$50 MILLION REGISTERED DIRECT OFFERING case study$VISL ANNOUNCES $50 MILLION REGISTERED DIRECT OFFERING PRICED AT-THE-MARKET UNDER NASDAQ RULES

$VISL today announced that it has entered into a definitive agreement with institutional investors for the purchase and sale of 18,181,820 shares of its common stock and common stock warrants to purchase up to 9,090,910 shares of common stock at a combined purchase price of $2.75 per share in a registered direct offering.

The common stock warrants will be immediately exercisable, have an exercise price of $3.25 per share and will expire five years from the date of issuance.

The closing of the offering is expected to occur on or about February 8, 2021, subject to the satisfaction of customary closing conditions.

finance.yahoo.com

ANNOUNCES CLOSING OF $50 MILLION REGISTERED DIRECT OFFERING PRICED AT-THE-MARKET UNDER NASDAQ RULES

finance.yahoo.com

What we can learn from the registered direct offerings?

Stockstrading

CLIS - this stock is going to the MOON ?? 1-2$First i´m not a professional adviser

Always do your job and think about what you are doing

In my opinion this Stock has a great portencial to hit 0.5 at the midle of March do to the major increase in volume even with most of the European brokers restrictions on Buying

I think in the future we will see this stock at 5-15$ very easy, just look at Facebook that does a similar thing

As you can see instead of going down the stock as respected the support line as has a brute force to continue to go up

Click Stream Corp has two app´s Hey Pal in my opion will be the major source of income due to the great design and advantages

In my opion we will see the 0,5$ very soon because most of the day traders have already sould their stocks and the longs are keeping up

The Fibo also looks great

Clis is testing the new resistance and when it break it i think that we will see a major increase

This is a long term stock

Dont think about taking profit´s in the next days but in the next month`s you will be very happy for taking the risk

leave your like and support our channel so we can grow day after day

1 Month TP - 0.5-1$

1 Year TP 2-3$

2 Years TP 5-6$

$DYNT Announces Extension of Key Distribution AgreementDynatronics Corporation Announces Extension of Key Distribution Agreement

Bird & Cronin Renews Group Purchasing Agreement with Intalere for Orthopedic Soft Goods and Bracing

Dynatronics announced today that its wholly-owned subsidiary, Bird & Cronin, LLC, renewed its purchasing agreement with Intalere, one of the leading national group purchasing organizations in the healthcare industry. The new agreement which extends the partnership through January 2024.

Intalere members will receive negotiated pricing on our full line of orthopedic bracing solutions for spine, upper and lower extremities including key products such as the Sprint® air walker boot and U2TM wrist brace. With more than 100,000 members from healthcare organizations all over the country, Intalere members make nearly $9 billion in purchases annually.

finance.yahoo.com

Apple shortThe breaking of the purple channel pushes the price down. The formation of a red channel is another sign of the strength of the sellers. The third sign is the increase in volume within the red resistance range.

in return

The center line of the green channel, which is orange, has usually been strong, and the Trend Magic line has sometimes been a good support line

The lower shadow of the one-hour candlestick was large when hitting the resistance of the red descending channel

These are also signs of the power of buyers.

But the power of buyers seems to be less than that of sellers because the signs of the body are weaker.

We can wait a little longer until everything is clear, but in this case we may lose a lot of profits!

Apple stock prices will probably go yellow. The range of $ 100 to $ 103 is good to buy, but people who want to take the risk to buy the stock cheaper and of course they may not be able to buy! They can wait until Apple shares hit the bottom of the green channel!

Also, if during the first 2 or 3 days of next week and the price manages to break the red downward channel upwards or the price manages to return completely to the purple channel, it is a good time to buy!

Personally, I find the yellow route more probable. But for more investments, I am waiting for the market to determine its path better and more!

Why $MOGO surged heavily in February?Mogo Reports Over 300% Increase in Bitcoin Transaction Volume in January

January new Bitcoin account additions increased by more than 140% from December 2020

"In January, we continued to experience growing demand for new MogoCrypto accounts and increasing transaction activity among members."

There are more than $13 trillion in assets1 held by Canadians and, while bitcoin continues to gain credibility as an asset class, the majority of Canadians do not own or have exposure to it.

Assuming we continue to experience strong uptake with MogoCrypto, it could represent a meaningful component of the growth in our Subscription & Services revenue in 2021.

finance.yahoo.com

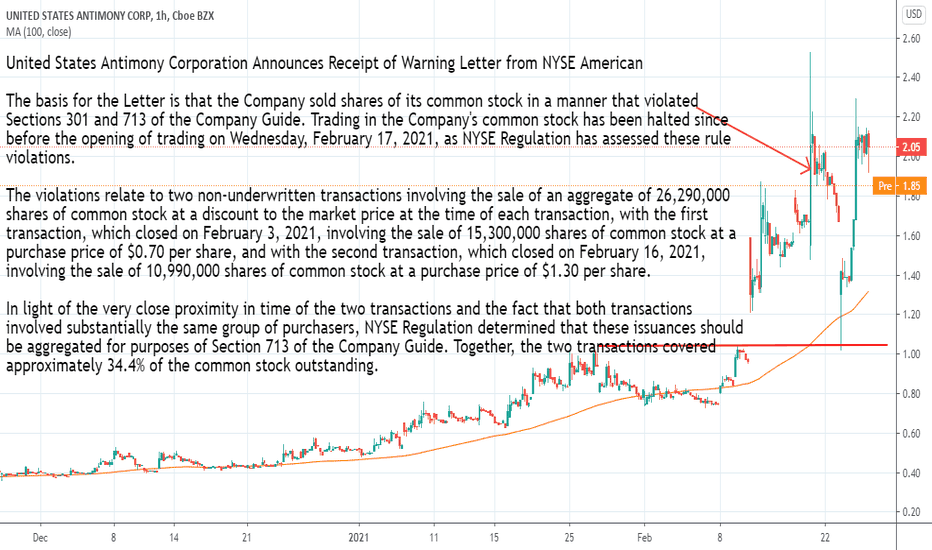

$UAMY Announces Receipt of Warning Letter from NYSE AmericanUnited States Antimony Corporation Announces Receipt of Warning Letter from NYSE American

The basis for the Letter is that the Company sold shares of its common stock in a manner that violated Sections 301 and 713 of the Company Guide. Trading in the Company's common stock has been halted since before the opening of trading on Wednesday, February 17, 2021, as NYSE Regulation has assessed these rule violations.

The violations relate to two non-underwritten transactions involving the sale of an aggregate of 26,290,000 shares of common stock at a discount to the market price at the time of each transaction, with the first transaction, which closed on February 3, 2021, involving the sale of 15,300,000 shares of common stock at a purchase price of $0.70 per share, and with the second transaction, which closed on February 16, 2021, involving the sale of 10,990,000 shares of common stock at a purchase price of $1.30 per share.

In light of the very close proximity in time of the two transactions and the fact that both transactions involved substantially the same group of purchasers, NYSE Regulation determined that these issuances should be aggregated for purposes of Section 713 of the Company Guide. Together, the two transactions covered approximately 34.4% of the common stock outstanding.

Section 301 of the Company Guide states that a listed company is not permitted to issue, or to authorize its transfer agent or registrar to issue or register, additional securities of a listed class until it has filed an application for the listing of such additional securities and received notification from the NYSE American that the securities have been approved for listing.

Section 713 of the Company Guide requires shareholder approval when additional shares to be issued in connection with a transaction involve the sale, issuance, or potential issuance of common stock (or securities convertible into common stock) equal to 20% or more of presently outstanding stock for less than the greater of book or market value of the stock.

As stated in the Letter, the Company failed to submit a completed listing application in advance of the February 16, 2021 transaction to obtain advance approval as required by Section 301 of the Company Guide and also did not obtain shareholder approval for the aggregate issuance of 26,290,000 shares that exceeded 20% of the common stock of the Company outstanding as required by Section 713 of the Company Guide. NYSE Regulation noted in the Letter that, after it became aware that the Company had entered into a purchase agreement in relation to the second transaction, NYSE Regulation informed representatives of the Company that it would be a violation of the applicable NYSE American rules for the Company to close the second transaction without first obtaining shareholder approval . Notwithstanding this clear guidance from NYSE Regulation, the Company went ahead with closing the transaction without notifying the Exchange.

The Company has been advised by NYSE Regulation that the Company's common stock will resume trading on the NYSE American following the issuance of this press release and the filing of a Current Report on Form 8-K disclosing the receipt of the Letter, which the Company anticipates will be prior to the open of trading on Friday, February 19, 2021.

finance.yahoo.com

Why $CTIB stock soared yesterday?investors also need to note that there has been no news regarding Yunhong this morning that could have triggered such a move.

It appears that the Yunhong stock is a target of users across social media platforms like StockTwits, Reddit, Facebook, and Twitter. Investors are buying up the stock in order to force short sellers to cover their positions and when that happens, the stock price usually rises further. Hence, it might be a good idea for investors to keep an eye on the Yunhong stock this morning.

ownsnap.com

KeyBanc Capital analyst Philip Gibbs raised rating- $10 target $TMST surged higher on very heavy volume, after KeyBanc Capital analyst Philip Gibbs said it's time to buy the steel maker's stock as the macro recovery is unfolding.

Gibbs raised his rating to overweight, after being at sector weight since July 2018, and set a $10 target for the stock, which is 19.8% above current levels. Gibbs said his new bullish view "post due diligence" reflects the macroeconomic recovery, better contract and spot pricing and widening raw material spreads, as well as "self-help," which includes cost cuts. The latest available data showed that short interest was 9.72% of the public float.

$RETO Stock surged on Two RumorsWhile the stock is running for the top, there has been nothing by way of press releases or SEC filings. So, what’s the deal?

- ReTo Eco-Solutions May Be an Olympic Provider. According to various social media posts, investors are awaiting an announcement surrounding involvement in the Olympic Games in Beijing. The rumor suggests that the company’s work with the 2022 Olympics in Beijing will be expanded, exciting investors.

- Merger With Apple Rumor. There’s another rumor hitting the tape too, and this one’s the big one. According to various social media posts, investors are awaiting the announcement of a merger. According to these rumors Apple is interested in merging with RETO.

- The Short Squeeze. the heavy short interest on the stock, combined with the ultra-tiny public float of under 15 million shares could lead to supply and demand related jumps in value. Ultimately, as the shorts race to cover their positions, demand for shares rockets, but with only under 15 million shares available to the public, the demand increase for RETO shares could lead to tremendous gains.

cnafinance.com

$NCTY Purchased Filecoin Mining Machines for US$10 millionThe9 Signed a US$10 million Framework Agreement on the Purchase of Filecoin (FIL) Mining Machines.

The9 had already purchased and deployed Filecoin mining machines, and Filecoin mining has been started. Currently The9 owns an independent node on Filecoin blockchain and 8 Pebibyte of effective storage mining power in the Filecoin network.

The9 will continue to purchase Filecoin mining machines under the Framework Agreement based on the trend of Filecoin price and Filecoin's economic incentive model.

finance.yahoo.com

$CTXR Announces Closing of $76.5M Registered Direct OfferingCitius Pharmaceuticals Announces $76.5 Million Registered Direct Offering Priced At-the-Market under Nasdaq Rules.

today announced that it has entered into definitive agreements with certain healthcare-focused and institutional investors for the purchase of an aggregate of 50,830,566 shares of its common stock and accompanying warrants to purchase up to an aggregate of 25,415,283 shares of its common stock, at a purchase price of $1.505 per share and accompanying warrant in a registered direct offering priced at-the-market under Nasdaq rules.

The warrants have an exercise price of $1.70 per share, will be immediately exercisable, and will expire five years from the issue date.

finance.yahoo.com

Citius Pharmaceuticals Announces Closing of $76.5 Million Registered Direct Offering Priced At-the-Market under Nasdaq Rules

finance.yahoo.com

Boeing-Backed Aerion Is in Talks for $ALTU SPAC ListingBoeing-Backed Aerion Is in Talks for Altitude SPAC Listing

The companies are discussing a deal that would value the combined firm at up to $3 billion, said the people, who asked to not be identified because the matter isn’t public. A deal could be announced as soon as this month, the people said.

The talks could still fall apart and end without an agreement, they said.

Aviation giant Boeing Co. announced a partnership with Aerion in 2019, along with a significant investment in the company, according to a statement at the time. Aerion had planned to finalize the design of its first supersonic business jet model last year, according to its website. Manufacture of the AS2 will start in 2023 with plans for it to be in service in 2027.

www.bloomberg.com

Why $DNK stock price surged heavily in november?Why DNK stock price surged heavily in november?

What triggered the stock price surge is a report by Chinese media outlet Thepaper.cn saying that 5I5J Holding Group (owner of Danke’s rival Xiangyu) is in takeover to buy Danke.

There have been reports that Danke was pursuing bankruptcy, but the company denied those reports on its Weibo account earlier then, according to South China Morning Post. One of the reasons why there is speculation about Danke filing for bankruptcy is due to upfront payments being collected from Danke tenants, but there was a failure to pay the landlords. This is why tenants and landlords protested at Danke offices later.

pulse2.com

$PHCF low float chinese stockSince the company has not announced any news directly and there are no SEC reports to trigger a stock price increase, it appears there was a coordinated move on social media to drive the price up.

I am seeing references to $PHCF in Twitter hashtags, Many of these posts mentioned the advantages of the high volume and relatively low float chinese stock.

gofundme???????????????????I didn't put glue on my hair but if I started a gofundme would you donate? I want to have a good amount of money to trade and take care of myself. Please don't comment anything negative I am just curious. I've seen people donate to others for a lot of things but would a bunch of people donate to jump-start a career?

BlackSky to List on NYSE via Merger $SFTWBlackSky, a Leading Real-Time Geospatial Intelligence, Imagery and Data Analytics Company, to List on NYSE Through a Merger With Osprey Technology Acquisition Corp.

The business combination agreement is expected to provide approximately $450 million of net proceeds to the combined company, assuming no redemptions, to fund expected future growth, including a fully committed $180 million common stock PIPE with participation from leading institutional investors including Tiger Global Management, Mithril Capital (co-founded by Ajay Royan and Peter Thiel), Hedosophia, and Senator Investment Group. Additionally, Osprey’s sponsor and its affiliates are investing over $20 million in the PIPE.

Pro forma equity value of the merger is expected to be nearly $1.5 billion at the $10.00 per share PIPE price.

BlackSky has established contracts with multiple government agencies in the United States and around the world. BlackSky’s pipeline of opportunities grew by $1.1 billion in the last twelve months and stands at $1.7 billion today.

The transaction is expected to close in July 2021.

finance.yahoo.com

$MFH blockchain stock making new highschina #Bitcoin play

Bitcoin continues to make new highs... $MFH soaking up dips.

Market is correcting itself after huge rise in blockchain stocks. It is a dip buy opportunity.

The take home message is that if you see a big rise in a range of stocks, be prepared for a dip. Always have some cash to buy the dips.

Dont panic sell your blockchain stocks. They might have another rally in a day or two.

$TUSK awarded a contract of $40 million in revenue Mammoth Energy Announces Growth of Engineering Services Company

$TUSK today announced that its wholly owned subsidiary, Aquawolf, LLC (“Aquawolf”), has been awarded a contract by a major utility to provide engineering and design services. The three-year contract is expected to generate up to approximately $40 million in revenue over the contract term.

finance.yahoo.com