Silver Analysis – Strong Bulls and a Clean Setup AheadLast month, Silver printed a new multi-decade high, a major technical milestone.

Since then, price has entered a sideways consolidation, forming a rectangle — but what stands out is this:

👉 Silver bulls have absorbed every dip, even when Gold dropped.

That’s strength. And strength usually precedes breakout.

🔍 Current Situation

At the time of writing, price is trading around 37.20,

and from the current structure, it looks like nothing is standing in the way of an upside break.

We don’t predict — we prepare...

And this chart looks ready.

🎯 Next Target: 40.00 USD?

A push to 40.00 looks like the next “normal” target.

But don’t forget: that’s a 3,000 pip move.

This type of move will require patience

Plan your trade.

Respect your risk.

Let the bulls work. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Supply and Demand

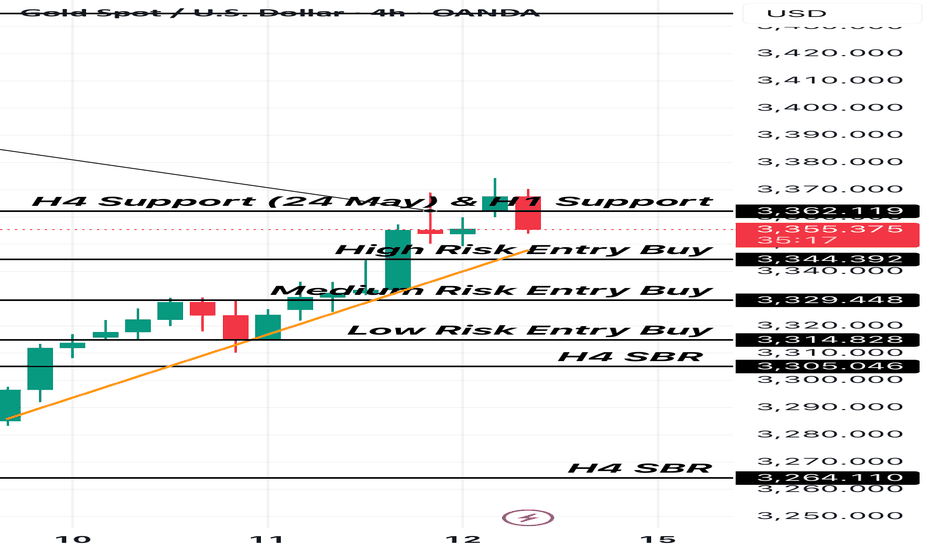

Gold (XAUUSD) Analysis – 4-Hour TimeframeGold (XAUUSD) Analysis – 4-Hour Timeframe

Currently, the price is moving in an upward trend and approaching a key resistance area. Recent volatility suggests that buyers have shown enough strength to break through previous resistance zones and are now attempting to overcome the next significant barrier ahead.

🔴 Bullish Scenario:

If the price manages to break above the current resistance and hold above it, we can expect a continuation of the upward move toward higher zones. In this case, the bullish wave could extend toward the next resistance levels (marked in blue).

🔴 Bearish Scenario:

If the price reacts negatively to the current resistance area and fails to break above it, a corrective decline may follow. The nearest support zone below could play a crucial role in maintaining the bullish structure. However, if this support is also broken, the path could open for a deeper pullback toward lower support levels.

XRPUSD SELL 3.197On the daily chart, XRPUSD stabilized and rebounded, with short-term bulls in the lead. At present, attention can be paid to the resistance near 3.197 above, which is a potential short position for a bearish bat pattern. At the same time, this position is in the previous supply area, and the downward target is around 2.340.

Will Solana reach $1400?After analyzing Solana’s complete data, it appears that a large diametric pattern is forming in the long term.

Currently, it seems we are in wave c of C.

If the key level of $187 is broken and price consolidates above it, we can be much more confident that we are indeed in wave c of C, confirming this scenario.

However, if the price fails to break and hold above $186 on higher timeframes like the 3D or weekly, and gets rejected downward, this scenario will be invalidated.

If confirmed, the targets for wave c of C are marked on the chart.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

NQ Power Range Report with FIB Ext - 7/14/2025 SessionCME_MINI:NQU2025

- PR High: 22890.50

- PR Low: 22803.00

- NZ Spread: 195.0

No key scheduled economic events

0.33% weekend gap to previous week low, unfilled

Session Open Stats (As of 1:15 AM 7/14)

- Session Open ATR: 289.88

- Volume: 36K

- Open Int: 270K

- Trend Grade: Neutral

- From BA ATH: -1.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NZD/JPY – 4H Technical and Fundamental AnalysisNZD/JPY – 4H Technical and Fundamental Analysis

NZD/JPY remains supported fundamentally by a hawkish stance from the Reserve Bank of New Zealand, which recently held rates at 5.50%, emphasizing ongoing caution around inflation. This tone continues to favor NZD strength in the short to medium term.

Adding to that, seasonal trends also support bullish momentum July and August have historically been weak for the Japanese yen and relatively strong for the New Zealand dollar, aligning with the current upside bias.

On our Technical Side

NZD/JPY recently broke above a minor key resistance at 87.900, following a multi-week period of consolidation. This breakout signaled renewed buyer interest and a potential shift into a bullish continuation phase.

After the breakout, price entered a clear accumulation zone, where early buyers positioned themselves just above support. However, smart money triggered a stop-loss hunt below 87.900, targeting liquidity trapped beneath that key level.

This liquidity grab formed a Clear liquidity within the liquidity zone, creating a cleaner setup for long opportunities. Price is now heading back toward the previous resistance now flipped into a key support level.

📍 Buy Limit Setup:

Buy Limit Entry: 88.030

Stop Loss: 87.570 (below liquidity zone)

Take Profit: 89.250 (next minor resistance zone)

📌 Disclaimer:

This is not financial advice. Always wait for proper confirmation before executing trades. Manage risk wisely and trade what you see—not what you feel.

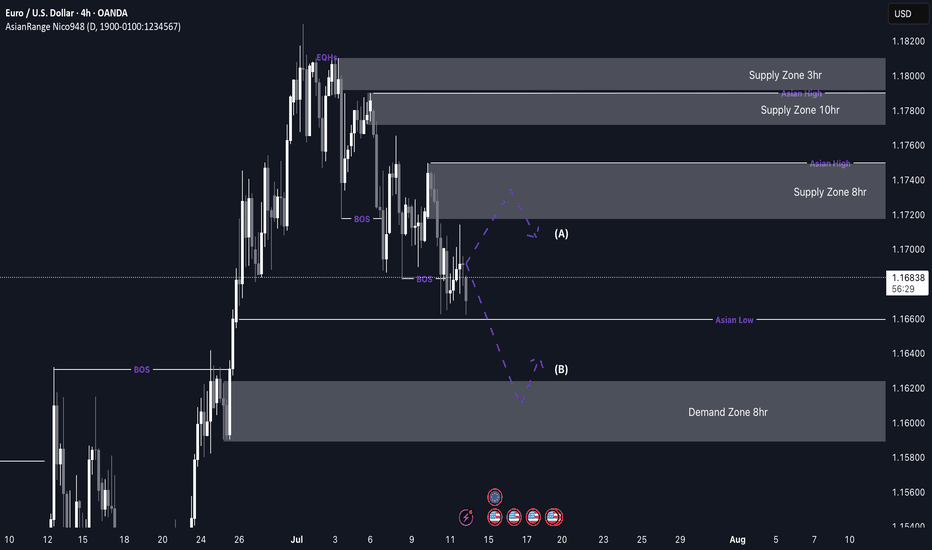

EUR/USD 4H Technical and Fundamental AnalysisEUR/USD 4H Technical and Fundamental Analysis

EUR/USD has dropped approximately –0.7% over the past week following a sharp risk-off move driven by geopolitical and economic tensions. The major catalyst was President Trump’s announcement of a 30% tariff on EU goods effective August 1, which triggered a strong rally in the U.S. dollar and put the euro under heavy pressure. Broader market concerns also intensified as traders braced for further tariffs targeting sectors like copper and pharmaceuticals, compounding bearish sentiment. On our Technical Side EUR/USD recently broke below a major support zone at 1.1700, confirming a Change of Character (CHoCH) and signaling that sellers are now in control. After the break, the pair entered a phase of bearish accumulation, suggesting institutional positioning ahead of a deeper move. A liquidity grab was observed above the previous short-term high, forming a potential stop-loss hunt a common smart money tactic before a major drop. The market now appears poised for another liquidity sweep before triggering our area of interest.

A clear break and close below 1.16870 would likely confirm continuation toward the next minor support at 1.16270, aligning with bearish momentum.

📌 Sell Setup:

Entry: Sell stop at 1.16870

Stop Loss: 1.17140 (above liquidity zone)

Take Profit: 1.16270 (next key support zone)

These developments are reinforcing downside pressure on the euro, while the U.S. dollar remains well-supported by risk aversion and safe-haven flows.

📌 Disclaimer:

This is not financial advice. Always wait for proper confirmation before executing trades. Manage risk wisely and trade what you see—not what you feel.

DXY SHORT?

## 📉 **DXY Bearish Setup for 2025 – Fed Cuts, Fiscal Strain, Technical Breakdown**

### 🧠 Thesis

The U.S. Dollar Index (DXY) is poised to remain under pressure through the rest of 2025 due to macro, policy, and technical headwinds. With the Fed preparing for multiple rate cuts, rising fiscal imbalances, and a strong global diversification away from USD, the broader trend points **downward**.

---

### 🔍 Fundamentals Driving USD Weakness

* **Federal Reserve Pivot**: 2–3 rate cuts expected in 2025 → erodes USD yield advantage.

* **Surging U.S. Deficits**: Debt-to-GDP nearing 130%, undermining investor confidence.

* **De-dollarization Trend**: Central banks diversifying reserves (yuan, gold, euro).

* **Political Noise**: Tariff risk + weak-dollar narrative from Trump camp adds pressure.

---

### 📊 Technical Outlook (1D/1W Charts)

* DXY is trading below **9/20/50 EMA**.

* RSI \~43 with hidden bearish divergence.

* Clear **descending channel** since mid-2024.

* Key **support zone: 97.90 – 96.40**.

* Below 97.90 opens path toward 96.00–95.00.

---

### 🛠️ Trade Setup

| Type | Short (swing/position) |

| -------- | ---------------------- |

| Entry | Break below 98.00 |

| Target 1 | 96.40 |

| Target 2 | 95.00 |

| SL | Above 99.50 |

| R\:R | \~2.5:1 |

---

### ⚠️ Risks

* Surprise inflation → Fed pauses cuts

* Safe haven bid from geopolitical shocks

* Strong upside breakout >101.00 = trend invalidation

---

### 💬 Final Note

As long as DXY remains below 99.50, rallies are selling opportunities. Watch the 97.90–98.00 level — a confirmed breakdown could mark a fresh leg lower toward 95.00 by year-end.

---

### 🏷️ Tags

`#DXY` `#USD` `#DollarIndex` `#Forex` `#Macro` `#Bearish` `#TradingSetup` `#ShortUSD`

---

ETH – $7k Target in Sight

7k incoming on CRYPTOCAP:ETH —timing is up in the air, but the chart looks stellar.

A decisive break above $3,500 should kick off aggressive expansion.

Meanwhile, ETHBTC has been rallying hard off its lows; I’m eyeing a 50% gain against BTC over the next 2–3 months.

Holding through this strength makes sense—it’s been a long time since we’ve seen these setups.

HBAR – Key Level Holding, Trend Could Follow

BINANCE:HBARUSDT looks great here around 15c—a strong pivotal area.

As long as this level holds, there’s a real chance we start trending from here.

There’s a clear abyss below, so invalidation is straightforward.

Utility tokens might be next to move—keeping a close eye on this one.

ETH – Watching the $2,900 Trigger for ATHsJust need BINANCE:ETHUSDT to break above $2,900 for the next trigger.

Feeling confident it will chew through the current supply zone.

Plenty of other coins are already showing clear direction, and Ethereum should follow.

Be patient—I doubt ETH will challenge the #1 spot, but a move above $2,900 opens the door to a potential new ATH.

$POPCAT - Chance of Seeing $1 in Q3

Haven’t posted much about Solana coins lately, but they’re starting to show signs of life again.

$POPCAT had a clear entry right at the weekly FVG below 33c. From here, it either retests the Monthly Open or begins a slow grind higher.

It performed exceptionally well last year, so there’s a good chance to offload some around the $1 mark if momentum picks up. BYBIT:POPCATUSDT

MOODENG – Wave 2 In Play, More Upside Ahead

Might be a bit bold here, but I see OKX:MOODENGUSDT pushing higher as long as it holds the 13c level.

It had a strong impulsive move, and this looks like wave 2 of the current momentum.

Daily downtrend signals from the local high have already expired, increasing the odds of continuation from here.

If momentum picks up, I’m eyeing 40–44c as a potential target zone.

MOODENG isn’t done yet!

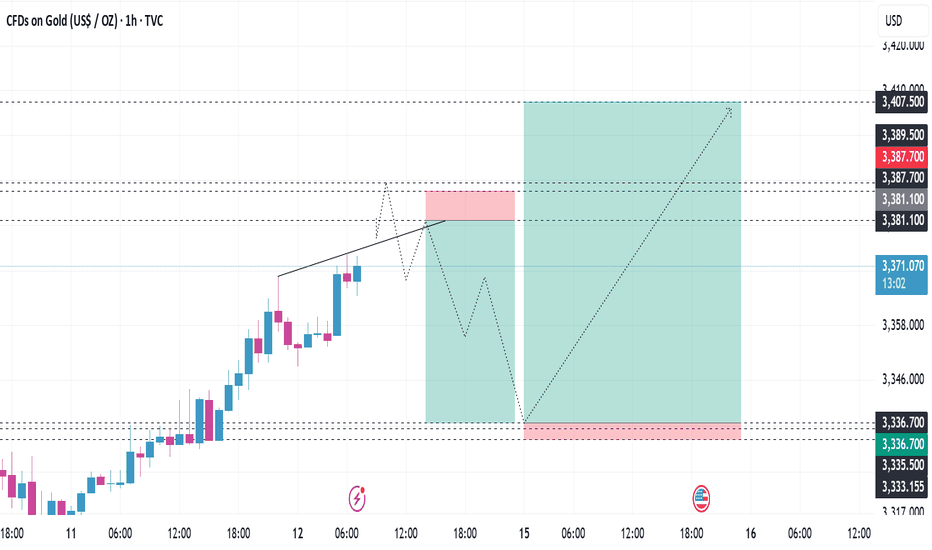

Update gold time 1 hourI checked on the 15 minute time frame and saw liquidity points for us to consider trading, Gold price is being supported, candlestick patterns are showing signs of breaking resistance so consider volume for the sell-off plan. If you do not have a buy order in the idea below 👇

then set up a buy order according to this trading idea, good luck to you and us.

NASDAQ: Time For A Pullback?In this Weekly Market Forecast, we will analyze the NASDAQ for the week of July 14 - 18th.

The NASDAQ had a strong week, until Tariff Tensions Friday arrived.

This by itself doesn't mean we should start looking for sells. Just like the S&P 500, I'm expecting short term bearishness, as price goes from ERL to IRL.

With Tuesday CPI Data coming, this short term consolidation is to be expected until the news is announced.

Let the markets pick a direction, and flow with it.

Have a plan of action in place so you can react to the price action promptly!

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

EUR/USD Sells from 1.17200 back downWeekly Outlook: EUR/USD (EU)

This week, my bias on EUR/USD is similar to GBP/USD, as both pairs have been following a consistent bearish trend. Based on this structure, I’ll be watching to see if price begins a retracement back into an area of supply.

I’ve marked out the 8-hour supply zone, which sits at a premium level and was responsible for the last break of structure to the downside. If price retraces into this zone, I’ll look for potential sell confirmations on the lower time frames.

If price doesn’t tap into the supply zone first, I’ll then shift my focus to the 8-hour demand zone below. In that case, I’ll watch closely for signs of accumulation and a bullish reaction from this level, which could signal the start of a rally.

Confluences for EUR/USD Sells:

✅ Bearish trend has been consistent for the past few weeks.

✅ Breaks of structure have formed new supply zones to trade from.

✅ Liquidity exists below current price, which may be targeted first.

✅ The lower demand zone remains unmitigated, suggesting further downside movement.

📌 On the way down toward demand, I expect price to form another break of structure to the downside. The plan is to ride the sells down into demand, then look for potential buy opportunities if price begins to accumulate and react.

Let’s stay sharp and disciplined — have a solid trading week, everyone! 📊

GBP/USD Shorts from 3hr/5hr supply zoneMy analysis this week centers around the continuation of the bearish trend we've been observing. Recently, there was a break of structure, and a new supply zone has formed—indicating a potential continuation of the downtrend.

I’ll be waiting for price to retrace back into these Points of Interest (POIs), where I’ll look for lower time frame confirmations to catch potential sell entries and ride the move down.

I believe there’s still some bearish pressure left, and I expect price to continue falling until it reaches the 6-hour demand zone. Once we approach that area, I’ll begin looking for Wyckoff accumulation patterns as a signal for a potential reversal or rally to the upside.

Confluences for GBP/USD Sells:

✅ GBP/USD has been bearish over the past few weeks, and this trend may continue.

✅ Breaks of structure have occurred, forming fresh supply zones ideal for entries.

✅ Liquidity exists below current price, which may get swept before a reversal.

✅ The lower demand zone still needs to be mitigated, suggesting more downside movement first.

📌 If price fails to react properly at the 3-hour supply, I’ll be watching for a move into the 5-hour supply zone, which sits in a more premium area and may offer a cleaner reaction.

Let’s stay patient and focused — wishing everyone a profitable trading week ahead! 📉💼

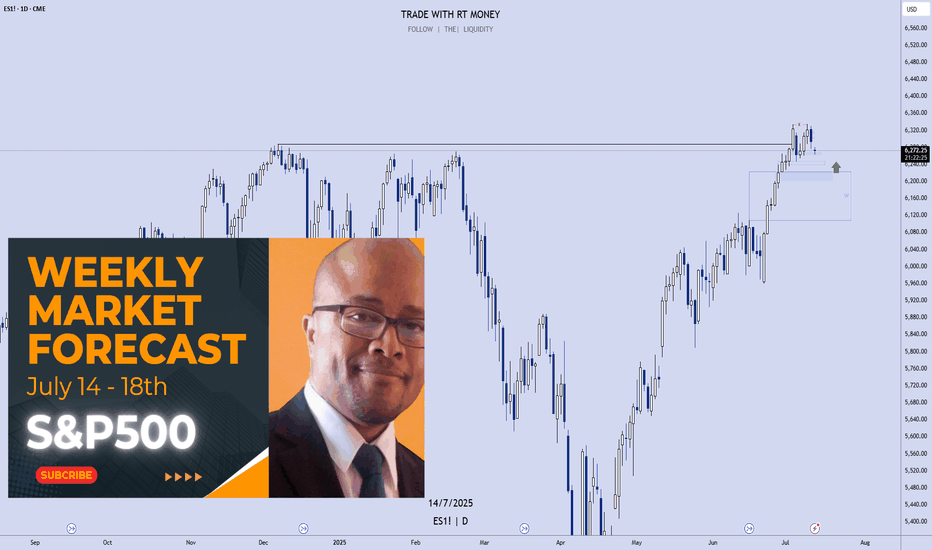

S&P 500: Time For A Pullback??

In this Weekly Market Forecast, we will analyze the S&P 500 for the week of July 14 - 18th.

The S&P 500 had a strong week, until Tariff Tensions Friday arrived.

This by itself doesn't mean we should start looking for sells. With Tuesday CPI Data coming, this short term consolidation is to be expected until the news is announced.

Let the markets pick a direction, and flow with it.

Have a plan of action in place so you can react to the price action promptly!

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

XAU/USD analysis & outlookWeekly Outlook: GOLD (XAUUSD)

This week, I’ll be monitoring different scenarios, as price is currently far from any of my key Points of Interest (POIs).

My nearest potential buy is around the 3-hour demand zone. While it's not the most ideal entry—since it isn’t located in a discounted area—I’ll still keep an eye on it.

That said, I would prefer to see a deeper retracement into the 6-hour demand zone, which is in a far more discounted region. This zone offers a stronger setup, and I could see price launching from there again if tapped.

We’ve already seen a strong bullish reaction from last week’s demand zone, and based on current momentum, I could see price continuing upward until it reaches my next sell opportunity—the 3-hour supply zone, which sits at a premium level.

Confluences for GOLD Buys:

✅ Bullish structure — price has broken to the upside and remains overall bullish.

✅ Fresh 3H and 6H demand zones formed, which price could return to.

✅ Liquidity above — including trendline liquidity and previous Asia highs.

✅ Fundamentals — potential tariff cuts could fuel long-term bullish momentum for gold.

✅ Bearish Dollar Index (DXY) aligns with the bullish gold outlook.

📌 If price doesn’t retrace and instead continues to push higher, I’ll wait for another break of structure to the upside on the way toward the supply zone before reassessing entries.

Let’s stay focused and let the market come to us. Wishing everyone a great trading week ahead! 👊📈