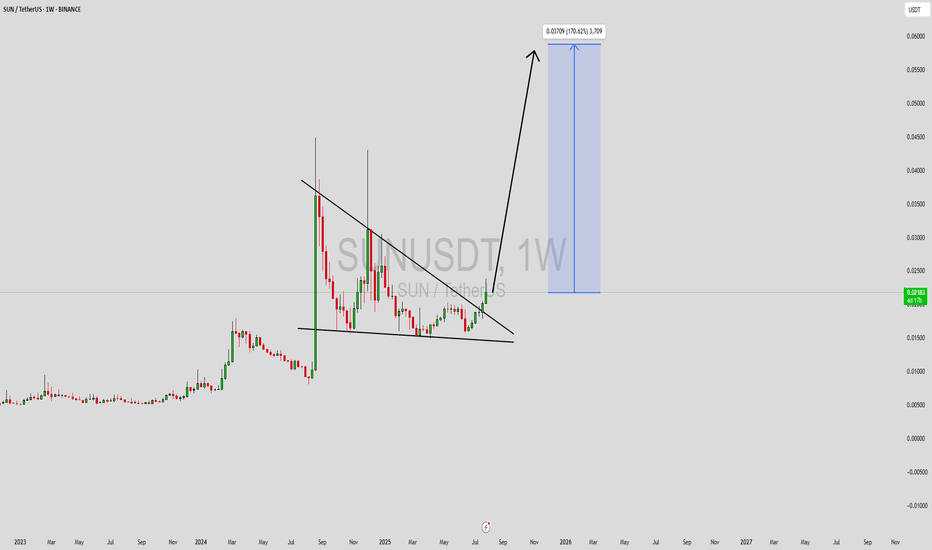

SUNUSDT Forming Potential BreakoutSUNUSDT is currently forming a promising potential breakout pattern that traders and investors should closely watch. The price action has shown a period of consolidation near key support zones, building a strong base for a potential explosive move. With volume gradually increasing and bulls taking control, the pair appears primed to break past resistance levels, signaling the beginning of a new uptrend phase.

The technical structure supports a bullish bias, with the potential to achieve a gain of 140% to 150%+ if the breakout materializes fully. Historical price behavior and recent candle formations suggest that SUNUSDT is gearing up for a rally, especially as it approaches a crucial trendline. If confirmed, this breakout could lead to a parabolic move, driven by renewed market interest and buying pressure.

SUN, being part of the TRON ecosystem, benefits from a solid foundation and increasing usage in DeFi applications. The token has seen growing investor interest, further fueling positive sentiment and long-term potential. The fundamentals are aligning well with the current technical outlook, providing additional confidence to bullish traders eyeing high-reward setups.

Given the momentum and improving market dynamics, SUNUSDT has become a high-potential watchlist candidate for both swing traders and long-term investors. A confirmed breakout above the current range could open the door to significant upside gains.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

SUN

Bearish potential detected for SUNEntry conditions:

(i) lower share price for ASX:SUN along with swing of DMI indicator towards bearishness and RSI downwards, and

(ii) observing market reaction around the share price of $20.46 (open of 19th May).

Stop loss for the trade would be:

(i) above the potential prior resistance of $21.36 from the open of 5th June, or

(i) above the high of the recent swing high once the trade is activated (currently $22.14 from the high of 1st July), depending on risk tolerance.

Bearish Head and Shoulders Pattern Confirmed 🚨 NYSE:SUN

Bearish Head and Shoulders Pattern Confirmed 🚨

NYSE:SUN

has formed a bearish head and shoulders pattern and has been rejected from the neckline. The target for this bearish move is the green line level.

📈 Technical Overview:

Pattern: Bearish Head and Shoulders

Neckline: Rejection confirmation

🎯 Target: Green line level.

SUN Rebuy Setup (12H)It is one of the assets owned by the creator of TRON.

It appears to be completing a large triangle and may move upward from the green zone to complete wave E.

The target could be the red box.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

TRX Perfect Bat Harmonic, Complex Correction, Double BottomTRX has created several simultaneous buy signals here. First we have the perfect bat harmonic, then we have wisemen on multiple timeframes, in a grey zone on the 4hr, perfect double bottom breaking all lows expect the final low, short-term momentum divergences, and a solid diametric count with at least 5 of 7 waves being time similar.

All of these signs are pointing to a bottom forming right now, meaning the lows should not be violated and TRX will go to all time highs from here. If we do make new lows it is probably a good idea to stop and reverse, and look for a new potential bottom. For now, all signs are pointing up, especially the longer-term count which has us beginning a supercycle this quarter.

Sun Token ($SUN): Strategic Entry into DeFi Ecosystem TokenI spend time researching and finding the best entries and setups, so make sure to boost and follow for more.

Sun Token ( NYSE:SUN ): Strategic Entry into DeFi Ecosystem Token

Sun Token (SUN) is a crypto in the CRYPTO market. The price is 0.02420828 USD currently with a change of -0.00058 (-0.02359%) from the previous close. The intraday high is 0.02517523 USD and the intraday low is 0.02232376 USD.

Trade Setup:

- Entry Price: $0.02197

- Stop-Loss: $0.00692

- Take-Profit Targets:

- TP1: $0.05232

- TP2: $0.08906

Fundamental Analysis:

Sun Token ( NYSE:SUN ) is integral to the TRON blockchain's decentralized finance (DeFi) ecosystem, facilitating governance and incentivization within the platform. Its role in promoting DeFi activities on TRON has garnered attention from investors seeking exposure to this growing sector.

Technical Analysis:

- Current Price: $0.02420828

- Moving Averages:

- 50-Day SMA: $0.02350000

- 200-Day SMA: $0.02200000

- Relative Strength Index (RSI): Currently at 55, indicating neutral momentum.

- Support and Resistance Levels:

- Support: $0.02250000

- Resistance: $0.02550000

Market Sentiment:

The DeFi sector continues to expand, with NYSE:SUN playing a pivotal role in TRON's ecosystem. Its integration into various DeFi protocols enhances its utility and appeal among investors.

Risk Management:

Implementing a stop-loss at $0.00692 helps mitigate potential losses, while the take-profit targets at $0.05232 and $0.08906 offer favorable risk-reward ratios. Given the token's volatility, strict adherence to these levels is crucial.

When the Market’s Call, We Stand Tall. Bull or Bear, Just Ride the Wave!

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Traders should conduct their own due diligence before making investment decisions.

$SUN sun just signaled a break out of falling channelSET:SUN has been on a down trend for Months!

Current Price: 0.020

Price action has continued in it's falling Channel and recently just broke slightly out of it!

Expecting Price Action to continue upwards.

#SUN Targets: 0.024, 0.032, 0.041

This Idea Invalidates under 0.0189

TRON is the leading large altcoin this cycle!!TRX was especially strong this bear market. It was able to steady itself from falling too far. Similar more to Bitcoin then other alts like Solana. TRX fell around 74% in the bear market like BTC. SOL fell more like 94%.

TRX now 150% above old highs and SOL below old highs.

This is not to take anything away from SOL but comparing TRX to the other strongest alt this cycle. I suspect SOL might end up following TRX in a TRX like breakout from its old 2021 highs.

TRX has been able to capture a key part of the crypto market in being a chain for stablecoin transfers and is trying to expand into more typical defi areas.

TRX Surging: Sun’s $6.2M Banana Purchase Sparks Market BuzzJustin Sun Buys "Comedian" for $6.2M

In a move that blends art, memes, and crypto culture, Justin Sun, the founder of TRON, has acquired Maurizio Cattelan’s iconic artwork, *Comedian*, at a Sotheby’s auction for $6.2 million. The infamous banana duct-taped to a wall has sparked debates in both the art and cryptocurrency communities. Sun described the artwork as a “cultural phenomenon” and plans to honor its quirky legacy by eating the banana 🍌 in the coming days.

This purchase, according to Sun, symbolizes a bridge between traditional art and the digital revolution, showcasing TRON’s innovative spirit and cultural relevance.

TRX: Riding the Momentum

The news of this high-profile purchase appears to have given CRYPTOCAP:TRX a boost in the market. The token is up 2.76%, trading within a bullish channel. The technical indicators point to a strong upward momentum:

- RSI: At 69, TRX is edging toward the overbought zone, signaling strong buying pressure.

- Chart Pattern: A bullish engulfing pattern suggests continued upward movement.

- Moving Averages: TRX is comfortably trading above key MAs, adding to the bullish sentiment.

A Stable Anchor in Volatile Waters*

Justin Sun’s strategic moves have helped CRYPTOCAP:TRX maintain stability amid market fluctuations. By aligning the token with headline-grabbing cultural events, Sun ensures TRON remains relevant and appealing to investors.

As CRYPTOCAP:TRX continues to trade within a stabilized threshold, it seems poised to attract more attention from both crypto enthusiasts and art lovers. The innovative combination of art and blockchain could lead to more institutional interest in the token.

Final Thoughts

Whether it’s a $6.2M banana or blockchain innovation, Justin Sun knows how to keep the spotlight on TRON. With CRYPTOCAP:TRX maintaining a strong technical position and benefiting from renewed attention, the token could see further gains in the coming weeks.

Will the banana become the spark for TRON’s next big rally? Stay tuned.

Is $SUNDOG the Next Big Thing? Price, Volume & Market PotentialIntroduction

In the rapidly evolving cryptocurrency space, each blockchain seems to have its own iconic tokens that capture the attention of both investors and enthusiasts alike. For the Tron blockchain, this token is Sundog ($SUNDOG) – a project that has gained traction as the “biggest dog meme” on Tron, bringing “sunshine, fun, and love” to the network. With an impressive rise in trading volume, price increases, and potential for further gains, $SUNDOG presents an intriguing opportunity for investors, especially given its technical and fundamental performance. Here’s an in-depth look at what makes $SUNDOG stand out in the crypto space.

Market Activity and Volume

Sundog ($SUNDOG) has shown robust market activity, with a recent 24-hour trading volume of $143,973,605, marking a 25.4% increase. This rise suggests growing interest in the token, especially on popular exchanges like Bybit, where the SUNDOG/USDT pair holds a trading volume of $65,349,913. Other major platforms like Gate.io and Bitget also support $SUNDOG trading, expanding its accessibility for a wider audience. This upward trend in trading volume reflects increasing liquidity and market interest, which can be a positive indicator for price stability and future growth.

Market Capitalization and Ranking

With a current market cap of $181,451,843, $SUNDOG ranks #353 on CoinGecko, signaling solid adoption. The token's supply consists of 1 billion tradable tokens, giving it a considerable presence on the market. The fully diluted valuation (FDV) also stands at $181,451,843, assuming the entire supply of 1 billion tokens is circulating. This market cap positions $SUNDOG well within the mid-tier market segment, giving it both stability and room for growth as it gains further traction.

Historical Price Performance

Analyzing $SUNDOG’s price history provides further insights into its potential. The token hit an all-time high of $0.3775 on September 27, 2024, and is currently trading 52.6% lower than this peak, presenting a potential opportunity for investors to buy in at a discounted price. Its all-time low, recorded on August 16, 2024, was $0.03989, making its current price 348.53% higher. This performance showcases resilience and potential long-term growth, especially as it continues to attract a dedicated community on Tron.

Comparative Performance

When comparing $SUNDOG’s recent price movements against other cryptocurrencies, it’s clear that the token has momentum. In the last seven days alone, $SUNDOG has increased by 71.1%, outperforming the global cryptocurrency market average of 29.4%. However, it falls slightly short compared to the broader meme coin segment, which has surged 106.9% in the same timeframe. Nevertheless, this steady upward trend aligns with the overall meme coin resurgence and indicates strong community support and market interest.

Technical Analysis

$SUNDOG is currently trading within a rising trend channel, a pattern often associated with continued upward momentum. It’s up 1.59% at the time of writing, and its position relative to moving averages highlights its technical strength. The token is trading above its 50- and 100-day moving averages, indicating bullish sentiment in the mid-term. However, it remains slightly below the 200-day moving average, suggesting that a breakout above this level could signal the next phase of bullish movement.

Relative Strength Index (RSI)

The RSI for $SUNDOG is 60, which, while not overbought, indicates strong momentum. An RSI above 50 suggests that buyers currently dominate the market, while an RSI near 70 would indicate overbought conditions. At this level, $SUNDOG shows potential for further gains without being in an overextended zone.

Governance and Utility on Sunpump Launchpad

Beyond its meme status, $SUNDOG serves as the governance token for Sunpump.fun, a launchpad platform on the Tron network. This use case enhances $SUNDOG’s utility, as holders participate in decision-making and vote on project proposals, making the token an integral part of the ecosystem. This governance feature also aligns with broader DeFi principles, giving users more influence and fostering a robust community that can drive $SUNDOG’s future growth.

Conclusion

With a strong foundation, active trading, and bullish technical indicators, $SUNDOG appears poised for potential growth. Its status as a governance token on the Sunpump.fun launchpad strengthens its appeal, adding utility beyond typical meme coin speculation. As it continues to gain traction on Tron and maintain its popularity across top exchanges, $SUNDOG presents an attractive opportunity for investors.

In summary, $SUNDOG is a unique asset in the meme coin world, combining community appeal with technical promise. With its rising trend, supportive fundamentals, and dedicated community on Tron, $SUNDOG is well-positioned to shine as a standout meme token.

SUN/USDT Breakout Alert: Ready for 200-300% Gain!!Hey everyone!

If you're enjoying this analysis, please give it a thumbs up and follow!

SUN is showing strong potential! It has broken out of a bull flag structure on the daily time frame and is holding above the flag, signaling a bullish move. Buy now and accumulate more on dips for maximum gains!

Entry range: CMP and accumulate up to $0.0185

Target: 200-300% potential upside

Stop Loss (SL): $0.0158

What do you think of SUN's current price action? Are you spotting a bullish setup? Share your thoughts and analysis in the comments below!

#SUN/USDT#SUN

The price is moving in a descending channel on the 1-day frame and is holding it very well and is about to break out to the upside

We have a bounce from the lower limit of the channel at 0.01600

We have a bearish trend of the RSI that is about to break out which supports the upside

We have a trend to stabilize above the 100 moving average

Entry price 0.01750

First target 0.02680

Second target 0.03337

Third target 0.04370

SUN/USDT: READY FOR A 100% MOVE!!Hey everyone!

If you're enjoying this analysis, a thumbs up and follow would be greatly appreciated!

SUN/USDT looks good here. It breaks out from the symmetrical triangle in a 4-hour time frame and is currently, being it. Buy some here and add more in the dip.

Entry range:- $0.025-$0.027

Target:- 80-100%

SL:- $0.024

What are your thoughts on SUN's current price action? Do you see a bullish pattern? Share your analysis in the comments below!

Sun under the eclips?I guess not.

NYSE:SUN is currently trading at $0.03235 after a pullback from recent highs. The price is finding support near the 0.5 Fibonacci retracement level. A potential rally could target $0.04136 and $0.06034 if the bullish momentum continues. The RSI suggests the market is neither overbought nor oversold, providing room for further movement. Keep an eye on the EMAs and support levels for signs of continuation or reversal.

TRON’s $4 Billion Ambition: Justin Sun’s Bold Bet on Meme CoinsIn a move that could redefine the trajectory of the TRON network, Justin Sun, the founder and CEO of TRON ( BINANCE:TRXUSDT ), has forecasted an ambitious revenue target of $4 billion for the coming year. This projection, if realized, would be a landmark achievement for the blockchain platform, driven by a strategic pivot towards meme coins and adjustments to network fees.

The $4 Billion Revenue Peak

Justin Sun’s bold prediction isn’t just a number plucked out of thin air. The $4 billion target is rooted in a comprehensive strategy that leverages TRON’s strengths while embracing the growing influence of meme coins in the cryptocurrency market. Sun anticipates that $3 billion in revenue is a conservative estimate, with the potential to exceed $4 billion through network optimizations and community-driven initiatives.

Sun has laid out a plan where $1 billion of this revenue will be ‘burned’—a practice that effectively reduces the supply of CRYPTOCAP:TRX , potentially increasing its value. The remaining $2 billion is earmarked for stakers and to cover transaction fees, creating a more attractive ecosystem for users and investors alike.

The Meme Strategy: A New Frontier

Central to Sun’s revenue forecast is TRON’s renewed focus on meme coins—a category of cryptocurrency that has gained significant traction in recent years. Sun believes that the community-driven nature of meme coins aligns well with the decentralized ethos of TRON ( BINANCE:TRXUSDT ), making it a strategic growth area.

The launch of SunPump, a meme token launchpad on the TRON network, is a testament to this strategy. Despite being just 11 days old, SunPump has already generated over $1.1 million in sales, indicating strong market interest and potential for further growth.

Network Adjustments: Lower Fees, Higher Capacity

To support this ambitious growth, Sun has proposed lowering transaction fees and raising the energy limit on the TRON network. These adjustments are expected to increase daily transactions to over 20 million within three months, significantly boosting TRON’s market share.

By increasing the network’s energy capacity, more TRX tokens will be staked, enabling free transfers and enhancing the network’s overall profitability. These measures are designed to make TRON a more attractive platform for developers and users, fostering long-term growth.

TRON’s Integration with Dex Screener

In addition to its meme coin strategy, TRON ( BINANCE:TRXUSDT ) has recently achieved a significant milestone with its integration into Dex Screener, a leading decentralized exchange tracking service. This listing is expected to enhance TRON’s visibility in the decentralized finance (DeFi) space, attracting more users and liquidity to the network.

The integration with Dex Screener is seen as a critical step in TRON’s broader strategy to expand its ecosystem and capitalize on the growing DeFi market. Coupled with the recent minting of one billion USDT tokens on the TRON network by Tether, TRON’s liquidity and market presence are set to strengthen further.

TRX Price Forecast: Bullish Trends with Caution

As of the latest market analysis, CRYPTOCAP:TRX , the native cryptocurrency of the TRON network, is trading at $0.1572 down by 2.54%. Despite a minor correction, TRX is showing signs of a bullish trend, with the potential to reach $0.20 in the near term. If this momentum continues, CRYPTOCAP:TRX could even achieve a new all-time high of $0.50.

However, the market is not without risks. In a bearish scenario, TRX could stabilize around $0.14, with the possibility of further declines to approximately $0.135 if negative trends persist.

Conclusion: A High-Stakes Gamble

Justin Sun’s $4 billion revenue forecast and strategic pivot towards meme coins represent a high-stakes gamble for TRON. While the potential rewards are significant, the path to success is fraught with challenges. However, with Sun’s track record of bold moves and the network’s growing ecosystem, TRON could very well be on the cusp of a new era of growth and innovation.

As the crypto market continues to evolve, TRON’s ability to adapt and capitalize on emerging trends will determine whether Sun’s ambitious vision becomes a reality. For now, all eyes are on TRON as it navigates this exciting yet uncertain future.

SUN Price prediction 2024 - SUN IS GOING TO SHINE AND $0,07 SUN Price Prediction 2024 - Will SUN Shine Bright?

Based on our analysis, SUN could reach an exciting target of $0.07 by the end of this year.

Current Trends

At the start of the year, SUN's trend looks promising and different from previous years. This isn't just about a percentage increase but also about its overall development.

Year 2023 was a red year and 100% not sumllair as the trends of this year.

The year 2024 already made some start trends also to see on chart.

What’s Next for SUN?

We’re keeping a close eye on SUN because it has shown some very interesting movements recently. For 2024, there are several possible targets:

$0.021

$0.025

$0.035

$0.047

The most optimistic target is $0.07, which would be up to a new all-time high (ATH).

Note

Always do your own research. This is not trading advice. The market can be unpredictable.

The market can go for a time stable, it's about the year 2024 this is not short-term update.