that surgically hit our $141.00 Target:

The Channel Down has since broke to the upside and a new Higher Lows structure has emerged but with a clear Resistance Zone for the time being. At the same time, the price is also just below the Higher Highs trend-line that started on the September 04 2024 High.

With the 1D RSI overbought (same as on February 25 2025), we don't give the upside much room to go, so we turn bearish here, targeting the 0.382 Fibonacci extension and Higher Lows trend-line at $160.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

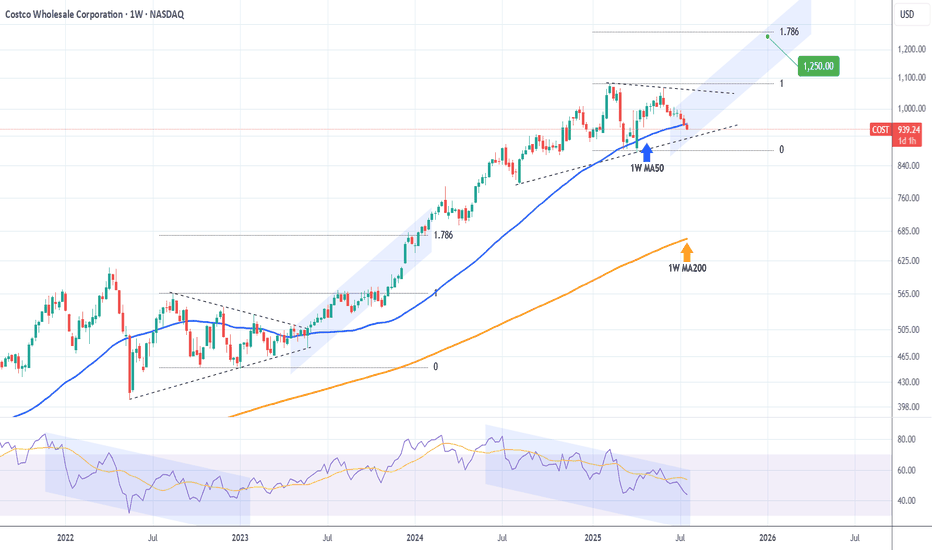

COSTCO Looking for a bottom to fuel rally to $1250.Last time we looked at Costco (COST) was 6 months ago (January 21) when we gave the most optimal buy signal exactly at the bottom of the Channel Up at the time, easily hitting our $1045 Target:

Since then, the stock has entered a new Accumulation Phase in the form of a Triangle and this week broke below its 1W MA50 (blue trend-line), which is where its previous bottom (Higher Low) was formed.

The last similar Triangle pattern was formed straight after the May 16 2022 market bottom and once it broke upwards it led to a massive rally. Even the 1W RSI sequences between the two fractals are similar.

Our Target is $1250, just below the 1.786 Fibonacci extension.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

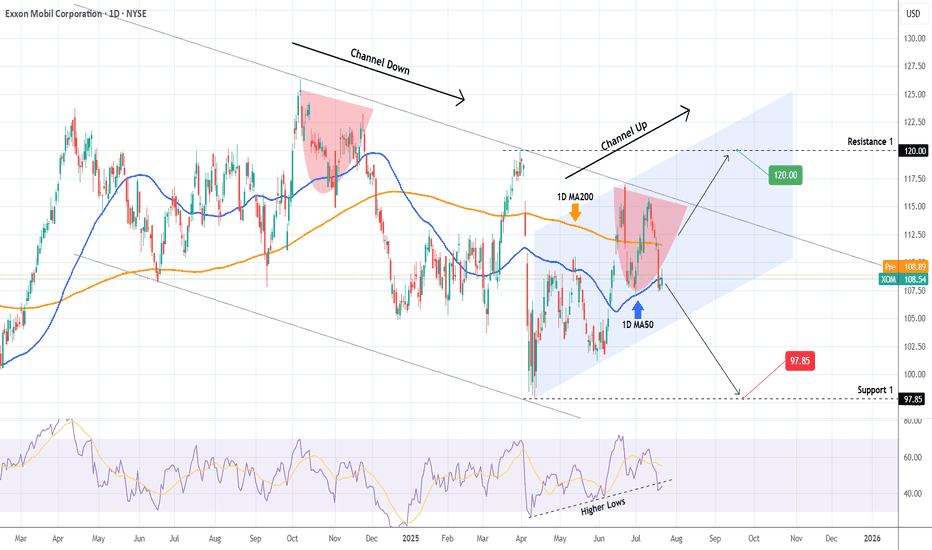

EXXON MOBIL Critical crossroads.Exxon Mobil (XOM) has been trading within a Channel Down since the June 17 2024 Low and just recently on the July 11 2025 High, it made a Lower High pattern similar to November 22 2024.

As long as the price trades below the 1D MA200 (orange trend-line), we expect to start the new Bearish Leg and test at least Support 1 (97.85).

If however it breaks above the 1D MA200 it will invalidate all prior Lower High patterns, and will most likely follow the (blue) Channel Up to break above the Channel Down. In that case, we will be targeting Resistance 1 (120.00).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

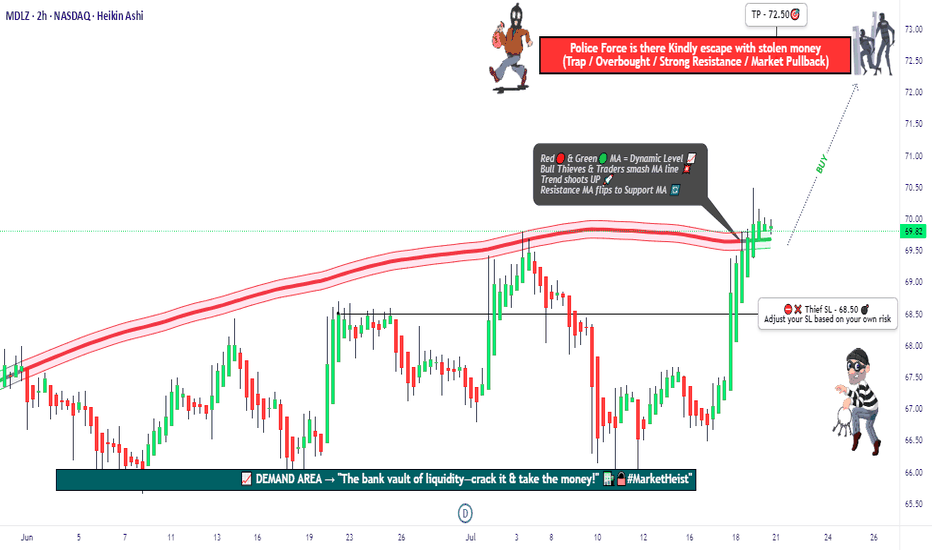

"MDLZ Heist LIVE! Quick Profit Grab Before Reversal!"🚨 MONDELEZ HEIST ALERT: Bullish Loot Zone! (Swing/Day Trade Plan) 🚨

Thief Trading Strategy | High-Risk, High-Reward Play

🌟 Greetings, Market Pirates! 🌟

Hola! Oi! Bonjour! Hallo! Marhaba!

To all Money Makers & Strategic Robbers 🤑💸—this is your blueprint to plunder "MONDELEZ INTERNATIONAL, INC" with precision.

🔎 THIEF TRADING ANALYSIS (Technical + Fundamental)

The Vault is Open! Bullish momentum detected, but caution—this is a high-risk police barricade zone (resistance level).

Overbought? Consolidation? Reversal? Yes. Bears lurk here, but we’re stealing profits before the trap snaps.

🎯 Target: 72.50 (or escape earlier if momentum fades).

🚨 Scalpers: Long-only! Use trailing stops to protect gains.

📈 ENTRY: How to Swipe the Loot

"Buy the Dip" Strategy: Optimal entries on pullbacks (15m/30m timeframe).

DCA/Layering Tactics: Spread limit orders for better risk control.

Aggressive Robbers: Enter now. Patient Thieves: Wait for retests.

🛑 STOP LOSS: Survival Rules

SL at 68.50 (nearest swing low wick on 2H chart).

Adjust based on risk/lot size—protect your capital!

⚡ CRITICAL ALERTS

📰 News Volatility: Avoid new trades during major releases. Lock profits with trailing stops!

📊 Fundamental Drivers: Check COT reports, macro trends, and sector sentiment Klick the 🔗.

⚠️ Reminder: This is NOT financial advice. DYOR and manage risk!

💥 BOOST THE HEIST!

Like 👍 + Boost 🔄 to fuel our next market robbery plan. Together, we trade smarter, steal bigger, and profit faster!

🚀 Stay tuned—more heists coming soon! 🤑🔥

SOUTHBANK - BUY SOUTHBANK - BUY NOW

Key points :

South Indian Bank strong Fundamentals .

Stock PE - 5.47

Industry PE - 10.8

Stock Price Trade at Below Book Value ..

Company Price - Possible to Double

Technical :

Monthly - Take Support

Day - Symmetrical Triangle Pattern Breakout

Entry - 25.45 Rs

Target - 35.55 Rs

Stoploss - 21 Rs

Expected - 39 %

This is Only for My Trade Setup . Dont follow Blindly . Take Educational Purpose Only .

We not any responsiblities for Profit and loss ..

Thank You . Happy Trading ..

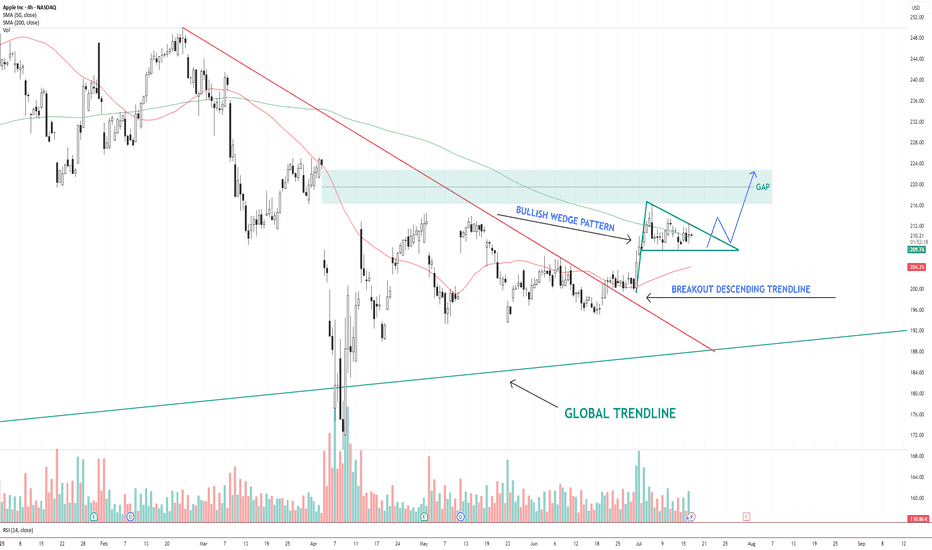

AAPL – Bullish Wedge Breakout Setup Toward Gap FillAAPL NASDAQ:AAPL has broken out of a descending trendline and is now consolidating inside a bullish wedge pattern . Price is holding above the 200 SMA and hovering near the 50 SMA.

The structure suggests a potential breakout above the wedge, with a clear gap area between $216–$224 acting as the next upside target.

Key levels:

Support: $206 (wedge base / 50 SMA)

Resistance: $216–$224 (gap zone)

Trend structure: Bullish consolidation after breakout

A clean breakout from the wedge with volume could trigger a continuation move toward the gap zone.

📌 Watching for confirmation and potential entry on a breakout + retest.

This is not financial advice. Always do your own research.

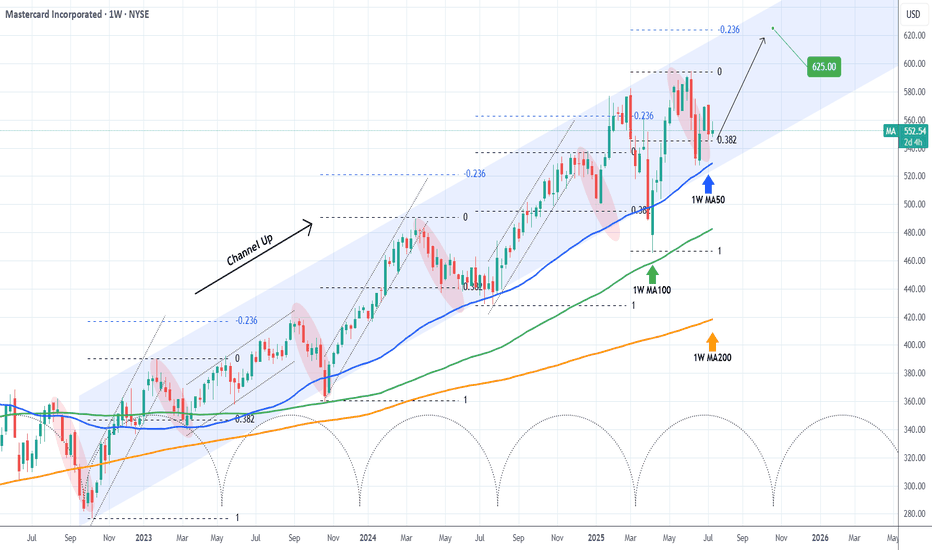

MASTERCARD Best buy entry now. Target $625.Mastercard (MA) has been trading within almost a 3-year Channel Up that only broke (but recovered naturally) during Trump's trade war. Still, the 1W MA100 (green trend-line) contained the downfall, as it always had.

Normally the Bearish Legs of this pattern tend to find Support on the 1W MA50 (blue trend-line), as the latest one did 3 weeks ago. Now that the price is trading still on the 0.382 Fibonacci retracement level, it historically is the best buy opportunity, as per all previous Bullish Legs.

The Channel Up has always priced its Higher High (top) on at least the -0.236 Fibonacci extension. As a result, we are targeting $625.00 before the year ends.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

SMCI: When a chart says it’s time to reconnect with the AI hypeOn the daily chart, Super Micro Computer Inc. (SMCI) is showing a clean bullish setup. Price broke out of a descending trendline (green dashed), confirmed it with a retest, and is now consolidating above the breakout zone. The golden cross — where the MA50 crossed above the MA200 — confirms a long-term trend reversal.

Volume profile indicates strong accumulation near $41–43. The 0.5 Fibonacci level at $41.84 acted as support. Above the current range, there’s low volume resistance up to $63.57 (0.786), followed by $66.44 and a final extension target at $79.82 (1.272).

Fundamentals: SMCI is a leading server hardware manufacturer. Demand for their systems has soared with the explosion of AI infrastructure. The company maintains solid financials, with rising quarterly revenue and growing presence in the cloud sector. Institutional investors have been actively increasing their positions since late 2023 — a sign of strong long-term conviction.

Tactical plan:

— Entry: market $42–43

— Target 1: $55.91

— Target 2: $63.57

When technicals scream textbook breakout and fundamentals bring AI momentum to the table — it might just be one of the best late entries in the AI wave this summer.

Is it right time and choice to buy UNH Stock - {15/07/2025}Educational Analysis says that UNH Stock (USA) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - NA

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this Stock brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading.

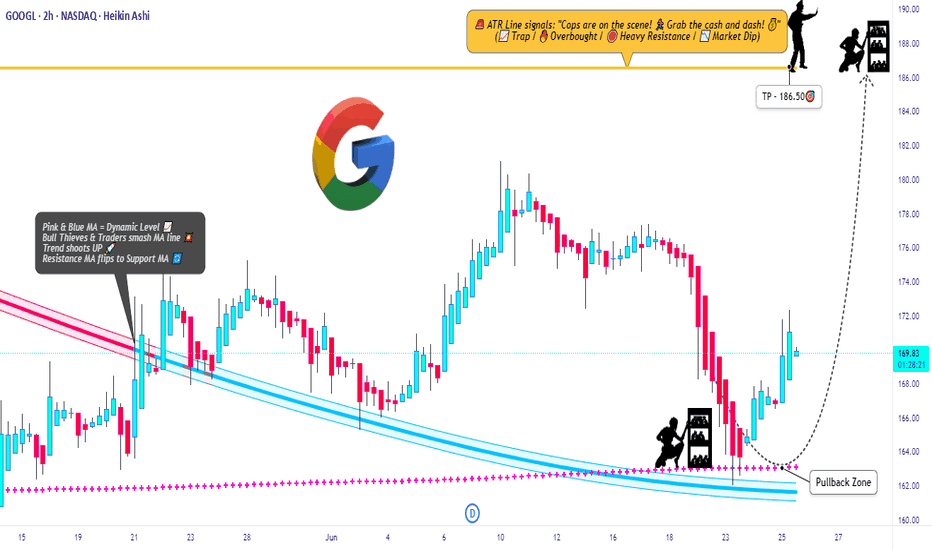

GOOGL Raid Plan: Bulls Set to Hijack the Chart!💎🚨**Operation GOOGL Grab: Robbery in Progress! Swing & Run!**🚨💎

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Silent Robbers, 🤑💰💸✈️

Get ready for another high-stakes market heist – this time, we’re raiding the vaults of GOOGL (Alphabet Inc.) using the Thief Trading Strategy™. Based on sharp technical intel and subtle fundamental whispers, the setup is clear: the bulls have cracked the code, and it’s time to grab our loot.

🟢 🎯 ENTRY POINT - THE LOOT ZONE

"The vault is wide open!"

Snatch your bullish entry anywhere on the chart, but the pros will place limit buys on recent pullbacks (15m/30m zones), either on swing lows or highs. The pullback is your door in — don’t miss it!

🛑 STOP LOSS - ESCAPE ROUTE

Set the Thief SL at the recent 2H swing low (162.00).

But remember, each robber’s risk appetite is unique — adjust your SL based on your size, cash, and courage.

🎯 TARGET - GETAWAY MONEY

💼 Main Target: 186.50

Or if heat rises early, vanish with your gains before the full score hits. Disappear like a ghost — profit first, questions later!

🧲 FOR SCALPERS – THE QUICK GRAB

Only ride the long wave — shorting is off-limits in this mission.

If your wallet is loaded, dive in. If not, join the swing crew.

Use trailing SL to protect your cash stack 💰.

📈 THE SETUP – WHY THIS RAID WORKS

The GOOGL Market is bursting with bullish energy — a classic Red Zone robbery moment.

Overbought tension, fakeouts, trend shifts — exactly where we love to strike! Consolidation and reversals = opportunity for the brave.

📣 TRADING ALERT - NEWS AHEAD!

🚨 Avoid entries during news releases – they trigger alarms!

Use trailing SL to lock in your stash, especially during high-volatility windows.

🔍 TIPS FROM THE THIEF’S DESK

Stay updated with the latest whispers — from fundamentals to geopolitical noise, COT positioning to sentiment swings. The market changes faster than a thief on the run — so adapt fast!

💖 Show some love: 💥Hit that Boost Button💥

Let’s fuel this robbery plan with more power and precision.

Every day in the market is a new heist — let’s win like thieves, not sheep. 🏆💪🤝❤️🚀

I'll be back soon with another masterplan...

📡 Stay sharp, stay hidden — and always aim for the vault. 🤑🐱👤🎯

META Platforms Long Setup – Ready for the Next Move?💣 META Masterplan: Bullish Break-In Activated! 💼📈

🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Silent Strategists, 🤑💰💸✈️

We’ve locked in on our next high-value digital vault: META Platforms Inc.

Built on our signature Thief Trading Style™ — where fundamentals meet stealth technical precision — this is your map to the bullish jackpot.

📍 ENTRY PLAN – Door’s Unlocked!

✅ Enter at any level — this heist is already in motion.

OR

🎯 Set your Buy Limit on a 15m/30m swing low or high — classic pullback infiltration.

🛑 STOP LOSS – Your Exit Route

Before breakout? Hold the line.

After breakout? Drop your SL at the recent 4H swing low – and size it to your risk appetite.

This isn’t luck — it’s calculated theft. 🔐

🎯 TARGET ZONE – Grab & Vanish

🎯 Aim: 770.00

But if the cops (aka sellers) show up early, get out with your loot — no shame in a clean getaway.

“Profit is the win. Perfection is fantasy.”

⚡ SCALPERS' TIPS – Quick In & Out

💵 Big wallet? Enter now.

💳 Tight budget? Follow the swing team.

Either way — longs only, and trailing SL is your safety rope.

📊 WHY META? – Intel Behind the Mission

🔍 This plan is reinforced by:

🔥 Strong Fundamentals

📈 Sentiment Signals

🧠 Quantitative + Macro Flow

💼 COT Data

🌐 Intermarket Correlations

It’s all aligning — the pressure’s building, and the breakout door is creaking open...

🚨 TRADING ALERT – Stay Outta Trouble

💥 Avoid placing new trades during major news drops.

🎯 Use trailing SL to protect and lock profits — your getaway vehicle must be ready.

💖 Support the Heist? Smash Boost!

Fuel the mission — every Boost empowers the crew.

This is Thief Trading Style — we don’t chase, we plan, strike, and vanish with the win. 🏆💪🐱👤

📡 Another breakout mission incoming. Stay hidden. Stay profitable. 🤑🚀

A life-changing SBET long ideaSBET stock presents an amazing long opportunity that has a potential to do over 100x. After the break out of a down trend line, price retraced to the support, with price closing above this support level.

To advantage of this long opportunity, you can buy from the current market price while the exit can be at $1.34 and the targets can be at $123.70, $178.48, $541.22, $1041.90 and the final target at $2155.20.

Confluences for the long opportunity are as follows:

1. Break out of down trendline

2. Retest of the down trendline and support level.

3. Bullish divergence signal from awesome oscillator.

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

GME LONG IDEA UPDATEDIn my previous post regarding the long opportunity on GME stock, I called a long signal after a break out of a downtrend line. However, price had dropped down to the demand zone, giving another long opportunity.

To take advantage of this long opportunity, you can buy at the current market price, while the exit will be at $20.30 and the targets can be at $35.70, $47.90 and the final target at $64.70.

Confluences for the long idea are as follows:

1. Weekly break of structure

2. Valid Inducement

3. Orderflow

4. Price within the discount

5. Price respecting bullish trendline

6. Hammer candlestick confirmation

7. Price at a support level

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

OSCR LONG IDEALooking at the weekly chart of OSCR stock, there's a long opportunity which can be taken advantage of to make some money provided that market follows the projection.

In order to take advantage of this long opportunity, a buy order limit can be placed at $12.38 while the exit can be at $11.09 and the final target can be at $22.80.

Confluences for this long idea are as follows:

1. Weekly break of structure

2. Valid Inducement (structural liquidity)

3. Orderflow

4. Sweep

5. Valid demand zone in the discount level

6. Imbalance

7. Pattern confirmation formed after mitigation of a demand zone indicating that there's a bullish change of trend.

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

After 45% Profit On Last Trade, I Am Re-entering UMACTrading Family,

On our stock trades, using my new liquidity indicator, we have been solidly beating the market with a cool 15% profit since our first trade with it. If you had held the SPY from the same time, your profit would have been a more meager 6.5%. Our indicator is proving beneficial, to say the least. And the last time it gave me a buy signal on UMAC, we banked 45% in profit on my last exit. I then determined that if it did not give me a sell signal (it hasn't), I would look to re-enter at that 7.66 level. We have reached that level, and I have dipped my toes back in at 7.94. I would look to double up my position if we drop even further to that 6.44 level, but I don't know that we will. My target of 11.76 will give us another 48% profit on this trade, and I have a SL set at 6.18 for a nice 2.17 rrr.

Let's go!

Stew

ORACLE Can you foresee it at $2000??Oracle (ORCL) is having perhaps the most dominant recovery from Trump's Tariff lows out of the high cap stocks, trading comfortable on new All Time Highs.

This is no surprise to us, as like we've mentioned countless times on our channel, we are currently at the start of the A.I. Bubble and heavy tech giants are expected to see massive gains until 2032, where we've calculated the end of this Bull Cycle and the start of a strong Bear.

As mentioned, this situation is extremely similar to the Dotcom Bubble of the 1990s. Of course Oracle is nearly impossible to repeat the +38637% gains of that Golden Decade after the 1990 Oil Crisis but in Fibonacci price and time terms, it can technically complete a +3411% rise and hit $2000 in the next 7 years.

If you have a long-term investor mindset like us, this is a must stock to buy and hold.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

NVIDIA made history! First company with $4 trillion market cap!NVIDIA Corporation (NVDA) became today the first company in history to surpass a $4 trillion market value, as A.I. bulls extended the recent rally and pushed the price past the approximate $163.93 level needed to reach this market capitalization threshold.

The long-term trend on the 1D time-frame couldn't look more bullish. Coming off a 1D Golden Cross less than 2 weeks ago, the price has turned the 1D MA50 (blue trend-line) into Support and sits at +88.13% from the April 07 2025 Low.

This is the exact set-up that the market had when it was coming off the 2022 Inflation Crisis bottom (October 13 2022). As you can see, both fractals started with a -44% decline, bottomed and when they recovered by +88.13%, there were just past a 1D Golden Cross. In fact that Golden Cross (January 24 2023) was the last one before the current.

NVIDIA entered a Channel Up (green) on its recovery and for as long as the 1D MA50 was supporting, it peaked on the 2.618 Fibonacci extension before it pulled back below it.

If history repeats this pattern, we are looking at a potential peak around $390, which may indeed seem incredibly high at the moment, but as we pointed out on previous analyses, the market is in the early stages of the A.I. Bubble, similar to the Internet Bubble of the 1990s.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇