$DYNT Announces Extension of Key Distribution AgreementDynatronics Corporation Announces Extension of Key Distribution Agreement

Bird & Cronin Renews Group Purchasing Agreement with Intalere for Orthopedic Soft Goods and Bracing

Dynatronics announced today that its wholly-owned subsidiary, Bird & Cronin, LLC, renewed its purchasing agreement with Intalere, one of the leading national group purchasing organizations in the healthcare industry. The new agreement which extends the partnership through January 2024.

Intalere members will receive negotiated pricing on our full line of orthopedic bracing solutions for spine, upper and lower extremities including key products such as the Sprint® air walker boot and U2TM wrist brace. With more than 100,000 members from healthcare organizations all over the country, Intalere members make nearly $9 billion in purchases annually.

finance.yahoo.com

Stockssignals

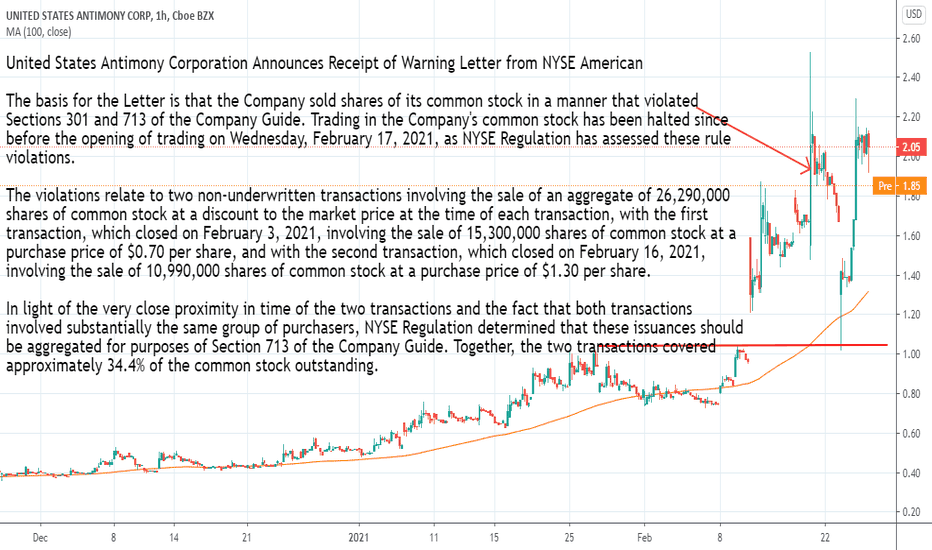

$UAMY Announces Receipt of Warning Letter from NYSE AmericanUnited States Antimony Corporation Announces Receipt of Warning Letter from NYSE American

The basis for the Letter is that the Company sold shares of its common stock in a manner that violated Sections 301 and 713 of the Company Guide. Trading in the Company's common stock has been halted since before the opening of trading on Wednesday, February 17, 2021, as NYSE Regulation has assessed these rule violations.

The violations relate to two non-underwritten transactions involving the sale of an aggregate of 26,290,000 shares of common stock at a discount to the market price at the time of each transaction, with the first transaction, which closed on February 3, 2021, involving the sale of 15,300,000 shares of common stock at a purchase price of $0.70 per share, and with the second transaction, which closed on February 16, 2021, involving the sale of 10,990,000 shares of common stock at a purchase price of $1.30 per share.

In light of the very close proximity in time of the two transactions and the fact that both transactions involved substantially the same group of purchasers, NYSE Regulation determined that these issuances should be aggregated for purposes of Section 713 of the Company Guide. Together, the two transactions covered approximately 34.4% of the common stock outstanding.

Section 301 of the Company Guide states that a listed company is not permitted to issue, or to authorize its transfer agent or registrar to issue or register, additional securities of a listed class until it has filed an application for the listing of such additional securities and received notification from the NYSE American that the securities have been approved for listing.

Section 713 of the Company Guide requires shareholder approval when additional shares to be issued in connection with a transaction involve the sale, issuance, or potential issuance of common stock (or securities convertible into common stock) equal to 20% or more of presently outstanding stock for less than the greater of book or market value of the stock.

As stated in the Letter, the Company failed to submit a completed listing application in advance of the February 16, 2021 transaction to obtain advance approval as required by Section 301 of the Company Guide and also did not obtain shareholder approval for the aggregate issuance of 26,290,000 shares that exceeded 20% of the common stock of the Company outstanding as required by Section 713 of the Company Guide. NYSE Regulation noted in the Letter that, after it became aware that the Company had entered into a purchase agreement in relation to the second transaction, NYSE Regulation informed representatives of the Company that it would be a violation of the applicable NYSE American rules for the Company to close the second transaction without first obtaining shareholder approval . Notwithstanding this clear guidance from NYSE Regulation, the Company went ahead with closing the transaction without notifying the Exchange.

The Company has been advised by NYSE Regulation that the Company's common stock will resume trading on the NYSE American following the issuance of this press release and the filing of a Current Report on Form 8-K disclosing the receipt of the Letter, which the Company anticipates will be prior to the open of trading on Friday, February 19, 2021.

finance.yahoo.com

Why $CTIB stock soared yesterday?investors also need to note that there has been no news regarding Yunhong this morning that could have triggered such a move.

It appears that the Yunhong stock is a target of users across social media platforms like StockTwits, Reddit, Facebook, and Twitter. Investors are buying up the stock in order to force short sellers to cover their positions and when that happens, the stock price usually rises further. Hence, it might be a good idea for investors to keep an eye on the Yunhong stock this morning.

ownsnap.com

DraftKings LongPlayA Well Respected channel clearly in a continued uptrend, I anticipate a pullback to the given support in the chart before a continuation to the upside .

Ensure to plan your trade , Entry , Exit , and SL ...and dont get greedy ...take profits on the way up ....Thanks For stopping by . ..Appreciate the support , show your appreciation with a Like/Follow and feel free to comment .

Shares of $VIOT surges due to hype in social mediaShares of $VIOT SURGES higher due to the uptick in discussions about this stock has been surging on social media platforms like Reddit, Twitter, StockTwits, Facebook, and Discord. In a StockTwits post, Insider-Analysis.com pointed out that 7 institutions increased their positions in the stock while 3 decreased as of this past quarter.

There is also a bullish report published about the company at Xueqiu.com. After translating the article to English, I read that Xueqiu believes that VIOT is expected to grow 10x this year due to its leadership position in appliances and Internet of Things devices.

VIOT was also listed on a number of day trading watch lists on Reddit. And VIOT was listed in the “Daily Movers” on the Robinhood trading platform — which also added to the momentum of this shares.

pulse2.com

Why $BRN skyrocketed in January?Barnwell Industries Reaches Agreement With MRMP Stockholders to End Potential Proxy Contest

$BRN is pleased to announce today that it has entered into a cooperation and support agreement with MRMP Stockholders, with respect to the potential proxy contest pertaining to the election of directors to our Board of Directors (the “Board”).

the Company will nominate its current slate of directors, which includes three of the MRMP nominees and two new independent directors elected in 2020, to stand for reelection to the Board at the upcoming 2021 annual meeting of stockholders.

The MRMP Stockholders have agreed to vote their shares of common stock of the Company in favor of the election of the designated slate, and the MRMP Stockholders have agreed to withdraw their proposed slate of directors.

I’m gratified that the Board of Directors will be unchanged from last year and be able to continue its efforts to move the Company forward.

The agreement that we have forged with the Company should avoid distraction and unnecessary expense allowing our Board to continue to position Barnwell for long term positive cash generation and further share price appreciation.”

finance.yahoo.com

Why $ELYS Game Technology soared in 2021Why Elys Game Technology soared in 2021

On november 25. Company Announced Appointment of Senior Gaming Industry Executive Matteo Monteverdi to CEO.

Matteo has been leading world-class B2B and B2C teams in the technology and digital industry for over 20 years between Silicon Valley and Boston. He spent the last decade of his career at the intersection of social gaming, digital betting, i-gaming and media working for international organizations in high growth segments.

finance.yahoo.com

Elys Game Technology Revenue Increases 44% to $9.7 Million for the Third Quarter of 2020

finance.yahoo.com

$TUSK awarded a contract of $40 million in revenue Mammoth Energy Announces Growth of Engineering Services Company

$TUSK today announced that its wholly owned subsidiary, Aquawolf, LLC (“Aquawolf”), has been awarded a contract by a major utility to provide engineering and design services. The three-year contract is expected to generate up to approximately $40 million in revenue over the contract term.

finance.yahoo.com

$LKCO Announces $15.0 Million Registered Direct OfferingLuokung Technology Corp. Announces $15.0 Million Registered Direct Offering

today announced that it has entered into a securities purchase agreement with certain institutional investors for a registered direct offering of approximately $15.0 million of ordinary shares at a price of $0.888 per share.

The Company will issue a total of 16,891,892 ordinary shares to the institutional investors. As part of the transaction, the Company will also issue to the investors warrants ("Warrants") for the purchase of up to 8,445,946 ordinary shares at an exercise price of $1.11 per share, which Warrants will have a term of three years from the date of issuance.

$LKCO $5.0 Million Registered Direct PlacementLuokung Announces Partnership Between EMG and Leading Electric Vehicle Manufacturer BAIC BJEV to Jointly Develop Mapping Services for Autonomous Driving

EMG recently worked with BAIC BJEV to provide HD map services in autonomous valet parking ("AVP") for BAIC New Energy vehicles. The two parties will cooperate in depth on L3 (conditional driving automation) to L4 (high driving automation) autonomous driving related projects.

finance.yahoo.com

Luokung Technology Corp. Announces $5.0 Million Registered Direct Placement

today announced that it has entered into a securities purchase agreement with certain institutional investors for a registered direct offering of $5.0 million of ordinary shares at a price of $0.52 per share. The Company will issue a total of 9,615,387 ordinary shares to the institutional investors. As part of the transaction, the Company will also issue to the investors warrants ("Warrants") for the purchase of up to 4,807,694 ordinary shares at an exercise price of $0.68 per share, which Warrants will have a term of three years from the date of issuance.

finance.yahoo.com

$OLB Announces Plan to Offer Cryptocurrency Payment OptionsOLB Group Announces Plan to Offer Cryptocurrency Payment Options via Blockchain Technology on its OMNICOMMERCE Platform and SecurePay TM Gateway

OLB’s SecurePay TM Payment Gateway to Enable Merchants to Seamlessly Offer Cryptocurrency Payments

$OLB upgraded its SecurePay payment gateway system to support Cryptocurrencies including Bitcoin, Ethereum, USDC and DAI across all merchant platforms.

SercurePay is compatible with mobile, tablet-based and cloud infrastructure and will be integrated into the merchants current payment ecosystem, in order to enable the acceptance of Cryptocurrency payments.

finance.yahoo.com

$AUVI Announces Acquisition of the Airocide Technology PlatformApplied UV Announces Acquisition of the Airocide(R) Technology Platform for Airborne Pathogen Reduction

Developed with NASA as a patented pathogen killing technology

Proprietary photocatalytic oxidation process thoroughly destroys viruses, bacteria, spores, and fungi as well as other carbon-based molecules

Airocide® air disinfection technology compliments and expands the SteriLumen platform, together providing a more comprehensive solution for air and surface

Accelerates the strategy to grow revenues through complimentary acquisitions

Enhances scale in the fast-growing disinfection device market

Akida's revenue for the full calendar year 2020 is estimated to be $4.7 million with EBITDA of approximately $921,000.

Airocide technology is widely accepted and currently used by nationally recognized brands such as Hard Rock Café, the US Army, Stag's Leap vineyards and many more.

finance.yahoo.com

$JG Partners with Kuaishou to Improve Monetization EfficiencyAurora Mobile $JG Partners with Kuaishou to Improve Monetization Efficiency

$JG today announced that it has entered into a partnership agreement with Kuaishou Technology (01024.HK) (“Kuaishou”), China’s leading short video content community and social platform, to improve advertising monetization efficiency.

By leveraging its powerful artificial intelligence (“AI”) and advanced analysis technologies, Aurora Mobile's advertisement SaaS services will enable Kuaishou to help brands and performance-based advertisers to accurately target potential customers, enhance advertising conversion rate, reduce operational costs, and promote a mutually beneficial relationship between Kuaishou and advertisers on its platform.

The short-form video market continues to experience huge growth. Short-form video advertising that features high traffic and conversion rates has become a preferred marketing approach for many brands and performance-based advertisers.

According to the cooperation agreement, Aurora Mobile will benefit from a revenue share agreement based on advertising revenues allocated to Kuaishou if the labels provided by Aurora Mobile are used by advertisers on the platform.

finance.yahoo.com

$AREC Announces Filing of SPAC Registration Statement$AREC American Resources Corporation Announces Filing of SPAC Registration Statement

$AREC Company's SPAC is targeting acquisitions in the land holding and resource industry, and will focus on advancing land and resource assets towards a modern-day business model of clean energy, recycling and redevelopment, and social impact.

$AREC today announced that American Acquisition Opportunity Inc., a special purpose acquisition company (the "SPAC" or "AAOI"), in which the Company has an indirect investment, filed a Registration Statement on Form S-1 (the "Registration Statement") with the Securities and Exchange Commission ("SEC") on February 4, 2021 in connection with a proposed initial public offering of its units.

The proposed public offering is expected to have a base offering size of $100 million, or up to $115 million if the underwriters' over-allotment option is exercised in full.

finance.yahoo.com

Sabra Capital Partners places a $7 target on SupercomSeeking alpha: Sabra Capital Partners places a $7 target on Supercom. Explosive Potential, Limited Downside: We view the base level value of the Company to be $7.00 per share based on a multi-year estimate that revenues will rebound back to $35mm. High conviction.

While none of its coronavirus tracking pilots have materialized into a formal, large scale contract, news is gaining momentum in the Company’s backyard, Israel.

seekingalpha.com

Alziehmer play IdeaAlziehmer play with good vol and Feb 9 Catalyst

milestones for Q1/Q2

1. First Patient In (FPI) for Phase III

(Study 301)

2. Top Line results for completed Phase

I/II (Study 201)

3. Commercial Scale Manufacturing

Batch Pre-IND Meeting Request for AD

Purchase Order for HybridTech Armor© Panels for Aircraft CarrierCPS Technologies Corporation receives Purchase Order for HybridTech Armor© Panels for Aircraft Carrier

CPSH today announced receipt of a purchase order for HybridTech Armor© Panels to be installed as the strike face of advanced ballistic shields to support U.S. Navy CVN class ships.

The purchase order covers panels to equip all crew-served weapons stations on one aircraft carrier.

We have received a $28.7 million IDIQ contract from the Navy to address the aircraft carrier fleet, with an initial delivery order for the first aircraft carrier.”

finance.yahoo.com

Acquires Exclusive Rights to Rare Earth Element InnovationsAmerican Resources Corporation Acquires Exclusive Rights to Purdue University's Rare Earth Element Innovations, Critical for Clean Energy Technologies.

An environmentally safer method of rare earth and other critical material separation and purification using ligand-assisted chromatography for coal, coal byproducts, recycled permanent magnets and Lithium Ion batteries.

Announced that, with the addition of Hasler Ventures LLC, the Company has licensed ligand assisted displacement ("LAD") chromatography patents and knowhow to further expanded its capability in environmentally friendly separation and purification of rare earth elements.

These exclusive patents and technologies, developed at Purdue University, are specific to the processing of separated and pure rare earth metals and critical elements from coal byproducts, recycled permanent magnets and lithium-ion batteries.

Rare earth elements (REEs) include the 15 elements in the lanthanide series plus scandium (Sc) and yttrium (Y). They are essential ingredients for magnets, metal alloys, polishing powders, catalysts, ceramics, and phosphors, which are important for high-technology and clean energy applications. The global REE market is estimated at approximately $4 billion dollars and growing at 8% per year.

finance.yahoo.com

Space launch company Astra to go public via merger with SPAC HOLastra-to-become-the-first-publicly-traded-space-launch-company-on-nasdaq-via-merger-with-holicity

BlackRock-managed funds and accounts lead investment in Astra to launch a new generation of space services to improve life on Earth.

The transaction reflects an implied pro-forma enterprise value for Astra of approximately $2.1 billion. Upon closing, the transaction is expected to provide up to $500 million in cash proceeds, including up to $300 million of cash held in the trust account of Holicity and an upsized $200 million PIPE led by funds and accounts managed by BlackRock.

In December 2020, Astra joined a small, elite group of companies that have made it to space. With over 50 launches in manifest across more than 10 private and public customers, including NASA and DOD, Astra has booked over $150 million of contracted launch revenue. Astra will begin delivering customer payloads this summer and begin monthly launches by the end of this year.

The proposed transaction, which is expected to be completed in the second quarter of 2021.

astra.com

Sunlight Financial LLC to List on NYSE Through Merger With SPRQSunlight Financial LLC, a Premier Residential Solar Financing Platform, to List on NYSE Through Merger With Apollo-Affiliated Spartan Acquisition Corp. II

Sunlight and Apollo-Affiliated Spartan Acquisition Corp. II (NYSE: SPRQ) Enter Into Business Combination Agreement

Institutional Investors Led By Chamath Palihapitiya, Coatue, Funds and Accounts Managed by BlackRock, Franklin Templeton and Neuberger Berman Commit to Invest $250 Million at Closing in Common Stock PIPE at $10.00 per Share

Pro Forma Implied Equity Value of the Combined Company is Approximately $1.3 Billion

Sunlight has arranged financing for more than an estimated 100,000 residential solar systems, which will produce over 500 megawatts of solar-generated electricity and avoid more than 10 million metric tons of carbon dioxide emissions.

Leading POS platform through which over $3.5 billion of loans have been originated in the rapidly growing residential solar market

Upon the closing of the transaction, existing Sunlight equityholders are expected to own approximately 50% of the combined company, Spartan stockholders are expected to own approximately 26%, and PIPE participants are expected to own approximately 19%.

The transaction is expected to close in the second quarter of 2021.

finance.yahoo.com

Closing of $103.5 Million Upsized Initial Public OfferingLMF Acquisition Opportunities, Inc. Announces Closing of $103.5 Million Upsized Initial Public Offering, Including Full Exercise of the Overallotment Option

the closing of its upsized initial public offering of 10,350,000 units, which included the full exercise of the underwriters' over-allotment option, at a price of $10.00 per unit.

Each unit consisted of one share of Class A common stock and one redeemable warrant, each warrant entitling the holder thereof to purchase one share of Class A common stock at a price of $11.50 per share.

finance.yahoo.com

Reddit army buying heavily shorted REV stockShares of REV were jumping again as a massive short squeeze on consumer stocks continued into its third day.

The squeeze instigated by a group of traders on Gamestop has now spread to other heavily shorted stocks

There was no news out on any of these three stocks today, and certainly nothing of the kind that would generate this kind of movement for fundamental reasons.

Instead, traders on platforms like Reddit have figured out that they can take advantage of heavily shorted small-cap stocks if enough of them start buying them, and that's what's happened with REV stock.

When a stock is shorted and starts to go up, short-sellers eventually have to buy back the shares or risk further losses, including a margin call forcing the repurchase.

At Revlon, 31% of the stock's float was sold short as of the end of December.

www.fool.com