AST SpaceMobile (ASTS) Analysis Company Overview:

AST SpaceMobile NASDAQ:ASTS is pioneering a global space-based cellular broadband network, enabling mobile connectivity in remote and underserved areas. Its BlueBird satellite technology and strategic partnerships position ASTS as a disruptor in satellite communications.

Key Growth Drivers:

BlueBird Satellite Deployment:

Successful launch of the first five BlueBird satellites demonstrates AST’s ability to deliver innovative mobile broadband solutions globally.

This milestone positions the company to begin revenue generation through early adoption and partnerships.

Space Development Agency (SDA) HALO Program:

AST’s selection for the Highly Agile and Low Orbit (HALO) program opens a significant opportunity in the government and defense sectors.

This collaboration may lead to diversified revenue streams and further innovation in secure satellite communications.

Network Expansion Plans:

Agreements for up to 60 additional satellite launches in 2025-2026 will drive subscriber growth, enable broader network coverage, and accelerate revenue generation.

Strategic Partnerships and Investments:

Backing from industry giants like AT&T, Verizon, Google, and Vodafone highlights ASTS’s credibility and potential to reshape the global communications market.

These partnerships may also enhance access to established customer bases, supporting rapid scaling.

Investment Outlook:

Bullish Stance: We are bullish on ASTS above $19.50-$20.00, driven by its transformative technology, strategic partnerships, and extensive market opportunities.

Upside Target: Our price target is $40.00-$42.00, reflecting ASTS’s potential to capture a substantial share of the growing satellite broadband market.

🚀 AST SpaceMobile—Connecting the World, Beyond Boundaries! #SpaceTech #ASTS #SatelliteRevolution

Stocktrading

Home Depot (HD) Analysis Company Overview:

Home Depot NYSE:HD , the largest home improvement retailer, leverages its extensive network of stores, robust e-commerce platform, and strategic acquisitions to maintain a dominant market position. The company continues to innovate and adapt to evolving consumer demands while capitalizing on macroeconomic trends.

Key Drivers of Growth:

Strategic Acquisition of SRS Distribution Inc.:

The acquisition enhances Home Depot’s market reach and diversifies its product offerings, particularly in specialty building materials.

This move is expected to drive revenue growth and profitability, strengthening its competitive position.

Projected Sales Growth:

Fiscal 2024 sales are projected to grow 3.8% year-over-year, showcasing Home Depot’s resilience and its ability to capitalize on consistent consumer demand for home improvement products.

Impact of Federal Reserve Rate Cuts:

Recent rate cuts are expected to stimulate housing activity, increasing demand for renovation and home improvement supplies, a key driver of Home Depot’s sales.

Strong Brand and Omni-Channel Presence:

Home Depot’s extensive store network and advanced e-commerce platform provide a seamless customer experience, offering resilience in both physical and digital retail markets.

The company’s reputation as a trusted supplier to both consumers and professionals enhances brand loyalty and repeat business.

Investment Outlook:

Bullish Stance: We are bullish on HD above $385.00-$390.00, supported by its strategic growth initiatives, favorable macroeconomic tailwinds, and robust operational performance.

Upside Target: Our price target is $570.00-$575.00, reflecting Home Depot’s strong growth potential and ability to navigate dynamic market conditions.

📈 Home Depot—Building the Future of Home Improvement! #HomeImprovement #GrowthStock #HD

When is a stock too high to buy? (Example: IHG)How do you know when you’ve missed the boat?

A stock has already gone up a tonne, so bascally you are too late!

Sometimes, you just have to let go, right?

Sometimes yes, but not always - let’s look at an example.

International Hotels Group (IHG)

Back in 2020, LSE:IHG IHG shares were trading down at ~2000 GBX, now they are a hairs breadth from 10,000 - that’s 5X in about 4 years. Not bad.

Can you really even think about buying shares at 10,000 that were 2,000 only 4 years ago. 🤔

We’re saying YES.. if you follow some guidelines.

Clearly this is not a value investment - this is a momentum trade.

To be buying IHG shares up here, one is basically arguing that the price at new highs indicates and buyers are in charge and the price is going to keep going up for the time being.

This helps define the trade risk very well.

If the trade is that IHG has broken out over the previous peak at ~8,800. We don’t want to be owning shares below this level - if they’re back below 8,800 the momentum has stalled and we need to be out.

To put it another way, we are not buying just under 10,000 and willing to hold the shares all the way back down to 2,000 again - no. We want to ride the momentum up - not down !

From here there’s a pretty good chance that momentum takes the price up to the 10,000 level. As a big round number, there is also a good chance that profit taking takes place here too.

That creates our buy zone between 8,800 and the current market price (9,750).

So what might a trading strategy look like to capture this situation?

The following is a way to have:

An intial risk of £1000 to test the waters

A total risk £3000 if/when the trade starts working

A 2X profit potential (with the opportunity to capture more)

Spread Betting Strategy: Target £6000+ Profit with £1000 Initial Risk

Entry Points and Stops

9000 GBX Entry:

Stop Loss: 8600 GBX.

Bet Size: £2.50 per point.

Risk: £1000.

9200 GBX Entry:

Stop Loss: 8800 GBX.

Bet Size: £2.50 per point.

Risk: £1000.

9400 GBX Entry:

Stop Loss: Trailing 400 points.

Bet Size: £2.50 per point.

Initial Risk: £1000.

Profit Targets

First Position (9000):

Gain: 1000 points.

Profit: £2500.

Second Position (9200):

Gain: 800 points.

Profit: £2000.

Third Position (9400):

Trailing Stop Profit Example:

10,400 GBX: Profit = £2500.

11,000 GBX: Profit = £4000 or more.

Summary

Total Risk: £3000.

Fixed Profit (First Two Positions): £4500.

Potential Profit (Third Position): Variable, based on trailing stop.

Reward-to-Risk Ratio: 2:1 or higher, depending on trend continuation.

Reliance Industries Ascending Triangle Retest"Reliance Industries is showing a potential ascending triangle formation on the weekly chart after a retest of a key trendline support. Watch for a breakout above the resistance zone to confirm bullish momentum. Key levels and patterns highlighted for a clearer trading strategy."

Zillow Group, Inc. (Z) AnalysisCompany Overview:

Zillow Group, Inc. NASDAQ:Z is a leading online real estate marketplace, transforming the real estate industry through innovative technology and strategic partnerships. Its platform serves as a bridge between high-intent homebuyers/renters and top-performing agents, fostering an ecosystem that drives revenue growth and enhances user satisfaction.

Key Drivers of Growth:

Agent Connections Strategy:

Zillow’s approach of connecting motivated buyers and renters with experienced agents generates immediate revenue through lead generation while cultivating a loyal user base, contributing to a self-sustaining growth flywheel.

Outpacing Industry Growth:

Analysts forecast 12% annual revenue growth for Zillow over the next three years, surpassing the 11% sector average. This positions the company to deliver superior stock performance amidst a competitive market.

Real Estate Tech Innovation:

Under the leadership of CEO Jeremy Wacksman, Zillow focuses on developing cutting-edge tools that streamline real estate transactions, such as advanced AI-driven property valuations and user-friendly interfaces. These innovations solidify its role as a leader in real estate technology.

Market Potential:

Zillow benefits from the increasing adoption of digital real estate solutions, supported by consumer demand for convenience and efficiency in property searches, transactions, and rentals.

Investment Outlook:

Bullish Stance: We are bullish on Z above $63.00-$64.00, given its strategic growth initiatives, sector-leading revenue projections, and technological advancements.

Upside Target: With its strong positioning, we target $105.00-$110.00, reflecting Zillow’s potential to capitalize on a growing market and its tech-driven competitive edge.

📈 Zillow—Innovating the Real Estate Landscape! #PropTech #RealEstateInnovation #ZillowGroup

Frontline FRO possible Breakout targeting $28Analysis

Trendline Breakout: Recently broke above a downward trendline; potential for bullish momentum.

Support and Resistance: Watch for support near the trendline and next resistance around 25-26 levels. Recent high volatility.

Key Points for Trading:

Entry Point: Consider entering on pullbacks to the trendline if volume confirms.

Risk Management: Set tight stop-losses below the trendline.

Target: Aim for resistance levels at $26,60 and $28,60 for potential profit taking.

Continued Monitoring: Watch price action and volume for sustained breakout strength.

Trend Forecast:

Bullish Bias: Short-term bullish trend possibly forming.

Support Level: Watch for support around the $23 mark.

Resistance Level: Immediate resistance near $25-$26.

Forecast Summary:

Expected Movement: Potential retest of resistance near $25-$26, with pullbacks to support.

Triggers: Earnings reports, market news, or geopolitical events could impact movement.

Risk: Tighten stop-losses to manage risk effectively.

Tesla’s Autonomous AmbitionsMusk’s Vision vs. Reality: Tesla’s Path to Revolutionizing Transportation

Tesla recently experienced its best trading day since 2013, with the stock soaring 23% following the release of its Q3 earnings report. While the financial results were solid, investors are largely drawn to Elon Musk’s ambitious vision for autonomy a vision that presents significant challenges but holds substantial potential

Tesla’s rebound in deliveries, higher profit margins, and an unexpected forecast projecting 20% to 30% sales growth for next year reinvigorated investor confidence after a somewhat muted response to the October 10th 'We, Robot' event

The event showcased new products like the highly anticipated Cybercab (robotaxi) and Optimus (a humanoid robot) Despite the excitement, the presentation lacked detailed information, causing Tesla’s stock to decline by nearly 10% the following day

Despite being over 20 years old, the investment appeal of Tesla is still driven more by its future potential than its current state. Musk envisions mass-producing autonomous vehicles and robots, aspiring to make Tesla the largest company globally. Traditional valuation models based on recent performance can’t fully capture this long term vision

Tesla’s journey can’t be understood in isolation

Just three days after the 'We, Robot' event, SpaceX successfully launched its Starship spacecraft for the fifth time. The SpaceX “chopsticks” system successfully caught the Super Heavy booster after liftoff a crucial step toward making the booster completely reusable. This breakthrough could transform space travel by significantly reducing turnaround times and reshaping cost structures.

Elon Musk, at the helm of both Tesla and SpaceX, has a talent for transforming bold ideas into reality. SpaceX’s success in making rockets reusable has drastically reduced the cost of space travel, demonstrating that affordability can drive broader adoption.

This strategy mirrors Tesla’s vision for autonomous vehicles: by creating self-driving cars like the Cybercab, Tesla aims to reshape transportation with similar cost-efficiency principles. However, as with any disruptive technology, the range of possible outcomes is vast.

A balanced perspective considers Musk’s track record while acknowledging that his timelines can often be highly optimistic.

In 2021, Benedict Evans described Musk as “a bullshitter who delivers.” Whether Tesla’s vision for full autonomy will come to fruition remains uncertain, and fully autonomous fleets could still be years away. Nonetheless, Musk’s accomplishments with SpaceX add weight to Tesla’s ambitions, granting him credibility in the eyes of many.

The question remains: Will Musk’s ambitious autonomy vision fully take shape?

Today’s highlights:

- Tesla Q3 FY24 Results

- Key takeaways from the 'We, Robot' event

- Notable quotes from the earnings call

- Insights on Waymo, Uber, and the future of ridesharing

Tesla Q3 FY24 Overview

Tesla’s revenue is primarily generated from three segments

1. Automotive (80% of revenue): This includes the sale of electric vehicles, such as models S, 3, X, Y, and the Cybertruck.

2. Services and Other (11% of revenue): This segment encompasses vehicle services, the Supercharger network, and sales of automotive parts and accessories.

3.Energy Generation and Storage (9% of revenue): Revenue from solar products and energy storage solutions like the Solar Roof and Powerwall.

Key Metrics for Q3 FY24:

-Production: 470,000 vehicles produced (+9% YoY, +14% QoQ).

-Deliveries: 463,000 vehicles delivered (+6% YoY, +4% QoQ), which was slightly below analysts’ expectations of 464,000 and fell short of the Q4 2023 record of 484,000 deliveries. Despite price cuts over the last two years, Tesla’s auto sales growth has leveled off.

Financial Highlights:

-Revenue: $25.2 billion, an 8% YoY increase but fell short of expectations by $0.5 billion.

-Gross Margin: 20% (+2 percentage points QoQ and YoY).

-Operating Margin: 11% (+5 percentage points QoQ, +3 percentage points YoY).

-Adjusted EPS: $0.72, beating estimates by $0.12.

Gross Margin Insights:

-Automotive Gross Margin: 17% (excluding regulatory credits), up from 15% in Q2 and 16% a year earlier. The cost per vehicle dropped to an all-time low of $35,100. Notably, the Cybertruck achieved a positive gross margin for the first time. The automotive segment included $326 million in software revenue.

-Services and Other Gross Margin: Reached 9%, marking the 10th consecutive quarter of positive margins and a new record high.

-Energy Generation and Storage Gross Margin: The highest margin segment at 31%, also hitting a record high.

Overall, while Tesla faced some delivery shortfalls and plateauing auto sales, it managed to improve profitability across its segments, with key milestones in cost reductions and positive trends in gross margins.

Tesla’s Margins and Cash Flow Performance

Tesla’s industry-leading margins are driven by three major advantages:

1.Economies of Scale: Achieved through its expansive gigafactories.

2.Direct-to-Consumer Sales**: Tesla sells directly online and through its showrooms, bypassing traditional dealership networks.

3.Low Marketing Costs: Tesla spends very little on advertising compared to traditional automakers.

While Tesla expects its margins to expand over time due to growth in its non-automotive segments and software sales, its automotive margins have been pressured by price cuts in the last two years to sustain demand.

Cash Flow Highlights:

-Operating Cash Flow**: Increased by 89%, reaching $6.3 billion

-Free Cash Flow**: Jumped by 223%, hitting $2.7 billion

These cash flow figures stood out in the quarterly report, demonstrating Tesla’s ability to fund its ambitious plans for autonomy despite heavy investments in AI.

Guidance

1.FY24 Improvement: Tesla now expects slight growth in vehicle deliveries for FY24 (previous guidance indicated “notably lower” growth), implying a record-setting Q4 to make up for a weaker first half. Energy storage deployment is projected to more than double.

2.FY25 Outlook Surprise: During the earnings call, Musk forecasted 20% to 30% delivery growth in FY25, surpassing market expectations. A new, more affordable model is anticipated to launch in the first half of FY25, potentially easing investor concerns about competition.

3.New Product Strategy: The upcoming affordable vehicles in 2025 will be based on Tesla’s existing platform, indicating less dramatic cost reductions than previously suggested. However, the Robotaxi will bring a fresh manufacturing strategy.

Key Takeaways

1.Volumes Rebounded: After a 7% decline in deliveries during the first half of 2024, volumes recovered in Q3. Prices have stabilized, and Tesla’s focus on reducing unit costs contributed to improved automotive gross margins. Management’s priorities remain on unit volume and maintaining low inventory levels.

2.More than Just EVs: Non-automotive segments, such as Energy and Services, accounted for 20% of Tesla’s revenue this quarter, up from 16% a year ago. Likewise, these segments contributed about 20% of Tesla’s gross margin, nearly double from the previous year. As these segments grow, their impact on Tesla’s profitability will become increasingly significant.

3.Operating Margin Gains: Improved by 3 percentage points year-over-year:

-Negative Impact: Price cuts, mainly due to financing incentives.

-Positive Impact**: Lower costs per vehicle, growth in non-auto segments, FSD revenue, increased deliveries, and higher regulatory credit revenue.

4.Free Cash Flow Surge: Doubled sequentially to $2.7 billion. Capital expenditures increased by 43% to $3.5 billion, largely driven by investments in AI infrastructure. Tesla plans to spend over $10 billion on AI this year.

5.Strong Balance Sheet: Tesla maintains a net cash position of nearly $30 billion, which management believes provides ample liquidity to support its product roadmap and sustain positive cash flow margins.

We, Robot’ Event Takeaways

Key insights from the recent announcements include:

- Cybercab (Robotaxi): Tesla introduced the much-awaited Cybercab, a sleek two-seater, but key technical details—such as sensor configurations and processing capabilities—were notably absent. Musk’s decision to forgo lidar technology, a feature commonly used by competitors like Waymo, could potentially raise regulatory concerns about safety and compliance.

1.Optimus (Humanoid Robot): While the Optimus robots were a hit at the event, performing tasks like serving drinks and dancing, this entertaining display overshadowed the reality of how far the technology is from practical use. Reports indicated that the robots were primarily operated by humans, raising questions about their actual autonomous capabilities and readiness for industrial applications.

2.Robovan: A surprise announcement was the debut of the Robovan, a versatile vehicle intended for both mass transit and cargo transport. Its stylish Art Deco-inspired design drew attention, but like the Cybercab, it lacked concrete details or technical insights to convince analysts that the product is close to entering production. The presentation didn’t provide enough information to quell investor skepticism about its feasibility.

3. Full Self-Driving (FSD) Progress: Elon Musk projected that Tesla’s FSD technology would achieve full autonomy by 2026, with the Cybercab and current models (like the Model 3 and Model Y) spearheading this effort in Texas and California. However, Musk’s history of ambitious FSD promises has been met with ongoing skepticism, and this presentation did little to change that. No new safety data or significant updates were provided to address reliability concerns, leaving regulatory and safety issues unresolved. Tesla still faces significant challenges in proving its FSD capabilities are ready for public use without human oversight and in obtaining regulatory approval at both federal and state levels.

4.Market Reaction: Analysts expressed mixed feelings about the event. While some found the futuristic concepts inspiring, others noted the lack of substantial progress and the vague nature of Musk’s promises. This left investors questioning how close Tesla truly is to achieving its autonomy and robotics goals. For many, the event leaned more towards spectacle than solid evidence of progress.

Shareholder Deck Updates

1.Supercharger Network: Tesla’s Supercharger Network received widespread industry support, with most automakers now adopting Tesla’s North American Charging Standard (NACS). This acceptance is likely to boost Tesla’s Services segment and improve its margins in the long term. The number of Supercharger stations increased by 20% year-over-year to 6,706. Tesla also rehired some of the nearly 500 Supercharger team members who had been laid off earlier in the year, indicating renewed focus on this segment.

2.Market Share: Tesla’s market share remained steady in North America and Europe on a sequential basis, but saw a noticeable improvement in China, signaling stronger competitiveness in the region.

These details paint a picture of a company with promising ambitions but facing significant challenges in bringing its bold visions to reality. Investors will be watching closely for concrete progress and clearer timelines moving forward.

Key Updates from the Earnings Call

Full Self-Driving (FSD) Progress

- Tesla has surpassed 2 billion miles driven using its FSD (supervised) technology, which forms a core part of the company’s data advantage. This milestone underpins Tesla’s long-term autonomy thesis. Additionally, Tesla launched **FSD version 12.5** and introduced the Actually Smart Summon feature, enabling vehicles to autonomously drive to their owners in parking lots.

AI Training Capacity

- Musk shared that Tesla expects to have **nearly 90,000 H100 clusters dedicated to AI training** by the end of the year, enhancing the company’s machine learning capabilities.

Energy Storage Deployments

- Tesla deployed **6.9 GWh of energy storage** in Q3, although this fell short of the record 9.4 GWh achieved in Q2. The 40 GWh Megafactory in Lathrop is ramping up production, reaching 200 Megapacks in a single week. The **Shanghai Megafactory** is set to start shipping Megapacks in Q1 2025 with a run rate of 20 GWh. Tesla noted that energy deployments are inherently lumpy due to factors such as customer readiness and geographic order locations.

Key Quotes from the Earnings Call

Elon on the Cybercab:

- “I do feel confident of Cybercab reaching volume production in ‘26. We’re aiming for at least 2 million units a year, maybe 4 million ultimately.”

Musk envisions the Cybercab becoming a global, high-volume autonomous vehicle service. However, achieving this scale requires overcoming two major challenges: delivering level 5 autonomy at a competitive cost and navigating regulatory approval across regions with varying laws, road conditions, and weather considerations.

- Musk also dismissed the notion of a regular low-cost model, stating, “I think having a regular $ 25,000 model* is pointless.” He emphasized focusing on the Cybercab as a generational leap forward.

Musk on FSD:

- “Our internal estimate is **Q2 of next year** to be safer than human and then to continue with rapid improvements thereafter.”

He expressed confidence that full autonomy could be achieved in 2025 with existing vehicle models, although regulatory hurdles and safety standards remain significant barriers.

On Tesla’s Ridesharing App

- Tesla is already testing a *ridesharing capability* in the Bay Area for employees, with safety drivers currently in place. Musk anticipates launching the service for the public in California and Texas next year, pending regulatory approval. He added, “**I’d be shocked if we don’t get approval next year**,” but acknowledged that regulatory timelines are out of Tesla’s control.

Musk on Optimus:

- “We’re the only company that really has all of the ingredients necessary to scale humanoid robots.” He believes that the *Optimus robot* could become the “most valuable product ever made,” owing to Tesla’s combined AI and manufacturing advantages. However, the product remains at an early development stage and will likely take years to fully commercialize.

On Tesla’s Valuation:

- Musk reiterated his bold prediction: “Tesla will become the most valuable company in the world and probably by a long shot” He argued that Tesla’s strategic focus on future advancements in energy, transport, robotics, and AI sets it apart from competitors who are only targeting short-term trends.

Waymo, Uber, and Rideshare Future

There are two distinct paths to achieving full autonomy

1.Waymo’s Approach: Waymo focuses on highly structured, geo-fenced environments with extensive pre-mapping and sensor-based systems like lidar to ensure safety.

2.Tesla’s Approach: Tesla aims to develop a generalized self-driving system that works with computer vision and AI, relying on its fleet’s extensive data advantage and scaling software improvements. However, Tesla’s reluctance to use lidar technology and regulatory challenges could hinder its timeline for achieving level 5 autonomy.

These differing strategies highlight the varied paths to delivering a future of autonomous transportation, with each approach facing unique technical and regulatory hurdles.

Levels of Autonomy

- Tesla's FSD (Supervised): Tesla’s Full Self-Driving system remains at **Level 2**, meaning it still requires driver supervision to operate. In contrast, **Waymo** operates at **Level 4** in certain cities, where its vehicles can drive without human intervention, albeit under specific conditions.

-Jumping Levels: Musk’s vision for the Cybercab aims to skip from Level 2 to **Level 5 autonomy**, which implies no need for human input at all—a huge leap.

Technology Approach

-Tesla’s Strategy: Tesla relies on a **camera and AI-only approach**, focusing on software and data scalability rather than expensive hardware. Musk’s bet is that advanced software can eventually solve all driving scenarios.

- Waymo’s Strategy: Waymo uses a **hardware-intensive model** with a combination of LiDAR, radar, and cameras**, providing highly precise navigation. However, the reliance on multiple sensors leads to higher production costs per vehicle, around **$200,000** each.

Scaling Challenges

-Waymo’s Limitation: The high cost of Waymo's vehicles has hindered its ability to scale quickly, while Tesla plans to leverage its extensive fleet data to improve its autonomous systems over time.

-Tesla’s Repeated Delays: Despite its aspirations, Tesla’s full autonomy timeline has faced numerous delays. Scaling quickly while achieving robust and safe autonomy remains a significant challenge for the company.

Safety and Regulation

-Waymo’s Approach: Waymo has built trust with regulators by deploying vehicles cautiously in select cities and prioritizing safety, but its operations remain limited geographically.

-Tesla’s Regulatory Hurdles: The Cybercab’s design lacks traditional controls like steering wheels and pedals, raising concerns about regulatory approval. These changes could face substantial scrutiny, particularly if safety standards require features Tesla’s design omits.

Tesla and Uber: Competitors or Partners?

-Potential Partnership: Uber CEO Dara Khosrowshahi found the Cybercab vision "pretty compelling" and didn’t dismiss the possibility of a collaboration. Uber already partners with Waymo to offer autonomous rides in cities like **Phoenix, Atlanta, and Austin**. Khosrowshahi’s openness to partnership means there’s potential for Tesla's Cybercab fleet owners to list their vehicles on Uber to boost earnings.

-Hybrid Model: By leveraging Uber’s vast network, Tesla could quickly gain scale in local markets, especially given Uber’s capability to serve diverse customer needs. This could lead to a hybrid model where Tesla’s autonomous vehicles are available on Uber alongside other options.

Regulatory Challenges: An Obstacle to Elon’s Vision ?

-Waymo’s Critique: Former Waymo CEO John Krafcik criticized the Cybercab, highlighting its impracticality for a large-scale robotaxi business. Waymo’s approach focuses on accessibility and safety with taller vehicles and high-mounted sensors, whereas Tesla’s design was light on crucial technical details.

-Possible Lidar Mandate: Krafcik also noted that if regulators eventually require LiDAR technology for safety compliance, Tesla’s camera-only approach could face a significant setback. Regulatory decisions are beyond Tesla’s control and could fundamentally reshape its autonomy strategy.

-Musk’s Political Maneuvering: Musk’s political activities and controversies could complicate Tesla’s regulatory relations. Building strong connections with regulators is critical, given their power to greenlight or halt the Cybercab’s deployment.

Final Thoughts

The coming years will be pivotal for Tesla as it strives to overcome both techno logical and regulatory challenges. The success of Tesla’s autonomy plans hinges not just on its technological progress but also on its ability to navigate complex and varied regulatory frameworks worldwide. Whether Musk’s bold vision for full autonomy becomes a realityor remains a distant dream will depend on a combination of innovative breakthroughs and the company’s capacity to gain and maintain regulatory approval.

Are you Moonish on Tesla or not?

NVDA | Unpacking NVIDIA’s Q3 FY25Building the Matrix, One GPU at a Time

This week, NVIDIA unveiled its October quarter results, capturing global attention as analysts closely monitored the stock's movements. While Wall Street often emphasizes short-term performance, a broader perspective highlights NVIDIA's remarkable rise. Over two years, its stock value has multiplied tenfold, outpacing tech giants like Alphabet and Amazon in profitability and edging closer to Microsoft and Apple in net income—a meteoric ascent for the history books.

The AI Inflection Point

NVIDIA's transformation began in November 2022 when OpenAI launched ChatGPT, described by CEO Jensen Huang as AI's "iPhone moment." Fast-forward two years, and NVIDIA's latest Blackwell GPU architecture is scaling up production, meeting surging demand. As Huang explained, "The age of AI is in full steam," driven by foundational model training and inference advancements. Two major trends underpin this shift:

-Platform evolution:Transitioning from traditional coding to machine learning.

-Emergence of AI factories:New industries powered by generative AI applications.

AI native startups are booming, and successful inference services are proliferating. If AI's trajectory mirrors the mobile revolution, this is akin to 2009 a pivotal moment with much more innovation ahead.

Q3 FY25 Highlights

NVIDIA's fiscal year ends in January, and the recently concluded October quarter (Q3 FY25) demonstrated strong momentum:

- Revenue: $35.1 billion (+17% quarter-over-quarter), exceeding expectations by $2 billion.

- Segment growth:**

- Data Center: +17% QoQ ($30.8 billion).

- Gaming: +14% QoQ ($3.3 billion).

- Automotive: +30% QoQ ($0.4 billion).

- Margins: Gross margin at 75%, operating margin at 62%.

- Cash flow: Operating cash flow of $17.6 billion; free cash flow of $16.8 billion.

- Q4 FY25 Guidance: Anticipates +7% revenue growth ($37.5 billion).

Key Drivers and Insights

-Data Center Dominance:Contributing 88% of overall revenue, driven by Hopper GPUs and the anticipated Blackwell production ramp.

-Gaming Growth:Propelled by GeForce RTX GPU demand and back-to-school sales.

-Automotive Innovation:Growth fueled by AI-powered autonomous driving solutions.

-Margins:Slight compression due to Blackwell production ramp, with recovery expected as production scales.

Looking ahead, demand for NVIDIA's Hopper and Blackwell GPUs outpaces supply, likely remaining constrained into FY26. However, challenges loom, including intensifying competition from AMD and custom AI chips.

The AI Scaling Debate

Skeptics argue AI scalability may be approaching its limits, but Huang is optimistic, citing advancements in reinforcement learning and inference-time scaling. He emphasized that AI's growth is driven by empirical laws, suggesting scalability could be extended through methods like post-training and test-time scaling.

CEO and CFO Perspectives

- Huang likens modern data centers to "AI factories," producing intelligence like power plants generate electricity.

- The shift to "physical AI" unlocks applications in industrial and robotics sectors, powered by NVIDIA's Omniverse.

- Blackwell GPUs are delivering significant cost reductions and accelerating AI workloads.

Investment Outlook

Despite valuation concerns, NVIDIA's profitability is tangible. However, the company's reliance on sustained GPU demand and a concentrated customer base presents risks. Meanwhile, competition from AMD is intensifying.

Final Thoughts

If ChatGPT was AI's "iPhone moment," the transformation is just beginning. Like the app economy in 2009, the AI-first revolution is poised to unlock entirely new markets and reshape industries. NVIDIA's leadership positions it at the forefront of this multi-trillion-dollar opportunity.

Redwire Corporation (RDW) AnalysisCompany Overview:

Redwire Corporation NYSE:RDW is a leading player in space infrastructure and advanced space technologies, driving innovation across multiple domains, including lunar exploration, in-space manufacturing, and solar power solutions. With a strong portfolio of high-profile contracts and cutting-edge capabilities, Redwire is well-positioned to capitalize on the growing space economy.

Key Developments:

NASA Lunar Gateway Contract:

Redwire secured a $100 million contract with NASA to develop solar arrays for the Lunar Gateway, a critical component of the Artemis program. This deal establishes a strong revenue base and reinforces Redwire’s role as a key partner in the advancement of lunar exploration.

Roll-Out Solar Array (ROSA):

The successful deployment of ROSA technology on the International Space Station (ISS) showcases Redwire’s engineering prowess. As demand for efficient and scalable space power solutions grows, ROSA positions Redwire to address increasing needs across satellite constellations and deep-space missions.

Strategic Acquisitions:

Redwire’s acquisition of QinetiQ Space NV, a European space infrastructure provider, expands its geographic footprint and diversifies its product offerings. This move enhances Redwire’s ability to serve international markets and strengthens its position as a global space technology leader.

In-Space Manufacturing Leadership:

Redwire’s participation in NASA’s OSAM-2 mission highlights its leadership in in-space manufacturing, an emerging and transformative capability that will enable the on-demand production and repair of spacecraft components in orbit.

Investment Outlook:

Bullish Outlook: We are bullish on RDW above the $9.50-$10.00 range, supported by its robust contract pipeline, proven technology, and strategic market expansion.

Upside Potential: Our price target is set at $20.00-$22.00, reflecting Redwire’s potential to grow its market share and capitalize on the increasing global investment in space infrastructure.

🚀 Redwire—Building the Future of Space! #SpaceInfrastructure #LunarExploration #InSpaceManufacturing

ADVENZYMES: Catching the Wave of OpportunityADVENZYMES (Advanced Enzyme Tech Ltd.)

Key Levels:

Demand Zone: ₹333.85 - ₹384.90

Stop Loss: Below ₹333.85 (on daily closing basis)

Target Zone: ₹523 - ₹543 (Golden Retracement Zone of the correction swing)

Structure & Trend:

The stock is currently in an ABC correction wave with Wave C extended.

A strong demand zone is visible near ₹333.85 - ₹384.90.

Buyers are likely to step in at this zone, creating a potential reversal opportunity.

Trade Plan:

Entry: Around ₹366 - ₹385 within the demand zone.

Targets:

First target: ₹450 (midway to retracement)

Final target: ₹523 - ₹543

Stop Loss: ₹333.85 on a daily close basis.

Note: Sellers might use the ₹523-₹543 zone for profit booking.

General Guidelines:

Risk Management: Adhere to strict stop losses as per the plan.

Confirmation: Look for price action signals (bullish candles, volume spikes) near entry zones.

Patience: Allow the trades to develop towards targets gradually.

Educational Purpose only

3 Stocks in ACCUMULATION Phase | STOCKS | BABA, HOOD, PYPLIf you have patience, stock trading can be very rewarding.

Something a little different today - SOCKS ! 🧦 These are my top 3 picks for stocks at the moments - for the sake of duration, we'll look at 3 per video.

What I look for in stocks, is longer term holds. Ideally they must be in accumulation phase, or have just broken out of my ideal buy zone.

_____________________

NYSE:BABA NASDAQ:HOOD NASDAQ:PYPL

BYD Co. (BYDDY) AnalysisCompany Overview: BYD Co. (Build Your Dreams), a leader in electric vehicles (EVs) and renewable energy, has firmly established itself as a global powerhouse in the EV market. Known for its vertically integrated model and diverse vehicle lineup, BYD continues to expand its dominance across key regions, solidifying its position as a top competitor in the EV and clean energy sectors.

Key Developments:

Market Leadership: OTC:BYDDY has surpassed Tesla as the world's largest EV seller, delivering 822,094 vehicles in Q3 2023 compared to Tesla's 435,059 deliveries. This achievement highlights BYD's growing global market share and its ability to meet surging demand, even in a highly competitive industry.

Diverse Product Lineup: BYD’s expansive vehicle range—from affordable compact cars to luxury models—appeals to a broad consumer base, reducing its dependence on a single market segment. This diversification strengthens its resilience and positions the company to capture additional market share across income brackets.

International Expansion: BYD is aggressively entering new markets, including Europe, Southeast Asia, and Latin America, tapping into regions with rising EV adoption rates. This international growth strategy provides BYD with new revenue streams, insulating it from potential regional economic fluctuations.

Rising EV Demand: With global EV adoption continuing to accelerate, BYD benefits from a tailwind of policy support for renewable energy and consumer demand for eco-friendly transportation options.

Investment Outlook: Bullish Outlook: We are bullish on BYDDY above the $62.00-$63.00 range, driven by its market leadership, product diversification, and robust international growth strategy.

Upside Potential: Our price target is set at $123.00-$125.00, reflecting the company’s potential to capitalize on its global expansion and strengthen its position as the top EV maker worldwide.

🚗 BYD—Driving the Future of EVs Globally! #ElectricVehicles #BYD #CleanEnergyRevolution

GER40 - Our View for the Next 5 Years ( Weekly) Hello Folks

This is my personal roadmap for tracking GER40 over the next five years, revisiting it month by month to see how things evolve.

Right now, I’m expecting a short-term pullback, but only for a brief period. If the market hits 20K early, it might need to take a breather before aligning with the right cycle timing. However, my focus remains clear: I’m only looking for long opportunities in the bigger picture.

The larger structure is bullish, and any short-term corrections are just part of the process before the next major move upward. It’s all about timing and staying patient as the market reveals its hand.

Let’s see how this plays out in the months ahead

MEDPLUS Soars!MEDPLUS Trade Details:

This trade setup on the 15-minute timeframe demonstrated a robust bullish trend with clean signals provided by the Risological Trading Indicator , resulting in all targets being achieved.

Key Levels:

Entry: 687.90

Stop Loss (SL): 683.95

Take Profit Targets:

TP1: 692.75

TP2: 700.65

TP3: 708.55

TP4: 713.40

Performance Analysis:

The steady uptrend, aligned with the dynamic moving averages, validated the long trade setup. Each profit target was systematically breached, emphasizing the accuracy of the entry and exit strategy.

Trade Outcome:

This trade proved to be a stellar performer, with all targets hit in quick succession, delivering exceptional results for intraday traders.

Maximize your trades with the Risological Indicator – precision, clarity, and profits!

AMD: Final shot to rise in this Channel. $290 if successful.Advanced Micro Devices are bearish on the 1D timeframe (RSI = 38.717, MACD = -4.560, ADX = 33.691) but just under neutrality on the 1W technical outlook (RSI = 43.494, MACD = -3.840, ADX = 18.724). This indicates that this is the final support long term to reverse the medium term bearish sentiment and this is quite evident on this chart where the price is at the bottom of the 2 year Channel Up.

Roughly every November inside this Channel (2022, 2023 and 2024), it is on a corrective wave (or has been the month before), so the symmetric structure on this pattern is very strong. Another reason to see a massive bullish wave next. The previous two peaked approximately 160 days after that low, completing a +141.24% rally from the HL. Consequently, we are aiming for a similar rally (TP = 290.00) by late April 2025.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

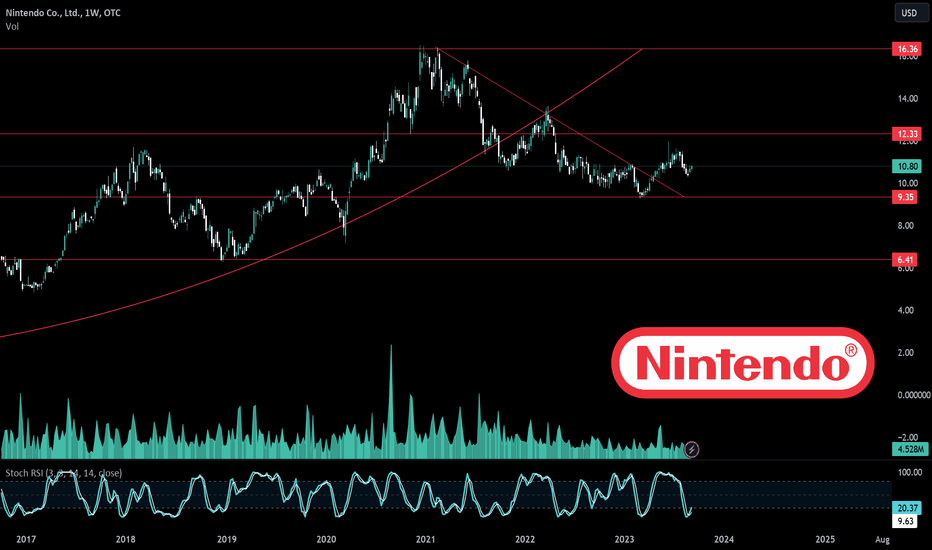

NTDOY | NINTENDO & Nintendo Switch 2 🍄The next Nintendo console might arrive in 2024

Nintendo has reportedly demonstrated the Nintendo Switch 2 behind closed doors at Gamescom last month.some trusted developers got an early look at the Switch 2 and some tech demos of how games run on the unannounced system.

There was reportedly a demo of an improved version of Zelda: Breath of the Wild that’s designed to run on the more advanced hardware inside the Nintendo Switch 2, VGC corroborated the claims and revealed that Nintendo also showcased Epic Games’ The Matrix Awakens Unreal Engine 5 tech demo running on the type of hardware Nintendo is targeting for its next console. The demo reportedly used Nvidia’s DLSS upscaling technology with ray tracing enabled, suggesting Nintendo and Nvidia are working on a significant chip upgrade for this next-gen console. in July that a new Nintendo Switch is being planned for a 2024 release.

With 43 years of making immensely popular video games under its belt, you'd think that the video game pioneers at Nintendo probably have the business of success fully figured out.

But companies must change with the times and, according to Nintendo of America president Doug Bowser, that means finding a way to engage people with the legacy brand that might never pick up a video game controller.

Bowser spoke about what the company learned this year during the Nintendo Live event in Seattle, Wa. on Sept 1, referencing the enormous box office success of the "The Super Mario Bros. Movie" as one of its key indicators that Nintendo has the ability to reach an audience beyond those that naturally reach for a controller.

"We launched The Super Mario Bros. Movie, which very quickly became the second-largest box office grossing animated film of all time at $1.3 billion," Bowser said. "We launched The Legend of Zelda: Tears of the Kingdom, which, 18 million units later after a very brief period of time, it's one of our fastest launch titles ever, and then the event today. So it's really this drumbeat of activities, entertainment-based activities where we're trying to find ways to continue to introduce more and more people, not just players, but people to Nintendo IP… So that's what we're excited about."

Bowser also spoke about the launch of Super Nintendo World at Universal Hollywood, which delivered an impressive 25% bump to Comcast's Q1 earnings this year.

"And if I think about folding into the bigger strategy, this year has really been a very unique, and I dare say banner year for Nintendo in a lot of ways," Bowser said.Nintendo also continues to benefit from the sales of its aging Nintendo Switch console, with 129.53 million units sold worldwide. That makes it the company's second best-selling console of all time, right behind the handheld Nintendo DS, which sold 154.2 million units before it was discontinued in 2014.

The success of "The Super Mario Bros. Movie" drove rumors that another big feature film based on Nintendo's flagship Legend of Zelda series was coming as well, but Nintendo hasn't made a formal announcement about that ... yet.

Gaming is in the midst of an M&A arms race. The protracted pandemic has made sure of that. Companies from all sides of the market, Microsoft, Take Two, Sony to name a few, are cutting deals to secure content. The volume and scale of those deals point to where gaming is heading - the precipice of major shake-ups across its core commercial and distribution models. Microsoft's eye bulging $69 billion deal for Activision is a testament to that shift. Costly as the deal is, it's arguably a small price to pay to secure some of the biggest franchises in gaming: Call of Duty, Warcraft, Candy Crush and Overwatch. Even more so, considering those titles span a community of 400 million active monthly players. In other words, the deal is the boldest sign yet that content is the future of gaming, not consoles.

Should you invest in Nintendo?

The question comes down to whether you are willing to pay about SGX:40B for Nintendo's IP and potential earnings powers. To me, a company that continues to produce in-demand and profitable content is worth that price tag, especially after having generated a net profit of 432.7B yen, or $2.97B in FY2023. That's a P/E of about 13.5 after subtracting out Nintendo's current assets - not a hefty sum given everything Nintendo has going for it. Nintendo's strategy seems to be working, with The Super Mario Bros. Movie not only performing well on its own but also providing a boost to other Nintendo offerings. While there are concerns, there are also plenty of catalysts moving ahead. I am excited to see new Nintendo initiatives including more theatrical releases of their IP and their (positive) effects on the rest of the company's products.

CD Projekt | CDR & Phantom Libertywhat a nice long and what a great day, hows tradin so far Chooms?

cyberpunk dlc phantom liberty coming on September 26th 2023 and cant wait to play this gem

as usual CDPR going to sell million of copies and making hundreds millions of dollar so for me CDR still is safe and good place to printing more money. 2023 is a great year to buy the dips and enjoying 2024 after that

C3.AI: Waiting for this huge buy breakout signal.C3.ai is on a neutral technical outlook both on the 1D and 1W timeframes (RSI = 51.525, MACD = -0.010, ADX = 22.326) as it is trading around the 1W MA50 for 5 straight weeks. This sideways price action is approaching the top of the June 2023 Channel Down, which on the greater scale technically looks like a giant Bull Flag. For the first time in its history, the 1W MA200 is at 33.00 and falling. A test of the top of the Channel Down may coincide with a 1W MA200. This is the level that separates the long term bearish from bullish trends. If it breaks we will go long and target the R1 level (TP = 49.00).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Tempus AI (TEM) Investment Analysis Company Overview: Tempus AI NASDAQ:TEM specializes in AI-driven healthcare solutions, focusing on improving patient outcomes and accelerating medical research. By leveraging extensive datasets and advanced analytics, Tempus provides innovative precision medicine solutions, solidifying its position in the growing AI healthcare sector.

Key Growth Drivers:

Strategic Acquisition of Ambry Genetics:

Tempus AI's acquisition of Ambry Genetics significantly enhances its capabilities in genetic testing. This deal, completed at favorable multiples of 1.9x revenue and 15x EBITDA, demonstrates strategic financial discipline.

The integration of Ambry Genetics is expected to boost Tempus's market presence, expanding its offerings in diagnostics and genetic analysis, and driving revenue growth.

Multi-Year Partnership with BioNTech:

A new multi-year partnership with BioNTech is a major validation of Tempus AI's expertise in precision medicine. This collaboration will focus on leveraging Tempus's vast datasets and computational biology tools to enhance BioNTech's research and development in personalized treatments.

The partnership could lead to significant advancements in oncology and other therapeutic areas, potentially resulting in considerable revenue gains from breakthrough discoveries and innovative treatment options.

Competitive Edge in AI-Enabled Precision Medicine:

Tempus AI's proprietary operating system and robust data library provide a competitive edge in the precision medicine market. The company's AI-driven platform allows for rapid analysis of complex datasets, aiding in the identification of personalized treatment options for patients.

This competitive advantage positions Tempus to capture a larger market share as demand for AI-enabled healthcare solutions continues to grow.

Technical Analysis and Investment Outlook:

Current Price Level: We are bullish on Tempus AI (TEM) above the $43.00-$44.00 range. This level reflects investor optimism, particularly following recent strategic initiatives like the Ambry Genetics acquisition and the BioNTech partnership.

Upside Potential: Our upside target for TEM is $85.00-$90.00, driven by expected revenue growth from new collaborations and enhanced genetic testing capabilities.

Catalysts to Watch: Updates on the integration progress of Ambry Genetics, along with developments from the BioNTech partnership, are key catalysts to monitor. These could significantly impact Tempus's revenue trajectory and investor sentiment.

🔍 Tempus AI—Revolutionizing Healthcare with Precision Medicine! #PrecisionMedicine #HealthcareAI #GeneticTesting #BioNTechPartnership