Structuretrading

AUDJPY & CADJPY Trade Recaps 08.08.25A long position on AUDJPY taken Monday for a -1%, the trade had great potential but one of those ones that didn't have enough steam to commit. Followed by a CADJPY short taken yesterday for a +2% manual close.

Full explanation as to why I executed on these positions and the management plan with both.

Any questions you have just drop them below 👇

AUDCAD / GBPAUD Trade Recaps 01.08.25A tester trade on AUDCAD with the reasons explained as to why this was a test position, and a short position executed on GBPAUD. Solid setup that this time around just didn't commit.

Full explanation as to why I executed on these positions and the management plan with both.

Any questions you have just drop them below 👇

Gold 31 July – Bearish Bias Holds, Watching Supply ZonesGold (XAUUSD) Analysis – 31 July

Market structure is now aligned across both higher and lower timeframes:

H4: Bearish

M15: Bearish

This alignment strengthens the probability of trend-continuation setups in favor of the dominant downtrend.

🔄 Current Market Behavior:

The M15 chart is currently in a pullback phase, retracing toward its previous lower high and approaching a key supply zone.

📍 Key Supply Zones to Watch:

Zone 1 – Immediate Supply Zone (3299 – 3305)

• First area of interest where price may react.

• If respected and followed by M1 confirmation, a short setup could be initiated.

• Watch for signs of exhaustion or sharp rejection.

Zone 2 – Higher Supply Zone (3326 – 3332)

• If the first zone fails, this becomes the next high-probability area.

• Well-aligned with the broader bearish structure — expect stronger reaction potential.

• Suitable for cleaner high RR short trades if price reaches this level.

✅ Execution Plan:

• Observe how price behaves inside the marked zones.

• Only plan short entries after M1 confirmation — this adds precision and prevents premature entries.

• Stay patient. Let the market come to you and reveal intent before acting.

📌 Summary:

Bias: Bearish

Structure: H4 and M15 both support downside bias

Zones in Focus:

– Primary: 3299–3305

– Secondary: 3326–3332

Execution: Wait for confirmation before entering.

Risk-Reward: Maintain 1:3 RR minimum (e.g., 40 pip SL, 120 pip TP).

Let the structure guide your setups — not impulse.

📘 Shared by ChartIsMirror

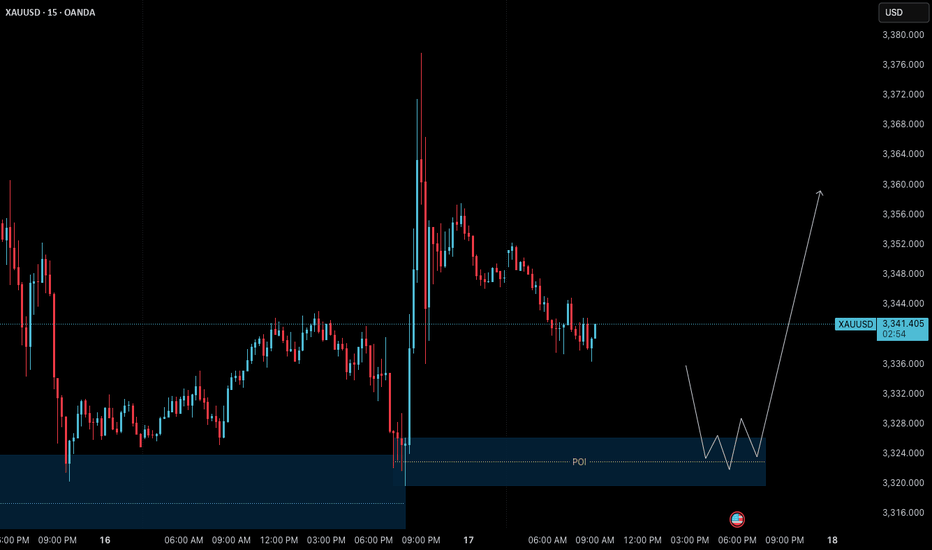

Gold 29 July – H4 Demand Holds, M15 Structure ShiftsGold (XAUUSD) Analysis – 29 July

The Mirror is Forming at 3310: Structure + Reaction in Focus

The market has successfully held the H4 demand zone, particularly near the critical level around 3310. This level is not just another number on the chart — it’s an inflection point. A possible first higher low or swing low, from which the next directional leg in gold could emerge.

Yesterday’s price action swept liquidity beneath this zone and then showed a strong bullish reaction. This isn’t just a bounce. It’s a behavioral shift — one that hints at absorption of selling pressure and the re-entry of aggressive buyers.

🔍 Structure Alignment: H4 + M15

On the H4 timeframe, price has stabilized within the demand zone.

Zooming into M15, we now see internal price action beginning to shift:

• First, a Change of Character (ChoCH) — the earliest clue that momentum is starting to turn.

• Then, a Break of Structure (BoS) to the upside — signaling potential bullish intent.

This multi-timeframe alignment — H4 support holding + M15 structure shifting — builds a strong case for a potential reversal and continuation of the uptrend.

📍 What Next?

The next step is to mark a refined M15 Point of Interest (POI) — a zone where price may pull back before making its next move upward.

We don’t chase price. We let it come to us.

✅ Look for Lower Timeframe Confirmation

Once price returns to your POI, it’s time to observe.

You’re not looking for obvious signals. You’re watching for subtle behavior —

a sharp reaction, a psychological flush, or a precise candle footprint that reveals intent.

The deeper signals aren’t always visible to the untrained eye — but they’re there for those who’ve studied the mirror.

( For those who know what to look for — this is where the sniper entry reveals itself. )

🎯 Summary

• Bias: Bullish — structure and reaction support long setups

• Plan: Wait for price to retest the M15 POI

• Execution: Only enter on confirmed lower timeframe intent and confluence

• Target: 120 pips (fixed, as per system)

• Stop Loss: 40 pips (always 1:3 R:R minimum)

📚 This is the kind of structure-based clarity we teach in The Chart is the Mirror .

Let the chart speak.

Let the structure guide you — not your emotion.

📘 Shared by @ChartIsMirror

GBPUSD - GBPJPY - USDJPY Trade Recaps 28.07.25Three positions taken last week. Some vital findings within my self-review process which showed a stop loss error with GBJPY causing me to miss a solid 4% trade, and a manual close on GBPUSD to bank a little extra profit.

Full explanation as to why I executed on these positions and the management plan with both.

Any questions you have just drop them below 👇

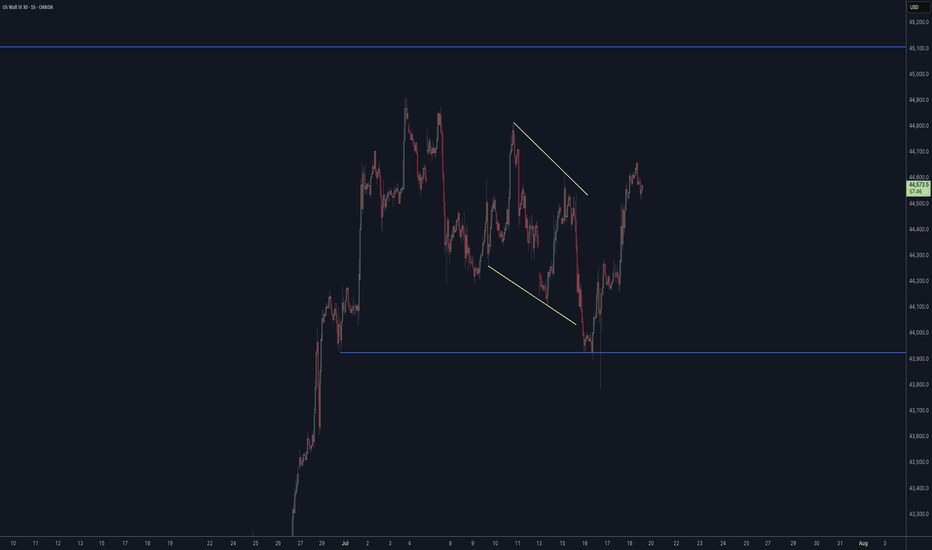

EURUSD & US30 Trade Recaps 18.07.25A long position taken on FX:EURUSD for a breakeven, slightly higher in risk due to the reasons explained in the breakdown. Followed by a long on OANDA:US30USD that resulted in a loss due to the volatility spike that came in from Trump.

Full explanation as to why I executed on these positions and the management plan with both.

Any questions you have just drop them below 👇

Gold (XAUUSD) – 17 July Analysis | Demand Zone in Play🟢 Gold (XAUUSD) – 17 July Analysis | Demand Zone in Play

Gold continues to follow the bullish structure we’ve been tracking in our recent posts. Yesterday's news-driven price action pushed the market to a new swing high near 3377.600 , confirming strength in higher timeframes. Now, price is currently in a retracement/pullback phase , pulling back toward a key intraday demand zone at 3326–3320 — offering potential opportunity for the next leg upward.

🔍 Where Are We Now?

The market is currently pulling back toward a key M15 demand zone: 3326–3320 . This level also aligns with a higher timeframe order block on the H4, making it a critical confluence area for structure-based traders.

This 3326–3320 zone is crucial because:

→ It’s a fresh M15 demand zone inside a higher timeframe bullish structure

→ It aligns with the H4 OB that previously acted as a launchpad

→ The overall trend remains bullish unless this zone is decisively broken

If the zone holds and we get LTF confirmation (such as M1 internal structure shift + micro-BoS), it may present a high-probability long setup.

⚙️ Structure Summary:

✅ H4: Bullish continuation structure with recent higher high

✅ M15: Pullback within bullish order flow

✅ M1 (for entry): Awaiting ChoCH + BoS as entry trigger inside POI

📌 Trade Setup Plan (upon confirmation):

→ Entry: From 3326–3320 demand zone

→ Stop Loss: 40 pips below entry

→ Take Profit: 120 pips (targeting new HH based on H4 projection)

→ Risk-to-Reward Ratio: 1:3

🧠 Key Trading Insight:

We never predict — we prepare .

We don’t chase price — we position with confirmation .

Discipline means waiting for price to invite us in , not entering just because a level looks attractive.

📈 Summary & Expectations:

➡️ Price is retracing into a structurally significant demand zone

➡️ Market bias remains bullish unless this zone fails

➡️ If the zone holds with valid M1 confirmation, we’ll consider a long setup targeting a new high

➡️ No confirmation = no trade. Patience > prediction.

📘 Shared by @ChartIsMirror

This analysis is part of our ongoing structure-based approach to trading Gold. All entries are derived from pure price action, multi-timeframe structure alignment, and trader discipline — as taught in our book:

“The Chart Is the Mirror: Mastering Gold with Structure, Stillness, and Price Action”