ICON — Breakout from Rectangle with H Projection Targeting $700ICON (3D) — Technical Structure Analysis

ICON has broken out from a prolonged horizontal rectangle pattern ($380–$540). The move activated a measured move structure with two H-sized waves. The first H was completed. The second H projects a move to the $700 area.

Key points:

-Confirmed breakout from range

-First H = 153 pts, completed

-Second H = 162 pts, targeting $700

-Price holding above breakout zone ($515–$541)

ICON has moved out of accumulation and entered trend expansion. As long as the support holds, the scenario remains valid. The technical model targets the $700 area.

Stockstowatch

Quantum's TSLA Trading Guide 4/13/25Sentiment: Neutral. EV and AI optimism persists, but tariff risks and high valuation concern traders. Chatter split—bulls eye robotaxi, bears see pullback.

Outlook: Neutral, slightly bearish. Options pin $250, with $240 puts active. ICT/SMT eyes $245-$250 buys to $260 if $245 holds. Bearish below $245 risks $240.

Influential News:

Federal Reserve: Two 2025 cuts support growth stocks, positive for $TSLA.

Earnings: Q1 due late April; no update today.

Chatter: Debates tariff impact vs. AI/EV growth.

Mergers and Acquisitions: None; focus on internal projects.

Other: Tariff volatility hit NASDAQ:TSLA ; stock swung (April 3-9).

Indicators:

Weekly:

RSI: ~50 (neutral).

Stochastic: ~45 (neutral).

MFI: ~40 (neutral).

SMAs: 10-day ~$255 (below, bearish), 20-day ~$260 (below, bearish).

Interpretation: Neutral, bearish SMAs signal weakness.

Daily:

RSI: ~48 (neutral).

Stochastic: ~50 (neutral).

MFI: ~45 (neutral).

SMAs: 10-day ~$255 (below, bearish), 20-day ~$260 (below, bearish).

Interpretation: Neutral, bearish SMAs suggest pullback.

Hourly:

RSI: ~45 (neutral).

Stochastic: ~55 (neutral).

MFI: ~50 (neutral).

SMAs: 10-day ~$255 (below, bearish), 20-day ~$260 (below, bearish).

Interpretation: Neutral, stabilizing.

Price Context: $252.31, 1M: +1%, 1Y: +38%. Range $240-$270, testing $250 support.

Options Positioning (May 2025):

Volume:

Calls: $260 (15,000, 60% ask), $270 (12,000, 55% ask). Mild bullish bets.

Puts: $240 (10,000, 70% bid), $245 (8,000, 65% bid). Put selling supports $245.

Open Interest:

Calls: $260 (40,000, +7,000), $270 (30,000, +5,000). Bullish interest.

Puts: $240 (25,000, flat), $245 (28,000, +4,000). Hedging. Put-call ~1.0.

IV Skew:

Calls: $260 (40%), $270 (42%, up 3%). $270 IV rise shows upside hope.

Puts: $240 (35%, down 2%), $245 (36%). Falling $240 IV supports floor.

Probability: 60% $240-$270, 20% <$240.

Karsan’s Interpretation:

Vanna: Neutral (~300k shares/1% IV). IV drop could pressure $250.

Charm: Neutral (~150k shares/day). Pins $250.

GEX: +50,000. Stabilizes range.

DEX: +7M shares, neutral.

Karsan view: GEX holds $240-$270; tariff news key.

ICT/SMT Analysis:

Weekly: Neutral, $240 support, $270 resistance. No $TSLA/ NYSE:NIO divergence.

Daily: Bullish at $250 FVG, targets $260. Bearish < $245.

1-Hour: Bullish >$250, $260 target. MSS at $245.

10-Minute: OTE ($249-$251, $250) for buys, NY AM.

Trade Idea:

Bullish: 50%. ICT/SMT buys $245-$250 to $260. Options show $260 calls. Fed cuts aid.

Neutral: 35%. RSI (~50), SMAs (bearish), $240-$270 range.

Bearish: 15%. Below $240 possible with tariffs. $240 put volume grows.

Quantum's KWEB Trading Guide 4/13/25Analysis:

Post-Close Options Activity (April 11):

Data: System reports 469.32K contracts traded on April 11, with puts at 10.99% (calls ~89%). High call volume at $31/$32 strikes suggests bullish bets.

Interpretation: Call-heavy flow indicates retail/institutional optimism, likely targeting a sweep above $31.35 (weekly high). Potential for a liquidity sweep trapping longs, aligning with ICT/SMT reversal.

RSI (14) Level and Trend:

Estimate: Daily RSI ~55 (neutral-bullish), based on April 11 close ($30.52, +2.97% from $29.62). Uptrend from April 8 low ($27.95) but below March 17 peak ($38.401) avoids overbought.

Interpretation: RSI supports bullish setups (above 50), with room for upside before resistance (~70). A sweep to $31.50 could push RSI higher, signaling OTE retracement.

Anonymized X Post Insights (April 11–13):

Summary: Posts highlight Chinese tech optimism (e.g., DeepSeek AI, consumer spending), tempered by tariff fears (Trump’s 125% threats). Some speculate on KWEB breaking $31, others note volatility risks.

Interpretation: Mixed sentiment leans bullish, with chatter about AI and stimulus driving buy-side interest. Tariff uncertainty suggests potential sell-side sweeps if news escalates.

Potential Reversals/Catalysts:

Liquidity Sweeps: Call-heavy options and X speculation point to a buy-side sweep above $31.35 (W-High), trapping retail longs before an OTE reversal to $30.00 (HVN).

Institutional Positioning: High call OI suggests dealers hedging bullish bets, but tariff risks could trigger smart money to fade retail.

Catalysts: Retail Sales (April 15) or tariff relief news could spike KWEB, while escalation could drive sell-side volatility.

Why: Sentiment aligns with ICT/SMT, where bullish retail chatter sets up sweeps, and smart money reverses at OTE. Neutral-bullish RSI and call volume support a setup.

Action: Log sentiment as neutral-bullish, expect sweep above $31 or drop to $29 on tariff news. Highlight for video: “KWEB’s call-heavy buzz could trap retail—watch for a smart money reversal.”

Tariff Impact

Assessment: Severe

Exposure:

KWEB’s holdings (e.g., PDD, JD.com, Tencent) rely on China’s internet economy, with significant supply chain and consumer exposure to U.S.-China trade. Tariffs (e.g., 125% proposed) raise costs for e-commerce and tech exports, hurting revenues.

Example: PDD (Temu) faces U.S. import duties, squeezing margins; JD.com’s logistics chain is tariff-sensitive.

Current Policy (April 13):

Context: Trump’s April 10 statement escalates tariffs to 125% on Chinese goods, with no relief confirmed by April 13. Web reports (Reuters, April 4) note market volatility from tariff fears, impacting KWEB’s April 8 low ($27.95).

Impact: Severe, as KWEB’s ETF structure amplifies holdings’ tariff pain (e.g., Alibaba, Tencent ADRs). Sentiment sours on escalation, driving sell-side sweeps.

Tariff Relief Potential:

Scenario: A 90-day pause or negotiation (rumored on X, inconclusive) could lift KWEB +3–5% ($31.50–$32.00), as seen in past relief rallies (e.g., February 2025, +1.6% on pause news).

Fundamentals: Relief boosts consumer spending on KWEB’s holdings, supporting bullish MSS. Without relief, bearish pressure persists.

AMT Tie-In: Tariff news creates imbalances (LVN breaks), with price seeking HVNs (e.g., $30.00) post-volatility.

Why: Severe tariff exposure makes KWEB sensitive to trade news, fueling sweeps (buy-side on relief, sell-side on escalation), per ICT/SMT.

Action: Rate tariff impact severe, monitor April 14 for negotiation updates. Video: “Tariffs could sink KWEB, but relief might spark a sweep to $32—stay sharp.”

News/Catalysts

Current (April 11, 2025)

Closing Price:

System Data: KWEB closed at $30.52 (currentPrice), +2.97% from prevDayClose ($29.62).

Verification: Matches April 11 high ($30.63), low ($29.41), open ($30.12).

Drivers:

Positive: Call-heavy options (89% calls) and AI buzz (DeepSeek, X posts) drove the rally. Web reports note Chinese tech resilience despite tariffs.

Negative: Tariff fears capped gains, with X posts citing Trump’s 125% threat as a drag.

Sector Trends: China ETFs rose (e.g., MCHI +2.1%, April 11), supporting KWEB’s move.

Why: Options flow and AI speculation fueled bullish momentum, but tariffs restrained breakout above $31.

Action: Highlight $30.52 close, +2.97%, driven by calls and AI. Video: “KWEB jumped 3% on AI hype, but tariffs loom large.”

Upcoming (Week of April 14–18)

Events:

April 15, Retail Sales (8:30 AM): Measures U.S. consumer spending, impacting KWEB’s e-commerce holdings (PDD, JD.com).

April 16–18, Tariff Talks: Potential U.S.-China negotiations, per X chatter (inconclusive).

Ongoing, China Stimulus: Rumored fiscal measures could lift Chinese tech, no date confirmed.

Predictions:

Bullish (+3%, ~$31.50): Strong Retail Sales (+0.5% MoM) or stimulus news boosts e-commerce, sweeping buy-side liquidity ($31.35).

Bearish (-3%, ~$29.50): Weak Retail Sales (-0.2% MoM) or tariff escalation triggers sell-side sweep ($29.41).

Neutral (±1%, $30.20–$30.80): Mixed data or no tariff news keeps KWEB near $30.00 (HVN).

Why: Catalysts drive displacement (sweeps to OHLC/LVNs), setting up OTE entries, per AMT/ICT.

Action: Set alerts for Retail Sales (April 15), monitor X for tariff updates. Video: “Retail Sales could push KWEB to $32 or drop it to $29—big week ahead.”

Technical Setup

Multi-Timeframe Analysis (Adjusted to April 11 Close, $30.52)

Weekly Chart

HVN (High Volume Node):

Level: $30.00 (POC, near W-Open $29.59, D-Close $30.52).

Role: Support, price consolidated March 24–April 11 ($29–$31).

Stance: Bullish (price above HVN, defending $30.00).

LVN (Low Volume Node):

Level: $31.50 (near W-High $31.35, April 4).

Role: Fast-move zone, price dropped post-$31.35 (April 4–8).

Stance: Neutral (price below LVN, potential sweep target).

EMA Trend:

Status: 8-week ($31.50) < 13-week ($32.00) < 48-week ($33.50), downtrend but flattening.

Stance: Neutral (price below EMAs, but $30.52 tests 8-week).

RSI (14):

Level: ~55 (neutral-bullish, up from 45 at $27.95, April 8).

Stance: Bullish (>50, room to 70).

MACD:

Status: Above signal, nearing zero (bullish crossover April 10).

Stance: Bullish (gaining momentum).

Bollinger Bands:

Status: Price at midline ($30.50), bands narrowing.

Stance: Neutral (breakout pending).

Donchian Channels:

Status: Above midline ($29.65, W-Low to W-High).

Stance: Bullish (breakout potential).

Williams %R:

Level: ~-40 (neutral, not overbought).

Stance: Bullish (>-50, rising).

ADR (Average Daily Range):

Status: Expanding (~3%, $0.90/day).

Stance: Bullish (volatility supports moves).

VWAP:

Status: Above VWAP (~$30.20, April 11).

Stance: Bullish (buyers control).

ICT/SMC:

MSS: Bearish (lower highs from $38.401, March 17, but higher low $27.95, April 8, signals potential shift).

Trend: Neutral (consolidation $29–$31, testing W-High $31.35).

Summary: Neutral-bullish, price at HVN ($30.00) with LVN ($31.50) as sweep target. Indicators favor upside, but MSS needs confirmation.

1-Hour Chart

Support/Resistance:

Support: $29.41 (D-Low, April 11), aligns with W-Open ($29.59), HVN ($30.00).

Resistance: $30.63 (D-High, April 11), near LVN ($31.50), W-High ($31.35).

Stance: Bullish (price above support, testing resistance).

RSI (14):

Level: ~60 (bullish, rising from 50 at $29.41).

Stance: Bullish (>50, not overbought).

MACD:

Status: Above signal, positive histogram.

Stance: Bullish (momentum building).

Bollinger Bands:

Status: Price near upper band ($30.60).

Stance: Bullish (breakout potential).

Donchian Channels:

Status: Above midline ($30.02).

Stance: Bullish (trend strength).

Williams %R:

Level: ~-30 (bullish, not overbought).

Stance: Bullish (>-50).

VWAP:

Status: Above VWAP (~$30.30, intraday April 11).

Stance: Bullish (buyers dominate).

ICT/SMC:

Buy-Side Liquidity: Above $30.63 (D-High), $31.35 (W-High), LVN ($31.50). Retail stops cluster here.

Sell-Side Liquidity: Below $29.41 (D-Low), $27.95 (W-Low/M-Low).

OB: Bullish OB at $29.80–$30.00 (April 10 consolidation, demand zone, near HVN $30.00).

FVG: Bullish FVG at $30.00–$30.20 (April 11 gap, unfilled, aligns with D-Open $30.12).

OTE: Fib 61.8%–78.6% from $29.41 (low) to $30.63 (high) = $30.05–$30.15 (overlaps OB/FVG/HVN).

Displacement: Potential impulsive move to $31.50 (LVN) or $29.00 (below D-Low) on Retail Sales or tariff news.

Summary: Bullish bias, with OTE ($30.05–$30.15) as entry zone post-sweep, supported by OB/FVG/HVN.

10-Minute Chart

Closing Move (April 11):

Status: Rallied to $30.52, closed near high ($30.63), strong volume.

Stance: Bullish (buyers pushed close).

EMA Direction:

Status: 8-EMA ($30.45) > 13-EMA ($30.40) > 48-EMA ($30.30), uptrend.

Stance: Bullish (EMAs rising).

RSI (14):

Level: ~65 (bullish, cooling from 70).

Stance: Bullish (>50, not overbought).

MACD:

Status: Above zero, bullish crossover.

Stance: Bullish (momentum intact).

VWAP:

Status: Above VWAP (~$30.40, late April 11).

Stance: Bullish (buyers control).

ICT/SMC:

Liquidity Sweep: Wick to $30.63 (8:50 AM, April 11) tested buy-side, no clear rejection yet.

Retracement: Potential retrace to $30.05–$30.15 (OTE) if sweep completes (e.g., April 14, 8:00 AM).

Entry Signal: Pin bar or engulfing at OTE (e.g., $30.10, 10-minute candle).

Summary: Bullish, awaiting sweep above $30.63 or $31.35, retrace to OTE for entry.

Options Data

Analysis:

GEX (Gamma Exposure):

Status: Positive GEX at $31 strike (high call OI), neutral at $30.

Impact: Dealers buy stock to hedge calls, supporting $31 pin or slight lift to $31.50.

Explanation: Positive GEX stabilizes price near high OI strikes, aligning with LVN ($31.50) sweep.

Stance: Neutral-bullish (pinning likely, breakout possible).

DEX (Delta Exposure):

Status: High call delta (+0.3, 89% call volume).

Impact: Bullish pressure, as dealers hedge calls by buying KWEB.

Explanation: Call-heavy delta fuels upside momentum, supporting buy-side sweep.

Stance: Bullish.

IV (Implied Volatility):

Status: Moderate (~25%, vs. 20–35% norm for KWEB).

Impact: Steady swings ($0.50–$1.00/day), good for ATM/OTM calls.

Explanation: Moderate IV balances premium cost and volatility, ideal for OTE entries.

Stance: Bullish (volatility supports options).

OI (Open Interest):

Status: Call-heavy (65% calls at $31, 20% at $32, 15% puts at $30).

Impact: Momentum toward $31–$32, potential pin at $31 (high OI).

Explanation: High call OI marks targets (W-High $31.35, LVN $31.50), puts at $30 guard HVN.

Stance: Bullish (calls drive upside).

Cem Karsan’s Application and Weekly Trading Breakdown:

Gamma: High at $31 (pinning risk), low at $32 (breakout potential).

Vanna: Rising IV (25% to 30% on Retail Sales) lifts calls, dealers buy KWEB, pushing to $31.50.

Charm: Near OPEX (April 18), $31 calls hold delta if ITM, spiking volatility April 17–18.

Volatility Skew: Call skew (higher IV for $32 vs. $30) favors upside breakouts.

Weekly OI (Exp. April 18): 65% calls at $31, 20% at $32. Pinning likely at $31 unless Retail Sales sparks breakout to $32.

Options Strategy:

Trade: Buy $31 calls at OTE ($30.10, April 14, 8:50 AM), premium ~$0.50.

Exit: $31.50 (W-High/LVN, premium ~$0.90), profit $0.40.

Stop: Below OB ($29.80, premium ~$0.20), risk $0.30.

R:R: 1.33:1 (adjust to 2:1 with partial exit).

ICT/SMC Tie-In: Enter post-sweep ($31.35), retrace to OTE ($30.10), target $31.50.

Vanna:

Status: IV rise (25% to 30%) amplifies calls, dealers buy KWEB.

Impact: Bullish lift to $31–$31.50, aligns with LVN sweep.

Explanation: Vanna boosts delta near high OI, supporting OTE reversal.

Charm:

Status: OPEX (April 18) nears, $31 calls gain delta if KWEB hits $31.

Impact: Volatility spikes April 17–18, favors quick OTE trades.

Explanation: Charm accelerates delta, amplifying sweep-to-OTE moves.

Timeframe Analysis:

Weekly (Exp. April 18):

OI: 65% calls ($31), 20% ($32), 15% puts ($30).

IV: Moderate (25%), rising on catalysts.

Stance: Bullish (calls dominate, breakout risk).

Monthly (Exp. May 2):

OI: Balanced (50% calls $32, 50% puts $29).

IV: Stable (~24%).

Stance: Neutral (consolidation likely).

3-Month (Exp. July 7):

OI: Call skew ($33–$35, 60% calls).

IV: Low (~22%).

Stance: Bullish (long-term upside).

Directional Bias:

Synthesis: Positive GEX ($31 pin), high call DEX (+0.3), moderate IV (25%), call-heavy OI (65% at $31), vanna (IV lift), charm (OPEX volatility), and ICT/SMC (buy-side sweep to $31.35, OTE at $30.10) suggest a bullish trend for April 14, with potential retracement post-sweep.

Why: Options data aligns with ICT/SMT (call OI = buy-side liquidity, OTE = dealer hedging zone), per AMT (LVN sweep, HVN reversal).

Action: Focus on $31 calls, highlight pinning vs. breakout. Video: “KWEB’s $31 call wall could pin or pop—perfect for an OTE play.”

Sympathy Plays

Correlated Assets:

MCHI (iShares MSCI China ETF): Tracks broader Chinese equities, rises ~2–3% if KWEB rallies (e.g., $31.50), due to shared holdings (Alibaba, Tencent).

BABA (Alibaba ADR): KWEB’s top holding, moves +3–4% on KWEB’s sweep to $31.35, driven by e-commerce/AI overlap.

Opposite Mover:

GLD (SPDR Gold ETF): Risk-off asset, fades ~1–2% if KWEB rallies (risk-on), as investors shift from safe havens to tech.

Why: Sympathy plays confirm sector momentum (Chinese tech), while GLD hedges tariff fears, per ICT/SMT sentiment.

Action: Monitor MCHI/BABA for confirmation, GLD for divergence. Video: “If KWEB pops, MCHI and BABA follow—watch gold for the flip side.”

Sector Positioning with RRG

Sector: Technology – Emerging Markets (China Internet).

RRG Position: Improving (vs. MCHI ETF).

Rationale: KWEB’s April 11 rally (+2.97%) outpaces MCHI (+2.1%), with RSI (~55) and call OI signaling strength. Tariff fears weaken absolute gains, but relative momentum grows.

Tie-In: Improving quadrant supports bullish MSS, OTE entries at HVN ($30.00).

Why: RRG aligns with sentiment (call-heavy) and technicals (above HVN), per AMT value area.

Action: Highlight Improving RRG for video: “KWEB’s gaining steam in China tech—prime for a sweep setup.”

Targets

Bullish:

Target: +3.5% to $31.60.

Levels: W-High ($31.35), LVN ($31.50), next resistance ($32.00).

Rationale: Buy-side sweep to $31.35 (W-High), breakout to LVN on Retail Sales or tariff relief, per ICT/SMC.

Bearish:

Target: -3.2% to $29.55.

Levels: D-Low ($29.41), below W-Open ($29.59), HVN ($29.50).

Rationale: Sell-side sweep below $29.41 on weak Retail Sales or tariff escalation, retracing to HVN, per AMT.

Why: Targets tie to OHLC (W-High, D-Low), HVNs/LVNs, and catalysts, ensuring ICT/SMC alignment (liquidity to OTE).

Quantum's T (AT&T) Trading Guide 4/11/25T (AT&T Inc.)

Sentiment

• Sentiment is neutral with a bearish tilt. April 10 options activity shows put-heavy volume at $26 strikes, reflecting caution. RSI (14) at ~50 (estimated, flat trend at $26.40 close) suggests indecision. X posts highlight concerns over telecom debt loads and tariff risks on equipment imports, but some speculate on institutional accumulation below $26.50. A liquidity sweep below $26.33 could trigger a bullish reversal if buy-side liquidity is tapped.

Catalyst: Potential sweep below $26.33 may spark short covering.

Tariff Impact - Rating: Moderate.

• Explanation: T relies on imported telecom equipment, facing cost pressures from tariffs on China (active as of April 11). No relief announced, so margins could tighten, capping upside. X posts suggest tariff fears weigh on sentiment, but domestic revenue focus limits fundamental damage.

News/Catalysts

• Driver: Flat telecom sector performance on April 10, with T holding steady amid mixed market signals. X posts cited stability but no clear catalyst.

• Upcoming: CPI (April 11): High CPI could hurt T (-1.5%) due to rate hike fears; low CPI may lift it (+1%) as a yield play.

• Retail Sales (April 15): Strong data supports T (+1%); weak data pressures (-1%) due to consumer spending risks.

Technical Setup

Weekly Chart:

• HVN: $26.00 support (bullish).

• LVN: $27.00 resistance (neutral).

• EMA Trend: 8-week ≈ 13-week > 48-week (neutral).

• RSI (14): ~50 (neutral).

• MACD: Near signal line (neutral).

• Bollinger Bands: At midline (neutral).

• Donchian Channels: At midline (neutral).

• Williams %R: ~-50 (neutral).

• ADR: Stable (neutral).

• VWAP: At VWAP $26.40 (neutral).

• ICT/SMC: No clear MSS; consolidation phase.

One-Hour Chart:

• Support/Resistance: Support at $26.33; resistance at $26.56. Stance: neutral.

• RSI (14): ~50 (neutral).

• MACD: Near zero (neutral).

• Bollinger Bands: At midline (neutral).

• Donchian Channels: At midline (neutral).

• Williams %R: ~-50 (neutral).

• VWAP: At VWAP $26.50 (neutral).

• ICT/SMC: Sell-side liquidity below $26.33; OB at $26.40; FVG at $26.35–$26.45; OTE at $26.45; no displacement.

10-Minute Chart:

• Closing Move: Flat into close.

• EMA Direction: 8/13/48 EMAs flat (neutral).

• RSI (14): ~50 (neutral).

• MACD: Near zero (neutral).

• VWAP: At VWAP $26.50 (neutral).

• ICT/SMC: Potential sweep below $26.33; OTE at $26.45; no clear entry signal yet.

Options Data

• GEX: Neutral, pinning at $26.50. Dealers hedge minimally.

• DEX: Put delta bias (-0.15), bearish pressure.

• IV: Low (~18%), limited swings.

• OI: Put-heavy (55% puts at $26), capping upside.

Cem Karsan’s Application:

• Weekly Trading Breakdown: OI at $26 suggests pinning. Low gamma limits volatility; vanna neutral; charm favors puts near OPEX.

• Strategy: Buy $26.50 calls at $26.45 (OTE), exit at $27, profit $0.30, risk $0.40. Ties to sweep below $26.33.

• Vanna: Stable IV, no dealer-driven lift.

• Charm: Puts gain delta near OPEX, pressuring $26.

Timeframe Analysis:

• Weekly (exp. April 18): Put OI at $26, low IV, bearish stance.

• Monthly (exp. May 16): Balanced OI, neutral stance.

• 3-Month (exp. July 18): Neutral outlook.

• Directional Bias: Neutral, leaning bearish unless sweep triggers reversal.

Sympathy Plays

• Correlated Assets: VZ (+1%), CCI (+0.5%).

• Opposite Mover: If T fades, risk-on SPOT rises (+1%).

Sector Positioning with RRG - Sector: Communication Services – Telecom.

• RRG Position: Lagging vs. XLC, reflecting weak momentum.

Targets

• Bullish: +2% to $27.00 (OB).

• Bearish: -2% to $25.87 (FVG).

Quantum's KR Trading Guide 4/11/25

KR (Kroger Company)

Sentiment

• Analysis: Market sentiment for KR is neutral leaning bullish. Post-close options activity on April 10 shows balanced put/call volume, with slight call dominance at strikes near $69, suggesting cautious optimism. RSI (14) at the April 10 close (estimated ~60 based on recent uptrend to $67.96) indicates momentum without overbought conditions, supporting a potential continuation. Anonymized X chatter highlights speculation on grocery sector stability amid tariff uncertainties, with some noting KR’s domestic focus as a hedge against import risks. A potential liquidity sweep above recent highs ($68.76) could signal institutional buying, setting up a reversal to the upside.

Catalyst: Watch for a sweep above $68.76 triggering bullish momentum, driven by retail investor interest on X.

Tariff Impact - Rating: Minimal.

• Explanation: KR’s exposure to tariffs is limited due to its primarily domestic supply chain and focus on U.S.-sourced goods. While imported specialty products could face cost pressures, these are a small fraction of revenue. No tariff relief or escalation was announced on April 10, so sentiment remains stable. Fundamentals are unaffected, but speculative X posts suggest tariff fears could cap upside unless clarity emerges.

News/Catalysts

• No specific company news on April 10, but sector strength in consumer staples drove modest gains, with KR benefiting from defensive positioning amid broader market volatility. X posts noted KR as a “safe play” in uncertain times.

• Upcoming: CPI Data (Today, April 11): Stronger-than-expected CPI could pressure consumer staples (-1% move) as investors rotate to cyclicals; weaker CPI could boost KR (+2%) as a defensive name.

• Retail Sales (April 15): Robust data may signal consumer strength, lifting KR (+1.5%); weak data could hurt (-1%) due to spending concerns.

Technical Setup

Weekly Chart:

• HVN: $66.50 as support (bullish, price above).

• LVN: $70.00 as resistance (neutral, price below).

• EMA Trend: 8-week > 13-week > 48-week (bullish uptrend).

• RSI (14): ~62 (bullish, above 50).

• MACD: Above signal line (bullish).

• Bollinger Bands: Near upper band (bullish).

• Donchian Channels: Above midline (bullish).

• Williams %R: ~-20 (neutral, not overbought).

• ADR: Expanding (bullish, volatility rising).

• VWAP: Above weekly VWAP at $67.00 (bullish).

• ICT/SMC: Higher highs/lows confirm bullish Market Structure Shift (MSS).

One-Hour Chart:

• Support/Resistance: Support at $67.50 (weekly HVN confluence); resistance at $68.76 (daily high). Stance: bullish above support.

• RSI (14): ~65 (bullish).

• MACD: Above signal (bullish).

• Bollinger Bands: At upper band (neutral, potential pullback).

• Donchian Channels: Above midline (bullish).

• Williams %R: ~-15 (neutral).

• VWAP: Above hourly VWAP at $68.20 (bullish).

• ICT/SMC: Buy-side liquidity above $68.76; Order Block (OB) at $67.50 demand zone; FVG at $68.00–$68.10; OTE (Fib 61.8%) at $68.30; displacement seen in early April 11 rally.

10-Minute Chart:

• Closing Move: Strong rally into April 10 close, holding above $67.96.

• EMA Direction: 8/13/48 EMAs rising (bullish).

• RSI (14): ~60 (neutral).

• MACD: Above zero (bullish).

• VWAP: Above VWAP at $68.30 (bullish).

• ICT/SMC: Liquidity sweep above $68.40 in pre-market; retracement to OTE at $68.30; pin bar forming as entry signal.

Options Data

• GEX: Neutral, slight bullish pinning at $68. Dealers may buy stock to hedge, supporting price at $68–$69. Explanation: Gamma Exposure balances calls/puts, stabilizing price near strikes.

• DEX: Moderate call delta bias (+0.25), indicating bullish pressure. Explanation: Net call buying drives directional momentum.

• IV: Moderate (~22%, near norm), suggesting steady swings. Explanation: Implied Volatility supports consistent options pricing.

• OI: Call-heavy (60% calls at $69 strike), favoring upside momentum. Explanation: Open Interest at $69 signals potential breakout target.

Cem Karsan’s Application:

• Weekly Trading Breakdown: High call OI at $69 (exp. April 18) suggests pinning or breakout potential. Gamma supports stability at $68; vanna indicates dealers buy on IV spikes to 23%, lifting price. Charm accelerates delta near OPEX, favoring $69 calls if in-the-money.

• Strategy: Buy $69 calls at $68.30 (OTE), exit at $69.50, profit $0.50, risk $0.40. Ties to liquidity sweep above $68.76, targeting $69 OB.

• Vanna: Rising IV to 23% could push dealers to buy, lifting KR to $69 (bullish).

• Charm: Near OPEX, $69 calls hold delta if ITM, boosting volatility.

Timeframe Analysis:

• Weekly (exp. April 18): 60% call OI at $69, moderate IV, bullish stance.

• Monthly (exp. May 16): Balanced OI, stable IV, neutral stance.

• 3-Month (exp. July 18): Slight call skew, low IV, bullish outlook.

• Directional Bias: Bullish, driven by call OI, positive GEX, and OTE setup at $68.30.

Sympathy Plays

• Correlated Assets: WMT (+2% if KR rallies), COST (+1.5%).

• Opposite Mover: If KR rallies (defensive), risk-on names like SHOP fade (-1%).

Sector Positioning with RRG

• Sector: Consumer Staples – Food Retail.

• RRG Position: Improving vs. XLP ETF, aligning with bullish sentiment and technicals.

Targets

• Bullish: +3% to $70.50 (next liquidity zone, OB at $70).

• Bearish: -2% to $66.60 (FVG at $66.50).

CHSN Price Watch: Critical Levels to MonitorCHSN is approaching a key decision point. If we see a confirmed break above the $0.33 high, there’s strong potential for a move up to $0.58, with $0.75 as a possible extension.

On the flip side, if the price breaks below the $0.29 low, we could see a retracement down to the $0.21 level.

Kris/Mindbloome Exchange

Trade Smarter Live Better

Berkshire Hathaway | No More Apple Pie & Bank Bread!No More Apple Pie and Bank Bread | Buffett’s Recipe for Market Caution

Berkshire Hathaway has recently disclosed its earnings amid fluctuating around a $1 trillion valuation. A notable update is its continued reduction of stakes in overvalued assets, including a 20% decrease in holdings of Apple and Bank of America, boosting its cash reserves to $325 billion

Although Warren Buffett himself isn't favoring share buybacks at present, Berkshire Hathaway stands as a compelling investment option

Why Berkshire Hathaway's $325 Billion Cash Pile Signals Market Caution

The company's net earnings remain subject to significant fluctuations due to rules requiring valuation changes of investment holdings. However, there was a slight decline in operating earnings, mainly driven by lower insurance underwriting income. Despite this, that segment is historically volatile, and year over year aka YoY, the company has maintained strong performance.

Yea2date aka YTD, operating earnings have risen over 10%, totaling just under $33 billion compared to just below $29 billion last year. This points to an annualized earnings estimate of approximately $44 billion, implying a price2earnings aka P/E ratio of about 22, without factoring in over $320 billion in cash and significant investment holdings.

Excluding cash and investments, the adjusted P/E ratio is closer to single digits. Share buybacks have paused, reflected in a ~1% decrease in the outstanding shares YoY, signaling Berkshire's assessment of current market valuations.

Segment Highlights

The various business units within Berkshire Hathaway showcase its robust asset base and earning capacity. Insurance underwriting income saw a sharp YoY drop, but other business areas performed strongly. Income from insurance investments remained solid, and BNSF, its railroad subsidiary, also showed strong results despite a double digit YoY decline.

Berkshire Hathaway Energy continues its growth, cementing its position in the utility sector with significant renewable energy ventures. For context, NextEra Energy (NEE), with a market capitalization of $160 billion, posted quarterly earnings around 10% higher.

Berkshire's other controlled and non-controlled businesses contribute over $13 billion annually, underpinning its diversification and consistent earnings performance. This strength across segments underscores its formidable financial health.

Market Context

Currently, market valuations are elevated by historical standards.

Excluding periods of earnings dips, market enthusiasm is exceptionally high, with the S&P 500 P/E ratio nearing 30x, approaching levels last seen in 1999. Buffett and Berkshire appear to view a 3% yield from such a P/E as unattractive, especially when bonds offer higher returns.

The 2008 Playbook

Berkshire's track record of effectively utilizing its cash reserves is notable. Excluding its insurance float, the company still holds $150 billion in cash.

During the 2008 financial crisis, Berkshire leveraged its liquidity for strategic investments in companies like General Electric, Swiss Re, Dow Chemical, and Bank of America, as well as finalizing the full acquisition of BNSF in 2010. This proactive use of capital proved advantageous.

The current strategic sale of assets suggests Berkshire is preparing for potential market downturns. Given high S&P 500 valuations, reallocating part of an S&P 500 position into Berkshire Hathaway could be wise, ensuring exposure to a cash-rich portfolio capable of seizing future opportunities. Meanwhile, Berkshire’s earnings are valued lower than the broader market, potentially minimizing major downturn risks.

Investment Risks

A key risk is that timing the market is inherently challenging, with the adage "time in the market beats timing the market" serving as a caution. If Berkshire's market outlook is incorrect, its $300+ billion in cash could underperform while broader markets remain strong, which would diminish its appeal as an investment.

Final Thoughts

Berkshire Hathaway has taken the bold step of liquidating some of its most significant and priciest holdings, opting to incur capital gains taxes to increase liquidity. This move has bolstered its cash position to $325 billion, $150 billion above its float level. Meanwhile, its strong operational businesses continue generating healthy cash flow.

Drawing on its successful strategies during the 2008 crisis, Berkshire appears to be positioning itself for another downturn amid current high market valuations. We advise investors to consider shifting part of their S&P 500 exposure into Berkshire Hathaway for enhanced diversification and potential benefits in a market correction, long story short Berkshire Hathaway remains a robust investment opportunity but wont make millionaire!

What do you think moonypto fam?

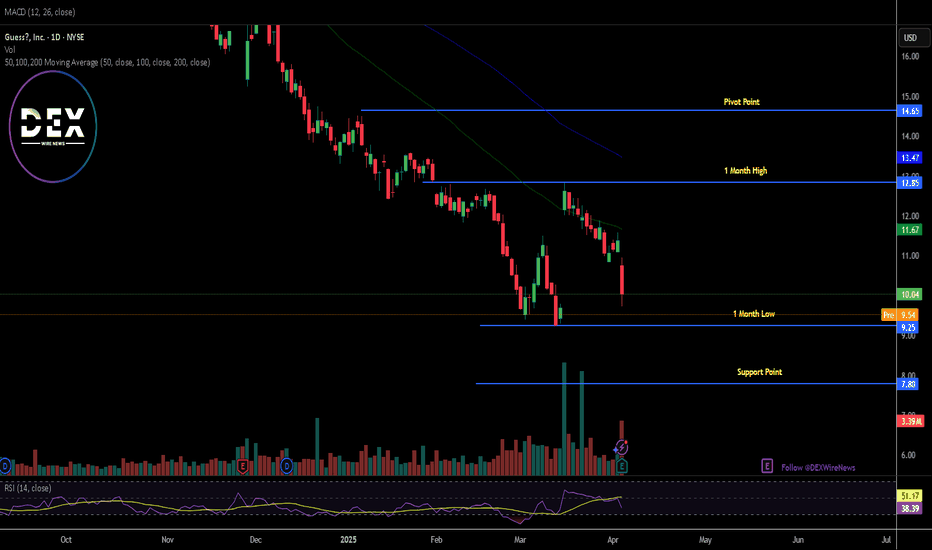

Guess?, Inc. Reports Fiscal Year 2025 Fourth Quarter ResultsGuess?, Inc. (NYSE: NYSE:GES ) a company that designs, markets, distributes, and licenses lifestyle collections of apparel and accessories for men, women, and children- operating through five segments: Americas Retail, Americas Wholesale, Europe, Asia, and Licensing, reports fiscal year 2025 fourth quarter results.

Reports Highlights

Fourth Quarter Fiscal 2025 Results:

Revenues Increased to $932 Million, Up 5% in U.S. Dollars and 9% in Constant Currency

Delivered Operating Margin of 11.1%; Adjusted Operating Margin of 11.4%

GAAP EPS of $1.16 and Adjusted EPS of $1.48.

Full Fiscal Year 2025 Results:

Revenues Increased to $3.0 Billion, Up 8% in U.S. Dollars and 10% in Constant Currency

Delivered Operating Margin of 5.8%; Adjusted Operating Margin of 6.0%

GAAP EPS of $0.77 and Adjusted EPS of $1.96

Full Fiscal Year 2026 Outlook:

Expects Revenue Increase between 3.9% and 6.2% in U.S. Dollars

Expects GAAP and Adjusted Operating Margins between 4.3% and 5.2% and 4.5% and 5.4%, Respectively

Expects GAAP EPS between $1.03 and $1.37 and Adjusted EPS between $1.32 and $1.76

Plans to Execute Business and Portfolio Optimization Expected to Unlock Approximately $30 Million in Operating Profit in Fiscal Year 2027

Financial Performance

In 2024, Guess?'s revenue was $3.00 billion, an increase of 7.88% compared to the previous year's $2.78 billion. Earnings were $60.42 million, a decrease of -69.15%.

Analyst Forecast

According to 5 analysts, the average rating for GES stock is "Strong Buy." The 12-month stock price forecast is $21.6, which is an increase of 115.14% from the latest price.

As of the time of writing, NYSE:GES shares closed Thursday's session down 11.78% extending the loss to Friday's premarket trading down by 2.38%. With a weaker RSI of 38, should trades open, NYSE:GES shares might break the 1-month low pivot and dip to the $7 support point. About $2.85 trillion was wiped out from the US stock market yesterday.

IAG Airlines Group what next? $261 Reached & Breached! $172?🤔 IAG Airlines Group what next?

ℹ️ $261 Reached & Breached!

Will the $261 be regained and start to offer some support or is $172 NEXT?❓️❔️❓️

🌍 To be completely transparent I have no horse in this race at the moment BUT I really would like a serious flush to try and accumulate a long-term POSITION.

🟢SeekingPips🟢 is not interested at current price at all unless we start to see some SERIOUS VOLUME START TO COME IN TO PLAY

IAG Stock Took some heat! Is there anything to take here?🟢SeekingPips🟢 has this on the radar.

⭐️ Have your levels ready and wait for your A+⭐️ Setup.

ℹ️ Our levels are here marked out.

I have ZERO interest in taking a position here however a deeper sell-off and I will start paying attention.❗️

⚠️ ALERTS set and LEVELS marked.

🟢Now go away and ENJOY your WEEKEND and lets HURRY UP AND WAIT and lets see what NEXT WEEK has for us👍

Snow White's very low ratings - Bullish Disney stock ?The SnowWhite IMDB rating can't get any worse - could the same be said of Disney stock?

Price is the ultimate proof but buying the shares of a well established company when sentiment is at a low point can be a fruitful endevour.

The poor box office showing + very weak ratings for Snow White - maybe a contrarian buy signal ?

A) The stock is attempting a long term double bottom via is 2020 + 2023 lows

B) A breakout over the downtrend line (orange) could confirm a bullish trend change

Bottom of the ratings ➡️ Bottom in the stock? NYSE:DIS

Everyone’s scared of booze stocks… Why I’m still buyingThis analysis is provided by Eden Bradfeld at BlackBull Research.

One of the things I find interesting is that a lot of people say “why do you like booze stocks so much Eden” and yet many of these same people are at the pub, or buying En primeur from Glengarry Wines. The short answer is — I like stocks that trade at multi-year lows with a predictable product. There is a fairly hysterical article in the FT wondering “Is alcohol the new tobacco?” To which I say, well, tobacco companies are absolute cash machines. The best performing stock in the S&P, of all time, to the best of my knowledge, is Altria.

I know investing in tobacco is not fashionable (and yet, how many people do you see on the street vaping?). I know it goes against “ESG” and the scolds at public health slap you on the hand and say “gosh that is very bad for you!”. But the truth is that tobacco does generate tremendous profits — the net income margin for British American Tobacco is 39.1%. For those in the back, that’s for every $1 you sell, you make 39.1 cents of profit. There’s very few businesses with such fantastic operating margins — Visa’s net income margin is 56%. If I owned only one stock forever, I guess it’d probably be Visa.

My point is — waving your hands about and saying “oh no! Tobacco!” belies the economics of it. The tobacco companies are doing very well, thank you very much. It will come as no surprise that cigarette smoking has been replaced by vaping. To paraphrase Oscar Wilde, news of nicotine’s demise has been greatly exaggerated.

This is not saying to invest in tobacco stocks, but my point is that human habits don’t change. They merely evolve, but the song remains the same.

To be fair — alcohol consumption is declining. But it isn’t declining at a rate that calls for any kind of alarm. Most of the companies I follow — Brown Forman, Diageo, Constellation, etc, reported largely flat sales. It’s also instructive to look to history.

In other words — alcohol consumption has largely normalised in the last few decades. There’s still cause for worry — I think wine is one area of concern, and Cognac is another — both industries need to think about how they introduce younger drinkers to their product. This is why I largely shy away from wine (and why Constellation is selling their wine portfolio). “Evergreens” like Guinness (a Diageo brand) and Jack Daniel’s (a Brown-Forman brand) are predictable.

Once again — a bunch of ratios for ya’ll:

Brown-Forman: 18x fwd earnings

Pernod: 12x fwd earnings

Constellation Brands: 13.25x fwd earnings

And so on… these stocks trade like they are discount retailers in biddlybunk Ohio. They are not. There’s the issue. There’s where value lies. Cigarettes never went away; they became vapes. In my opinion, I don’t see booze going away anytime soon either.

RITES: INVERSE H&S BREAKOUTThe Inverse Head and Shoulders pattern is a bullish reversal chart pattern that signals a potential trend reversal from bearish to bullish. It consists of three key components:

Structure of the Pattern:

Left Shoulder: A price decline followed by a temporary rally.

Head: A deeper decline forming the lowest point, followed by another rally.

Right Shoulder: A decline similar in size to the left shoulder but not as deep as the head, followed by a move higher.

Neckline: A resistance level that connects the highs of the two rallies after the left shoulder and head.

The Inverse Head and Shoulders pattern in RITES, with a neckline at ₹225, indicates a potential bullish reversal. The stock has formed a well-defined left shoulder, head, and right shoulder, suggesting that selling pressure is weakening. The target price for this breakout is ₹263 calculated by measuring the distance from the head’s low to the neckline and projecting it upwards. If the stock sustains above the neckline, it could gain further momentum. However, traders should consider placing a stop-loss at 212 to manage risk in case of a failed breakout.

GUJRAT GAS: INVERSE H&SThe Inverse Head and Shoulders pattern is a bullish reversal chart pattern that signals a potential trend reversal from bearish to bullish. It consists of three key components:

Structure of the Pattern:

Left Shoulder: A price decline followed by a temporary rally.

Head: A deeper decline forming the lowest point, followed by another rally.

Right Shoulder: A decline similar in size to the left shoulder but not as deep as the head, followed by a move higher.

Neckline: A resistance level that connects the highs of the two rallies after the left shoulder and head.

The Inverse Head and Shoulders pattern in Gujrat Gas, with a neckline at ₹396, indicates a potential bullish reversal. The stock has formed a well-defined left shoulder, head, and right shoulder, suggesting that selling pressure is weakening. A breakout above ₹406, supported by strong volume, could confirm the pattern and trigger an upward move. The target price for this breakout is ₹440, calculated by measuring the distance from the head’s low to the neckline and projecting it upwards. If the stock sustains above the neckline, it could gain further momentum. However, traders should consider placing a stop-loss below the right shoulder i.e. 376 to manage risk in case of a failed breakout.

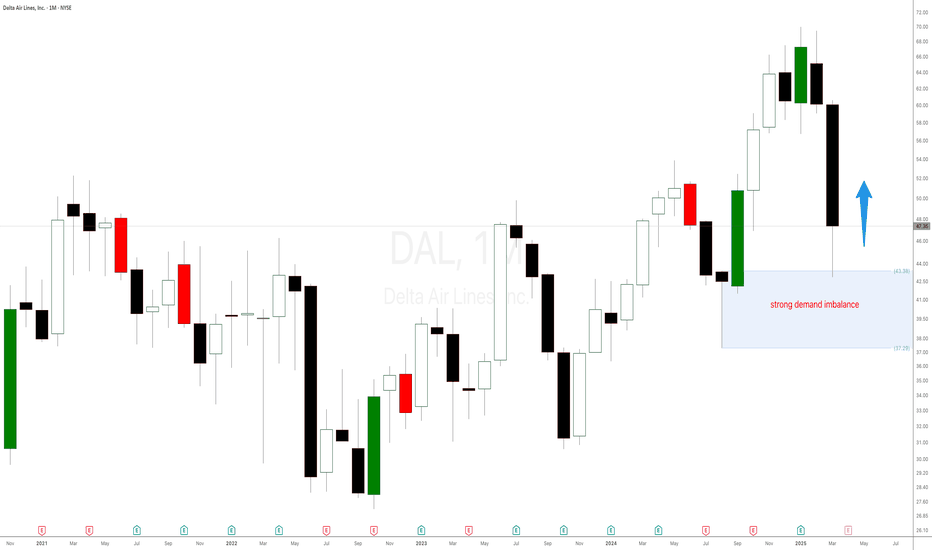

Watch This Before Trading Delta Airlines Stock in 2025!The Art of Trading: Price Action, Supply and Demand, and Patience in Delta Airlines. Trading in the stock market is a skill that requires a deep understanding of market dynamics, disciplined decision-making, and the ability to remain patient in the face of volatility. Among the most effective strategies for achieving consistent success are price action analysis, supply and demand principles, and meticulous money management. This supply and demand stock analysis will explore how these strategies can be applied to Delta Airlines (DAL), focusing on key price levels, candlestick patterns, and the importance of patience in making informed investment decisions.

A strong demand level for Delta Airlines (DAL) has been identified at $43. This level represents a price zone where buyers have historically shown significant interest, leading to price reversals. By waiting for the stock to retrace to this level, traders can enter positions with a higher probability of success as the likelihood of renewed buying pressure increases.

SRF: Breakout of Symmetrical TriangleA symmetrical triangle is a chart pattern in technical analysis that forms when the price consolidates with lower highs and higher lows, creating a converging triangle shape. This pattern indicates a period of consolidation before the price breaks out in either direction.

SRF stock has already given a bullish breakout. One should go long on the stock with Stop loss below 2550 for the measured target of 3475-80 zone.

Abbott and Amazon: Two Bright Spots in a Sea of Red◉ Abbott Laboratories NYSE:ABT

● The stock previously faced strong resistance near the $134 level, leading to an extended consolidation phase.

● During this period, a Rounding Bottom pattern emerged, signalling a potential continuation of the upward trend.

● Following a recent breakout, the stock has surged to its all-time high and is expected to maintain its upward momentum in the coming days.

◉ Amazon NASDAQ:AMZN

● Since August 2020, Amazon's stock has been consolidating, forming a clear Inverted Head & Shoulders pattern.

● After breaking above the neckline, the stock rallied sharply and reached an all-time high near $242.

● Following this, the price pulled back to retest the breakout level and with a successful retest, the stock is now well-positioned to resume its upward trend.

2 Minute DXYZ Analysis: Key Levels to Watch for the Next MoveWe hit our 34 target on DXY, but what’s next? If we break above 49, we could see a solid bull run. However, if weakness continues, we might test lower levels at 31, then 29, and possibly 23.50 for a deeper correction.

Watching these levels closely—what’s your outlook on DXY? Drop your thoughts below.

Kris/Mindbloome Exchange

Trade Smarter Live Better