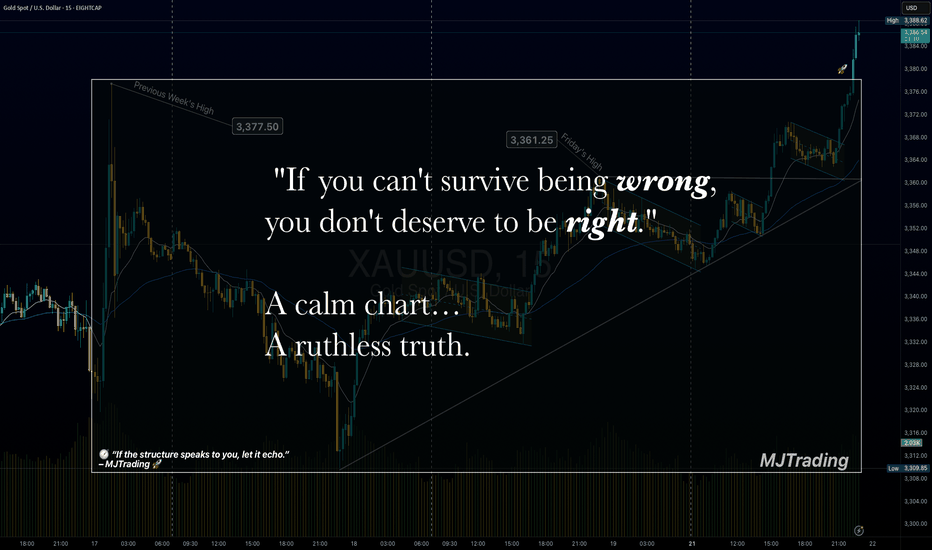

Survive first. Thrive later.🧠 Trading Psychology x Risk Management

"If you can't survive being wrong, you don't deserve to be right."

💬 A calm chart…

A ruthless truth.

Most traders obsess over being right.

But the market only rewards those who manage being wrong.

Risk control isn’t just technical — it’s emotional.

Survive first. Thrive later.

— MJTrading

Psychology Always Matters:

Click on them for notes in the caption...

#MJTrading #ChartDesigner #TradingPsychology #RiskManagement #MindfulTrading #CapitalPreservation #SmartMoney #XAUUSD #ForexDiscipline #15minChart #GoldAnalysis #MentalEdge #Gold

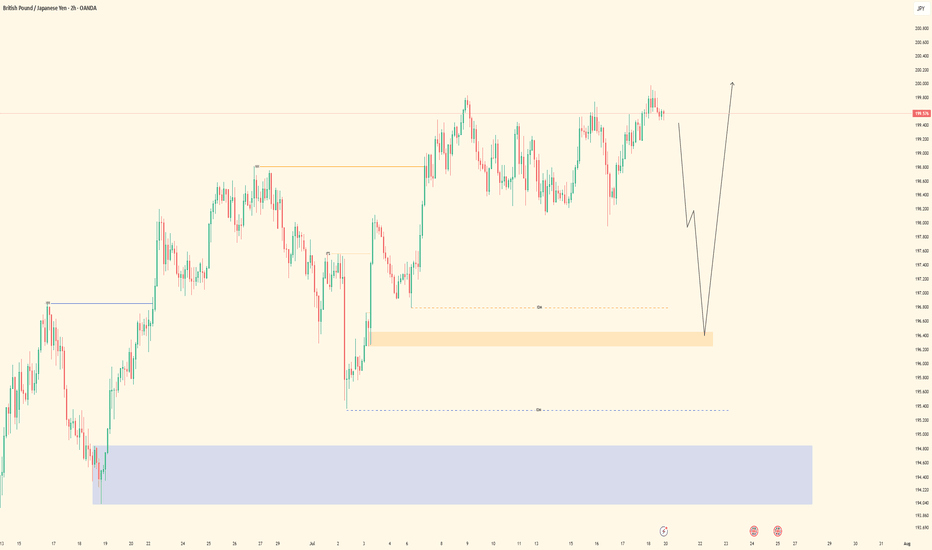

Structure

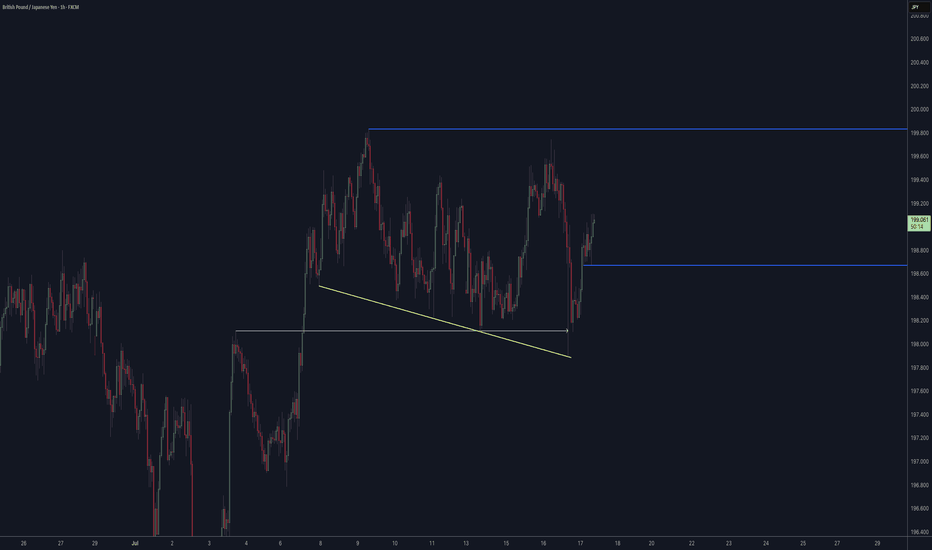

GBPJPY- UPDATED ANALYSIS GBPJPY Bias: Bullish HTF Overview (4H): Price remains in strong bullish structure, with higher highs continuing to break. No signs of deep pullbacks toward major SSLs, confirming strength in the current leg. LTF Confirmation (30M): Clean refined structure now visible. Market gave a textbook pullback into a fresh demand zone (30M OB) after sweeping minor liquidity. No need to expect a deeper move unless invalidated. Entry Zone: Watching for price reaction from the refined 30M OB. If price respects this level, I’ll drop to 5M for LH break → 1M for entry precision. Targets: Eyes on recent high as first TP, followed by extended targets if momentum continues. Mindset Note: Sometimes the best move is simply refining levels and letting the setup come to you. No rush, just alignment.

GBPJPY - Bullish Continuation Setup• Pair: GBPJPY

• Bias: Bullish (Buy)

• HTF Overview (4H):

• Strong bullish momentum with clear breaks to the upside.

• No signs of price reaching deeper 4H SSL — continuation more likely.

• MTF Refinement (30M):

• Watching for price to mitigate lower 30M OB zone.

• Expecting bullish continuation from that area.

• Entry Zone:

• Wait for LTF confirmation inside 30M OB.

• Switch to trader mode after valid CHoCH / intent confirmation.

• Targets:

• Structure highs / clean extension into the next liquidity pool.

• Mindset Note:

• Be patient, trust bullish structure. Let price come to you.

Bless Trading!

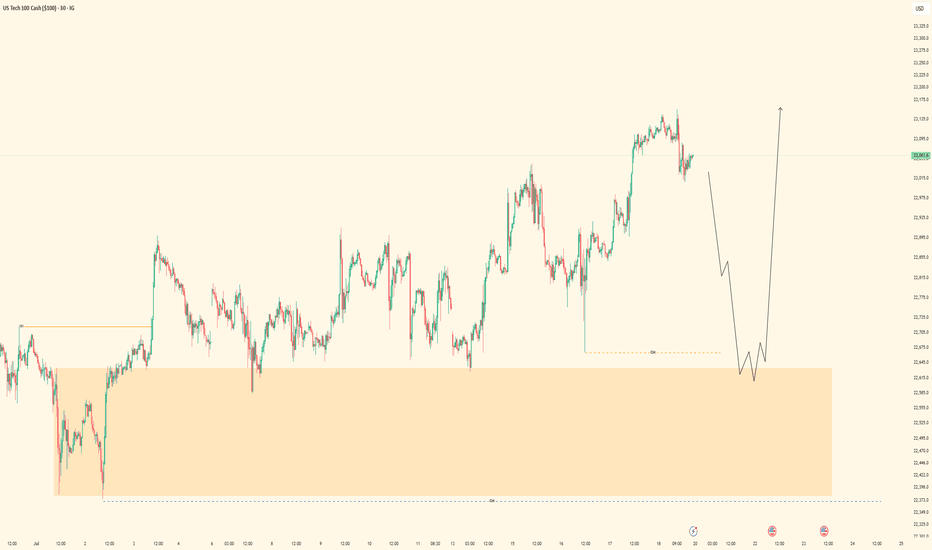

NAS100 - Bullish Trend Continuation Setup• Pair: NAS100 (Nasdaq)

• Bias: Bullish

• HTF Overview (4H):

• Strong bullish structure and momentum from last week.

• Price consistently printing higher highs with no signs of reversal.

• MTF Refinement (30M):

• Waiting for a clean sweep of SSL (sell-side liquidity).

• Looking for price to dip into 30M OB for continuation opportunity.

• Entry Zone:

• Watch 30M OB — once price sweeps liquidity and confirms, execute long.

• Targets:

• Structure highs / previous weekly highs.

• Mindset Note:

• Simple execution plan — ride the trend, trust the structure.

• Wait for confirmation before switching from analyst to trader mode.

Bless Trading!

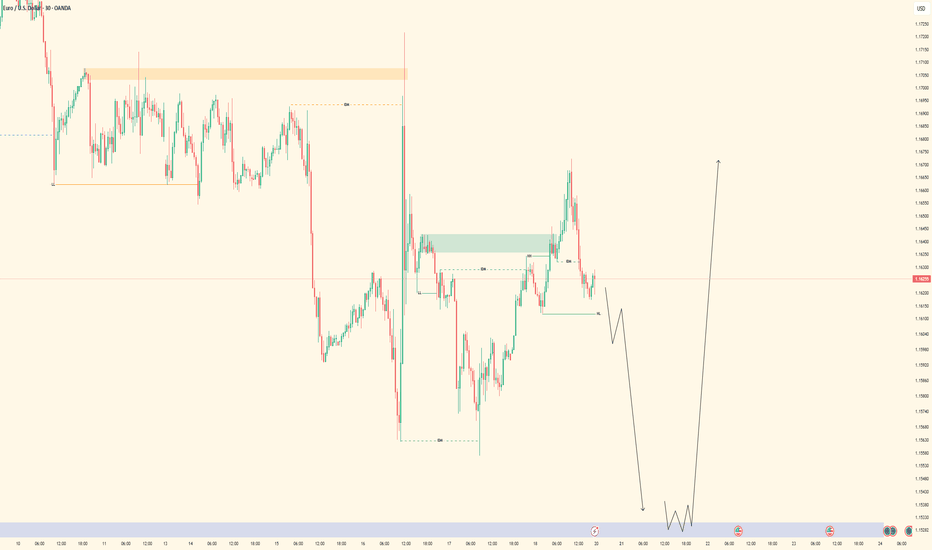

EURUSD - Bullish Bias with Tactical Short Setup• Pair: EURUSD

• Bias: Bullish overall | Tactical short into demand

• HTF Overview (4H):

• Bullish structure confirmed.

• Price took out SSL liquidity — likely draw is internal structure OB below.

• Expecting deeper pullback before continuation.

• MTF Refinement (30M):

• Looking for price to sell off into 4H OB.

• Price already mitigated 30M OB and rejected — watching for follow-through.

• LTF Confirmation (5M):

• Still in analysis mode — waiting on a CHoCH from 5M OB.

• Green lines on chart reflect 5M internal structure.

• Entry Zone:

• Enter short only after 5M shift confirms.

• Ride short into 4H OB demand zone.

• Targets:

• Short-term: 30M lows.

• Major: 4H OB for bullish reaction.

• Mindset Note:

• No rush to enter — analysis leads, execution follows.

• Let price deliver confirmation before switching to trader mode.

Bless Trading!

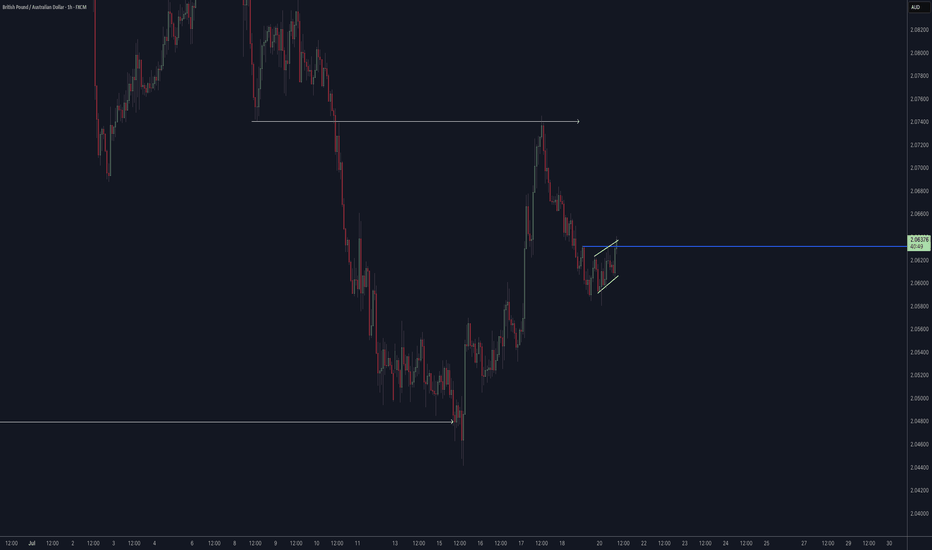

GBPUSD - Bullish Bias with Tactical Short Setup• Pair: GBPUSD (GU)

• Bias: Bullish overall | Tactical short for OB mitigation

• HTF Overview (4H):

• Price broke major highs — clear bullish intent.

• Pullback last week suggests price is targeting 4H SSL for liquidity + OB mitigation before further upside.

• MTF Refinement (30M):

• Price structure currently presents a temporary sell bias.

• BSL has been taken — confirming liquidity sweep.

• Eyeing price to run lower into 4H OB zone.

• LTF Confirmation (5M/1M):

• Waiting on LTF confirmation to ride the move down into the 4H OB.

•Only entering after analysis is complete and CHoCH shows cleanly.

• Entry Zone:

• Tactical short after LTF confirms.

• Final long setup expected from 4H OB after mitigation.

• Targets:

• 30M lows as short-term target.

• 4H OB as the major zone for potential bullish reversal.

• Mindset Note:

• It’s analysis before execution.

• Staying in sync with HTF logic while sniping intraday plays for precision entries.

Bless Trading!

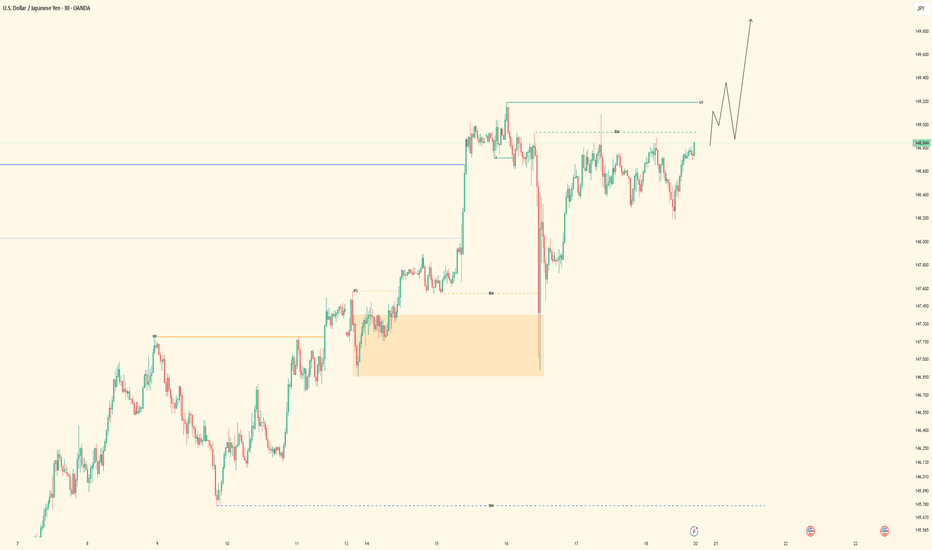

USDJPY - Bullish Structure in Play• Pair: USDJPY (UJ) • Bias: Bullish • HTF Overview (4H): • Clean external break to the upside confirms bull control heading into the new week. • Structure shift is undeniable — market bias is now favoring continued strength.

• MTF Refinement (30M): • Zoomed in to the 30M and identified internal liquidity (SSL) taken out. • Strong mitigation of internal OB followed. • Still in analysis mode — no trades taken yet.

• LTF Confirmation (5M): • Waiting on a refined CHoCH (marked by green lines at highs). • Once that prints and rules align, I’ll shift into trader mode for the execution.

• Entry Zone: • 30M OB mitigation + LTF (5M) CHoCH confirmation.

• Mindset Note: • Patience is the play. No guessing, no hesitation — just clean reads and precision strikes. • Analysis first, execution second. That’s the system.

Bless Trading!

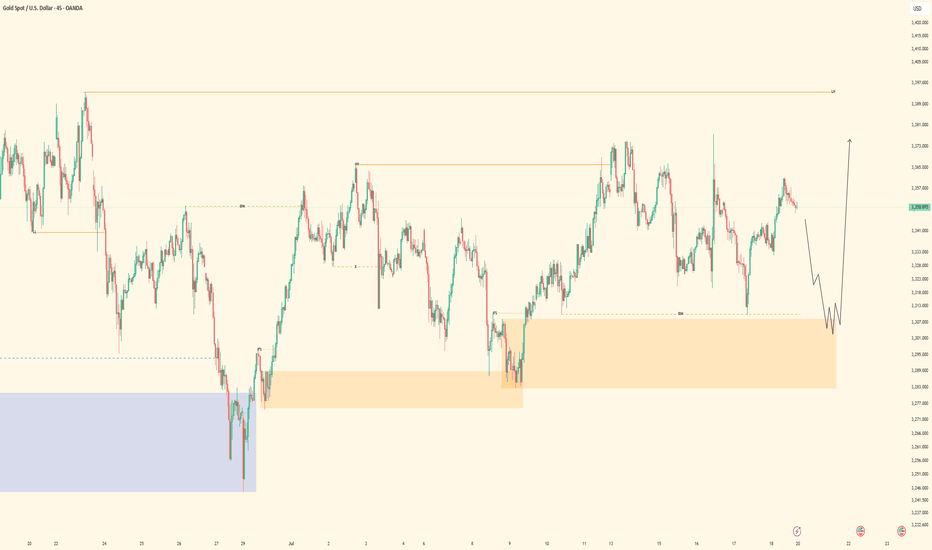

XAUUSD - Bullish OutlookPair: XAUUSD (Gold) Bias: Bullish HTF Overview (4H): Price has taken major liquidity and mitigated a strong order block. We’re now seeing internal breaks of structure forming to the upside, indicating momentum toward the next high around 3440.000.

MTF Refinement (30M – 45M): Refined bullish structure is forming on the 30M chart, with clear signs of continuation. I’m watching for a deeper mitigation into the 30M OB where LTF confirmations (5M and below) will validate entry. The 45M helps provide a broader structure perspective and context.

Entry Zone: Pending — awaiting mitigation into the 30M OB + lower timeframe confirmation (i.e., 5M LH break or refined CHoCH).

Mindset Note: Currently in analyst mode — preparing for execution only after structure respects the top-down narrative. No rushing. Let price come to me.

Bless Trading!

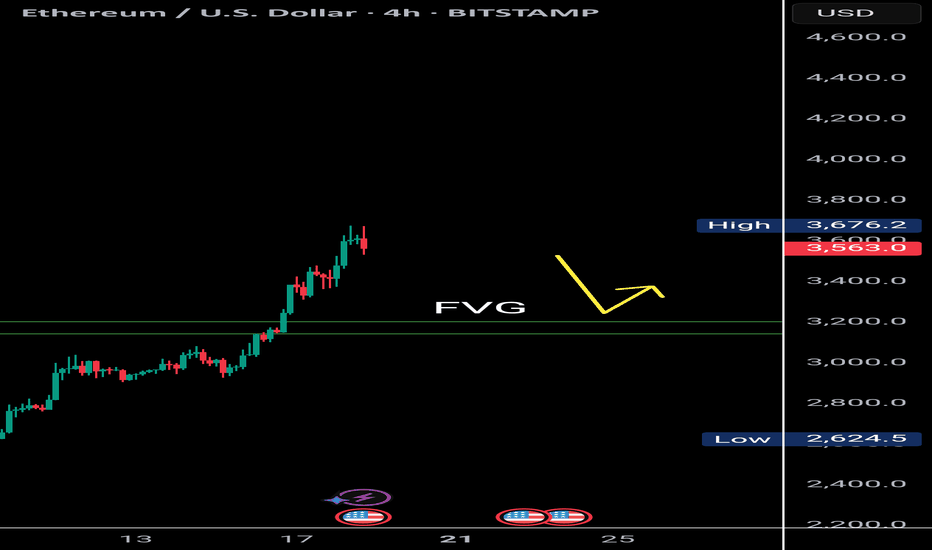

$Eth Faces Double Top Resistance with Bearish RSI DivergenceETH/USDT | 4H Analysis

Ethereum is currently showing signs of weakness on the 4H chart, forming a potential double top pattern around the $3,700-$3,680 range.

Adding to this, the RSI is exhibiting bearish divergence, suggesting that bullish momentum is fading. There's a visible liquidity gap between $3,200–$3,180, which might act as a magnet in the short term. A retest of this zone is likely before ETH attempts to resume its upward move.

Key Observations:

🟠 Double top structure on 4H chart

🔻 Bearish RSI divergence

🕳️ Favorable gap: $3,200 – $3,180

🔁 Watch for price reaction after retest

⚠️ If ETH holds the $3,180 support after filling the gap, a bullish bounce toward higher levels could follow.

📌 This idea is for educational purposes. Trade wisely with proper risk management.

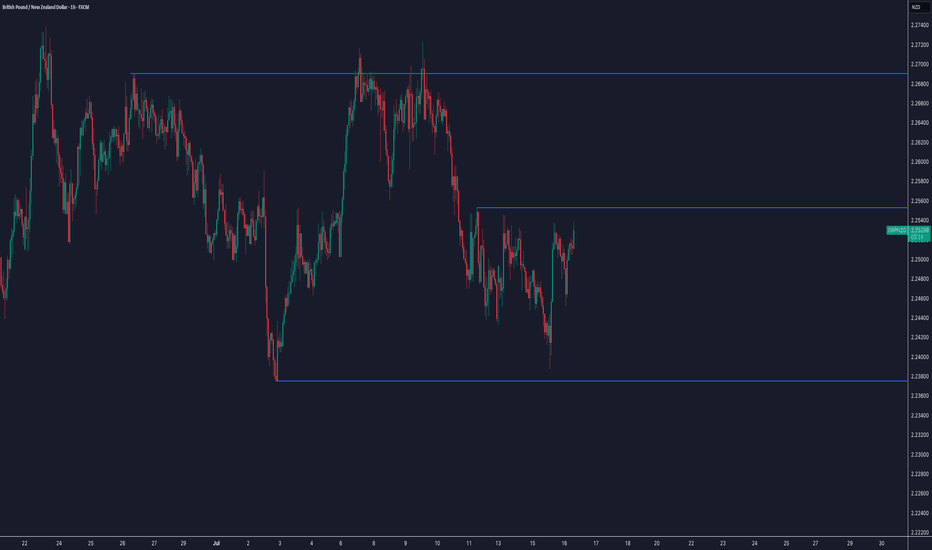

GBPUSD| - Bullish BiasHTF Overview (4H): Strong bullish structure in play, with multiple highs being broken and momentum firmly to the upside. Price is clearly respecting bullish order flow, suggesting continuation.

MTF Refinement (30M): Identified a 30M OB aligned with the trend. Waiting for price to mitigate this zone, as it could serve as the springboard for the next impulsive leg up.

Execution Plan: Once the 30M OB is mitigated, I’ll drop to LTF (1M/5M) to watch for confirmation — CHoCH, BOS, or microstructure shift — before executing longs.

Mindset: Bull momentum is intact — patience and confirmation are key to riding it with precision.

Bless Trading!

USDJPY| - Bullish Play Within Bearish HTF ContextHTF Overview (4H): Structure is still technically bearish, with buy-side liquidity (BSL) untouched and a major 4H supply OB unmitigated above. Expecting price to seek out that zone before any full reversal.

MTF Refinement (30M): Refined structure shows a potential bullish leg forming to push toward the 4H supply. Price is reaching for nearby sell-side liquidity (SSL), acting as inducement.

Execution Plan: Waiting for a clean sweep of SSL. Once that occurs and the 30M OB is mitigated, I’ll drop to LTF (1M/5M) to confirm bullish intent with CHoCH or BOS before executing a long.

Mindset: Playing the internal bullish wave with precision while respecting higher timeframe narrative. Quick to react if the HTF bias reasserts itself.

Bless Trading!

XAUUSD (GOLD) - Bullish BiasHTF Overview (4H): Structure remains bullish after a recent break of highs. Liquidity above was taken, followed by a clean mitigation of a 4H OB — signaling strength and smart money continuation.

MTF Refinement (30M): Aligned with the bullish narrative, 30M shows price is likely reaching for nearby sell-side liquidity before resuming the upward move. Watching for price to sweep that liquidity zone next.

Execution Plan: Once the 30M OB is mitigated, I’ll drop to the 1M/5M for internal structure shifts — CHoCH or BOS — to confirm long entry.

Mindset: Not chasing — letting liquidity play its role and waiting for the OB + confirmation confluence before executing.

Bless Trading!

GBPJPY - Bullish BiasHTF Overview (4H): Price broke bullish structure with clean directional intent. Order flow remains aligned to the upside with no immediate signs of weakness.

MTF Refinement (30M): Zoomed into 30M for deeper structure clarity. Observing price actively reaching for sell-side liquidity (SSL) below a key low — a classic inducement setup forming.

Execution Plan: Waiting for a liquidity sweep below the SSL. Once swept, I’ll monitor the nearby 30M OB for mitigation. LTF confirmations (1M/5M CHoCH or BOS) will be needed before committing to a long entry.

Mindset: Patience over prediction — let liquidity do its job, then ride with smart money.

Bless Trading!

NASDAQ - Bullish BiasHTF Overview: 4H shows strong bullish intent with momentum driving price higher. Clear upside direction supported by sustained breaks in structure.

Liquidity Note: Noticed a key liquidity zone beneath current price (marked in blue). Although deeper mitigation was possible, price remained bullish.

MTF Refinement (30M): Dropped to the 30M for structural clarity and saw an earlier reaction. A bullish OB was formed and respected — now monitoring it for a potential mitigation.

LTF Execution Plan: If the 30M OB is revisited, I’ll be looking to the 1M/5M for confirmation (CHoCH or BOS) before executing long positions.

Mindset: Momentum is with the bulls — just waiting for smart money to confirm their next move.

Bless Trading!

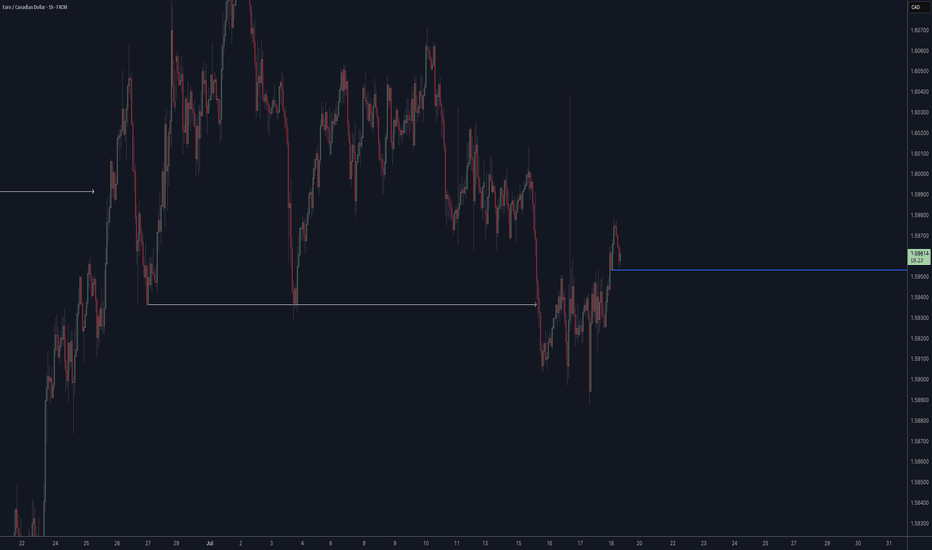

EUR/USD| - Bullish BiasHTF Context: Noted a clear break of structure to the upside, signaling strong bullish intent. Originally expected a deeper liquidity grab, but price shifted before reaching lower zones.

MTF Refinement: Dropped down to the 30M for better alignment — spotted a liquidity sweep confirming smart money interest.

LTF Execution Plan: Now watching for mitigation of the 30M OB. Once tapped, I’ll look for internal structure shift (1M/5M BOS or CHoCH) to confirm continuation.

Mindset: Staying patient — if price wants higher, it should respect this OB and show its hand first.

Bless Trading!

EURGBP - Follow The Bulls!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈EURGBP has been overall bullish trading within the rising channel marked in blue. And it is currently retesting the lower bound of the channel.

Moreover, the orange zone is a strong daily support.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of the lower blue trendline and support.

📚 As per my trading style:

As #EURGBP approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

11.07.25 USDJPY Trade Recap + Re-Entry for +2.5%A long position taken on USDJPY for a breakeven, followed by a premature re-entry that I took a loss on. I also explain the true re-entry I should have taken for a 2.5% win.

Full explanation as to why I executed on these positions and also more details around the third position that I did not take.

Any questions you have just drop them below 👇