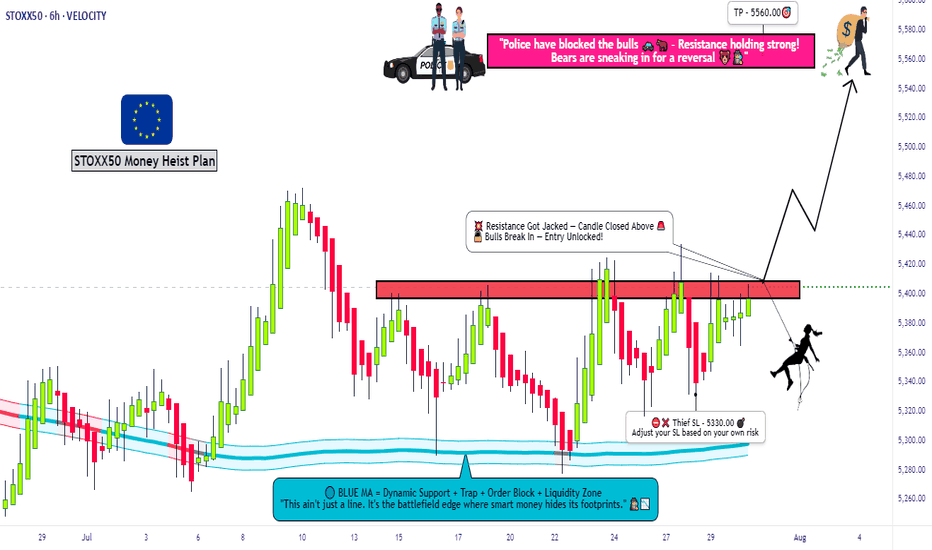

Greed Alert: STOXX 50 Momentum Signals But Caution Needed🚨 STOXX50 RESISTANCE BREAKOUT PLAY! 💥 | THIEF TRADER STYLE 🔓📈

🧠 Thief Trader Master Plan: BULLISH ATTACK

🎯 Entry: Breakout above 5420 (Major RESISTANCE WALL 🧱)

🛑 Stop Loss: 5330 — Strict risk control, no funny business 😤

🚀 Target: 5560 — Smart money aims high 💰

👀 We spotted a strong momentum brewing — bulls are charging to break through the ceiling. Once 5420 cracks, it's game on.

🔥 Watch the levels, respect the trade, and let’s rob the market clean 💼💸

🧠 Market Sentiment Outlook

Retail Traders

🐂 Bullish: 55%

🐻 Bearish: 35%

😐 Neutral: 10%

Institutional Traders

🐂 Bullish: 60%

🐻 Bearish: 30%

😐 Neutral: 10%

😨😍 Fear & Greed Index

Score: 69/100 → Greed 🤠

Insight: Market tilts toward optimism — but tread carefully; overvaluation risks are real.

📈 Fundamental Strength Score

Score: 72/100

Drivers:

💰 Earnings Surge – AB InBev (+8.7%), Munich RE (+4.8%)

📉 Stable Eurozone Data

🚀 Momentum Building – STOXX 50 approaching all-time highs

🌍 Macro Economic Score

Score: 65/100

Factors:

⚖️ Tariff Delays – U.S. tariffs on Canada/Mexico pushed to April 2

📅 Eurozone PMI Preview

🌎 Tensions Rising – U.S.–Iran geopolitical friction

🔎 Key Highlights

🧠 Sentiment Check: Greedy mood – watch for pullbacks

💼 Earnings Season: Q2 winners driving index higher

⚠️ Volatility Triggers: Geopolitics + tariff policy

📉 Opportunity Alert: Fear score <20? Historically undervalued zone

📊 Technical Signal: STOXX 50 >125-day MA = uptrend confirmed

🧭 Always combine real-time data with sound technical and fundamental insights.

📌 Stay informed. Stay sharp. 🚀

💬 Drop your thoughts below.

❤️ SMASH that like button if this helped you.

👥 Support the Thief Trader team — we're in this to help you win.

📡 Stay sharp. Stay ruthless. Stay profitable.

— Thief Trader 🔐📊

Stoxx50_analyse

"STOXX50/EURO50" Trading Plan: Ride the Wave or Get Trapped?🚨 EUROPEAN INDEX HEIST: STOXX50 Breakout Robbery Plan (Long Setup) 🚨

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Attention Market Bandits & Index Robbers! 🏦💶💸

Using 🔥Thief Trading tactics🔥, we're targeting the STOXX50/EURO50 for a clean breakout heist. The plan? Go long and escape before the MA trap snaps shut. Overbought? Yes. Risky? Absolutely. But real thieves profit when weak hands panic. Take your cut and run! 🏆💰

📈 ENTRY: TIME TO STRIKE!

Wait for MA breakout at 5460.00 → Then move fast!

Buy Stop Orders: Place above Moving Average

Buy Limit Orders: Sneak in on 15M/30M pullbacks

Pro Tip: Set a BREAKOUT ALARM - don't miss the action!

🛑 STOP LOSS: DON'T GET CAUGHT!

For Buy Stop Orders: Never set SL pre-breakout - amateurs get burned!

Thief's Safe Zone: Recent swing low (5300.00 on 4H chart)

Rebels: Place SL wherever... but don't cry later! 😈

🏴☠️ TARGET: 5680.00 (OR ESCAPE EARLY!)

Scalpers: Long only! Trail your SL like a pro

Swing Traders: Ride this heist for max gains

💶 MARKET CONTEXT: BULLISH BUT TRAPPY

Fundamentals: Macro data, COT reports, Quant analysis

Market Sentiment: Intermarket flows, positioning

Full Analysis: Check our bio0 linkss 👉🔗 (Don't trade blind!)

⚠️ WARNING: NEWS = VOLATILITY TRAP!

Avoid new trades during high-impact news

Lock profits with trailing stops - greed gets you caught!

💥 SUPPORT THE HEIST!

Smash that Boost Button 💖→ Stronger crew = bigger scores!

Steal profits daily with the Thief Trading Style 🎯🚀

Next heist coming soon... stay sharp! 🤑🐱👤🔥

"STOXX50/EURO50" Index Market Money Heist (Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "STOXX50/EURO50" Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Moving Average Line area. It's a Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (4900) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 5370

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸"STOXX50/EURO50" Index Market Heist Plan (Swing/Day Trade) is currently experiencing a Bullish trend.., driven by several key factors.☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Future trend targets with Overall outlook score... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"STOXX50/EURO50" Index Market Money Heist (Day / Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "STOXX50/EURO50" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (4500) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (4800) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 4200 (or) Escape Before the Target

"STOXX50/EURO50" Index CFD Market Heist Plan (Day / Swing Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EURO50 / STOXX 50 Indices CFD Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🚀

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the EURO50 / STOXX 50 Indices CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (5400) then make your move - Bearish profits await!" however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or Swing high or low level should be in retest.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at (5450) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 5300 (or) Escape Before the Target

Secondary Target - 5130 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Index-Specific Analysis, Sentimental Outlook, Intermarket Analysis, Future Prediction:

EURO50 / STOXX 50 Indices CFD Market is currently experiencing a Neutral trend., driven by several key factors.

🔴Fundamental Analysis

Fundamental factors assess intrinsic drivers:

Economic Growth:

Eurozone GDP at 1.2% (Q4 2024, ECB projection)—modest growth supports equities—mildly bullish.

Corporate Earnings:

STOXX50 firms report 8% year-over-year growth, led by consumer goods and industrials—bullish, though energy lags.

Interest Rates:

ECB at 2.5%, no immediate cuts—real yields (~0.5%) pressure equities—bearish short-term.

Inflation:

HICP at 2.8%—above ECB’s 2% target, aids exporters but squeezes margins—mixed.

Trade Environment:

U.S. tariffs (10% on China) shift trade to Europe—bullish long-term for exporters.

Explanation: Fundamentals lean bullish with earnings and trade gains, but ECB rates and inflation temper short-term upside.

⚪Macroeconomic Factors

Macroeconomic influences on the STOXX50:

Eurozone:

PMI 46.2 (Eurostat)—stagnation persists—bearish.

ECB’s 2.5% rate and stimulus talks—bullish offset.

U.S.:

Fed at 3-3.5%, PCE 2.6%—USD softening (DXY ~105) boosts exports—bullish.

Tariffs disrupt trade—mixed, Eurozone benefits relatively.

Global:

China 4.5%, Japan 1%—slow growth curbs demand—bearish.

Oil $70.44—stable, neutral.

Geopolitical Risk:

Russia-Ukraine tensions—bearish sentiment, bullish for defense stocks.

Explanation: Macro factors are mixed—USD weakness and tariffs favor Europe, but global slowdown and stagnation limit gains.

🟠Commitments of Traders (COT) Data

COT data reflects futures positioning:

Speculators:

Net long ~35,000 contracts (down from 45,000)—cautious bullishness—bullish.

Hedgers:

Net short ~40,000 contracts—stable, profit-taking—neutral.

Open Interest:

~85,000 contracts—steady interest—neutral to bullish.

Explanation: COT shows a market with room for upside, not overbought, supporting a cautiously bullish stance.

🟡Index-Specific Analysis

Factors unique to the STOXX50:

Technical Levels:

50-day SMA ~5,500, 200-day SMA ~5,300—price below 50-day, above 200-day—neutral consolidation.

Support at 5,450, resistance at 5,600—price near support.

Sector Composition:

Financials (20%), industrials (18%), consumer goods (15%)—trade shifts boost financials/industrials—bullish tilt.

Volatility Index (VSTOXX):

18%—±65-point daily swings—neutral risk perception.

Market Breadth:

65% of stocks above 200-day MA—broad participation—mildly bullish.

Explanation: Technicals suggest consolidation, with sectoral strength offering resilience.

🟢Market Sentiment Analysis

Investor and trader mood:

Retail Sentiment:

60% short at 5,480 (social media)—contrarian upside—bullish signal.

Institutional:

J.P. Morgan targets 5,700 by Q4 2025, Citi flags volatility—neutral to bullish.

Corporate:

Hedging at 5,500-5,600—neutral, awaiting clarity.

Social Media:

Bearish short-term (tariff fears), bullish long-term (recovery)—mixed.

Explanation: Sentiment is cautious—retail shorts suggest a potential squeeze, institutional views support longer-term gains.

🔵Geopolitical and News Analysis

Geopolitical events and news:

U.S.-China Trade Tensions:

Trump’s 10% tariff on China (Mar 6)—shifts trade to Europe—bullish for exporters, bearish short-term volatility (Reuters).

Russia-Ukraine Conflict:

Escalation risks (e.g., energy disruptions)—bearish sentiment, bullish for defense (e.g., Airbus)—mixed (Bloomberg, Mar 7).

EU Policy:

ECB projections (Mar 6) cite geopolitical drag—bearish. Defense spending talks—bullish for industrials (ECB.europa.eu).

France-Germany:

Stable coalition aids EU integration—mildly bullish.

Explanation: Geopolitics add volatility—tariffs and conflicts weigh short-term, trade benefits and defense spending lift long-term prospects.

🟣Intermarket Analysis

Relationships with other markets:

EUR/USD:

Below 1.0500—weaker euro aids exports—bullish.

DAX:

~19,500—strong correlation, similar dynamics—bullish alignment.

S&P 500:

~5,990—stable, neutral; U.S. risk-off lifts STOXX50—mildly bullish.

Commodities:

Oil $70.44—neutral; gold $2,930 (risk-off)—bullish for Eurozone as hedge market.

Bond Yields:

Eurozone 2.2% vs. U.S. 3.8%—yield gap attracts capital—bullish.

Explanation: Intermarket signals are bullish—EUR/USD, bonds, and gold favor STOXX50, with equities providing cautious support.

🟤Next Trend Move

Projected price movements:

Short-Term (1-2 Weeks):

Range: 5,450-5,600.

Dip to 5,450 if tariff fears grow; up to 5,600 if ECB signals dovishness or trade data beats.

Medium-Term (1-3 Months):

Range: 5,400-5,700.

Below 5,450 targets 5,400; above 5,600 aims for 5,700, tied to earnings/policy.

Catalysts: ECB statements, PMI (Mar 10), U.S. trade updates.

Explanation: Short-term consolidation is likely, with downside risks from geopolitics and upside from policy support.

⚫Overall Summary Outlook

The STOXX50 at 5,480.00 faces bearish short-term pressures (geopolitical uncertainty, stagnation, tariff fears) offset by bullish drivers (earnings, trade shifts, USD softness). COT and intermarket signals suggest cautious optimism, technicals indicate consolidation, and sentiment balances short-term caution with long-term hope. A short-term dip to 5,450 is probable, with medium-term upside to 5,700 if fundamentals hold.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

STOXX50 "EURO STOCK 50" Indices Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the STOXX50 "EURO STOCK 50" Indices market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade after the breakout of MA level 5000.00

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 30min period, the recent / nearest low or high level.

Goal 🎯: 5130.00 (or) escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️

Considering these factors, the STOXX50 / EURO STOCK 50 index may experience a Bullish trend in the short-term, driven by:

Strong European economic growth, driven by strong consumer spending and investment.

Low interest rates and negative real interest rates, which can increase demand for stocks and reduce demand for bonds.

Potential for a rebound in corporate earnings, driven by strong profit margins and cost-cutting measures.

Bullish Factors:

Strong European economic growth, driven by strong consumer spending and investment.

Low interest rates and negative real interest rates, which can increase demand for stocks and reduce demand for bonds.

Potential for a rebound in corporate earnings, driven by strong profit margins and cost-cutting measures.

Growing investment demand for European stocks, driven by their potential for long-term growth and dividend yields.

Diversification benefits of investing in the European market, which can reduce portfolio risk and increase returns.

Some of the key stocks that make up the STOXX50 / EURO STOCK 50 index include:

SAP SE: A leading software company

Sanofi SA: A leading pharmaceutical company

Total SA: A leading energy company

Bayer AG: A leading pharmaceutical company

Deutsche Telekom AG: A leading telecommunications company

These stocks can have a significant impact on the performance of the STOXX50 / EURO STOCK 50 index, and investors should keep a close eye on their earnings and valuations when making investment decisions.

Market Sentiment:

Bullish sentiment: 70%

Bearish sentiment: 30%

Neutral sentiment: 0%

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

STOXX 50 / EURO 50 Bullish Robbery Plan To Steal MoneyHello My dear,

Robbers / Money Makers & Losers.

This is our master plan to Heist STOXX 50 / EURO 50 Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is Trap / overbought / Consolidation / Trend Reversal at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Note: If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss : Recent Swing Low using 2h timeframe

Warning : Fundamental Analysis comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

STOXX50 ready for its next upside to 5,041Since our last trade analysis, STOXX50 reached our target at 4,370 from the W Formation pattern that broke up and out of.

Today, we have our confirmation of another bullish pattern for upside, the Box Formation.

The price has broken up and above the pattern and we have upward momentum indicators confirming upside to come including:

7>21>200 - Bullish

RSI>50

Target 1 will be to 5,041

ABOUT THE INDEX

STOXX 50:

The STOXX 50 is a stock index that represents 50 of the largest and most liquid stocks across 18 European countries.

It is one of the most widely followed European equity indices.

Blue-chip companies:

The index comprises blue-chip companies from various industries, including banking, technology, healthcare, energy, and consumer goods.

Diverse countries:

The STOXX 50 includes companies from major European economies, such as Germany, France, Switzerland, the Netherlands, Spain, and others.

Historical performance:

The index was launched in February 1998 with a base value of 1,000 points.

STOXX50 Volatility Analysis 21-25 Nov 2022 STOXX50 Volatility Analysis 21-25 Nov 2022

We can see that currently the implied volatility for this week is around 3.08%, raising from 3.07% of last week , according to VDAX data

(DAX Volatility Index which is highly correlated with VOLATILITY INDEX for STOXX)

With this in mind, currently from ATR point of view we are located in the 2th percentile, while according to VDAX, we are on 4th percentile.

Based on this, we can expect that the current weekly candles ( from open to close ) are going to between:

Bullish: 2.8% movement

Bearish: 2.1% movement

At the same time, with this data, we can make a top/bot channel which is going to contain inside the movement of this asset,

meaning that there is a 21.1% that our close of the weekly candle of this asset is going to be either above/below the next channel:

TOP: 4050

BOT: 3800

Taking into consideration the previous weekly high/low, currently for this candle there is :

27% probability we are going to touch previous low of 3850

78% probability we are going to touch previous high of 3950

Lastly, from the technical analysis point of view, currently 80% of the weekly moving averages are in a bullish trend, and

a combination of moving averages and oscillators are in 40% bullish stance

STOXX 50 Monthly Forecast Movements 1-30 November 2022 STOXX 50 Monthly Forecast Movements 1-30 November 2022

We can see that for this month, the implied volatility is around 7.3%, increasing from 7.18% of last month.

This is currently placing us in the 60th percentile according to ATR and 91th according to VDAX.

Based on this percentile calculation, on average the monthly movement for the candle(from open of the candle to the close of the candle) is:

BEARISH Candle : 4.89%

BULLISH Candle : 4.46%

With this in mind we can expect with a close to 12.2% probability that our close of the monthly candle is going to close either above or below the next channel:

BOT: 3368

TOP: 3888

Lastly, based on the calculations that we had for touching the previous candle high and low values, we can estimate that there is a :

75% chance that we are going to touch the previous monthly high of 3630(already happened yesterday)

25% chance that we are going to touch the previous monthly low of 3252

we see 2021-2022 is bull marketsee FDAX1! , 6 month ago dax was in this condition so you will see 4000 then 4100

we strongly recomand dont sell (when price is above daily ema200) only looking for buy in deep and hold it until 4000(new high)

if you have old sell now,close it near 3600 and pick buy and hold near 3 week

instead sell,enjoy bull market,looking only buy,buystop on 15min high