AUDNZD Breakout Retest – Ready for the Next Bullish Leg?

AUDNZD has broken out of a prolonged consolidation box, supported by a demand zone below. Price is currently retesting the breakout level, which often acts as a launchpad for the next move.

🧠 Key Observations:

🔷 Consolidation Breakout – Price cleanly broke above the consolidation range.

🔁 Retest in Progress – A potential bullish retest is unfolding at 1.0800 area.

🟦 Demand Zone below offers strong support around 1.0730–1.0750.

🎯 Target: 1.08750 (pre-identified resistance zone)

----------

📌 Trade Plan:

🎯 Take Profit (TP): 1.0875

🛑 Stop Loss (SL): Below 1.0750 demand zone

🧭 Bias: Bullish

📊 Strategy: Breakout–Retest–Rally

Supplyanddemmand

NASDAQ Bullish Play into Liquidity Before Potential ReversalForecast:

NOTE: At this moment, this is a forecast and trades will be taken dependent on live PA.

Price has reacted strongly off the 21,410–21,430 Daily Order Block, suggesting bullish intent. If bullish structure holds, I expect a move into the 22,060–22,130 liquidity zone, where sell-side setups could form.

This is a classic Buy to Sell model:

Buy from OB at ~21,420

Target liquidity above recent highs (~22,100+)

Look for shorts after sweep into 22,130–22,220 range

Invalidation: Break and close below 21,410 suggests the OB failed — potential deeper drop toward 20,700.

GOLD → Need to break Triangle Pattern !!!Gold Analysis

Following a rejection at the 3,120.00 level last Thursday — a key H4 demand zone — gold is currently forming a triangle pattern.

🟢 Bullish Scenario:

If the price breaks above the 3,250.00 level, it may present a buying opportunity with the nearest target at 3,320.00 .

🔴 Bearish Scenario:

If the price breaks below the lower trendline of the triangle pattern, the nearest selling target is seen around 3,055.00.

Best Regard

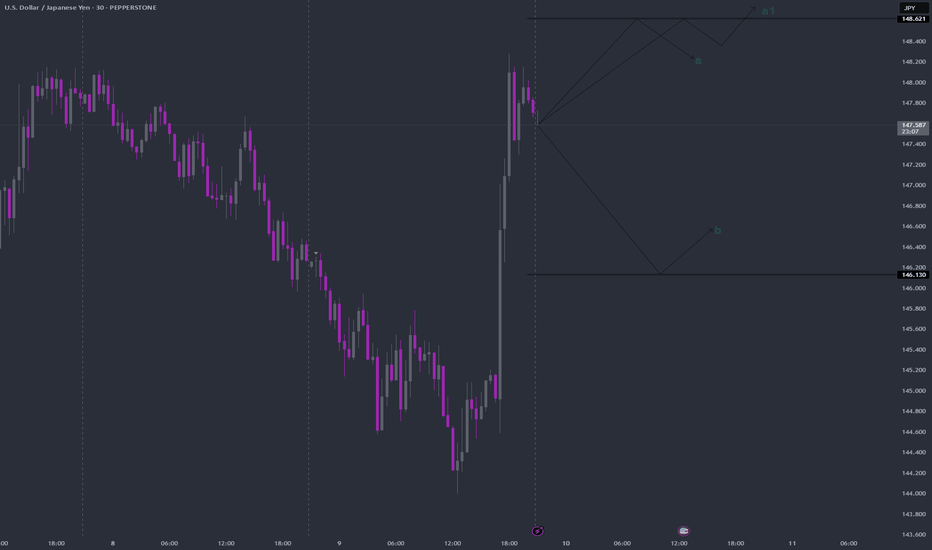

USDJPY Bullish Breakout Setup – Retest at Key Demand ZoneUSDJPY is respecting a clean bullish structure after rebounding from the 140.100 base. Price made a higher high near 148.650, followed by a pullback into the previous demand zone around 145.000.

Technical Breakdown:

Market Structure: Higher highs and higher lows indicate a strong uptrend.

Demand Zone: Clean reaction from the 145.000 zone, which previously acted as resistance-turned-support.

Target Zones:

First TP: 147.900 (previous swing high)

Final TP: 150.600 (key resistance level)

Invalidation Level : Close below 144.800 could invalidate this bullish scenario.

If price sustains above 145.000, the bullish trend is likely to continue.

As always, manage risk carefully.

Like & Follow for more clean, high-timeframe breakdowns!

USDJPY - at potential Buy SetupOANDA:USDJPY is nearing a significant support area that has reversed bearish trends into bullish momentum. This support level aligns with prior price reactions and represents a strong foundation for potential upward moves.

If buyers confirm their presence with bullish price action, such as long lower wicks or bullish engulfing candles, I expect the price to go toward 151,100. Also, a break below this support could signal further bearish continuation.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management!

Bitcoin's Bullish Breakout: Targeting $126,500!

Introduction: Bitcoin (BTC) has recently experienced a significant price surge, reaching new heights. For those new to cryptocurrency trading, understanding this movement is crucial. In this post, we'll break down the current BTC price action and discuss potential trading strategies.

Current BTC Price: As of now, Bitcoin is trading at $101,254.00 USD.

Key Levels to Watch:

Support Level: $94,500 USD

Resistance Level: $105,000 USD

Market Sentiment: The market is currently bullish, with increased trading volume and positive news surrounding Bitcoin's adoption.

Potential Price Target: Based on the "Cup and Handle" pattern, a technical analysis chart pattern, the projected price target for Bitcoin is $126,500 USD.

Trading Strategy for Beginners:

1. Entry Point: Consider entering a long position if the price retraces to the $94,500 support level.

2. Stop-Loss: Set a stop-loss just below the $92,000 level to manage risk.

3. Take-Profit: Aim for a take-profit at the $126,500 target.

Important Note: Cryptocurrency markets are highly volatile. It's essential to conduct thorough research and only invest funds you can afford to lose.

Conclusion: Bitcoin's recent price action presents potential trading opportunities. By understanding key levels and technical indicators, beginners can navigate the market more effectively. Always remember to trade responsibly and stay informed.

Let's Discuss! What are your thoughts on Bitcoin's current price action? Do you agree with the projected target of $126,500? Share your insights and let's engage in a constructive discussion!

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions.

By inviting readers to share their thoughts and engage in a discussion, you can foster a more interactive environment and encourage traders to participate in the comments section.

10 Brutal Truths About Why Retail Support & Resistance Fail !CAPITALCOM:GOLD

10 Reasons Why Retail Support and Resistance Levels Fail: Unlocking Gann’s Secrets to Market Mastery

Here’s a deeply researched, professional explanation for each point, infused with Gann’s quotes, examples, and concepts, to open the eyes of traders to why retail methods often fail and how Gann's wisdom provides clarity.

1. Static Levels in a Dynamic Market -

Explanation: Retail traders often draw support and resistance (S/R) lines as static horizontal levels, expecting the market to repeatedly respect them. However, Gann emphasized the dynamic nature of markets, stating:

"Markets are never still; they are always moving, reflecting time and price interplay."

Markets are influenced by cycles, trends, and time frames, making S/R levels fluid rather than fixed. For instance, Gann’s Square of Nine shows how support and resistance rotate based on angles and time increments, offering precise levels that adapt dynamically. Retail traders fail to adjust their levels as time progresses, missing key changes in price behavior.

2. Failure to Incorporate Time -

Explanation: Retail S/R methods typically ignore the role of time, which is a critical element in Gann's work. Gann wrote:

"Time is the most important factor in determining market movements."

Support may fail not because the level was invalid but because the "time factor" for that level has expired. For example, in Gann’s Time Cycles, support at a certain price might hold only for a specific duration. When that time passes, the level loses its relevance. Retail traders, unaware of such timing principles, are often blindsided when the market breaks their "strong" levels.

3. Lack of Confluence with Angles -

Explanation: Gann’s methodologies prioritize the confluence of price and angle relationships. He believed that price moves in harmony with geometric angles, stating:

"When price meets time at an angle, a change is imminent."

Retail traders fail to consider these angular relationships, focusing only on flat horizontal lines. For example, a 45° angle from a significant low often acts as a true support, but retail traders, relying solely on previous price zones, miss these powerful turning points.

4. Overcrowding and Psychological Herding -

Explanation: S/R levels widely used by retail traders often attract a large number of orders at the same price zone, making them predictable and vulnerable to institutional manipulation. Gann noted:

"The crowd is often wrong, and the minority drives the market."

Institutions exploit this herding by triggering stop-losses just below support or above resistance, creating false breakouts. For instance, Gann’s "Law of Vibration" explains how markets seek equilibrium by disrupting imbalances created by crowd psychology.

5. Ignoring Volume Analysis

Explanation: Retail traders rarely integrate volume into their S/R analysis. Gann emphasized the importance of volume, stating:

"Price movements must be confirmed by volume to validate strength."

Support may appear to hold, but without accompanying volume, the level lacks significance. A practical Gann-based example would involve observing increased volume near a critical angle or price zone, signaling genuine strength or weakness at that level.

6. Using Recent Highs/Lows Without Context -

Explanation: Many retail traders base S/R levels on recent highs and lows, assuming these are universally strong zones. Gann criticized such oversimplified approaches, writing:

"The past governs the future, but only through proper analysis of cycles and patterns."

Without analyzing historical patterns and cycles, these levels are often superficial. For example, Gann's Master Charts reveal that true resistance may lie at a harmonic distance from an earlier historical pivot, not necessarily at the recent high.

7. Misunderstanding False Breakouts -

Explanation: Retail traders often misinterpret false breakouts as failures of support or resistance. Gann explained this phenomenon through his price and time squares, stating:

"A breakout without harmony is often a trap, designed to mislead the majority."

For instance, a false breakout above resistance might align with a Gann angle signaling a reversal, confusing those relying solely on retail S/R levels.

8. Ignoring Market Structure and Trend -

Explanation: Retail traders often focus on S/R levels without understanding the broader market structure or trend. Gann believed:

"The trend is your friend until time signals the end."

Support is more likely to hold in an uptrend, while resistance is stronger in a downtrend. A classic Gann principle involves combining market structure with angular analysis to determine whether S/R levels will hold or break.

9. Failure to Account for Gann's Price Harmonies -

Explanation: Gann’s studies reveal that price moves in harmonic relationships, often tied to Fibonacci ratios and geometric principles. Retail traders using arbitrary S/R levels fail to respect these harmonies. For example, Gann's observation of price doubling or halving (e.g., $50 to $100) often defines true support or resistance.

10. Reliance on One-Timeframe Analysis -

Explanation:

Retail traders frequently analyze S/R on a single timeframe, missing the interplay between multiple timeframes. Gann emphasized multi-timeframe alignment, writing:

"The major trend governs the minor trend, and the minor trend refines the major."

Support on an hourly chart may fail if it conflicts with resistance on a daily chart. Gann’s multi-timeframe methods ensure alignment, reducing the likelihood of failure.

Updated Closing Thought-

By understanding the reasons why retail support and resistance often fail and incorporating Gann’s time-tested principles, traders can elevate their skills to a professional level. Gann's focus on time, price, and geometry provides a roadmap to understanding the market with unparalleled precision.

This content is invaluable for anyone seeking trading mastery, so don't keep it to yourself! Save this and share it with your friends so they can benefit too. Follow for more absolutely valuable and free trading insights!

A case for long term investment and DCANYSE:VALE Is at an inflection point. It is a stock I have been watching for a long time as it has a nice Elliott wave pattern (If correct)

Here I present the Weekly chart as I consider it for my long term portfolio (3+ years BUY and Hold)

Although the chart presented here looks great (Read: Phenomenal), as an analyst utilising multiple methods, the story does not unfold as easily as I'd like.

As can be seen in the snapshot below there are multiple 'anomalies' still outstanding at those green zones on the magnified weekly chart. They may or may not be filled, but our awareness of them should cause us to move forward with caution.

On the Elliottwave side of things, there are two ways of looking at this. Either the recent top at ~$23 was wave i of 3 of (3) or the top of Primary w(1). If the latter is true then we will likely drop lower in to one of the green bands.

So the question remains - how do we take advantage of this given a drop to just above $3?

1) You can Dollar Cost Average in at each stage distributing your allocated capital

2) Wait for a bounce in a five wave move and enter at the correction for w2 of that bounce. Use the low for a stop loss.

There is no perfect way to manage the unknowns, you can only manage your primary objective, which should be to safeguard your capital -

If you want to know my thoughts on NYSE:VALE and other names give this a boost and follow.

best of luck!

EURCAD shortShorts on EURCAD could be a nice play depending on how we approach our supply zone. I have 3 zones currently marked out but the first one was a previous structure point and had a little bit of accumulation so I have a higher confidence in that one holding. Will be waiting for lower timeframe entry after price arrives at the zone.

EURAUD SHORTThis week gave a big drop on EUR/AUD and turned the Daily and 4h timeframes bearish as well as giving a clean head and shoulders pattern on the daily timeframe. I will be looking for a pull back into the 4h supply zone which also aligns with the daily H&S neckline so I think it will have a high probability of bouncing from there.

BPCL 240 MINS MY VIEW The Structure looks good to us, waiting for this instrument to correct and then give us these opportunities as shown on this instrument (Price Chart).

Note: Its my view only and its for educational purpose only. Only who has got knowledge about this strategy, will understand what to be done on this setup. its purely based on my technical analysis only (strategies). we don't focus on the short term moves, we look for only for Bullish or Bearish Impulsive moves on the setups after a good price action is formed as per the strategy. we never get into corrective moves. because it will test our patience and also it will be a bullish or a bearish trap. and try trade the big moves.

we do not get into bullish or bearish traps. We anticipate and get into only big bullish or bearish moves (Impulsive Moves). Just ride the Bullish or Bearish Impulsive Move. Learn & Know the Complete Market Cycle.

Buy Low and Sell High Concept. Buy at Cheaper Price and Sell at Expensive Price.

Please keep your comments useful & respectful.

Keep it simple, keep it Unique.

Thanks for your support

Tradelikemee Academy

Saanjayy KG

Copart (CPRT) LongAsset Class: Stocks

Income Type: Daily

Symbol: CPRT

Trade Type: Long

Trends:

Short Term: Up

Long Term: Down

Set-Up Parameters:

Entry: 51.74 (at the Breakout)

Stop: 50.88

TP 54.28 (3:1)

Trade idea:

A breakout from a descending channel on the 1H , zone formed by a drop-base-rally with Fair Value Gap . The setup has a 3:1 RRR. The RSI is oversold , heading up, and showing divergence.

!!Be aware of pending Economic Reports. If price is within 20 pips of proximal value at time of major impact report, then Confirmation entry.

Trade management:

**When price hits 1:1 or T1, consider moving stop to entry in case of pullback.

**Disclaimer**:

The trading strategies, ideas, and information shared are for educational and informational purposes only. They do not constitute financial advice or a recommendation to buy or sell any securities, currencies, or financial instruments. You should do your own research or consult with a licensed financial advisor before making any trading decisions. The author assumes no responsibility for any losses incurred from following these trading ideas.

GBPUSD BULLISH **British pound GBP Value Correlation to USD

>We are now in the Oversold region Signaling for a bullish trend week.

Technicals:

>Price entered the Demand Zone last week, and could be ready to rally this week.

>We can see 2 consecutive higher lows

>Price could reach to the opposing Supply Zone that initiated the bearish imbalance.

OTHERS:

>Scalpers can ride the bullish trending week

>Long term traders can position for a Sell for when it reached the opposing supply zone and we get an overbought reading

***As always, trade safe and make sure to do your due diligence when analyzing the charts.***

GBPJPY BUY TRADE Oct 8 2024This trade comes to fruition after checking for manipulation of lows using 4H-1H-30min-15min.

Allowing me to activate the said pending order -Buy limit during London session (metatrader 4 platform) . I marked that demand because using the order flow, I can see enough evidence to go long. Risking 0.5% of the capital. Every trade that I initiate comes from the basic idea of supply and demand.

(please check the attached charts for a detailed structure of entry and exit points)

Always be patient and look for proof before you put pending order.

DE40The German index DE40 has reached a zone where Daily timeframe buyers might step in, with a good chance of driving the price back up.

The signal is to buy, but where to find the exact entry is something that each individual can figure out. I prefer to buy now, with a stop-loss slightly below the daily lows or if you are searching for best R:R, then wait until the price enters even deeper into the zone.

In any case, stay cautious, as NFP could also cause some price fluctuations.

Trade safe!

NZDUSD STILL BEARISH >The New Zealand Dollar had an explosive rally last week, deeply penetrating and ultimately invalidating the highlighted supply zone, indicating the exhaustion of any remaining unfilled orders.

>We can now observe five invalidated supply zones lined up on the chart.

>Above these zones lies a high-quality, fresh supply zone, where significant stop-loss orders and a large volume of sell orders could potentially accumulate in anticipation of the upcoming FED speech on Thursday, which may act as a catalyst for a sharp drop.

>The US Dollar Index remains undervalued (refer to my USD analysis for more insights).

>Given that the NZD is currently overvalued, the price may soon seek reasons to turn bearish. For this to happen, a considerable volume of sell orders will be needed to trigger a downward move.

***As always, trade safe and make sure to do your due diligence when analyzing the charts.***

AUDUSD SHORT >We have a Rally-Base-Drop(RBD) Weekly Supply Zone coverage for the RBD Daily Supply Zone

>We have a high quality Leg-out(Imbalance) from Weekly TF and an Explosive leg-out from Daily Supply

*Stochastic RSI confirmation (This is not a Timing tool, We always follow the Law of Supply and Demand):

-Stoch RSI is at Overvalued Zone, meaning price is looking for a Supply Zone to Drop the price. In AUDUSD's case, it already hit the Supply zone. Ride the trend.

>5,10,15 year Seasonality is Down-trending until 1st week of October.

**NOTE**

-Seasonality tool is just a set-up and an add-on guide.

-Supply and Demand is our timing tool.

Signal is good until 1st week of October or until Updated.

Trade Safe

Sept 19 2024 Buy TRADE GBPUSDThis was taken at around 12PM EST. Buy limit activated because of IMB price touch. I was waiting for this buy trade since yesterday because daily and 4h structure of GBPUSD was bullish.

Demand introduced last Monday and then continue going up to the supply yesterday ( Tuesday) . This was a textbook entry of bullish structure.

RR: 1:7

50,000 USD FTMO Account.

#supplyanddemand