SUIBTC

#SUI/USDT Update – Bounce Setup from Demand Zone?#SUI

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 3.27, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price higher at 3.20.

Entry price: 3.38

First target: 3.58

Second target: 3.65

Third target: 3.80

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

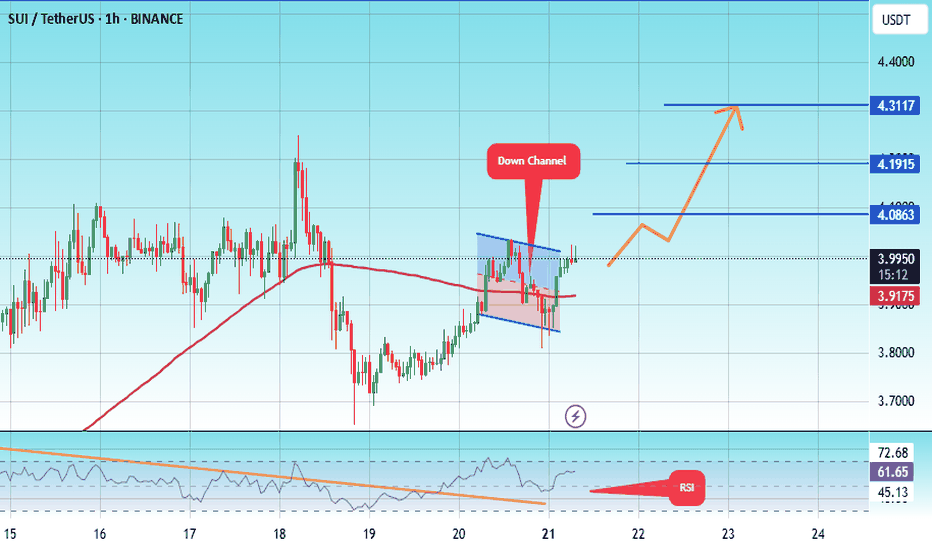

#SUI/USDT potentail to 4.30 $#SUI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 3.85.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 3.80, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the Moving Average 100.

Entry price: 3.99.

First target: 4.08.

Second target: 4.19.

Third target: 4.30.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

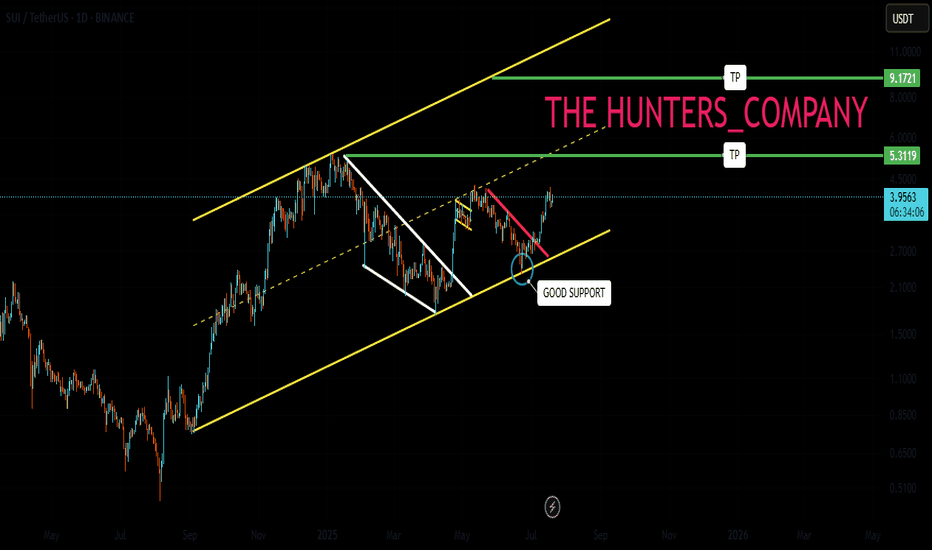

SUI : HODL BASKETHello friends🙌

🔊We have come to introduce a signal that can be a good option for your investment portfolio.

Given that the price is in the ascending channel and has good support from buyers, it is expected that this time the price will break the middle line of the channel and move to the ceiling of the channel and succeed in reaching ATH...

Don't forget about capital and risk management.⚠

🔥Follow us for more signals🔥

*Trade safely with us*

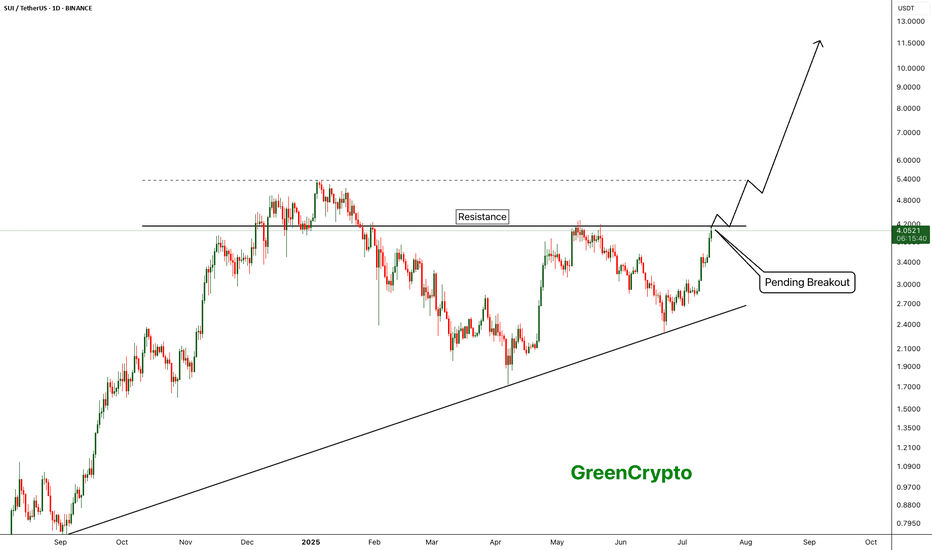

SUI - Breakout of the year- SUI is currently trading near the resistance line. Price was reject around this resistance line in the previous pump.

- Given the current bullish market, price is expected to breakout from this resistance easily

Entry Price: 4.04

StopLoss: 3.2

TP1: 4.5059

TP2: 5.3810

TP3: 6.5106

TP4: 7.8772

TP5: 10+

Don't forget to set stoploss.

Stay tuned for more updates

Cheers

GreenCrypto

#SUI/USDT ready to surge 13% toward $3.72 target?#SUI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 3.30.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 3.20, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 3.44

First target: 3.53

Second target: 3.62

Third target: 3.72

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#SUI/USDT#SUI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 2.90.

We are experiencing a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are heading toward stability above the 100 Moving Average.

Entry price: 3.00

First target: 3.07

Second target: 3.15

Third target: 3.24

SUIUSDT Forming Falling WedgeSUIUSDT is currently showing a very strong bullish technical setup as it forms a classic falling wedge pattern, which is widely known in crypto trading for its high probability of signaling a reversal to the upside. The pattern, combined with increasing volume, is suggesting that buyers are stepping in to absorb the remaining supply. With an expecting gain projection of 90% to 100%+, this crypto pair is gaining a lot of attention from traders looking for high-reward opportunities in the altcoin market.

SUI is an emerging project that has been gaining momentum thanks to its innovative technology and scalable blockchain infrastructure. The community around SUI continues to grow, fueled by new partnerships, ecosystem development, and increased investor confidence. This fundamental growth aligns well with the technical breakout setup, making the current price action even more interesting for swing traders and long-term holders alike.

The support zone that has formed around the base of the wedge pattern appears to be holding firmly, providing a solid foundation for a potential rally. If SUIUSDT manages to confirm its breakout and attract further buying volume, traders could see a strong move toward the next resistance levels. Monitoring on-chain activity, sentiment, and overall market conditions will be key to navigating this move efficiently.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

#SUI Ready to Grow up?#SUI

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 2.83, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price higher at 2.75.

Entry price: 2.87.

First target: 2.95.

Second target: 3.04.

Third target: 3.14.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

SUI - Only way is up.BINANCE:SUIUSDT (1W CHART) Technical Analysis Update

SUI is currently trading at $2.77and showing overall bullish sentiment

Price has touches the trending support and managed to bounce back from the support, this is a good sign. I see a good opportunity for long trade here with a decent stoploss.

Entry level: $ 2.77

Stop Loss Level: $ 1.77

TakeProfit 1: $ 3.6997

TakeProfit 2: $ 4.2126

TakeProfit 3: $ 5.7785

TakeProfit 4: $ 9.5494

TakeProfit 5: $ 14.1762

Max Leverage: 5x

Position Size: 1% of capital

Remember to set your stop loss.

Follow our TradingView account for more technical analysis updates. | Like, share, and comment your thoughts.

Cheers

GreenCrypto

#SUI/USDT#SUI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 3.10.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading toward stability above the 100 Moving Average.

Entry price: 3.30

First target: 3.34

Second target: 3.57

Third target: 3.76

#SUI/USDT#SUI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 3.10.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading toward stability above the 100 Moving Average.

Entry price: 3.30

First target: 3.34

Second target: 3.57

Third target: 3.76

#SUI/USDT#SUI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 3.40.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 3.70

First target: 3.81

Second target: 3.91

Third target: 4.09

#SUI/USDT#SUI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 3.64.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 3.70

First target: 3.77

Second target: 3.84

Third target: 3.96

SUI: Watch this bull flag formation! Previously, the price formed a falling wedge pattern and broke out to the upside, resulting in a notable gain of 27%.

Currently, the price is just below a critical resistance level. A break above this level could push the price to at least $0.425.

It’s wise to monitor this setup closely if you want to capitalize on the next upward movement!

The idea is to buy when the price breaks above 0.411$ and take profits at the levels shown in the chart.

Targets:

1. 0.425$

2. 0.45$

3. 0.47$

-------------------------------------------

About our trades:

Our success rate is notably high, with 10 out of 11 posted trade setups achieving at least their first target upon a breakout price breach (The most on TW!). Our TradingView page serves as a testament to this claim, and we invite you to verify it!

#SUI/USDT#SUI

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 3.82, which acts as strong support from which the price can rebound.

Entry price: 3.90

First target: 4.10

Second target: 4.32

Third target: 4.52

#SUI/USDT#SUI

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 3.35, which acts as strong support from which the price can rebound.

Entry price: 3.43

First target: 3.62

Second target: 3.80

Third target: 4.00

SUI Looks Bearish (2H)From the point where we placed the red arrow on the chart, it appears that the correction in SUI has begun.

An expansionary wave structure is visible, which could potentially push SUI toward the green zone.

Targets are marked on the chart. As long as the supply zone holds, the price may move toward the targets and the green box.

A 4-hour candle closing above the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

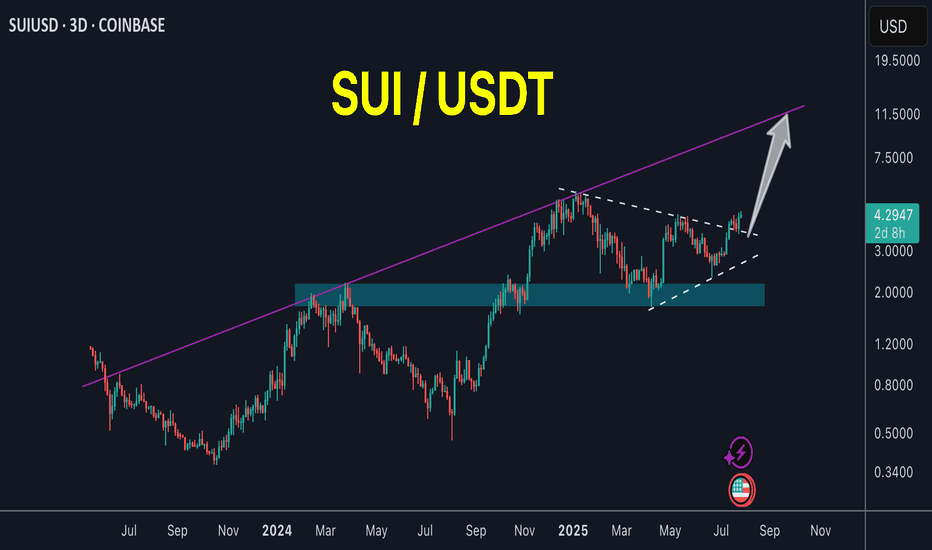

SUI whats the target ?SUI / USDT

SUI is just following my scenario 2 in previous analysis.. click here

What next ? :

With current big price surge we are looking for previous ATH , after that the main resistances are: 7$ and 9$/10$

They are considered very strong resistance but if the price could overcome them we will see SUI flying like never before

Always do risk management

Make your plan and dont FOMO

Best of wishes

#SUI/USDT#SUI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 2.14.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 2.20

First target: 2.31

Second target: 2.39

Third target: 2.46

SUI - Double Digit is next - Alt season LeaderCorrection of the SUI is over, currently trading around the previous Support zone. i'm expecting this support to hold and bounce back from the support zone.

Once the price breaks from the falling wedge pattern we can expect the bullish momentum to start and hit new all time high.

Entry: after wedge breakout

Target 1: 2.8

Target 2: 3.49

Target 3: 4.5

Target 4: 5.3

Target 5: 6.3

Target 6: 9.2

SL below 1.68

Cheers

GreenCrypto