Sugar

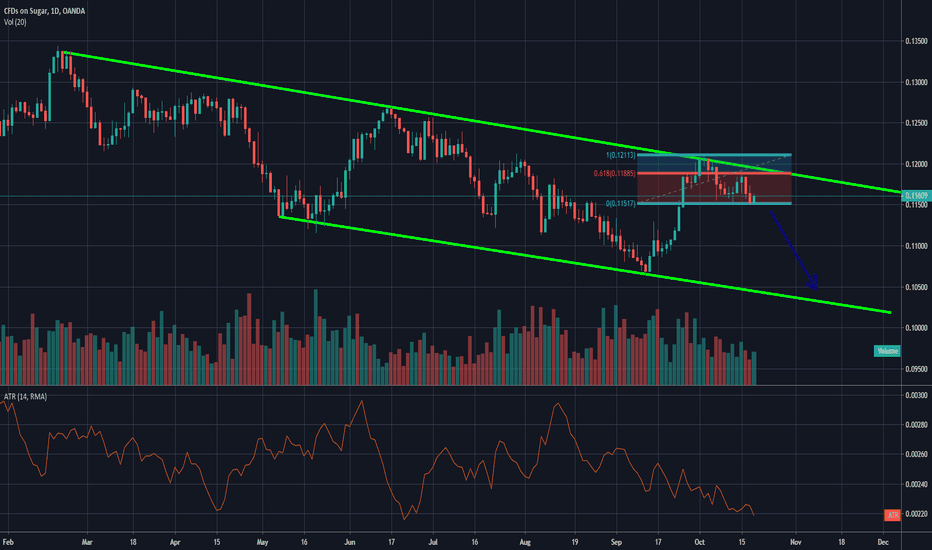

SUGAR breaking out or not?We have to wait a bit before market shows direction, right now sugar broke out of bearish channel

and went all the way up to support of last time,

either we move further up ( in that case you can open a long )

if it drops we will see a retreat to the marked level.

my advice is wait 6-10 hours when market is open before you open the position.

When short TP is 0.1

When long TP is 0.113

SUGAR FUTURES (SB1!) DailyDates in the future with the greatest probability for a price high or price low.

The Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing date. Djinn Indicators work on all charts, for any asset category and in all time frames. Occasionally a Djinn Predictive Indicator will miss its prediction date by one candlestick. If multiple Djinn prediction dates are missed and are plowed through by same color Henikin Ashi candles the asset is being "reset". The "reset" is complete when Henikin Ashi candles are back in sync with Djinn price high or low prediction dates.

One way the Djinn Indicator is used to enter and exit trades:

For best results trade in the direction of the trend.

The Linear Regression channel is used to determine trend direction. The Linear Regression is set at 2 -2 30.

When a green Henikin Ashi candle intersects with the linear regression upper deviation line (green line) and both indicators intersect with a Djinn prediction date a sell is triggered.

When a red Henikin Ashi candle intersects with the linear regression lower deviation line (red line) and both indicators intersect with a Djinn prediction date a buy is triggered.

This trading strategy works on daily, weekly and Monthly Djinn Predictive charts.

This is not trading advice. Trade at your own risk.

SUGAR FUTURES (SB1!) WeeklyDates in the future with the greatest probability for a price high or price low.

The Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing date. Djinn Indicators work on all charts, for any asset category and in all time frames. Occasionally a Djinn Predictive Indicator will miss its prediction date by one candlestick. If multiple Djinn prediction dates are missed and are plowed through by same color Henikin Ashi candles the asset is being "reset". The "reset" is complete when Henikin Ashi candles are back in sync with Djinn price high or low prediction dates.

One way the Djinn Indicator is used to enter and exit trades:

For best results trade in the direction of the trend.

The Linear Regression channel is used to determine trend direction. The Linear Regression is set at 2 -2 30.

When a green Henikin Ashi candle intersects with the linear regression upper deviation line (green line) and both indicators intersect with a Djinn prediction date a sell is triggered.

When a red Henikin Ashi candle intersects with the linear regression lower deviation line (red line) and both indicators intersect with a Djinn prediction date a buy is triggered.

This trading strategy works on daily, weekly and Monthly Djinn Predictive charts.

This is not trading advice. Trade at your own risk.

SUGAR FUTURES (SB1!) MonthlyDates in the future with the greatest probability for a price high or price low.

The Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing date. Djinn Indicators work on all charts, for any asset category and in all time frames. Occasionally a Djinn Predictive Indicator will miss its prediction date by one candlestick. If multiple Djinn prediction dates are missed and are plowed through by same color Henikin Ashi candles the asset is being "reset". The "reset" is complete when Henikin Ashi candles are back in sync with Djinn price high or low prediction dates.

One way the Djinn Indicator is used to enter and exit trades:

For best results trade in the direction of the trend.

The Linear Regression channel is used to determine trend direction. The Linear Regression is set at 2 -2 30.

When a green Henikin Ashi candle intersects with the linear regression upper deviation line (green line) and both indicators intersect with a Djinn prediction date a sell is triggered.

When a red Henikin Ashi candle intersects with the linear regression lower deviation line (red line) and both indicators intersect with a Djinn prediction date a buy is triggered.

This trading strategy works on daily, weekly and Monthly Djinn Predictive charts.

This is not trading advice. Trade at your own risk.

"One day every one will own mobile phones/sugar/bitcoin" updateThey were very right about sugar. Since the 70s-80s, sugar consumption went absolutely ballistic, people became complete addicts as the substance is addictive and creates cravings for more, and add to that the idiotic advice clown "experts" gave to every one "fat bad fat make disease fat make you fat" so people felt good about droping fat food and adding sugar and businesses added tons of sugar and so on, world consumption went from 75 million tons in 1975 to 150 million tons in 2007 according to some source, this seems to agree with other data about per capita consumption I have seen. The pre 1975 increase did not stop, it actually followed the same trendline as previous, with world consumption growing at a sterady rate.

Buuut production simply grew too (actually prices are so cheap US producers get free money from the government), more people growing sugar, better tech so fields produce more, increased planetary CO2 levels that cause canes to grow faster stronger bigger better.

Right about demand. Rekt anyway :)

They were oh so right about mobile phones. Now every one even in mozambique owns a smartphone. Too bad Nokia isn't the only company making phones and they didn't find the huge success every one was dreaming of just because they had a few popular phones at the time. It reached a peak share price of $62.50.

At its peak Nokia was valued $300 billion. Microsoft bought the mobile phone branch which they later sold to a finnish company for £350 million. Nokia itself is valued around $15 billion, the share price never went back to ath and is now $2.75. Nokia never became this huge trillion dollar behemoth investors were hoping.

I was in high school in the 2000s, I remember the FOMO and every one wanted a nokia phone and was a snake expert (the garbage game that was on the phone).

In a cruel irony twisted outcome, Apple DID become the trillion dollar mobile phone behemoth :) REKT! Double rekt! Multi kill rekt! Hahaha!

Maybe the plebs are right about imaginary electronic money? No reason why it does not continue to develop itself.

But will bitcoin become a trillion dollar behemoth? That ridiculous ponzi? No way xd

"Experts" that work in crypto have a conflict of interest and want you to buy and really know finance well (like sargent pompliano that has no clue self proclamied expert), claim that it is really big and taking over and bla bla bla same old same old.

I piss myself when I see something like this from CNBC with POMP face on it "A crypto expert explains why bitcoin is a good hedge against global turmoil" I just die xd

Ian Balina that is a complete clown is "an expert". The high school dropout kid that bought crypto at 13 is an expert too, he is legit giving speeches with a public of hundreds of clueless idiots, he gets invinted to ted talks, to cnbc, and more. A dog on Twitter is an expert because he bought crypto in early 2017. Dozens of "finance guys that run hedge funds" are all of a sudden experts. People actually fall for this.

You're an expert! And you're an expert! And you! And you! Every one is an expert!

As an expert myself (I hold a title of engineer in electronic payments technically I'm an expert & I have a stronger claim to the title expert than any of them) I advice every one to stay away from this ponzi.

This clear ponzi scheme will continue its sucker rally, and have many more. But it will go down.

I completely expect another "BULL MARKET IT BACK" situation as explained here...

Follow the coronavirus & global situation...

Going to take a couple more months imo to be able to see it happen, and crypto investors get the burn they deserve.

If every thing (with global fears and spx500 and btc price action) goes as planned there might be a buy, althought maybe not if it's like 2018-2019 (where to enter? on a breakout? just fomo in blindly with no sotp? haha this is what noobs recommend and they are persuaded of being right).

A "bull market is back" short around 10k would be lovely! Maybe won't go that far, maybe will go higher, we will see.

HERSHEY: $154 takes the Lead WITH SUGAR at $14/tonHershey (HSY): $154 <-- $83 Kitkat, Kisses, Reese's ETC . this sexy stock rewards those loyal sweet tooth (+70%)

Mondelez (MDLZ): $55 <- $36 makers of our very own OREO NABISCO RITZ etc making decent gains of (+50%)

Tootsie Roll (TR) $$34 <-- $26 Frooties and Classic Tootsie that gave decent gains as well

the underlying asset SUGAR (+28%) provides decent life to PLANTERS TRADERS and DEALERS

for Local Philippines the SUGARLANDERS should be upsizing positions and leveling up lifestyles

with new MANSIONS CARS and lavish parties again..

Listed issues in the business of AGRI AGRO etc..

CAT: ₱16.0

ANI: ₱12.0

DELM: ₱5.0

VMC: ₱2.55

FRUITS: 1.80

RCI: ₱1.75

Sugar down to .1246 , Temporarily ShortLooking like the RSI got up there on the longer time frames, MACD rolling down on the 4hr. Blow off top formation? We have support and strong volume profile at around .1246- .1295 . Please do not confuse my ammature speculation with professional trading advice.

Long Term Prospects for SUGARUSDThe SUGARUSD is in a correction of a long-term Bear Market with price trading above the 50 week ema, but below the 200 and 800 week emas. The 50 week ema is currently trending upwards slightly, though the long term emas are mostly flat, signaling accumulation/distribution. The price action appears to be finishing up the third of five waves up, coming against prior resistance, so a pullback is likely. Since this is a c-wave it should sharp and short in duration.

The Market is in a Bear Market rally on the daily, with price above the 50 ema which is above the 200 ema, but still below the 800 ema. Price is currently testing the 800 ema with the a-wave top a little above that at .13333. Both are levels the third wave of this c-wave could pull back from in a fourth wave. A measured move upwards for this c-wave would take price to 0.14178.

The Market is in a Bull Market on the 4 hour, with price above the 50 ema, which is above the 200 ema, which is above the 800 ema. Price would have to close below 0.13090 to be considered in an correction. The price action looks like it is getting ready to burst upwards to 0.13333 over the New Years week.

There is an opportunity here to short against overhead resistance when a top formation appears. The longer term opportunity is to buy the bottom formation from an upcoming pullback for a powerful up move to complete the c-wave.

This is my SUGARUSD look ahead for my own trading purposes. FUTURES trading involves risk. Feel free to comment, but trade off of this post at your own peril.

Sugar #11(NYBOT)-Mar. tend to be weak betw. 2 Nov. and 9 Dec.Sugar #11(NYBOT)-Mar. contract

Sell on approximately 11/02 - Exit on approximately 12/09

Percentage Correct: 87

Average Profit on Winning Trades: 0.89

Average Profit Amount on Winning Trades: $1001.97

Number of Winners: 13 out of 15

Average Loss on Trades: -1.10

Average Loss Amount on Losing Trades: -1232.00

Average Net Profit Per Trade 0.63

Average Net Profit Per Trade 704.11

SEASONAL TENDENCIES ARE A COMPOSITE OF SOME OF THE MORE CONSISTENT COMMODITY FUTURES SEASONALS THAT HAVE OCCURRED OVER THE PAST 15 YEARS. THERE ARE USUALLY UNDERLYING FUNDAMENTAL CIRCUMSTANCES THAT OCCUR ANNUALLY THAT TEND TO CAUSE THE FUTURES MARKETS TO REACT IN A SIMILAR DIRECTIONAL MANNER DURING A CERTAIN CALENDAR PERIOD OF THE YEAR. EVEN IF A SEASONAL TENDENCY OCCURS IN THE FUTURE, IT MAY NOT RESULT IN A PROFITABLE TRANSACTION AS FEES, AND THE TIMING OF THE ENTRY AND LIQUIDATION MAY IMPACT ON THE RESULTS. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT HAS IN THE PAST OR WILL IN THE FUTURE ACHIEVE PROFITS UTILIZING THESE STRATEGIES. NO REPRESENTATION IS BEING MADE THAT PRICE PATTERNS WILL RECUR IN THE FUTURE. HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS. RESULTS NOT ADJUSTED FOR COMMISSION AND SLIPPAGE.

SUGARUSD LongSugar has just broken out of a falling wedge pattern which could also be bullish flag. Nothing too complex, but I marked out where any divergences have played out coupled with the RSI > 65 signalling intermediate tops. I think sugar has anywhere from 5 to 10 percent to go up before marking another intermediate top.

For this trade, use the CANE ETF. I would suggest a stop below today's open and to just let this trade run.

SUGAR SHORT D1 UPDATE - DOUBLE TOP REVERSAL COMING?Hey traders, this is the update for the Sugar trade that I am still currently in.

Looks like price has come back up to the green trend line before reversing.

Looking left we see that price reached this exact area before, creating a potential double top pattern.

If you did not enter before, now would be a great time with a risk to reward of 3.

If price can break the neckline bears will be in full control.

The moving averages are also looking like a bearish cross soon on the MACD.

Daily trade analysis and ideas:

Telegram: t.me

Facebook: www.facebook.com

Twitter: forex_dojo

Instagram: www.instagram.com

Website: www.forexshinobi.com

Tiktok: @forexshinobi

ForexShinobi

SUGAR DAILY ANALYSIS - TL TOUCH AND 61.8% FIB RETRACE SHORT?Sugar came up to test the upper green trendline before price reversed.

Price then retraced to the 61.8 Fib Level before moving back down.

It looks like the bears are in control for now, and Sugar should continue to push lower as October comes to an end.

Daily trade analysis and ideas:

Telegram: t.me

Facebook: www.facebook.com

Twitter: forex_dojo

Instagram: Jaylen.Forex

Website: www.forexshinobi.com

ForexShinobi

SugarUS LongSugar weekly candle just closed above the 20 ma and the 21 ema. Looking left when that occurred in the past we had at least one additional full body weekly candle close above those moving averages before trend reversal OR start of a further uptrend , especially in those cases that 21 ema crossed over the 20 ma to the upside.

Linking this idea with my previous long position on Sugar.