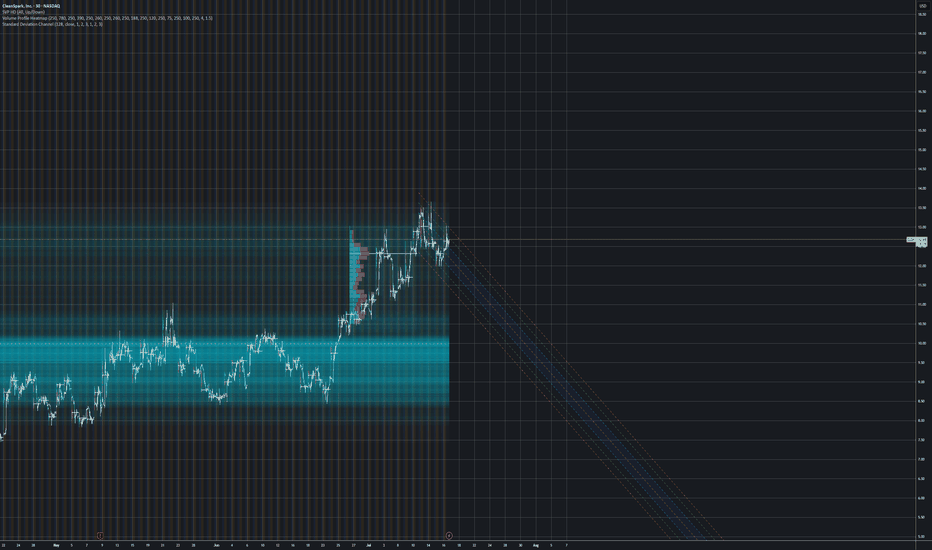

[$CLSK] CleanSpark Inc. - Farming [$BTC] LongNASDAQ:CLSK

no finanical advice

📑market outlook

+ Fed rate cut priced in --> short term risk-on environment

+ total FIAT-debasement in motion --> Precious &Crypto are poomping

- geo-political risk can drag down the 'weaker ANTI-Fiat' risk-on positions

💡idea

we want to farm BTC indirectly by selling covered-calls /placing cash secured puts

🧪approach

derivatives options with i.e. 0.1 BTC ~ 10,000 USD

🏁target

get 2% yield per month

⚠️ caution

Only weekly options: --> Crypto Cycle could take hits of -50% which would basically demolish your position

--> check weekly volume/sentiment on BTC

Don't forget:

⏳ Theta is our alley. Always have been!

Supply and Demand

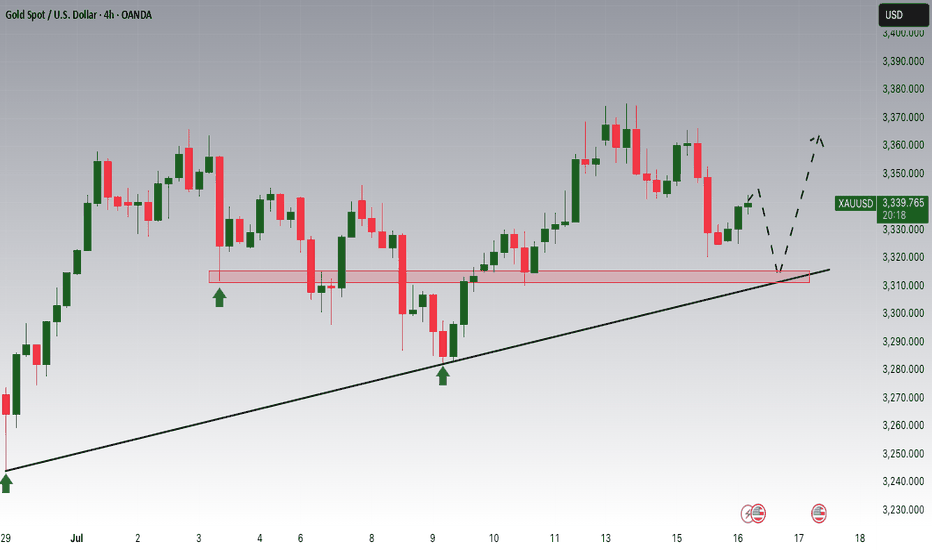

Potential buys?Trade Journal Entry – XAUUSD (Gold Spot)

Date: July 16, 2025

Platform: TradingView (Demo Account)

Timeframe: 4H

Direction: Long

Status: Active, In Profit

Unrealized Profit: +301.54 GBP

Entry: ~3,327

Stop Loss: Below 3,316 zone

Take Profit (TP): ~3,492

Risk:Reward Estimate: ~1:4 or better

Market Context

Previous pullback into the sell-side liquidity and POI zone held firmly.

Price rejected from POI and aggressively moved upward, confirming bullish order flow.

POI (Point of Interest) is marked intentionally — awaiting a return to the zone after price closes above the wick.

A full buy confirmation is expected only upon a bullish close above the wick, followed by a retest into the POI.

Trade Logic

Trade was initiated based on:

- Break of market structure (BMS)

- Sweep of sell-side liquidity

- Bullish intent shown via momentum candles

- Expectation: price returns to POI after wick close for full confirmation

Management Plan

- Consider partial TP at 3,365–3,375 zone.

- Trail SL below latest higher low on lower TF.

- Wait for price to revisit POI after close above wick before scaling in full size.

Emotional Reflection

Feeling composed. The trade plan is well-structured with a POI-based confirmation strategy. No rush to fully size until POI is respected post-wick close.

Reflection Questions

- Did I stick to my POI confirmation logic?

- Am I patient enough to wait for a close above the wick?

- Is my entry risk properly managed while awaiting confirmation?

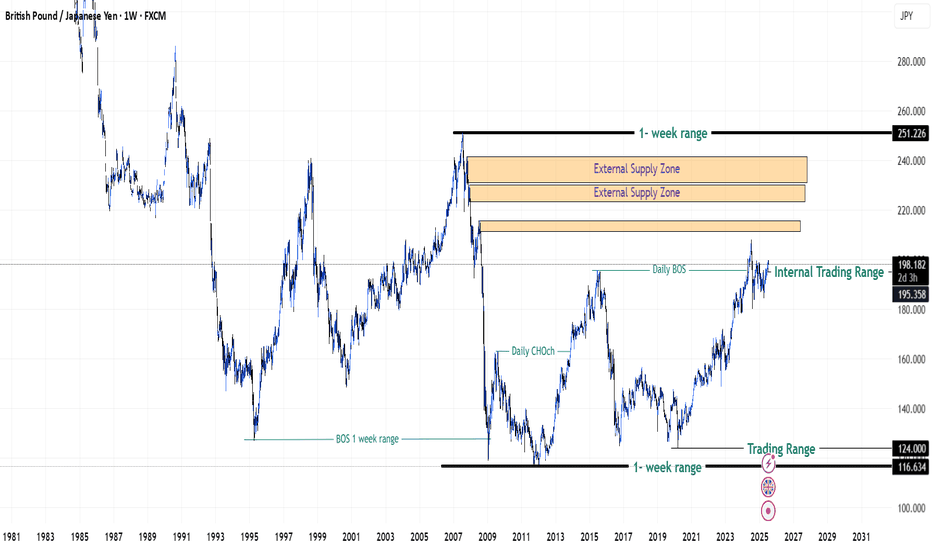

GBPJPY in Premium Zones of 2008 Financial Crisis - {17/07/2025}Educational Analysis says that GBPJPY (FX pair) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - FXCM

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Will Jpy start to lose value like it is doing since 2019 or it will do free fall same like 2008 crisis.

Let's see what this FX pair brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading.

#BNBUSDT: A Major Bull Move Incoming $1000 Target! Binance coin is currently in consolidation phase, with no clear direction of where it will go. We consider two possible areas where it may reverse. Both of these areas have a chance to hit $1000, which we believe the price could head towards once reversed.

If you like our idea, please like and comment!

Good luck and trade safely,

Team Setupsfx_

XAGUSD(SILVER):To $60 the silver is new gold, most undervaluedSilver has shown remarkable bullish behaviour and momentum, in contrast to gold’s recent decline. Despite recent news, silver remains bullish and unaffected by these developments. We anticipate that silver will reach a record high by the end of the year, potentially reaching $60.

There are compelling reasons why we believe silver will be more valuable in the coming years, if not months. Firstly, the current price of silver at 36.04 makes it the most cost-effective investment option compared to gold. This presents an attractive opportunity for retail traders, as gold may not be suitable for everyone due to its nature and price.

Silver’s price has increased from 28.47 to 36.25, indicating its potential to reach $60 in the near future. We strongly recommend conducting your own analysis before making any trading or investment decisions. Please note that this analysis is solely our opinion and does not guarantee the price or future prospects of silver.

We appreciate your positive feedback and comments, which encourage us to provide further analysis. Your continuous support over the years means a lot to us.

We wish you a pleasant weekend.

Best regards,

Team Setupsfx

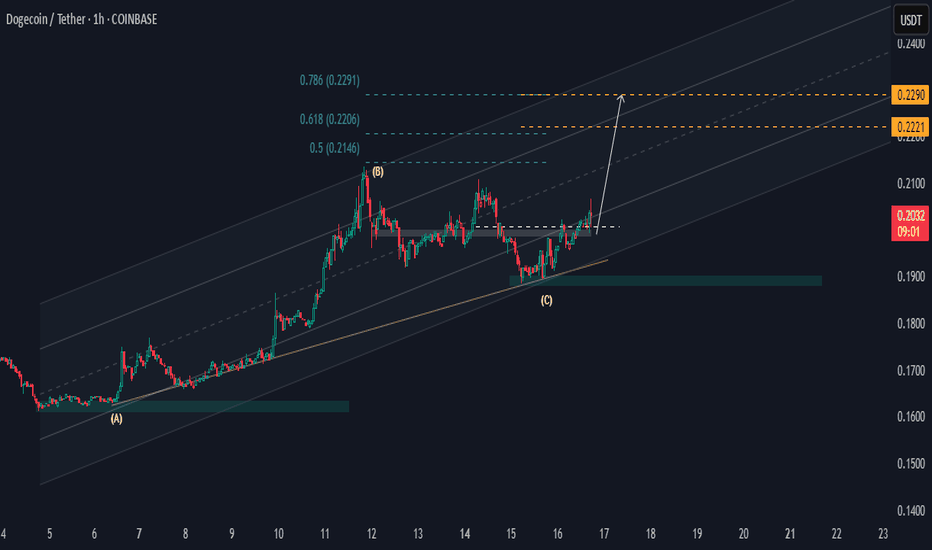

DOGEUSDT: Time For Bulls To Rule! The Dogecoin is currently trading at a key buying level, making it a potential opportunity to buy. However, we need confirmation before making a purchase or entering a trade. This trade could take time to develop as we are currently in the accumulating phase. To be certain of the price direction, we need to enter the distribution phase. While a single swing trade could be a target, you can set your own risk management parameters.

Good luck and trade safely!

Team Setupsfx_

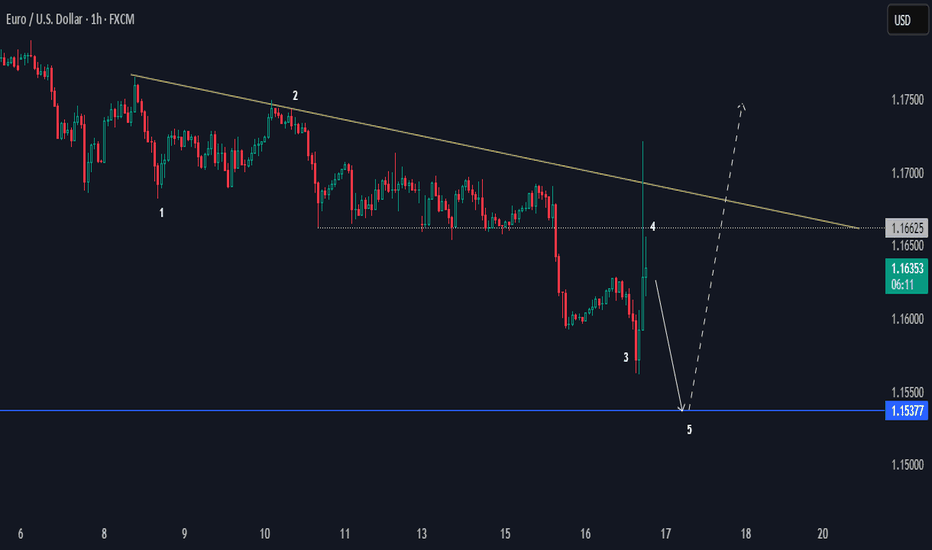

EURUSD Bearish Sentiments Below LowEURUSD looks bearish at H1 for a bias of 1.15377. It's an unusual price action; the overall trend in a higher time frame is bullish, but the 1.1700 had strong bearish pressure.

The current momentum is bearish below 1.16625, making that level a key area zone.

Happy Trading,

K.

Patanjali Foods: A Potential Reversal Brewing Near Demand Zone?The price has now retraced back into a key value zone between 1,610 - 1,635, which has previously acted as a strong base. This zone also coincides with high volume activity on the visible range volume profile - suggesting accumulation interest.

Technically, the stock is near the 0% Fibonacci extension with multiple confluences of past support and volume, forming a potential base.

If this holds, look for retracement targets:

• First bounce zone: ₹1,687 (50% Fib)

• Further recovery: ₹1,745–₹1,775 (Fib 61.8–78.6%)

Long-term: ₹1,861 (161.8% Fib extension), ₹2,016 (261.8%)

Fundamentals Snapshot:

• Market Cap: ~₹58,000 Cr

• P/E: ~34x | P/B: ~3.8x

• Promoter Holding: 80.82% (No pledging)

• Debt-to-Equity: ~0.25

• ROCE: ~13.2% | ROE: ~10.4%

• FII Holding: 3.6%, DII Holding: 6.3%

Patanjali’s brand strength in edible oils, packaged foods, and growing FMCG integration offers secular demand visibility. The recent correction seems sentiment-driven, not structural.

Keep in Focus:

A decisive close above 1,660 could indicate a short-term reversal.

This chart is for educational use only and not a buy/sell recommendation.

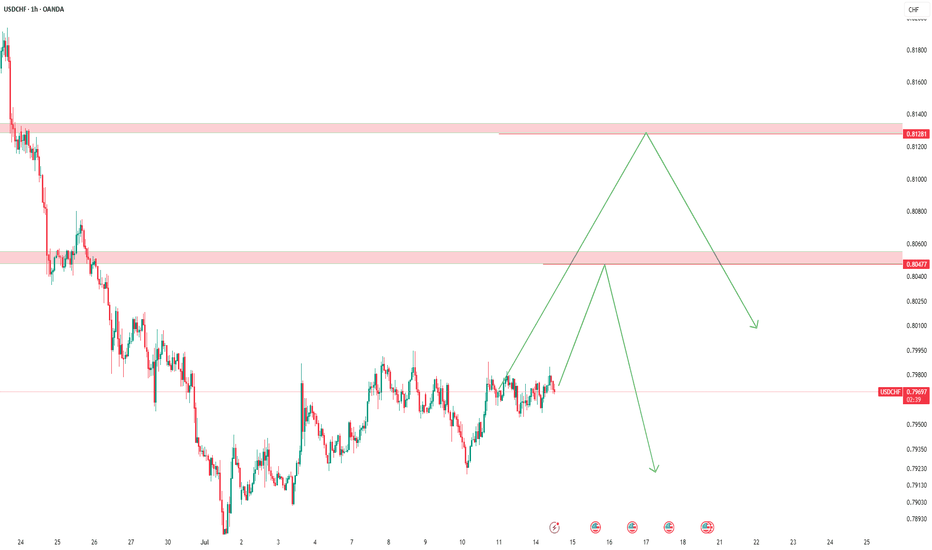

USDCHF – Two Levels, One PlanWe’re watching two key resistance zones for a potential short.

If the first level holds and gives a signal, we’ll short from there.

If that level breaks, we may switch to a short-term buy up to the next level.

Once price reaches the second resistance, we’ll be ready for another sell opportunity.

No predictions — just following the flow.

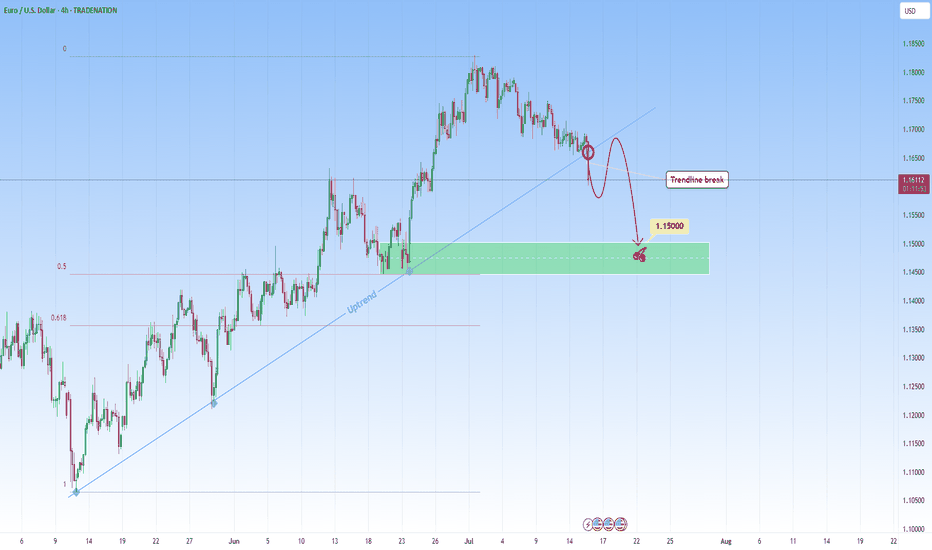

EURUSD: Sell Opportunity after Trendline breakEURUSD was in a steep uptrend but it might stop with this recent break through the uptrend. A break like this one on a strong trendline that had multiple touches, indicates either a potential reversal or major pause in the trend. This candle that broke the trendline signals the first hint of structural change.

I will be waiting for a retest and look to get involved in a short setup.

Ideally, what I look for in retests is to be met with a confirming candle. This would confirm the sellers have taken over and validate the change from uptrend to potential downtrend or consolidation phase.

My target would be around 1.1500.

Just sharing my thoughts for the charts, this isn’t financial advice. Always confirm your setups and manage your risk properly.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis .

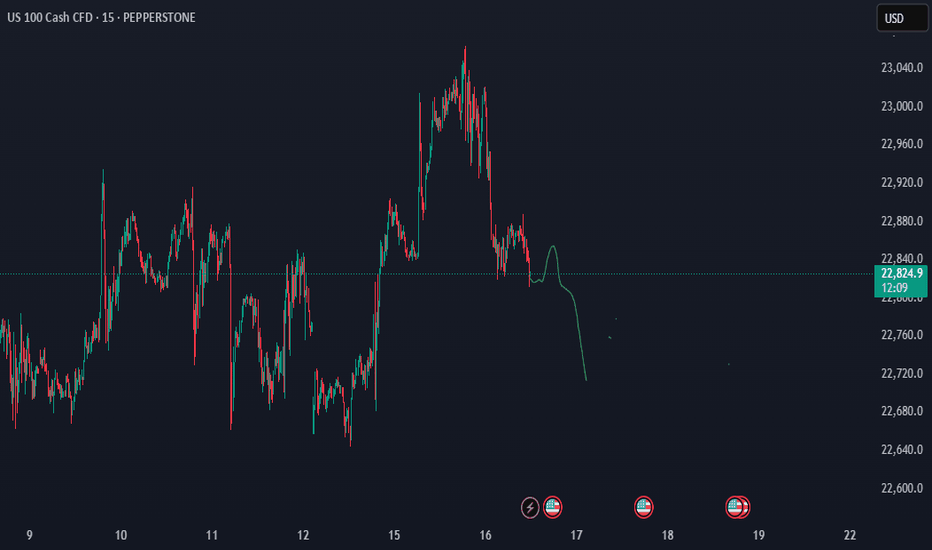

DOGEUSDT Above Key SupportHi there,

DOGE/USDT looks bullish at H1 with two potential price targets for a bias of 0.2290.

The price made a higher low at the 0.1900 area zone and pushed above the key level of 0.1990, and it is hovering above this level. Now, as long as the 0.1900 sustains the 0.1963 low, then the price will rally to previous highs.

Happy Trading,

K.

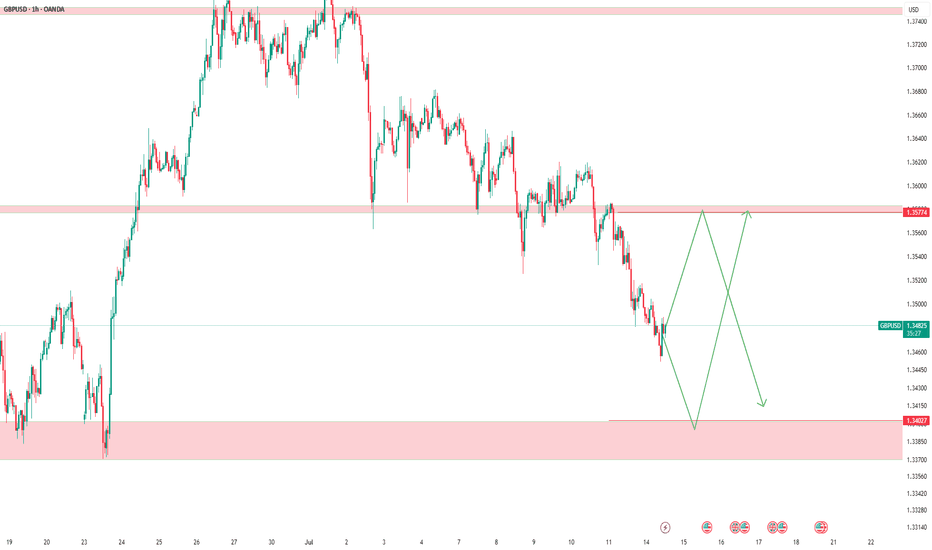

GBPUSD – Levels, Adjustments, and Scenario PlanningAs mentioned in our pinned analysis, we had two levels on GBPUSD —

✅ Both of them were broken.

📉 After the break of the first level, we shorted the pullback and took a great profit.

📍 Now after the second level has also broken, I’ve adjusted the level slightly —

There’s a chance price retraces to 1.35774 before continuing its drop.

🟢 Below, there’s a solid buy zone.

🔁 My Updated Scenarios:

✅ If price pulls back to the short level before hitting the buy zone → I’ll take the short.

⚠️ But if price touches the buy zone first, then any short afterward will just be partial or used for pyramiding — not a major trade.

Let’s stay patient and let the market tell us what to do.

📌 All previous scenarios are still valid.

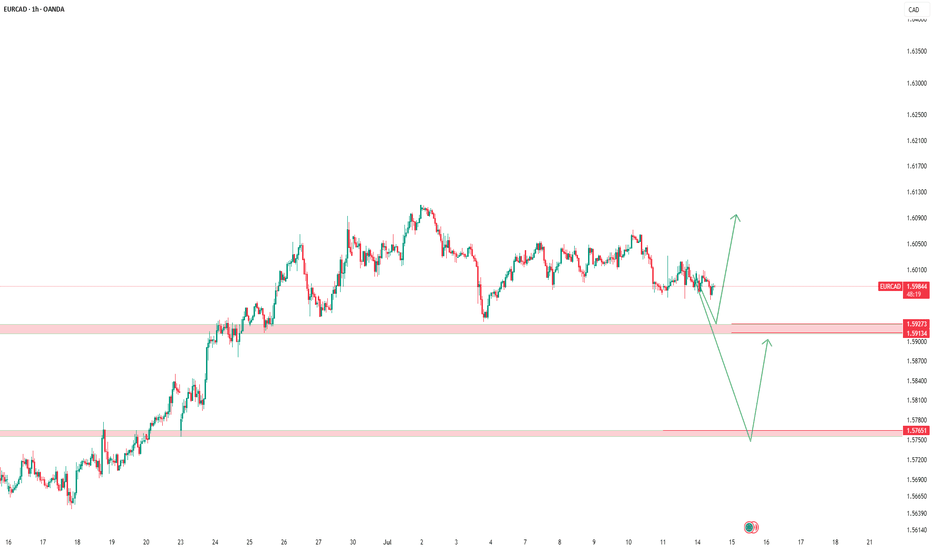

EURCAD – Two Key Levels, One Solid PlanOn this pair, we have two important levels:

🟡 The first level might act as a trap (stop hunting).

So don’t rush to buy — wait for confirmation.

🟢 The second level offers a safer buy opportunity.

As always, our plan stays firm —

we don’t tell the market what to do, we follow it.

🔻 If a clean break and valid pullback occurs on the first level,

a short trade toward the lower level is possible.

⚠️ This pullback short scenario is only valid until price reaches the lower level.

If price hits the lower level and starts moving up,

any short position becomes much riskier.

Discipline > Prediction.

Where is the rebuy zone for CKB? (2D)From the point where we placed the red arrow on the chart, the CKB correction has begun.

It seems that CKB is in a bearish wave C.

We have identified two entry points for rebuy, where a position can be taken in the spot market.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Ethereum $ETH – Perfect Accumulation to Rally Move!

🔸 Ethereum CRYPTOCAP:ETH – Perfect Accumulation to Rally Move!

ETH perfectly hit our long-term buying zone between $1,900 – $1,500, where we accumulated heavily. This range once again acted as a strong demand zone and launchpad.

🔸 Target: $4,000 – $4,500

After hitting our buying range, ETH has now rallied to $3,250 — showing strong bullish momentum. If price continues to hold above $3,000, the next target zone is $4,000 – $4,500.

🔸 Risk Level:

Any breakdown below $2,200 would weaken the structure and shift the bullish outlook. This is our invalidation level on a higher time frame.

🔸 Outlook:

Partial profit-taking around $3,200 – $3,500 zone

Hold remaining positions for $4,000+ targets

Use $2,900 – $3,100 zone for fresh or re-entries on dips

Maintain tight stop loss under $2,200 if adding new exposure

Ethereum's Road to $7500 – Strategic Entries & Profit Optimizati🔵 Entry Zone: My first position is placed at $2225.5, aligning with a strong support level, while a secondary entry at $1857.5 serves as an additional safeguard against unexpected market swings—lowering my average purchase price and protecting capital.

💰 Profit-Taking Strategy: For low-risk traders, securing a 40% profit from the first entry is a prudent move to lock in gains early. However, my long-term target remains ambitious.

🚀 Main Target: Based on valuation models and fundamental news, Ethereum’s upside potential points toward $7500. However, I personally plan to secure 90% of my holdings at $6000, ensuring strong profit realization while leaving room for further upside.

This setup balances risk management, smart positioning, and strategic profit optimization. Let’s see how ETH’s trajectory unfolds!

Entry1: 2225.5

Entry 2: 1857.5

If your second entry is successful, you are required to withdraw 50 to 70 percent of your capital to maintain your capital. I will definitely update this setup.

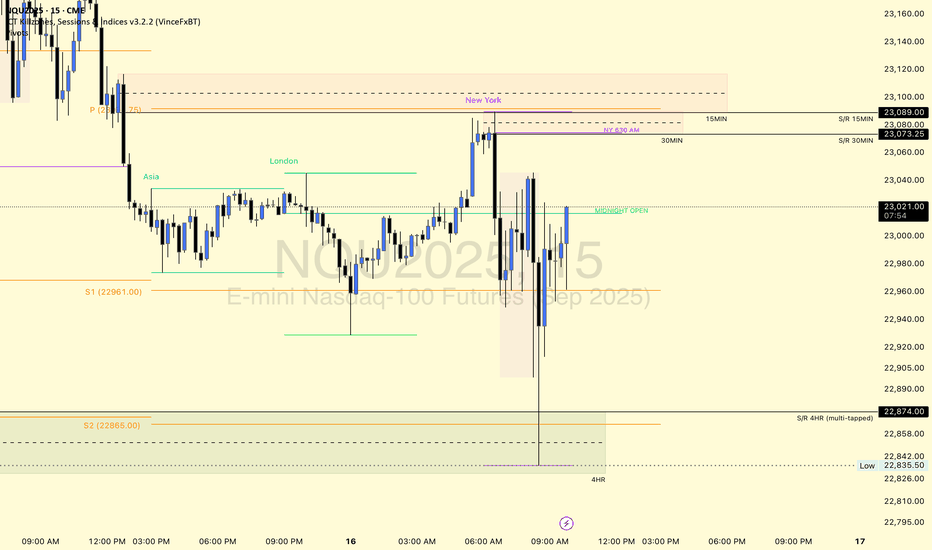

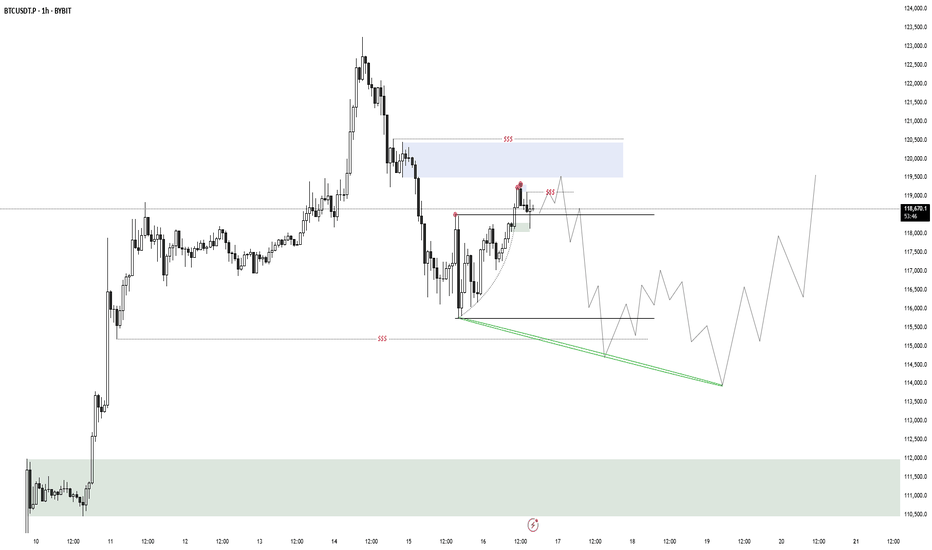

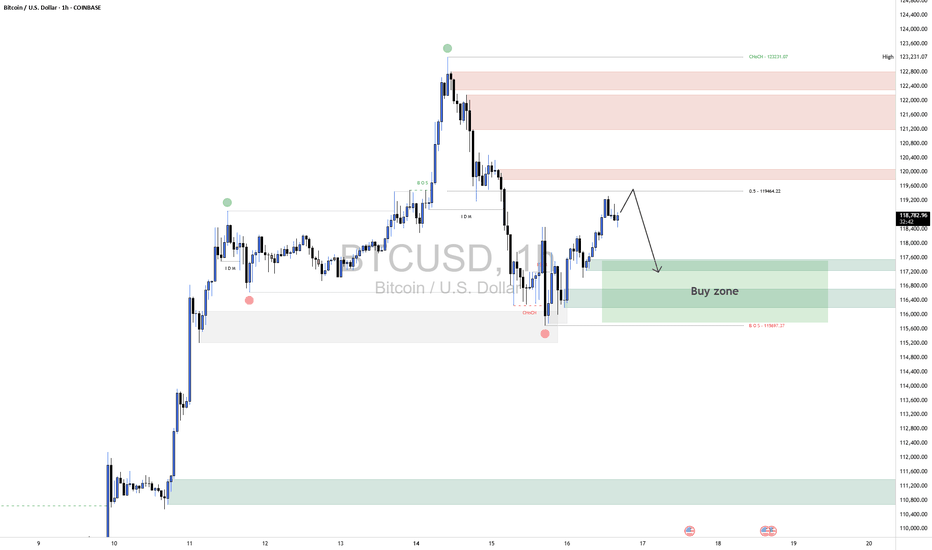

BTCUSD ShortBTCUSD 1H Technical Analysis

⚙️ Scenario Outlook:

Bias: Bearish

Preferred Play: Wait for price to enter the 119,000–120,000 supply zone. If price shows signs of exhaustion or bearish confirmation (e.g. bearish engulfing, strong rejection), a short position becomes favorable.

Targets: First target at 117,200; final target near 115,600–115,000 range, depending on how price behaves within the intermediate demand.

🔼 Supply Zone (Resistance):

Zone: 119,000–120,000

This red zone marks a previously unmitigated supply area aligned with the 50% Fibonacci retracement level from the prior bearish impulse. It's expected to act as the final resistance before the next move lower. A rejection from here would confirm bearish intent and offer optimal risk-to-reward for short setups.

🔽 Demand Zones (Support Targets):

First Demand Zone: 117,200–117,600

This green border is your first liquidity pocket to watch. It may offer a brief reaction or bounce, but if bearish momentum holds, price is likely to continue through it.

Deeper Demand Zone: 115,600–116,200

This is the stronger accumulation area, marked by your lower green zone. It sits just above the previous CHoCH and BOS lows, making it a prime liquidity sweep and reversal candidate if price moves deeply into it.