Nat West breakoutClear breakout from 327, which was established resistance since 2016. Inverse Head and Shoulders pattern completed.

Volumes have been ramping up since Feb this year and the shares are not oversold on the weekly RSI yet.

Market likes their results today too.

In my opinion, heading for 400p.

Do your own research and this is NOT a solicitation to hold, buy or sell.

Stocktrading

UnitedHealth (UNH) Share Price PlummetsUnitedHealth (UNH) Share Price Plummets

UnitedHealth shares crashed by nearly 23% yesterday after the healthcare giant reported weaker-than-expected Q1 2025 results:

→ Earnings per share: actual = $7.20, expected = $7.29

→ Revenue: actual = $109.5bn, expected = $111.5bn

Technical Analysis of UNH Share Chart

As far back as a year ago, we highlighted key support around the $450 level. Yesterday’s negative news caused this support to once again demonstrate its strength by holding back further decline — but will it hold?

Taking the price action marked on the chart as a base, we can establish the structure of a descending channel (shown in red), with the price gapping sharply lower into the bottom half of this channel — and yesterday’s candle high (marked with an arrow) suggests that the median line has turned into resistance.

Yesterday’s candle closed near its lows, so it is reasonable to assume that bearish pressure may persist (with the aim of testing the lower boundary) — in which case, the $450 support zone, in place since early 2022, could be at risk.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Apple – More Pain to come? Apple’s NASDAQ:AAPL chart right now? Honestly, it’s a mess. It’s one of those setups where you can’t confidently say much with conviction , but one thing feels clear to me: it should go lower before it gets better.

Zooming out to the 3-day timeframe , you can spot something interesting: the downtrend from 2022 to 2023 looks almost identical to the one we’ve seen from July 2023 to April 2024 — same structure, same slow bleed, and almost the exact same duration. That kind of symmetry doesn’t happen by accident.

After that, we had a massive rally from April/May 2024 , but now we’re already seeing a sharp retracement — down over 35%. My take? We probably need one more leg lower to really shake things out before Apple makes a meaningful move higher, maybe toward $250–$260 .

To get there, I think we still need to retest the $160–$150 zone. If we break below that and head toward $120, then we’re in real trouble structurally — that would shift the whole outlook.

Yes, the recent bounce from the VWAP level was clean , and it looked strong — but I wouldn’t rule out one more flush before we get the real recovery. Apple is in no-man’s-land right now, and until we hit key levels or reclaim broken structure, it’s caution over confidence.

Quantum's PLTR Trading GuideSentiment: Bullish. AI and government contract hype drives enthusiasm, though valuation risks noted. Chatter lean bullish, citing growth momentum.

Outlook: Neutral, slightly bearish. Options pin $88, with $85 puts active. ICT/SMT eyes $86-$88 buys to $92 if $86 holds. Bearish below $86 risks $80.

Influential News:

Federal Reserve: Two 2025 cuts aid growth stocks, positive for $PLTR.

Earnings: Q1 due early May; no update today.

Chatter: Bullish on AI/contracts, some warn of pullback.

Mergers and Acquisitions (M&A): No confirmed NASDAQ:PLTR M&A; partnership expansions rumored.

Other: Tariff volatility hit tech; NASDAQ:PLTR resilient.

Indicators:

Weekly:

RSI: ~75 (overbought).

Stochastic: ~85 (overbought).

MFI: ~80 (overbought).

SMAs: 10-day ~$86 (above, bullish), 20-day ~$85 (above, bullish).

Interpretation: Overbought, bullish SMAs suggest pullback risk.

Daily:

RSI: ~72 (overbought).

Stochastic: ~80 (overbought).

MFI: ~75 (overbought).

SMAs: 10-day ~$86 (above, bullish), 20-day ~$85 (above, bullish).

Interpretation: Overbought, bullish SMAs but caution warranted.

Hourly:

RSI: ~70 (neutral).

Stochastic: ~75 (overbought).

MFI: ~70 (neutral).

SMAs: 10-day ~$86 (above, bullish), 20-day ~$85 (above, bullish).

Interpretation: Overbought, bullish momentum fading.

Price Context: $88.55, 1M: +2%, 1Y: +303%. Range $80-$92, testing $88 resistance.

Options Positioning (May 2025):

Volume:

Calls: $90 (10,000, 60% ask), $95 (8,000, 55% ask). Bullish bets on $90+.

Puts: $85 (7,000, 70% bid), $80 (5,000, 65% bid). Put buying grows.

Open Interest:

Calls: $90 (30,000, +5,000), $95 (20,000, +4,000). Bullish positions.

Puts: $85 (18,000, +3,000), $80 (15,000, +2,000). Hedging. Put-call ~0.7.

IV Skew:

Calls: $90 (45%), $95 (47%, up 3%). $95 IV rise shows upside bets.

Puts: $85 (40%, up 2%), $80 (38%). Rising $85 IV signals downside fear.

Probability: 60% $80-$92, 20% <$80.

Karsan’s Interpretation:

Vanna: Positive (~200k shares/1% IV). IV drop could pressure $88.

Charm: Positive (~100k shares/day). Pins $88.

GEX: +80,000. Caps upside.

DEX: +4M shares, bullish.

Karsan view: High GEX limits $92+; pullback to $85 likely.

ICT/SMT Analysis:

Weekly: Bearish at $88 OB, targets $85. Bullish > $92.

Daily: Bearish at $88 FVG, targets $85. Bullish > $90.

1-Hour: Bearish < $88, $85 target. MSS at $90.

10-Minute: OTE ($87-$88.50, $87.75) for sells, NY AM.

Trade Idea:

Bullish: 45%. ICT/SMT buys $86-$88 to $92. Options favor $90 calls. AI hype supports.

Neutral: 30%. $80-$92 range, balanced options.

Bearish: 25%. Below $85 likely with overbought signals. $85 put volume rises.

Quantum's NVDA Trading Guide 4/13/25Sentiment: Neutral. AI chip dominance drives optimism, but tariff risks and valuation concerns temper enthusiasm. Chatter posts split—bulls see growth, bears eye correction.

Outlook: Neutral, slightly bearish. Options pin $110, with $105 puts active. ICT/SMT eyes $108-$110 buys to $115 if $108 holds. Bearish below $108 risks $105.

Influential News:

Federal Reserve: Two 2025 cuts support growth stocks, positive for $NVDA.

Earnings: Q1 due May; no update today.

Chatter: Debates AI growth vs. tariff/supply chain risks.

Mergers and Acquisitions (M&A): No confirmed NASDAQ:NVDA M&A; AI chip partnerships rumored.

Other: Tariff volatility hit NASDAQ:NVDA ; stock swung (April 3-9).

Indicators:

Weekly:

RSI: ~50 (neutral).

Stochastic: ~45 (neutral).

MFI: ~40 (neutral).

SMAs: 10-day ~$112 (below, bearish), 20-day ~$115 (below, bearish).

Interpretation: Neutral, bearish SMAs signal weakness.

Daily:

RSI: ~48 (neutral).

Stochastic: ~50 (neutral).

MFI: ~45 (neutral).

SMAs: 10-day ~$112 (below, bearish), 20-day ~$115 (below, bearish).

Interpretation: Neutral, bearish SMAs suggest pullback.

Hourly:

RSI: ~45 (neutral).

Stochastic: ~55 (neutral).

MFI: ~50 (neutral).

SMAs: 10-day ~$112 (below, bearish), 20-day ~$115 (below, bearish).

Interpretation: Neutral, stabilizing.

Price Context: $110.93 (April 11), 1M: -9%, 1Y: +28%. Range $105-$120, testing $110 support.

Options Positioning (May 2025):

Volume:

Calls: $115 (12,000, 60% ask), $120 (10,000, 55% ask). Mild bullish bets.

Puts: $105 (8,000, 70% bid), $108 (6,000, 65% bid). Put selling supports $108.

Open Interest:

Calls: $115 (35,000, +6,000), $120 (25,000, +5,000). Bullish interest.

Puts: $105 (20,000, flat), $108 (22,000, +3,000). Hedging. Put-call ~1.0.

IV Skew:

Calls: $115 (40%), $120 (42%, up 3%). $120 IV rise shows upside hope.

Puts: $105 (35%, down 2%), $108 (36%). Falling $105 IV supports floor.

Probability: 60% $105-$120, 20% <$105.

Karsan’s Interpretation:

Vanna: Neutral (~300k shares/1% IV). IV drop could pressure $110.

Charm: Neutral (~150k shares/day). Pins $110.

GEX: +60,000. Stabilizes range.

DEX: +8M shares, neutral.

Karsan view: GEX holds $105-$120; tariff news key.

ICT/SMT Analysis:

Weekly: Neutral, $105 support, $120 resistance. No $NVDA/ NASDAQ:AMD divergence.

Daily: Bullish at $110 FVG, targets $115. Bearish < $108.

1-Hour: Bullish >$110, $115 target. MSS at $108.

10-Minute: OTE ($109-$111, $110) for buys, NY AM.

Trade Idea:

Bullish: 50%. ICT/SMT buys $108-$110 to $115. Options show $115 calls. Fed cuts aid.

Neutral: 35%. RSI (~50), SMAs (bearish), $105-$120 range.

Bearish: 15%. Below $105 possible with tariffs. $105 put volume grows

Quantum's T (AT&T) Trading Guide 4/13/25Sentiment: Neutral. Dividend yield (4-5%) and debt reduction ($123B) attract income seekers, but telecom competition and tariff fears limit enthusiasm. X posts praise stability, though growth concerns persist.

Outlook: Neutral, slightly bullish. Options pin $27, with call buying eyeing $28. ICT/SMT supports $26-$26.50 buys to $27.50-$28 if support holds. Bearish risk below $25 low unless earnings falter.

Influential News:

--Federal Reserve: Rates unchanged, two 2025 cuts expected, easing debt costs. Liquidity boost mildly positive.

--Earnings: Q1 due April 23 (EPS $1.97-$2.07 vs. $2.13). Fiber (28.9M locations) and cash flow (>$16B) could lift if beat.

--Chatter: X mixed—stability vs. tariff risks. Analyst focus on earnings revisions.

--Mergers and Acquisitions (M&A): Talks to acquire Lumen’s fiber unit ($5.5B+), potentially boosting growth but risking debt concerns.

--Other: Tariffs caused volatility; RUS:T stable. Broadband expansion adds value.

Indicators:

--Weekly:

----RSI: ~45 (neutral).

----Stochastic: ~50 (neutral).

----MFI: ~40 (neutral).

----SMAs: 10-day ~$27.10 (below, bearish), 20-day ~$27.30 (below, bearish).

----Interpretation: Neutral, bearish SMA signals suggest consolidation.

--Daily:

----RSI: ~48 (neutral).

----Stochastic: ~55 (neutral).

----MFI: ~45 (neutral).

----SMAs: 10-day ~$27.10 (below, bearish), 20-day ~$27.30 (below, bearish).

----Interpretation: Neutral, bearish SMAs indicate pullback but recovery possible.

--Hourly:

----RSI: ~50 (neutral).

----Stochastic: ~60 (neutral).

----MFI: ~50 (neutral).

----SMAs: 10-day ~$27.10 (below, bearish), 20-day ~$27.30 (below, bearish).

----Interpretation: Neutral, mildly bullish momentum.

Price Context: $26.79 (April 11 close), 1M: -6%, 1Y: +59%. Range $25-$29, holding $26 support amid tariff concerns.

Options Positioning (May 2025):

-Volume:

----Calls: $27 (3,500, 60% ask = buying), $28 (2,500, 55% ask). Bullish bets on $27-$28.

---Puts: $25 (2,000, 70% bid = selling), $26 (1,500, 65% bid). $25 put selling supports $26 floor.

-Open Interest:

---Calls: $27 (10,000, +2,000 = buying), $28 (7,000, +1,500). Institutional bullishness.

---Puts: $25 (4,000, flat), $26 (6,000, +1,000). Hedging, not bearish. Put-call ~0.9.

-IV Skew:

---Calls: $27 (25%), $28 (27%, up 2%). $28 IV rise shows $28+ speculation.

---Puts: $25 (22%, down 1%), $26 (24%). Falling $25 IV reinforces $26 support.

-Probability: 60% $25-$28, 20% >$29.

Karsan’s Interpretation:

---Vanna: Neutral (~50k shares/1% IV). Stable IV limits flows; earnings IV spike could push

$27.50.

---Charm: Neutral (~20k shares/day). Pins $27.

---GEX: +20,000. Dealers sell $28, buy $26, holding range.

---DEX: +1M shares, neutral.

---Karsan view: GEX pins $26-$28; catalyst needed.

ICT/SMT Analysis:

--Weekly: Neutral, $25 support, $29 resistance. No $T/ NYSE:VZ divergence (~$43 NYSE:VZ ).

--Daily: Bullish at $26 FVG, targets $28. Bearish < $26.

--1-Hour: Bullish >$26.50, $27.50 target. MSS at $26.50.

--10-Minute: OTE ($26.69-$26.80, $26.73) for buys, NY AM (8:30-11:00 AM).

Trade Idea:

---Bullish: 60%. ICT/SMT buys $26-$26.50 to $27.50-$28 (OTE $26.73). Options favor $27-$28

calls. Earnings, M&A, Fed cuts support.

---Neutral: 30%. RSI (~45), SMAs (bearish), $25-$29 range, balanced options (put-call ~0.9).

---Bearish: 10%. Below $25 needs earnings miss. Low $25 put volume.

15 April Nifty50 trading zone #15 April Nifty50 trading zone

#Nifty50 #Toady #TCS #NIFTYBANK #options

99% working trading plan

👉Gap up open 22910 above & 15m hold after positive trade target 23020, 23180

👉Gap up open 22910 below 15 m not break upside after nigetive trade target 22690 ,22492

👉Gap down open 22690 above 15m hold after positive trade target 22910, 23020

👉Gap down open 22690 below 15 m not break upside after nigetive trade target 22492, 22330

💫big gapdown open 22492 above hold 1st positive trade view

💫big Gapup opening 22022 below nigetive trade view

📌 Trade plan for education purpose I'm not responsible your trade

More education following me

Quantum's KWEB Trading Guide 4/13/25Analysis:

Post-Close Options Activity (April 11):

Data: System reports 469.32K contracts traded on April 11, with puts at 10.99% (calls ~89%). High call volume at $31/$32 strikes suggests bullish bets.

Interpretation: Call-heavy flow indicates retail/institutional optimism, likely targeting a sweep above $31.35 (weekly high). Potential for a liquidity sweep trapping longs, aligning with ICT/SMT reversal.

RSI (14) Level and Trend:

Estimate: Daily RSI ~55 (neutral-bullish), based on April 11 close ($30.52, +2.97% from $29.62). Uptrend from April 8 low ($27.95) but below March 17 peak ($38.401) avoids overbought.

Interpretation: RSI supports bullish setups (above 50), with room for upside before resistance (~70). A sweep to $31.50 could push RSI higher, signaling OTE retracement.

Anonymized X Post Insights (April 11–13):

Summary: Posts highlight Chinese tech optimism (e.g., DeepSeek AI, consumer spending), tempered by tariff fears (Trump’s 125% threats). Some speculate on KWEB breaking $31, others note volatility risks.

Interpretation: Mixed sentiment leans bullish, with chatter about AI and stimulus driving buy-side interest. Tariff uncertainty suggests potential sell-side sweeps if news escalates.

Potential Reversals/Catalysts:

Liquidity Sweeps: Call-heavy options and X speculation point to a buy-side sweep above $31.35 (W-High), trapping retail longs before an OTE reversal to $30.00 (HVN).

Institutional Positioning: High call OI suggests dealers hedging bullish bets, but tariff risks could trigger smart money to fade retail.

Catalysts: Retail Sales (April 15) or tariff relief news could spike KWEB, while escalation could drive sell-side volatility.

Why: Sentiment aligns with ICT/SMT, where bullish retail chatter sets up sweeps, and smart money reverses at OTE. Neutral-bullish RSI and call volume support a setup.

Action: Log sentiment as neutral-bullish, expect sweep above $31 or drop to $29 on tariff news. Highlight for video: “KWEB’s call-heavy buzz could trap retail—watch for a smart money reversal.”

Tariff Impact

Assessment: Severe

Exposure:

KWEB’s holdings (e.g., PDD, JD.com, Tencent) rely on China’s internet economy, with significant supply chain and consumer exposure to U.S.-China trade. Tariffs (e.g., 125% proposed) raise costs for e-commerce and tech exports, hurting revenues.

Example: PDD (Temu) faces U.S. import duties, squeezing margins; JD.com’s logistics chain is tariff-sensitive.

Current Policy (April 13):

Context: Trump’s April 10 statement escalates tariffs to 125% on Chinese goods, with no relief confirmed by April 13. Web reports (Reuters, April 4) note market volatility from tariff fears, impacting KWEB’s April 8 low ($27.95).

Impact: Severe, as KWEB’s ETF structure amplifies holdings’ tariff pain (e.g., Alibaba, Tencent ADRs). Sentiment sours on escalation, driving sell-side sweeps.

Tariff Relief Potential:

Scenario: A 90-day pause or negotiation (rumored on X, inconclusive) could lift KWEB +3–5% ($31.50–$32.00), as seen in past relief rallies (e.g., February 2025, +1.6% on pause news).

Fundamentals: Relief boosts consumer spending on KWEB’s holdings, supporting bullish MSS. Without relief, bearish pressure persists.

AMT Tie-In: Tariff news creates imbalances (LVN breaks), with price seeking HVNs (e.g., $30.00) post-volatility.

Why: Severe tariff exposure makes KWEB sensitive to trade news, fueling sweeps (buy-side on relief, sell-side on escalation), per ICT/SMT.

Action: Rate tariff impact severe, monitor April 14 for negotiation updates. Video: “Tariffs could sink KWEB, but relief might spark a sweep to $32—stay sharp.”

News/Catalysts

Current (April 11, 2025)

Closing Price:

System Data: KWEB closed at $30.52 (currentPrice), +2.97% from prevDayClose ($29.62).

Verification: Matches April 11 high ($30.63), low ($29.41), open ($30.12).

Drivers:

Positive: Call-heavy options (89% calls) and AI buzz (DeepSeek, X posts) drove the rally. Web reports note Chinese tech resilience despite tariffs.

Negative: Tariff fears capped gains, with X posts citing Trump’s 125% threat as a drag.

Sector Trends: China ETFs rose (e.g., MCHI +2.1%, April 11), supporting KWEB’s move.

Why: Options flow and AI speculation fueled bullish momentum, but tariffs restrained breakout above $31.

Action: Highlight $30.52 close, +2.97%, driven by calls and AI. Video: “KWEB jumped 3% on AI hype, but tariffs loom large.”

Upcoming (Week of April 14–18)

Events:

April 15, Retail Sales (8:30 AM): Measures U.S. consumer spending, impacting KWEB’s e-commerce holdings (PDD, JD.com).

April 16–18, Tariff Talks: Potential U.S.-China negotiations, per X chatter (inconclusive).

Ongoing, China Stimulus: Rumored fiscal measures could lift Chinese tech, no date confirmed.

Predictions:

Bullish (+3%, ~$31.50): Strong Retail Sales (+0.5% MoM) or stimulus news boosts e-commerce, sweeping buy-side liquidity ($31.35).

Bearish (-3%, ~$29.50): Weak Retail Sales (-0.2% MoM) or tariff escalation triggers sell-side sweep ($29.41).

Neutral (±1%, $30.20–$30.80): Mixed data or no tariff news keeps KWEB near $30.00 (HVN).

Why: Catalysts drive displacement (sweeps to OHLC/LVNs), setting up OTE entries, per AMT/ICT.

Action: Set alerts for Retail Sales (April 15), monitor X for tariff updates. Video: “Retail Sales could push KWEB to $32 or drop it to $29—big week ahead.”

Technical Setup

Multi-Timeframe Analysis (Adjusted to April 11 Close, $30.52)

Weekly Chart

HVN (High Volume Node):

Level: $30.00 (POC, near W-Open $29.59, D-Close $30.52).

Role: Support, price consolidated March 24–April 11 ($29–$31).

Stance: Bullish (price above HVN, defending $30.00).

LVN (Low Volume Node):

Level: $31.50 (near W-High $31.35, April 4).

Role: Fast-move zone, price dropped post-$31.35 (April 4–8).

Stance: Neutral (price below LVN, potential sweep target).

EMA Trend:

Status: 8-week ($31.50) < 13-week ($32.00) < 48-week ($33.50), downtrend but flattening.

Stance: Neutral (price below EMAs, but $30.52 tests 8-week).

RSI (14):

Level: ~55 (neutral-bullish, up from 45 at $27.95, April 8).

Stance: Bullish (>50, room to 70).

MACD:

Status: Above signal, nearing zero (bullish crossover April 10).

Stance: Bullish (gaining momentum).

Bollinger Bands:

Status: Price at midline ($30.50), bands narrowing.

Stance: Neutral (breakout pending).

Donchian Channels:

Status: Above midline ($29.65, W-Low to W-High).

Stance: Bullish (breakout potential).

Williams %R:

Level: ~-40 (neutral, not overbought).

Stance: Bullish (>-50, rising).

ADR (Average Daily Range):

Status: Expanding (~3%, $0.90/day).

Stance: Bullish (volatility supports moves).

VWAP:

Status: Above VWAP (~$30.20, April 11).

Stance: Bullish (buyers control).

ICT/SMC:

MSS: Bearish (lower highs from $38.401, March 17, but higher low $27.95, April 8, signals potential shift).

Trend: Neutral (consolidation $29–$31, testing W-High $31.35).

Summary: Neutral-bullish, price at HVN ($30.00) with LVN ($31.50) as sweep target. Indicators favor upside, but MSS needs confirmation.

1-Hour Chart

Support/Resistance:

Support: $29.41 (D-Low, April 11), aligns with W-Open ($29.59), HVN ($30.00).

Resistance: $30.63 (D-High, April 11), near LVN ($31.50), W-High ($31.35).

Stance: Bullish (price above support, testing resistance).

RSI (14):

Level: ~60 (bullish, rising from 50 at $29.41).

Stance: Bullish (>50, not overbought).

MACD:

Status: Above signal, positive histogram.

Stance: Bullish (momentum building).

Bollinger Bands:

Status: Price near upper band ($30.60).

Stance: Bullish (breakout potential).

Donchian Channels:

Status: Above midline ($30.02).

Stance: Bullish (trend strength).

Williams %R:

Level: ~-30 (bullish, not overbought).

Stance: Bullish (>-50).

VWAP:

Status: Above VWAP (~$30.30, intraday April 11).

Stance: Bullish (buyers dominate).

ICT/SMC:

Buy-Side Liquidity: Above $30.63 (D-High), $31.35 (W-High), LVN ($31.50). Retail stops cluster here.

Sell-Side Liquidity: Below $29.41 (D-Low), $27.95 (W-Low/M-Low).

OB: Bullish OB at $29.80–$30.00 (April 10 consolidation, demand zone, near HVN $30.00).

FVG: Bullish FVG at $30.00–$30.20 (April 11 gap, unfilled, aligns with D-Open $30.12).

OTE: Fib 61.8%–78.6% from $29.41 (low) to $30.63 (high) = $30.05–$30.15 (overlaps OB/FVG/HVN).

Displacement: Potential impulsive move to $31.50 (LVN) or $29.00 (below D-Low) on Retail Sales or tariff news.

Summary: Bullish bias, with OTE ($30.05–$30.15) as entry zone post-sweep, supported by OB/FVG/HVN.

10-Minute Chart

Closing Move (April 11):

Status: Rallied to $30.52, closed near high ($30.63), strong volume.

Stance: Bullish (buyers pushed close).

EMA Direction:

Status: 8-EMA ($30.45) > 13-EMA ($30.40) > 48-EMA ($30.30), uptrend.

Stance: Bullish (EMAs rising).

RSI (14):

Level: ~65 (bullish, cooling from 70).

Stance: Bullish (>50, not overbought).

MACD:

Status: Above zero, bullish crossover.

Stance: Bullish (momentum intact).

VWAP:

Status: Above VWAP (~$30.40, late April 11).

Stance: Bullish (buyers control).

ICT/SMC:

Liquidity Sweep: Wick to $30.63 (8:50 AM, April 11) tested buy-side, no clear rejection yet.

Retracement: Potential retrace to $30.05–$30.15 (OTE) if sweep completes (e.g., April 14, 8:00 AM).

Entry Signal: Pin bar or engulfing at OTE (e.g., $30.10, 10-minute candle).

Summary: Bullish, awaiting sweep above $30.63 or $31.35, retrace to OTE for entry.

Options Data

Analysis:

GEX (Gamma Exposure):

Status: Positive GEX at $31 strike (high call OI), neutral at $30.

Impact: Dealers buy stock to hedge calls, supporting $31 pin or slight lift to $31.50.

Explanation: Positive GEX stabilizes price near high OI strikes, aligning with LVN ($31.50) sweep.

Stance: Neutral-bullish (pinning likely, breakout possible).

DEX (Delta Exposure):

Status: High call delta (+0.3, 89% call volume).

Impact: Bullish pressure, as dealers hedge calls by buying KWEB.

Explanation: Call-heavy delta fuels upside momentum, supporting buy-side sweep.

Stance: Bullish.

IV (Implied Volatility):

Status: Moderate (~25%, vs. 20–35% norm for KWEB).

Impact: Steady swings ($0.50–$1.00/day), good for ATM/OTM calls.

Explanation: Moderate IV balances premium cost and volatility, ideal for OTE entries.

Stance: Bullish (volatility supports options).

OI (Open Interest):

Status: Call-heavy (65% calls at $31, 20% at $32, 15% puts at $30).

Impact: Momentum toward $31–$32, potential pin at $31 (high OI).

Explanation: High call OI marks targets (W-High $31.35, LVN $31.50), puts at $30 guard HVN.

Stance: Bullish (calls drive upside).

Cem Karsan’s Application and Weekly Trading Breakdown:

Gamma: High at $31 (pinning risk), low at $32 (breakout potential).

Vanna: Rising IV (25% to 30% on Retail Sales) lifts calls, dealers buy KWEB, pushing to $31.50.

Charm: Near OPEX (April 18), $31 calls hold delta if ITM, spiking volatility April 17–18.

Volatility Skew: Call skew (higher IV for $32 vs. $30) favors upside breakouts.

Weekly OI (Exp. April 18): 65% calls at $31, 20% at $32. Pinning likely at $31 unless Retail Sales sparks breakout to $32.

Options Strategy:

Trade: Buy $31 calls at OTE ($30.10, April 14, 8:50 AM), premium ~$0.50.

Exit: $31.50 (W-High/LVN, premium ~$0.90), profit $0.40.

Stop: Below OB ($29.80, premium ~$0.20), risk $0.30.

R:R: 1.33:1 (adjust to 2:1 with partial exit).

ICT/SMC Tie-In: Enter post-sweep ($31.35), retrace to OTE ($30.10), target $31.50.

Vanna:

Status: IV rise (25% to 30%) amplifies calls, dealers buy KWEB.

Impact: Bullish lift to $31–$31.50, aligns with LVN sweep.

Explanation: Vanna boosts delta near high OI, supporting OTE reversal.

Charm:

Status: OPEX (April 18) nears, $31 calls gain delta if KWEB hits $31.

Impact: Volatility spikes April 17–18, favors quick OTE trades.

Explanation: Charm accelerates delta, amplifying sweep-to-OTE moves.

Timeframe Analysis:

Weekly (Exp. April 18):

OI: 65% calls ($31), 20% ($32), 15% puts ($30).

IV: Moderate (25%), rising on catalysts.

Stance: Bullish (calls dominate, breakout risk).

Monthly (Exp. May 2):

OI: Balanced (50% calls $32, 50% puts $29).

IV: Stable (~24%).

Stance: Neutral (consolidation likely).

3-Month (Exp. July 7):

OI: Call skew ($33–$35, 60% calls).

IV: Low (~22%).

Stance: Bullish (long-term upside).

Directional Bias:

Synthesis: Positive GEX ($31 pin), high call DEX (+0.3), moderate IV (25%), call-heavy OI (65% at $31), vanna (IV lift), charm (OPEX volatility), and ICT/SMC (buy-side sweep to $31.35, OTE at $30.10) suggest a bullish trend for April 14, with potential retracement post-sweep.

Why: Options data aligns with ICT/SMT (call OI = buy-side liquidity, OTE = dealer hedging zone), per AMT (LVN sweep, HVN reversal).

Action: Focus on $31 calls, highlight pinning vs. breakout. Video: “KWEB’s $31 call wall could pin or pop—perfect for an OTE play.”

Sympathy Plays

Correlated Assets:

MCHI (iShares MSCI China ETF): Tracks broader Chinese equities, rises ~2–3% if KWEB rallies (e.g., $31.50), due to shared holdings (Alibaba, Tencent).

BABA (Alibaba ADR): KWEB’s top holding, moves +3–4% on KWEB’s sweep to $31.35, driven by e-commerce/AI overlap.

Opposite Mover:

GLD (SPDR Gold ETF): Risk-off asset, fades ~1–2% if KWEB rallies (risk-on), as investors shift from safe havens to tech.

Why: Sympathy plays confirm sector momentum (Chinese tech), while GLD hedges tariff fears, per ICT/SMT sentiment.

Action: Monitor MCHI/BABA for confirmation, GLD for divergence. Video: “If KWEB pops, MCHI and BABA follow—watch gold for the flip side.”

Sector Positioning with RRG

Sector: Technology – Emerging Markets (China Internet).

RRG Position: Improving (vs. MCHI ETF).

Rationale: KWEB’s April 11 rally (+2.97%) outpaces MCHI (+2.1%), with RSI (~55) and call OI signaling strength. Tariff fears weaken absolute gains, but relative momentum grows.

Tie-In: Improving quadrant supports bullish MSS, OTE entries at HVN ($30.00).

Why: RRG aligns with sentiment (call-heavy) and technicals (above HVN), per AMT value area.

Action: Highlight Improving RRG for video: “KWEB’s gaining steam in China tech—prime for a sweep setup.”

Targets

Bullish:

Target: +3.5% to $31.60.

Levels: W-High ($31.35), LVN ($31.50), next resistance ($32.00).

Rationale: Buy-side sweep to $31.35 (W-High), breakout to LVN on Retail Sales or tariff relief, per ICT/SMC.

Bearish:

Target: -3.2% to $29.55.

Levels: D-Low ($29.41), below W-Open ($29.59), HVN ($29.50).

Rationale: Sell-side sweep below $29.41 on weak Retail Sales or tariff escalation, retracing to HVN, per AMT.

Why: Targets tie to OHLC (W-High, D-Low), HVNs/LVNs, and catalysts, ensuring ICT/SMC alignment (liquidity to OTE).

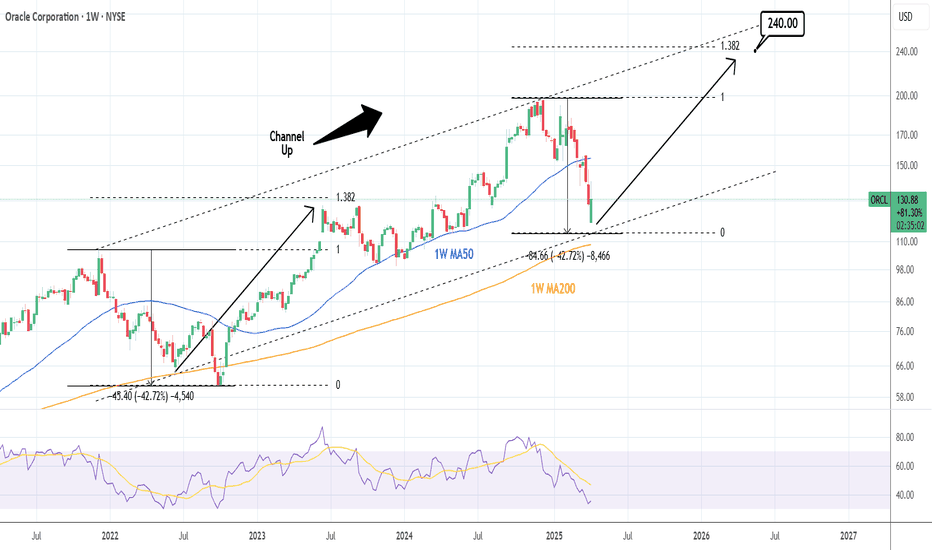

ORACLE: On a 3 year bottom. Buy opportunity for 240 long termOracle is bearish on its 1W technical outlook (RSI = 35.862, MACD = -4.360, ADX = 42.565) as this week it reached almost the same levels of correction as the 2022 Bear Market (-42.72%). This is also nearly a HL bottom for the 3 year Channel Up and as the 1W MA200 is right below, a great long term buy opportunity. The bullish wave after the 2022 bottom almost reached the 1.382 Fibonacci, so we have a technical level to target this time also (TP = 240).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

XPeng Inc. (XPEV) – Driving the Smart EV Revolution Company Snapshot:

XPeng NYSE:XPEV is solidifying its status as a smart electric vehicle pioneer, blending cutting-edge AI, proprietary battery tech, and global expansion to challenge the status quo in EV innovation.

Key Catalysts:

Product Innovation 🚀

New 2025 G6 & G9 feature 5C fast-charging AI batteries

Turing-powered autonomous driving is among the most advanced in China

XNGP smart driving system reaches 86% active user penetration across cities

AI-Defined Vehicles 🤖

Launch of XPENG P7+, an AI-enhanced EV with futuristic user interfaces

Showcases XPeng’s edge in machine learning + mobility

Global Expansion 🌍

Entering UK, Indonesia, and Switzerland, boosting brand recognition & revenue diversification

Creates strategic foothold in key international EV markets

First-Mover Advantage 🔧

One of the few companies to integrate full-stack smart driving + proprietary battery tech

Strong R&D focus (40% of workforce) keeps XPeng at the forefront of next-gen mobility

Investment Outlook:

✅ Bullish Above: $17.50–$18.00

🚀 Upside Target: $25.00–$26.00

📈 Growth Drivers: Global footprint, AI-defined mobility, and rising EV adoption

⚡ XPeng – The AI brain behind tomorrow’s drive. #XPEV #EVInnovation #AIOnWheels

Quantum's T (AT&T) Trading Guide 4/11/25T (AT&T Inc.)

Sentiment

• Sentiment is neutral with a bearish tilt. April 10 options activity shows put-heavy volume at $26 strikes, reflecting caution. RSI (14) at ~50 (estimated, flat trend at $26.40 close) suggests indecision. X posts highlight concerns over telecom debt loads and tariff risks on equipment imports, but some speculate on institutional accumulation below $26.50. A liquidity sweep below $26.33 could trigger a bullish reversal if buy-side liquidity is tapped.

Catalyst: Potential sweep below $26.33 may spark short covering.

Tariff Impact - Rating: Moderate.

• Explanation: T relies on imported telecom equipment, facing cost pressures from tariffs on China (active as of April 11). No relief announced, so margins could tighten, capping upside. X posts suggest tariff fears weigh on sentiment, but domestic revenue focus limits fundamental damage.

News/Catalysts

• Driver: Flat telecom sector performance on April 10, with T holding steady amid mixed market signals. X posts cited stability but no clear catalyst.

• Upcoming: CPI (April 11): High CPI could hurt T (-1.5%) due to rate hike fears; low CPI may lift it (+1%) as a yield play.

• Retail Sales (April 15): Strong data supports T (+1%); weak data pressures (-1%) due to consumer spending risks.

Technical Setup

Weekly Chart:

• HVN: $26.00 support (bullish).

• LVN: $27.00 resistance (neutral).

• EMA Trend: 8-week ≈ 13-week > 48-week (neutral).

• RSI (14): ~50 (neutral).

• MACD: Near signal line (neutral).

• Bollinger Bands: At midline (neutral).

• Donchian Channels: At midline (neutral).

• Williams %R: ~-50 (neutral).

• ADR: Stable (neutral).

• VWAP: At VWAP $26.40 (neutral).

• ICT/SMC: No clear MSS; consolidation phase.

One-Hour Chart:

• Support/Resistance: Support at $26.33; resistance at $26.56. Stance: neutral.

• RSI (14): ~50 (neutral).

• MACD: Near zero (neutral).

• Bollinger Bands: At midline (neutral).

• Donchian Channels: At midline (neutral).

• Williams %R: ~-50 (neutral).

• VWAP: At VWAP $26.50 (neutral).

• ICT/SMC: Sell-side liquidity below $26.33; OB at $26.40; FVG at $26.35–$26.45; OTE at $26.45; no displacement.

10-Minute Chart:

• Closing Move: Flat into close.

• EMA Direction: 8/13/48 EMAs flat (neutral).

• RSI (14): ~50 (neutral).

• MACD: Near zero (neutral).

• VWAP: At VWAP $26.50 (neutral).

• ICT/SMC: Potential sweep below $26.33; OTE at $26.45; no clear entry signal yet.

Options Data

• GEX: Neutral, pinning at $26.50. Dealers hedge minimally.

• DEX: Put delta bias (-0.15), bearish pressure.

• IV: Low (~18%), limited swings.

• OI: Put-heavy (55% puts at $26), capping upside.

Cem Karsan’s Application:

• Weekly Trading Breakdown: OI at $26 suggests pinning. Low gamma limits volatility; vanna neutral; charm favors puts near OPEX.

• Strategy: Buy $26.50 calls at $26.45 (OTE), exit at $27, profit $0.30, risk $0.40. Ties to sweep below $26.33.

• Vanna: Stable IV, no dealer-driven lift.

• Charm: Puts gain delta near OPEX, pressuring $26.

Timeframe Analysis:

• Weekly (exp. April 18): Put OI at $26, low IV, bearish stance.

• Monthly (exp. May 16): Balanced OI, neutral stance.

• 3-Month (exp. July 18): Neutral outlook.

• Directional Bias: Neutral, leaning bearish unless sweep triggers reversal.

Sympathy Plays

• Correlated Assets: VZ (+1%), CCI (+0.5%).

• Opposite Mover: If T fades, risk-on SPOT rises (+1%).

Sector Positioning with RRG - Sector: Communication Services – Telecom.

• RRG Position: Lagging vs. XLC, reflecting weak momentum.

Targets

• Bullish: +2% to $27.00 (OB).

• Bearish: -2% to $25.87 (FVG).

AMD: Best level to buy since Oct 2022.Advanced Micro Devices are virtually oversold on the 1W technical outlook (RSI = 30.639, MACD = -13.430, ADX = 36.312) having hit the bottom (HL) of the 3 year Channel Up. The 1W RSI is slightly even lower it was on the previous bottom of October 10th 2022. This should be the start of the new long term bullish wave, which based on the previous one should make a HH on the 1.236 Fibonacci extension, approximately a +300% rally (TP = 280.00).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Trump Delays Tariffs for 90 Days. The S&P 500 Rebounds SharplyTrump Delays Tariffs for 90 Days. The S&P 500 Rebounds Sharply

As shown in the chart of the S&P 500 (US SPX 500 mini on FXOpen), the index is currently trading near the 5,500 level.

This result is highly encouraging, considering that as recently as yesterday morning, the index was hovering around 4,900.

Why Have Stocks Risen?

The strong rebound seen yesterday evening was triggered by a statement from the US President — he announced a 90-day delay in the implementation of wide-ranging global trade tariffs, which had originally been unveiled on 2 April and led to a sharp drop in the index (as indicated by the arrow).

However, this does not apply to China, for which tariffs were not delayed but increased. "Due to the lack of respect China has shown towards global markets, I am raising the tariff imposed on China by the United States of America to 125%, effective immediately," said Donald Trump, according to media reports.

Overall, US stock markets responded positively to the news, and Goldman Sachs economists have withdrawn their US recession forecasts.

Technical Analysis of the S&P 500 Chart (US SPX 500 mini on FXOpen)

Despite yesterday’s sharp rebound, the stock market remains in a downtrend (as indicated by the red channel).

From a bullish perspective:

→ A Double Bottom pattern (A–B) has formed around the 4,900 level;

→ Price has moved into the upper half of the channel.

From a bearish perspective:

→ Bulls must overcome key resistance near the psychological 5,000 level;

→ While tariffs have been delayed, they have not been cancelled. As such, the risk of an escalating trade war is likely to continue putting pressure on the S&P 500 index (US SPX 500 mini on FXOpen) in the coming months.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NVIDIA: Still has a long way to go.NVIDIA turned from oversold to neutral on its 1D technical outlook (RSI = 48.969, MACD = 44.021, ADX = 44.021) and is about to do the same on 1W too, as today's 90-day tariff pause announcement is giving the market an aggressive comeback. Technically though that doesn't seem enough to restore the tremendous bullish sentiment of 2023 and 1st half of 2024 as the trend is currently restricted by not only the 1D MA50 and MA200 but a LH trendline also coming straight from the ATH.

The same kind of LH kept NVDA at bay on its last main correction to the August 5th 2024 bottom. This started a +44.46% rally that got rejected on the LH trendline. If we apply that today we get a projected 1D MA200 test just under the LH trendline. A TP = 125.00 fits perfectly on the short term, but long term we still have a long way to go.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

S&P 500 Index Under Pressure – Another -10% Drop Incoming?Today, I want to analyze the S&P 500 Index ( FOREXCOM:SPX500 ) for you. This index is one of the most important indices in the US stock market , which has been determining the direction of parallel financial markets such as crypto and especially Bitcoin ( BINANCE:BTCUSDT ) for the past few days, so an analysis of this index can be important for us.

The S&P 500 Index started to fall after Donald Trump imposed new tariffs on countries around the world, which was like a coronavirus .

The question is whether this fall is temporary or will continue . To answer this question, we need to consider many parameters, but if we look at the sds chart from a technical analysis chart , we can expect a further decline .

The S&P 500 Index is moving near the Resistance zone($5,284-$5,095) and is completing a pullback . It also lost its important Uptrend lines last week, which is not good news for the S&P 500 Index and US stocks .

From an Elliott wave theory , the S&P 500 IndexS&P looks like it has completed the main wave 4 , and we should expect the next decline(-10%) .

I expect the S&P 500 Index to attack the Heavy Support zone($4,820-$4,530) at least once more. The area where we can expect the S&P 500 Index to pull back is the Potential Reversal Zone(PRZ) .

What do you think? Will the S&P 500 Index continue its downward trend, or was this decline temporary?

Note: If the S&P 500 Index touches $5,408, we can expect further Pumps.

Note: There is a possibility of a Bear Trap near the Heavy Support zone($4,820-$4,530) and PRZ.

Please respect each other's ideas and express them politely if you agree or disagree.

S&P 500 Index Analyze (SPX500USD),4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

AAPLAAPL price is in the correction period. If the price cannot break through the 258.56 level, it is expected that the price will drop. Consider selling the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

Quantum's BAC Trading Guide 4/8/25BAC (Bank of America Corporation) - Sector: Financials (Banking)

Sentiment:

--Neutral (slight bullish tilt). Pre-market options lean call-heavy, RSI likely ~48 (up from ~45 with +1.8% from $35.58 to $36.23), X posts overnight mixed—rate fears vs. recovery hopes—suggesting a bounce from $34.19 (April 4).

Tariff Impact:

--Moderate. 10% tariffs could hit loan demand (trade-sensitive clients), but BAC’s diversified revenue softens impact. Sentiment drives here.

News/Catalysts:

--Consumer Credit (April 8) key—strong data could lift BAC; X posts on banking resilience or tariff delays might boost today.

Technical Setup:

-Weekly Chart:

---HVN near $37 as resistance, weekly low ~$34 as support (April 4: $34.19).

---Sideways (8-week EMA ≈ 13-week ≈ 48-week, reflecting $35–$40 range).

---RSI ~48 (neutral),

---MACD near signal (histogram flat),

---Bollinger Bands near midline,

---Donchian Channels at midline,

---Williams %R -50 (neutral).

-One-Hour Chart:

---Support at $35.58 (prev. close), resistance at $36.68 (day high), weekly alignment.

---RSI ~50, MACD near signal (histogram flat),

---Bollinger Bands near midline,

---Donchian Channels at midline,

---Williams %R -48 (neutral).

-10-Minute Chart:

---Pre-market uptick to $36.23, 8/13/48 EMAs flat-to-up, RSI ~52,

---MACD flat near zero.

Options Data:

--GEX: Neutral (slight bullish tilt)—pinning shifts mildly upward.

--DEX: Neutral (slight bullish tilt)—call delta edges out puts.

--IV: Low—~20–25% vs. norm 25–30%, steady post-drop.

--OI: Balanced (slight call tilt)—OI leans above $36.

--Directional Bias: Neutral (slight bullish tilt). GEX’s mild upward pinning, DEX’s call delta hint at buying, low IV limits big swings, and slight call-heavy OI nudges up—neutral with a bullish edge.

Sympathy Plays:

--JPM (JPMorgan Chase): Rises if BAC gains, falls if BAC fades.

--WFC (Wells Fargo): Gains with BAC upside, drops if BAC weakens.

--Opposite Mover: BAC rallies → cyclicals like ALK fade; BAC dumps → JPM/WFC soften.

Sector Positioning with RRG: --- Financials (Banking).

--RRG Position: Improving Quadrant. BAC’s bounce from $34.19 lifts it vs. XLF.

Targets: Bullish +2% ($36.95, hourly resistance); Bearish -2% ($35.50, hourly support).

SoFi Technologies (SOFI) – Prepping for Liftoff?Analysis Overview:

The chart suggests that SOFI may be setting up for a major bullish reversal, but confirmation is still needed. Let’s break it down:

Key Bullish Factors:

✅ Optimal Trade Entry (OTE)

Price is currently sitting at an OTE level, a premium zone for long setups often used by smart money. These zones historically mark powerful reversal points.

✅ Monthly Fair Value Gap (FVG) Respected

The stock tapped into a monthly FVG—a high-probability demand zone—suggesting institutional interest. A break and close above this zone would strengthen the bullish case significantly.

✅ 30 Moving Average (MA) as Confirmation

Price is still below the 30MA. A clear break and close above the 30MA would serve as the first strong confirmation that buyers are regaining control.

✅ Massive Upside Potential

If this plays out, the first target is the previous buy-side liquidity at $18.33, and if momentum sustains, we could even see a long-term move toward the all-time high at $28.54—a potential 228% gain from current levels.

What We Want to See Before Full Confidence:

🔹 Price to break and close above the 30MA

🔹 Clear displacement through the Monthly FVG

🔹 Sustained bullish volume stepping in

Conclusion:

SOFI could be gearing up for a powerful upside run, but let the market confirm it. Watch the 30MA and how price behaves around the FVG. If those get respected and price pushes higher—this could be a sleeper play to watch in 2025.

🧠 As always... DYOR (Do Your Own Research)!

SMCI: Enormous buy opportunity for a $70 Target.Super Micro Computer went from oversold to almost neutral on its 1D technical outlook (RSI = 42.789, MACD = -2.030, ADX = 39.343) as it is having an enormour turnaround on the 1W MA200 and the bottom of the Channel Up today. This is so far the biggest 1D green candle since January 19th 2024. The 1D RSI is on the same rebound as the February 3rd bottom was, so at least a +158.65% bullish wave is to be expected. Go long, TP = 70.00.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Bearish Setup on NFLX: Correction Wave (C) UnfoldingTF: 4h

NFLX appears bearish at the moment. The corrective structure on the 4-hour timeframe suggests a potential decline. The current formation indicates that wave B likely completed at 998.61 , and the stock has now begun its descent into wave (C) of the correction.

The correction may extend to the 100% projection of wave A at 788.67 , or potentially deepen to 659.06 , aligning with the 1.618 Fibonacci extension of wave A. After the completion of wave (C), traders can buy for the target up to wave B at 998.61 .

I will continue to update the situation as it evolves.

NVDA’s Final Act: A Breakout Waiting to HappenNVDA appears to be nearing the completion of its corrective phase, setting the stage for a potential move to new highs. The current pattern resembles a falling wedge, indicative of an ending diagonal formation, which often signals a reversal and the start of an upward trend.

The structure of the corrective channel, along with the termination of the diagonal pattern, suggests a high likelihood of a running flat formation. Buyers are likely to intensify demand pressure as the price approaches the lower boundary of the trendline. A trend reversal may occur if there is a decisive breakout above the Wave 4 level of the ending diagonal.

Buying opportunity with minimal stop is possible after the reversal from lower side of the channel. Targets can be 112 - 120 - 132 - 140.

I'll be sharing more details shortly.