SUI Rebounds from Key Demand Zone – Bullish Continuation Ahead?SUI has recently bounced from a key supply and demand zone between the 0.618 ($2.36) and 0.786 ($1.52) Fibonacci retracement levels, showing strong buyer interest in this range. This zone also coincides with a previous resistance line that has now flipped into support, adding further confluence to this area as a significant level for trend continuation.

After pulling back from its recent high around $5.44, SUI respected the 0.618 Fib level and has begun to recover, currently trading around $2.71. If momentum continues, the next resistance levels lie at the 0.5 ($2.95) and 0.382 ($3.54) Fib levels, followed by a potential move back toward the $4.26 zone.

Suianalysis

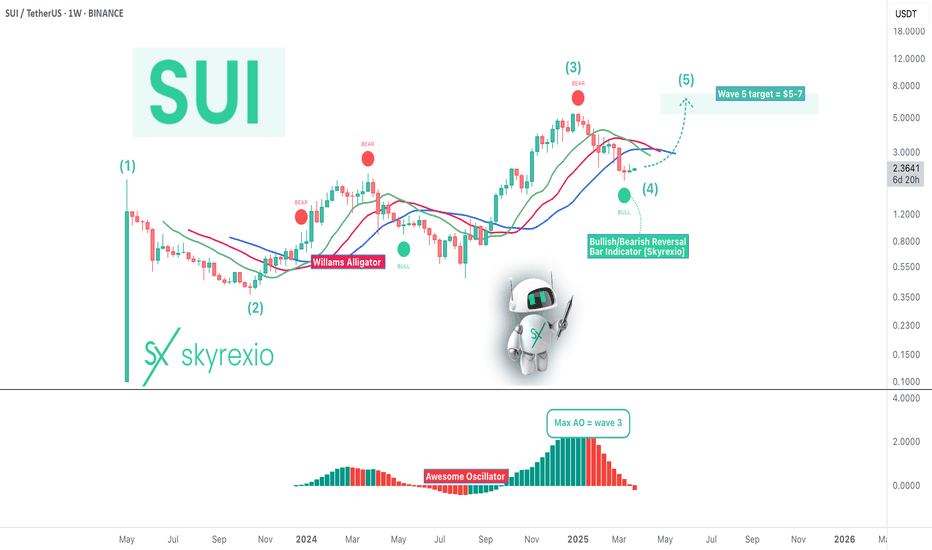

SUI - Last Growth Ahead Before Bear MarketHello, Skyrexians!

It's time to update BINANCE:SUIUSDT idea. Last time we pointed out that wave 3 has been finished and correction incoming. Now we are seeing this correction. Today we got the indicating that correction is over and we can see the great growth soon.

Let's look at the weekly chart. Here we can see the Elliott waves structure. Wave 3 has been finished at the recent top. Awesome oscillator gives us the hint that bull run will continue, but now that much because we have only wave 5 ahead which has a target $5-7 in the next 3-6 months. The strong confirmation that correction is over is the green dot on the Bullish/Bearish Reversal Bar Indicator below the alligator's lines.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

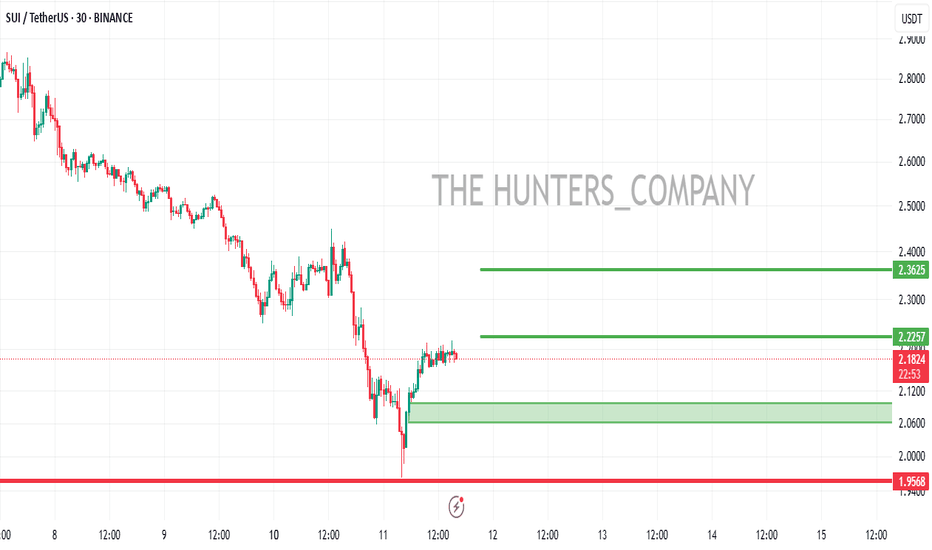

A GREAT OPPORTUNITY JUST CAME UP! LONGS OR SHORTSHi everyone!

While everyone believes that SUI/USDT is the real deal, Our experienced team has another opinion!

While SUI shows accumulative signals and bullish pattern to confuse all of us the retail traders..

We working very hard guys for you in order to reach the financial freedom!

SUI/USDT is about to crash!!!

And we talk at least for a 30% drop.. Yes you read very well!

Now here is the thing.. You have to manage your risk!

You have to be prepared for a 20% pump, that's why you are not opening big positions straight away. Spread your capital for every 5%.. And when the price will reach 2.41 disappear.. Take your profits and enjoy them, as we will do!

Stay tuned for more..

SUI Sustains Above Key Support: A Trend Breakout to Watch..!SUI has maintained a key support level following a false breakout while simultaneously breaking out of the downtrend. You can consider taking a long position at the current or 3.370 levels, with a stop loss set at 3.000. The first target is at 4.000, the second at 4.500, and the third at 5.000, respectively.

#SUI/USDT#SUI

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 2.70

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the Moving Average 100

Entry price 3.196

First target 3.36

Second target 3.56

Third target 3.83

SUIUSDT: Is This the Start of a Major Breakout?Yello, Paradisers! Is #SUIUSDT gearing up for a massive rally, or are we looking at a classic fakeout before another leg down? Let’s break it down.

💎#SUI has been proving itself as one of the strongest altcoins lately, bouncing back aggressively after a deviation below key support. Right now, the price is on the verge of reclaiming this level, and if bulls manage to turn it back into solid support, we could see a strong continuation to the upside.

💎The first key target for bulls sits at $4.35, a moderate resistance level that will serve as the initial test of SUI’s strength. If buyers manage to push the price above this region with strong momentum and sustained volume, it would signal increasing bullish control and open the door toward a much higher level.

💎This descending resistance zone, located between $4.70 - $4.85, is where things get serious. This area has historically acted as a supply zone, meaning sellers could step in aggressively to defend it. For SUI to push significantly higher, bulls must break through this region with conviction—ideally with a strong daily close above it and rising volume to confirm the breakout.

💎If buyers succeed in flipping this zone into support, we could see a retest of SUI’s 52-week highs at $5.25 - $5.40. However, this level is not just another resistance—it’s a strong resistance zone where large players may look to take profits, leading to sharp rejections or increased volatility.

💎On the downside, SUI is currently trying to flip the $4.05 - $3.95 region into a firm support base. The longer bulls can hold above this level, the stronger the momentum for a move higher. If selling pressure kicks in, there’s another strong support zone at $3.70 - $3.60, which could act as a key defense against deeper pullbacks.

Paradisers, as always, patience and discipline are key here. The market is setting up for a major move, but only those who stick to solid trading strategies will capitalize on it.

MyCryptoParadise

iFeel the success🌴

SUI: Further DownSui has sold off sharply in recent days, losing around 35% of its value since the top of the turquoise wave B at the resistance near $5.36. In the short term, this decline should continue until the price reaches the anticipated low of the magenta corrective wave (4) within the same-colored Target Zone between $3.23 and $2.70. From there, we expect an impulsive rise with the magenta wave (5), allowing Sui to break well above the $5.36 resistance and establish the high of the larger green wave . A premature breakout beyond $5.36 has a 30% probability according to our primary scenario.

SUIUSDT - Heavy correction ahead!3d chart shows breakdown of major trendline , bearish retest complete!

continuation of decline

The downtrend is expected to continue toward the 0.786 Fibonacci level.

If the price fails to hold this level, the decline is likely to extend further into the highlighted support zone on the chart

Best regards Ceciliones 🎯

Skyrexio | SUI Is In Huge Trouble, Be CarefulHello, Skyrexians!

The best crypto of 2024 is BINANCE:SUIUSDT , while other altcoins dumped significantly this asset set the ATH every day. This growth caused a lot of optimism and not SUI almost doesn't have haters. It means that price action needs to be cooled off and we will explain you why.

On the daily time frame you can see the entire impulse which consists of 5 waves. This is the complete impulse because of divergence on the Awesome oscillator. This is extremely bearish sign especially in conjunction with the Bullish/Bearish Reversal Bar Indicator which has already printed two red dots. You can check its accuracy before. For example it catches perfectly the bottoms of waves 2 and 4.

These red dots does not mean that we will see the bear market, but major correction is in progress. The logical target is 0.61 Fibonacci at $1.35.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

SOLD SUI and waiting for re-entryI had been accumulating SUI since last Sept when it broke above $1.0. But yesterday I sold my SUI position. It is probably not a good idea for many, but I did.

My overall bias for SUI is extremely bullish and I believe it will go much higher once BTC decides to move up. However, both daily RSI and MACD were forming a very clear negative divergence over two months. On top of that, the price tried to reach ATH, but failed, retested the previous higher high but failed. It gave me a sign of the weaking, so I sold it.

Now, I am going to wait for an opportunity to buy back. My rules for a long entry are as follows:

I use two time frames - weekly/daily and daily/4h.

My first rule for long:

1) MACD in the higher timeframe needs to be in the bull territory which is above 0. The angle of MACD is not important. It needs to be in the bull zone.

2) Stochastics (9,3,3) in the higher timeframe needs to reset and stochastics lines need to cross and start to move upwards. It cannot be in the overbought territory. If these two conditions are met in the higher time frame, I go to the lower time frame to start looking for an exact entry point.

3) MACD lines in the lower timeframe properly cross and enter the bullzone or cross and move upwards above the bull zone. Green vertical lines I drew in the chart are good examples.

4) Stochastics (9,3,3) in the lower timeframe cannot be in the overbought territory.

5) if the price is taking off from the critical area such as EMA21and resistance/horizontal/trendline, it even confirms it is a good area of entry.

SUI - time for price correction? Sui peaked at $2.22 in April 2024. Prior to that, momentum indicators started to develop a major neegative divergence. Eventually, the price dropped below the previous higher high at $1.95 and went through a prolonged price correction.

The same set up is emerging. The price recently reached $5.30 but now it is dropping below the previous high (not confirmed yet) at $4.94 area. If today's daily candle closes below $1.95 and MACD lines cross and start to point downwards, I might consider to open a short position.

My overall bias for SUI is bullish. I don't usually trade with leverage. I invest heavily in SUI and I don't intend to sell any of my SUI holdings at this stage. However, if the chart set up shows me a very clear sign for a decent correction, I will consider to open a short position to swing trade in 4H chart. I will update my analysis later.

SUI Roadmap==>>Short-term!!!First, let's take a look at the previous BINANCE:SUIUSDT Roadmap that I shared with you on October 8, 2024 , which was well done with this analysis (I told you both the correction and the increase).

The SUI token has experienced significant growth in the past 24 hours , driven by several key factors :

1- Expansion of the DeFi Ecosystem : The Sui Network has experienced a significant increase in Total Value Locked (TVL), signaling growing adoption and investor confidence.

2- Rising Open Interest : A noticeable increase in open interest indicates higher liquidity and greater participation from traders, further driving price appreciation.

3- Increase in Daily Active Addresses : The number of active addresses on the Sui network has grown, reflecting heightened user engagement and network activity.

4- Haedal Protocol Secures Seed Funding : Haedal Protocol, focused on liquid staking solutions for Sui, closed a successful seed funding round with major investors like Hashed and the Sui Foundation. Its haSUI ( PYTH:HASUIUSD ) token enables users to earn staking rewards while maintaining liquidity for DeFi activities, contributing to Sui's ecosystem growth with over $200M in TVL.

----------------------------------------------

Now let's look at the SUI token chart on the 1-hour time frame and see if we still have a chance to profit from the increase in SUI!?

SUI managed to break the Resistance zone($5.00-$4.76) and seems to be completing the pullback now .

According to the theory of Elliott waves , SUI seems to be completing microwave 4 of microwave 3 of the main wave 5 .

I expect SUI to start increasing again after the pullback is completed, and we can profit at least +10% from the SUI token .

⚠️Note: If SUI falls below the Resistance zone($5.00-$4.76), we should expect it to fall further.⚠️

🙏Please respect each other's ideas and express them politely if you agree or disagree.🙏

Sui Analyze (SUIUSDT),1-hour time frame⏰.

🔔Be sure to follow the updated ideas.🔔

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Is SUIUSDT on the Brink of a Major Breakout?Yello, Paradisers! #SUIUSDT has been showing remarkable strength, steadily climbing within an ascending channel and gaining momentum from its ascending support. Adding to the bullish narrative, the price is forming an inverse head-and-shoulders pattern—a powerful indicator suggesting the potential for a continuation to higher levels.

💎However, a significant challenge lies ahead. #SUI faces a major resistance zone between $4.80 and $5.00—a critical level that has repeatedly acted as a barrier, preventing the price from breaking higher. Notably, this range also aligns with the neckline of the pattern, making it a pivotal breakout area.

💎A successful breakout, accompanied by strong trading volume, could spark a bullish surge targeting the $5.45–$5.70 range, where the 1.618 Fibonacci extension resides. This area might prompt partial profit-taking as traders capitalize on the move. However, if momentum continues to remain strong, SUI could soar even higher, reaching the next significant resistance levels around $6.50–$6.80, fulfilling the pattern's target.

💎On the downside, SUI is well-supported. Initial support is seen at the $4.00–$3.90 zone, with additional strong support at the ascending trendline near $3.65—a level that has held firm for over 45 days, reinforcing its significance.

Patience and discipline are key here, Paradisers. The market often tests both bulls and bears before making decisive moves, so stay vigilant.

MyCryptoParadise

iFeel the success🌴

No Matter How Far You Fly, You Will Return SUI!No matter how far you fly, you will return to my primary demand zone, SUI.

While SUI is showing very nice increases, it is also active in terms of volume, there are buyers inside, but they are slowly running out, you see long wick candles, the reason I skipped the first demand zone is that everyone will be waiting there and such zones are directly skipped in dump situations of the market.

You saw this in the recent dump, in all my analyses, I wrote in 10 different analyses that dumps could come, and therefore the first box should not be used without approved upward breakouts. In fact, I did not give the first boxes in many analyses at the risk of being left out. That is why 10 of the 15 demand zones I shared came as points and are at an average of 15% profit. Right now, I pulled the stop of all of them to the entry and took my profit.

I will be patient for SUI because I did not act early. If you could not get it at cheap prices, your only solution is to be patient. If you cannot be patient, unfortunately, you cannot be a hunter. Maybe you hunt a few things by chance, but in the end you will be hunted.

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

Bulls Say Go, Bears Say No—Who Wins SUI’s Show?SUI is dancing around $4.644, giving traders a reason to sit up and watch.

1. If SUI gets a clean break above $4.956, bulls could grab the reins and push toward the next stop at $5.46. That’s where things could get interesting for those looking for upward momentum (Solid Green Projection).

2. On the flip side, if the price struggles to hold and slides below $4.644, it might signal hesitation in the market. A quick dip to retest $4.644 followed by a rebound would be a good sign that buyers are still in the game (Dashed Green Projection).

3. However, if $4.644 breaks down without a fight, bears could come storming in. A drop toward the next key support at $4.063 would be the logical move (Red Projection).

For now, SUI is at a crossroads—will it charge forward or stumble? Keep an eye on $4.956 and $4.644; they’re the real decision-makers here.

sui usdt"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

SUIUSDT Elliott Waves Analysis (Investment idea)Hello friends.

Please support my work by clicking the LIKE button👍(If you liked). Also i will appreciate for ur activity.

Everything on the chart.

Entry: market and lower

Targets: 2.5 - 5 - 7.5 - 10

Optimistic target: 15 - 20$

after first target reached move ur stop to breakeven

Stop: (depending of ur risk).

ALWAYS follow ur RM

risk is justified

It's not financial advice.

DYOR!

SUI price need correctionCRYPTOCAP:SUI price has fulfilled all of its goals and even more.

Now, according to the canons of TA, the OKX:SUIUSDT price should correct and "test" the liquidity zone of $1.90-2.30.

And from there, the pair could continue to grow and update the ATH.

The critical level for the trend to continue is $1.60

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

$SUI WARNING: pump then dumpNYSE:SUI is experiencing a significant pump due to BlackRock's announcement of a specific NYSE:SUI trust fund. However, on August 3rd (and on the 3rd of every month until January 2025), NYSE:SUI will undergo a large token unlock for their Series B and C investors.

The concern is that there was no immediate impact from this token unlock, suggesting that the VCs may be waiting for retail investors to FOMO into NYSE:SUI following the BlackRock announcement before they dump their coins.

Once the FOMO cools down, it's likely that the VCs will sell, which could cause the price to drop.

NYSE:SUI is currently in a downtrend, forming a falling wedge pattern due to the monthly token unlocks that began in July 2024. The upcoming inflation will be difficult for the market to absorb. The token unlocks will slow down in January 2025.

DYOR

$SUIUSDT : Ready for a Comeback Breakout!BINANCE:SUIUSDT is attempting to break out from resistance after a recent false breakout and subsequent retracement. With layer 1 blockchains gaining momentum, there’s potential for a significant upward move. Traders should keep an eye on key resistance levels as the price makes this push.

It's crucial to manage risk effectively: always use a stop loss and only invest a small portion of your capital in any trade. This approach will help safeguard your investment while positioning you for potential gains. Follow us for more signals!

BINANCE:SUIUSDT Currently trading at $2

Buy level: Above $2

Stop loss: Below $1.45

TP1: $3

TP2: $4.5

TP3: $6

TP4: $7

Max Leverage 3x

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts