$PUMP Price Will Hit $0.006 this July 2025 see on Chart...🚀 NYSE:PUMP Price Will Hit $0.006 this July 2025, NYSE:PUMP is Showing a Double Bottom Pattern Looking on Chart now.

Double Bottom Pattern is a Reversal Pattern and It's will Manipulation Price of Pump. I'm Find a Three White Shoulders Candle in bottom price area on 4h Chart & It is a Bullish Candle. Now Price Retest and If it's Breakout it will be happened this month.

#Write2Earn #TrendingPredictions #AltcoinSeasonLoading #pump #SUBROOFFICIAL

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not available for any losses you may incur. Past performance is not a reliable predictor of future performance.

Subroofficial

$BNB Chart Showing Bullish Flag Pattern and Price Will Hit +$750CRYPTOCAP:BNB Previously Chart showing Bullish Inverse Head and Shoulder Pattern and Gain Profit of Range. It's a Reversal Pattern .

Now Chart Showing a Bullish Flag Pattern and it's Continuation Pattern. Time to Bullish for BNB Coin for FOMC 10th July Thursday 2025.

The upsloping 20-day EMA and the RSI just above the midpoint indicate a slight edge to the bulls. If the $665 resistance falls, the BNBUSD pair could rise to $675 and then to $698.

Sellers are likely to pose a solid challenge at $698 because a break above it could propel the pair to $732. I'm guess BNB Price Breakout of ATH and $888 Mystery will Happen.

This optimistic view will be negated in the near term if the price turns down and breaks below the moving averages. The pair may then drop to $636.

NEWSBTC: BNB Price Gears Up for Upside Break — Will Bulls Deliver?

BNB price is gaining pace above the $650 support zone. The price is now showing positive signs and might aim for more gains in the near term.

BNB price is attempting to recover from the $620 support zone.

The price is now trading above $655 and the 100-hourly simple moving average.

There is a key contracting triangle forming with resistance at $662 on the hourly chart of the BNB/USD pair (data source from Binance).

The pair must stay above the $655 level to start another increase in the near term.

BNB Price Eyes More Gains

After forming a base above the $620 level, BNB price started a fresh increase. There was a move above the $645 and $650 resistance levels, like Ethereum and Bitcoin.

The price even surged above the $660 level. A high was formed at $666 before there was a downside correction. The price dipped below the 50% Fib retracement level of the upward move from the $650 swing low to the $666 swing high.

The price is now trading above $655 and the 100-hourly simple moving average. On the upside, the price could face resistance near the $662 level. There is also a key contracting triangle forming with resistance at $662 on the hourly chart of the BNB/USD pair.

The next resistance sits near the $665 level. A clear move above the $665 zone could send the price higher. In the stated case, BNB price could test $672. A close above the $672 resistance might set the pace for a larger move toward the $680 resistance. Any more gains might call for a test of the $700 level in the near term.

Another Decline? If BNB fails to clear the $662 resistance, it could start another decline.

Initial support on the downside is near the $655 level and the 61.8% Fib retracement level of the upward move from the $650 swing low to the $666 swing high. The next major support is near the $650 level.

The main support sits at $644. If there is a downside break below the $644 support, the price could drop toward the $632 support. Any more losses could initiate a larger decline toward the $620 level.

Technical Indicators

Hourly MACD – The MACD for BNB/USD is gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BNB/USD is currently above the 50 level.

Major Support Levels – $655 and $650.

Major Resistance Levels – $662 and $665.

#Write2Earn #BinanceSquareFamily #BinanceTurns8 #BNB #SUBROOFFICIAL

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not available for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment.

$ETH Price Will Rising $3098 in Q3, Bullish Flag Inverse AngleCRYPTOCAP:ETH price will Rising $3098 in Q3 in 2025, Price Showing a Bullish Flag Inverse Angle. it's a Reversal Pattern and Manipulation Price. See more on Chart.

Crypto News: An Ethereum address holding 900 ETH started moving coins Monday after spending nearly 10 years dormant.

The holder received these genesis coins in 2015 when ETH traded below 50 cents.

These pre-mined tokens were distributed to early Ethereum contributors before mining began.

Their current value reaches 2.2 million with ETH trading around 2,529 per coin.

This represents potential gains exceeding 5,000% from the original sub-dollar entry price.

The move follows similar whale activity, including a 27.6 million Ethereum sale in April.

Last week saw a Bitcoin whale move 8 billion after 14 years of hodling.

ETH remains 48% below its 2021 all-time high of 4,878 despite recent stability.

The holder technically isn't a whale, which requires a minimum of 10,000 ETH at current prices.

#Write2Earn #BinanceSquareFamily #ETH #SUBROOFFICIAL

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested.

$SOL Price Will Hit $228 Q3, Inverse Head and Shoulder Pattern✨ CRYPTOCAP:SOL Price Will Hit $228 in Q3 of 2025 | Solana Chart Showing Inverse Head and Shoulder Pattern. It's a Bullish Reversal Pattern.

‣ Solana price is hovering below key resistance; a breakout above $159 and it's going to $228.

ETF Buzz Grows, but Price Action Still Caught in Limbo Here is why this could be the catalyst that sends price to all time highs Do THIS before that happens.

‣ Solana ETF Buzz Grows, but Price Action Still Caught in Limbo

🔸BlockNews The SEC has asked SOL ETF applicants to revise and refile submissions by end of July, fueling speculation of an ETF approval before October. Solana’s daily active addresses just hit a record 15.39 million, pointing to rising demand and user engagement on the network.

#Write2Earn #NFPWatch #BinanceSquareFamily #TrumpTariffs #SUBROOFFICIAL

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility.

$LOT Price Showing Symmetrical Triangle Pattern & Breakout aboveASX:LOT is a League of Traders Trading Competition Platform. LOT is an Native token of this platform.

Every Trading Player Have LOT point and they convert to LOT token and get on there wallet. Who Join LOT Trading League for LOT point? The main competition is top level and get free price.

💡 TOKEN OVERVIEW ( ASX:LOT )

Market capitalization: 3.89 M USD

Fully diluted market cap : 25.90 M USD

Trading volume 24h: 2.89 M USD

All time high: 0.044869 USD

Circulating supply: 150.00 M

Max supply: 1.00 B

Total supply: 1.00 B

A new Native token Release on Binance Alpha and when it's release on Binance Coin than we will see more pumping this Native Token Price.

ASX:LOT price now at $0.026186 and this year 2025 I'm Prediction the price will be happened $0.45-$0.75 hit. If Biggest Tournament will start this year on this Platform. Than Possible to worldwide Tournament make more Pumping price. Because of the Big investor will become investment on this LOT native Token.

We have to decisions long-term investment this coin. The main thing is that some Coin will be scammed. But League of Traders Platform is the Legit of Cross Chain Trading Competition.

The Crypto Scammer will not Permission listed there token on the Top Exchange of Binance Market. #SUBROOFFICIAL

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not available for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment.

$BTC Price Showing a Bullish Flag Pattern & Breakout see chart..CRYPTOCAP:BTC Price Breakout of Bullish Flag Pattern. I'm guess it's going to the next Price Zone $115K and if Breakout thank going $122K price zone.

I was telling some coins that was saying Multiple Profit and now coins are driving on the way. There are coin is ETH, BNB, XRP, SOL, TRX, TON, SUI, ADA, ICP, ARB, XLM.

Ric Edelman Urges Up to 40% Crypto Allocation, Predicts Bitcoin Surge to $500K

Top advisor Ric Edelman recommends investors allocate up to 40% to crypto, forecasting Bitcoin could reach $500K with rising institutional demand.

Ric Edelman advises investors to allocate 10% to 40% of their portfolios to crypto, based on their risk tolerance.

Edelman predicts Bitcoin could reach $500,000 if just 1% of global assets shift into the cryptocurrency sector. His endorsement is viewed as a major TradFi signal, given his $300 billion asset management influence in the advisory industry.

Ric Edelman, the founder of Edelman Financial Engines and DACFP, has recommended investors shift a significant portion of their portfolio to cryptocurrency. In a recent whitepaper, Edelman advised allocating between 10% and 40% to crypto, depending on individual risk tolerance.

This guidance marks a break from the conventional 60/40 stock-to-bond portfolio model, which he believes is no longer practical in a rapidly advancing economic environment.

According to Edelman, conservative investors should hold 10% in crypto, moderate investors 25%, and aggressive investors 40%. He cited technological advancements and increased life expectancy as reasons to move away from traditional investment formulas. He emphasized that ignoring crypto means betting against an asset class that has outperformed all others over the past 15 years.

Bitcoin Price Could Hit $500,000 with Minimal Asset Shift

Edelman also presented a bullish projection for Bitcoin, suggesting it could reach $500,000. He explained that a 1% allocation of the $750 trillion in global assets toward Bitcoin would inject $7.5 trillion into the market. Based on current valuations, this inflow could significantly drive the asset’s price. He underlined this estimate as simple arithmetic based on supply and demand trends.

Edelman pointed to growing institutional interest and policy changes as key drivers for crypto’s rise. He highlighted that Tether, a major stablecoin, reported $13 billion in profits last year, surpassing companies like McDonald’s and Ford. He also noted that a pro-crypto political climate, especially following Donald Trump’s reelection, is setting favorable conditions for digital assets.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not available for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment.

$XAU Showing Bearish Flag Pattearn & Dropped $3K Support area...TVC:XAU Showing Bearish Flag Pattearn & Dropped $3K Support area. Price dropping now and back to $3K price level area. price FVG touch and Strong support $3K Price Level area. Here is many support Holder.

Stoploss: $3,536

Entry: $3,377

1st Target point $3,377

2nd Target point $3,249

3rd Target point $3,028

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not available for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment.

$ARB time to fly $1 this bull run 2025 and it's Last Wave...AMEX:ARB Time to Fly and Touching $1 this Quarter. I guess it will be happened and gain bonuses $1+ and $2+ if big investor entry on this token.

My Magic Indicator Say ARB Price have touch Yellow line. Previous Day, Bounce back to above Yellow Line and It's Bull Run 2025 for ARB .

From News: ARB Eyes Trend Reversal With Breakout Signal Above $0.45 This Week

Arbitrum is trading at $0.41 inside a falling wedge and a breakout above $0.45 might confirm a wide shift from its yearlong downward trend.

Arbitrum has formed a falling wedge with lower highs and higher lows now compressing price at $0.41.

If the price moves above $0.45 with strong volume this could confirm a new bullish pattern for $ARB.

The wedge has been forming since 2024 and a breakout may signal the start of a strong trend reversal.

The descending wedge pattern forming on the Arbitrum chart spans nearly one year, beginning from its 2024 highs near $2.50. Several failed rallies marked by red arrows define the top boundary, while green arrows at the base represent support retests. This structure has now tightened into a narrow apex where breakout probability increases significantly.

#Write2Earn #BinanceSquareFamily #Binance #BTC☀ #SUBROOFFICIAL

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not available for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment.

$BNB Surprised $678 Price Mega Big pumping & Touch to $700+ ✨ CRYPTOCAP:BNB Surprised $678 Price Mega Big pumping & Trying to $700+ Milestone again.

💫 From Breaking News:

• BNB Eyes $700 as CZ Pushes 90% Binance Chain Fee Cut

•Bhutan Partners with Binance Pay and DK Bank to Launch the World’s First National Crypto-Based Tourism Payment System

BNB price surged over 10%, hitting $642.92 after CZ’s 90% BSC gas fee cut proposal.

RSI reached 78.42, confirming strong bullish momentum and overbought conditions.

BNB may test $700 if Binance validators approve the proposed BEP-336 transaction model.

On May 9, Binance Coin (BNB) climbed to $642.92, rising over 10% in 24 hours. The price rally followed a proposal from Binance founder Changpeng Zhao (CZ) to cut gas fees on Binance Smart Chain (BSC) by 90%.

#Write2Earn #bnb #BinanceSquareFamily #MarketRebound #SUBROOFFICIAL

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested.

$ETH Surprised $2.4K Price Mega Big pumping & touch to $3K ✨ CRYPTOCAP:ETH Surprised $2.4K Price Mega Big pumping & Trying to $3K Milestone again.

💫 From Breaking News:

• Ethereum Foundation Invests $32.65M in Ecosystem Growth

• Ethereum To Expand Network Capacity with Gas Limit Increase

Ethereum blockchain is preparing for a major upgrade that could make its network faster, cheaper, and more efficient. Developers have proposed raising the gas limit by 66% in a new development, from 36 million to 60 million units.

This change aims to improve the number of transactions the network can handle per block. This is to help users and developers enjoy smoother and more affordable activity on the blockchain.

Developer Says Testing Success Leads to Mainnet Rollout

Ethereum core developer Parithosh Jayanthi recently confirmed that the upgrade had passed early tests and is now ready for broader use. The new gas limit was successfully tested on the Sepolia and Holesky testnets. According to Jayanthi, the final rollout to Ethereum’s mainnet will begin shortly.

This is the second time Ethereum has raised its gas limit in 2025. The first increase happened in February, when the limit increased from 30 million to 36 million. These changes came after there hadn’t been any gas increase on the network since 2021.

#Write2Earn #ETH #BinanceSquareFamily #MarketRebound #SUBROOFFICIAL

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested.

$BTC Finally $100K Surprised and Take Profit Done✨ CRYPTOCAP:BTC Surprise Finally Touch $100K Milestone again, All Take Profit and bonus Done.

💫 From Breaking News:

• Arizona Bitcoin Bill: Crucial SB 1373 Advances for State Bitcoin Reserve

• New Hampshire Becomes First to Approve Bitcoin Reserve—Will Other States Follow?

First introduced in January, HB 302, gives officials the ability to allocate state funds to both precious metals, and specific digital assets with a market capitalization of over $500 billion. That means Bitcoin, which, as of this writing, has a market cap of roughly $1.9 trillion per TradingView, is a prime candidate.

The newly enacted law states that any digital assets obtained must be kept using high security custody protocols. This can be done directly in a state managed multisignature wallet, via a qualified financial institution custody, or by investment in U.S. regulated exchange traded products (ETPs). Dennis Porter, CEO and Co-Founder of Satoshi Action, said:

“Satoshi Action drafted the model, New Hampshire engraved it into law, and now every treasurer nationwide can follow that roadmap. HB 302 proves you can protect taxpayer money, diversify reserves, and future-proof state treasuries all while embracing the most secure monetary network on Earth. New Hampshire didn’t just pass a bill; it sparked a movement.”

#Write2Earn #BTC #BinanceSquareFamily #MarketRebound #SUBROOFFICIAL

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested.

$BTC FINALLY BULL RALLY ON CHART NOW & 2nd TAKE PROFIT DONEJUST IN NEWS : BTC Bear Market To Last 90 Days, Analyst Predicts, as Trade War Fears and Whale Activity Impact Prices

Bitcoin has entered a bear market, with its price dropping over 20% from its all-time high. Market analyst Timothy Peterson expects the downturn to last 90 days, arguing that this decline is weaker than most past bear markets. He noted that out of the 10 previous downturns, only four—2018, 2021, 2022, and 2024—have been worse in terms of duration. Peterson does not see BTC sinking far below $50,000 but says a slide in the next 30 days could be followed by a 20-40% rally after April 15. He believes this could trigger renewed buying interest and push Bitcoin higher.

Investor sentiment has been affected by global trade war concerns following tariffs imposed by U.S. President Donald Trump and retaliatory measures from multiple trading partners. The uncertainty has led to a decline in speculative investments. The Glassnode Hot Supply metric, which tracks BTC held for a week or less, has fallen from 5.9% in November 2024 to 2.3% by March 20, signaling reduced short-term trading activity. A CryptoQuant report also suggests that most retail investors are already in the market, countering expectations that a surge of new traders would drive prices up.

Ether has also struggled, losing over 51% in three months since peaking above $4,100 on December 16, 2024. Analysts say ETH must reclaim the $2,200 range to gain upward momentum. “If price can generate a strong enough reaction here, then #ETH will be able to reclaim the $2,196-$3,900 Macro Range (black),” wrote crypto analyst Rekt Capital in a March 19 X post. Despite positive regulatory developments, such as the U.S. Securities and Exchange Commission dropping its lawsuit against Ripple, ETH has yet to see significant gains.

Market uncertainty remains high, with some analysts expecting economic pressures to last until at least April 2025. Despite short-term volatility, long-term projections remain optimistic. VanEck has predicted a $6,000 cycle top for ETH and a $180,000 peak for BTC in 2025.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions.

$ETH PRICE RIDE TO $3K ON THIS BULL RUN 2025As of March 16, 2025, here are the latest developments in the Ethereum ecosystem:

Market Performance

Ethereum (ETH) is currently trading around $1,900, reflecting a 7.71% decrease over the past 24 hours.

Security Concerns

The FBI has accused North Korean-backed hackers, known as the Lazarus Group or TraderTraitor, of executing a $1.5 billion theft from Bybit, a Dubai-based cryptocurrency exchange. This heist, primarily involving Ethereum, is considered the largest in crypto history. The stolen assets are being laundered across multiple blockchains, raising significant security concerns within the crypto community.

Network Upgrades

The Ethereum community is anticipating the activation of the Pectra upgrade on the mainnet. This upgrade is expected to enhance network performance and could potentially drive ETH prices toward the $5,000 mark. However, the exact timeline for Pectra's implementation remains uncertain.

Competitive Landscape

Ethereum faces increasing competition from other layer-one blockchains. Notably, Solana (SOL) is reportedly forming a bullish setup that could lead to a substantial price surge, potentially impacting Ethereum's market dominance.

Investment Opportunities

For those interested in Ethereum investments, platforms like ICOminer offer cloud mining services with stable daily returns and principal refund guarantees. This presents an alternative avenue for earning passive income through Ethereum.

Privacy and Decentralization

Recent research has highlighted privacy issues within Ethereum's peer-to-peer network, revealing that validators can be deanonymized, which poses risks to decentralization. Additionally, studies indicate an oligopolistic trend in Ethereum's block-building auctions, suggesting increased centralization.

These developments underscore the dynamic nature of the Ethereum ecosystem, encompassing market fluctuations, security challenges, technological advancements, and competitive pressures.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions.

$BNB Price Travel $888 Price Level Area and see more chart CRYPTOCAP:BNB OVERVIEW

ENTRY AREA IS $613 AND STOPLOSS $500 BELOW, LAST TRAVEL $888 PRICE LEVEL IN 2025

Bubblemaps Launches Token Generation Event on BNB Chain, Sets Fundraising Goal of $800K

According to an announcement from Binance, the event, which is exclusively hosted on the BNB chain via PancakeSwap, will run from 8:00 AM UTC to 10:59 AM UTC.

The TGE offers investors the opportunity to acquire 40 million BMT tokens priced at $0.02 each as the project team tries to raise $800,000 in BNB to fund further developments. This event would distribute 4% of Bubblemaps’ total supply of 1 billion tokens in return to participants.s

The project team noted that each wallet’s contribution would determine its share, which is proportional to the total BNB deposited. There is a participation cap of 3 BNB per wallet to ensure fair distribution.

Binance’s Pascal Hardfork to Enhance BNB Chain – Key Features and Price Impact Table of Contents Announcements / Trading Analysis

Binance’s Pascal Hardfork to Enhance BNB Chain – Key Features and Price Impact BNB.

Binance’s Pascal Hardfork to Enhance BNB Chain – Key Features and Price Impact

What the Pascal Hardfork Brings to BNB Chain

BNB Price Action and Market Predictions

BNB Chain’s Future Upgrades

Conclusion

March 11, 2025 – Binance’s BNB Chain has scheduled the Pascal Hardfork for March 20, bringing significant upgrades, including Ethereum compatibility on the mainnet. This move aligns with BNB Chain’s broader 2025 roadmap to enhance scalability, transaction efficiency, and decentralized governance.

The Ethereum EIP-7702 implementation enables gasless transactions, batch approvals, and multi-signature support, making it easier for users to interact with decentralized applications (dApps) on BNB Chain. The upgrade also activates BEP-439, which improves transaction security through BLS12-381 curve verification.

What the Pascal Hardfork Brings to BNB Chain

BNB Chain developers have emphasized the importance of this upgrade for Ethereum Virtual Machine (EVM) compatibility, helping bridge the gap between Binance and Ethereum ecosystems. Key benefits include:

Enhanced User Experience – dApps can now pay gas fees on behalf of users.

Stronger Security – BLS12-381 verification ensures secure smart contract execution.

Faster Transactions – The Pascal Hardfork sets the stage for future updates that will reduce block time.

Community Governance – The “Vote to List” and “Vote to Delist” mechanisms allow BNB stakers to decide which tokens stay on the BNB Smart Chain.

The upgrade requires node operators, validators, and exchanges to update to v1.5.7, or risk desynchronization from the network.

BNB Price Action and Market Predictions

As of writing, BNB trades at $564.56, fluctuating within the $550–$575 range.

Analysts observe structural shifts, with key resistance and support levels shaping the next price movement:

Bearish scenario – If BNB fails to hold $550, it may decline further to $525 or even $500.

Bullish scenario – Holding above $550 could push BNB to $600, with a potential breakout to $650.

BNB’s previous high at $725 indicates strong resistance, and a rejection from $575 may confirm further downside. However, if momentum shifts, the upgrade could help BNB regain ground amid broader altcoin market movements.

A distinctive feature of this TGE is the immediate tradability of tokens post-subscription, eliminating traditional lock-up periods. Investors can trade BMT tokens immediately after the event on either Binance Wallet’s DEX or directly on PancakeSwap. This real-time liquidity is a bold play, designed to attract traders and investors eager for quick action.

#BTC☀ #BinanceAlphaAlert #BinanceSquareFamily #Write2Earn #SUBROOFFICIAL

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions.

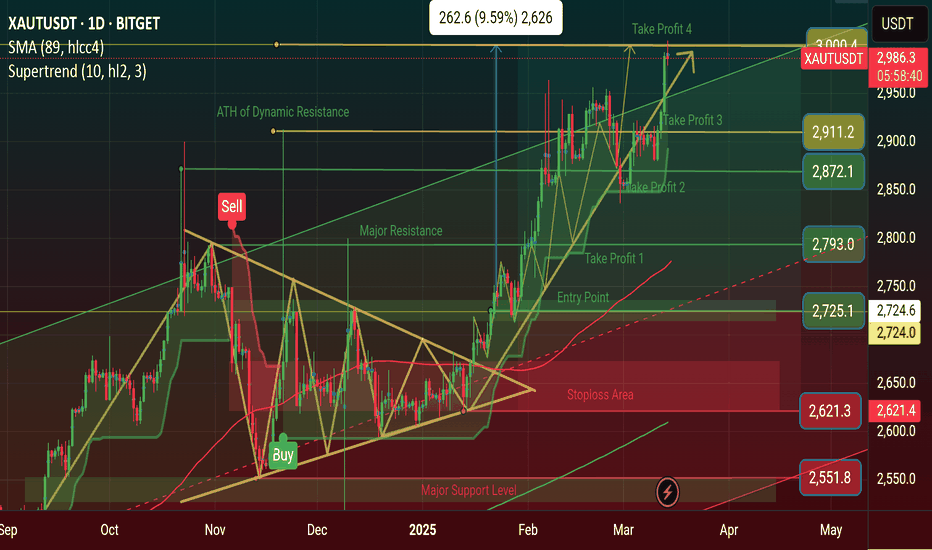

$XAU TAKE PROFIT 4 DONE & Price Serged 9.79% ~ $3005 ATH NOW TVC:XAU TAKE PROFIT 3 DONE & Price Serged 9.77% ~ $2,963 ATH NOW

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not available for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment.

$BTC Price Showing Head and Shoulder Pattern On Chart, CPI DATACRYPTOCAP:BTC Price Showing Head and Shoulder Pattern On Chart, CPI DATA, $95K Soon as Possible?

Bitcoin high-entry buyers are driving sell pressure, price may ‘floor’ at $70K

Bitcoin's “top buyers” are selling heavily, with onchain analytics firm Glassnode calling it a “moderate capitulation event.”

Bitcoin buyers who purchased around when it hit a $109,000 all-time peak in January are now panic-selling as the cryptocurrency declines, says onchain analytics firm Glassnode, which isn’t ruling out that Bitcoin could slide to $70,000.

Glassnode said in a March 11 markets report that a recent sell-off by top buyers has driven “intense loss realization and a moderate capitulation event.”

Short-term holders fled as Bitcoin dropped from peak

The surge in buyers paying higher prices for Bitcoin

BTC $82,482 in recent months is reflected in the short-term holder realized price — the average purchase price for those holding Bitcoin for less than 155 days.

In October, the short-term realized price was $62,000. At the time of publication, it’s $91,362 — up about 47% in five months, according to Bitbo data.

Meanwhile, Bitcoin is trading at $81,930 at the time of publication, according to CoinMarketCap. This leaves the average short-term holder with an unrealized loss of roughly 10.6%.

Related: Bitcoin slides another 3% — Is BTC price headed for $69K next?

On the same day, BitMEX co-founder Arthur Hayes said that Bitcoin may retest the $78,000 price level and, if that fails, may head to $75,000 next.

Glassnode explained that a similar sell-off Bitcoin pattern was seen in August when Bitcoin fell from $68,000 to around $49,000 amid fears of a recession, poor employment data in the United States, and sluggish growth among leading tech stocks.

#BTC☀ #BinanceAlphaAlert #BinanceSquareFamily #Write2Earn #SUBROOFFICIAL

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions.

$PIUSDT Price Road to $11 Price Prediction 2025 Pi Network News: Can Pi Coin Price Hit $11? Key Levels Revealed, Pi Already Get place 11 of the Market.

Pi Network has gained 6.8% in the past 24 hours, outperforming major cryptocurrencies like Bitcoin (+7.5%), Ethereum (+8.9%), XRP (+11.1%), BNB (+9.8%), and Solana (+7.8%). But that’s not the real surprise.

Since its mainnet launch, PI's price has skyrocketed by an incredible 1,775.77%, while the overall crypto market has dropped by 11% in the same period. That’s a staggering contrast - and a sign that something big is happening.

With PI breaking key resistance levels and speculation about a major exchange listing growing, investors are wondering: How much higher can PI go? Could we see a breakout past $2? Let’s dive in.

💗 Why Is PI’s Price Rising?

Since February 20, PI has gained an incredible 1,775.75%, with a 7.5% jump in just the last 24 hours. This steady rise shows that Pi Network is moving independently of the broader market, maintaining strong momentum.

Key Reasons Behind PI’s Price Rally

Several factors are driving PI’s price increase:

Mainnet Migration Deadline Approaching

Pi Network is reaching its final deadline for users to migrate their holdings. According to a recent blog post from the team, March 17 is the last day to complete the migration. This deadline may be increasing buying pressure as investors prepare for the next phase.

🧡 Potential Binance Listing

Speculation around a Binance listing is another major factor. In a recent Binance community poll, over two-thirds of participants supported listing PI. If Binance or other major exchanges list it, the price could see a significant boost.

US Election Impact on Crypto

Donald Trump’s return to office is bringing a more crypto-friendly stance from the US government, which could benefit projects like Pi Network.

💝 Can PI Break $2.2?

Experts believe that if PI moves past the $2.2 resistance level with strong volume, it could rally toward $11. However, if it fails to break through, selling pressure could push it down to $1.5 Stoploss price area

To maintain its bullish trend, PI needs to hold support above $1.7. The price is currently just 1.11% below the key $2.2 level, making the next few days crucial in determining its next move.

🩷 Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Pi Network has defied market trends and harsh criticism before, and if history is any guide, this rally might just be getting started.

🩵 Why Is Pi Coin’s Price Rising?

Pi Coin’s price is rising due to increasing exchange interest, migration deadlines, and strong community support, pushing demand higher.

💜 Nano History Will Pi Coin Reach $11?

If Pi breaks the $2 resistance with strong volume, experts predict a rally toward $11. Failure could lead to a drop below $1.5

💛 Is Binance Listing Pi Coin?

Binance has not officially listed Pi yet, but a recent community poll shows strong support, increasing the chances of a future listing.

$SOL Price LONG Setup February 2025 | 1D | SOLUSDT See on Chart✨SOL Price LONG Setup February 2025 | 1D | SOLUSDT

Solana News: VanEck Predicts $520, But This $0.01 Token is the One to Watch in 2025

VanEck, a prominent investment management firm, has recently predicted a strong run for Solana in 2025, saying the token could hit $520. This projection is based on Solana’s anticipated market share growth in the smart contract sector, which is expected to rise from 15% to 22% in 2025. Given this, Solana’s market capitalization could skyrocket to $250 billion, driving Solana’s price to $520 based on an estimated 486 million circulating tokens.

Solana Price Prediction: $150 Looking Inevitable

Solana is currently trading at $168 though it continues to plummet, having seen a drastic loss in the last 24 hours. As noted by Crypto Daily, a dip below $150 could pave Solana’s path to much lower prices, such as $140 and under.

• Solana (SOL) Technical Analysis and Key Levels

The potential reason behind this fear is the recent breakdown of the crucial support level at $180, which SOL failed to hold. Additionally, it has fallen below the 200 Exponential Moving Average (EMA), indicating that the asset is in a downtrend.

Based on recent price action and historical patterns, it appears that SOL is bearish, with a high probability of staying between $160 and $180 until it crosses the $190 mark. However, SOL falls below the $160 level, there is a strong possibility it could drop another 20% to reach $120 in the future.

According to the data, traders betting on the bullish side are currently dominating the asset, as they are over-leveraged at the $162.8 level and hold $145 million worth of long positions. This over-leveraged level suggests that traders believe SOL’s price won’t fall below this point, which currently acts as strong support.

#Write2Earn #BinanceAlphaAlert #BNBChainMeme #solana #SUBROOFFICIAL

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance any investment.

$SOL Price LONG Setup February 2025 | 1D | SOLUSDTSee on Chart, Recently News- Ethereum Price Holding Above $2600 Could Spark an Altseason?

Ethereum price is currently testing a crucial support level at $2,670, hovering dangerously close to the $2,600 threshold which is crucial for its price and other altcoins.

This price, just above 0.618 Fibonacci retracement level, was a key support that could dictate ETH’s and other altcoins short-term trajectory.

If Ethereum fails to maintain the $2600 level, it could signal a broader downturn, potentially impacting the anticipated altcoin season.

Ethereum has been navigating within an expansive ascending channel since mid-2023, adhering to both support and resistance levels delineated by Fibonacci retracement lines.

Notable touches at the 0.236 Fibonacci level around $1,456 and rebounds off the 0.382 level around $1,767 demonstrate the historical significance of these zones.

A fall below the current level near $2,670 might see ETH targeting lower supports at $2,414 and possibly $2,175.

Conversely, a rebound from the $2,600 level could reignite bullish sentiment, possibly pushing prices towards upper resistance levels near $3,140 and beyond.

This potential recovery would be critical in maintaining the momentum required for an altseason, characterized by widespread gains across various altcoins.

How Whales Could Spark an Altseason?

The total balances for wallets holding between 10k to 100k ETH surged, reaching 16 Million ETH by February 2025, compared to just above 14 Million in early 2024.

This substantial accumulation coincided with a noticeable uptick in ETH’s price.

It escalated from around $2,400 in December 2024 to over $3,800 in January 2025 before slightly retracting.

After a peak in early 2025, ETH price headed into a downward trend while the balances in whales’ wallets did not shown a similar decline.

This indicates a potential holding strategy rather than a sell-off.

Recently From News- Ethereum (ETH), the king of altcoins, has been steadily climbing, with analysts predicting a potential rally to $10,000 in 2025 as institutional adoption grows. Historically, when Ethereum moves, ERC-20 tokens follow, meaning that a major ETH rally could send Shiba Inu (SHIB) and Mutuum Finance (MUTM) soaring. With ETH currently priced at $2,773, a push toward $10,000 would likely create a bull market for ERC-20 tokens.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance any investment.

$BTC Long Setup February 2025 | 4H | BTCUSDT See on Chart,✨ CRYPTOCAP:BTC Long Setup February 2025 | 4H | BTCUSDT

Recent News: Czech Central Bank Explores Bitcoin Amid Cautions Over Crypto Risks

Analyst Says Bitcoin Could Reach $100K in 1-2 Weeks, Trying to Create New Support. Bitcoin's price has recently bounced from a key support level, located just below the 78.6% retracement, which has been a focal point in the last few days. The price formed a local low and attempted a move to the upside. However, the bullish rally is still in its early stages, and the momentum seems too small to be considered a strong trend just yet.

Currently, Bitcoin has failed to break the previous swing high from February 3rd, which is around $96,700. For the bulls to show strength, a break above this level is essential. While this move up could be a sign of things to come, the price action is not yet strong enough to confirm a substantial low.

Crypto analyst Michael say Bitcoin and Ethereum in the coming weeks. He believes Bitcoin could reach $100K within 1-2 weeks, with the current consolidation phase offering a great entry point for investors. As Bitcoin holds at lower levels, van de Poppe sees it as a chance for a potential breakout.

Market Implications

The price area between GETTEX:89K and $57K may receive backing from institutional investors and ETFs yet a significant market fall below $57K would signal extended bearish trends. Long-term holders keep GETTEX:25K as their essential reference point for the market because previous market bottoms reached this exact value.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance any investment.

$ETH Price LONG setup 2025 | 4H | ETHUSDTSee or Chart, From Recently News - Ethereum eyes $3000 resistance level – why investors are accumulating this presale gem

Ethereum Price Confirms Bullish Reversal

After facing increased volatility due to broader market trends, Ethereum's price has broken a critical resistance level around the $2,727-$2,730 range. The large-cap altcoin might retest this zone, confirming it as the new support before its next leg up. Notably, Ethereum's price has been consolidating near recent highs and has formed a potential bullish continuation pattern. If the altcoin’s retest holds, the price of ETH could surge towards $2,769 and beyond.

The price has rebounded off a crucial support level at $2,503, which aligns with previous demand zones. Its relative strength index (RSI) reading on the daily time frame has been hovering around the neutral zone, neither overbought nor oversold, indicating room for movement in either direction. The next significant test of the ETH coin could be reclaiming the $3,349 level, which might signal bullish momentum returning.

A confirmed close above $3,349 could trigger a rally toward higher values. However, if the price of Ethereum fails to hold above the $2,700 level, it could set the stage for a deeper correction, pulling back the price towards the $2,503 and $2,125 support levels. Ethereum’s RSI on the 1-hour chart suggests mild bullish divergence, hinting at a potential upside, but confirmation is needed through increased volume and sustained price movement above $2,881.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance any investment.

$BNB LONG SETUP | Binance Coin Price Predictions for This Week Binance Coin (BNB) Price Predictions for This Week

Key Support levels: $600

Key Resistance levels: $701. Massive Bounce off Key Support

After BNB touch $500 for a brief moment in early February, the price shot up to $700 in less than 10 days. This reversal was abrupt and significant, confirming that the support at $600 is well defended by buyers. At the time of this post, BNB is under the key resistance at $700.2. Sellers are Defending the $700 Resistance

As soon as the price moved above $700, sellers came in strong to push the price under this key level. After an impressive performance, BNB could not break this level which continues to act as a key resistance at the time of this post. Nevertheless, buyers could attempt another breakout later.3. Sustained Buy Volume Meets Sellers

Prior to BNB reaching $700, the buy volume was sustained and increased gradually. However, as soon as the price moved above $700 sellers dominated with the highest daily volume recorded so far in 2025. This has put a pause to the rally, and for it to continue, buyers need to turn $700 into a key support.

🔥 Market Analytics Info ( CRYPTOCAP:BNB )

Fully Diluted Market Cap: $94.2B

Volume 24 hour: $2.25 B

Total Supply: 142.48 B BNB

Circulating Supply: 142.48 B BNB

Market Cap: $94.02 B

All Time High: $793.35

All Time Low: $0.0961

Already have 90 Day Returns 2.84%

Now 7 Day Returns 13.99%

🔥Chart Analysis ( CRYPTOCAP:BNB )

💫2025 ATH : $793.35

🎆ENTRY POINT : $613.63, $588.50, $564.54

🎇STOPLOSS ZONE : $502.87

1ST TARGET $684.43

2ND TARGET $745.47

3RD TARGET $792.78

ATH 4TH TARGET $877.85

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not available for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment.