Supply and Demand

NZDUSD: Important Breakout 🇳🇿🇺🇸

NZDUSD looks bearish after a false violation of a current daily structure high.

The price dropped with a high momentum bearish candle, violating

a significant support cluster and closing below that.

The pair may fall even more.

Next support - 0.5952

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

#OTHERS.D ~ Do you believe in Castles in the SKY?I believe that the Others dominance metric divided by an ounce of real money #Gold gives us a valuable insight into the fabled altseasons.

Because as this chart shows theres only been 4 in actuality

and you normal get a double bubble in a cycle.

So I believe we are at the cusp of turning things around as most people have given up on the concept of altcoins ever pumping again.

But it was just the business cycle #PMI that has depressed prices for the past few years.

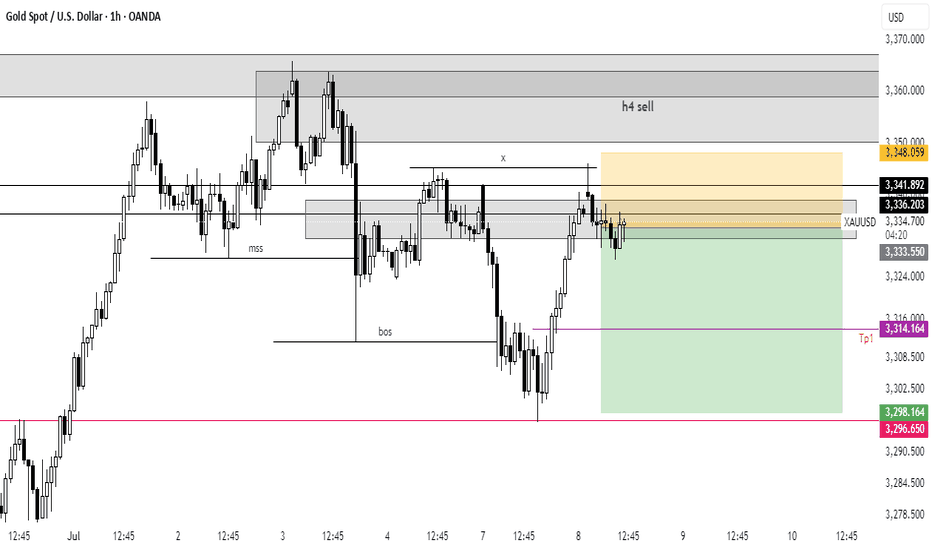

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

We like it when the indicators and algo's work but when it doesn't quite go to the KOG Report plan it is a bit disappointing. It just goes to show the market has it's plan and all we're doing is adapting and looking to take a few crumbs from it.

Following on from yesterday, we had a red box break and our bias level broke which meant no long trade early session, instead, we completed all but one of the bearish targets in one swoop.

We then updated traders suggesting the liquidity indicators are showing that a reversal is on the way and as support formed at the key level we managed to get the long instead into the 3330 level which is where we are now. Support now is the 3320 region but as you can see we're above the red box. That makes this a crucial level, if we hold, we continue with the plan on the KOG Report and potentially get our short from higher up, or, we wait and see how that box below reacts to price.

Either way, it's too late in the session to do anything, we'll come back tomorrow.

RED BOX TARGETS:

Break above 3350 for 3355, 3360, 3362, 3365, 3374, 3388 and 3396 in extension of the move

Break below 3335 for 333✅1, 3324✅, 3321✅, 3310✅, 3306✅ and 3293 in extension of the move

As always, trade safe.

KOG

KOG - US30US30

Looking at this we have a clean reversal in play suggesting we’re going to get lower order regions before a potential RIP. The red boxes have been added and may give us opportunities to capture the tap and bounces on the smaller TFs.

If we can support lower, we could very well see this push up into the ideal target level we have illustrated.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

TIAUSDT Monitoring Completion of Bearish 5-Wave FormationTIAUSDT remains in a structured downtrend, nearing completion of a potential 5-wave bearish pattern similar to a previous setup that led to an upside breakout before resuming the decline. A similar scenario is anticipated this time, with plans to go long if price action confirms a strong rejection around Wave 5.

A projected ABC corrective move outlines the near-term bullish targets. The $4.648 level will act as a key pivot; a breakout above it could shift momentum bullishly, opening the path toward $9.144. However, failure at that level may trigger renewed downside toward the $1.30–$1.55 demand zone.

BankNifty levels - Jul 09, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamics evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We trust that this information proves valuable to you.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you successful trading endeavors!

Nifty levels - Jul 09, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

GBPCAD: Bullish Continuation Ahead?! 🇬🇧🇨🇦

One of the pairs that we discussed on the today's live stream

is GBPCAD.

The price nicely respected a key daily/intraday horizontal support.

A double bottom pattern on that and a bullish violation of its neckline

provide strong bullish confirmations.

I expect up move to 1.8666

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

The Unicorn Model: : Guide to ICT’s Best Standalone setup🦄 The ICT Unicorn: The Most Powerful Setup in ICT

Among all the concepts of ICT, the Unicorn setup stands out as the ultimate precision entry model, it’s confluence perfected. Why? Because it merges two of the most potent ideas in ICT theory: Breaker Blocks and Fair Value Gaps into a single zone.

This combination creates the most high-probability, sniper-level setup in the entire ICT playbook.

Why It’s the Best you think?

Most ICT setups (like simple FVGs, order blocks, or liquidity sweeps) offer high-probability trades on their own, but the Unicorn setup stacks the odds in your favor by combining multiple layers of confirmation. This makes it the most disciplined and rewarding entry model for traders who rely on market structure.

Core Concepts Explained

A breaker block is a former order block that gets invalidated when price breaks structure, then acts as support or resistance upon a retest. It’s a sign of a shift in market intent, from bullish to bearish or vice versa.

A fair value gap (FVG) is a three-candle pattern where a sudden price move creates an imbalance, a "gap" between the wicks of the first and third candle. Price often retraces into that gap before continuing its trend.

When these two concepts overlap, a breaker block and a fair value gap in the same zone, it forms the “unicorn” setup. It suggests a strong level where liquidity has been taken and institutions may re-enter.

How the Setup Work s

First, you identify a market structure shift, like a break in a previous high or low. Then look for the breaker block left behind by that move. Within that block, check if there’s a fair value gap (the imbalance zone). When price retraces back into that confluence zone, wait for a reaction, often a strong reversal or continuation.

Entry is usually taken when price shows rejection within the zone on a lower timeframe. Your stop-loss goes just beyond the breaker block, and your target can be the next high/low or a logical liquidity pool.

Example of a bearish Unicorn Model:

Best Conditions to Use It

This setup works best when used in line with the higher timeframe trend. Many traders analyze structure on the 1-hour or 4-hour chart, then drop to 5-minute or 15-minute charts to enter. It’s commonly used in forex and indices but also works well in crypto or commodities.

Avoid using it during news events though. Like all ICT concepts, it requires patience and practice to identify clean setups and avoid forcing trades.

Example spotted on a Gold setup:

ICT Unicorn Model was first introduced in 2022, primarily applied to the Nasdaq 100 (NQ) and S&P 500 (ES). What stood out immediately was its precision, the kind of clean structure and consistency you don’t often find in most strategies.

As it was tested further, it was clear this wasn’t just for indices. The model transitioned beautifully into forex, especially on major pairs like GBP/USD and EUR/USD, delivering sharp entries as well.

I also tested it on metals like gold (XAU/USD) and silver (XAG/USD), as well as the Dollar Index (DXY), and the results spoke for themselves. Even in crypto, where volatility is the norm, the Unicorn setup held its ground.

It’s rare to find a trading model that adapts across markets this well.

Final Thoughts

The ICT Unicorn is all about confluence and precision. You’re not trading every breaker or every FVG, only the ones that align, especially with a clean shift in structure. When used with proper risk management, it can be a high-probability setup in your playbook.

XAU/USD 08 June 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

You will note that price has targeted weak internal high on two separate occasions forming a double top which is a bearish reversal pattern. This is in-line with HTF bearish pullback phase.

Remainder of analysis and bias remains the same as analysis dated 23 April 2025.

Price has now printed a bearish CHoCH according to my analysis yesterday.

Price is now trading within an established internal range.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,500.200.

Note:

The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively.

Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

H4 Timeframe - Price has failed to target weak internal high, therefore, it would not be unrealistic if price printed a bearish iBOS.

The remainder of my analysis shall remain the same as analysis dated 13 June 2025, apart from target price.

As per my analysis dated 22 May 2025 whereby I mentioned price can be seen to be reacting at discount of 50% EQ on H4 timeframe, therefore, it is a viable alternative that price could potentially print a bullish iBOS on M15 timeframe despite internal structure being bearish.

Price has printed a bullish iBOS followed by a bearish CHoCH, which indicates, but does not confirm, bearish pullback phase initiation. I will however continue to monitor, with respect to depth of pullback.

Intraday Expectation:

Price to continue bearish, react at either M15 supply zone, or discount of 50% internal EQ before targeting weak internal high priced at 3,451.375.

Note:

Gold remains highly volatile amid the Federal Reserve's continued dovish stance, persistent and escalating geopolitical uncertainties. Traders should implement robust risk management strategies and remain vigilant, as price swings may become more pronounced in this elevated volatility environment.

Additionally, President Trump’s recent tariff announcements are expected to further amplify market turbulence, potentially triggering sharp price fluctuations and whipsaws.

M15 Chart:

SOL Long Term Long PositionJSE:SOL credit rating has been stamped with a Ba1 by Moody's which is very unfavourable to the company, wholistically. This is as a result of its weakening operating performance mainly attributed to low demand in the chemicals market and weak oil prices.

With expectations of higher FX:USOIL prices and JSE:SOL being pretty much undervalued, trading near its supporting level of 8600 ZAC, a positive outlook is still evident. Long positions have been executed at 9574 ZAC with a possibility to further capitalize when necessary.

Cite: Sasol outlook downgraded to negative by Moody's Ratings, Ba1 rating affirmed - Luke Juricic

#SOL Update #3 – July 8, 2025🟠 #SOL Update #3 – July 8, 2025

Solana, much like Litecoin, is still undergoing corrections following its latest impulsive move. While it currently holds above a strong support level, two significant resistance zones are ahead.

The market is undecided, and Solana's direction remains uncertain, making it one of the riskiest assets to trade today.

If the $145 support fails, the price may drop toward $137. Conversely, a daily close above $159 could trigger a move toward $167. For now, it's best to stay on the sidelines and monitor the price action closely.

🇪🇺 EURUSD – July 8 | Ranging After FakeoutAfter breaking Thursday’s low, EURUSD gave us 30 pips then started ranging right at that level. Today’s price action is mildly bullish, but likely just a retest of the 4hr bearish structure that’s formed.

📌 Key Levels:

🔼 Safe Buys:

Above 1.18075 (strong resistance)

→ Breakout = ~70 pip opportunity

🔽 Sells / Deeper Pullback:

Below 1.16869

→ Potential 60 pip drop into next liquidity zone

⚠️ Current range is tight and indecisive — not worth trading until we get a break.

Bias still bullish longer-term, but patience needed here.

🇨🇦 USDCAD – July 8 | Trendline Test and Liquidity WatchYesterday USDCAD closed strong bullish (+100 pips) into the March 2024 trendline, which it’s respected multiple times this year.

But there’s a key detail:

➡️ Today’s high is a pip away from yesterday’s — and there’s no upper wick.

That makes this a liquidity risk zone.

📌 What I’m watching:

🔻 Break of 1.36383 = potential shift to bearish intraday structure

→ First target: 1.35827 (yesterday’s low)

→ Then: 1.35432 for swing sell continuation

🔺 Small liquidity grab above today's high possible before drop

🧭 Bias: Bearish on daily + higher timeframes

🎯 Waiting for confirmation, not assumption